Portfolio Lending Real Estate Loans: Close on 3 Properties in 30 Days

Portfolio Lending Real Estate Loans: Close on 3 Properties in 30 Days

Your conventional lender just told you “no” for the fifth time this year.

You’ve built a solid portfolio of four financed rental properties generating consistent cash flow. Your credit is excellent. Your properties perform well. But when you try to finance property number five, every conventional lender hits you with the same wall: Fannie Mae limits you to four financed properties.

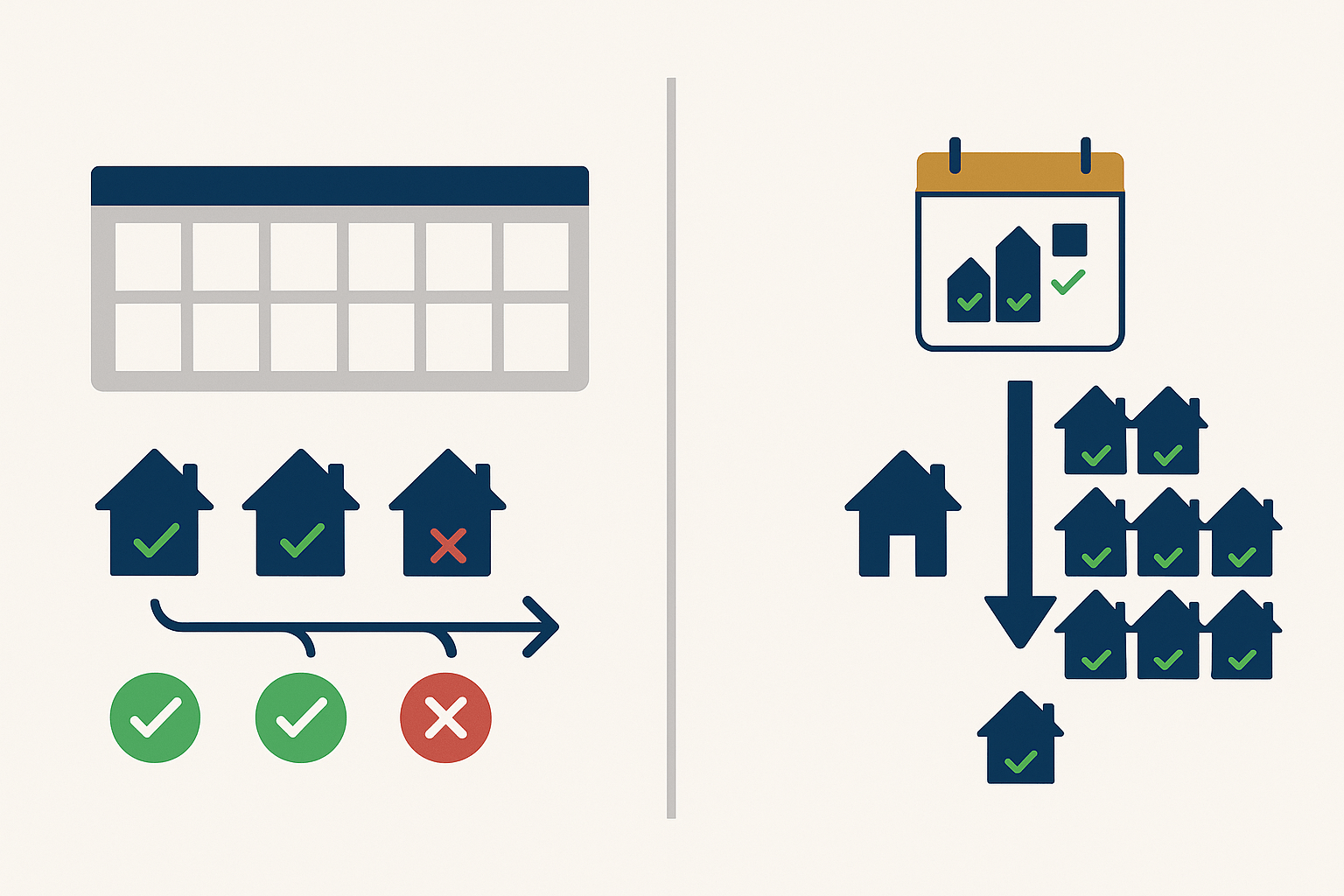

Meanwhile, you’re watching three perfect acquisition opportunities slip away because you can’t move fast enough. Each property requires separate applications, different underwriters, staggered closings consuming months. By the time you close on one property, the other two deals have evaporated.

Your competitor just closed on three properties simultaneously in 30 days. Their secret? Portfolio lending real estate loans that bypass conventional limits and let aggressive investors scale at the speed their markets demand.

Key Summary

Portfolio lending real estate loans allow investors to finance multiple properties simultaneously through one lender who holds the financing in-house rather than selling to Fannie Mae or Freddie Mac, eliminating conventional financing restrictions and dramatically accelerating acquisition velocity.

In this guide:

- Complete explanation of portfolio lending real estate loans structure and how portfolio lenders differ from conventional mortgage originators (mortgage lending fundamentals)

- Qualification requirements including credit, income documentation, reserves, and property performance standards for portfolio programs (real estate financing options)

- Strategic advantages including unlimited property financing, flexible underwriting, and simultaneous closings enabling rapid scaling (investment property financing)

- Rate and cost analysis comparing portfolio lending to conventional financing with break-even calculations for growth-focused investors (real estate investment analysis)

Portfolio Lending Real Estate Loans: Understanding the Core Difference

Most real estate investors don’t understand the fundamental difference between conventional mortgage lending and portfolio lending, leading them to assume all financing works the same way. This misconception prevents them from accessing the financing tools that would accelerate their growth.

