BRRRR Method: Buy One Property, Get Your Down Payment Back, Repeat

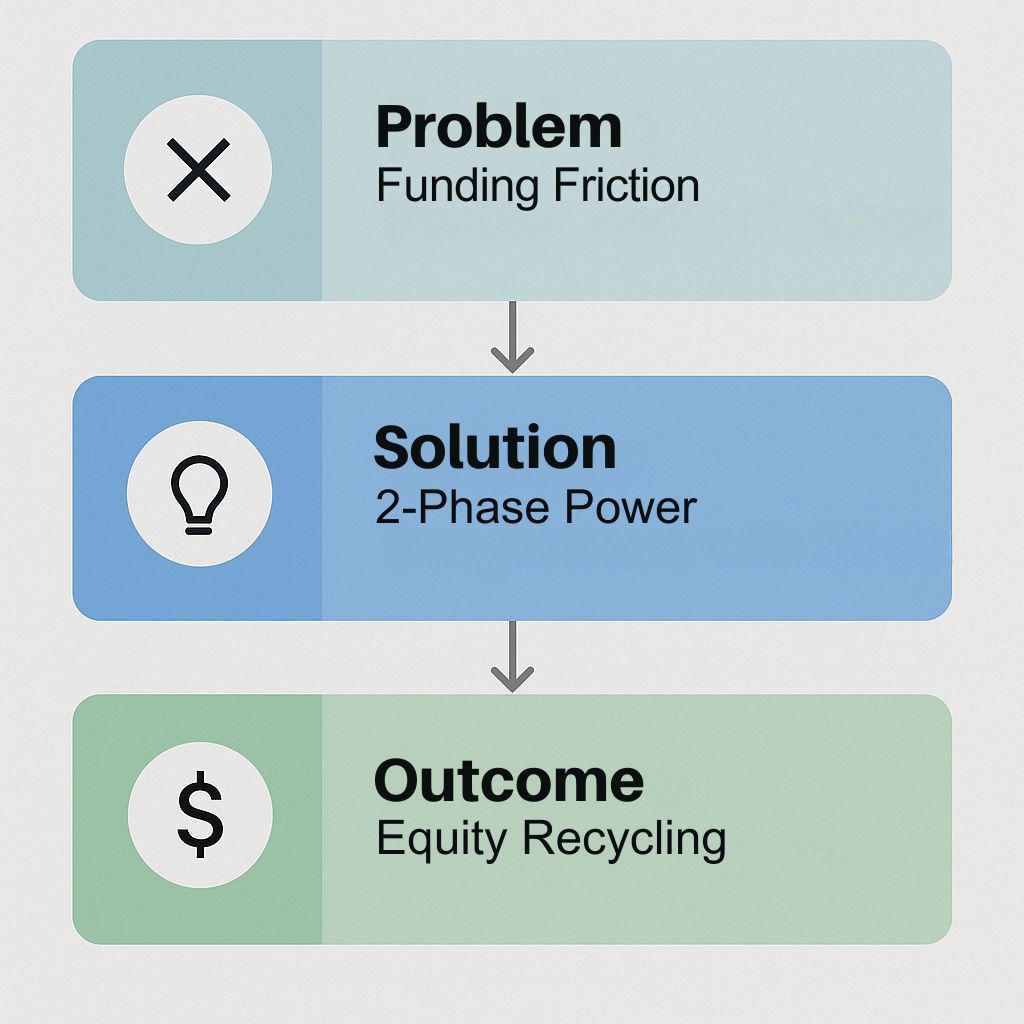

You’ve saved $40,000 for your first investment property. Traditional buy-and-hold investing lets you purchase maybe two properties before running out of capital. But what if you could buy that first property, pull your $40,000 back out, then use it again for property two? And then again for property three? That’s exactly what the BRRRR method accomplishes—allowing investors to scale portfolios without constantly needing new capital.

The BRRRR method stands for Buy, Rehab, Rent, Refinance, Repeat. This strategy combines value-add investing with strategic refinancing to recycle your initial capital repeatedly. While it requires more active involvement than simple buy-and-hold investing, the BRRRR method can accelerate portfolio growth dramatically for investors willing to coordinate renovations and manage short-term complexity.

Most first-time investors hear about the BRRRR method and assume it’s too complex or risky for beginners. The reality? The BRRRR method simply strings together five activities you’d do anyway—buying property, making improvements, finding tenants, obtaining financing, and repeating the process. Understanding each phase prevents the mistakes that make this strategy difficult while unlocking its wealth-building potential.

Key Summary

This comprehensive BRRRR method guide explains each phase of the buy-rehab-rent-refinance-repeat strategy, from finding properties to pulling cash out through refinancing, helping first-time investors understand how to scale portfolios by recycling capital.

In this guide:

- The complete BRRRR method process broken down phase-by-phase with realistic timelines and capital requirements (real estate investment strategies)

- How to find and evaluate properties suitable for the BRRRR method strategy versus traditional rentals (property selection criteria)

- Financing options at each phase including acquisition financing and refinancing strategies (real estate financing methods)

- Common BRRRR method mistakes that prevent capital recovery and how to avoid them (due diligence best practices)

BRRRR Method: Understanding The Complete Strategy Before You Start

The BRRRR method isn’t a single transaction—it’s a strategic sequence of five distinct phases that work together to create wealth-building leverage. Understanding how these phases connect prevents the disconnected thinking that causes most BRRRR failures.

