NEXA Mortgage Becomes NEXA Lending: What Changed and What It Means for Loan Officers and Homebuyers

NEXA Mortgage Becomes NEXA Lending: What Changed and What It Means for Loan Officers and Homebuyers

NEXA Mortgage Rebrands as NEXA Lending: The Complete Story

The mortgage industry watched with interest as the nation’s largest mortgage brokerage announced a major rebrand in October 2025. NEXA Mortgage—long known for championing the “Brokers Are Better” movement—rebranded as NEXA Lending and shifted its messaging from broker advocacy to wholesale lending. For loan officers considering partnerships and homebuyers searching for the right financing partner, understanding this evolution reveals important insights about the changing mortgage landscape.

As a division of NEXA Lending (formerly NEXA Mortgage), Stairway Mortgage has a front-row seat to these changes. This transformation isn’t just cosmetic—it signals a fundamental shift in how one of America’s largest mortgage companies positions itself and serves clients nationwide.

Learn more about our NEXA Mortgage partnership and how it benefits your financing journey.

The “Brokers Are Better” Era: How It Started

Since 2018, NEXA Mortgage flew the “Brokers Are Better” banner with pride. The slogan emerged from the Association of Independent Mortgage Experts (AIME) and quickly spread across the industry as both a recruiting tool and consumer-facing message. Leaders like Anthony Casa, president and CEO of UMortgage, and United Wholesale Mortgage CEO Mat Ishbia championed this approach.

For the company, the strategy worked remarkably well. The firm grew from a startup in 2017 to the nation’s largest brokerage by headcount within just a few years. Currently, NEXA sponsors approximately three thousand loan officers according to NMLS Consumer Access—a testament to the appeal of the broker model and the company’s aggressive growth strategy.

The “Brokers Are Better” message resonated because it highlighted genuine advantages:

- Access to multiple lenders versus a single bank’s products

- Competitive wholesale rates not available to consumers directly

- Broker fiduciary responsibility to find the best loan for each client

- Flexibility to match unique borrower situations with specialized programs

But the campaign also created sharp divides between brokers and retail lenders, fostering industry tensions that eventually became counterproductive.

