Interest Only Loan: 7 Smart Ways to Reduce Monthly Payments and Maximize Cash Flow

Key Details: What You’ll Learn About Interest-Only Loans

- An interest-only loan allows you to pay only the interest portion during an initial period, substantially reducing monthly obligations while building equity through appreciation (Consumer Financial Protection Bureau mortgage payment types)

- Jumbo loans, DSCR investor loans, portfolio loans, and home equity lines of credit commonly offer interest-only payment features across multiple property types

- Interest-only periods typically range from five to ten years before transitioning to fully amortizing payment structures (Fannie Mae interest-only mortgage guidelines)

- Real estate investors, high-net-worth individuals, entrepreneurs, and transitional borrowers benefit most from interest-only payment structures when strategically deployed

- Loan balance remains constant during interest-only periods while property values typically appreciate, creating equity growth without principal paydown (Federal Reserve housing market data)

- Qualification requires demonstrating ability to afford eventual fully amortizing payments, not just reduced interest-only amounts (HUD mortgage lending standards)

- Strategic planning for payment transitions and understanding total borrowing costs prevents payment shock when interest-only periods conclude (CFPB mortgage disclosure requirements)

Ready to explore your options? Schedule a call with a loan advisor.

Understanding the Interest-Only Payment Strategy

An interest-only loan offers a unique payment structure that can transform your monthly cash flow management. Rather than paying both principal and interest from day one, you make reduced monthly payments covering only the interest portion during an initial period. This strategy creates breathing room in your budget while you build wealth through appreciation, business growth, or strategic investments.

Many borrowers discover this approach when exploring financing options for luxury properties, investment real estate, or during transitional life situations. The interest-only feature appears across multiple loan programs—from jumbo mortgages to DSCR investor financing—giving you flexibility to match your financing to your financial strategy.

In this comprehensive guide, you’ll learn how interest-only payments work, which loan programs offer this feature, when this strategy makes financial sense, and how to avoid common pitfalls. We’ll also show you how Stairway Mortgage’s expertise helps you navigate this powerful financing tool with confidence.

How Interest-Only Loans Work: The Mechanics Explained

The Two-Phase Payment Structure

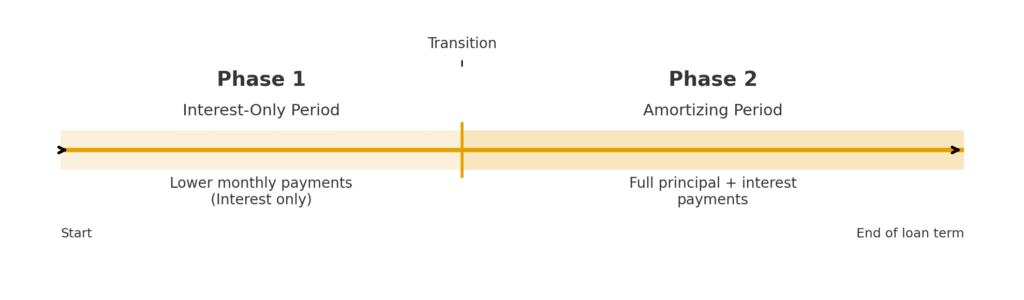

Interest-only financing operates in two distinct phases. During the initial period—typically ranging from five to ten years—your monthly obligation covers only the interest charges on your loan balance. The principal amount remains unchanged during this time, which creates substantially lower monthly payments compared to traditional conventional financing.

After the interest-only period concludes, your loan transitions to fully amortizing payments. These payments now include both principal and interest, recalculated over the remaining term. Your monthly obligation increases during this second phase since you’re now paying down the actual loan balance while continuing to cover interest charges.

This structure works particularly well for strategic borrowers who anticipate income growth, plan to refinance before the transition occurs, or intend to sell the property within the initial period. Understanding both phases helps you plan effectively and avoid payment shock when the structure changes. Use our payment comparison calculator to model different scenarios.