The five BRRRR method phases:

Buy: Purchase property below market value, typically requiring repairs or updates that most buyers avoid

Rehab: Renovate property to bring it up to market standards or better, forcing appreciation through strategic improvements

Rent: Place quality tenants at market rent rates, stabilizing the property and creating documented income

Refinance: Obtain new financing based on the property’s improved value, ideally recovering 100% of your invested capital

Repeat: Use recovered capital to purchase the next property, scaling your portfolio without requiring new capital sources

Why the BRRRR method works mathematically:

Traditional buy-and-hold investing leaves your equity locked in properties. If you invest $40,000 to purchase a $200,000 rental property, that $40,000 stays invested until you sell—limiting you to the number of properties your available capital can fund.

The BRRRR method extracts that $40,000 back through refinancing, allowing you to reuse it. If you successfully recover your $40,000, you now own a cash-flowing rental property and still have your original $40,000 to invest in the next deal.

This capital recycling allows investors to control $600,000 worth of property using only $40,000 in initial capital—purchasing three properties instead of one. Each property generates cash flow and appreciates independently, dramatically accelerating wealth building compared to traditional investing.

The catch that makes BRRRR method challenging:

You can only refinance up to a percentage of the property’s appraised value—typically 75-80% for investment property refinancing. This means you must create sufficient forced appreciation through renovations to recover your initial investment.

Example: You purchase a distressed property for $160,000, invest $30,000 in renovations, and pay $5,000 in closing costs—total investment of $195,000. After renovations, the property appraises for $240,000. Refinancing at 75% loan-to-value gives you $180,000 in new financing. After paying off your acquisition financing and fees, you might recover $160,000-170,000 of your $195,000 investment—getting back 82-87% of your capital.

Successful BRRRR investing requires buying at sufficient discounts and making cost-effective improvements that create more value than they cost. This is where most beginners struggle—overpaying for properties or spending too much on renovations that don’t generate proportional value.

When the BRRRR method makes sense:

This strategy works best when:

- You have renovation skills or reliable contractor relationships

- You can find properties selling below market value

- Your market supports value-add improvements (improvements increase value more than their cost)

- You have time to coordinate renovations and tenant placement

- You want to scale a portfolio faster than traditional investing allows

When investors use the BRRRR method calculator before starting projects, they can model whether potential properties actually work for this strategy or whether traditional buy-and-hold makes more financial sense.

BRRRR Method Phase 1: Buy Properties Below Market Value

The BRRRR method’s success or failure is determined in the purchase phase. Overpaying leaves insufficient room for profitable refinancing regardless of how well you execute subsequent phases.

The 70% rule for BRRRR method purchases:

Many experienced BRRRR investors follow the 70% rule: Your purchase price plus renovation costs should not exceed 70% of the after-repair value (ARV).

Formula: (Purchase Price + Renovation Costs) ≤ (ARV × 0.70)

Example: Property’s ARV after renovations will be $250,000 Maximum total investment: $250,000 × 0.70 = $175,000 If renovations cost $35,000, maximum purchase price: $140,000

This 70% threshold provides cushion for refinancing fees, market fluctuation, and appraisal variations while ensuring you can recover most or all of your invested capital through refinancing.

Some investors use 65% for extra safety margin or 75% in competitive markets where finding deeper discounts proves difficult. The key is understanding your market’s refinancing standards and working backward to calculate acceptable purchase prices.

Where to find below-market properties:

Properties suitable for the BRRRR method don’t appear on retail MLS listings priced at market value. You need sources where motivated sellers accept discounts:

Distressed property listings: Foreclosures, short sales, and bank-owned properties often sell below market value. These properties typically need repairs deterring traditional buyers but perfect for BRRRR investors.

Off-market deals: Direct-to-seller marketing through direct mail, driving for dollars, or wholesaler networks produces properties not competing with retail buyers. Motivated sellers often accept below-market prices for quick, certain closings.

Estate sales and probate: Properties inherited by beneficiaries who don’t want to manage rentals or coordinate repairs often sell at discounts for quick resolution.

Tired landlords: Long-term landlords exhausted from management sometimes sell rental properties at discounts to avoid vacancy, repairs, or tenant problems.

MLS listings with extended market time: Properties sitting unsold for 60+ days might have motivated sellers willing to accept below-market offers, especially if properties need repairs.

When investors use programs like hard money loans or fix and flip financing for BRRRR acquisitions, they often gain competitive advantages in fast-closing scenarios where sellers value certainty over price maximization.

Analyzing BRRRR method potential:

Before making offers on potential BRRRR properties, verify the numbers work:

Step 1: Determine after-repair value using recent comparable sales of renovated properties in the target neighborhood

Step 2: Estimate renovation costs conservatively, adding 15-20% contingency for unexpected issues

Step 3: Calculate maximum purchase price using 70% rule or your market-specific threshold

Step 4: Verify you can place quality tenants at rents supporting your refinancing and cash flow goals

Step 5: Confirm refinancing will recover sufficient capital to make the strategy worthwhile

Many beginning BRRRR investors skip this analysis, buying properties that seem like “good deals” without verifying they work for the complete BRRRR cycle. Properties that work for traditional buy-and-hold don’t automatically work for BRRRR—you need sufficient value-add opportunity and discount to make the strategy viable.

