Rent vs Buy Calculator: The Real Math for Twenty-Somethings

Rent vs Buy Calculator: The Real Math for Twenty-Somethings

Rent vs Buy Calculator and the Real Math Behind Your Housing Decision

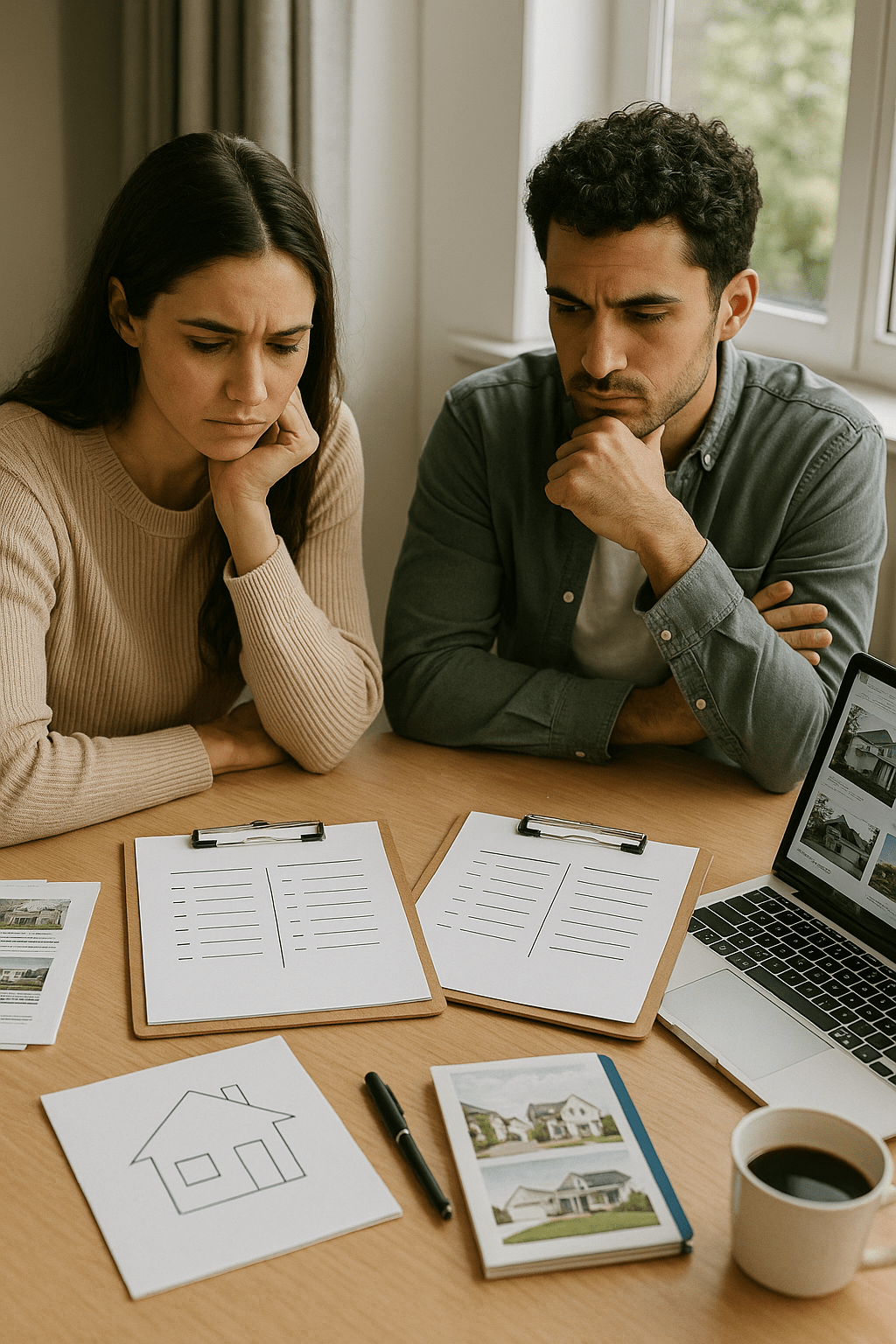

Whether you’re a young adult trying to decide if homeownership makes sense now or a parent helping your twenty-something navigate this choice, the rent versus buy decision isn’t as simple as most calculators suggest. The real question isn’t just about monthly costs—it’s about building wealth, timing, and your specific life situation.

