Landlord Responsibilities: What You’re Really Signing Up For (And What You’re Not)

Landlord Responsibilities: What You’re Really Signing Up For (And What You’re Not)

You’re about to close on your first rental property. The numbers work, the location checks out, and you’re ready to start building wealth through real estate. But here’s the reality check nobody warned you about: becoming a landlord means accepting a specific set of legal responsibilities that don’t care whether you’re ready for them or not.

The difference between successful first-time landlords and those who sell their properties within a year often comes down to understanding exactly what you’re responsible for—and what you’re not. This isn’t about being pessimistic; it’s about making informed decisions that protect both your investment and your sanity.

Let’s cut through the confusion and break down the actual legal obligations you’ll face as a landlord, along with the smart strategies that help you manage them without losing sleep.

Key Summary

This comprehensive guide covers the legal responsibilities landlords must fulfill by law, from habitability requirements to repair obligations, plus the gray areas where state laws and lease agreements determine your duties.

In this guide:

- Your non-negotiable legal obligations as a landlord including habitability standards and safety requirements (landlord-tenant law fundamentals)

- Exactly which repairs you’re responsible for versus which ones tenants must handle (property maintenance standards)

- How state and local laws affect your responsibilities for utilities, pest control, and snow removal (state landlord-tenant regulations)

- The financial implications of landlord responsibilities and how they affect your rental property calculator projections (real estate investment analysis)

Landlord Responsibilities: The Foundation of Habitability You Cannot Avoid

Here’s what every first-time investor needs to understand before signing purchase documents: your primary legal obligation as a landlord is maintaining a habitable living space. This isn’t negotiable, and no lease agreement can waive these requirements.

The “warranty of habitability” exists in virtually every state, though specific requirements vary. At its core, this means you must provide a rental property that’s safe, sanitary, and fit for human occupancy.

What habitability actually means in practice:

Your property must have functioning plumbing with hot and cold running water. Toilets must work. Sinks and showers must drain properly. If your tenant calls about a backed-up toilet at 10 PM on Saturday, that’s not a Monday morning problem—it’s a habitability issue requiring immediate response.

Heat is legally required in most states during winter months. The specific temperature varies by jurisdiction, but expect requirements around 68°F during daytime hours. No heat in January isn’t just inconvenient—it’s a violation of your legal obligations that could result in rent withholding, repair-and-deduct actions, or code enforcement penalties.

Electrical systems must be safe and functional. This means working outlets, proper circuit breakers, and no exposed wiring. When tenants report electrical issues, you’re not evaluating whether it’s “important enough” to address—you’re required to ensure electrical safety.

Weatherproofing protects tenants from the elements. Roofs must not leak. Windows and doors must close and lock. Walls and ceilings must be intact. These aren’t cosmetic issues; they’re fundamental habitability requirements.

The property must comply with all applicable building, housing, and health codes. This includes everything from smoke detectors to carbon monoxide alarms to proper ventilation. Even if you didn’t cause a code violation, you’re responsible for correcting it.

When financing your rental property with FHA loans or conventional financing, lenders will verify the property meets habitability standards through their appraisal process. However, your legal obligations continue long after closing. What passes inspection today must remain habitable throughout the tenancy.

Habitability failures carry serious consequences. Tenants may legally withhold rent, hire contractors to make repairs and deduct costs from rent, break the lease without penalty, or sue for damages. Local code enforcement can issue violations, fines, and in extreme cases, condemnation orders.

Understanding these baseline responsibilities before you purchase prevents the shock many first-time landlords experience when their “passive income” requires active maintenance. Run your numbers with realistic repair and maintenance costs—many new investors underestimate these expenses by 50% or more.

Which Repairs Fall Under Landlord Repair Obligations (And Which Don’t)

The line between landlord and tenant repair responsibilities confuses even experienced investors. State law, local ordinances, and your lease agreement all play a role, but certain patterns emerge across jurisdictions.

Repairs you’re almost always responsible for:

Structural issues are your domain. This includes foundation problems, roof leaks, wall cracks, floor integrity, and any issue affecting the building’s structural soundness. When water comes through the ceiling or cracks appear in the foundation, that’s your responsibility regardless of what your lease says.