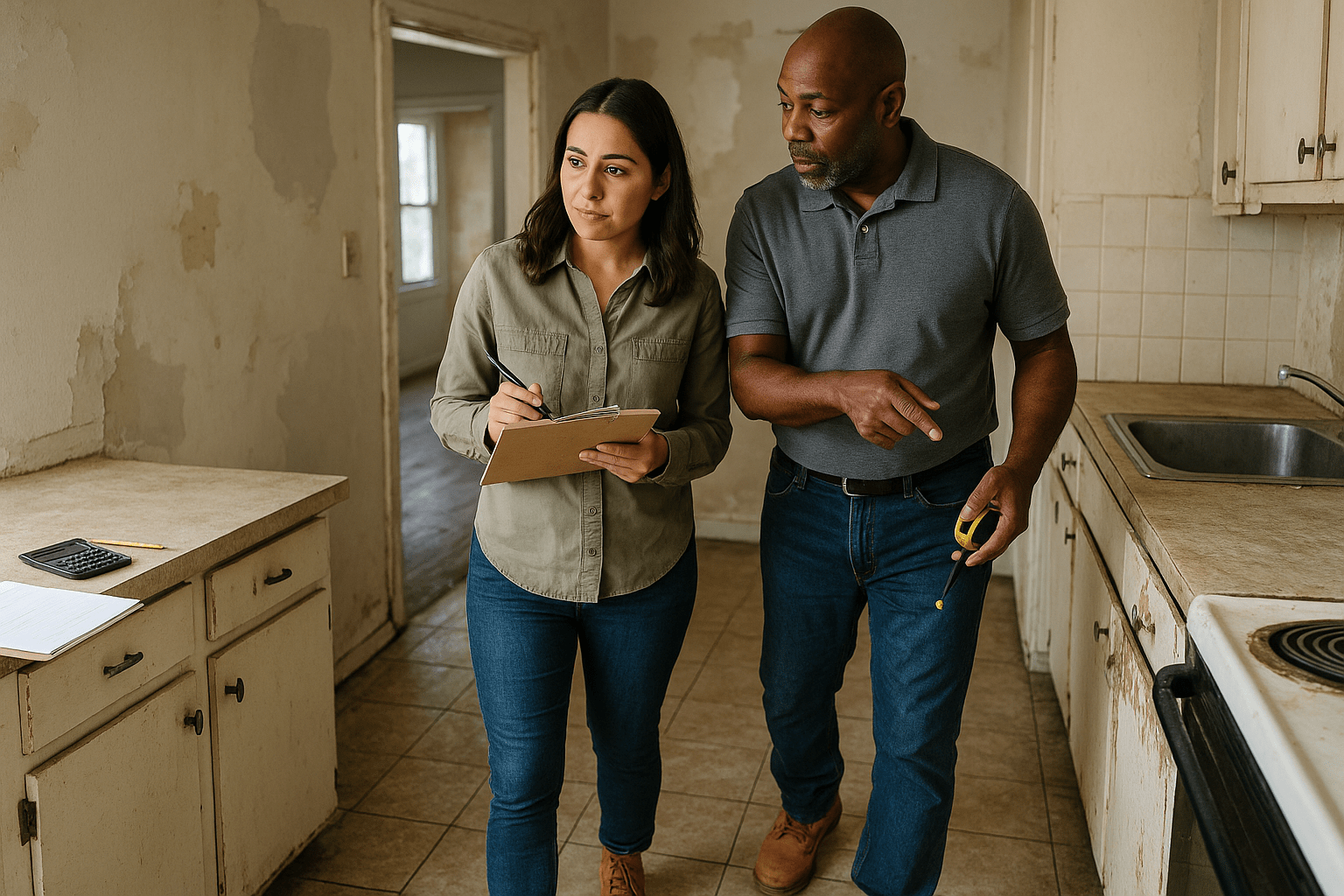

BRRRR Method Phase 2: Rehab Properties For Maximum Value

The renovation phase makes or breaks BRRRR method success. Spending too much creates negative returns. Spending too little leaves properties unable to command target rents or appraise at needed values. Strategic renovation targeting maximum value for minimum cost separates successful BRRRR investors from struggling ones.

Strategic renovations that force appreciation:

Not all improvements generate equal returns. Focus renovation budgets on changes that increase property value and rental appeal most per dollar spent:

Kitchen and bathroom updates: These spaces disproportionately affect both property values and tenant appeal. Strategic kitchen improvements (cabinets, countertops, appliances, flooring) and bathroom upgrades (vanities, fixtures, tile) generate strong returns.

Flooring replacement: New flooring throughout properties dramatically improves perception and photographability. Durable, attractive flooring (LVP, quality laminate) costs $3-6 per square foot installed but influences rent and value significantly.

Fresh paint inside and out: Paint is the highest-return improvement. Neutral colors throughout interiors and maintained exteriors cost relatively little but transform property appearance.

Functional systems repair: HVAC, plumbing, electrical, and roof must function properly. While these repairs don’t add glamour, they’re essential for appraisals, inspections, and tenant satisfaction.

Curb appeal improvements: Landscaping, exterior paint, front door replacement, and attractive lighting create strong first impressions affecting both appraised value and tenant quality.

Renovations that don’t justify their cost in BRRRR investing:

Avoid improvement categories that cost more than the value they create:

High-end finishes: Luxury countertops, designer fixtures, and premium flooring rarely generate proportional rent or value increases for working-class rental properties

Structural changes: Moving walls, adding square footage, or creating open concepts cost substantially more than their appraised value contribution

Excessive customization: Unique features that appeal to your personal taste might not appeal to appraisers or tenants, limiting value creation

Systems over-improvement: Installing top-tier HVAC systems or luxury water heaters when mid-grade alternatives function equally well for tenants wastes capital

Renovation budget management:

Successful BRRRR investors maintain strict budget discipline preventing cost overruns that destroy deal profitability:

Get detailed contractor bids before purchasing: Never buy properties hoping renovations will cost less than your estimates. Verify renovation costs through written contractor estimates before committing to purchases.

Use fixed-price contracts: Time-and-materials arrangements create budget uncertainty. Fixed-price contracts with clear scope of work protect against cost overruns while incentivizing efficient contractor performance.

Maintain contingency reserves: Budget 15-20% above estimated renovation costs for unexpected issues. Older properties hiding problems behind walls require contingency planning.

Do some work yourself strategically: If you have skills in painting, landscaping, or cosmetic improvements, doing some work yourself reduces costs. However, avoid DIY on specialized trades (electrical, plumbing, HVAC) unless properly licensed and experienced.