In this guide, you’ll discover:

- How to use rent vs buy analysis for your actual situation (not generic national averages)

- Break-even timeline that shows when buying starts building wealth

- Hidden costs of both renting and owning that calculators often miss

- How your timeline and goals affect which choice builds more wealth

- Real scenarios showing when each option makes financial sense

The young adults building wealth in their twenties understand that this decision depends on your specific market, timeline, and financial situation—not universal rules.

Ready to run the numbers for your situation? Schedule a call to discuss whether buying or continuing to rent makes more sense for your wealth-building goals right now.

Why Most Rent vs Buy Calculators Miss the Point

Here’s the problem with generic calculators: They compare monthly payments in a vacuum, ignoring the wealth-building mechanics that make homeownership powerful. Monthly cost is just one variable—and often not the most important one.

What typical calculators overlook:

Forced Savings Through Principal Paydown:

- Every mortgage payment builds equity automatically

- Rent payments build zero equity ever

- This compounds dramatically over years

- The discipline of required payment creates wealth

Appreciation Capture:

- Home values typically increase over time

- You capture 100% of appreciation on owned property

- Renters receive zero benefit from property appreciation

- Leverage amplifies returns on your down payment investment

Tax Benefits:

- Mortgage interest deduction for qualifying buyers

- Property tax deductions

- No tax benefits from rent payments

- Can significantly reduce real cost of ownership

Inflation Hedge:

- Fixed-rate mortgage payment stays constant

- Rent increases with inflation every year

- Your payment becomes smaller relative to income

- Major advantage over longer timelines

The wealth-building difference: After five years of renting, you have zero equity and paid increasingly higher rent. After five years of owning, you’ve built substantial equity through principal paydown and appreciation, while your payment stayed fixed.

Use the FHA loan calculator to see real mortgage costs including principal, interest, taxes, and insurance for properties you’re considering.

What’s the Real Break-Even Timeline for Your Market?

Break-even isn’t when monthly costs equalize—it’s when total ownership costs are offset by equity building and appreciation. This timeline varies dramatically by market and situation.

Break-even calculation components:

Upfront Costs to Own:

- Down payment (though this becomes equity)

- Closing costs

- Moving costs

- Initial furniture and setup

Ongoing Ownership Costs:

- Mortgage principal and interest

- Property taxes

- Homeowners insurance

- HOA fees if applicable

- Maintenance and repairs

- Utilities (if higher than renting)

Ongoing Renting Costs:

- Monthly rent payments

- Renters insurance

- Annual rent increases

- Moving costs when changing rentals

- Storage fees if needed

Wealth-Building Offsets:

- Equity from principal paydown

- Home appreciation

- Tax benefits

- Avoided rent increases

Typical break-even timelines:

- Strong appreciation markets: Often two to three years

- Moderate markets: Three to five years

- Slower markets: Five to seven years

- Your specific timeline depends on local conditions

The critical consideration: If you’re planning to stay in your area beyond the break-even point, buying usually builds more wealth. If you’re moving in under two years, renting often makes more financial sense due to transaction costs.

See how conventional loan programs compare to renting for different timelines and home prices in your market.

How Do Rent Increases Affect Long-Term Wealth?

This is where the math shifts dramatically in favor of ownership. Most twenty-somethings dramatically underestimate how rent increases compound over time.