How Conventional Mortgage Lending Works

When you obtain a conventional mortgage, your loan originator typically intends to sell that financing to Fannie Mae or Freddie Mac on the secondary market. These government-sponsored enterprises purchase mortgages meeting specific criteria, providing liquidity to the mortgage market.

This secondary market system creates the financing availability and competitive pricing most borrowers enjoy. However, it also imposes rigid limitations because Fannie and Freddie only purchase financing meeting their specific standards.

The most constraining limitation for investors: Fannie Mae and Freddie Mac will only purchase up to four financed residential investment properties per borrower. Once you’ve financed four properties through conventional channels, you hit a wall. Property number five and beyond require different financing approaches.

Additional conventional restrictions include:

- Strict debt-to-income ratio requirements (typically 43-45% maximum)

- Standardized income documentation (W-2s, tax returns, pay stubs)

- Property type limitations (standard residential only)

- Occupancy requirements (minimum occupancy percentages)

- Loan-to-value restrictions (75-80% typically for investment properties)

- Credit score minimums (typically 620-640)

These standards protect Fannie and Freddie from risk but constrain investor flexibility. You must fit into their box precisely, regardless of whether that box makes sense for your specific situation.

What Makes Portfolio Lending Different

Portfolio lenders don’t sell their financing to Fannie Mae or Freddie Mac. Instead, they hold financing in their own portfolio—hence the name “portfolio lending.”

By keeping financing on their books, portfolio lenders aren’t bound by Fannie and Freddie restrictions. They can establish their own underwriting criteria based on their risk tolerance and business strategy rather than following government-sponsored enterprise guidelines.

This fundamental structural difference creates enormous flexibility:

- No arbitrary property count limits (finance 5, 10, 20+ properties)

- Flexible income documentation (bank statements, asset-based, stated income in some cases)

- Customized underwriting (focus on deal quality, not just borrower boxes)

- Faster closing timelines (no secondary market approval needed)

- Relationship-based lending (repeated business creates favorable terms)

Portfolio lending real estate loans aren’t “alternative” or “subprime” financing—they’re simply a different business model serving investors conventional lenders can’t accommodate within their constraints.

Think of it this way: conventional lending is like shopping at a big-box retailer with strict return policies and one-size-fits-all products. Portfolio lending is like working with a boutique shop that can customize offerings for serious customers building long-term relationships.

Portfolio Lenders vs. Conventional Lenders

Several types of institutions offer portfolio lending:

Community banks and credit unions: These institutions often keep financing in portfolio rather than selling to secondary markets. They focus on relationship banking and typically offer portfolio lending for local real estate investors they know and trust.

Private portfolio lenders: Specialized lenders focusing exclusively on real estate investors. They understand investment property financing intimately and structure programs specifically for portfolio building.

Commercial banks: Larger banks with commercial lending divisions often provide portfolio lending for real estate investors, particularly those with substantial portfolios or commercial property holdings.

Correspondent lenders: These lenders may initially fund through warehouse lines but maintain ongoing relationships with investors and can offer portfolio-style flexibility even while ultimately selling some financing.

The key distinction isn’t the institution type—it’s whether they’re underwriting to sell to Fannie/Freddie or underwriting to keep in their own portfolio. This underwriting destination determines the flexibility and limitations you’ll face.

When investors hit conventional limits, many discover DSCR loans as their first alternative, which often function as portfolio lending products since they don’t conform to conventional standards and aren’t typically sold to agencies.

Breaking Through the 4-Property Conventional Limit

The most immediate benefit of portfolio lending real estate loans for active investors is eliminating the conventional four-financed-property restriction that stops portfolio growth dead.

Understanding Fannie Mae’s Four-Property Limit

Fannie Mae established the four-financed-property limit to manage risk exposure to individual borrowers. Their guidelines state they’ll purchase mortgages on up to four one-to-four-unit investment properties plus your primary residence (five total financed properties).

This limit applies regardless of:

- How much equity you have in existing properties

- How strong your cash flow from current properties is

- How excellent your credit or income looks

- How much liquid reserves you maintain

You can own 20 properties outright with zero financing and still only finance four additional investment properties conventionally. The restriction doesn’t count unfinanced properties—only those with conventional financing against them.

Many investors don’t realize the restriction exists until they try financing property five. By then, they’ve structured their entire acquisition strategy around conventional financing, only to discover it won’t support continued growth.

The limit applies per borrower, not per entity. Buying properties in different LLC names doesn’t bypass the restriction if the same person guarantees the financing. Some creative strategies exist (spouse financing separately, business entity financing), but these require careful structuring and often create complications.

Portfolio Lending’s Unlimited Potential

Portfolio lenders set their own property count limits based on their risk management—and many set no hard limits at all.

Instead of counting properties, sophisticated portfolio lenders evaluate:

- Total portfolio performance (aggregate cash flow, occupancy, reserves)

- Borrower experience and track record

- Property quality and diversification

- Debt service coverage across the entire portfolio

- Total exposure relative to borrower’s net worth and liquidity

You might finance 10, 15, 20+ properties with a single portfolio lender if your portfolio performs well and you maintain strong financial positioning. The conversation shifts from “you’ve hit your limit” to “let’s evaluate this next opportunity within the context of your overall portfolio.”