Calculating Interest-Only Payments

Calculating your monthly interest-only payment involves straightforward mathematics. You multiply your loan balance by your annual interest rate, then divide by twelve months. Unlike fully amortizing conventional loans where payment calculations require complex formulas, interest-only payment amounts remain consistent and predictable.

For example, if you secure favorable financing with an attractive annual rate on a substantial loan balance, your monthly interest-only payment stays constant throughout the initial period. This predictability helps with budgeting and financial planning, especially when managing multiple investment properties or business expenses.

Use the payment comparison calculator to see exactly how interest-only payments compare to traditional amortization schedules. You’ll immediately recognize the monthly savings and can determine whether this strategy aligns with your financial goals.

Building Equity Through Appreciation

While your loan balance doesn’t decrease during the interest-only period, your property typically builds equity through market appreciation. In growing markets, this appreciation can substantially increase your net worth even though you’re not paying down principal. This dynamic creates opportunities for strategic refinancing or profitable property sales.

Consider how property values have historically increased over time in desirable markets. Your equity grows from appreciation while you maintain lower monthly obligations. This combination allows you to allocate cash toward other investments, business opportunities, or additional rental property acquisitions.

The rental property calculator helps you project appreciation potential alongside your interest-only payment structure. You can model different appreciation scenarios to understand your equity position over time.

Loan Programs Offering Interest-Only Features

Jumbo Loans with Interest-Only Options

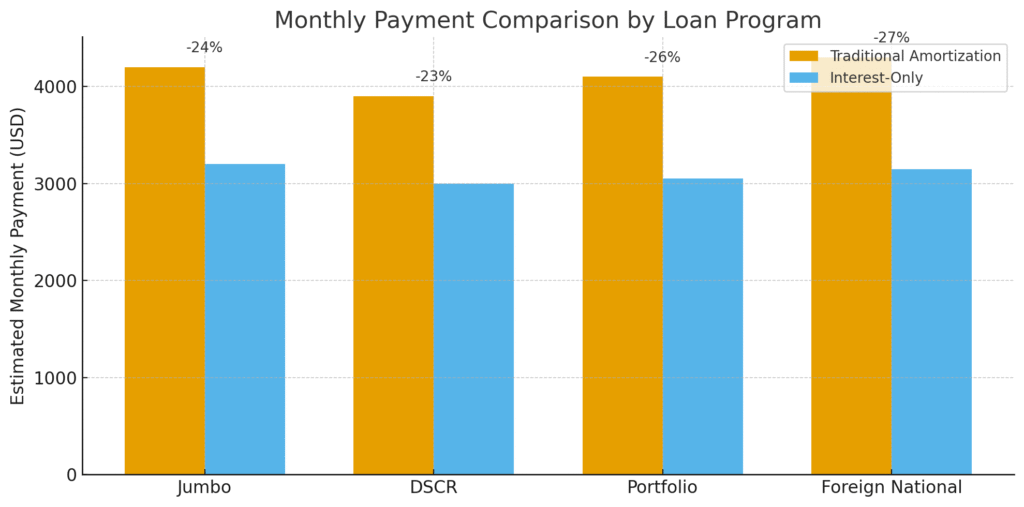

Jumbo loans frequently include interest-only payment options for borrowers financing luxury properties above conforming loan limits. These programs recognize that high-net-worth borrowers often prefer maximizing cash flow and liquidity rather than rapidly paying down debt on appreciating assets.

The jumbo loan calculator for purchase demonstrates how interest-only payments reduce monthly obligations on substantial loan amounts. Many successful borrowers featured in our jumbo loan case studies strategically chose this option to maintain flexibility while their properties appreciated.

Jumbo loan interest-only periods typically extend for five, seven, or ten years. After this initial period, the loan recalculates to fully amortizing payments over the remaining term. This structure works exceptionally well for borrowers who expect income growth or plan strategic refinancing with jumbo programs before the transition occurs.