Track costs against budget weekly: Don’t wait until project completion to discover cost overruns. Weekly budget tracking catches problems early when adjustments are still possible.

When renovating properties that will be refinanced using conventional loan appraisals, understand what appraisers value versus what you personally prefer. Appraisers compare your property to recent sales of similar properties—they’re not rewarding creativity but rather confirming your property matches neighborhood standards.

Use the rental property calculator during renovation planning to model how different improvement scenarios affect your ultimate cash-on-cash return and refinancing success, ensuring renovation choices align with your financial objectives.

BRRRR Method Phase 3: Rent Properties To Stabilize Income

Lenders won’t refinance vacant properties. You need placed tenants with established rental history proving the property generates documented income at your projected rent levels. The rent phase establishes the property as a performing rental asset, not just a renovated house.

Tenant placement timing in BRRRR method:

Most refinancing lenders require 6-12 months of rental history before refinancing. This means you’re carrying higher-cost acquisition financing for this entire period—usually hard money loans or fix and flip financing with significantly higher costs than traditional financing.

Your timeline from purchase to refinancing typically looks like:

- Month 1-2: Renovations and inspections

- Month 3: Tenant screening and placement

- Month 3-9: Rental seasoning period (6 months rental history)

- Month 9-10: Refinancing process

- Month 10: Refinancing closes, capital recovered

This 9-10 month timeline means you’re paying high-cost acquisition financing for nearly a year. Faster renovation and tenant placement reduces your carrying costs significantly.

Achieving target rents:

Your BRRRR method analysis assumed specific rent levels supporting both cash flow and refinancing appraisals. Failing to achieve target rents threatens the entire strategy:

Price at market rates from day one: Don’t underprice hoping to rent faster. Under-market rent creates lower appraisal comps and reduces your refinancing proceeds.

Professional marketing attracts quality tenants: High-quality photos, compelling descriptions, and multi-platform advertising generate stronger tenant pools and support target pricing.

Screen tenants rigorously: The BRRRR method works long-term only if properties maintain stable occupancy and rent collection. Weak tenant screening creates problems affecting both immediate rent and future refinancing.

Document everything: Lenders want to see lease agreements, rent collection records, and tenant payment history. Maintain professional documentation from day one of tenancy.

Using rent to support refinancing:

Refinancing lenders evaluate properties partially based on documented rental income. Your lease agreements prove the income you claimed in your refinancing application reflects actual market performance.

Lenders typically analyze:

- Executed lease agreements showing term, rent amount, and tenant information

- Bank statements showing rent deposits

- Payment history demonstrating consistent rent collection

- Market rent comparisons confirming your rent aligns with area rates

Properties renting significantly below market rates raise red flags about property condition or area desirability. Properties renting above market rates create skepticism about sustainability. Your rents need to fall within 90-110% of market rent averages to support refinancing approval and appraisals.

When you’re planning to refinance using programs like DSCR loans that qualify based primarily on property income rather than personal income, achieving and documenting target rents becomes even more critical since the property’s rental performance is the primary qualification factor.

BRRRR Method Phase 4: Refinance To Recover Your Capital

Refinancing converts your temporary acquisition financing into permanent financing while extracting your invested capital for redeployment. This phase determines whether you successfully recycle capital or simply own a renovated rental with your cash stuck in equity.

Refinancing requirements for BRRRR method:

Most lenders refinancing BRRRR properties require:

Seasoning period: 6-12 months of rental history with placed tenants and documented rent collection. Some lenders require shorter seasoning; others want full year.

Appraisal at after-repair value: The property must appraise at or above your projected after-repair value. Low appraisals limit refinancing proceeds and prevent capital recovery.

Debt service coverage ratio: The property’s rental income must cover financing costs by specified ratios, typically 1.20-1.25 DSCR minimum.

Property condition: The property must meet livable standards with all systems functional, no safety issues, and maintenance current.

Clear title: Any liens from contractors, tax issues, or title problems must be resolved before refinancing.

Borrower qualifications: While DSCR-style loans focus primarily on property income, most refinancing requires reasonable borrower credit and financial standing.

Maximizing refinancing proceeds:

Several strategies increase refinancing proceeds, improving capital recovery:

Document all improvements: Provide the appraiser with detailed improvement lists, before/after photos, and contractor invoices showing renovation investment. Appraisers can’t value improvements they don’t know about.

Choose comparable sales carefully: Suggest comparable sales to the appraiser showing strong values for renovated properties like yours. While appraisers select their own comps, strategic suggestions sometimes influence selections.

Time refinancing strategically: Refinance when your market shows strong sales activity and rising prices. Weak markets with declining sales produce lower appraisals.

Complete all work before appraisal: Unfinished projects or deferred maintenance items give appraisers reasons to reduce values. Complete everything before scheduling appraisal.

Consider multiple refinancing quotes: Different lenders use different appraisal standards and loan-to-value ratios. Shopping refinancing options might reveal better proceeds from alternative lenders.

What happens when refinancing doesn’t recover full capital:

Sometimes refinancing recovers only 70-85% of your invested capital rather than 90-100% you hoped. Several options exist:

Keep property with remaining capital invested: Accept that some equity stays in the property. You still own a cash-flowing rental with some forced equity—just not as a pure BRRRR success.

Use lines of credit to supplement: If you have access to HELOCs or home equity loans on other properties, you might supplement refinancing proceeds with borrowed equity to recover full capital.

Wait for appreciation: Some investors refinance again in 12-24 months after additional market appreciation increases property values to levels supporting full capital recovery.

Sell if necessary: If a BRRRR deal fails to produce acceptable refinancing proceeds and you need capital for other investments, selling might be better than tying up capital in underperforming projects.