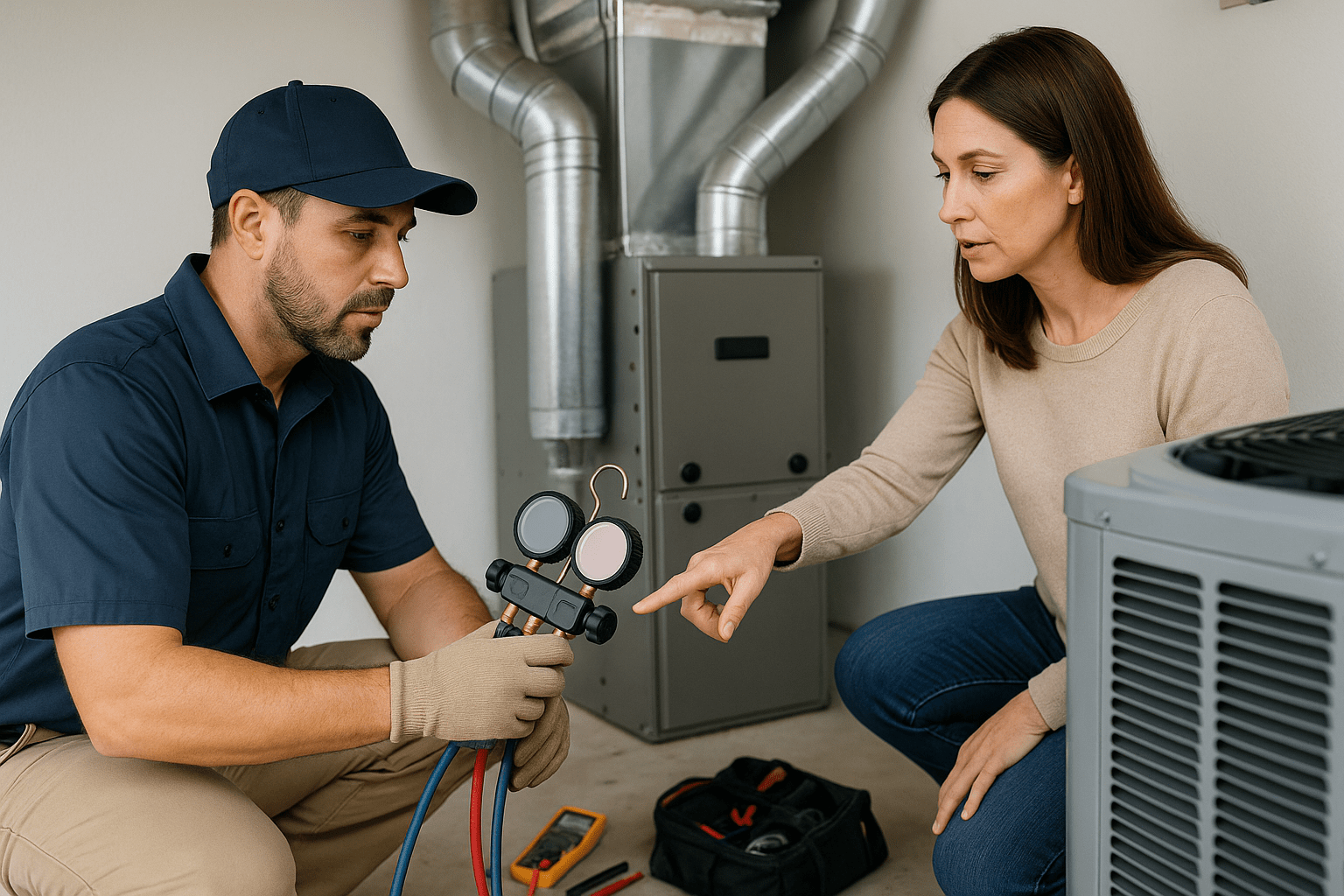

Major system failures belong to you. Furnaces that quit heating, air conditioners that stop cooling, water heaters that fail—these are landlord responsibilities. The same applies to plumbing systems, electrical panels, and septic systems. These aren’t conveniences; they’re essential services you must provide.

Appliances you provide become your responsibility. If you include a refrigerator, dishwasher, or washer/dryer in the rental, you’re typically responsible for maintaining and repairing them. Many experienced landlords specifically exclude appliances from rentals for this reason, but if market conditions require them, factor repair costs into your analysis.

Safety equipment maintenance is non-negotiable. Smoke detectors, carbon monoxide detectors, fire extinguishers, and security systems you installed all require your maintenance. Many jurisdictions require landlords to test these devices regularly and maintain documentation.

Repairs that often fall to tenants:

Damage caused by tenant negligence or misuse is their problem. If your tenant’s child draws on walls with permanent marker, that’s not your repair. If they pour grease down drains causing clogs, they’re responsible for the plumber. If they break a window, they pay for replacement.

Normal wear and tear creates gray areas. A carpet that wears out after eight years of normal use is your replacement cost. A carpet stained by a tenant’s pet is their responsibility. The distinction matters legally and financially.

Minor repairs sometimes belong to tenants, depending on your lease and local law. Some states allow landlords to require tenants to handle repairs under a specific dollar amount (often $100-$200). Many leases require tenants to change HVAC filters, replace light bulbs, and handle minor fixes.

The smartest approach combines clear lease language with realistic expectations. Your lease should specify exactly which repairs fall to which party, but remember that you cannot contractually eliminate your legal obligations for habitability and major repairs. Many first-time landlords try to make tenants responsible for too much, creating enforcement problems and legal exposure.

Consider using a rental property calculator that factors in realistic repair costs based on property age and condition. Most investors should budget 1-2% of property value annually for repairs and maintenance, with higher percentages for older properties.

When investors use DSCR financing to purchase rental properties, they’re often buying properties that need immediate systems upgrades. Understanding repair responsibilities before closing helps you budget accurately and avoid negative cash flow surprises.

Are Landlords Responsible For Light Bulbs? The Small Stuff That Adds Up

This question might seem trivial, but it represents a broader category of minor maintenance issues that consume surprising amounts of time and money for unprepared landlords.

The technical answer: State law and your lease agreement determine light bulb responsibility. Most jurisdictions consider light bulb replacement a tenant responsibility unless the bulb is in a common area or an area the tenant cannot safely access.

The practical answer: How you handle light bulbs and similar minor issues significantly affects your landlord experience.

Many successful landlords include a clause in their lease specifying that tenants are responsible for light bulbs, HVAC filter changes, and other routine maintenance tasks. This sets clear expectations and reduces nuisance calls for issues tenants can easily handle themselves.

However, some landlords prefer different approaches. If you have a high-end rental with specialty bulbs (LED fixtures, recessed lighting, etc.), you might choose to handle bulb replacement to ensure proper types are used. If your tenants are elderly or disabled, you might include light bulb changes in your service.

Minor maintenance items that create surprising workload:

HVAC filter changes should happen monthly or quarterly depending on the system. Many landlords include this in their lease as a tenant responsibility, but then must enforce it to protect their HVAC investment. Some property managers handle filter changes and bill the service back to landlords because it’s more cost-effective than replacing HVAC systems prematurely.

Smoke detector batteries typically require annual replacement. While this seems minor, it’s actually a safety issue with legal implications. Some landlords handle this during annual property inspections. Others make it a tenant responsibility but verify compliance during inspections.

Dryer vent cleaning prevents fires and improves efficiency. Whether this falls to landlord or tenant depends on your lease, but someone needs to handle it annually. Many landlords include this in their preventive maintenance program because the consequences of neglect are severe.

Gutter cleaning prevents water damage that becomes expensive landlord problems. While tenants sometimes agree to handle this task, many landlords prefer to control it through professional service to protect their investment.

