1031 Exchange for Dummies: Swap Properties Tax-Free and Keep Building Wealth

1031 Exchange for Dummies: Swap Properties Tax-Free and Keep Building Wealth

Active real estate investors eventually face a wealth-killing dilemma: properties appreciating substantially create massive capital gains tax bills when sold, potentially consuming 25-40% of profits through federal and state taxation plus depreciation recapture. A property purchased for $200,000 and sold for $400,000 generates $200,000 gains—but after federal capital gains at 15-20%, state taxes averaging 5-10%, and depreciation recapture at 25%, you might net only $130,000-$150,000 after taxes. That $50,000-$70,000 tax bill represents lost capital that could have funded additional acquisitions continuing your wealth-building momentum.

Section 1031 of the Internal Revenue Code provides a legal mechanism allowing real estate investors to defer these capital gains taxes indefinitely by exchanging properties rather than selling them outright. When structured properly, 1031 exchanges let you sell appreciated properties, reinvest all proceeds into replacement properties of equal or greater value, and pay zero taxes on the transaction—preserving your full equity for continued portfolio growth rather than surrendering substantial portions to tax obligations.

Understanding how 1031 exchanges work, which properties qualify, what strict timelines govern the process, and how to avoid disqualification pitfalls separates sophisticated active investors who scale portfolios efficiently from those who surrender 30%+ of their wealth to unnecessary taxation during every property transition. This guide breaks down 1031 exchange for dummies into straightforward steps, explaining complex tax code provisions in accessible language while providing actionable implementation strategies transforming theoretical tax deferral knowledge into practical wealth preservation.

Key Summary

This comprehensive guide explains 1031 tax-deferred exchanges in plain language, helping active investors preserve capital through strategic property swaps rather than taxable sales.

In this guide:

- How 1031 exchanges work to defer capital gains taxes on investment property sales and what qualifies for tax-deferred treatment (IRS 1031 exchange rules)

- Critical deadlines including 45-day identification and 180-day closing requirements that determine whether exchanges succeed or fail (1031 exchange timeline requirements)

- What “like-kind” property means and which replacement properties qualify for tax-deferred exchanges (qualified 1031 exchange properties)

- Common mistakes that accidentally disqualify exchanges and how to structure transactions maintaining IRS compliance (1031 exchange compliance)

What Is a 1031 Exchange and How Does It Work?

A 1031 exchange for dummies begins with understanding the fundamental concept: instead of selling investment properties and paying capital gains taxes on profits, you exchange properties for other investment properties, deferring all tax obligations until some future sale where you don’t complete another 1031 exchange. The IRS treats properly structured exchanges as continuations of investment rather than realization events triggering taxation, allowing indefinite tax deferral across multiple successive exchanges throughout your investing career.

The mechanism works through qualified intermediaries—third-party facilitators who hold your sales proceeds temporarily, preventing you from receiving money directly and maintaining the exchange’s non-taxable status. When you sell your relinquished property, proceeds go directly to the qualified intermediary rather than to you. The intermediary holds funds in secure escrow accounts while you identify and acquire replacement properties within strict IRS timelines, then releases funds directly to sellers of your replacement properties completing the exchange without you ever touching the money yourself.

Tax deferral differs fundamentally from tax elimination—you’re postponing rather than avoiding taxes permanently. However, indefinite deferral through successive exchanges, combined with stepped-up basis rules benefiting your heirs at death, often transforms deferrals into permanent tax avoidance. If you complete 1031 exchanges throughout your lifetime, your heirs inherit properties at fair market values at your death—eliminating all deferred gains permanently. This strategy, sometimes called “swap until you drop,” converts temporary deferral into permanent tax elimination through estate planning integration.

The term “like-kind” confuses many investors but actually provides tremendous flexibility. For 1031 exchange real estate transactions, any real property held for investment qualifies as like-kind to any other investment real property—single-family rentals exchange into commercial buildings, raw land exchanges into apartment complexes, retail properties exchange into industrial warehouses. The IRS doesn’t require similar property types, just that both relinquished and replacement properties are investment real estate rather than personal residences or property held primarily for resale (dealer property).

Boot represents any non-like-kind value received during exchanges, triggering partial taxation equal to the boot received. If you exchange properties of unequal values and receive $30,000 cash balancing the transaction, that $30,000 represents taxable boot even though the remainder of the exchange qualifies for deferral. Similarly, debt reduction constitutes boot—if you exchange from a property with $300,000 mortgage debt into a property with only $250,000 debt, the $50,000 debt reduction represents taxable boot. Avoid boot by ensuring replacement properties equal or exceed both the value and debt of relinquished properties.

Depreciation recapture creates additional tax complexity that 1031 exchanges address. Investment properties generate annual depreciation deductions reducing taxable income during ownership, but this accumulated depreciation gets “recaptured” at sale—taxed at higher 25% rates rather than preferential capital gains rates. A property generating $100,000 depreciation over 10 years creates $25,000 depreciation recapture tax at sale. However, 1031 exchanges defer depreciation recapture just like capital gains, preserving full equity for reinvestment rather than surrendering portions to recapture taxation.

Multiple property exchanges complicate calculations but remain completely permissible. You can exchange one property for three replacement properties, or consolidate three properties into one replacement—the IRS cares only that total replacement property value and debt equal or exceed relinquished property totals. These multiple property exchanges help investors consolidate geographically dispersed portfolios into concentrated holdings, or diversify single large properties into multiple smaller assets. Calculate total values, debts, and equity carefully when structuring multiple property exchanges ensuring all requirements get satisfied across combined transactions.

Reverse exchanges occur when you acquire replacement properties before selling relinquished properties—literally reversing the normal sequence. These transactions require exchange accommodation titleholders temporarily holding replacement properties until you close on relinquished property sales within 180 days. Reverse exchanges cost more than forward exchanges (typical fees increase from $800-$1,500 to $2,500-$5,000+) but provide strategic advantages when perfect replacement properties become available before you’ve sold relinquished properties, or when market conditions favor acquiring first and selling second.

Understanding 1031 tax exchange mechanics requires recognizing what doesn’t qualify for tax deferral. Primary residences don’t qualify (though partial 1031 treatment might apply to mixed-use properties), property held primarily for resale (fix-and-flip properties treated as inventory rather than investment), personal property including vehicles or equipment (eliminated from 1031 eligibility by 2017 tax reform), and foreign real estate exchanging for U.S. property. Restrict 1031 exchanges to domestic investment real estate held for rental income or long-term appreciation avoiding these disqualification categories.