Refinancing costs reduce recovered capital:

Remember that refinancing isn’t free. Typical costs include:

- Appraisal fees: $400-600

- Lender fees: 1-2% of loan amount

- Title insurance: $800-1,500

- Recording and doc prep: $300-500

- Total: 2-3.5% of refinancing loan amount

On a $200,000 refinance, costs run $4,000-7,000, reducing net proceeds. Factor these costs into your initial BRRRR analysis to avoid surprise capital shortfalls.

When using conventional loan refinancing for your BRRRR properties, understand that investment property refinancing typically allows 75% loan-to-value versus 80% sometimes available for primary residences. This 5% difference significantly affects capital recovery on marginal deals.

BRRRR Method Phase 5: Repeat The Process To Scale Your Portfolio

Successfully completing one BRRRR cycle proves you understand the strategy. Repeating the process multiple times builds substantial wealth through leveraged portfolio growth.

Using recovered capital for deal two:

Assuming you successfully recovered most or all of your invested capital from property one, you now have that capital available for property two while still owning property one as a cash-flowing asset.

Property one:

- Property value: $240,000

- Financing: $180,000 (75% LTV refinance)

- Your equity: $60,000

- Cash flow: $300-500 monthly after all expenses

- Status: Owned and stabilized, generating passive income

Available capital for property two:

- Recovered capital from property one: $35,000-40,000 (depending on refinancing results)

- Original capital: Recycled from property one

- New capital needed: $0 (unless you want to scale faster)

This capital recycling allows you to purchase property two using the same capital that bought property one, while property one continues generating returns and appreciating independently.

Scaling velocity with BRRRR method:

The BRRRR method’s power multiplies with repetition:

Year 1: Purchase property one, complete BRRRR cycle, recover $40,000 Year 2: Purchase property two with recovered capital, complete BRRRR cycle, recover $40,000 again Year 3: Purchase property three with recovered capital

By year three, you control three properties worth $720,000 using only $40,000 in original capital. Each property generates cash flow and appreciates independently. Your total portfolio produces $900-1,500 monthly cash flow while building equity through appreciation and loan paydown across all properties.

Compare this to traditional investing where your $40,000 purchases only one property over the same period. The BRRRR method’s capital recycling creates 3x the portfolio in the same timeframe with the same capital.

When to pause between BRRRR cycles:

While aggressive investors immediately start deal two while deal one completes its refinancing process, conservative investors benefit from pausing between cycles:

Pausing allows you to:

- Ensure property one stabilizes fully with quality tenants

- Recover physically and mentally from intensive BRRRR process

- Reassess strategy based on lessons learned

- Build additional cash reserves for safety

- Research next target market or property type

Many successful BRRRR investors complete 1-2 deals annually rather than 3-4, prioritizing quality over quantity. Slower scaling with higher success rates beats rapid scaling with problematic properties.

Expanding beyond your initial capital through portfolio leverage:

Once you own 2-3 BRRRR properties, additional capital options emerge:

Portfolio loans allow you to finance multiple properties under single lending relationships, often with better terms than individual property financing.

HELOCs on accumulated equity let you access capital from existing properties to fund new purchases. As your properties appreciate and loans pay down, your borrowable equity increases.

Private money lenders or partnerships might invest in your deals after you prove success with initial BRRRR projects. Experienced BRRRR investors often graduate from using only their capital to coordinating investor capital for larger or multiple simultaneous projects.

Cash flow from existing properties can be saved and redeployed, adding to recovered capital for larger or better opportunities.

Maintaining quality as you scale:

The biggest mistake scaling BRRRR investors make is sacrificing deal quality for deal volume. Not every property works for BRRRR. Not every deal closes successfully. Not every renovation comes in on budget.

Successful portfolio scaling requires:

- Maintaining strict property acquisition criteria

- Using reliable contractor teams consistently

- Following systematic tenant screening regardless of pressure to fill vacancies

- Preserving adequate cash reserves for unexpected issues

- Being willing to walk away from marginal deals

Properties purchased in haste or with compromised standards create problems that derail your entire strategy. One seriously problematic property can consume profits from three successful deals.

Use the investment growth calculator to model how different BRRRR repetition rates affect your long-term wealth building, helping you balance aggressive growth with sustainable quality standards.

BRRRR Method Financing: Choosing The Right Loans For Each Phase

The BRRRR method requires two distinct financing stages: acquisition/renovation financing, then long-term refinancing. Understanding which financing options work for each phase prevents the costly mistakes of using inappropriate loan programs.

Acquisition and renovation financing options:

Phase 1 and 2 (Buy and Rehab) require financing that:

- Closes quickly (15-30 days)

- Allows renovation work during loan period

- Doesn’t require the property to be rent-ready

- Accepts properties in distressed condition

Appropriate acquisition financing:

Hard money loans: Short-term financing (6-24 months) based primarily on property value. These loans typically cost 8-12% interest with 2-5 points upfront, but they close quickly and allow extensive renovations. Hard money lenders often fund both purchase and renovation costs.

Fix and flip loans: Similar to hard money but structured specifically for renovation projects. These programs often include built-in renovation holdbacks, allowing you to purchase property and draw renovation funds as work completes.

FHA 203k loans: If you’re willing to live in the property initially (house-hacking BRRRR), FHA 203k finances purchase and renovations together at standard FHA rates. After 12 months, you can move out and convert to rental property, then refinance to recover capital.

HomeStyle renovation loans: Conventional equivalent of FHA 203k, available for both owner-occupied and investment properties. Better rates than hard money but slower closing and more documentation requirements.

Cash: Some investors use cash for acquisition and renovation, avoiding financing costs entirely. This works well if you have substantial capital but limits scaling velocity.