The reality most first-time landlords discover: Every “minor” issue you make a tenant responsibility requires enforcement, inspection, or eventual correction when tenants don’t comply. Sometimes it’s more cost-effective to handle routine maintenance yourself or through a property manager, building costs into your rent pricing.

Smart investors using tools like the investment growth calculator include realistic property management costs in their projections, whether they’re self-managing or hiring professionals. These “small stuff” costs add up quickly.

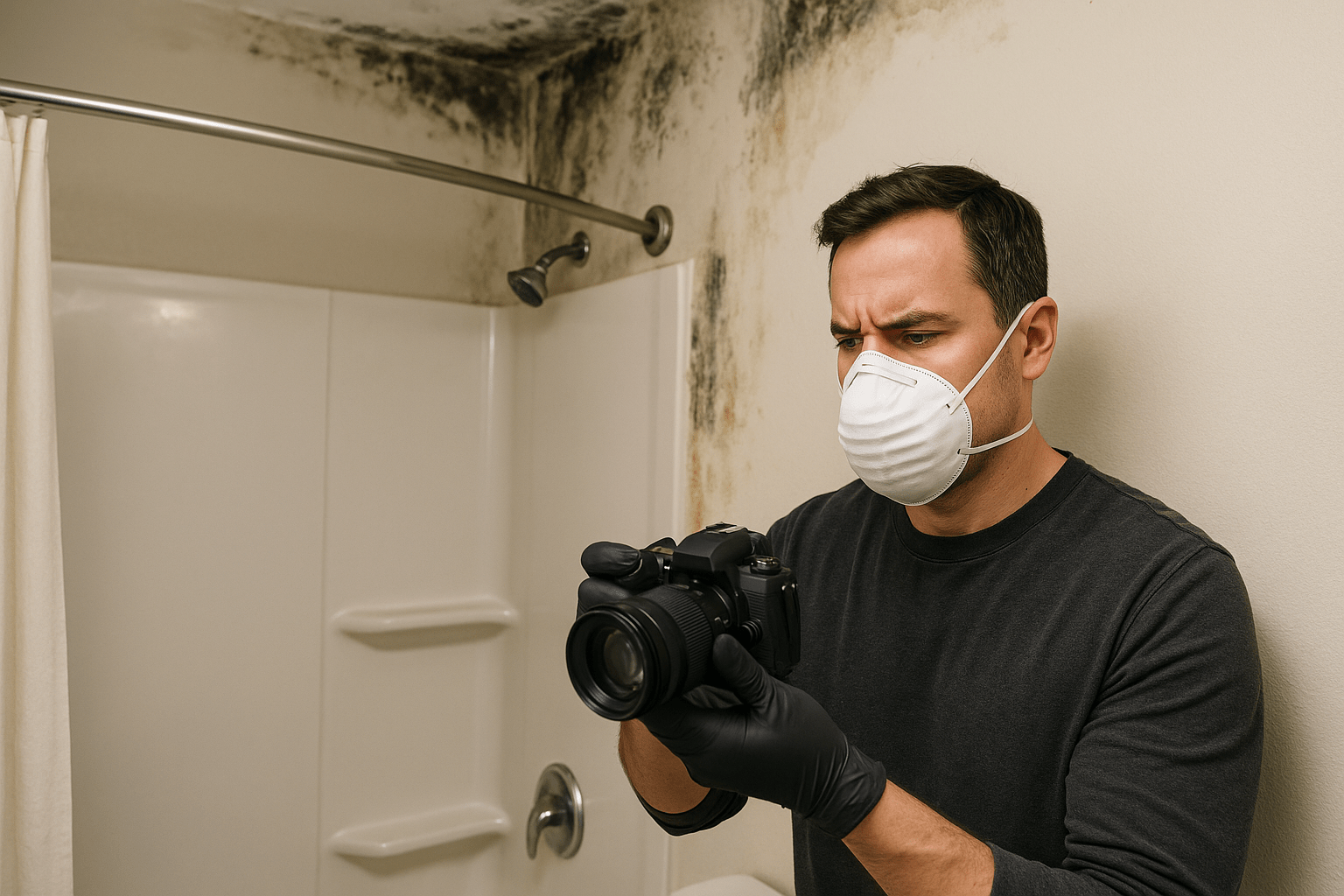

Are Landlords Responsible For Mold? Understanding Your Environmental Obligations

Mold represents one of the most serious—and expensive—landlord responsibilities. The legal landscape around mold has evolved significantly, and first-time landlords who don’t understand their obligations face substantial liability.

Your legal responsibility for mold:

You must address moisture problems that cause mold. This includes fixing leaky roofs, repairing plumbing leaks, addressing condensation issues, and correcting any building defect that allows water intrusion. Mold itself is typically a symptom of an underlying moisture problem that falls under your habitability obligations.

You must respond promptly to tenant reports of mold or moisture. “Promptly” varies by jurisdiction, but 24-72 hours is typical for initial response on serious issues. Ignoring mold complaints or delaying repairs creates legal liability if tenants develop health issues.

You must follow proper mold remediation procedures when addressing mold problems. In many states, this means hiring certified mold remediation contractors for significant mold issues. DIY cleanup with bleach doesn’t meet legal standards for substantial mold problems.

When mold becomes a tenant responsibility:

Tenants are typically responsible for mold that results from their failure to maintain reasonable cleanliness or ventilation. If your tenant never opens windows, runs humidifiers constantly, or fails to report water leaks promptly, they may bear responsibility for resulting mold.

However, this creates a gray area because you must still prove tenant negligence caused the mold problem. In practice, landlords often end up addressing mold even when tenant behavior contributed to it, then pursuing reimbursement through security deposits or legal action.

The financial reality of mold:

Minor mold cleanup might cost $500-$1,500 for a bathroom or small area. Significant mold remediation in multiple rooms can easily reach $10,000-$30,000. Worst-case scenarios involving structural damage and full-home remediation can exceed $50,000.

Even more expensive than remediation are mold-related lawsuits. If tenants develop respiratory issues or other health problems they attribute to mold exposure, you face potential medical costs, relocation expenses, rent abatement, and punitive damages.