The rent increase reality:

Year One:

- Rent: Starting monthly amount

- Mortgage: Fixed amount (if fixed-rate)

Year Three:

- Rent: Significantly higher after multiple increases

- Mortgage: Exactly the same payment

Year Five:

- Rent: Substantially higher than original

- Mortgage: Still unchanged

Year Ten:

- Rent: Dramatically higher than starting point

- Mortgage: Identical to day one (feels like bargain)

The wealth impact calculation: Over ten years, rent payments might increase substantially in total costs. That same ten years of fixed mortgage payments? Your housing cost stayed flat while you built equity and captured appreciation.

Your income considerations: As your income increases (typical in twenties and thirties), your fixed mortgage payment becomes smaller percentage of income. Meanwhile, rent consumes increasingly larger portion as it rises with market.

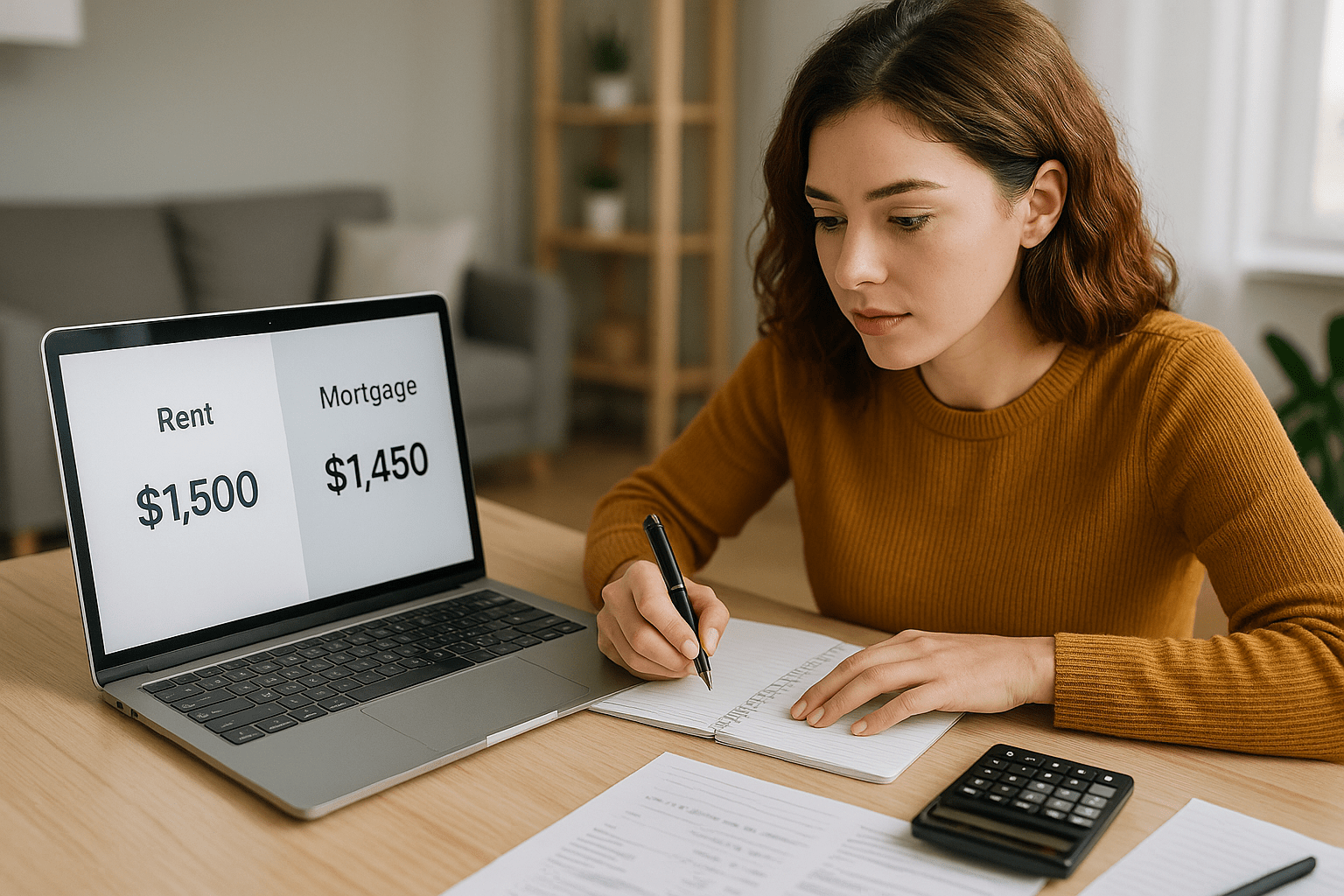

The compound effect example: Starting with comparable costs of rent and mortgage payments, by year five the mortgage payment might represent significantly lower real cost when considering equity building, while rent has increased substantially with zero equity.

Use the rent vs buy calculator specifically designed to show how rent increases and equity building affect long-term wealth over different timelines.

What Hidden Costs Are You Missing in Each Option?

Both renting and owning have costs that don’t show up in simple calculations. Understanding these changes which option actually costs less in your situation.

Hidden renting costs:

Flexibility Premium:

- Rent prices include landlord’s profit margin

- Paying for convenience of month-to-month flexibility

- Covering landlord’s maintenance, taxes, insurance with markup

- Premium for not dealing with repairs directly

Wealth Opportunity Cost:

- Money paid in rent builds zero equity

- Down payment savings sitting in account instead of building equity

- Missed appreciation in rising markets

- No tax benefits

Instability Costs:

- Forced moves when landlord sells or doesn’t renew

- Moving expenses every few years

- Time and hassle of relocating

- Potential rent spikes in hot markets

Hidden ownership costs:

Maintenance and Repairs:

- Major systems eventually need replacement

- Unexpected repairs happen

- Regular upkeep requirements

- DIY time or professional service costs