The 1031 Exchange Timeline: Critical Deadlines You Cannot Miss

Time governs 1031 exchange success or failure—missing strict IRS deadlines by even one day completely disqualifies exchanges, converting them into taxable sales with full capital gains obligations. Understanding and meeting these non-negotiable timelines represents the difference between preserving wealth through tax deferral and surrendering 30-40% of proceeds to avoidable taxation.

The 45-day identification period begins the moment relinquished properties close and proceeds transfer to qualified intermediaries. You have exactly 45 calendar days—not business days—to formally identify potential replacement properties in writing to your qualified intermediary. This deadline is absolute with zero extensions regardless of weekends, holidays, natural disasters, or any other circumstances. If day 45 falls on a weekend or holiday, the deadline doesn’t extend to the next business day—it remains day 45, requiring weekend or holiday action if necessary.

Identification rules specify exactly how many properties you can identify as potential replacements. The three-property rule allows identifying up to three properties of any value without restrictions. The 200% rule permits identifying unlimited properties as long as their combined fair market values don’t exceed 200% of your relinquished property’s sale price. The 95% rule provides a safety valve—you can identify unlimited properties of any total value, but you must close on 95% of that identified value within the 180-day period or the exchange fails. Most investors use the three-property rule identifying their top three choices providing flexibility without complex value calculations.

Written identification requirements demand specific property addresses—vague descriptions like “a triplex in Memphis” don’t satisfy IRS requirements. Identify properties by legal descriptions or street addresses clearly establishing which specific properties you intend to acquire. Your written identification goes to your qualified intermediary via email, fax, mail, or electronic submission to their online portals, with delivery confirmation critical proving timely submission. Never rely on verbal identification or informal communications—only written identification delivered to qualified intermediaries within 45 days satisfies IRS requirements.

The 180-day exchange period begins simultaneously with the 45-day identification period, providing 180 calendar days from relinquished property closing to complete acquisition of replacement properties. This deadline is also absolute without extensions. However, if your tax return filing deadline occurs before the 180th day (possible if you sell relinquished properties late in your tax year), the exchange deadline becomes your tax return due date including extensions. This compressed timeline affects December and early-January closings potentially reducing your effective exchange period from 180 days to 90-120 days.

Concurrent deadlines create strategic timing considerations. Since both deadlines begin simultaneously, you can theoretically identify properties on day 45 and close on replacements by day 180, but this aggressive approach leaves only 135 days to complete acquisitions after identification—potentially insufficient for due diligence, financing, and closing complexities. Sophisticated investors identify properties early (often within 15-30 days) allowing maximum time for acquisition completion, or arrange replacement property purchases in advance then formally identify them meeting IRS documentation requirements.

Partial exchange timing allows closing on identified replacement properties at different times within the 180-day window. If you identify three properties, you might close on property A at day 60, property B at day 120, and property C at day 175—all within the deadline. This staggered approach works particularly well when consolidating multiple relinquished properties into several replacement properties, allowing sequential closings as each replacement property becomes available rather than forcing simultaneous closings creating operational complexity and potential financing challenges.

Failed identification doesn’t necessarily doom entire exchanges if you’ve structured them properly. If you identify three properties but fail to close on any within 180 days, the exchange fails and you’ll owe taxes on the full gain. However, if you close on one or two of three identified properties, you’ve successfully exchanged into what you acquired—partial success is better than complete failure. This reality encourages identifying multiple properties rather than single backup-free options, and working diligently toward closing on at least one identified property even if preferred choices become unavailable.

Extension impossibility requires planning around these deadlines rather than hoping for flexibility that doesn’t exist. The IRS provides no hardship extensions, no disaster relief extensions (even during hurricanes, wildfires, or pandemics), and no financial market disruption extensions. Successful 1031 exchange real estate transactions require beginning the process with sufficient time for due diligence, having pre-approved financing through DSCR loans or other investor-friendly programs, and maintaining constant communication with qualified intermediaries, title companies, and lenders ensuring everyone understands deadline criticality.

Calculate your specific deadlines immediately upon closing your relinquished property. If you close on January 15, your 45-day identification deadline is March 1 (or February 29 in leap years), and your 180-day closing deadline is July 14. Mark these dates prominently in your calendar, set multiple reminders, and work backward from deadlines creating milestones ensuring adequate progress. Missing these deadlines by even hours completely disqualifies exchanges—treating them with appropriate urgency is non-negotiable for successful tax deferral.

Like-Kind Property Requirements: What Qualifies for 1031 Exchanges

Understanding which properties qualify as “like-kind” for 1031 tax-deferred exchange purposes determines what you can exchange into, influencing your portfolio optimization strategies and long-term wealth-building approaches. The good news for real estate investors: like-kind requirements provide tremendous flexibility allowing diverse property type exchanges as long as fundamental investment purposes remain consistent.