This approach makes mathematical sense. A borrower with 10 properties all showing strong debt service coverage, low vacancy, and consistent performance represents better risk than a borrower with four properties barely cash flowing with high turnover.

Portfolio lenders who specialize in investor financing understand this distinction. They’re not applying arbitrary consumer lending limits to sophisticated investors running real businesses.

Strategic Implications for Growth

Eliminating the four-property limit transforms your acquisition strategy fundamentally.

Linear growth becomes exponential: Instead of being forced to slow down after four properties, you can maintain or accelerate acquisition pace. Many investors acquire properties 5-12 faster than properties 1-4 because they’ve refined their systems and have established financing relationships.

Market timing improves: When attractive opportunities appear in clusters, you can act on multiple deals simultaneously rather than choosing which opportunities to pursue and which to abandon due to financing constraints.

Geographic diversification becomes possible: Portfolio lenders often provide financing across multiple states and markets, enabling you to chase the strongest returns rather than being limited to your local market where conventional lenders operate.

Capital efficiency increases: By maintaining financing relationships with portfolio lenders, you can often finance new acquisitions more quickly with less capital per deal (higher LTV in some cases), leaving more reserves for additional acquisitions.

Scale creates advantages: Working with one lender on 10 properties often yields better pricing and terms than working with 10 different lenders on one property each. Volume creates negotiating leverage.

Calculate how unlimited property financing affects your portfolio growth trajectory using an investment growth calculator that models acquisition velocity over 5-10 years with and without conventional restrictions.

Qualification Requirements for Portfolio Lending Real Estate Loans

While portfolio lending eliminates conventional restrictions, it doesn’t eliminate qualification requirements. Understanding what portfolio lenders evaluate helps you position for approval and favorable terms.

Credit Score and History

Portfolio lenders typically require credit scores similar to conventional lending, though some flexibility exists for borrowers with strong compensating factors.

Minimum credit scores:

- Most portfolio lenders: 660-680 minimum

- Some programs: accept 640 with strong reserves and equity

- Premium pricing: often requires 700+ for best terms

Unlike conventional lending with rigid credit tiers, portfolio lenders can evaluate credit contextually. A borrower with 675 credit but $500,000 in liquid reserves and a strong track record might receive better consideration than a 720-credit borrower with minimal reserves.

Portfolio lenders particularly examine:

- Payment history on existing mortgages (must be current, no 30-day lates in 12 months)

- Overall credit utilization (prefer under 30%)

- Recent derogatory items (inquire about circumstances)

- Bankruptcy or foreclosure timing (typically 3-5 years seasoning required)

Credit issues that would disqualify you conventionally might be approvable through portfolio lending if you can tell the story and demonstrate resolution. Portfolio lenders underwrite the full picture, not just credit scores.

Income Documentation Flexibility

This is where portfolio lending real estate loans shine for investors who don’t fit conventional income documentation boxes.

Conventional approach: Lenders want W-2s, two years of tax returns, and pay stubs proving stable income meeting debt-to-income ratio requirements. For investors writing off substantial expenses, tax returns often show minimal income, making conventional qualification impossible despite strong cash flow from properties.

Portfolio approach: Many portfolio lenders offer alternative documentation:

Bank statement programs: Qualify based on 12-24 months of bank deposits showing cash flow rather than tax returns. These programs work brilliantly for self-employed investors whose bank deposits far exceed reported taxable income.

Asset-based qualification: Some programs qualify based on liquidity and assets rather than income. If you have $2 million in liquid investments generating $50,000 annually in taxable income, asset-based programs might qualify you based on portfolio value rather than reported income.

DSCR-only programs: Focus exclusively on whether property rental income covers the mortgage payment plus expenses (debt service coverage ratio). Your personal income becomes irrelevant—only property performance matters.

Hybrid approaches: Combine property cash flow with personal income or assets to meet qualification standards.

This flexibility enables aggressive tax planning without sacrificing borrowing capacity. Many investors using bank statement loans or similar programs discover they can write off more expenses for tax purposes while maintaining full financing access through portfolio lenders.

Reserve Requirements

Portfolio lenders universally require substantial reserves demonstrating you can weather vacancies, repairs, or market downturns across your entire portfolio.

Typical reserve requirements:

- 6 months PITI (principal, interest, taxes, insurance) per financed property

- For a property with $2,000 monthly PITI: $12,000 reserves required

- For 5 properties: $60,000 total reserves minimum

These reserves must be liquid—cash, savings, retirement accounts (with appropriate haircut), or brokerage accounts. Equity in real estate or illiquid assets typically doesn’t count.

Reserve requirements often scale with portfolio size and property performance:

- Strong performing portfolio with low LTV: might reduce to 4-5 months per property

- Newer investor with higher leverage: might increase to 9-12 months per property

- Properties showing consistent strong occupancy: may require fewer reserves than properties with recent vacancy

Some portfolio lenders offer portfolio-level reserve calculations rather than property-by-property requirements. Instead of requiring 6 months reserves on each of 10 properties separately, they might require 36-48 months total reserves across the entire portfolio. This approach recognizes that vacancies rarely hit all properties simultaneously.

Smart investors maintain well above minimum reserves. Lenders view strong reserve positions favorably during underwriting and may offer better pricing or terms. Reserves also provide real protection when multiple properties face vacancies or require major maintenance simultaneously.

Property Performance Standards

Portfolio lenders care deeply about property cash flow and performance since they’re holding the risk rather than selling to agencies.

Debt service coverage ratio (DSCR): Most portfolio lenders require 1.20-1.25 DSCR minimum, meaning property net operating income must exceed annual debt service by 20-25%.