See how a financial advisor successfully leveraged jumbo financing to purchase their dream home while maintaining cash flow for other investments. The jumbo cash-out refinance case study shows how business owners access equity strategically.

DSCR Loans for Real Estate Investors

DSCR loans offer interest-only features specifically designed for real estate investors prioritizing cash flow. Since these loans qualify based on property rental income rather than personal income, the interest-only structure maximizes monthly cash flow from rental operations.

Investors appreciate how interest-only payments on DSCR financing create positive cash flow even in competitive rental markets. Review our DSCR loan case studies to see how experienced investors leverage this strategy when building rental property portfolios.

The combination of debt service coverage qualification and interest-only payments creates powerful leverage opportunities. You can acquire more properties while maintaining comfortable cash flow positions across your portfolio. This approach accelerates wealth building for active real estate investors. Use the DSCR refinance calculator to model scenarios.

See how one real estate agent purchased their fourth rental property without income verification, and how another investor accessed equity to purchase their fifth property using DSCR cash-out refinancing.

Portfolio Loans with Flexible Structures

Portfolio loans frequently accommodate interest-only payment structures since lenders retain these loans rather than selling them to secondary markets. This flexibility allows for customized solutions matching your unique financial situation and investment strategy.

Portfolio lenders can structure interest-only periods matching your specific needs—whether that’s maximizing current cash flow, minimizing payments during property transitions, or creating flexibility for strategic planning. These loans work especially well for unique properties or complex financial situations where conventional programs lack flexibility.

The portfolio loan case studies showcase how borrowers with non-traditional situations successfully utilized interest-only features. From mixed-use properties to high-net-worth individuals with complex income structures, portfolio loans solve problems conventional financing cannot address.

Foreign National Loans

Foreign national loans commonly include interest-only payment options for international borrowers investing in U.S. real estate. This structure makes particular sense when borrowers maintain primary income sources in their home countries while building U.S. real estate portfolios.

International investors appreciate how interest-only payments minimize cash outflows while properties appreciate in U.S. markets. Use the foreign national loan calculator to model your scenarios. The foreign national purchase case study demonstrates how a Canadian architect invested successfully.

These programs recognize that sophisticated international investors often prefer maintaining liquidity rather than accelerating principal paydown. Interest-only structures align with global investment strategies where capital flexibility outweighs rapid debt reduction. See how an Australian financial advisor refinanced their U.S. investment property strategically.

Strategic Applications of Interest-Only Financing

Maximizing Investment Property Cash Flow

Real estate investors frequently choose interest-only payments to maximize cash flow from rental properties. Lower monthly obligations mean more money remaining after covering property expenses, creating stronger positive cash flow positions that support portfolio growth through DSCR investor loans.

Consider how reduced monthly payments impact your rental property financial performance. Every dollar saved in mortgage payments potentially contributes to positive monthly cash flow, emergency reserves, or capital for acquiring additional rental properties. This strategy particularly benefits investors in markets where rental rates support operations but don’t provide substantial excess cash flow under traditional financing.

The rental property calculator shows exactly how interest-only payments affect your monthly cash flow projections. You can model different scenarios to determine whether this strategy creates meaningful improvements in your investment returns. Compare with the DSCR loan calculator for specific investor scenarios.

Bridge Financing During Transitions

Interest-only payments provide breathing room during transitional life situations. Whether you’re relocating for work, building a new home, or managing temporary income changes, lower monthly obligations help you navigate transitions without financial strain.

Many borrowers use interest-only features strategically during periods when expenses temporarily exceed income. The reduced payment obligation creates budget flexibility while you establish new income streams, sell previous properties, or complete major life transitions. This approach provides financial stability when you need it most.

Transitional situations often resolve within the interest-only period, allowing you to refinance conventionally or sell before payments increase. Strategic planning ensures you exit the interest-only structure before the higher amortizing payments begin.

