Should I Invest in a Short-Term Rental or Long-Term Tenant?

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

Short-Term Rental or Long-Term Tenant? Pros & Cons

So you’ve got a property (or plan to buy one)…

Now you’re wondering:

Should I rent it out long-term — or go the Airbnb route?

Both strategies can build cash flow.

But they’re very different in terms of management, income, and lifestyle.

Let’s break it down so you can decide which model fits your property, your goals, and your capacity.

Short-Term Rentals (Airbnb, VRBO, etc.)

How it works: You rent the property nightly or weekly to short-term guests — think vacationers, traveling nurses, digital nomads.

Pros:

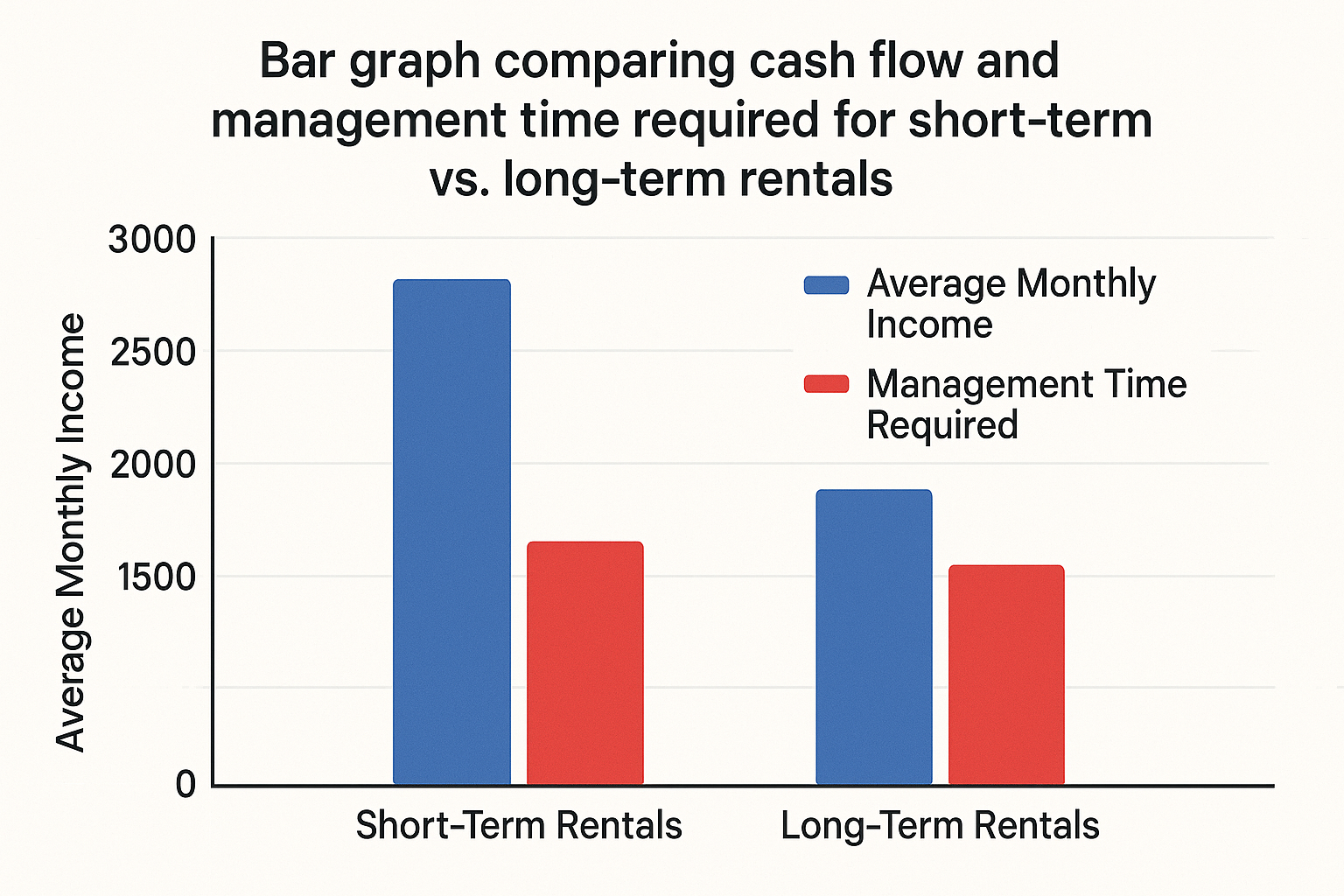

- Higher income potential (can earn 2–3x long-term rent)

- Flexibility: Block dates for personal use

- Attractive for popular or seasonal areas

- Allows creative setups (tiny homes, ADUs, basements, etc.)

Cons:

- More management (cleanings, guest turnover, reviews)

- More regulation (local rules, licensing, zoning)

- Inconsistent cash flow in off-season or downturns

Best for:

- Properties in hot locations

- People willing to automate or hire property managers

- Investors seeking maximum monthly upside

Want to see the numbers on short-term rental income? Calculate your Investment Growth now to project potential returns from different rental strategies and property appreciation over time.

Long-Term Rentals

How it works: You rent the property to a tenant with a 6–12+ month lease. Monthly rent is stable and predictable.

Pros:

- Passive income: Less daily management

- Predictable cash flow: Set rent each month

- Fewer legal/regulatory headaches

- Easier to manage for first-time landlords

Cons:

- Less income potential in high-demand areas

- Property wear and tear from long-term use

- Slower ability to adjust pricing or strategy

Best for:

- People who want stability and simplicity

- Owners who value hands-off cash flow

- Markets with strong year-round demand

Understanding long-term rental cash flow is essential. Calculate your Buy & Hold: Cashflow, Appreciation, Equity, Depreciation & Tax Savings now to see the complete financial picture of traditional rental property ownership including tax benefits.

So… Which One’s Right for You?

Ask yourself:

- Do I want cash flow or peace of mind?

- Do I enjoy hospitality, or prefer passive income?

- Am I investing for monthly returns or long-term stability?

- What does my city allow — and what’s trending locally?

Sometimes it’s not either/or. You can even do both — using one property for short-term now and long-term later.

We’ll help you map out the right move based on your goals.

Ready to finance your rental property strategy? Calculate your DSCR Investment Purchase Loan Payment now to explore investor financing that qualifies based on property income—whether short-term or long-term rental.

Need help evaluating your rental options?

At Stairway Mortgage, we help investors choose and finance the rental strategy that matches their goals, capacity, and market.

📘 Download our homebuyer guides for real estate investors.

🧮 Analyze rental strategies with our Buy & Hold Calculator.

🏠 Explore investment financing on our Buy a House page.

💰 See investor loans with our DSCR Calculator.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call