Transaction Costs:

- Buying costs (inspections, appraisals, closing costs)

- Selling costs when you eventually move (commissions, closing)

- Time and effort of purchase process

- Potential costs if selling below break-even timeline

Reduced Flexibility:

- Harder to relocate quickly for opportunities

- Tied to specific location

- Must sell or rent out if moving

- Risk if you need to sell during market downturn

The honest assessment: Renting costs more monthly in most markets but provides flexibility. Owning builds wealth but requires longer commitment. Neither is universally “better”—it depends on your timeline and goals.

Review this FHA loan case study showing how a physical therapist analyzed rent versus buy decision and chose to purchase.

When Does Renting Actually Make More Sense?

Homeownership isn’t always the smart choice—especially for young adults in certain situations. Being honest about when renting wins prevents costly mistakes.

Scenarios where renting makes more financial sense:

Short Timeline (Under 2-3 Years):

- Transaction costs eat into appreciation

- Don’t reach break-even point

- Risk of needing to sell in down market

- Flexibility valuable for career moves

Unstable Career or Income:

- Job could require relocation

- Income insufficient for comfortable mortgage payment

- Probationary period at new company

- Considering graduate school or major career change

Extremely High-Price Markets:

- Rent-to-price ratio heavily favors renting

- Down payment takes many years to save

- Mortgage payment significantly higher than rent

- Better return investing down payment elsewhere

Major Life Uncertainty:

- Relationship status may change

- Considering moving cities

- Testing out neighborhood before committing

- Not sure about staying in area long-term

Insufficient Emergency Fund:

- Can’t handle unexpected repairs

- No reserves beyond down payment

- One emergency away from financial stress

- Should build savings first

The strategic consideration: Renting isn’t “throwing money away” if it’s the right choice for your timeline and situation. It’s buying flexibility and optionality, which has real value for young adults still figuring out life direction.

Use the down payment assistance programs to see if grants make buying feasible sooner than you thought possible.

When Should You Stop Renting and Start Owning?