Refinancing options for the permanent phase:

Phase 4 (Refinance) requires financing that:

- Provides long-term stability (15-30 year terms)

- Offers competitive costs since you’ll carry this financing for years

- Bases lending decisions on stabilized property performance

- Allows maximum loan-to-value to recover invested capital

Appropriate refinancing programs:

Conventional investment property loans: Standard investment property financing offering competitive costs and terms. These loans typically allow 75% loan-to-value on investment property refinancing with rates approximately 0.5-0.75% above owner-occupied rates.

DSCR loans: Debt service coverage ratio loans qualify based primarily on property income rather than personal income. Ideal for investors building portfolios since qualification doesn’t depend on your employment income or debt-to-income ratios. DSCR loans sometimes allow 75-80% loan-to-value depending on property performance and borrower strength.

Portfolio loans: Once you own multiple properties, portfolio refinancing might offer better terms than individual property loans. These products bundle multiple properties under single lending relationships, sometimes with more flexible underwriting.

The financing cost reality:

Many beginning BRRRR investors underestimate the total financing costs across both phases:

Example project carrying costs:

- Hard money acquisition: 10% interest + 3 points upfront on $150,000 = $18,000 for 12 months

- Conventional refinance closing: 2.5% of $180,000 = $4,500

- Total financing costs: $22,500

On a project where you invest $50,000 total capital and recover $48,000 through refinancing, these financing costs represent nearly half your capital investment. Understanding and planning for these costs prevents surprise financial shortfalls.

Use the BRRRR method calculator to model complete project costs including both acquisition financing and refinancing costs, ensuring your deals actually work financially after accounting for all expenses.

Common BRRRR Method Mistakes And How To Avoid Them

Understanding where BRRRR investors commonly fail prevents expensive learning through personal mistakes. These are the problems that derail BRRRR success most frequently:

Mistake 1: Overpaying for properties:

The most common and most expensive BRRRR mistake is buying properties that don’t provide sufficient discount to support the complete cycle. If you pay too close to market value, even perfect renovations won’t create enough equity for successful refinancing.

Prevention: Use the 70% rule rigorously. Walk away from properties that don’t meet your buying criteria regardless of how much you like them. Patient discipline in acquisitions beats rushing into marginal deals.

Mistake 2: Renovation cost overruns:

Underestimating renovation costs destroys BRRRR profitability more than any other factor. Projects budgeted at $30,000 that actually cost $45,000 eliminate your refinancing equity and prevent capital recovery.

Prevention: Get detailed contractor bids before purchasing. Add 20% contingency to estimates. Never buy properties hoping renovations will cost less than you fear. Require fixed-price contracts with clear scopes of work.

Mistake 3: Over-improving properties:

Enthusiastic investors often install improvements that don’t generate proportional value increases. Spending $50,000 in renovations that only increase property value by $40,000 wastes capital and destroys BRRRR returns.

Prevention: Study comparable sales carefully. Match renovation quality to neighborhood norms rather than your personal preferences. Focus on strategic improvements generating maximum value per dollar spent. Avoid luxury finishes in working-class neighborhoods.

Mistake 4: Slow execution eating holding costs:

Projects taking 15 months instead of 10 months cost an additional $5,000-10,000 in holding costs and acquisition financing interest. These extended timelines also delay your ability to start the next project, reducing scaling velocity.

Prevention: Maintain aggressive but realistic project timelines. Use reliable contractors with proven track records. Stay involved in project management without micromanaging. Have backup contractors identified for critical situations.

Mistake 5: Failing to achieve target rents:

Properties that don’t rent at projected levels create cascading problems: lower cash flow reducing your ability to cover carrying costs, lower rental comps hurting appraisals, and potentially inability to meet DSCR requirements for refinancing.

Prevention: Research market rents thoroughly before purchasing. Don’t assume your renovations will command premium rents without comparable data supporting that assumption. Price competitively to attract quality tenants quickly.

Mistake 6: Appraisal problems preventing refinancing:

Low appraisals prevent recovering sufficient capital, trapping your equity in properties and preventing the “repeat” phase. Appraisals coming in $20,000-30,000 below expectations create serious capital recovery problems.

Prevention: Use conservative after-repair value estimates in initial analysis. Don’t chase appreciation during renovation periods. Provide detailed documentation to appraisers. Consider getting pre-refinancing desktop appraisals to identify problems early when adjustments are still possible.

Mistake 7: Inadequate cash reserves:

BRRRR projects require substantial capital reserves beyond purchase and renovation budgets. Unexpected issues, extended vacancy, or refinancing delays consume cash quickly. Investors running out of reserves often make desperate decisions harming long-term success.

Prevention: Maintain cash reserves equal to 30-40% of total project costs beyond purchase price and renovation budget. Have access to lines of credit for emergencies. Don’t start project two until project one successfully completes refinancing.

BRRRR Method Versus Traditional Buy-And-Hold: Choosing Your Strategy

The BRRRR method isn’t universally superior to traditional buy-and-hold investing. Understanding when each strategy makes sense helps you choose appropriate approaches for your goals, skills, and resources.

When BRRRR method works better:

Choose the BRRRR method when:

You want to scale quickly with limited capital: The capital recycling allows portfolio growth without requiring new capital sources for each property.

You have renovation skills or reliable contractors: Successful BRRRR requires coordinating renovations efficiently and cost-effectively. If you lack these capabilities, BRRRR becomes much harder.

Your market rewards improvements: Some markets show strong returns on renovations where improvements cost less than resulting value increases. These markets suit BRRRR better than markets where renovations barely increase values.

You can find below-market properties: BRRRR requires acquisition discounts. If your market doesn’t provide access to distressed or below-market properties, traditional investing might work better.

You have time for active involvement: BRRRR demands significantly more time and attention than passive buy-and-hold. If you lack available time, paying more for turnkey properties might serve your goals better.

