House Hacking for Beginners: Live for Free While Building Wealth

House Hacking for Beginners: Live for Free While Building Wealth

House Hacking for Beginners: The Strategy That Eliminates Your Largest Expense

Whether you’re a young adult looking to escape the rent trap or a parent helping your twenty-something build wealth early, house hacking is the most powerful strategy for eliminating housing costs while building equity. This isn’t just theory—tens of thousands of young adults live for free (or get paid to live) by implementing this approach.

In this comprehensive guide, you’ll discover:

- What house hacking actually means and why it’s perfect for young adults

- Different house hacking strategies from beginner to advanced

- How to qualify for house hacking properties with minimal down payment (according to FHA guidelines)

- Real numbers showing how house hacking eliminates rent and builds wealth

- Step-by-step implementation from finding properties to managing tenants

- Common mistakes that derail house hacking attempts and how to avoid them

The young adults building serious wealth in their twenties aren’t just buying homes—they’re strategically eliminating their largest expense while forcing tenants to build their equity.

Ready to explore house hacking for your situation? Schedule a call to discuss whether this strategy fits your goals and how to implement it successfully.

What Exactly Is House Hacking?

House hacking is purchasing a property, living in part of it, and renting out the other part(s) to cover your housing costs. At its core, it transforms your primary residence into a wealth-building investment that pays you instead of costing you.

The basic concept:

- Buy property using owner-occupied financing (lower down payment, better rates)

- Live in one portion as your primary residence

- Rent remaining portion(s) to tenants

- Rental income pays most or all of mortgage payment

- Your housing cost dramatically reduced or eliminated

- Build equity while living for free or near-free

Why it’s powerful for young adults:

Financial Acceleration:

- Eliminates largest monthly expense (housing)

- Builds equity through forced savings

- Captures property appreciation

- Creates positive cash flow in many cases

- Allows aggressive saving for next investment

Lifestyle Fit:

- Young adults often more flexible about living situations

- Willing to share property with tenants/roommates

- Less need for privacy than families with children

- Can handle minor property management duties

- Time to build systems before life gets complicated

Wealth Compounding:

- Start building rental property portfolio in twenties

- Equity from first property funds second purchase

- Experience gained managing tenants and properties

- Tax benefits of real estate ownership

- Compound effect over decades is extraordinary

The strategy works because you’re using other people’s rent money to pay your mortgage while you live there essentially for free. After a few years, you can move to your next property and convert the first one to a full rental, beginning your investment portfolio.

Use the FHA loan program designed for owner-occupied multi-unit properties with minimal down payment requirements.

What Are the Different House Hacking Strategies?

House hacking isn’t one-size-fits-all. Different property types and strategies work for different personalities, budgets, and markets. Understanding your options helps you choose the approach that fits your situation.

Strategy #1: Multi-Unit Property (2-4 Units)

How it works:

- Purchase duplex, triplex, or fourplex

- Live in one unit as primary residence

- Rent remaining units to separate tenants

- Each unit has own entrance, kitchen, bathroom

- Maximum privacy for owner and tenants

Financial example (Fourplex):

- Purchase price: $400,000

- Down payment (FHA 3.5%): $14,000

- Monthly mortgage payment: $2,800

- Rent per unit: $1,200

- Three rented units: $3,600 monthly

- Your housing cost: -$800 (you get paid $800 to live there)

Best for:

- Buyers who want privacy from tenants

- Those comfortable with property management

- Markets where multi-units are available

- People planning long-term rental portfolio

Challenges:

- Higher purchase prices than single-family

- More complex management (multiple leases)

- Vacancy in one unit still impacts income

- May require more maintenance

Strategy #2: Single-Family Home with Rented Bedrooms

How it works:

- Purchase regular single-family house

- Live in master bedroom

- Rent additional bedrooms to roommates

- Share common areas (kitchen, living room)

- More interaction with “tenants”

Financial example (3-Bedroom House):

- Purchase price: $300,000

- Down payment (FHA 3.5%): $10,500

- Monthly mortgage payment: $2,100

- Rent per bedroom: $800

- Two rented bedrooms: $1,600 monthly

- Your housing cost: $500 (plus your own room)

Best for:

- Those comfortable with roommate situations

- Markets where multi-units are scarce or expensive

- Buyers wanting single-family home long-term

- People with friends who need housing

Challenges:

- Less privacy than separate units

- Shared space management

- Finding compatible roommates

- Potential for interpersonal conflicts

Strategy #3: Duplex (Side-by-Side or Up/Down)

How it works:

- Purchase property divided into two units

- Live in one, rent the other

- Separate entrances and utilities

- Moderate privacy and proximity

Financial example:

- Purchase price: $350,000

- Down payment (FHA 3.5%): $12,250

- Monthly mortgage payment: $2,450

- Rent for other unit: $1,700

- Your housing cost: $750

Best for:

- Balance between privacy and proximity

- First-time house hackers testing waters

- Those wanting simpler management than fourplex

- Buyers planning to rent both units eventually

Challenges:

- Limited to two income streams

- Shared walls or floors with tenant

- May hear noise from other unit

- Yard/parking sharing issues

Strategy #4: ADU (Accessory Dwelling Unit) Rental

How it works:

- Purchase property with existing ADU/guest house

- Or add ADU to property you own

- Live in main house, rent ADU

- Maximum separation from tenant

Financial example:

- Purchase price: $380,000 (with existing ADU)

- Down payment (conventional 5%): $19,000

- Monthly mortgage payment: $2,650

- ADU rent: $1,400

- Your housing cost: $1,250

Best for:

- Those wanting maximum privacy

- Properties with detached structures

- Markets allowing ADU construction

- Buyers with capital to add ADU later

Challenges:

- Finding properties with existing ADUs

- Cost to build ADU if adding ($100,000+)

- Zoning restrictions in some areas

- Single tenant risk

Calculate potential cash flow for each strategy using the rental property calculator with real numbers from your target market.

How Do You Qualify for a House Hacking Property?

Here’s the strategic advantage: You’re buying as owner-occupied primary residence, which means better financing terms than investment properties even though you’re clearly investing.

Qualification requirements:

FHA Loans (Most Popular for House Hacking):

- Down payment: 3.5% minimum

- Credit score: 580+ for 3.5% down, 500+ for 10% down

- Property: Up to 4 units allowed

- Occupancy: Must live in one unit as primary residence

- Income: 75% of projected rental income counts toward qualification

- Debt-to-income: Can go up to 50% in some cases

Conventional Loans:

- Down payment: 5% for 1-2 units, 15-25% for 3-4 units

- Credit score: 620+ typically required

- Property: Up to 4 units allowed

- Occupancy: Must live in one unit for one year minimum

- Income: 75% of rental income after vacancy factor

- Debt-to-income: Generally 43-45% maximum

VA Loans (If Eligible):

- Down payment: 0% for qualified veterans

- Credit score: No minimum (lender dependent)

- Property: Up to 4 units allowed

- Occupancy: Must occupy one unit

- Income: Rental income helps qualification

- Benefit: No down payment plus no mortgage insurance

The income qualification magic: When you apply for a fourplex mortgage, the lender counts 75% of the projected rent from the three units you’ll rent out. This rental income helps you qualify for a larger loan than you could based on job income alone.

Example qualification:

- Your income: $60,000 annually ($5,000 monthly)

- Projected rent (3 units × $1,200): $3,600

- 75% of rent counted: $2,700

- Total qualifying income: $7,700 monthly

- This lets you afford much more house than $5,000 alone

Review complete FHA loan requirements for multi-unit owner-occupied properties.

How Do You Find a Good House Hacking Property?

Not every multi-unit property makes a good house hack. Finding properties where the numbers work requires understanding what to look for and how to analyze deals.

Key criteria for house hacking properties:

The Financial Requirements:

- Rent from units (minus vacancy) should cover 80-100%+ of mortgage payment

- Property price fits within your loan qualification

- Down payment amount is achievable for you

- Neighborhood supports consistent tenant demand

- Operating expenses are reasonable and verifiable

The Location Factors:

- Near employment centers, universities, or medical facilities

- Safe neighborhood you’re comfortable living in

- Good schools (helps with tenant quality and resale)

- Public transportation or parking available

- Walkable to amenities (increases rental demand)

The Property Condition:

- Major systems (roof, HVAC, plumbing) in good condition

- Units are rentable without massive renovation

- Separate utilities or easy to divide

- Adequate parking for all occupants

- Layout works for privacy between units

Where to find house hacking properties:

Online Listing Sites:

- Zillow, Realtor.com filtered for multi-unit

- Apartment listing sites showing “for sale”

- MLS access through real estate agent

- Off-market properties through networking

Real Estate Agent Specialization:

- Find agent experienced with multi-unit properties

- They can identify properties before they hit market

- Understand house hacking strategy

- Help you analyze rental income potential

Drive Neighborhoods:

- Target areas with high rental demand

- Look for “For Sale” signs on multi-units

- Note properties needing cosmetic work (opportunity)

- Understand neighborhood dynamics personally

The analysis process:

Step 1: Calculate Maximum Purchase Price

- What you qualify to borrow based on income

- What down payment you can afford

- Resulting maximum purchase price

Step 2: Research Market Rents

- Check Zillow, Craigslist, Facebook Marketplace

- Call on rental listings to verify prices

- Understand rent ranges for different unit sizes

- Factor in vacancy (usually 5-8% annually)

Step 3: Run the Numbers

- Purchase price and down payment

- Monthly mortgage payment (principal, interest, insurance, taxes)

- Projected rental income (realistic, not optimistic)

- Operating expenses (insurance, maintenance, management)

- Net cash flow: income minus all expenses

Step 4: The 1% Rule Screening

- Monthly rent should equal or exceed 1% of purchase price

- Example: $400,000 property should generate $4,000+ monthly rent

- Not absolute rule but useful initial filter

- Harder to achieve in expensive markets

Red flags to avoid:

- Rental income won’t cover even 60% of mortgage

- Serious deferred maintenance you can’t afford to fix

- Neighborhood shows declining rental demand

- Zoning issues or illegal units

- Property significantly overpriced for market

See example properties and analysis in this rental property case study showing successful multi-unit investment.

What Does the First Year of House Hacking Actually Look Like?

Theory sounds great, but what’s the reality of living in a property while managing tenants? Understanding the first year helps you prepare mentally and financially for the experience.

Month 1-3: Initial Setup

Move-In and Preparation:

- Move into your unit while preparing others

- Make necessary repairs to rentable units

- Clean and paint empty units

- Take quality photos for listings

Marketing and Tenant Screening:

- List units on rental websites

- Screen applicants thoroughly (credit, background, income verification)

- Choose tenants based on data, not desperation

- Sign leases with proper terms and deposits

Systems Setup:

- Collect security deposits and first month rent

- Set up rent collection method (Venmo, Zelle, check, online portal)

- Create maintenance request system

- Get proper insurance (landlord policy)

Month 4-8: Establishing Rhythm

Operations Normalization:

- Tenants settled into routines

- Rent collection becomes systematic

- Small maintenance requests handled

- Learning property management on the job

Financial Management:

- Track all income and expenses meticulously

- Build maintenance reserve fund

- Pay mortgage automatically

- Calculate actual vs. projected cash flow

Relationship Building:

- Establish professional but friendly rapport with tenants

- Set boundaries around availability

- Handle issues quickly and fairly

- Be responsive without being friends

Month 9-12: Optimization

Lease Renewals or Turnover:

- Decide whether to renew current tenants

- Raise rent to market rates if appropriate

- Handle any turnover professionally

- Improve units during vacancies

Financial Assessment:

- Calculate first year cash flow

- Total equity built through principal paydown

- Appreciation captured (if any)

- Compare to what you’d have paid renting

- Plan for tax benefits

Future Planning:

- Assess if strategy is working for you

- Consider timeline for next purchase

- Evaluate what you’d do differently

- Build equity and qualification for property #2

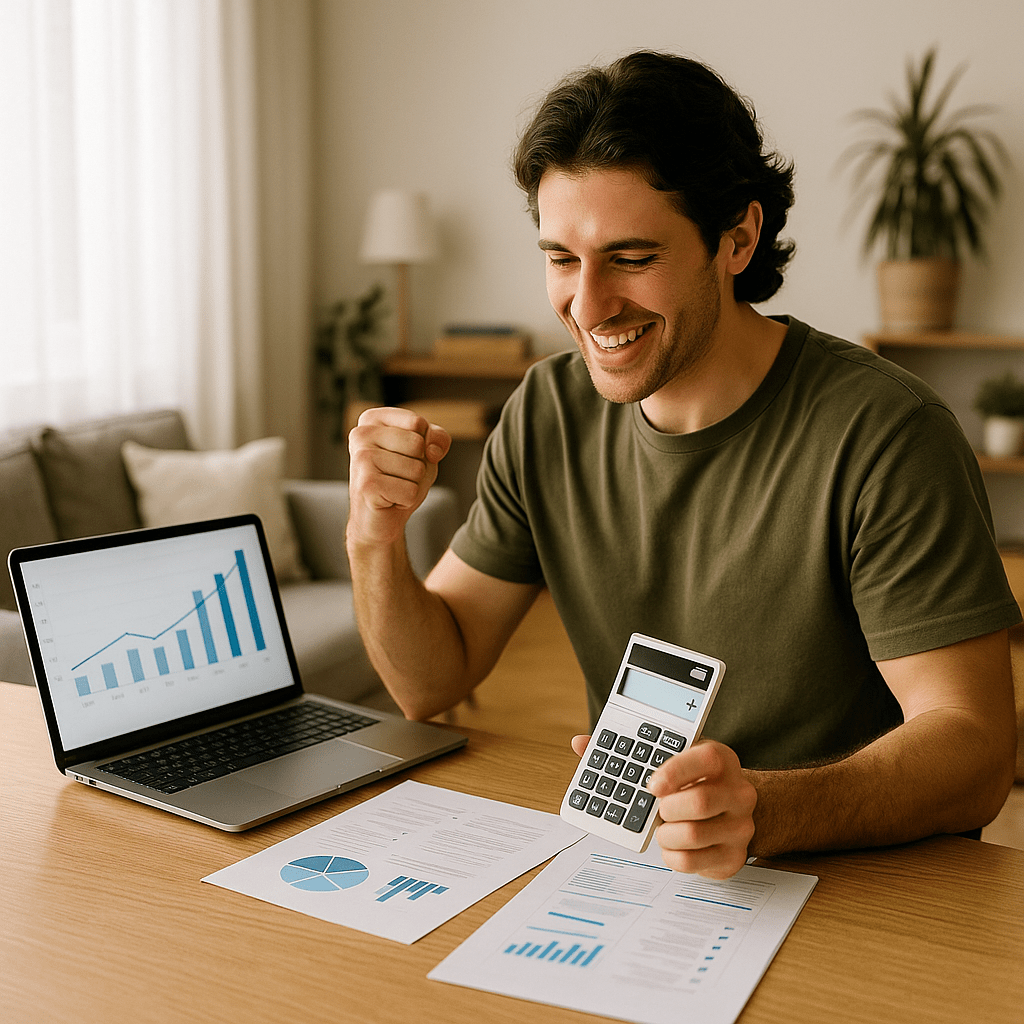

The realistic financial outcome (example fourplex):

- Mortgage payments: $33,600 annually

- Rental income collected: $42,000 (accounting for some vacancy)

- Operating expenses: $6,000 (insurance, maintenance, reserves)

- Net cash flow: +$2,400 for year

- Principal paydown: ~$4,800

- Appreciation (5%): $20,000

- Total wealth created year one: $27,200

- Alternative (renting elsewhere): -$18,000 paid in rent

- Difference: $45,200 swing in net worth

What Are the Biggest House Hacking Challenges?

House hacking isn’t all upside—understanding challenges helps you prepare and decide if this strategy fits your personality. Successful house hackers manage these issues; unsuccessful ones get overwhelmed by them.

Challenge #1: Living with/Near Tenants

The Reality:

- Less privacy than living alone

- May hear noise from other units

- Can’t control who comes and goes

- Your home is also your investment property

Management Strategies:

- Set clear boundaries from day one

- Choose tenants carefully through rigorous screening

- Establish quiet hours in lease if needed

- Accept some loss of privacy as cost of free housing

- Remember it’s temporary stepping stone

Challenge #2: Property Management Responsibilities

The Reality:

- Tenants need things fixed (sometimes urgently)

- Late-night calls about maintenance issues

- Handling conflict or problem tenants

- Time commitment beyond regular job

- Learning curve if never managed property

Management Strategies:

- Screen tenants extremely well to minimize problems

- Build network of reliable contractors

- Set expectations for reasonable response times

- Consider property manager if it’s overwhelming

- View it as learning valuable business skills

Challenge #3: Financial Volatility

The Reality:

- Vacancy means covering full mortgage yourself

- Unexpected repairs can be expensive

- Tenants sometimes pay late or not at all

- Operating expenses fluctuate

- Must have reserves for emergencies

Management Strategies:

- Maintain 3-6 months reserves for mortgage

- Budget conservatively on rental income

- Have separate emergency fund

- Vet tenants’ financial stability thoroughly

- Buy property where you could afford payment alone if needed

Challenge #4: Mixing Personal and Business

The Reality:

- Your home is your business property

- Can’t easily escape work environment

- Neighbor dynamics affect business

- Personal life visible to tenants

- Harder to maintain boundaries

Management Strategies:

- Keep business records separate

- Be professional even when home

- Don’t become friends with tenants (friendly but boundaried)

- Have separate entrance if possible

- Remember the financial benefits justify temporary discomfort

Challenge #5: Exit Strategy Complexity

The Reality:

- Can’t easily sell part of property

- Moving out requires transition planning

- Converting to full rental has steps

- May be difficult to live there forever

- Must think ahead about next move

Management Strategies:

- Plan exit strategy before buying

- Understand how to convert to investment property

- Build equity for next purchase

- Know you can sell if needed (last resort)

- View as stepping stone, not forever home

The honest assessment: House hacking requires maturity, discipline, and acceptance of trade-offs. You’re sacrificing some comfort and privacy short-term for significant wealth building. Not everyone’s personality fits this strategy—and that’s okay. But for those who can handle the challenges, the financial rewards are extraordinary.

How Do You Scale from First to Multiple Properties?

The real power of house hacking emerges when you repeat the strategy. Your first property builds equity and experience for property two, which funds property three, creating exponential wealth growth.

The scaling roadmap:

Year 1-2: Property #1 (House Hack)

- Buy fourplex with FHA 3.5% down

- Live in one unit, rent three

- Build equity through principal paydown

- Capture market appreciation

- Learn property management skills

- Generate positive cash flow

Year 3-4: Property #2 (Repeat House Hack)

- Move to second fourplex

- First property becomes full rental (4 units rented)

- Use equity from property #1 for down payment on #2

- Live in unit of property #2, rent three units

- Now have 7 total rental units

Year 5-6: Property #3 (Scale Further)

- Option A: Buy third property using same strategy

- Option B: Buy larger multi-family (5+ units) with commercial loan

- Convert property #2 to full rental

- Now have substantial rental portfolio

- Significant monthly cash flow from multiple properties

The wealth compounding math:

After Year 2:

- Property #1: $50,000 equity (appreciation + principal)

- Personal housing cost: Minimal or zero

- Experience: Managing 3 tenants for 2 years

After Year 4:

- Property #1: $85,000 equity (now full rental)

- Property #2: $50,000 equity (currently house hacking)

- Total equity: $135,000

- Monthly cash flow from property #1: $800

- Personal housing cost: Still minimal

After Year 6:

- Property #1: $120,000 equity

- Property #2: $90,000 equity

- Property #3: $55,000 equity

- Total equity: $265,000

- Combined monthly cash flow: $2,400

- Personal housing cost: Still minimal or zero

The strategic transitions:

When to Move to Property #2:

- You’ve maximized learning from property #1

- Market conditions favor purchase

- Saved additional down payment from positive cash flow

- Found next good deal

- Tired of current living situation

Converting to Full Rental:

- Give proper notice if tenant in your unit

- Move all personal belongings out

- Rent your former unit at market rate

- Now collecting rent on all units

- Property #1 becomes cash flow machine

Long-Term Strategy Options:

- Continue house hacking indefinitely (serial house hacker)

- Transition to pure investor after several properties

- Keep some as long-term rentals, sell others

- Use equity to buy larger commercial properties

- Build to financial independence through real estate

The key insight: Most rental property investors struggle to buy their first property due to down payment requirements on investment properties. House hackers solve this by using owner-occupied financing repeatedly, building a portfolio that would have taken decades through traditional investment property purchases.

Review how investors successfully scaled using strategies in these DSCR loan case studies for multi-property portfolios.

How Stairway Mortgage Supports House Hacking Success

We’ve helped hundreds of young adults implement house hacking strategies successfully. Our expertise in owner-occupied multi-unit financing makes us ideal partners for this wealth-building approach.

Our house hacking support:

Strategy Development:

- Assess if house hacking fits your situation

- Identify which strategy works for your market

- Calculate realistic numbers for properties you’re considering

- Explain qualification requirements and process

Financing Optimization:

- Structure loan to maximize rental income consideration

- Use FHA, VA, or conventional based on your situation

- Help you qualify for maximum property value

- Coordinate multiple income sources if needed

Property Analysis:

- Review properties you’re considering

- Verify rental income projections are realistic

- Calculate true cash flow including all expenses

- Identify any red flags before you commit

Scaling Support:

- Plan next purchase while operating first property

- Use equity from property #1 for property #2

- Transition properties from owner-occupied to investment

- Structure loans for portfolio building

Ready to explore house hacking? Schedule a call to discuss your situation and create a personalized implementation plan.

