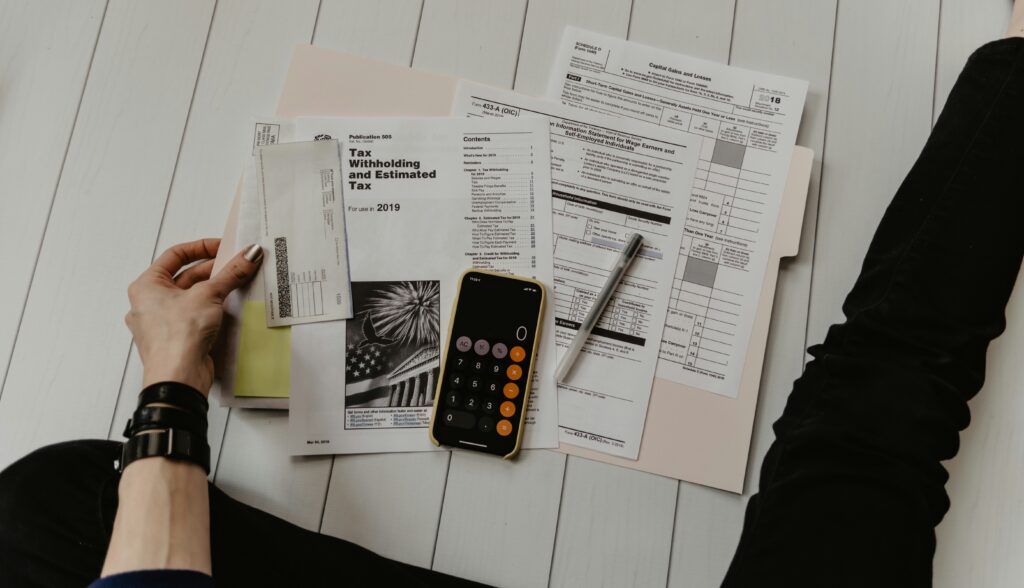

Debt Consolidation Calculator: See How Much You Can Save Monthly

The Debt Consolidation Calculator helps you see, in plain numbers, whether rolling your existing credit cards, personal loans, or other balances into one new loan actually works in your favor. By entering your current debts, interest rates, and monthly payments, then comparing them to a proposed consolidation loan, the Debt Consolidation Calculator shows your new payment, total interest, and how much faster (or slower) you could get out of debt. It’s a simple way to cut through confusion and decide if consolidation is a smart move—not just a different bill.

Use the Debt Consolidation Calculator as you shop lenders, adjust loan terms, or test different payoff strategies so you can clearly see the real cost and savings of each option. As you tweak interest rates, loan amounts, or payoff timelines, the Debt Consolidation Calculator updates your numbers instantly, helping you choose a plan that lowers stress, protects your cash flow, and moves you toward becoming debt-free with confidence.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Important Disclaimer

This calculator is for illustrative purposes only and does not constitute financial, legal, or investment advice. Results are based on general assumptions and may not reflect actual performance or eligibility. This is not a loan estimate or approval. Please consult with a licensed mortgage advisor before making financial decisions.

Related Posts

Subscribe to our newsletter

Get new calculators and money tools in your inbox.