When traditional buy-and-hold works better:

Choose traditional rental investing when:

You want truly passive income: Buying properties in good condition that don’t need improvements and are already rented provides more passive experience than BRRRR projects requiring intensive involvement.

You lack renovation expertise: Investors without contractor relationships or renovation experience often struggle with BRRRR projects. Traditional investing avoids these complications.

Your market doesn’t provide sufficient discounts: In competitive markets where finding properties at 70% of ARV proves impossible, traditional investing at market prices makes more sense.

You have substantial capital for multiple deals: If you have $200,000+ available for investing, you can purchase multiple traditional rentals without needing capital recycling that BRRRR provides.

You prefer financial simplicity: BRRRR requires coordinating multiple financing sources, managing renovation budgets, and planning complex refinancing. Traditional investing offers simpler financing and operations.

Hybrid approaches combining strategies:

Many successful investors use both strategies strategically:

Use BRRRR for properties offering clear value-add opportunities while buying turnkey rentals for properties already in good condition. This balances growth velocity with operational simplicity.

Start with traditional investing to build experience and confidence, then transition to BRRRR once you understand rental property operations and develop contractor relationships.

Use BRRRR during market downturns when distressed opportunities abound, then shift to traditional investing during competitive markets when finding BRRRR-suitable properties proves difficult.

Financial comparison:

Traditional buy-and-hold:

- Capital requirement: $40,000 per property

- Properties owned after three years: 1-2 (depending on savings)

- Portfolio value: $200,000-400,000

- Complexity: Low

- Time requirement: 3-5 hours monthly per property

BRRRR method:

- Capital requirement: $40,000 initial (recycled repeatedly)

- Properties owned after three years: 2-4 (depending on execution)

- Portfolio value: $400,000-800,000

- Complexity: High

- Time requirement: 15-25 hours monthly during renovation and stabilization

Neither approach is universally better. The right choice depends on your specific circumstances, skills, and objectives. Many investors successfully build wealth through either strategy—the key is matching strategy to your capabilities and commitment.

When you’re evaluating whether BRRRR or traditional investing makes sense for your situation, use both the BRRRR method calculator and the rental property calculator to model both approaches with real numbers, comparing results before committing to either strategy.

Moving Forward: Starting Your First BRRRR Method Project

Ready to attempt your first BRRRR project? Follow this systematic approach minimizing risk while maximizing learning:

Step 1: Education before action (2-3 months):

Study successful BRRRR projects in your target market. Join real estate investing groups, attend local meetups, and interview investors who’ve successfully completed BRRRR cycles. Understanding market-specific nuances prevents expensive beginner mistakes.

Learn renovation fundamentals even if you’ll hire contractors. Understanding what work costs, how long projects take, and what improvements generate value helps you manage contractors effectively.

Research financing options available in your market. Get pre-approvals for both acquisition financing and refinancing so you understand your real costs and capabilities before finding properties.

Step 2: Build your team (1-2 months):

Successful BRRRR requires reliable professionals:

Real estate agent: Find agents working with investors who understand distressed properties and below-market acquisitions. Retail residential agents often lack experience with BRRRR-suitable properties.

Contractor: Interview multiple contractors, check references, and review past projects. Start with small projects to test reliability before committing to major renovations.

Lender relationships: Establish relationships with both acquisition lenders (hard money or fix-and-flip) and refinancing lenders (conventional or DSCR). Understanding your options before needing them prevents scrambling mid-project.

Property manager: Even if you plan to self-manage initially, knowing professional management options provides backup if needed.

Step 3: Analyze 20-50 properties before buying:

Develop pattern recognition by running complete BRRRR analysis on many properties before purchasing. This repetition helps you:

- Quickly identify properties meeting acquisition criteria

- Accurately estimate renovation costs

- Recognize neighborhoods supporting target rents

- Calculate realistic after-repair values

Most successful BRRRR investors analyze 30+ properties before buying their first one. This “free” education through analysis prevents expensive mistakes when you finally commit capital.

Step 4: Start small and build confidence:

Your first BRRRR project should:

- Need only cosmetic improvements (not structural work)

- Be located near you (easier management and oversight)

- Cost less than your budget allows (reducing financial pressure)

- Be a property type you understand (single-family before multi-unit)

Successful first projects build confidence and skills supporting larger, more complex future deals. Failed first projects often discourage investors from continuing despite BRRRR’s long-term potential.

Step 5: Document everything for future reference:

Track your complete first project:

- Acquisition costs and timeline

- Renovation budget versus actual costs

- Tenant placement process and timeline

- Refinancing experience and results

- Total capital recovery and timeline

This documentation provides two benefits: learning what worked and what didn’t for project two, and demonstrating experience to future lenders or potential partners.

Step 6: Evaluate results honestly:

After completing your refinancing, calculate your actual returns:

- Total capital invested: Purchase price + renovations + holding costs + financing costs

- Capital recovered: Refinancing proceeds after paying off acquisition financing

- Net capital remaining in deal: Total invested – capital recovered

- Annual cash flow: Monthly net income × 12

- Cash-on-cash return: Annual cash flow ÷ net capital remaining

Compare these actual results to your initial projections. Where did estimates prove accurate? Where did you over or underestimate? This honest evaluation dramatically improves project two’s accuracy and success probability.

Ready to get pre-approved for BRRRR method financing? Understanding your actual borrowing capacity for both acquisition and refinancing phases helps you target appropriate properties that work for your capital and financing situation. Whether you’re using hard money loans for acquisition, conventional refinancing, or DSCR loans for long-term financing, knowing your options before finding properties prevents losing deals to financing uncertainty.

Frequently Asked Questions About BRRRR Method

How much money do I need to start using the BRRRR method?