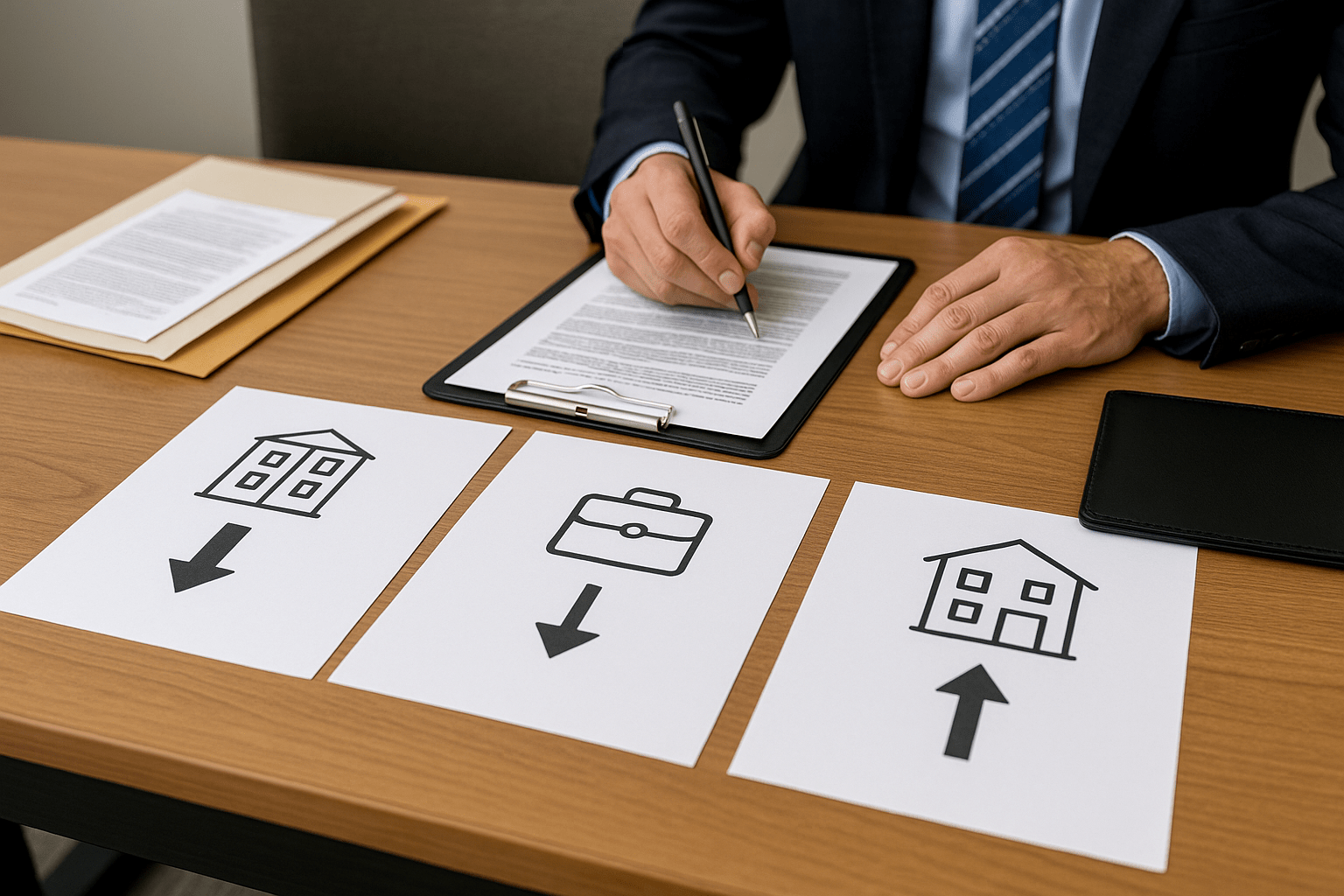

Investment property held for rental income or long-term appreciation forms the core qualifying category. Single-family rentals, multifamily apartments, commercial office buildings, retail shopping centers, industrial warehouses, raw land held for investment, vacation rentals operated as businesses, and even certain leasehold interests all qualify as like-kind to each other. You can exchange a duplex for a strip mall, vacant land for apartment complexes, or retail buildings for industrial properties—property type differences don’t prevent like-kind treatment as long as all properties involved are investment real estate.

Primary residences explicitly don’t qualify for 1031 exchanges because they’re not held for investment purposes despite being real estate. However, properties converting from primary residences to rentals can qualify for 1031 treatment after establishing sufficient rental history. The IRS hasn’t specified exact rental periods required, but most tax professionals recommend 12-24 months of documented rental activity before attempting 1031 exchanges on converted primary residences. During this rental period, treat properties identically to any investment property—lease to unrelated tenants at market rents, report rental income and expenses properly, and maintain properties as genuine businesses rather than personal use disguised as investment.

Vacation homes create complex situations depending on personal use versus rental operation. Properties rented consistently to unrelated parties at market rents with minimal personal use might qualify for 1031 treatment, while vacation homes used primarily personally with occasional rental qualify as personal property ineligible for exchanges. The IRS evaluates these situations based on primary purpose—genuine investment versus personal enjoyment with incidental rental. If pursuing 1031 exchanges involving vacation properties, maintain meticulous records documenting business purpose, market-rate rental operations, minimal personal use, and professional property management demonstrating investment intent.

Fix-and-flip properties generally don’t qualify for 1031 exchanges because they’re held as inventory for resale rather than investment. The IRS distinguishes between investment property held for passive income or appreciation and dealer property held for active resale. However, this distinction isn’t always clear-cut—real estate investors might hold some properties as long-term rentals (qualifying for 1031 treatment) while quickly flipping others (not qualifying). Document your intent at acquisition through financing choices (rental property financing suggests investment intent), lease agreements showing rental operations, and holding periods demonstrating investment rather than dealer activity.

Out-of-state exchanges work perfectly under 1031 rules—you can exchange California properties for Texas properties, Florida properties for Tennessee properties, or any other interstate combination. The IRS doesn’t restrict geographic locations as long as properties qualify as U.S. domestic real estate held for investment. This flexibility allows strategic portfolio repositioning from high-tax states to low-tax states, expensive appreciation markets to cash-flowing markets, or any other geographic optimization supporting your wealth-building objectives. Calculate these relocations carefully using our 1031 exchange calculator understanding tax implications and ongoing financial impacts of different market selections.

Improvements to owned land sometimes qualify as replacement property in build-to-suit or construction exchanges, where you exchange into land you already own and use exchange proceeds funding improvements to that land. These transactions require complex structuring through exchange accommodation titleholders managing construction while maintaining 1031 compliance, but they enable building custom properties perfectly suited to your investment objectives rather than accepting available properties that might not meet your specific needs. Build-to-suit exchanges typically cost $5,000-$15,000 in additional qualified intermediary and legal fees beyond standard exchange costs, but this investment sometimes proves worthwhile creating optimal replacement properties.

Delaware statutory trusts (DSTs) provide fractional interests in professionally managed institutional-quality properties, allowing investors to complete 1031 exchanges into passive ownership positions without direct property management responsibilities. These securities qualify as replacement properties under IRS Revenue Ruling 2004-86 when structured properly. DSTs work particularly well for investors wanting to downsize from active management, consolidate from multiple properties into single fractional interests, or access institutional commercial real estate otherwise requiring millions in direct investment. However, DSTs are illiquid securities with specific suitability requirements—consult with securities professionals before pursuing these as 1031 replacement properties.

Property exchanges involving related parties trigger special scrutiny and holding period requirements. The IRS permits exchanges between related parties but imposes two-year holding requirements on both exchanged properties—neither party can dispose of their received properties within two years or the original exchange becomes retroactively taxable. This rule prevents family members effectively cashing out through related-party exchanges then quickly selling received properties. If considering related-party exchanges, plan to hold both properties beyond two-year thresholds or structure transactions through unrelated intermediaries avoiding these complications entirely.

