How Adult Children Can Help Parents Navigate a Reverse Mortgage

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

When it comes to big financial decisions in retirement, most aging parents aren’t looking for permission — they’re looking for partnership.

Reverse mortgages can offer real relief, flexibility, and independence for seniors. But they also raise questions for adult children who want to protect their parents’ well-being and long-term legacy.

Here’s how to be a helpful, informed, and supportive part of the process — without creating conflict or confusion.

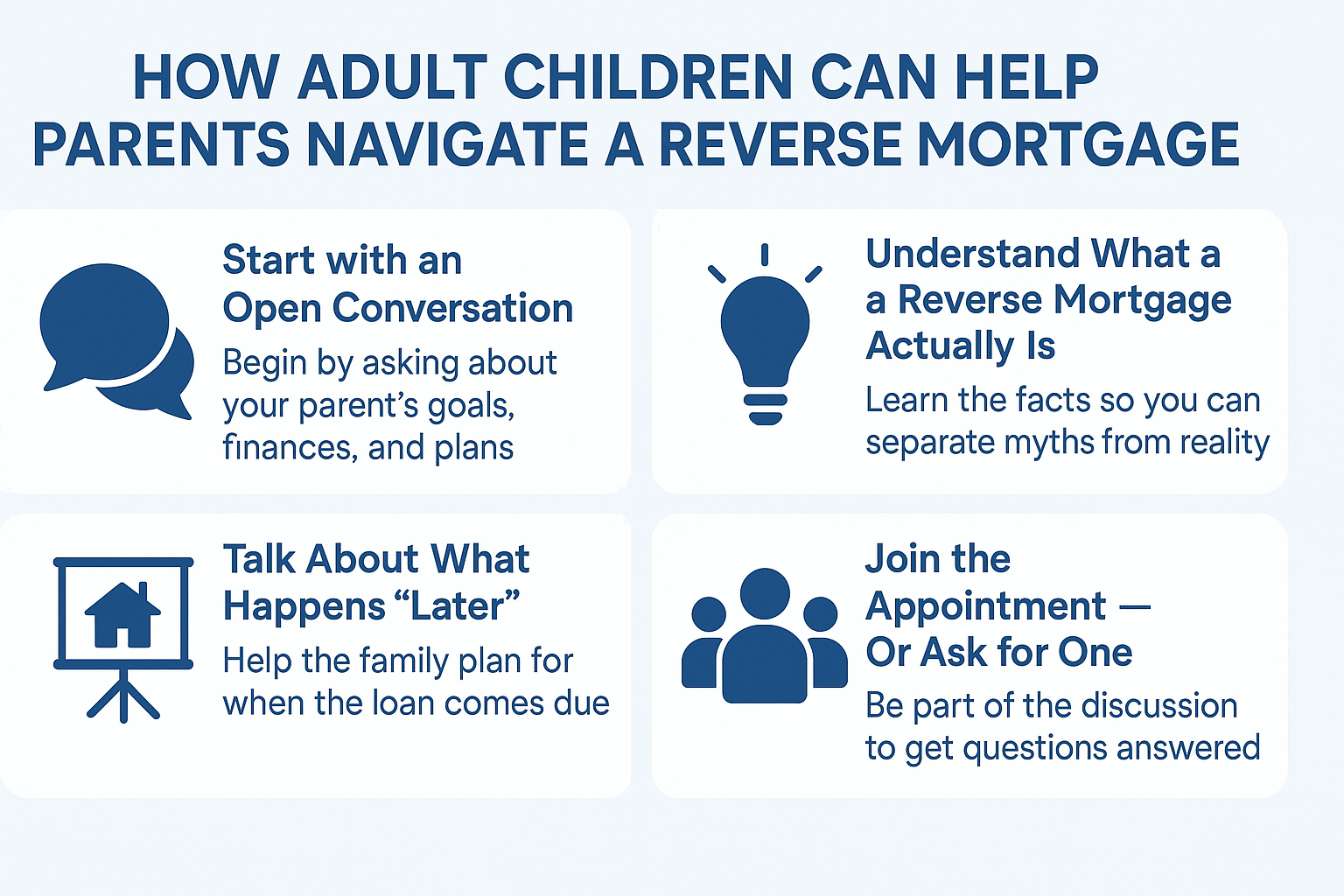

Start with an Open Conversation

The decision to explore a reverse mortgage often comes with a mix of emotion: relief, uncertainty, and even pride.

Your role isn’t to control the decision — it’s to help make sure it’s informed.

Begin by asking:

- What are your goals? (Cash flow, aging in place, eliminating a mortgage?)

- What concerns do you have about your current finances?

- Have you talked to anyone about your long-term housing or care plans?

Sometimes, asking gently opens the door more effectively than advising directly.

Understand What a Reverse Mortgage Actually Is

It’s not the “bank taking the house.”

It’s not “borrowing against the future.”

It’s a federally insured financial tool that lets seniors access the equity in their home — while retaining ownership and control.

With a reverse mortgage:

- There are no required monthly mortgage payments

- Parents can stay in the home for life (if taxes and insurance are kept current)

- The loan is repaid when the home is sold or the last borrower passes

- Any remaining equity goes to the heirs

The key is understanding how it fits within your parent’s bigger plan.

Talk About What Happens “Later”

Many families are unsure what happens when the reverse mortgage ends.

Here’s what you need to know:

When your parent passes away or moves out:

- The loan becomes due

- You can sell the home, refinance it, or walk away

- If the home is worth more than the loan, you keep the equity

- If the home is worth less, the FHA insurance pays the difference — and you owe nothing

This is called non-recourse protection, and it’s one of the strongest consumer safeguards in lending.

Join the Appointment — Or Ask for One

Most reverse mortgage professionals (like us) are happy to include family in the conversation.

We’ll take the time to:

- Explain the numbers

- Clarify the loan structure

- Show what it means for the estate

- And answer your questions as clearly as we do your parents’

There’s no pressure. Just real information from people who understand both the financial side and the emotional side.

It’s Not Just About Finances — It’s About Dignity

At the end of the day, a reverse mortgage is about more than numbers.

It’s about:

- Staying in a beloved home

- Relieving financial stress

- Avoiding dependence on children

- And aging with dignity and control

If you can help your parent explore that possibility — without fear or guilt — you’ve already done something powerful.

Final Thought

Helping your parents explore a reverse mortgage doesn’t mean pushing them into one.

It means offering clarity, support, and calm conversation — so they can make the decision that fits their goals.

Let’s build wisely. Their stairway starts here — and we’re honored to walk beside you.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call