Real Estate Investment for Beginners: What the Wealthy Know About Building Wealth

- By Jim Blackburn

- on

- Buy A House, DSCR Loans, Real Estate Investor, Tax Strategies, Wealth Building

The Wealth Gap: What the Rich Know About Real Estate

Let’s talk about the truth behind the wealth gap.

It’s not just income.

It’s not just education.

It’s ownership — especially real estate ownership.

The wealthy understand how to use real estate as a tool, not just a place to live.

And once you understand what they know, you can start making the same moves — even without a fortune to start with.

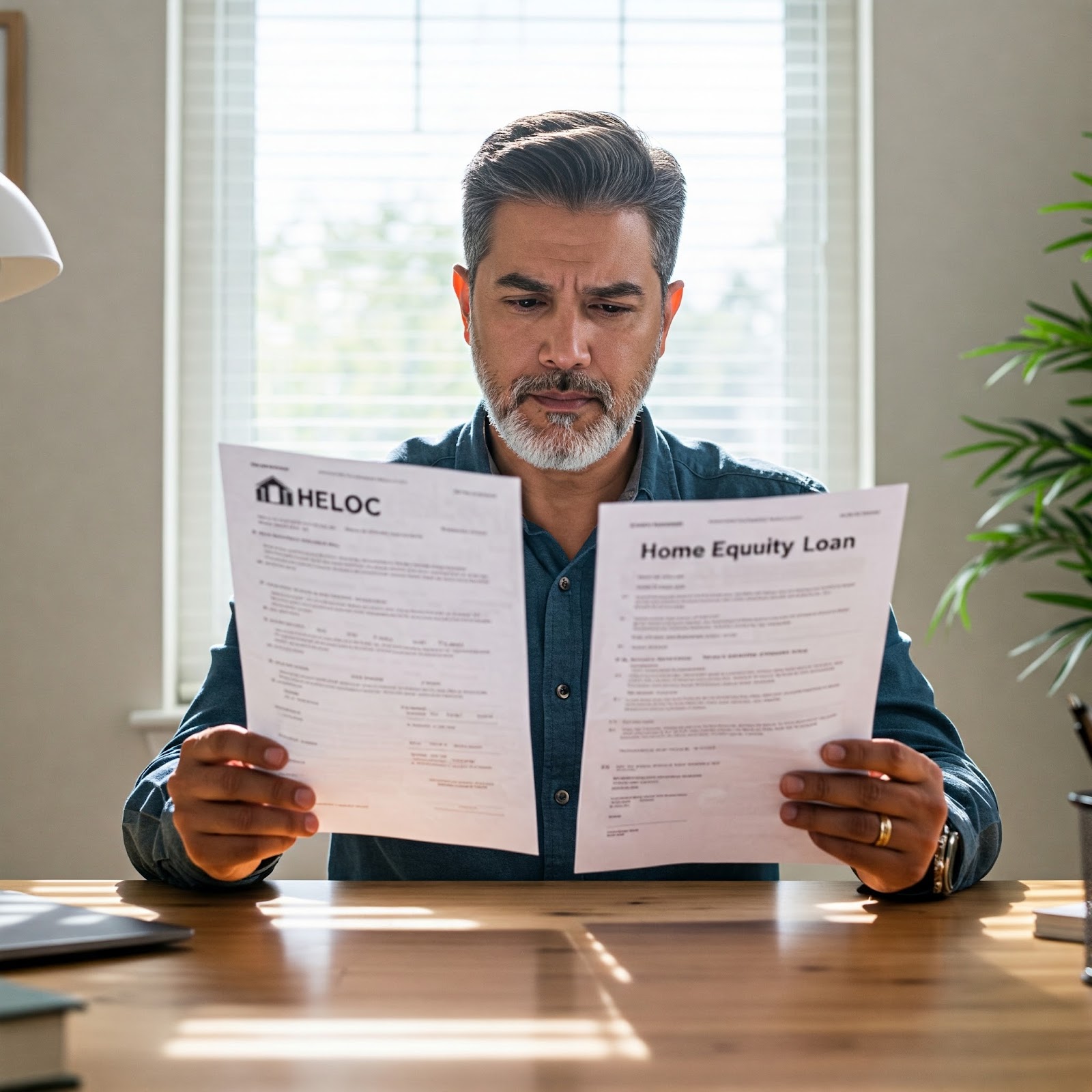

Wealthy People Don’t Just Buy Homes — They Leverage Them

The average person buys a home for comfort.

The wealthy buy for control — and they:

- Use leverage to own appreciating assets

- Turn homes into income-generating properties

- Reposition equity over time (HELOCs, cash-outs, 1031s)

- Build portfolios that grow faster than inflation

You don’t have to be rich to use these strategies.

But you do need to think like someone who wants to be.

Want to understand wealth-building through real estate? Calculate your Buy & Hold: Cashflow, Appreciation, Equity, Depreciation & Tax Savings now to see how property ownership creates wealth through multiple channels simultaneously.

