Fixed vs. Adjustable Rates — When & Why

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

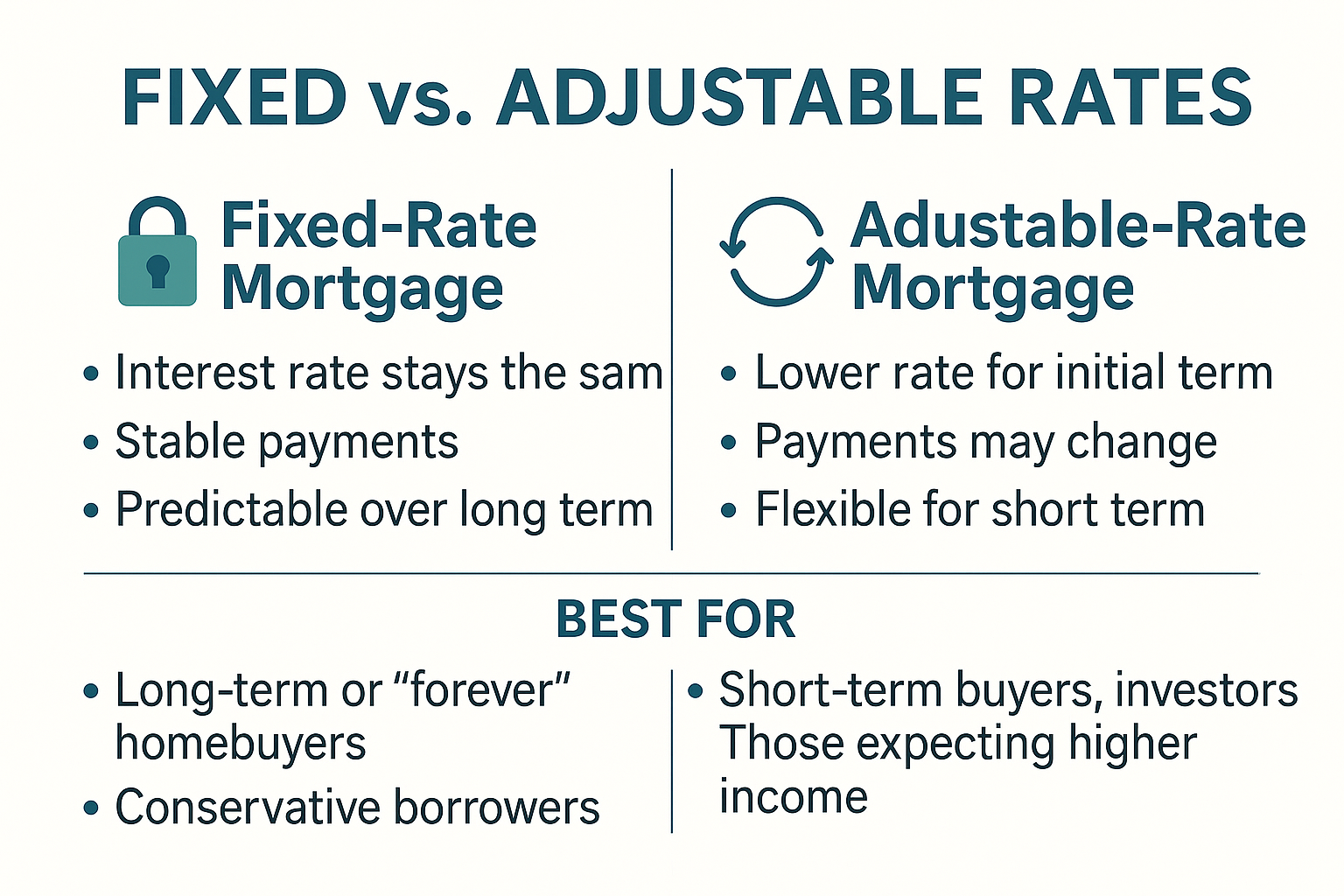

One of the most important decisions you’ll make when financing a home is choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM).

And while one isn’t always “better” than the other, the right choice depends on your goals, timeline, and risk comfort — not just today’s rate.

Let’s break down how each one works, and when it makes sense to choose one over the other.

Fixed-Rate Mortgage: Stability First

A fixed-rate mortgage locks in your interest rate for the life of the loan (typically 15, 20, or 30 years). That means your monthly principal and interest payment never changes.

Best for:

- Buyers planning to stay in the home 7+ years

- People who prefer predictable payments

- Times when rates are already low

Pros:

- Stability = peace of mind

- Easy to budget long-term

- No surprises, even if market rates rise

Cons:

- Usually a slightly higher rate than ARMs (at first)

Less flexibility if you plan to move or refinance soon

Adjustable-Rate Mortgage (ARM): Flexibility Now, Risk Later

An ARM starts with a lower interest rate for a set time (typically 5, 7, or 10 years), then adjusts annually based on the market.

Best for:

- Buyers planning to sell, refinance, or relocate in 5–10 years

- Investors looking to maximize cash flow early

- People who are comfortable taking some risk for savings

Pros:

- Lower rate up front = lower monthly payment

- Can save thousands in the short-term

- Good for “starter” homes or strategic moves

Cons:

- Uncertainty after the fixed period ends

- Payment may rise significantly if rates increase

Requires strategy — not set-it-and-forget-it

So… Which One Should You Choose?

Ask yourself:

- How long do I plan to stay in this home?

- Is this my forever home or a stepping stone?

- How much flexibility do I need vs. how much risk can I handle?

If you want security and plan to hold long-term, a fixed-rate loan might be best.

If you’re buying strategically, moving within 5–7 years, or expect income to increase, an ARM could save you money short-term — as long as you have a plan.

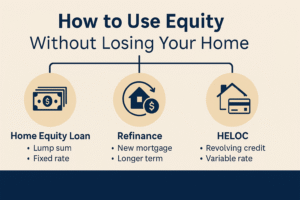

Bonus: You Can Refinance Either Way

Remember: Your first loan doesn’t have to be your last.

Whether you choose fixed or adjustable today, you can always refinance later to lock in new terms.

We help clients run both short- and long-term projections to see which option builds more wealth over time.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call