Business Investment Opportunities

Entrepreneurs and business owners often prefer interest-only mortgage payments because freed-up monthly cash flow can fund business growth opportunities. Rather than tying capital in home equity through principal paydown, you maintain liquidity for business investments potentially generating superior returns.

Consider how redirecting principal payments toward business opportunities might accelerate your wealth building. If your business generates strong returns on invested capital, maintaining lower mortgage payments while investing in operations makes strategic sense. This approach requires discipline but can dramatically accelerate financial goal achievement.

The bank statement loan program frequently pairs with interest-only features for self-employed borrowers. Use the bank statement calculator to explore qualification scenarios. Review how other business owners structured their financing in our case studies to see this strategy in action.

High-Net-Worth Financial Planning

High-net-worth individuals frequently incorporate interest-only mortgages into sophisticated financial planning strategies through jumbo loan programs. Rather than rapidly paying down low-cost mortgage debt, these borrowers maintain liquidity for investment opportunities potentially generating superior returns in equities, private investments, or business ventures.

This strategy makes particular sense when mortgage interest rates remain favorable compared to expected returns from alternative investments. Wealthy individuals often prioritize maintaining liquid capital over accelerating debt paydown, especially when tax benefits partially offset interest costs.

Financial advisors working with affluent clients frequently recommend interest-only structures as part of comprehensive wealth management plans. The strategy balances debt management with investment opportunity optimization, creating flexible financial positions supporting long-term wealth building. Calculate scenarios using the jumbo refinance calculator.

Home Equity Access with Interest-Only Features

Interest-Only HELOCs

Home equity lines of credit frequently feature interest-only payment structures during their draw periods. This combination creates maximum financial flexibility—you access equity as needed while maintaining minimal monthly obligations covering only interest charges on outstanding balances.

During the draw period, you pay interest only on funds you actually use rather than the entire credit line. This structure provides enormous flexibility for managing projects, investments, or opportunities as they arise. You maintain substantial available credit while minimizing monthly obligations.

The HELOC calculator helps you understand how interest-only payments work on revolving credit lines. See our HELOC case study showing how a financial advisor accessed home equity for rental property acquisition while maintaining low monthly obligations.

Interest-Only Home Equity Loans

Unlike HELOCs, home equity loans provide lump-sum financing rather than revolving credit. Some programs offer interest-only payment options during initial periods, creating reduced monthly obligations while you pursue business opportunities, complete renovations, or make strategic investments.

Interest-only home equity loans work particularly well when you need substantial capital for time-sensitive opportunities but want minimal monthly payment obligations during initial implementation phases. The fixed-rate structure provides payment certainty during the interest-only period.

Calculate potential payments using the home equity loan calculator to see how interest-only options reduce monthly obligations. The home equity case study demonstrates how a dentist leveraged this structure for practice expansion.

Strategic Equity Access Scenarios

Accessing home equity with interest-only payment structures creates opportunities for strategic wealth building without substantially increasing monthly obligations. Whether funding business expansion, purchasing additional investment properties, or making strategic investments, this approach preserves cash flow while deploying capital.

Consider scenarios where you need substantial capital but want to minimize monthly cash outflow. Interest-only equity access provides the funds while maintaining financial flexibility. This strategy works exceptionally well when investment returns substantially exceed borrowing costs.

Many successful wealth builders leverage home equity strategically while maintaining comfortable cash flow positions. The interest-only feature makes this leverage accessible without creating financial strain. Model your scenarios with the rental property calculator.

Alternative Income Documentation Programs

No-Doc and Bank Statement Loans

No-doc loans and bank statement loans frequently offer interest-only payment options since these programs already accommodate non-traditional borrower situations. The combination of alternative documentation and interest-only payments creates maximum flexibility for self-employed borrowers and entrepreneurs.