Why NEXA Mortgage Became NEXA Lending

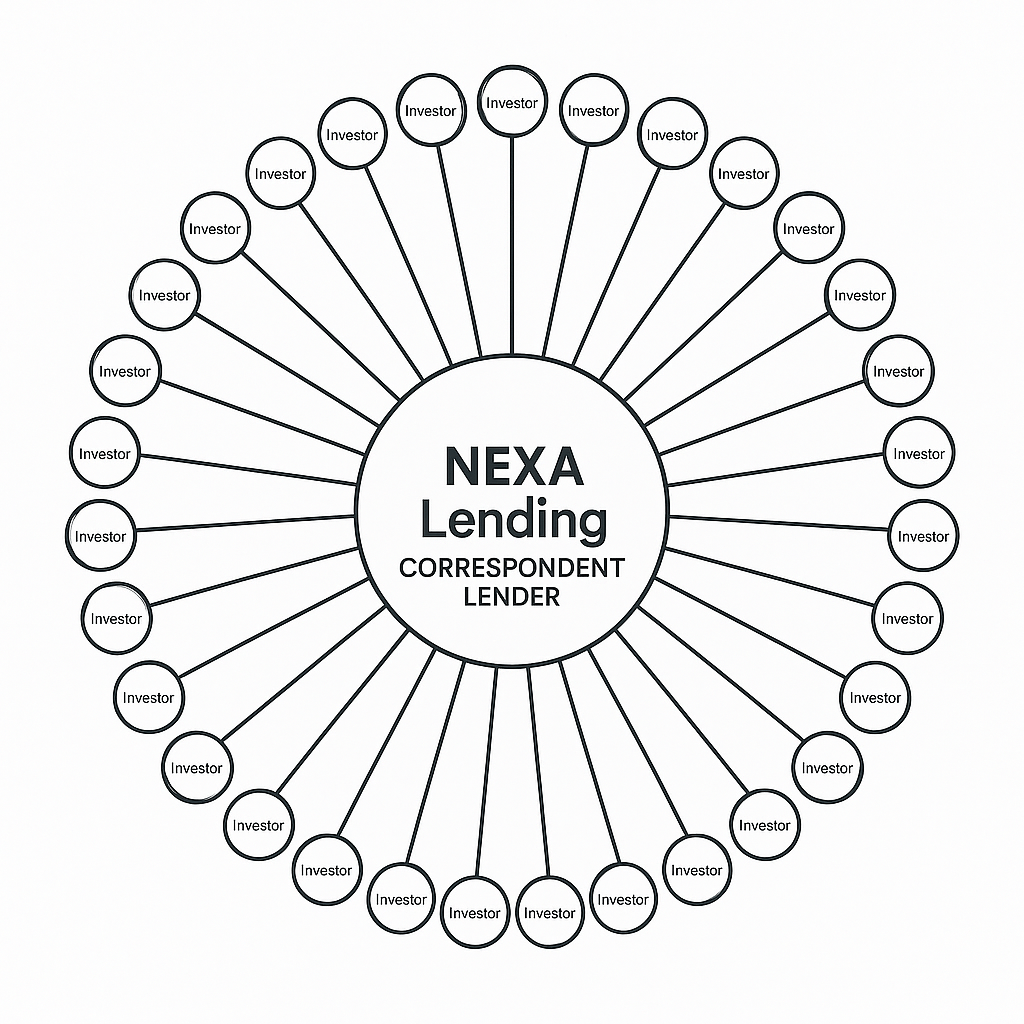

According to CEO Mike Kortas in an exclusive interview with National Mortgage Professional, the rebrand reflects NEXA’s evolution from a broker shop to a correspondent-heavy lender. The company now funds over half of its loans—approaching sixty percent—through a corresponding environment.

“We are a lender, more than we are a broker now,” Kortas explained. “The difference between us and retail is that we have wholesale rates and we share the purchase advice on every single transaction.”

The shift addresses several strategic objectives:

Attracting Independent Retail Loan Officers Kortas said the rebrand aims squarely at independent retail loan officers who may have dismissed NEXA because of its broker label. The perception that wholesale means lost control is a myth, he argues—one perpetuated by middle-level management in retail firms that adds margin to rates.

Eliminating Industry Division The “Brokers Are Better” slogan succeeded in gaining market share and raising awareness, but Kortas now sees the rhetoric as no longer serving the broker community. “The line in the sand, the rift there, the arguments and the fights just are not worth it to the broker community,” he stated.

Emphasizing Maturity and Evolution “Let’s grow up. Let’s stop fighting each other,” Kortas emphasized. The rebrand is as much about tone as structure—moving from confrontation to collaboration while maintaining the core advantages of wholesale lending.

From Blue to Black and White: Visual Rebrand

NEXA Lending changes its colors from flashy blue to classic black and white. CEO Mike Kortas announced the transformation to an audience of over 900 loan officers at NEXAFest, explaining it’s more than a simple makeover: “Our NEXAns will still bleed blue, but we have chosen to go with black and white as our colors, reflecting our long-standing commitment to transparency.”

The visual shift reinforces the company’s message of professional evolution and industry leadership beyond divisive rhetoric.

The Correspondent Advantage: Control Without Constraints

One common objection to wholesale lending centers on underwriting control. Retail lenders often claim their in-house underwriters give them more influence over loan approvals. Kortas counters this directly:

“I have pods of underwriters at all these lenders that only underwrite for NEXA Lending. It’s no different. No loan officer in the industry has the ability to make an underwriter force a decision.”