Calculate DSCR:

- Property generates $2,400 monthly rent = $28,800 annually

- Operating expenses (taxes, insurance, maintenance, management, CapEx): $8,640

- Net operating income: $20,160

- Annual debt service at 7.5% on $200,000 for 30 years: $16,776

- DSCR = $20,160 ÷ $16,776 = 1.20

Properties showing 1.25+ DSCR receive favorable consideration. Properties at 1.15-1.20 might be approved but at less favorable terms. Properties below 1.10 DSCR typically face rejection unless strong compensating factors exist.

Occupancy requirements: Portfolio lenders want to see properties occupied and generating income, not vacant and speculative. Most require properties to be currently occupied or generate income from existing leases within 90 days of financing.

Property condition: Lenders want properties in good, rentable condition. Major deferred maintenance, code violations, or properties requiring substantial rehabilitation typically don’t qualify for portfolio lending (though they might qualify for specialized rehab financing).

Property type: Most portfolio lenders focus on standard residential properties (single-family, 2-4 units, small multifamily). Some extend to commercial multifamily, mixed-use, or other property types, but these require specialized underwriting.

Use a DSCR loan calculator to model whether properties meet minimum cash flow requirements before pursuing portfolio lending to avoid wasting time on properties that won’t qualify.

The Simultaneous Closing Advantage

One of portfolio lending’s most powerful benefits is closing multiple properties simultaneously or in rapid succession through relationship-based underwriting.

Why Conventional Lending Can’t Close Multiple Deals Fast

Conventional lenders underwrite each property transaction independently through their standard process:

- Complete application for Property A

- Underwriting reviews and conditions Property A

- Close Property A (45-60 days typically)

- Wait for Property A to reflect on credit report (30-45 days)

- Start application for Property B

- Repeat entire process

This sequential approach makes closing on three properties take 4-6 months minimum. In fast markets, deals you identified on day one have disappeared by the time you can close on deal three.

Additionally, conventional lenders struggle with recent acquisitions. When you close on Property A in January, most conventional lenders won’t count that property’s rental income toward qualifying for Property B in February. They want 12-24 months of rental history documentation before counting rental income, creating a chicken-and-egg problem where you can’t finance additional properties until existing properties season.

Portfolio Lending’s Rapid Deployment

Portfolio lenders managing their own risk can close multiple properties simultaneously or in rapid succession once they’ve underwritten your overall financial position.

Single underwriting review: After evaluating your credit, income, reserves, and existing portfolio performance, portfolio lenders can approve multiple acquisitions without re-underwriting from scratch for each property.

Portfolio-level approval: Some portfolio lenders provide “approved to acquire” status essentially pre-approving you for multiple acquisitions up to a specified total commitment. You find properties, submit basic deal information, and proceed to closing within 15-30 days.

Same-day closings: Portfolio lenders can coordinate closing three properties on the same day if timing aligns. Conventional lending makes this nearly impossible due to separate underwriting and secondary market sale requirements.

Immediate rental income recognition: Portfolio lenders can credit rental income from recently acquired properties toward qualifying for new acquisitions. Close Property A in January, and its verified lease immediately counts toward qualifying for Properties B and C in February.

This speed translates directly to more deals closed. In competitive markets, being able to close in 21 days versus 60 days often means the difference between winning and losing deals. Sellers choose faster closings when multiple offers exist at similar prices.

Real-World Acquisition Scenarios

Scenario 1: The Three-Property Package You identify three properties from a retiring landlord willing to sell all together at a discount. The seller wants to close within 30 days on all three properties simultaneously.

Conventional financing: Impossible. No conventional lender will close three properties for one borrower on the same day. You lose the deal.

Portfolio lending: You submit all three properties to your portfolio lender who underwrites the package deal. With strong reserves and good DSCR on all three properties, the lender approves all three for simultaneous closing. You save $45,000 through the package discount.

Scenario 2: The Fast Market Your market is appreciating 12% annually. You identify two excellent properties in January that meet your criteria.

Conventional financing: Close Property A in March (60 days). Start Property B application in April after Property A reports to credit (30 days lag). Close Property B in June (60 days). Total time: 6 months. By June, properties have appreciated 6%, costing you $24,000 in additional purchase price.

Portfolio lending: Submit both properties together in January. Close both in February. Total time: 30-45 days. You acquire both before significant appreciation occurs.

Scenario 3: The Geographic Diversification You want to expand into two new markets simultaneously to diversify away from your concentrated local holdings.

Conventional financing: Most conventional lenders operate regionally. You’d need to establish relationships with lenders in two new markets, provide extensive documentation twice, and close sequentially. Timeline: 4-6 months minimum.

Portfolio lending: National portfolio lenders can finance properties across multiple states. Submit both out-of-state properties together, close both within 30-45 days through a single lender relationship.

Many successful investors attribute their portfolio growth directly to portfolio lending’s speed and flexibility, allowing them to execute on opportunities conventional financing would have made impossible. Investors using portfolio loans to scale rapidly often acquire 5-8 properties in the time conventional borrowers acquire 2-3.

Rates, Costs, and Pricing Structure

Portfolio lending real estate loans typically cost more than conventional financing. Understanding the pricing structure and calculating when higher costs are worthwhile helps you make informed decisions about when to use portfolio lending strategically.

Interest Rate Premiums

Portfolio lending rates typically run 0.5-2.0 percentage points above comparable conventional financing, depending on program features, leverage, and borrower strength.