Self-employed individuals appreciate how interest-only payments free up cash flow for business reinvestment or growth opportunities. Rather than tying capital in mortgage principal paydown, you maintain liquidity for business needs while your property appreciates. This approach aligns financing structure with entrepreneurial priorities.

These programs recognize that business owners often prefer cash flow flexibility over rapid debt reduction. Interest-only features complement alternative documentation requirements, creating comprehensive solutions for non-traditional borrowers. Use the bank statement calculator to explore your options.

Hard Money and Fix-and-Flip Financing

Hard money loans and fix-and-flip financing frequently utilize interest-only payment structures since these loans focus on short-term project financing rather than long-term amortization. Interest-only payments minimize holding costs during renovation periods.

Real estate investors flipping properties want minimal monthly obligations during renovation phases. Interest-only payments reduce carrying costs, improving project profitability. Since these loans typically close within months rather than years, the interest-only structure makes perfect sense.

Project-based financing naturally aligns with interest-only payments. You minimize costs during holding periods and repay loans fully upon property sale or refinancing into permanent DSCR financing. Calculate your project costs using the hard money calculator or fix-and-flip calculator.

Conventional and Government Programs

Conventional Loan Interest-Only Options

Select conventional loans offer interest-only payment structures, though availability varies by lender and borrower qualifications. These programs typically require excellent credit profiles and substantial equity positions since lenders view interest-only conventional loans as higher risk than traditional amortization.

When available, conventional interest-only financing provides attractive terms for well-qualified borrowers. Use the conventional loan calculator to model how interest-only payments might reduce your monthly obligations compared to traditional financing structures.

Conventional programs offer stability and competitive terms when you qualify for interest-only features. These loans work well for borrowers seeking maximum financial flexibility while maintaining conventional financing benefits. Compare purchase and refinance scenarios to find the best approach.

ARM and Fixed-Rate Considerations

Interest-only features appear in both adjustable-rate and fixed-rate loan structures. Fixed-rate interest-only loans provide payment certainty during the interest-only period, while ARM-based interest-only loans may offer lower initial rates but include rate adjustment risk.

Each structure serves different borrower needs and risk tolerances. Fixed-rate options provide complete payment certainty during interest-only periods, making budgeting straightforward and predictable. ARM-based interest-only loans may start with more favorable rates but include potential for rate adjustments affecting monthly obligations.

Understanding these distinctions helps you select the structure aligning best with your financial planning horizon and risk preferences. Consider how long you anticipate maintaining the financing and whether rate stability or initial rate optimization matters most. Use our payment comparison tools to evaluate different structures.

Smart Strategies for Interest-Only Success

Matching Terms to Your Timeline

Successfully using interest-only financing requires matching interest-only periods to your strategic timeline. If you plan selling or refinancing within five years, a five-year interest-only period aligns perfectly. Avoid situations where interest-only periods end before you execute your exit strategy.

Consider your financial planning horizon carefully before committing to interest-only structures. Will your income increase substantially during the interest-only period? Do you plan refinancing or selling before amortizing payments begin? Honest assessment of your timeline prevents payment shock when structures transition.

Strategic borrowers view interest-only periods as deliberate financial planning tools rather than permanent solutions. They match interest-only terms to specific financial goals and exit strategies, whether that’s building rental portfolios or accessing equity strategically.

Building Reserves Despite Lower Payments

While interest-only payments reduce monthly obligations, disciplined borrowers use the savings to build emergency reserves rather than increasing lifestyle expenses. This approach creates financial safety nets supporting long-term success even as loan structures eventually transition.

Consider automatically transferring payment savings into dedicated reserve accounts. This discipline ensures you benefit from lower payments through improved financial security rather than lifestyle inflation that becomes difficult to reverse when payments increase.

Building reserves during interest-only periods demonstrates the financial discipline that separates successful strategic borrowers from those who struggle when payment structures change. Make reserves a priority rather than an afterthought.