The correspondent model actually provides more flexibility, he argues. If an underwriter at one company applies an unreasonable overlay or condition, NEXA can simply move the file to another lender and fund the loan under that company’s guidelines. This optionality—the beauty of non-delegated correspondent lending—gives loan officers more pathways to approve challenging files.

What “Wholesale” Really Means for Borrowers

The shift from “broker” to “wholesale” language may seem like semantics, but it carries real meaning for homebuyers and real estate investors:

Access to Competitive Rates Wholesale rates typically offer better pricing than retail because they eliminate layers of markup added by middle management at traditional banks.

More Loan Program Options Working with a company like NEXA Lending—and by extension, Stairway Mortgage as its division—gives borrowers access to hundreds of lenders and specialized programs rather than being limited to one bank’s products.

Fiduciary Responsibility Despite the name change, the fundamental broker advantage remains: loan officers at wholesale companies work for borrowers, not banks. This alignment of interests drives better outcomes.

Flexibility for Complex Scenarios Self-employed borrowers, real estate investors, and anyone with non-traditional income documentation benefits enormously from the flexibility wholesale lending provides.

The Retail vs. Wholesale Debate Continues

Although brokers may be toning down their message, the retail-versus-wholesale battle is unrelenting. NEXA Lending COO Jason duPont recently clashed with mortgage banker Dr. Rick Roque in “The Fight Of The Century”—a spirited debate aimed at settling once and for all: Who is better, mortgage bankers or mortgage brokers?

The answer, as with many industry debates, depends on borrower needs:

- Traditional W-2 employees with strong credit may find competitive options through either channel

- Self-employed individuals and real estate investors typically benefit from wholesale’s flexibility

- Anyone valuing choice and comparison shopping advantages from broker relationships

What This Means for Loan Officers Considering NEXA Lending

According to Geri Farr, NEXA Lending Chief Growth Officer: “Changing from NEXA Mortgage to NEXA Lending is more than symbolic. It’s a statement about growth and momentum. We’ve proven what’s possible in mortgage; now we’re expanding our lending platform to meet the needs of today’s market and tomorrow’s vision.”

The company showcased this vision at NEXAFest 2025, where industry leaders and over 900 loan officers gathered to discuss the future of wholesale lending and the rebrand’s implications.

For loan officers evaluating whether to join our team within NEXA’s nationwide network, several factors stand out:

Access to Multiple Funding Sources Most loan officers choose correspondent channels more often than traditional wholesale, according to Kortas. This suggests correspondent provides better client outcomes in many scenarios.

Dedicated Underwriting Pods Having dedicated underwriters familiar with your files streamlines the process and builds consistency.

Industry-Leading Support NEXA Lending’s infrastructure, technology platforms, and operational support enable loan officers to focus on client relationships rather than administrative burdens.

Competitive Positioning The shift away from divisive “Brokers Are Better” rhetoric to professional wholesale positioning may help loan officers build relationships with referral partners who previously viewed broker language skeptically.

Interested in learning how Stairway Mortgage combines NEXA Lending’s infrastructure with our unique approach? Explore our branches, careers, and internship opportunities.

Stairway Mortgage’s NEXA Lending Partnership

Stairway Mortgage operates as a division of NEXA Lending (formerly NEXA Mortgage), which means our loan officers and clients benefit from all the advantages Kortas describes while maintaining our specialized focus on real estate investors and self-employed borrowers.

Founded by Jim Blackburn, Stairway Mortgage represents a unique partnership model that combines NEXA Lending’s infrastructure with a values-driven approach to client service and loan officer development. Learn more about the founder’s philosophy and values that shaped why we chose NEXA as our foundation.

Through our NEXA Mortgage partnership, we provide:

- Access to the nation’s largest mortgage brokerage infrastructure

- Support from industry-leading technology and operations

- Competitive wholesale rates across hundreds of lenders

- Specialized programs for investment properties and alternative income verification

- Training through the exclusive Certified Stairway Advisor (CSA) designation, developed by Jim Blackburn based on 20 years of experience guiding loan officers and partners

Whether you’re a loan officer seeking a strong partner or a borrower navigating complex financing needs, the NEXA Lending evolution strengthens our ability to deliver exceptional outcomes.