How to Start a 1031 Exchange: Step-by-Step Process

Executing successful 1031 exchanges requires methodical planning beginning before listing relinquished properties for sale, not after closings when time pressure intensifies. Following these systematic steps ensures IRS compliance while maximizing strategic value from tax-deferred transactions.

Step one involves engaging qualified intermediaries before closing on relinquished properties—never after sales complete. Qualified intermediaries cannot be related parties, your employees, attorneys, accountants, or real estate agents within two years prior to exchanges. These independent third parties prepare exchange agreements, receive sales proceeds, hold funds during exchange periods, and facilitate replacement property acquisitions maintaining 1031 compliance throughout. Interview multiple qualified intermediaries comparing fees ($800-$1,500 for standard forward exchanges), experience with property types similar to yours, insurance coverage protecting exchange funds, and responsiveness. Select intermediaries before accepting offers on relinquished properties, allowing them to draft exchange documents for inclusion in purchase contracts.

Step two requires including 1031 exchange language in purchase contracts for relinquished property sales. Buyers must acknowledge properties are being sold as part of 1031 exchanges, allowing assignment of contracts to qualified intermediaries. Standard residential contracts might not include this language automatically—work with real estate attorneys adding appropriate 1031 provisions preventing buyer objections to exchange mechanics after contracts execute. This language typically states: “Seller reserves the right to assign this contract to a qualified intermediary for purposes of completing a Section 1031 tax-deferred exchange.”

Step three involves identifying potential replacement properties before relinquished property sales close, even though formal identification to qualified intermediaries comes later. Pre-identify several suitable replacement properties, conduct preliminary due diligence, and potentially submit offers or letters of intent signaling serious acquisition interest. This advance work dramatically improves your probability of closing on replacement properties within tight 180-day windows, compared to starting replacement property searches only after relinquished property sales complete. Active investors often have replacement properties under contract before closing on relinquished properties, treating sales and acquisitions as coordinated transactions rather than separate sequential events.

Step four happens at relinquished property closing when sales proceeds transfer directly from buyers to qualified intermediaries rather than to you. Title companies familiar with 1031 exchanges handle this routine step, wiring funds to qualified intermediary escrow accounts per closing instructions. You never receive or control these funds—crucial for maintaining exchanges’ tax-deferred status. If you receive proceeds even temporarily before transferring them to qualified intermediaries, you’ve triggered taxable events disqualifying exchanges entirely. Trust the process allowing proceeds to transfer directly from closings to qualified intermediaries without your involvement.

Step five requires submitting formal written identification of replacement properties to qualified intermediaries within 45 days of relinquished property closings. Identify properties by complete street addresses or legal descriptions, send identification via email or certified mail creating delivery proof, and keep copies of all identification communications. Most investors identify three properties using the three-property rule, providing flexibility if first-choice properties become unavailable. Ensure identified properties meet equal-or-greater-value and debt requirements avoiding partial exchange taxation—the values and debt levels on replacement properties should match or exceed your relinquished property totals.

Step six involves financing replacement property acquisitions, which sometimes creates challenges when relinquished property proceeds held by qualified intermediaries can’t be accessed for initial capital until closings. Two approaches solve this problem: using bridge loans or personal funds temporarily funding initial capital with qualified intermediary proceeds reimbursing you at closing, or structuring acquisitions with minimal initial capital through DSCR financing where lenders understand 1031 exchange mechanics and coordinate funding with qualified intermediary disbursements. Plan replacement property financing early in the process, ensuring lenders understand 1031 timelines and coordinate closings appropriately.

Step seven completes replacement property acquisitions within 180 days of relinquished property closings. Qualified intermediaries wire exchange proceeds directly to replacement property sellers or title companies at closings, you provide any additional funds necessary if replacement properties exceed relinquished property values, and new properties title in your name completing exchanges. If acquiring multiple replacement properties, coordinate closings sequentially as each property becomes available—you don’t need simultaneous closings on all identified properties, just completion of all acquisitions within the 180-day window.

Step eight involves proper tax reporting on Form 8824 with your federal tax return for the year containing the exchange. This form documents exchange details including relinquished and replacement property descriptions, dates, values, and realized gains. Even though you’re deferring taxes, you must report exchanges to the IRS showing compliance with all requirements. Work with tax professionals experienced in 1031 exchanges ensuring accurate Form 8824 completion and proper carryover basis calculations for replacement properties reflecting deferred gains reducing future depreciation benefits.

Common 1031 Exchange Mistakes That Cost Investors Thousands

Even sophisticated active investors make preventable mistakes during 1031 exchanges, accidentally triggering partial or complete taxation on transactions intended for full tax deferral. Understanding these common errors helps you avoid costly pitfalls that destroy exchanges’ wealth-preservation benefits.

Receiving proceeds directly represents the most catastrophic mistake instantly disqualifying exchanges. If you close on relinquished properties and receive sales proceeds even briefly before transferring them to qualified intermediaries, you’ve triggered taxable sales—no 1031 deferral available. This mistake often occurs when investors don’t engage qualified intermediaries before closings or when title companies unfamiliar with 1031 procedures wire proceeds to sellers instead of intermediaries. Prevent this by engaging qualified intermediaries early, including exchange language in purchase contracts, and providing detailed closing instructions to title companies specifying qualified intermediary wire information before closing dates.

Missing the 45-day identification deadline destroys exchanges completely with zero flexibility. Investors sometimes underestimate how quickly 45 days passes, fail to prioritize replacement property identification, or assume they’ll find properties easily without advance planning. Then day 40 arrives, they haven’t identified anything, and panic sets in trying to find qualifying properties within five remaining days. Avoid this disaster by beginning replacement property searches immediately after listing relinquished properties, identifying potential replacements within 20-30 days leaving comfortable buffers, and treating the 45-day deadline as the most important date in your exchange timeline.

Failing to meet equal-or-greater-value requirements creates taxable boot reducing exchange benefits. If you exchange from a $500,000 property into a $450,000 replacement, the $50,000 value shortfall represents taxable boot even though you’ve deferred gains on the remaining $450,000. Similarly, if your relinquished property carries $300,000 debt and your replacement property has only $250,000 debt, the $50,000 debt reduction creates taxable boot. Calculate these requirements carefully—replacement properties must meet or exceed both total value and total debt from relinquished properties to achieve complete tax deferral.