Rate comparison example:

- Conventional investment property: 7.25%

- Portfolio lending (standard): 7.75-8.25%

- Portfolio lending (higher leverage or alternative documentation): 8.50-9.50%

The spread varies based on several factors:

Leverage: Higher loan-to-value ratios command rate premiums. A portfolio loan at 80% LTV might price at 7.75%, while the same loan at 85% LTV might price at 8.50%.

Documentation type: Full documentation portfolio lending prices closer to conventional rates (7.75-8.25%). Bank statement or asset-based programs typically add 0.5-1.0% to rates (8.25-9.25%).

Property count: Your first portfolio lending deal might price at 8.25%. Once you have 6-8 properties financed with the same lender, rates might drop to 7.75% through relationship pricing.

Term structure: Many portfolio lending programs offer 30-year amortization but with 5-year, 7-year, or 10-year balloons requiring refinancing. Longer fixed-rate terms command premium pricing.

Market conditions: Portfolio lending pricing fluctuates with overall rate environments and lender liquidity. In tight credit markets, spreads widen. In loose credit markets, spreads narrow.

While 1-2% higher rates sound expensive, the math often works in your favor when considering opportunity cost and portfolio growth velocity.

Points and Fees

Portfolio lenders often charge origination points and fees beyond what conventional lenders charge, though this varies significantly by lender and program.

Typical fee structure:

- Origination points: 1-2 points (1-2% of financing amount)

- Processing fee: $500-$1,000 per property

- Underwriting fee: $500-$800 per transaction

- Documentation fee: $300-$500

- Total upfront costs: 1.5-3.0% of financing amount

Some portfolio lenders charge higher points but offer lower rates, while others charge minimal points but higher rates. Calculate total cost over your expected hold period when comparing options.

No-point options: Many portfolio lenders offer zero-point pricing with higher interest rates. This option works well for investors planning to refinance within 3-5 years or those prioritizing initial capital preservation over long-term interest costs.

Volume discounts: Lenders often reduce or eliminate points for repeat borrowers or multiple simultaneous acquisitions. Your sixth property might close with zero points while your first property paid 2 points.

Refinance programs: Some portfolio lenders offer streamlined refinancing for existing portfolio borrowers at reduced fees, creating an ecosystem where you originate at higher costs but refinance cheaply later.

The True Cost-Benefit Analysis

Portfolio lending makes financial sense when the benefits of rapid scaling, unlimited properties, or alternative documentation exceed the cost of higher rates and fees.

Scenario: Three properties acquired simultaneously

Conventional approach:

- Finance Property 1 at 7.25%, close in 60 days

- Wait 45 days for seasoning

- Finance Property 2 at 7.25%, close 60 days later (total 165 days)

- Wait 45 days for seasoning

- Finance Property 3 at 7.25%, close 60 days later (total 270 days)

- Total timeline: 9 months

- All three properties appreciate 9% during acquisition period

- Additional costs from appreciation: $54,000 on $600,000 total acquisition

Portfolio approach:

- Finance all three at 8.25%, close simultaneously in 30 days

- Acquire before appreciation occurs

- Higher interest cost: approximately $6,000 annually on $600,000 financing at 1% rate premium

- Savings from avoiding appreciation: $54,000

The portfolio lending approach saves $48,000 net in year one despite higher rates, then costs an additional $6,000 annually thereafter. Break-even occurs after 8+ years—by which time you’ve likely refinanced or sold properties.

Scenario: Breaking through the 4-property limit

Investor wants to acquire properties 5-8, generating $2,000 monthly cash flow each after all expenses including financing costs.

Conventional approach:

- Unable to finance properties 5-8 conventionally

- Must pay all cash or find alternative financing

- Missing $8,000 monthly cash flow ($96,000 annually)

- Opportunity cost: $96,000+ annually

Portfolio approach:

- Finance properties 5-8 through portfolio lending at 8.50% versus 7.25% conventional equivalent

- Higher interest cost: approximately $2,000 annually per property = $8,000 total

- Net cash flow: $88,000 annually

The portfolio lending approach generates $88,000 annual cash flow versus $0 from not acquiring the properties. The higher interest rate is irrelevant when the alternative is not growing your portfolio.

Calculate your specific break-even using a rental property calculator that compares total returns across different financing structures and acquisition timelines.

When Portfolio Lending Makes Strategic Sense

Portfolio lending real estate loans aren’t the right choice for every situation. Understanding when portfolio lending delivers maximum advantage helps you deploy this tool strategically.

Active Acquisition Phases

Portfolio lending shines during aggressive acquisition periods when you’re actively scaling your portfolio.

Ideal timing:

- You’ve identified multiple target properties in a 3-6 month window

- You’re moving from 4-10 properties to 15-25 properties over 2-3 years

- You’re entering new markets requiring simultaneous diversification

- Market conditions favor immediate acquisition before appreciation

During these phases, speed and unlimited property capacity justify premium pricing. You’re maximizing acquisition velocity when opportunities exist, understanding that market windows don’t remain open indefinitely.

Many successful investors use “sprint and coast” strategies: aggressive acquisition during favorable market conditions using portfolio lending, followed by consolidation periods where they refinance to conventional financing (when possible) or optimize existing holdings before the next acquisition sprint.

Breaking Through Conventional Limits

The most obvious use case: you’ve hit the conventional four-property wall and want to continue growing.

Once you’ve financed four properties conventionally, portfolio lending becomes your primary financing path for properties five and beyond unless you’re paying all cash or using partners.