The transition from renting to owning should be strategic, not impulsive. Certain indicators show you’re ready to make the shift even if you’re young.

Green lights for buying:

Financial Readiness:

- Saved down payment for your target loan program

- Strong emergency fund separate from down payment

- Stable income sufficient for mortgage qualification

- Credit score meets lender requirements

- Debt-to-income ratio in good range

Life Stability:

- Planning to stay in area minimum three to five years

- Career path relatively clear

- Relationship status settled

- Know neighborhood you want to live in

- Understand commitment required

Market Conditions:

- Home prices reasonable relative to rent

- Inventory available in your price range

- Interest rates acceptable

- Not obvious bubble conditions

- Good selection in target areas

Mental Readiness:

- Willing to handle maintenance issues

- Comfortable with homeownership responsibility

- Understand it’s investment, not just place to live

- Ready for less flexibility short-term

- Excited about building equity

The timing framework: You don’t need to be 100% certain about next ten years. You need reasonable confidence in next three to five years plus understanding that even if you move, you can sell or rent the property.

The wealth-building advantage: Every month you wait while financially ready is a month of rent payments that could have been equity building. The perfect time often never arrives—good enough timing with solid fundamentals works.

See how FHA loans allow homeownership with minimal down payment, making the transition from renting much more accessible than most young adults realize.

What About House Hacking to Eliminate Rent Entirely?

Here’s where the rent versus buy calculation gets interesting: What if buying actually eliminates housing costs instead of just converting rent to mortgage?

The house hacking strategy:

Multi-Unit Purchase:

- Buy duplex, triplex, or fourplex with minimal down payment

- Live in one unit as primary residence

- Rent other units to tenants

- Rental income covers mortgage payment partially or fully

- Housing costs dramatically reduced or eliminated

Single-Family Rental Rooms:

- Buy house with extra bedrooms

- Rent rooms to roommates

- Rental income offsets mortgage payment

- Maintains single-family home feel

- Easier property management than multiple units

The math that changes everything: Compare rent payment to living for free in property you own while tenants cover mortgage. After few years, you’ve built substantial equity while paying minimal or zero housing costs.

Example scenario:

- Monthly rent: $1,500

- Purchase fourplex: $400,000

- Down payment: 3.5% FHA

- Mortgage payment: $2,800

- Rent from three units: $3,600

- Your housing cost: $0 (plus $800 cash flow)

- After four years: Built equity while living free

The young adult advantage: Twenty-somethings are often more willing to share living space with roommates or tenants. This flexibility creates wealth-building opportunity not available to buyers needing private single-family homes.

Explore house hacking strategies and use the rental property calculator to see how rental income eliminates your housing costs entirely.

How Stairway Mortgage Helps You Make This Decision

We understand that rent versus buy isn’t a calculator question—it’s a life decision requiring personalized analysis. Our approach helps you see clearly which path builds more wealth for your specific situation.

Our rent vs buy analysis:

Personalized Calculation:

- Your actual rent costs in current market

- Real mortgage costs for homes you’d buy

- Your specific down payment and closing costs

- Local appreciation rates and rent increases

- Break-even timeline for your situation

Qualification Assessment:

- Whether you can qualify to buy now

- What home prices fit your income

- Down payment needed for target homes

- Timeline if you need to improve credit or save more

- Creative strategies to buy sooner

Timeline Guidance:

- How long you need to stay to reach break-even

- Wealth accumulation projections over different periods

- Risk analysis if you might move sooner

- Flexibility options if you need to relocate

Strategy Development:

- House hacking opportunities in your market

- Down payment assistance you qualify for

- Optimal loan program for your goals

- Path to transition from renting when ready

Ready for personalized rent versus buy analysis? Schedule a call to run the real numbers for your specific situation and goals.

Ready to Stop Guessing and Start Planning?

You’ve learned the real variables that determine whether renting or buying builds more wealth for you. The decision isn’t about following conventional wisdom—it’s about analyzing your specific market, timeline, and financial situation.