Prevention strategies that protect your investment:

Address moisture problems immediately when they arise. A $500 plumbing repair today prevents a $15,000 mold remediation next year. This is where having adequate reserves makes the difference between manageable maintenance and financial disaster.

Include ventilation requirements in your lease. Specify that tenants must use bathroom exhaust fans during showers, report water leaks within 24 hours, and maintain reasonable ventilation. While this doesn’t eliminate your responsibilities, it creates documentation of your expectations.

Conduct regular property inspections (with proper notice) to identify moisture problems early. Many experienced landlords inspect properties quarterly or semi-annually, catching issues before they become major problems.

Install moisture monitoring devices in problem areas like basements or crawl spaces. Some modern property management systems include sensors that alert landlords to humidity spikes or water presence before visible damage occurs.

When you’re financing rental properties with programs like DSCR loans, your lender doesn’t factor in catastrophic repair costs like major mold remediation. You need reserves beyond your financing to handle these situations. Most experienced investors maintain 6-12 months of operating expenses in reserves per property, with higher amounts for older buildings.

Consider umbrella insurance coverage beyond standard landlord policies. Mold claims often exceed basic policy limits, and umbrella coverage provides additional protection at relatively low cost.

Pest Control Apartment Laws: Who Pays The Exterminator?

Pest control responsibility varies significantly by state law, local ordinance, and specific circumstances. Understanding these rules before you rent your first property prevents expensive surprises and tenant disputes.

General legal principles:

Most jurisdictions require landlords to provide pest-free properties at move-in and maintain buildings in ways that prevent infestations. This means sealing entry points, fixing plumbing leaks that attract pests, and maintaining proper sanitation in common areas.

Pest problems existing at move-in or caused by building defects are typically landlord responsibilities. If your new tenant discovers cockroaches in the first week, that’s your problem to solve regardless of lease language claiming otherwise.

State-by-state variation creates complications:

Some states explicitly require landlords to pay for all pest control. California, for example, considers pest-free housing part of habitability, making landlords responsible for eliminating infestations except when tenants clearly caused them.

Other states allow lease agreements to allocate pest control costs to tenants for certain pest types. Many landlords in these jurisdictions include clauses making tenants responsible for pest problems that result from their behavior.

Still other states remain silent on pest control, leaving the issue to lease agreements and common law principles around habitability and property maintenance.

Common pest control scenarios:

Cockroaches and rodents typically fall to landlords when infestations affect multiple units or clearly result from building conditions. A single-family home with mice entering through foundation gaps is a landlord problem. A tenant who leaves food out attracting ants creates a different situation.

Bed bugs create unique challenges because they travel with people and belongings but spread through building structures. Many landlords now include specific bed bug clauses in leases, but legal responsibility often depends on proving how the infestation started—nearly impossible in practice.

Termites and structural pests are almost always landlord responsibilities. These pests threaten the building itself, not just tenant comfort, placing them squarely in landlord territory.

Smart pest control strategies:

Many experienced landlords include quarterly preventive pest control service as part of property maintenance, building costs into rent pricing. This prevents infestations from developing and provides documentation of proactive management.

When pest problems arise despite preventive measures, address them immediately regardless of whose “fault” they might be. The cost of quick extermination is usually less than the cost of tenant turnover, rent abatement demands, or legal action.

Include clear pest prevention requirements in your lease. Require tenants to maintain cleanliness, report pest sightings immediately, and cooperate with extermination efforts. While this doesn’t eliminate your legal responsibilities, it creates behavioral expectations that prevent many problems.

Consider the pest history of any property before purchase. Properties with recurring pest issues will continue having them unless you make significant building modifications. Factor these costs into your acquisition analysis—using your rental property calculator to model pest control costs in realistic scenarios.

Properties financed with FHA loans require pest inspections in many regions, particularly for termites. While this protects you from buying infested properties, remember that pest prevention becomes an ongoing operational expense affecting your cash flow projections.

Are Landlords Responsible For Snow Removal? Weather-Related Obligations

Snow removal responsibility depends heavily on your location, property type, and lease agreement. But regardless of contractual language, landlords face certain non-negotiable obligations around weather safety.

Legal requirements in snow-prone regions:

Most jurisdictions require property owners to maintain safe ingress and egress routes. This means you must keep primary walkways, stairs, and parking areas reasonably clear of snow and ice to prevent slip-and-fall accidents.

The specific timeline varies. Some cities require snow removal within 24 hours of snowfall ending. Others specify shorter periods—sometimes as little as 6 hours for sidewalks. Check your local ordinances for exact requirements.

Liability for injuries from snow and ice falls primarily on property owners regardless of who’s contractually responsible for removal. If your tenant slips on an icy walkway and breaks their ankle, you’re the defendant in the lawsuit even if your lease says tenants handle snow removal.

Single-family versus multi-unit properties:

With single-family rentals, many landlords make snow removal a tenant responsibility through the lease agreement. This works better with stable long-term tenants who live in the property full-time and can handle the responsibility.

However, smart landlords still verify compliance and have backup plans. If your tenant doesn’t shovel and someone gets injured, your “tenant responsibility” clause won’t prevent your liability. Some landlords prefer to hire snow removal services and build costs into rent rather than risk tenant non-compliance.

With multi-unit properties, landlords almost always handle snow removal for common areas. Walkways, parking lots, and shared stairs are landlord territory. Even when individual tenants are responsible for their own stoops or designated parking spots, common areas remain the landlord’s obligation.

Practical snow removal strategies:

Establish relationships with snow removal contractors before winter arrives. Many contractors offer seasonal contracts providing priority service during storms. These contracts typically cost more than per-storm pricing but guarantee availability when you need it most.

For properties where tenants handle snow removal, include specific lease requirements. Define which areas need clearing, acceptable timelines, and consequences for non-compliance. Many landlords require photographic proof of snow removal after major storms.

Consider liability implications in your decision-making. The cost of professional snow removal service for an entire winter is usually less than one slip-and-fall settlement. Many experienced landlords simply include snow removal in their operating budget and handle it professionally rather than depending on tenants.