Planning for Payment Transitions

Understanding exactly when and how your payments will change prevents surprises and financial strain. Calculate your future fully amortizing payments before committing to interest-only financing. Ensure you’ll comfortably afford increased payments or have clear refinancing strategies in place.

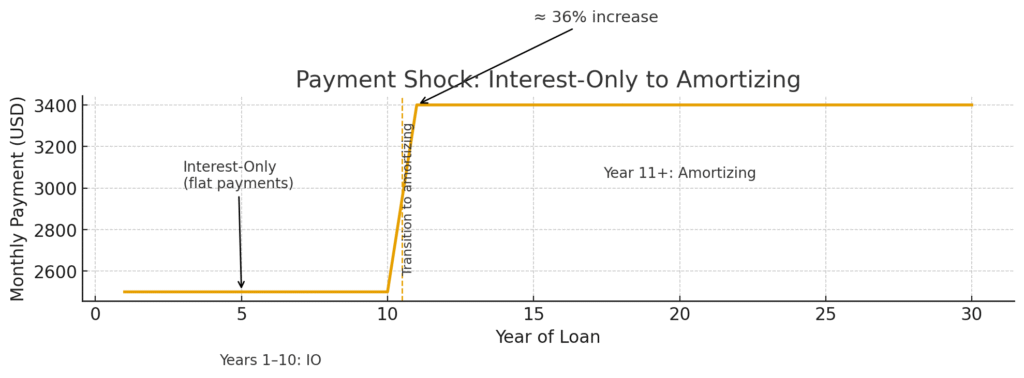

The payment transition from interest-only to fully amortizing can create substantial payment increases—sometimes thirty to forty percent higher than interest-only amounts. Planning for this change ensures smooth transitions without financial hardship.

Many successful borrowers set calendar reminders years in advance of payment transitions. This forward planning creates time for strategic refinancing, property sales, or income adjustments supporting higher payment obligations.

Strategic Refinancing Before Transitions

Refinancing before interest-only periods end provides opportunities to extend interest-only structures, transition to different loan programs like DSCR loans or portfolio loans, or capitalize on improved property values. This proactive approach prevents being forced into higher payments if your financial situation hasn’t evolved as anticipated.

Monitor interest rate environments and property values throughout your interest-only period. Opportunities for beneficial refinancing may appear well before your current structure transitions. Staying informed and proactive creates more favorable outcomes than waiting until forced transitions occur.

Strategic refinancing allows you to continually optimize your financing structure as markets and your financial situation evolve. Interest-only periods create natural checkpoints for reevaluating your overall financial strategy through various refinance calculators.

Avoiding Common Interest-Only Pitfalls

Understanding True Cost of Borrowing

Interest-only payments create lower monthly obligations but don’t reduce your loan balance during the initial period. This means you’ll pay substantially more total interest over the complete loan term compared to traditional amortization unless you sell or refinance before the interest-only period ends.

Calculate total interest costs across different scenarios using payment comparison calculators. Understanding true borrowing costs helps you make informed decisions about whether interest-only structures align with your financial goals. Sometimes the long-term costs outweigh short-term cash flow benefits.

Sophisticated borrowers view interest-only structures as tactical tools rather than permanent solutions. They understand cost implications and plan strategic exits before total interest costs become problematic.

Qualifying for Eventual Higher Payments

Lenders typically require you to qualify based on fully amortizing payments rather than interest-only amounts. This means you’ll need income supporting higher payments even though you initially make reduced interest-only payments. This qualification requirement protects both you and lenders from financial distress.

Don’t view lower qualifying payments as license to borrow more than you can truly afford. The qualification process assumes you’ll eventually make fully amortizing payments. Ensure your income and financial situation actually support those higher amounts.

Conservative borrowing that comfortably qualifies for fully amortizing payments creates more sustainable financing structures than stretching to borrow maximum amounts based on interest-only calculations. Use loan calculators to verify comfortable qualification levels.