Minimum capital for BRRRR varies by market but typically requires $35,000-50,000 for your first project in most markets. This covers your equity contribution (typically 20-25% of purchase price), renovation costs, holding costs during renovations and tenant placement, and fees for both acquisition and refinancing. Some markets allow successful BRRRR with $25,000 in lower-cost areas, while expensive markets might require $75,000+. Additionally, maintain cash reserves equal to 30-40% of your project investment for unexpected issues. Using hard money or fix-and-flip financing often requires less upfront capital than cash purchases but increases your carrying costs during the hold period. Your total capital requirement depends heavily on your target property price range, renovation scope, and local financing requirements.

Can I use the BRRRR method with FHA financing?

Yes, through FHA 203k renovation loans combined with house-hacking strategy. Purchase a multi-unit property (2-4 units) using FHA 203k financing, living in one unit while renovating and renting the others. This approach requires only 3.5% equity contribution and finances renovations within the loan. After 12 months of owner-occupancy, you can move out, convert your unit to rental, and refinance into conventional investment property financing to recover capital. This modified BRRRR approach allows investors with minimal capital ($10,000-15,000) to start, though it requires living in the property during the initial phase. The main limitation is FHA 203k renovations cannot exceed approximately $35,000 in most markets, restricting you to properties needing only moderate improvements rather than extensive renovations.

How long does a complete BRRRR method cycle take?

Typical BRRRR cycles take 9-14 months from property acquisition to refinancing completion. Timeline breaks down approximately: property search and acquisition (1-3 months), renovations and inspections (1-3 months), tenant placement (2-4 weeks), rental seasoning period before refinancing (6-12 months depending on lender requirements), and refinancing process (4-8 weeks). Experienced investors with reliable teams sometimes complete cycles in 7-8 months, while first-time BRRRR investors often need 12-15 months as they learn the process. Factors extending timelines include renovation complications, difficulty finding tenants, extended refinancing lender requirements, or appraisal delays. Faster completion reduces your holding costs significantly—a 10-month cycle might cost $3,000-5,000 less in acquisition financing interest than a 14-month cycle, meaningfully improving returns.

What happens if the property doesn’t appraise high enough during refinancing?

Low appraisals are one of the most common BRRRR challenges, preventing full capital recovery. Your options include: 1) Accept lower refinancing proceeds, leaving more capital invested than planned—you still own a cash-flowing property but can’t recycle as much capital. 2) Order a second appraisal through a different lender (costs $400-600 but sometimes produces higher values). 3) Wait 6-12 months for additional market appreciation then refinance again. 4) Challenge the appraisal with additional comparables if you have strong evidence of higher value. 5) Use a home equity line of credit on other properties to supplement refinancing proceeds if recovering capital is critical for your next deal. 6) Sell the property if refinancing proceeds are insufficient and you need capital for other investments. Prevention through conservative after-repair value estimates in initial analysis is always better than scrambling to solve low appraisal problems.

Is the BRRRR method too risky for first-time investors?

The BRRRR method carries more risk and complexity than traditional buy-and-hold investing but isn’t inherently too risky for first-timers who prepare properly. Risks include: renovation cost overruns eliminating profitability, tenant placement difficulties extending holding costs, low appraisals preventing capital recovery, and unexpected property issues consuming reserves. However, first-time investors can manage these risks through: starting with properties needing only cosmetic improvements, maintaining 40%+ capital reserves beyond base budget, getting fixed-price contractor bids before purchasing, using conservative value estimates in analysis, and choosing properties in stable neighborhoods with strong rental demand. Many investors successfully complete first BRRRR projects by treating them as learning experiences, starting smaller than their capital allows, and building confidence before attempting more complex projects. The biggest mistake is attempting BRRRR without adequate capital, reliable contractors, or understanding of local market dynamics—these factors cause failures, not the strategy itself.

Can I do multiple BRRRR projects simultaneously?

Experienced BRRRR investors often manage 2-4 simultaneous projects, but attempting multiple projects simultaneously as a first-time investor rarely succeeds. Managing multiple renovations requires: extensive contractor networks (different teams for different projects), substantial capital reserves (unexpected issues multiply across projects), sophisticated project management skills, and tolerance for significant complexity. Most successful investors complete their first 2-3 BRRRR cycles individually before attempting simultaneous projects. Once you’ve proven your systems and built reliable teams, simultaneous projects can accelerate portfolio growth substantially—completing 3 projects in 12 months rather than 36 months sequentially. However, the risk of simultaneous failures also increases if you lack experience or adequate systems. A conservative approach is completing project one successfully, starting project two while project one stabilizes in the rent phase, and gradually overlapping projects as your capabilities grow rather than immediately attempting multiple complex projects simultaneously.

Related Resources

For First-Time Investors Learning BRRRR Method:

Investment Property Analysis: Evaluating BRRRR Deals teaches the financial analysis required to determine if properties work for BRRRR strategy.

Finding Off-Market Investment Property Deals explains where to source below-market properties suitable for BRRRR method.

Rental Property Cash Flow: Understanding BRRRR Returns helps you project and verify cash flow from BRRRR properties.

Taking Next Steps In Your BRRRR Journey:

House Hacking: Your First BRRRR Project explains using FHA 203k financing to start BRRRR investing with minimal capital.

Scaling Beyond Four Properties: Portfolio BRRRR discusses accelerating portfolio growth through repeated BRRRR cycles.

Financing Your BRRRR Projects:

Hard Money Loan provides acquisition financing for BRRRR properties allowing quick closes and extensive renovations.

Fix and Flip Loan offers combined purchase and renovation financing structured specifically for BRRRR strategies.

DSCR Loan qualifies you for refinancing based on property income, ideal for BRRRR investors scaling portfolios.

FHA 203k Loan allows first-time investors to start BRRRR with minimal capital through owner-occupied renovation financing.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.