Understand your insurance coverage for winter weather incidents. Standard landlord policies typically cover slip-and-fall claims, but verify your specific coverage and consider umbrella policies for additional protection.

Regional considerations:

In areas with heavy, frequent snow, professional removal is often the only practical approach. Expecting tenants to handle repeated storms throughout long winters creates compliance issues and safety risks.

In areas with occasional snow, a hybrid approach might work. Tenants handle light snowfalls while landlords arrange professional service for significant storms or ice events.

In areas where snow is rare, having a reliable contractor on call for emergency situations prevents scrambling during the few times you need service.

When you’re evaluating properties in different regions, weather-related maintenance costs vary dramatically. A rental in Buffalo, New York requires substantially different budgeting than one in Nashville, Tennessee. Your rental property calculator should reflect realistic local costs.

Landlord Responsibility After Fire: When Disaster Strikes Your Rental

Fire represents every landlord’s nightmare scenario. Understanding your responsibilities after fire damage helps you respond appropriately when the worst happens.

Immediate responsibilities:

Secure the property to prevent further damage and unauthorized access. This might mean boarding up windows, installing temporary fencing, or hiring security services depending on damage severity.

Notify your insurance carrier immediately. Most policies require prompt notification of losses, and delays can jeopardize coverage. Document everything with photographs and written records.

Address habitability issues that make the property unlivable. If fire damage renders the property uninhabitable, you must release tenants from the lease or provide alternative housing in most jurisdictions. You cannot require tenants to pay rent for an uninhabitable property.

Preserve tenant belongings when possible. While you’re not responsible for replacing tenant property (that’s what renters insurance covers), you have duties around preserving salvageable items and providing reasonable access for tenants to retrieve belongings.

Financial responsibilities:

You’re typically responsible for repairing fire damage to restore the property to habitable condition. This obligation exists whether fire was caused by your negligence, tenant negligence, or pure accident. Your insurance should cover these costs (minus your deductible), but you’re ultimately responsible.

If fire resulted from your negligence (faulty wiring you knew about, code violations you ignored, failure to maintain smoke detectors), you may face liability for tenant property damage, relocation costs, and injury claims.

Rent abatement during repairs is typically required. Tenants don’t pay rent for uninhabitable properties. Some leases include provisions for partial rent during partial habitability, but complete fire damage usually means zero rent until repairs complete.

Lease continuation or termination:

Most leases include provisions addressing fire or casualty damage. Common approaches include automatic termination if damage exceeds a certain percentage of property value, landlord option to terminate, or tenant option to terminate.

If your lease doesn’t address fire damage specifically, state law determines whether tenants can terminate. Many jurisdictions allow tenants to void leases when properties become uninhabitable through no fault of theirs.

Some landlords and tenants choose to continue leases with rent abatement during repairs, resuming normal terms once the property is habitable again. This works when both parties want to maintain the tenancy and repairs are expected to complete reasonably quickly.

Prevention and preparation:

Install and maintain proper fire detection and suppression systems. Smoke detectors, carbon monoxide detectors, and fire extinguishers are legal requirements in most jurisdictions. Some landlords go further with sprinkler systems in higher-risk properties.

Conduct regular safety inspections focusing on fire risks. Check electrical systems, heating equipment, dryer vents, and other potential ignition sources. Many fires are preventable with proper maintenance.

Require tenants to maintain renters insurance. While this doesn’t eliminate your responsibilities, it ensures tenants can cover their belongings and temporary housing costs without demanding you compensate them.

Maintain adequate landlord insurance including loss of rent coverage. Standard policies cover property damage, but loss of rent coverage compensates you for lost income during repairs. This can be the difference between financial survival and disaster when major repairs take months.

When you’re financing multiple rental properties through programs like portfolio loans, a fire affecting one property can threaten your entire investment strategy if you lack adequate reserves and insurance. Build sufficient cushion into your financial planning to absorb temporary setbacks without compromising your other properties.

Are Landlords Responsible For Unpaid Utility Bills? Money Matters Beyond Rent

Utility responsibility creates frequent confusion and occasional financial shocks for unprepared landlords. The rules vary by utility type, local regulations, and your lease agreement.

General principles:

Tenants typically pay for utilities they control and consume in their individual units. This includes electricity, gas, water, sewer, and trash service when individually metered.

Landlords typically pay for utilities serving common areas in multi-unit properties. Hallway lighting, parking lot lights, and shared laundry facilities run on landlord-paid utilities.

The gray area emerges with non-metered utilities, utility transfers, and tenant non-payment situations.

When landlords remain responsible despite tenant obligations:

Some municipalities hold property owners ultimately responsible for water, sewer, and trash bills regardless of lease agreements stating tenants will pay. If your tenant doesn’t pay their water bill, the city may place a lien on your property or shut off service. You end up paying the bill to protect your property.

This situation varies significantly by location. Some jurisdictions allow landlords to transfer utility accounts entirely to tenants, eliminating landlord liability. Others maintain property owner responsibility as a method of ensuring utility bills get paid.

Before purchasing rental property, verify local policies around utility responsibility. Properties where landlords remain ultimately liable for utilities require different rent pricing and lease structures than properties where tenants bear full responsibility.

Strategies for managing utility responsibilities:

Require proof of utility transfer within a specific timeframe after move-in. Many landlords include lease clauses requiring tenants to establish utility accounts within 5-7 days and provide proof of account establishment.

Include utility payment requirements clearly in lease agreements. While this doesn’t eliminate all problems, it creates enforcement mechanisms when tenants fail to meet obligations.

Consider requiring utility deposits for high-risk tenants. Some landlords collect deposits equal to 2-3 months of estimated utility costs, refundable when tenants provide proof of final utility payment after move-out.

In jurisdictions where landlords remain ultimately responsible for certain utilities, consider RUBS (Ratio Utility Billing System) or including utilities in rent. While this adds administrative complexity, it prevents surprise bills and protects against tenant non-payment.

