Common Reverse Mortgage Myths — Debunked with Real Facts

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

Reverse mortgages have helped millions of older homeowners enjoy retirement with more freedom, less stress, and greater financial control.

And yet… there’s still a lot of confusion out there.

Let’s clear the air. These are the most common myths we hear — and the facts that help set the record straight.

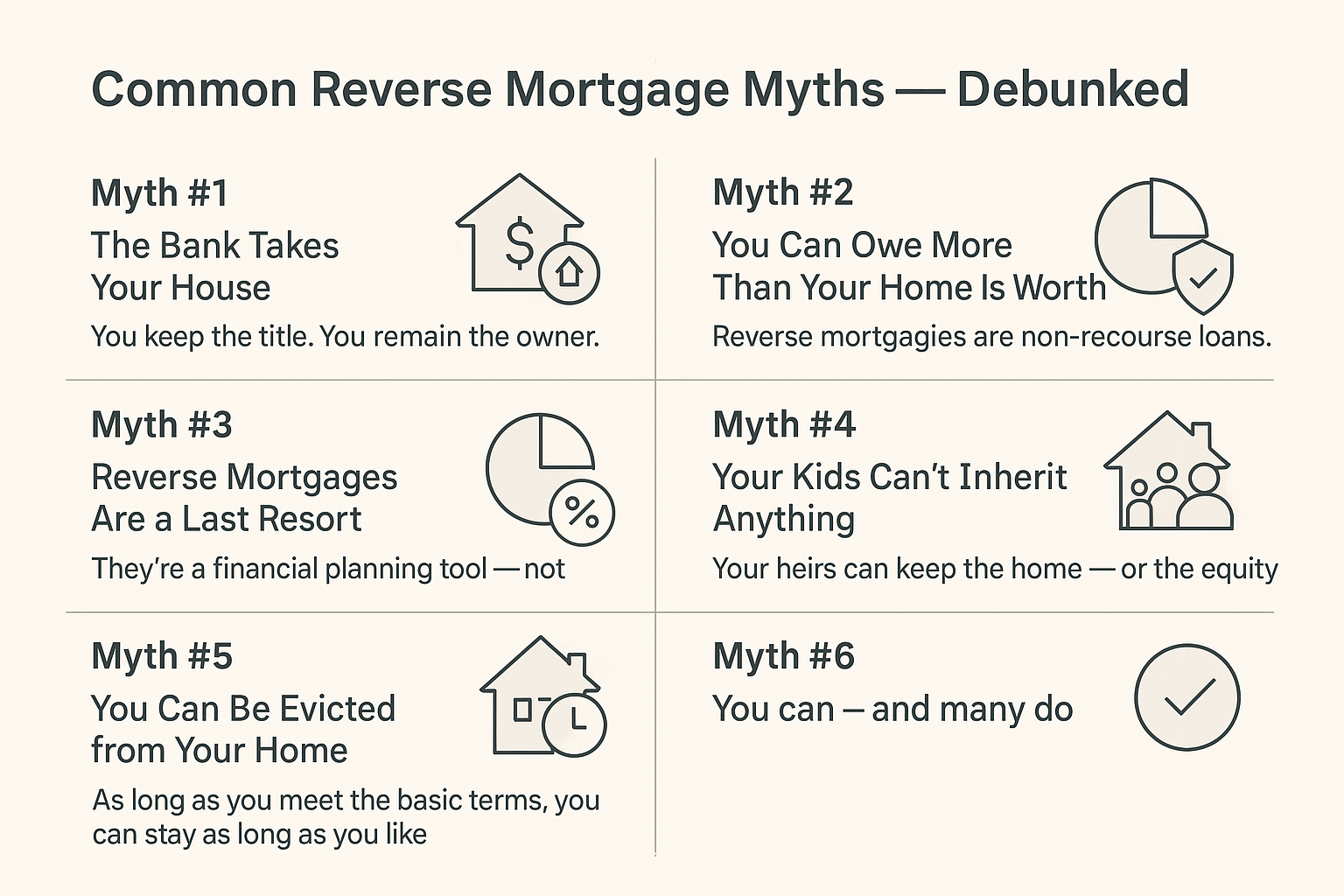

Myth #1: The Bank Takes Your House

Reality: You keep the title. You remain the owner.

A reverse mortgage is a loan — not a transfer of ownership. Just like a traditional mortgage, you still own the home, control decisions, and retain the right to sell or refinance.

The loan becomes repayable only when you move out, sell, or pass away.

Myth #2: You Can Owe More Than Your Home Is Worth

Reality: Reverse mortgages are non-recourse loans.

That means you’ll never owe more than the home is worth — even if property values drop. If the loan balance ever exceeds the home’s value, FHA insurance covers the difference. Neither you nor your heirs will be responsible for the shortfall.

Myth #3: Reverse Mortgages Are a Last Resort

Reality: They’re a financial planning tool — not a bailout.

In fact, more financial advisors are recommending reverse mortgages as part of a proactive retirement strategy. They’re used to reduce risk, increase flexibility, and protect other assets — not just to survive.

Myth #4: Your Kids Can’t Inherit Anything

Reality: Your heirs can keep the home — or the equity.

When the loan ends, your family can:

- Refinance the balance and keep the home

- Sell it and keep the remaining proceeds

- Or walk away if the loan exceeds the home’s value (with no financial penalty)

You can even involve your children in the planning process from day one.

Myth #5: You Can Be Evicted from Your Home

Reality: As long as you meet the basic terms, you can stay as long as you like.

You’re simply responsible for:

- Paying property taxes

- Keeping up homeowners insurance

- Maintaining the home in reasonable condition

- Living there as your primary residence

These are the same responsibilities any homeowner has — reverse mortgage or not.

Myth #6: You Can’t Get a Reverse Mortgage If You Have a Mortgage

Reality: You can — and many do.

In fact, paying off an existing mortgage is one of the most common reasons people get a reverse mortgage. The reverse loan wipes out your monthly mortgage payment, freeing up cash for other needs.

Myth #7: It’s Too Complicated

Reality: It’s simpler than most people think — when you have the right guide.

Yes, reverse mortgages have rules — and they should. But when you work with a trusted, experienced team, you’ll get:

- Clear answers

- Easy-to-understand options

- A no-pressure environment focused on you

Final Thought

Don’t let myths stand between you and your options.

A reverse mortgage might not be right for everyone — but for the right homeowner, it can open the door to a more secure, empowered retirement.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call