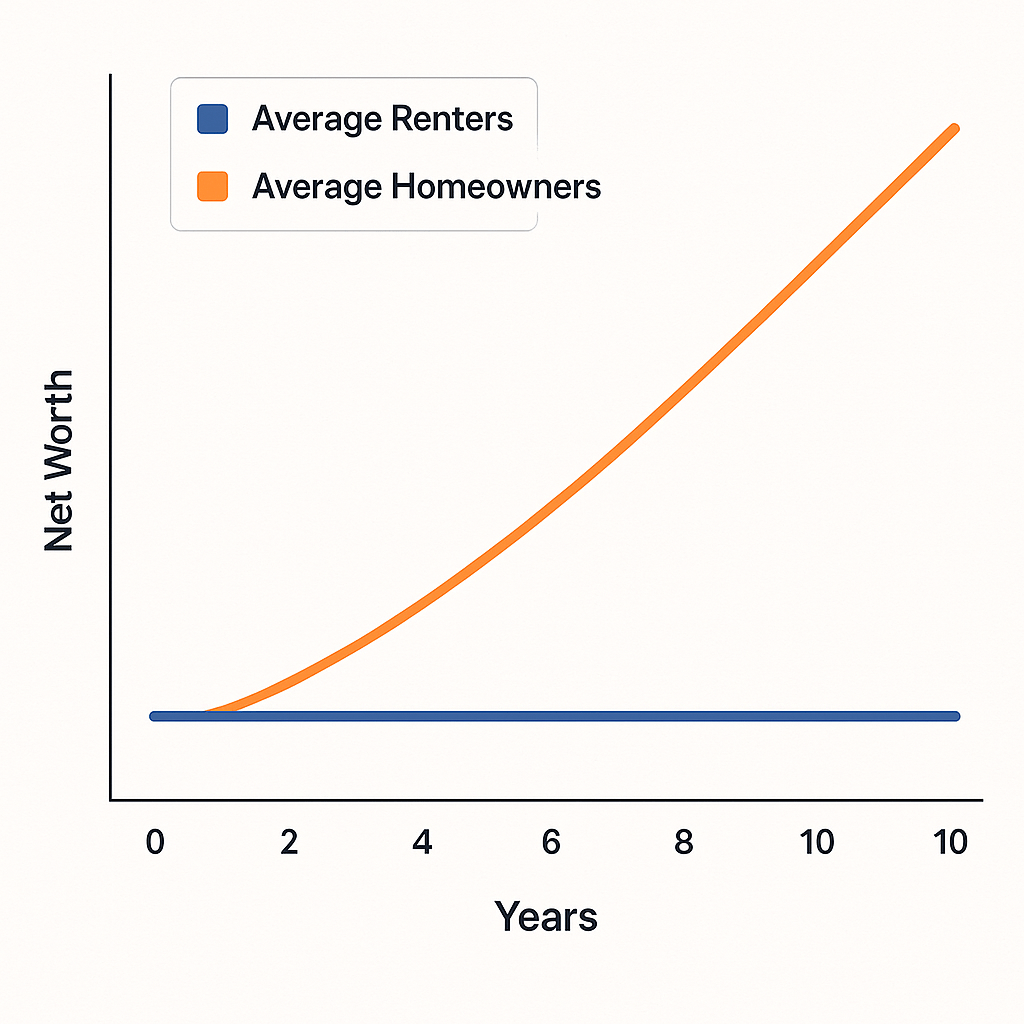

Why Renters Get Left Behind

When home prices go up, renters pay more.

When interest rates rise, renters lose buying power.

When inflation kicks in, renters feel it first.

Meanwhile, homeowners with locked-in payments and appreciating assets ride the wave.

The result?

A widening wealth gap — one real estate closing at a time.

Ready to stop renting and start building wealth? Calculate your Conventional Purchase Loan Payment now to see how homeownership locks in your housing costs while building equity as inflation increases property values.

Real Estate Isn’t Just Wealth Storage — It’s Wealth Creation

Real estate gives you:

- Leverage (control more with less)

- Cash flow (rentals pay you monthly)

- Appreciation (home value grows over time)

- Tax benefits (keep more of what you earn)

This is why real estate is the foundation of most generational wealth.

And why now — not someday — is the best time to get started.

Interested in investment properties for wealth acceleration? Calculate your DSCR Investment Purchase Loan Payment now to explore how rental properties create cash flow and appreciation while providing tax advantages.

Ready to get on the wealth-building side of the gap?

At Stairway Mortgage, we help you build wealth through real estate—using the same strategies wealthy investors have used for generations.

📘 Download our homebuyer guides about wealth building.

🧮 Analyze strategies with our Buy & Hold Calculator.

🏠 Start your journey on our Build a Wealth Plan page.

💰 Explore investment financing with our DSCR Calculator.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call