The financial impact on your investment:

Unexpected utility bills can significantly affect cash flow, particularly for newer investors operating with thin margins. A tenant who doesn’t pay water bills for six months before moving out can leave you with $600-$1,200 in unexpected costs.

Some utilities become liens against your property if unpaid, affecting your ability to refinance or sell. Water and sewer bills commonly carry lien rights, meaning the municipality can force payment through your property.

When analyzing potential rental property purchases, research the local utility landscape. Properties in jurisdictions where landlords face utility liability require higher rent to offset risk, or alternatively, you structure leases to include utilities in rent from the start.

For investors using DSCR financing to purchase rental properties, utility costs directly affect your debt service coverage ratio calculations. If you’re borderline on DSCR requirements, unexpected utility responsibilities can push your property into negative cash flow territory, affecting your ability to scale your portfolio.

Tenant Rights During Major Repairs: Balancing Your Obligations With Property Access

Major repair projects create tension between landlord responsibilities and tenant rights. Understanding how to manage significant repairs while respecting tenant occupancy prevents legal problems and relationship breakdowns.

Your right to access for repairs:

State law universally grants landlords reasonable access to rental properties for repairs, maintenance, and inspections. However, “reasonable” comes with constraints protecting tenant privacy and quiet enjoyment rights.

Most jurisdictions require 24-48 hours advance notice for non-emergency access. Your lease should specify the notice requirement matching or exceeding state minimums. Emergency repairs (burst pipes, gas leaks, fire hazards) allow immediate access without notice.

Access must occur during reasonable hours, typically defined as normal business hours on weekdays unless tenants agree otherwise. Evening and weekend access requires tenant consent except for genuine emergencies.

You cannot abuse access rights to harass tenants or interfere with their quiet enjoyment of the property. Requesting daily access for minor issues or conducting unnecessarily disruptive repairs can create legal liability.

Tenant rights during extended repairs:

Tenants may be entitled to rent abatement during major repairs that substantially interfere with property use. The specific reduction depends on the degree of interference—full abatement if property becomes uninhabitable, partial abatement if repairs affect only portion of property.

Tenants cannot be forced to vacate during repairs unless the property becomes genuinely uninhabitable or local code requires vacancy. Even then, you may need to provide alternative housing or allow lease termination without penalty.

Tenants have the right to reasonable notice about repair schedules, expected completion timelines, and any disruptions they should anticipate. Surprising tenants with major renovation projects without warning violates their quiet enjoyment rights.

Some jurisdictions require landlords to offer temporary relocation assistance for repairs expected to last beyond a certain duration. This might include hotel costs, storage fees, or rent discounts on alternative properties you control.

Managing major repair projects:

Communicate extensively before starting major projects. Provide detailed written notice explaining the work, why it’s necessary, expected timeline, and how tenants will be affected. This prevents misunderstandings and demonstrates professionalism.

Schedule disruptive work when it least impacts tenants. Many landlords coordinate major projects between tenancies or arrange temporary relocations when repairs require it. The cost of vacancy or relocation is often less than the cost of tenant disputes and potential rent abatement.

Hire professional, licensed contractors for major work. Beyond ensuring quality repairs, professional contractors carry insurance protecting you from liability and understand how to work in occupied properties minimizing tenant disruption.

Document everything related to major repairs. Photographs before and after work, copies of notices provided to tenants, contractor invoices, and tenant communications create records protecting you if disputes arise.

The financial reality:

Major repairs during tenancy cost more than the same repairs during vacancy. You’re paying contractors to work around tenant schedules, potentially paying rent abatement, and accepting longer timelines. Many experienced landlords prefer scheduling major repairs between tenancies when possible.

However, some repairs cannot wait for tenant turnover. Roof leaks, HVAC failures in extreme weather, and structural issues require immediate attention regardless of occupancy. Having adequate reserves for these situations prevents difficult decisions between financial strain and legal obligations.

When you’re scaling a rental portfolio using financing options like DSCR loans, major repair costs across multiple properties can strain reserves quickly. Smart investors maintain repair reserves based on property age and condition, with higher amounts for older buildings requiring more frequent major repairs.

How Landlord Responsibilities Affect Your Investment Pro Forma

First-time investors often overlook how landlord responsibilities impact their financial projections. The difference between your pro forma and reality often comes down to understating these operational realities.

Hidden costs in landlord responsibilities:

Responsive management availability costs money whether you self-manage or hire professionals. Tenants don’t restrict problems to business hours. Late-night emergencies, weekend repairs, and holiday issues all require response. Self-managing landlords sacrifice personal time; those hiring managers pay for 24/7 availability.

Preventive maintenance programs reduce emergency repairs but add ongoing costs. Professional HVAC service, gutter cleaning, pest control, and safety inspections cost $1,500-$3,000 annually for typical single-family rentals. Many new investors budget only for repairs, not prevention, creating long-term problems.

Liability insurance protecting against responsibility-related lawsuits costs more than basic property insurance. Umbrella policies, higher liability limits, and specific coverage for issues like lead paint or mold add substantial annual costs that affect cash flow.

Administrative time tracking responsibilities, coordinating repairs, and documenting compliance has real value. Self-managing landlords must account for their time opportunity cost; those hiring management pay 8-12% of rent covering these administrative functions.

Budgeting for actual landlord responsibilities:

Conservative investors budget 10-15% of gross rent for repairs and maintenance. This covers both routine maintenance and moderate repairs. Older properties or those in harsh climates require higher percentages.

Emergency reserves beyond your operating budget protect against major responsibility events. Most experienced investors maintain 6-12 months of operating expenses per property covering situations like major HVAC replacement, roof repairs, or extended vacancy following major damage.

Property management costs—whether professional fees or your own time valuation—should appear in every pro forma. Properties that “work” only if you provide free management don’t actually work. Your time has value, and your analysis should reflect it.

Legal and compliance costs including attorney consultations, required disclosures, and regulatory compliance add up. Budget $500-$1,500 annually per property for these expenses depending on your jurisdiction’s requirements.