Using exchange proceeds for non-qualifying purposes triggers partial taxation equal to amounts diverted from replacement property acquisitions. If you complete exchanges but use $20,000 of proceeds for personal expenses, property improvements on properties you already own, or any purpose other than acquiring identified replacement properties, that $20,000 becomes taxable boot. All exchange proceeds must flow from relinquished property sales directly into replacement property acquisitions through qualified intermediaries—no detours for other purposes regardless of how reasonable they might seem.

Related-party exchanges without proper structuring create problems when either party sells received properties within two years. If you exchange properties with your sibling then they sell the property they received from you within two years, the IRS treats your original exchange as a taxable sale retroactively. Structure related-party exchanges only when both parties intend genuinely holding properties long-term as investments, and document these intentions thoroughly should IRS scrutiny arise. Better yet, avoid related-party exchanges when possible using arm’s-length transactions with unrelated parties eliminating these complications.

Attempting to exchange personal-use properties like vacation homes used primarily personally creates disqualification risk when IRS examines primary property purposes. If you used a property personally 180 days yearly and rented it 30 days, calling it “investment property” for 1031 purposes won’t survive IRS scrutiny. Convert personal properties to genuine investment uses—lease to unrelated tenants, eliminate personal use, treat as businesses—for 12-24 months establishing clear investment purpose before pursuing 1031 exchanges. Document this conversion thoroughly through lease agreements, rental income reporting, professional management, and complete cessation of personal use.

Ignoring state tax issues when exchanging across state lines creates unexpected tax obligations. While federal tax defers through 1031 exchanges, some states impose exit taxes on residents disposing of in-state property regardless of 1031 treatment. California, for example, might require withholding even on 1031 exchanges depending on specific circumstances. Research state-specific rules for both the state where you’re selling relinquished properties and the state where you’re acquiring replacement properties, understanding any state-level compliance requirements separate from federal 1031 treatment.

Inadequate due diligence on replacement properties rushed by tight deadlines leads to acquiring unsuitable properties that underperform or require unexpected capital. The compressed 45-day identification and 180-day closing timelines pressure investors into insufficient analysis accepting properties they wouldn’t otherwise pursue. Resist this pressure by pre-qualifying replacement properties before listing relinquished properties, conducting thorough inspections and financial analysis despite time pressure, and walking away from questionable properties even if it means incomplete exchanges—owning bad properties creates larger long-term losses than paying taxes on good property sales.

Improper basis tracking after exchanges compounds in successive transactions creating tax reporting errors and potential IRS penalties. Your replacement property’s basis equals your old basis plus additional capital invested minus any boot received—not the replacement property’s purchase price. This carryover basis affects depreciation calculations and eventual capital gains when you ultimately sell without exchanging. Maintain meticulous records tracking basis through each successive exchange, work with tax professionals ensuring accurate Form 8824 completion, and update basis calculations for each property transfer throughout your ownership.

Financing Replacement Properties in 1031 Exchanges

Financing challenges unique to 1031 exchanges stem from typical acquisition financing requiring initial capital at closings, but exchange proceeds remaining with qualified intermediaries until closings complete. Understanding how to structure replacement property financing within 1031 constraints determines whether you can successfully complete exchanges within 180-day deadlines.

DSCR financing provides ideal solutions for 1031 exchange replacement properties because DSCR loans qualify based solely on rental income covering debt service rather than requiring personal income verification or substantial initial capital from borrowers beyond exchange proceeds. Lenders experienced with 1031 exchanges coordinate directly with qualified intermediaries, allowing exchange proceeds to fund initial capital requirements at closing while lenders provide remaining financing based on property cash flow analysis. Calculate replacement property debt service coverage using our DSCR loan calculator ensuring properties generate sufficient income qualifying for financing without personal income documentation.

Conventional financing works for 1031 exchanges when you qualify based on personal income and maintain sufficient cash reserves beyond exchange proceeds meeting lender reserve requirements. However, conventional loans limited to 10 financed properties constrain investors using 1031 strategies for portfolio scaling—if you’ve reached this limit, alternative financing through DSCR, portfolio loans, or bank statement programs becomes necessary. Additionally, conventional lenders sometimes struggle coordinating closings with qualified intermediary fund releases, requiring borrower education helping lenders understand 1031 mechanics and qualified intermediary coordination procedures.

Bridge financing temporarily funds replacement property acquisitions when permanent financing isn’t immediately available or when you need fast closings capturing time-sensitive opportunities during exchange periods. Short-term bridge loans from 6-24 month terms at higher interest rates (typically 8-12%) close quickly allowing timely replacement property acquisitions, then refinance into permanent lower-cost financing once properties season and operations stabilize. This approach prevents missing 180-day deadlines due to slow conventional underwriting while maintaining acquisition momentum during exchanges.

Initial capital coordination requires creative structuring when exchange proceeds alone don’t cover initial investment requirements plus financing costs. Three approaches solve this: using personal funds temporarily providing initial capital then reimbursing yourself from qualified intermediary proceeds at closing (permissible under IRS rules), arranging purchase contracts where sellers finance portions reducing initial capital needs, or structuring maximum loan-to-value financing through specialized lenders minimizing initial capital requirements. Document personal fund usage carefully when pursuing reimbursement strategies—qualified intermediaries need clear records showing funds legitimately reimbursed for exchange-related expenses rather than improper proceeds access disqualifying exchanges.

Multiple replacement properties create financing complexity requiring coordination across several lenders, title companies, and closing dates within the 180-day window. Consider using portfolio lenders financing multiple properties through single loan applications and coordinated closings, simplifying administrative processes compared to separate lenders for each property. Alternatively, finance properties sequentially as each becomes available rather than attempting simultaneous closings—acquire property A at day 60, property B at day 120, property C at day 175, allowing adequate time for individual financing processes without overwhelming coordination demands.

Interest rate locks during exchange periods protect against rate increases between relinquished property sales and replacement property closings. If you sell relinquished properties when rates are 7.0% but replacement property closings occur 150 days later when rates reach 7.5%, this increase affects financing costs and potentially property cash flow making deals less attractive. Lock replacement property financing rates early when possible, understanding lock periods might need extending (for additional fees) if closings delay. Factor these potential rate increase risks into replacement property analysis ensuring deals work even if rates rise modestly before closings complete.