The Future of Wholesale Lending

NEXA Lending’s rebrand signals broader industry trends:

Professionalization of the Broker Channel Moving beyond slogans and rhetoric toward sophisticated, professional positioning reflects the industry’s maturation.

Correspondent Model Growth As more brokers adopt correspondent capabilities, the line between “broker” and “lender” blurs—giving professionals more tools to serve clients.

Technology Integration Companies investing in digital platforms, automated underwriting interfaces, and seamless client experiences will dominate regardless of whether they call themselves brokers or lenders.

Client-Centric Focus The best outcome for borrowers comes from professionals who prioritize finding the right loan—not defending a particular business model.

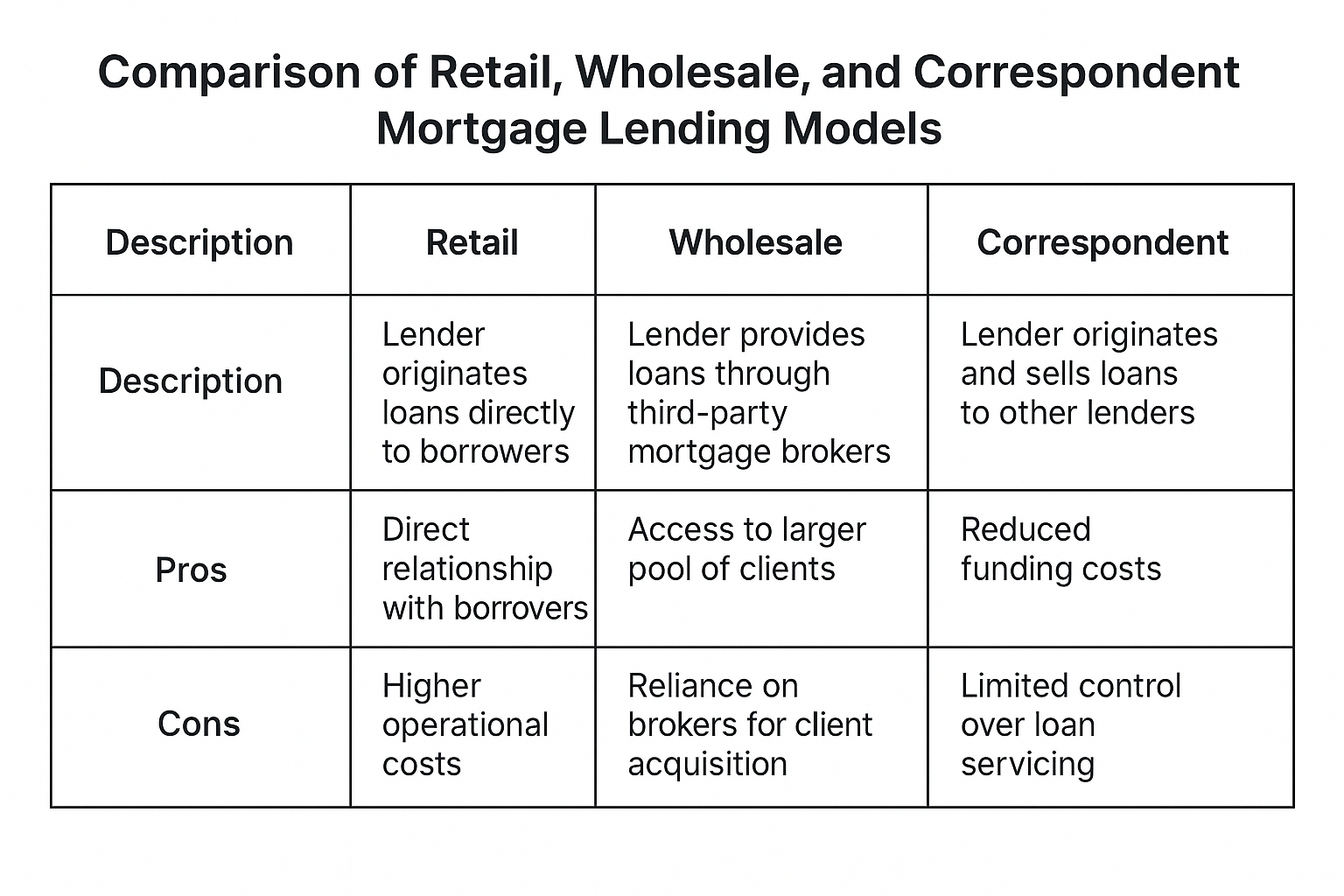

How to Choose Between Retail and Wholesale

For homebuyers and real estate investors making financing decisions, consider these factors:

Retail Lenders (Banks and Credit Unions) Best for: Borrowers with straightforward W-2 income, strong credit, and standard property types who value relationship banking or want to consolidate services.

Wholesale Lenders (Brokers and Correspondents like NEXA Lending/Stairway Mortgage) Best for: Self-employed borrowers, real estate investors, those with complex income documentation, anyone valuing choice among multiple lenders, and borrowers with unique property types.

The Middle Ground NEXA Lending’s correspondent model represents a hybrid approach—combining broker flexibility with lender infrastructure for best-of-both-worlds positioning.

Frequently Asked Questions About NEXA Lending

Is NEXA Lending the same company as NEXA Mortgage?

Yes, NEXA Lending is the rebranded name for NEXA Mortgage. The company underwent this transformation in October 2025 to better reflect its correspondent lending model and move beyond “Brokers Are Better” rhetoric.

What does the name change mean for existing NEXA Mortgage loan officers?

The rebrand doesn’t change the fundamental business model or support structure. Loan officers continue accessing the same lender network, technology platforms, and operational support—with enhanced correspondent capabilities and more professional industry positioning.