Using financial tools effectively:

The rental property calculator helps model these costs realistically. Input conservative estimates rather than optimistic ones. Properties that barely work with optimistic projections will lose money in reality.

The investment growth calculator demonstrates how landlord responsibility costs compound over time. A property with thin margins from year one only gets tighter as maintenance needs increase with building age.

Passive income calculator tools reveal the true passive nature of rental income after accounting for landlord responsibilities. Many investors discover their rental income requires substantial active management to generate returns, changing their overall investment strategy.

When you finance properties with loans like conventional financing or DSCR loans, your lender evaluates debt coverage based on gross rents. They don’t reduce rent for realistic landlord responsibility costs. You must model these costs separately to understand true cash flow and avoid over-leveraging your portfolio.

What You’re Not Responsible For: Understanding The Boundaries

Understanding what you’re not responsible for matters as much as knowing your obligations. First-time landlords who accept responsibility for everything burn out quickly and lose money unnecessarily.

Tenant-caused damage:

Normal wear and tear belongs to you, but damage beyond normal wear falls to tenants. Carpet that wears out after reasonable use is your cost. Carpet stained by pet urine is tenant responsibility, properly documented and deducted from security deposits.

The challenge comes in proving damage exceeds normal wear. Detailed move-in and move-out inspections with photographs create documentation supporting security deposit deductions. Without proper documentation, judges typically rule in favor of tenants.

Tenant property and belongings:

You’re not responsible for tenant personal property except in situations involving your negligence or breach of habitability. If your tenant’s expensive TV is stolen, that’s not your responsibility unless the theft resulted from locks you failed to repair after tenant reports.

Required disclosure of crime risks varies by state, but you’re generally not an insurer of tenant safety beyond maintaining reasonably secure premises. Requiring renters insurance protects tenants while limiting your exposure to their loss claims.

Cosmetic preferences:

Tenants cannot require you to upgrade properties beyond habitability standards. If your tenant wants granite countertops instead of the functional laminate you provided, that’s a preference not a responsibility. If tenants want to paint walls different colors, that’s their choice—with written permission and agreement about restoration requirements.

This principle extends to aging but functional items. Your tenant might prefer a newer refrigerator or more modern light fixtures, but as long as existing items function properly, you’re not obligated to upgrade at tenant request.

Services beyond your agreement:

Lease agreements define your services. If you didn’t promise lawn care, snow removal, or pest control, you’re not automatically responsible for providing them. Of course, local law might require certain services regardless of lease language, but services beyond legal requirements and your lease promises aren’t your responsibility.

This creates opportunity for premium pricing. Some landlords charge higher rent including comprehensive services, while others offer lower base rent with tenants handling more responsibilities. Know your local market and price accordingly.

Tenant life circumstances:

You’re not responsible for solving tenant financial problems, relationship issues, or life challenges. While compassion and flexibility can build goodwill, remember you’re running a business. Tenant job loss creating rent payment issues isn’t your responsibility to solve.

Many experienced landlords make the mistake of becoming too emotionally involved in tenant situations. While treating tenants with respect and dignity matters, you cannot become their financial safety net without compromising your own investment.

The boundaries protect your investment:

Clear boundaries prevent scope creep where you gradually accept more responsibility than necessary. Your lease should explicitly define what you provide, what tenants handle, and what falls outside the landlord-tenant relationship.

When problems arise, distinguish between issues you’re legally responsible for, issues your lease commits you to, and issues that are simply tenant requests. Responding appropriately to each category prevents burnout while maintaining legal compliance.

Smart property management means saying “no” professionally when appropriate. “I understand that’s frustrating, but that’s not something covered under our lease agreement” maintains professionalism while enforcing boundaries.

Moving Forward: Making Informed Decisions About Landlord Responsibilities

Your path forward as a rental property investor depends on realistic understanding of landlord responsibilities combined with smart systems and resources minimizing their burden.

Before you buy your next property:

Research local landlord-tenant law thoroughly. State statutes, city ordinances, and housing codes all affect your responsibilities. Many areas offer free landlord training courses through housing departments or real estate associations—take advantage of these resources.

Calculate conservative operating budgets including realistic responsibility costs. Use tools like the rental property calculator to model scenarios with higher-than-expected repair costs, longer vacancies, and inevitable responsibility surprises. Properties that work only with optimistic projections will disappoint.

Evaluate property condition focusing on systems and structures creating the most responsibility. Older HVAC systems, aging roofs, and outdated electrical all represent imminent responsibility events. Factor replacement costs into your acquisition analysis or negotiate purchase prices accounting for deferred maintenance.

Consider property management costs even if you plan to self-manage initially. Understanding the full cost of professional management gives you an exit option if self-management becomes burdensome. Many successful investors start self-managing but transition to professional management as their portfolios grow.

Building systems that manage responsibilities efficiently:

Create response protocols for common responsibility scenarios. Written procedures for handling repair requests, emergency situations, and routine maintenance ensure consistent, appropriate responses even when you’re not available.

Develop a reliable contractor network before you need it. Established relationships with plumbers, electricians, HVAC technicians, and general contractors mean faster, more reliable service when problems arise. Many experienced landlords maintain preferred vendor lists with 2-3 options per trade.

Implement preventive maintenance programs reducing emergency repairs. Annual HVAC service, quarterly pest control, and seasonal property inspections catch problems before they become expensive emergencies. The cost of prevention is typically 30-50% less than emergency repairs.

Use technology streamlining responsibility management. Property management software, online rent payment systems, and digital maintenance request platforms reduce administrative burden while improving documentation for legal protection.

Protecting yourself legally and financially:

Maintain comprehensive landlord insurance including liability coverage, loss of rent protection, and umbrella policies. The cost of proper insurance is minor compared to potential lawsuit settlements or uninsured property damage.

Document everything related to your landlord responsibilities. Photographs of property conditions, copies of tenant notices, records of repairs performed, and logs of tenant communications create protection if disputes arise.

Consult with landlord-tenant attorneys before problems escalate. Many attorneys offer consultation packages specifically for landlords, providing guidance on compliance, dispute resolution, and liability protection. The cost of preventive legal advice is far less than defending against lawsuits.