Your next steps:

- Calculate Your Numbers: Use rent vs buy calculator with real local data

- Assess Your Timeline: Determine realistic commitment period

- Evaluate Readiness: Check financial and life stability factors

- Get Pre-Qualified: See what you actually qualify to purchase

Different paths work for different people:

- Some buy early and build wealth through appreciation

- Others rent strategically while building career flexibility

- Many use house hacking to eliminate housing costs

- All succeed by making informed decisions based on data

The young adults building wealth aren’t blindly following rules about when to buy. They’re analyzing their specific situation and acting when the math favors ownership.

Get pre-approved to see what homes you could buy instead of renting, or take our discovery quiz to explore your best path forward.

Frequently Asked Questions

How do I know if I can afford to buy instead of rent?

Compare your current rent payment to potential mortgage payment (including principal, interest, taxes, insurance) for homes you’d consider buying. If mortgage payment is comparable to or less than rent, you can likely afford it—especially when factoring in that you’re building equity instead of just paying rent. Use the FHA loan calculator with real home prices in your area to see actual monthly costs. Don’t forget to factor in maintenance costs (roughly 1% of home value annually) that you don’t pay as renter.

What if home prices are much higher than rent in my market?

In very expensive markets where buying costs significantly more than renting, the break-even timeline extends. However, you may still come out ahead long-term through appreciation and forced savings. Consider house hacking strategies where rental income from other units offsets your costs, or look at slightly less expensive neighborhoods where rent-to-price ratios are better. Some young adults choose to rent while saving aggressively, then buy when they have larger down payment or move to more affordable market.

Is there a rule of thumb for rent vs buy decisions?

The traditional guideline says if you’re staying in an area for at least three to five years, buying usually makes more sense than renting. However, this varies by market—strong appreciation areas might break even in two years, while slower markets might need seven years. A better rule: buy when you have financial stability, sufficient savings, and reasonable confidence in staying in the area beyond the break-even point. The specific timeline matters more than arbitrary rules.

Can I buy a house and rent it out if I move?

Yes, this strategy lets you build wealth through real estate even if you relocate. Your primary residence purchased with minimal down payment can become a rental property when you move. You’ll need to qualify for your next home purchase while carrying the rental property, but rental income (with proper documentation) typically helps your qualification. This approach lets young adults start building rental property portfolio early. Review conventional loan programs for investment property requirements.

What if I’m not sure I’ll stay in my city long-term?

If there’s significant uncertainty about staying beyond two to three years, renting provides flexibility worth paying for. However, many young adults overestimate how uncertain their timeline really is. If you’re reasonably confident about next three years and understand you could sell or rent the property if needed, buying can still make sense. The key is honest assessment of likelihood you’ll stay versus desire for optionality. Don’t let hypothetical uncertainty prevent wealth-building if you’re realistically committed to your location.

Also Helpful for Smart Stewards

Related Resources:

- All Available Loan Programs – Explore financing options

- House Hacking Guide – Eliminate housing costs

- FHA Loans – Minimal down payment path

What’s Next in Your Journey?

Continue building your Smart Stewards strategy:

- First Time Home Buyer Assistance (Post #12) – Finding help and building team

- Home Purchase Budget (Post #13) – 2-year roadmap to ownership

- Buying Your First Home (Post #14) – Success stories from young adults

Explore Your Complete Options

Calculate Your Scenarios:

- Rent vs Buy Calculator – Personalized comparison

- FHA Loan Calculator – Real mortgage costs

- Rental Property Calculator – House hacking scenarios

See Real Success Stories:

- FHA Loan Success – Transitioned from renting

- House Hacking Success – Eliminated housing costs

- All Case Studies – Every journey documented

Ready to Take Action:

- Schedule a Call – Discuss your rent vs buy analysis

- Discovery Quiz – Find your best path

- Get Pre-Approved – See what you can buy

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.