Ready to Eliminate Your Housing Costs?

You’ve learned how house hacking eliminates the largest expense in most budgets while building substantial wealth. The young adults achieving financial freedom in their thirties almost universally house hacked in their twenties.

Your next steps:

- Assess Fit: Determine if house hacking matches your personality and goals

- Choose Strategy: Decide which approach works for your market and situation

- Run Numbers: Calculate what properties in your area would cash flow

- Get Qualified: Understand what you can afford to purchase

Different paths work for different people:

- Some house hack one property and stop

- Others serial house hack building large portfolios

- Many do it for 3-5 years then transition to regular homeownership

- All who try it build substantially more wealth than those who don’t

The difference between young adults building wealth and those staying broke is often one decision: to house hack or pay rent. The strategy isn’t for everyone, but for those with flexibility and determination, it’s the fastest path to financial freedom.

Get pre-approved to see what house hacking properties you qualify for, or take our discovery quiz to explore whether this strategy fits your situation.

Frequently Asked Questions

Do I have to live with tenants in house hacking?

Not necessarily—it depends on which strategy you choose. With multi-unit properties (duplex, triplex, fourplex), each unit typically has separate entrance, kitchen, and bathroom, so you’re living near but not with tenants. With single-family house hacking, you’re sharing common spaces with roommates. Choose the strategy matching your comfort level. Many people prefer multi-unit specifically for the privacy while still eliminating housing costs. See FHA loan requirements for multi-unit owner-occupied properties.

How much money do I need to start house hacking?

With FHA financing, you can start house hacking with as little as 3.5% down payment plus closing costs—often totaling $15,000-$25,000 depending on purchase price. Some buyers combine personal savings with family gift funds or down payment assistance programs to reach this amount. The down payment assistance programs can significantly reduce the cash you need to start. Compare this to years of paying rent with zero return.

What if I can’t find good tenants?

Tenant quality directly correlates with your screening process. Use thorough applications including credit checks, background checks, income verification, and references. Many successful house hackers never have significant tenant problems because they screen carefully upfront. Set clear expectations in detailed leases. Be professional and responsive. Most tenants want stable housing and will be reliable if you select well. Consider working with property management company if tenant management feels overwhelming.

Can I house hack if I have roommates now?

Yes, actually having roommates now demonstrates you can handle shared living situations—key for single-family house hacking. You’re essentially converting from paying a landlord to being the landlord while your “roommates” pay your mortgage. The transition is natural. Many successful house hackers started by getting comfortable with roommates, then bought a house and continued the same dynamic while building equity. Use the rental property calculator to see the financial difference.

What’s the biggest mistake new house hackers make?

The most common mistake is underestimating operating expenses and overestimating rental income, leading to negative cash flow they can’t sustain. Always use conservative rental income projections (accounting for vacancy and expenses), thorough property inspections before purchase, and maintain adequate financial reserves. Second biggest mistake is choosing incompatible tenants due to inadequate screening—always verify income, credit, background, and references. Take time to find right tenants rather than accepting first applicant out of desperation.

Also Helpful for Smart Stewards

Related Resources:

- All Available Loan Programs – Explore multi-unit financing

- FHA Loans – Popular house hacking choice

- Rental Property Strategies – Build portfolio

Complete Your Smart Stewards Journey

You’ve completed the Smart Stewards series! Continue to First-Time Home Buyers journey:

- First Time Homebuyer Checklist (Post #16) – Are you ready?

- FHA vs Conventional (Post #17) – Choose your loan

- How to Make an Offer (Post #20) – Win in competitive markets

Explore Your Complete Options

Calculate Your Scenarios:

- Rental Property Calculator – Model house hacking cash flow

- FHA Loan Calculator – Multi-unit purchase costs

- All Calculators – Explore every option

See Real Success Stories:

- Multi-Unit Purchase Success – House hacking journey

- Portfolio Building – Scaling strategies

- All Case Studies – Every path documented

Ready to Take Action:

- Schedule a Call – Discuss house hacking

- Discovery Quiz – Find your strategy

- Get Pre-Approved – See what you qualify for

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.