Consider forming LLCs or other legal structures protecting personal assets from landlord liability. While structures don’t eliminate responsibilities, they create legal separation between rental properties and your personal wealth.

The long-term perspective:

Successful landlords accept that responsibilities come with the territory. The goal isn’t eliminating responsibilities—it’s managing them efficiently while maintaining profitable operations.

Properties with solid fundamentals—good locations, strong rental demand, appropriate pricing—generate sufficient income covering responsibility costs while still producing returns. Properties acquired with thin margins leave no room for the reality of landlord responsibilities.

Your skills managing responsibilities improve with experience. First-year landlords often struggle with issues that experienced investors handle routinely. The learning curve matters, but so does building proper systems from the start.

Consider whether landlording fits your personality and lifestyle. Some investors thrive on the management aspects of real estate. Others discover they prefer passive investments or different property types requiring less intensive management. Neither approach is wrong—but understanding your preferences prevents making investments misaligned with your goals.

Ready to get pre-approved for your next rental property? Make sure your financing approach accounts for the true costs of landlord responsibilities. Whether you’re using FHA financing for a house-hacking property or DSCR loans for an investment property, understanding responsibility costs helps you structure deals that work in reality, not just on paper.

Frequently Asked Questions About Landlord Responsibilities

Are landlords responsible for pest control in all situations?

Landlord responsibility for pest control depends on state law, the type of pest, and what caused the infestation. Generally, landlords must provide pest-free properties at move-in and address infestations resulting from building defects or existing conditions. If pests appear due to tenant behavior (leaving food out, poor sanitation), tenants may be responsible. However, many landlords include preventive pest control in their operating budgets to avoid disputes and protect property value. In states like California, pest control is considered part of habitability, making it primarily a landlord responsibility regardless of cause.

What happens if a landlord doesn’t fulfill their repair responsibilities?

When landlords fail to make required repairs, tenants have several legal remedies depending on state law. These typically include withholding rent until repairs are made, hiring contractors to make repairs and deducting costs from rent (repair-and-deduct), breaking the lease without penalty, or suing for damages including reduced property value, relocation costs, and sometimes punitive damages. Additionally, local code enforcement can issue violations, fines, and in extreme cases, condemnation orders. The severity of consequences depends on the severity of the repair issue—habitability violations like no heat carry more serious consequences than cosmetic issues.

Can lease agreements eliminate landlord responsibilities for repairs?

No—landlords cannot contractually eliminate legal responsibilities for habitability and major repairs required by state law. Even if your lease says “tenant is responsible for all repairs,” this language cannot override state habitability requirements. Courts will void lease provisions that attempt to waive landlord obligations for essential services like heat, water, structural integrity, and safety. However, leases can allocate responsibility for minor repairs, cosmetic updates, and maintenance tasks beyond legal minimums. The key distinction is between legally required responsibilities (which cannot be waived) and additional services (which can be negotiated).

How quickly must landlords respond to repair requests?

Response time requirements vary by repair severity and state law. Emergency repairs affecting habitability—no heat in winter, major water leaks, gas leaks, or loss of electricity—typically require immediate response (within hours). Non-emergency repairs affecting habitability—like broken appliances or minor leaks—generally require response within 24-72 hours and completion within reasonable timeframes (often 7-30 days depending on complexity). Non-urgent repairs might have longer response requirements. Many states don’t specify exact timelines but require “reasonable” response, which courts interpret based on the repair’s impact on tenant comfort and safety. Smart landlords establish their own response protocols exceeding minimum requirements.

Do landlords have to pay for hotel costs during major repairs?

Whether landlords must pay for tenant hotels during repairs depends on the situation and jurisdiction. If repairs result from landlord negligence or habitability violations, you likely owe alternative housing costs. If repairs result from casualty events like fire (regardless of fault), some jurisdictions require temporary housing assistance while others simply allow tenants to break leases. Your insurance may cover these costs if included in your policy. Many leases address this scenario specifically—some require landlord-paid hotels for repairs exceeding certain durations, others simply allow lease termination. If repairs make the property completely uninhabitable, tenants at minimum shouldn’t pay rent and may have rights to lease termination without penalty.

Are landlords responsible for tenant safety from crime?

Landlord responsibility for tenant safety from crime is limited but real. You must maintain reasonably secure premises including working locks, adequate lighting in common areas, and repairs to security features like gates or alarm systems. You cannot guarantee tenant safety from crime, but you can be liable for criminal injuries if they result from your negligence (failure to fix broken locks after tenant reports, inadequate security in properties with known high crime). Many states require disclosure of serious crimes occurring on property. Landlords are not insurers of tenant safety and generally aren’t responsible for random criminal acts. However, maintaining reasonable security measures and making prompt security-related repairs protects both tenants and your legal exposure.

Related Resources

For First-Time Investors Building Knowledge:

House Hacking: Living In Your First Investment Property While Building Wealth explains how to minimize landlord responsibilities while learning property management by owner-occupying your first rental property.

Rental Property Cash Flow: What First-Time Investors Get Wrong helps you model realistic expenses including landlord responsibility costs that affect your bottom line.

Property Management vs Self-Management: Making The Right Choice breaks down when to hire professional management and when to handle landlord responsibilities yourself.

Taking Next Steps In Your Investment Journey:

Scaling Beyond Four Properties: Portfolio Growth Strategies discusses how managing landlord responsibilities changes as your portfolio grows beyond conventional financing limits.

Creating Systems For Investment Property Success provides frameworks for efficiently managing landlord responsibilities across multiple properties.

Financing Your Rental Properties:

FHA Loan financing allows first-time investors to purchase multi-unit properties with low initial investment, making landlord responsibilities more manageable with multiple rental incomes.

Conventional Loan programs offer competitive financing for investment properties when you’re ready to move beyond owner-occupied restrictions.

DSCR Loan financing qualifies you based on property income rather than personal income, ideal for investors scaling portfolios where landlord responsibilities create passive income replacing active employment.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.