Market Risk and Appreciation Assumptions

Relying exclusively on property appreciation to build equity creates risk if markets decline during your ownership period. While properties typically appreciate over long periods, short-term market fluctuations can leave you with less equity than anticipated when refinancing or selling.

Avoid assuming continuous appreciation without considering market cycle risks. Conservative financial planning accounts for potential market downturns rather than assuming perpetual appreciation. This cautious approach creates more sustainable strategies.

Diversifying your wealth-building approach rather than relying exclusively on real estate appreciation reduces concentration risk. Interest-only financing works best as part of comprehensive financial strategies rather than standalone approaches depending entirely on market appreciation. The rental property calculator helps model conservative scenarios.

Avoiding Payment Shock

The transition from interest-only to fully amortizing payments creates “payment shock” if you’re unprepared for substantially higher monthly obligations. This shock can strain budgets and create financial difficulty if you haven’t planned appropriately.

Prevent payment shock through advance planning and financial preparation. Calculate your future payments years before they increase. Build income growth expectations conservatively and create backup refinancing strategies if your situation doesn’t evolve as anticipated.

Sophisticated borrowers occasionally make voluntary principal payments during interest-only periods, gradually reducing loan balances and moderating future payment increases. This approach provides middle ground between pure interest-only and fully amortizing structures.

How Stairway Mortgage Makes Interest-Only Financing Easy

Access to Multiple Interest-Only Programs

Stairway Mortgage connects you with over 300 lenders offering diverse interest-only loan programs. This extensive network means we find options matching your specific situation rather than forcing you into ill-fitting programs. Whether you need jumbo financing, investor loans, or alternative documentation programs, we access interest-only features across multiple loan types.

Our broker structure means we work for you rather than representing a single lender. We compare programs from hundreds of sources to find the optimal combination of interest-only features, competitive terms, and flexible structures matching your financial strategy.

This multi-lender access creates competitive advantages impossible when working with single-lender institutions. We negotiate on your behalf, comparing terms and finding the best possible programs for your unique situation across jumbo, portfolio, and DSCR programs.

Expert Guidance Through Complex Structures

Interest-only financing includes numerous structural variations and strategic considerations. Our experienced team helps you understand exactly how different programs work, calculate true costs, plan for payment transitions, and match interest-only periods to your financial timeline.

We guide you through qualification requirements, explain payment transition mechanics, and help you develop strategies preventing payment shock when structures change. This education-focused approach ensures you make informed decisions aligned with your long-term financial goals.

Many borrowers appreciate how we explain complex financing concepts in accessible language. We break down calculations using various calculators, compare scenarios, and ensure you completely understand your financing structure before committing.

Strategic Planning for Long-Term Success

Beyond simply arranging financing, we help you develop comprehensive strategies maximizing interest-only benefits while managing associated risks. We’ll calculate payment transitions, identify optimal refinancing windows, and create proactive plans ensuring smooth financial management throughout your loan term.

Our team helps you think strategically about interest-only periods as tactical tools within broader wealth-building plans. We consider your complete financial picture—income growth expectations, investment strategies, property appreciation potential—when recommending structures.

This strategic advisory approach distinguishes Stairway from transaction-focused lenders. We invest time understanding your goals and creating financing plans supporting long-term success rather than simply closing loans. Whether you’re building rental portfolios or accessing equity strategically, we guide you every step.

Fast Pre-Approvals and Smooth Closings

Our streamlined processes deliver pre-approvals within 24 hours, allowing you to move quickly when opportunities arise. Whether you’re purchasing investment properties, refinancing existing loans, or accessing home equity, fast pre-approvals create competitive advantages in active real estate markets.

We leverage technology and efficient workflows to minimize paperwork burden while maintaining thorough due diligence. Our team coordinates directly with lenders, processors, and underwriters to keep your transaction moving smoothly toward closing.