Seller financing on replacement properties reduces conventional financing needs, solving capital and qualification challenges simultaneously. Negotiate seller carry-backs covering 10-30% of purchase prices, reducing required conventional financing amounts and initial capital needs. Sellers willing to carry financing often accept replacement property purchase terms more favorable to buyers, recognizing financing flexibility helps transactions close within tight 1031 deadlines. Present seller financing as win-win: buyers meet exchange requirements efficiently, sellers receive ongoing income streams plus interest exceeding alternative investment returns they might receive on lump-sum sales proceeds.

Cash purchases of replacement properties eliminate financing coordination entirely but require substantial wealth beyond exchange proceeds. If relinquished property sales generate $400,000 proceeds and replacement properties cost $600,000, you need $200,000 additional cash beyond exchange proceeds funding acquisitions without financing. Many investors use combinations—cash for one replacement property, financing for another—optimizing cash deployment across multiple properties while meeting exchange requirements. Calculate these approaches using our rental property calculator understanding how different financing structures affect cash flow, returns, and portfolio growth.

Strategic Uses of 1031 Exchanges: Optimizing Your Portfolio

Beyond simple tax deferral, sophisticated investors use 1031 exchanges strategically repositioning portfolios, consolidating holdings, diversifying geographically, or transitioning between active and passive management. Understanding these strategic applications transforms exchanges from defensive tax tools into offensive wealth-building strategies.

Geographic repositioning through 1031 exchanges allows moving from high-tax, low-cash-flow appreciation markets into low-tax, high-cash-flow markets without triggering taxation on accumulated gains. Exchange expensive California coastal properties into multiple Tennessee or Texas rental properties, transforming equity positions generating minimal cash flow but substantial paper gains into diversified portfolios generating immediate monthly income with lower ongoing tax burdens. This strategy particularly benefits investors approaching retirement wanting to convert appreciation-focused holdings into income-generating assets supporting lifestyle needs without employment income.

Consolidation strategies exchange multiple smaller properties into fewer larger properties, reducing management complexity and operational overhead. If you own six scattered single-family rentals requiring individual property management, repairs, tenant turnover, and financial tracking, exchange all six into a single 12-unit apartment building with professional on-site management. This consolidation maintains total portfolio value while dramatically reducing management burdens, potentially improving net income through operational efficiencies despite managing similar total unit counts through better economies of scale.

Diversification approaches exchange concentrated holdings into multiple markets or property types spreading risk across different economic drivers. If your entire portfolio concentrates in one city dependent on single industry, exchange portions into properties in diverse markets with different economic bases. Similarly, exchange heavy retail concentrations into mixed portfolios including residential, office, and industrial properties—reducing risk that single sector downturns destroy portfolio performance. Calculate these diversification trades carefully ensuring replacement properties meet equal-or-greater-value requirements while achieving geographic or sector spreading objectives.

Quality upgrades trade smaller older properties requiring extensive maintenance and generating frequent tenant problems into newer higher-quality properties with better tenant bases and lower operational demands. Exchange from C-class older properties in declining neighborhoods into newer B-class properties in stable improving areas—potentially maintaining similar purchase prices but dramatically improving tenant quality, rent collection reliability, and property appreciation potential. This upgrade strategy improves portfolio quality systematically over time without triggering taxation on gains accumulated in properties you’re exiting.

Active-to-passive transitions help investors reducing direct management involvement as circumstances change—health issues, aging, business commitments, or simply wanting more freedom. Exchange multiple directly managed properties into Delaware statutory trusts providing fractional institutional property ownership with zero management responsibilities, or into professionally managed apartment complexes where you maintain ownership but delegate all operations. These transitions preserve capital through continued real estate ownership while eliminating management burdens that become increasingly onerous with age or changing life circumstances.

Leverage repositioning adjusts portfolio debt profiles through exchanges, either increasing leverage deploying extracted equity into additional properties or reducing leverage improving cash flow and security. Exchange fully leveraged properties into partially debt-financed replacements supplementing exchange proceeds with additional cash, reducing total portfolio debt loads and increasing monthly cash flow through lower debt service. Alternatively, exchange properties with minimal debt into maximum-leverage acquisitions, using new mortgages on replacement properties extracting equity that would otherwise remain trapped in low-debt properties—though be cautious this creates taxable boot from debt reduction unless structured carefully.

Estate planning integration treats 1031 exchanges as tools for building inheritable wealth. Exchange systematically throughout your lifetime deferring all gains, then pass properties to heirs who inherit at stepped-up basis eliminating deferred gains permanently. If you’ve completed six successive 1031 exchanges over 30 years building $2 million in deferred gains, your heirs receive properties at their fair market values at your death—completely eliminating the $2 million deferred tax liability. This “swap until you drop” strategy transforms temporary deferral into permanent elimination through estate planning—one of the most powerful wealth-building and preservation strategies available to real estate investors.

Market cycle timing uses 1031 exchanges positioning portfolios optimally within real estate cycles. In late expansion phases when appreciated markets show overheating signs, exchange from expensive markets near potential corrections into stable cash-flowing markets likely weathering downturns better. During recovery phases, exchange from stable markets that didn’t decline into recovering markets offering both value and appreciation potential. This tactical repositioning maintains full investment while optimizing holdings for changing market conditions—difficult to achieve through traditional buy-and-sell approaches losing 30-40% of equity to taxes reducing redeployment capital.

Tax Planning Beyond 1031: Combining Strategies for Maximum Benefit

1031 exchanges work most powerfully when integrated with comprehensive tax planning strategies, creating synergistic benefits exceeding any single approach alone. Sophisticated investors combine multiple tax strategies maximizing wealth preservation and building long-term net worth efficiently.

Cost segregation studies accelerate depreciation on replacement properties acquired through 1031 exchanges, creating current-year tax deductions despite having deferred capital gains from relinquished properties. These engineering-based studies identify property components qualifying for shorter 5, 7, or 15-year depreciation schedules rather than default 27.5-year residential or 39-year commercial schedules. A $1 million replacement property might generate $30,000-$60,000 in first-year depreciation through cost segregation compared to $25,000-$36,000 under standard methods—creating additional $5,000-$25,000 in annual tax deductions. Invest $5,000-$15,000 in cost segregation studies on replacement properties generating returns through increased depreciation deductions for sophisticated tax planning integration.