Some investors maintain four properties conventionally and finance all additional properties through portfolio lending. Others eventually refinance existing properties into portfolio lending to consolidate the entire portfolio with one lender, accessing relationship pricing and simplified operations.

Self-Employed or High-Net-Worth Investors

Portfolio lending works exceptionally well for borrowers whose financial situations don’t fit conventional boxes despite strong actual financial positions.

Self-employed investors: If you write off substantial expenses reducing taxable income, conventional lenders might decline your financing despite strong cash reserves and property performance. Portfolio lending’s bank statement and asset-based programs qualify you based on actual cash flow rather than tax returns.

High-net-worth investors: Borrowers with $5 million in liquid investments might show minimal “income” through strategic tax planning. Asset-based portfolio programs qualify these investors based on wealth and liquidity rather than W-2 income.

Retirees: Conventional lenders struggle with retired investors living off investment returns and Social Security. Portfolio lenders can structure programs using asset depletion or investment income recognition methods conventional lenders can’t accommodate.

Strategic Refinancing Opportunities

Portfolio lending isn’t just for purchases. Strategic cash-out refinancing through portfolio lenders enables portfolio growth through equity extraction from existing properties.

Scenario: You own five properties free and clear worth $1.5 million total. You want to extract equity to acquire five more properties.

Conventional refinancing: Limited to four properties. Even if you refinance four properties, you still can’t finance the next acquisition conventionally.

Portfolio refinancing: Refinance all five properties simultaneously through a portfolio lender, extract $750,000 equity at 70% LTV, use proceeds to acquire properties 6-10. Close the entire transaction—five refinances and five purchases—within 45-60 days through coordinated portfolio lending.

Some investors use DSCR cash-out refinancing strategically to fund rapid expansion, extracting equity from stabilized properties to acquire new opportunities without depleting liquid reserves.

When to Avoid Portfolio Lending

Portfolio lending isn’t optimal for every situation:

Single property acquisitions with time: If you’re acquiring one property and have 60-90 days to close, conventional financing typically offers better rates and terms. Use portfolio lending’s speed advantage only when speed matters.

First 1-4 properties: Until you’ve hit conventional limits, conventional financing usually provides better economics. Save portfolio lending relationships for when you actually need them rather than burning relationship capital on properties you could finance conventionally.

Long-term hold with high sensitivity to financing costs: If you plan to hold properties 20+ years and financing costs significantly impact returns, conventional financing’s lower rates might justify slower growth. Run the numbers carefully.

Markets where appreciation isn’t a factor: In stable markets where properties won’t appreciate during a 6-month acquisition period, conventional lending’s sequential approach costs less without meaningful opportunity cost.

Finding the Right Portfolio Lender

Not all portfolio lenders serve real estate investors equally well. Finding lenders who specialize in investor financing and offer truly flexible programs requires research and relationship building.

Types of Portfolio Lenders

Community banks: Local and regional banks often keep financing in portfolio. They excel at relationship-based lending but typically serve only their geographic footprint. Best for investors focused in specific markets where the bank operates.

National portfolio lenders: Specialized lenders focusing exclusively on real estate investors nationwide. They offer sophisticated programs, finance properties in all 50 states, and understand investor needs intimately. Best for investors buying across multiple markets or needing specialized products.

Credit unions: Member-owned credit unions sometimes offer portfolio lending to members. Rates may be competitive, but property count limits and geographic restrictions often apply. Best for local investors building initial portfolios.

Private lenders: Private money sources provide portfolio-style flexibility but at higher costs (9-12%+ rates). Best for short-term financing or situations where traditional portfolio lenders decline.

Correspondent lenders: Some lenders operate as correspondents, funding through warehouse lines while maintaining ongoing relationships with investors. They blend some portfolio lending flexibility with near-conventional pricing. Best for investors wanting conventional-like pricing with slightly enhanced flexibility.

Evaluation Criteria

When comparing portfolio lenders, evaluate these key factors:

Property count limits: Do they set maximums, or will they finance unlimited properties based on portfolio performance? Some “portfolio lenders” still cap you at 6-10 properties.

Geographic coverage: Do they lend in your target markets? National coverage enables diversification; local-only coverage constrains growth.

Program flexibility: Do they offer bank statement, asset-based, and DSCR programs, or only full-documentation options? Flexibility matters as your situation evolves.

Closing speed: Can they reliably close in 21-30 days, or do they require 45-60 days despite portfolio lending claims? Speed without execution is worthless.

Rate competitiveness: Compare rates and fees across multiple lenders. Portfolio lending rates vary significantly—shop for value.

Relationship approach: Do they treat you as a transaction or a relationship? The best portfolio lenders view you as a long-term client worth investing in through competitive terms and responsive service.

Refinance options: Do they offer streamlined refinancing for existing borrowers, or must you start from scratch each time? Portfolio lenders with strong refinance programs provide long-term value.

Reputation and track record: Research online reviews, ask for references, and verify the lender has experience closing transactions like yours. New lenders might promise flexibility but lack execution capability.

Building Lender Relationships

Portfolio lending works best as a relationship-based partnership, not a transactional one-off.

Start before you need them: Establish portfolio lender relationships when you finance property 3-4, before you’ve hit conventional limits. Early relationships position you for rapid action when opportunities arise.

Be a repeat customer: Portfolio lenders reward repeat business with better pricing, faster closings, and more flexibility. Spreading deals across multiple lenders prevents you from building valuable relationships.

Communicate proactively: Keep portfolio lenders updated on your acquisition plans, portfolio performance, and financial position changes. Lenders who understand your strategy can structure optimal solutions.

