You’ve built equity in your home — that’s great.

Now you want to put that equity to work, maybe for:

But there’s one thing you don’t want to do:

Risk your home in the process.

Good news — there are safe, smart, and flexible ways to use your equity without overextending or jeopardizing your property.

Let’s explore them.

Equity is the difference between what your home is worth and what you still owe.

Example:

But that doesn’t mean you can pull all $180K — lenders usually let you borrow up to 80–90% of your home’s value, depending on the program.

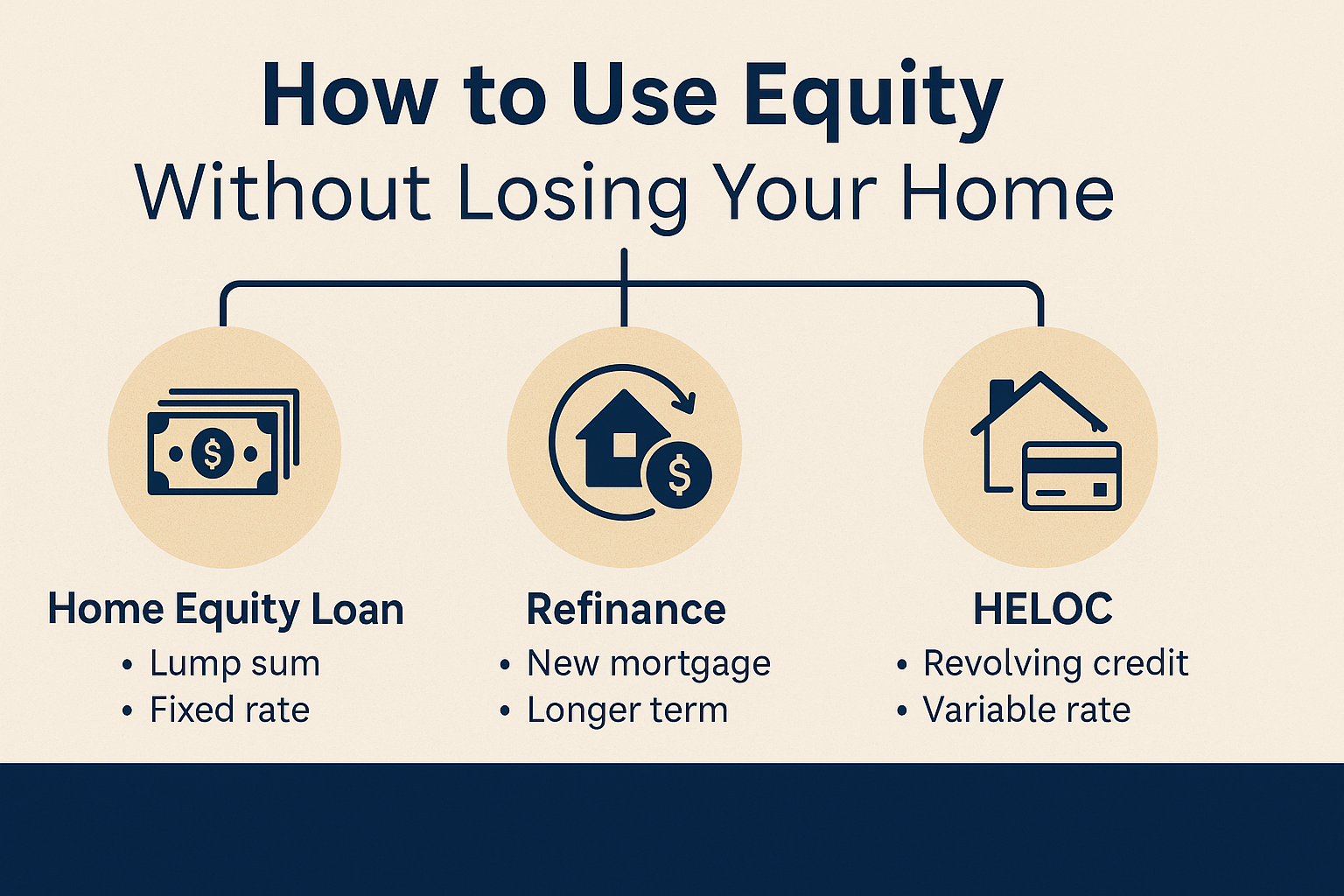

Here are your safest equity-access tools:

Each has a different purpose — we’ll help you match your goals to the right strategy.

Want to avoid ever “losing your home”? Follow these rules:

Use the funds for assets, not just expenses

(Investments, renovations, debt consolidation > boats and vacations)

They either:

There’s a sweet spot in the middle — and we’ll help you find it.

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call