Real estate professional status designation enables active participation losses to offset ordinary income without passive activity loss limitations. If you qualify as a real estate professional spending 750+ hours annually in real estate activities, losses from rental properties including depreciation can offset W-2 or business income—not just passive real estate income. Combine this status with 1031 exchanges and cost segregation: exchange into properties, conduct cost segregation studies generating paper losses, use those losses offsetting active income through real estate professional status—all while deferring capital gains on exchanged properties. This triple-strategy approach creates substantial tax benefits beyond any single method alone.

Opportunity Zone investing in designated economically distressed areas provides capital gains deferral and potential elimination through different mechanisms than 1031 exchanges. If you can’t complete 1031 exchanges successfully, sell properties recognizing gains, then invest those gains into Opportunity Zone funds within 180 days deferring recognition until 2026 or fund sales. Hold Opportunity Zone investments 10+ years and all appreciation on those investments becomes completely tax-free. This alternative to 1031 exchanges works particularly well when suitable replacement properties aren’t available or when timelines prevent completing exchanges successfully.

Installment sales spread capital gains recognition over multiple years rather than concentrating all taxation in sale years. If you can’t complete 1031 exchanges and must recognize gains, structure sales where buyers pay you over time—perhaps 20-30% initially with remaining amounts paid over 5-10 years. This spreads gain recognition across multiple tax years potentially keeping you in lower tax brackets compared to one-year recognition of entire gains. Combine installment sales with partial 1031 exchanges where you exchange what you can, then structure remaining portions as installment sales—hybrid approaches optimizing tax outcomes when perfect 1031 execution isn’t feasible.

Charitable remainder trusts provide tax deductions, avoid capital gains, and generate lifetime income streams when you’re charitably inclined. Transfer highly appreciated properties into charitable remainder trusts receiving immediate charitable deductions for present values of remainder interests, trusts sell properties tax-free inside trusts, then trusts pay you lifetime income streams from proceeds. At death, remaining trust assets pass to designated charities. This strategy works best for investors with substantial wealth, charitable intentions, and desire for additional income—combining philanthropy with sophisticated tax planning reducing capital gains burdens substantially.

Delaware statutory trust investments as replacement properties in 1031 exchanges provide passive ownership positions in institutional commercial real estate—office buildings, shopping centers, apartment complexes—without direct management responsibilities. These securities qualify as replacement properties under specific IRS revenue rulings when structured properly. DSTs work particularly well for aging investors wanting to maintain real estate exposure and continue deferring gains without ongoing management burdens. However, DSTs are illiquid securities with specific suitability and minimum investment requirements (typically $25,000-$100,000 minimums)—not appropriate for all investors despite 1031 qualification.

Asset protection through entities like LLCs or land trusts protects replacement properties from liability claims and judgments. Structure 1031 exchanges so replacement properties title into single-asset LLCs or series LLCs creating legal separation between properties—if one property faces liability claims, other properties remain protected. This integration of asset protection with tax planning ensures long-term wealth preservation from both tax and legal perspectives. Consult asset protection attorneys structuring these entities properly before completing 1031 exchanges—retrofitting protection after the fact costs more and provides less robust insulation than proper planning during acquisition.

Your Next Steps: Executing Your First 1031 Exchange Successfully

Converting 1031 exchange knowledge into actual executed transactions requires systematic preparation and professional guidance ensuring compliance while optimizing strategic outcomes. Follow these prioritized action steps launching your first successful exchange avoiding costly mistakes that destroy tax deferral benefits.

Begin by evaluating whether 1031 exchanges align with your investment strategy and circumstances. If you own appreciated investment property considering selling, calculate potential capital gains taxes using your actual tax situation—federal capital gains rates, state income taxes, depreciation recapture, and net investment income taxes. Compare after-tax proceeds from outright sales against full equity preservation through 1031 exchanges, understanding how much wealth you’d forfeit to taxation versus preserve through deferral. Use our 1031 exchange calculator modeling various scenarios including successive exchanges showing compound benefits of systematic deferral over decades.

Interview qualified intermediaries before listing properties for sale, not after receiving offers. Research firms specializing in 1031 exchanges asking about their experience, typical clients, insurance coverage protecting exchange funds, fee structures, and educational resources helping first-time exchangers. Most qualified intermediaries charge $800-$1,500 for standard forward exchanges—reasonable costs for protecting hundreds of thousands in equity from taxation. Select intermediaries before marketing properties, allowing them to prepare exchange agreements and provide guidance throughout the entire process from listing through replacement property closings.

Identify potential replacement properties before closing on relinquished property sales—even before listing them if possible. This advance work dramatically improves your success odds compared to starting replacement searches only after selling relinquished properties and activating 45-day clocks. Drive potential markets, connect with local real estate agents specializing in investment properties, analyze available properties meeting your criteria, and potentially submit letters of intent or offers contingent on closing relinquished property sales. This proactive approach prevents the rushed decision-making that leads to acquiring unsuitable properties or missing deadlines entirely.

Engage real estate attorneys experienced with 1031 exchanges reviewing transaction documents, providing guidance on complex issues, and ensuring IRS compliance throughout processes. While qualified intermediaries handle exchange mechanics, attorneys protect your legal interests through purchase contract review, replacement property due diligence, entity structure recommendations, and general transaction guidance. Budget $2,000-$5,000 for attorney involvement in complete exchange processes—modest investments preventing much larger problems from inadequate legal representation during complex transactions.

Structure financing for replacement properties early understanding how exchange proceeds coordinate with lender funding requirements. Schedule a call discussing replacement property financing options for 1031 exchanges, ensuring lenders understand qualified intermediary coordination and timeline requirements. Whether using DSCR financing based on property income, conventional loans requiring personal qualification, or portfolio financing for multiple properties, arrange approvals before identifying properties ensuring financing won’t delay closings beyond 180-day deadlines.

Maintain meticulous records throughout exchange processes documenting all communications, decisions, and financial transactions. Keep copies of qualified intermediary agreements, identification letters, closing statements from both relinquished and replacement property transactions, and all correspondence with intermediaries, attorneys, and lenders. These records prove IRS compliance if audits occur and provide historical documentation for basis tracking affecting future depreciation and capital gains calculations when you eventually sell replacement properties or complete successive exchanges.