How does Stairway Mortgage fit into NEXA Lending?

Stairway Mortgage operates as a division of NEXA Lending, specializing in real estate investment properties, self-employed borrowers, and alternative income verification programs. We leverage NEXA Lending’s infrastructure while maintaining our specialized focus and personalized service.

Does NEXA Lending still offer wholesale rates?

Absolutely. Despite the move to correspondent lending for most transactions, NEXA Lending maintains wholesale rate access across hundreds of lenders. The advantage now includes both wholesale pricing and correspondent funding options.

Should I work with a mortgage broker or a retail lender?

The right choice depends on your specific situation. Borrowers with W-2 income and straightforward scenarios may find competitive options through either channel. Self-employed individuals, real estate investors, and anyone with complex income documentation typically benefit from the flexibility wholesale companies like NEXA Lending and Stairway Mortgage provide.

Ready to Experience the NEXA Lending Advantage?

Whether you’re a loan officer exploring partnership opportunities or a borrower seeking the perfect financing solution, Stairway Mortgage combines NEXA Lending’s industry-leading infrastructure with specialized expertise in real estate investing and self-employed borrower programs.

Our team understands the nuances of alternative income verification, investment property financing, and creative structuring that traditional retail lenders often can’t accommodate. With access to hundreds of lenders through the NEXA Lending network, we find solutions where others see obstacles.

What sets Stairway apart is our commitment to values-driven service and professional development. Discover the philosophy and values that guide our approach to partnerships, client relationships, and why we selected NEXA as our foundation.

Connect with a Stairway Mortgage Recruiter today to explore career and partnership opportunities or apply for a new mortgage now to take advantage of our NEXA Lending partnership with high volume pricing, correspondent flexibility, and personalized service for your unique financing needs—nationwide.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.