Meet in person when possible: Face-to-face meetings at investor conferences or office visits build relationships beyond paper applications. Personal connections create advocates within lending organizations.

Refer other investors: Portfolio lenders value referral sources. Connecting other investors with your lender strengthens your relationship and often results in reciprocal benefits through relationship pricing.

Pay on time and perform: Nothing builds lender relationships faster than consistent performance. Properties that cash flow well, maintain occupancy, and never miss payments make lenders eager to finance your next acquisition.

Working with Mortgage Brokers

Many investors access portfolio lending through mortgage brokers rather than directly with lenders.

Broker advantages:

- Access to multiple portfolio lenders through one application

- Experience matching borrowers to optimal lenders

- Negotiating power through volume relationships

- No cost to borrowers (lenders pay broker compensation)

Broker selection:

- Find brokers specializing in investor financing, not just residential mortgages

- Verify they have multiple portfolio lending relationships

- Ask about their typical investor clients and transactions closed

- Ensure they understand your specific situation and goals

Quality mortgage brokers provide tremendous value connecting investors with appropriate portfolio lenders and structuring optimal deals. Poor brokers waste time submitting applications to lenders likely to decline.

Interview 2-3 brokers before selecting one. The best brokers act as advisors guiding your financing strategy, not just order-takers processing applications. Schedule a call with experienced brokers who specialize in portfolio lending real estate loans and can connect you with lenders matching your acquisition strategy.

Implementation Strategy: Your Portfolio Lending Roadmap

Moving from conventional financing to portfolio lending requires strategic planning ensuring you’re positioned optimally when you need these programs.

Timeline Planning

Properties 1-4: Build foundation

- Use conventional financing for best rates and terms

- Establish strong performance track record

- Build reserves aggressively (target 12+ months per property)

- Document everything meticulously

- Research portfolio lenders without applying

Properties 3-4: Prepare transition

- Begin conversations with portfolio lenders

- Get pre-qualified for portfolio programs

- Understand your borrowing capacity

- Build relationships before you need them urgently

- Continue conventional financing if still available

Property 5+: Execute portfolio strategy

- Transition to portfolio lending as primary financing tool

- Close multiple properties simultaneously when opportunities exist

- Leverage relationship pricing through repeat business

- Consider refinancing earlier properties into portfolio lending for consolidation

- Scale aggressively during favorable market conditions

Financial Preparation

Portfolio lenders require stronger financial positioning than conventional lenders in some respects:

Reserve building:

- Target 9-12 months PITI reserves per property

- Maintain reserves in liquid, accessible accounts

- Don’t count on equity as reserves

- Build reserves before aggressive acquisition phases

Credit optimization:

- Keep mortgage payments current (no 30-day lates)

- Pay down credit cards (target under 30% utilization)

- Avoid new credit inquiries 6 months before applying

- Resolve any collections or derogatory items

Documentation organization:

- Maintain detailed property performance records

- Track rent rolls, occupancy, expenses meticulously

- Organize bank statements showing cash flow

- Document existing financing and property values

- Create portfolio summary showing aggregate performance

Entity structure:

- Consider LLC structures for liability protection

- Understand how entity ownership affects financing

- Work with CPAs on optimal tax and financing structures

- Ensure entity formation allows for financing eligibility

Deal Structure Optimization

Structure acquisitions to maximize portfolio lending approval probability:

Target properties with strong cash flow:

- 1.25+ DSCR provides cushion and favorable consideration

- Properties at 1.10-1.15 DSCR might be approved but at less favorable terms

- Avoid negative or break-even cash flow properties

Focus on conventional property types:

- Single-family, 2-4 units, small multifamily perform best

- Unique or unusual properties face additional scrutiny

- Standard residential properties in decent areas get approved fastest

Maintain geographic diversification:

- Don’t concentrate entire portfolio in one market if possible

- Portfolio lenders value diversification reducing risk

- Multiple markets provide stability if one market weakens

Buy right on price:

- Portfolio lenders often require appraisals

- Properties bought at or below market value demonstrate investment skill

- Overpaying on acquisitions suggests poor judgment affecting future approvals

Ongoing Portfolio Management

Portfolio lending success requires strong ongoing management maintaining lender confidence:

Performance monitoring:

- Track occupancy across all properties

- Monitor cash flow and debt service coverage

- Address problem properties quickly

- Maintain reserves at required levels

Lender communication:

- Provide annual portfolio performance updates

- Alert lenders to major changes proactively

- Request modifications if financial changes occur

- Build trust through transparent communication

Refinancing strategy:

- Consider refinancing to conventional rates when possible

- Use portfolio refinancing to extract equity strategically

- Time refinancing with market conditions and needs

- Evaluate rate reduction opportunities regularly

Conclusion: Scale Your Portfolio at Market Speed

Portfolio lending real estate loans transform how aggressive investors acquire properties, eliminating arbitrary limits and enabling acquisition velocity that matches market opportunities rather than financing constraints.

Key Takeaways:

- Portfolio lenders hold financing in-house rather than selling to Fannie Mae/Freddie Mac, eliminating the four-property conventional limit and enabling unlimited growth

- Qualification focuses on property performance, reserves, and portfolio-level metrics rather than rigid conventional standards

- Closing multiple properties simultaneously or in rapid succession through relationship-based underwriting dramatically accelerates portfolio building

- Higher rates of 0.5-2.0% over conventional financing are often justified by faster acquisition, opportunity capture, and growth velocity

- Success requires strategic preparation including strong reserves, clean credit, meticulous documentation, and proactive lender relationship building

The fundamental question isn’t “should I pay more for portfolio lending?” but rather “what growth opportunities am I missing without access to portfolio lending?”