Consider starting with a simpler single-property-to-single-property exchange for your first transaction, building competence and confidence before attempting complex multiple-property exchanges. Success on your first exchange provides experience and professional relationships making subsequent exchanges smoother—rushing into complex scenarios risks costly mistakes when inexperience meets complexity. Master basics first, then expand to sophisticated strategies after demonstrating you can execute fundamental exchanges successfully.

Plan for successive 1031 exchanges throughout your investing career rather than treating exchanges as one-time events. The greatest wealth-building power comes from systematic deferral across decades—exchanging every 5-10 years optimizing portfolio composition while preserving full equity. If you’re 40 years old and complete exchanges every 7 years until age 75, you’ll execute five successive exchanges building deferred gains that heirs inherit at stepped-up basis—permanently eliminating accumulated taxes. This long-term perspective transforms 1031 exchanges from tactical tools into strategic wealth-building foundations supporting multi-decade portfolio growth.

Execute your first 1031 exchange within 12 months if you own appreciated investment property. Knowledge without action builds no wealth—systematic deferral requires beginning. Yes, exchanges involve complexity, deadlines, and coordination demands. But the alternative—surrendering 30-40% of equity to avoidable taxation—costs far more than the effort required learning and executing successful exchanges. Thousands of investors complete 1031 exchanges annually—you can too with proper preparation and professional guidance.

Frequently Asked Questions

Can I live in my 1031 exchange replacement property after buying it?

No—converting 1031 exchange replacement properties into primary residences immediately after acquisition disqualifies the original exchange retroactively, creating capital gains tax liability on your relinquished property sale. The IRS requires replacement properties to be held for investment purposes, typically meaning at least 12-24 months of documented rental activity to unrelated tenants at market rents before converting to personal use. Even after this holding period, conversion from investment to personal residence triggers recognition of deferred gains—though you might then use primary residence capital gains exclusions years later when eventually selling if you meet those separate requirements. If you want to eventually live in a property, complete your 1031 exchange properly, lease it as a genuine investment for 24+ months establishing bona fide investment intent, only then convert to personal use understanding this conversion triggers tax on originally deferred gains. Never plan to immediately convert replacement properties to personal use—that’s considered improper exchange motivation disqualifying tax deferral entirely.

What happens if I can’t find suitable replacement properties within 45 days?

If you cannot identify any replacement properties within 45 days, your exchange fails completely and you owe full capital gains taxes on your relinquished property sale as if you never attempted an exchange. The 45-day deadline is absolute without extensions. However, you can identify properties you’re uncertain about closing on—identify three properties per the three-property rule even if you’re not certain you’ll acquire all of them. Then pursue closing on whichever identified properties remain viable within the 180-day period. Partial success (closing on one or two of three identified properties) still constitutes successful partial exchange deferring gains on what you acquired, even if you couldn’t close on all identified properties. To prevent 45-day deadline failures, begin replacement property searches before listing relinquished properties for sale, identify properties within 20-30 days leaving comfortable buffers, and consider identifying three properties rather than a single option providing backup alternatives if your first choice becomes unavailable.

Do I need to use a qualified intermediary or can I hold the money myself temporarily?

You absolutely must use a qualified intermediary—receiving proceeds yourself even temporarily completely disqualifies 1031 exchanges creating immediate taxable sales. This is one of the most critical and non-negotiable 1031 exchange requirements. Even holding funds for a single day between receiving them from relinquished property sales and transferring them to replacement property purchases destroys exchange tax-deferred status. Qualified intermediaries must be independent third parties unrelated to you—not your employee, attorney, accountant, real estate agent, or family member. They charge $800-$1,500 for standard exchanges, reasonable costs compared to the tens or hundreds of thousands you’ll save through successful tax deferral. Never attempt creative arrangements bypassing qualified intermediaries trying to save fees—the IRS doesn’t provide flexibility on this requirement, and violations trigger full taxation on exchanges you thought were tax-deferred.

Can I do a 1031 exchange with rental property I converted from my primary residence?

Yes, but you must establish sufficient rental activity and investment intent before attempting exchanges. Convert your primary residence into a genuine rental property—lease to unrelated tenants at market rents, report rental income and expenses properly, maintain the property as a business rather than personal asset, and document this rental activity for at least 12-24 months before pursuing 1031 exchanges. The IRS scrutinizes these conversions carefully ensuring properties truly became investment assets rather than personal residences disguised as rentals attempting to improperly access 1031 benefits. Don’t attempt “paper conversions” where you briefly list properties for rent, accept one short rental period from friends or family, then claim investment property status for 1031 purposes. Genuine conversions require extended periods of arm’s-length rental operations at market rents establishing clear investment intent. After this establishment period, converted primary residences qualify for 1031 treatment identically to properties purchased originally as investments. Conversely, primary residences held less than 12 months before conversion attempts face heightened IRS scrutiny potentially disqualifying exchanges.

How many times can I do 1031 exchanges—is there a limit?

No limit exists on how many successive 1031 exchanges you can complete throughout your lifetime. Many sophisticated investors execute exchanges every 5-10 years systematically, continuously deferring gains while optimizing portfolios—a strategy sometimes called “swap till you drop.” Each exchange defers taxation on that transaction’s gains, with deferred amounts accumulating across successive exchanges. If you complete six exchanges over 30 years building $2 million in deferred gains, you’ve legitimately deferred all of that taxation through proper sequential exchanges. The ultimate strategy: continue exchanging throughout your life, then pass properties to heirs who inherit at stepped-up basis equal to fair market values at your death—permanently eliminating all accumulated deferred gains through estate planning integration. This transforms temporary deferral into permanent elimination, creating one of real estate’s most powerful wealth-building and preservation mechanisms available to active investors.

Related Resources

Also helpful for active investors:

- Capital Gains Tax Strategies for Real Estate Investors — Beyond 1031 exchanges, additional tax minimization approaches

- Building Generational Wealth Through Real Estate — Long-term portfolio strategies including estate planning

- How to Scale Your Real Estate Portfolio — Growth strategies using 1031 exchanges systematically

What’s next in your journey:

- Portfolio Optimization for Active Investors — Strategic repositioning through exchanges

- Advanced Real Estate Tax Planning — Integrating multiple tax strategies

- Delaware Statutory Trusts for Passive Investing — Alternative 1031 replacement properties

Explore your financing options:

- DSCR Loan Program — Income-based financing ideal for replacement properties

- Portfolio Loan Program — Multi-property financing for complex exchanges

- Bridge Loan Program — Temporary financing during exchange periods

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.