Fast, reliable service means you capitalize on opportunities rather than missing them due to financing delays. We understand timing matters, especially when structuring interest-only financing for investment properties or strategic wealth-building plans.

Ready to Explore Interest-Only Financing?

Interest-only loans offer powerful flexibility for strategic borrowers prioritizing cash flow, investment opportunities, or financial adaptability. From maximizing rental property returns to maintaining liquidity during transitional periods, interest-only features create options impossible with traditional amortization structures.

Success requires understanding how these programs work, matching interest-only periods to your financial timeline, and planning proactively for payment transitions. With proper strategy and expert guidance, interest-only financing becomes a valuable tool supporting your wealth-building goals.

Stairway Mortgage’s team helps you navigate interest-only options across multiple loan programs—from jumbo loans to DSCR financing to home equity access—ensuring you find structures aligned with your unique financial situation. Our extensive lender network, strategic advisory approach, and commitment to your long-term success create competitive advantages impossible when working with traditional lenders.

Contact Stairway Mortgage today to explore whether interest-only financing fits your financial strategy. We’ll analyze your situation, compare programs from hundreds of lenders, and create customized solutions supporting your goals. Let us show you how strategic interest-only financing can enhance your financial flexibility while building long-term wealth.

Frequently Asked Questions

What happens when my interest-only period ends?

When your interest-only period concludes, your loan recalculates to fully amortizing payments covering both principal and interest over the remaining term. Your monthly payment increases—sometimes substantially—since you’re now paying down the loan balance in addition to interest charges. The exact increase depends on your remaining loan balance, interest rate, and years left in the term.

Most borrowers plan strategic exits before interest-only periods end, either through refinancing into new interest-only terms or selling properties. Alternatively, if your income has grown as anticipated during the interest-only period, you’ll comfortably afford the higher fully amortizing payments.

Can I make principal payments during the interest-only period?

Yes, most interest-only loans allow voluntary principal payments anytime during the interest-only period without prepayment penalties. Making occasional principal payments reduces your loan balance, which moderates your eventual payment increase when the loan transitions to fully amortizing structure.

Some borrowers make strategic principal payments to balance cash flow flexibility with gradual debt reduction. This approach provides middle ground between pure interest-only and traditional amortization structures, reducing future payment shock while maintaining most interest-only benefits.

How does an interest-only loan affect my taxes?

Mortgage interest remains tax-deductible on interest-only loans just like traditional mortgages, subject to current tax law limitations. Since you’re paying substantial interest without principal reduction during interest-only periods, your annual interest deductions may actually be higher than with traditional amortization.

However, tax laws change, and individual situations vary dramatically. Consult qualified tax professionals about how interest-only financing affects your specific tax situation. We provide financing expertise but cannot offer tax advice.

What credit score do I need for interest-only financing?

Credit score requirements vary substantially by program type, with jumbo and conventional interest-only loans typically requiring excellent credit profiles—often 700 or higher. Alternative programs like DSCR loans or portfolio loans may accommodate lower credit scores since they focus on property cash flow or asset-based qualifications rather than traditional credit metrics.

Your complete financial profile matters more than credit scores alone. Lenders evaluate income stability, asset reserves, debt-to-income ratios, and property equity alongside credit scores when qualifying interest-only financing. Strong profiles in multiple areas can sometimes compensate for moderate credit scores.

Is an interest-only loan the same as negative amortization?

No, interest-only loans differ fundamentally from negative amortization loans. With interest-only financing, you pay all interest charges each month, so your loan balance remains constant during the interest-only period. Negative amortization means your monthly payment doesn’t even cover interest charges, so unpaid interest adds to your loan balance, increasing your debt over time.

Interest-only loans maintain stable balances during initial periods, then recalculate to fully amortizing payments. This structure provides payment flexibility without increasing your debt burden as negative amortization loans do. Use our calculators to understand payment structures clearly.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.