For investors serious about scaling beyond conventional limits, portfolio lending represents an essential financing tool. The rate premium becomes irrelevant when you’re acquiring properties that couldn’t be financed conventionally, capturing opportunities that would disappear through slower conventional processes, or building portfolios generating monthly cash flow that dwarfs the cost of slightly higher financing.

Most successful large-scale rental property investors use portfolio lending at some point in their growth trajectory. Those who resist portfolio lending due to rate concerns often remain stuck at 4-6 properties while their portfolio-lending competitors scale to 20-30+ properties creating substantially more wealth despite higher financing costs.

Start building portfolio lender relationships today, before you desperately need them tomorrow. The best time to establish financing sources is when you don’t need them urgently, enabling you to negotiate favorable terms and demonstrate value as a long-term client.

When you’ve identified the properties you want to acquire and understand how portfolio lending enables your growth strategy, take action. Get pre-approved for portfolio lending programs so you’re positioned to move quickly when opportunities arise, closing multiple properties while competitors are still filling out conventional financing applications.

Remember that portfolio lending isn’t about paying premium prices for financing—it’s about paying fair market value for flexibility, speed, and unlimited growth capacity that transforms your investing trajectory from linear to exponential.

Frequently Asked Questions

What is the minimum number of properties needed to qualify for portfolio lending?

Portfolio lending doesn’t require minimum property counts—you can use portfolio lending for your first acquisition if it makes sense strategically. However, most investors don’t need portfolio lending until reaching 4-5 conventionally financed properties where they hit Fannie Mae limits. Portfolio lending becomes most valuable once you own multiple properties and want to scale beyond conventional restrictions. Some portfolio lenders prefer working with experienced investors who’ve successfully managed properties, but programs exist for newer investors with strong financial positioning and solid first acquisitions.

Can I refinance existing conventional loans into portfolio lending?

Yes, many investors consolidate conventional financing into portfolio lending to simplify operations, access relationship pricing, or extract equity for new acquisitions. Portfolio lenders offer cash-out refinancing programs that can refinance multiple properties simultaneously, extracting equity across your entire portfolio in one transaction. This strategy works particularly well when you want to pull equity from 4-5 stabilized properties to fund acquisitions of properties 6-10. However, refinancing from lower conventional rates to higher portfolio rates only makes sense when you’re accessing equity or gaining meaningful operational benefits through consolidation.

How do portfolio lending rates compare to hard money or private money?

Portfolio lending rates (7.5-9.5% typically) fall between conventional financing (6.5-7.5%) and hard money/private money (9-14%). Portfolio lending provides institutional financing with reasonable rates for long-term holds, while hard money serves short-term bridge financing or situations where portfolio lenders decline. For acquisitions you plan to hold long-term, portfolio lending costs substantially less than hard money despite being more expensive than conventional. Most investors use hard money for fix-and-flip projects or bridge financing, then refinance into portfolio lending for permanent financing on rental properties.

Do portfolio lenders require cross-collateralization across multiple properties?

Some portfolio lenders cross-collateralize multiple properties while others treat each property as a separate transaction. Cross-collateralization means the lender holds liens across multiple properties securing one financing package, while separate financing means each property has its own independent mortgage. Cross-collateralization can provide better pricing but creates complexity if you want to sell individual properties. Ask lenders about their collateralization approach during initial conversations and understand implications for your strategy. Some investors prefer separate financing per property maintaining maximum flexibility, while others accept cross-collateralization for relationship pricing benefits.

What happens to portfolio lending if I want to sell a property?

Selling properties financed through portfolio lending works the same as selling conventionally financed properties—you pay off the financing at closing from sale proceeds. If your portfolio financing includes cross-collateralization across multiple properties, you may need lender approval or may need to substitute collateral when selling one property. Most portfolio lenders accommodate property sales within normal business operations, understanding investors periodically optimize portfolios through strategic dispositions. Some lenders impose prepayment penalties on fixed-rate portfolio lending (typically declining over 3-5 years), so understand prepayment terms before closing to avoid surprises when selling.

Related Resources

Also helpful for active investors:

- DSCR Loan Meaning: Qualify for Your Second Property Without W-2 Income – Understand income-based qualification alternative that many portfolio lenders offer alongside traditional documentation programs

- LLC S Corp vs LLC C Corp: Choose the Right Structure Before Property #3 – Learn entity structuring that affects how portfolio lenders underwrite and structure your financing

- Property Management Cost: When DIY Stops Making Sense for Portfolio Growth – Discover when professional management becomes essential for portfolios scaled through portfolio lending

What’s next in your journey:

- 1031 Exchange: Defer Taxes and Upgrade Your Portfolio – Explore tax-deferred exchange strategies that work alongside portfolio lending for portfolio optimization

- Investment Property Analysis: The 5-Minute Framework That Reveals Winners – Master deal analysis essential for identifying properties that meet portfolio lender cash flow requirements

- Calculating Cap Rate Real Estate: The One Number That Tells You Everything – Learn valuation metrics portfolio lenders use to evaluate property quality and pricing

Explore your financing options:

- Portfolio Loan Program – Access specialized portfolio lending programs designed for scaling real estate investors

- DSCR Loan Program – Finance properties based on cash flow without personal income documentation requirements

- Bank Statement Loan Program – Qualify using bank deposits for self-employed investors building rental portfolios

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.