New Construction vs Existing Home: Which Path Builds More Wealth?

New Construction vs Existing Home: Which Path Builds More Wealth?

New Home vs Old: Which Is Better for First-Time Buyers and Long-Term Wealth?

One of your first major decisions as a home buyer is whether to purchase new construction or an existing home. This choice affects not just where you live, but how quickly you build equity, what maintenance you’ll face, and which path leads to greater long-term wealth.

Many first-time buyers assume new construction is always better—modern features, no immediate repairs, builder warranties. Others believe existing homes offer better value—established neighborhoods, larger lots, more character for the money. The reality is more nuanced, and the best choice depends on your specific situation, market conditions, and wealth-building strategy.

Both paths can build substantial wealth. The question isn’t which is universally superior, but which aligns better with your circumstances, priorities, and financial goals.

In this guide, you’ll discover:

- Complete pros and cons of new construction (following NAHB homebuilding standards)

- Advantages and disadvantages of existing homes

- Financial implications affecting wealth building (per Fannie Mae market analysis)

- Warranty protection and maintenance cost differences

- Appreciation potential in different scenarios

- How your loan type affects your decision

This isn’t about declaring one option superior. It’s about providing the framework you need to make the right decision for your unique situation—the decision that builds the most wealth for you specifically.

Weighing your options between new and existing homes? Schedule a call to discuss how each path fits your financial situation and goals.

What’s the Difference Between New Construction and Existing Homes?

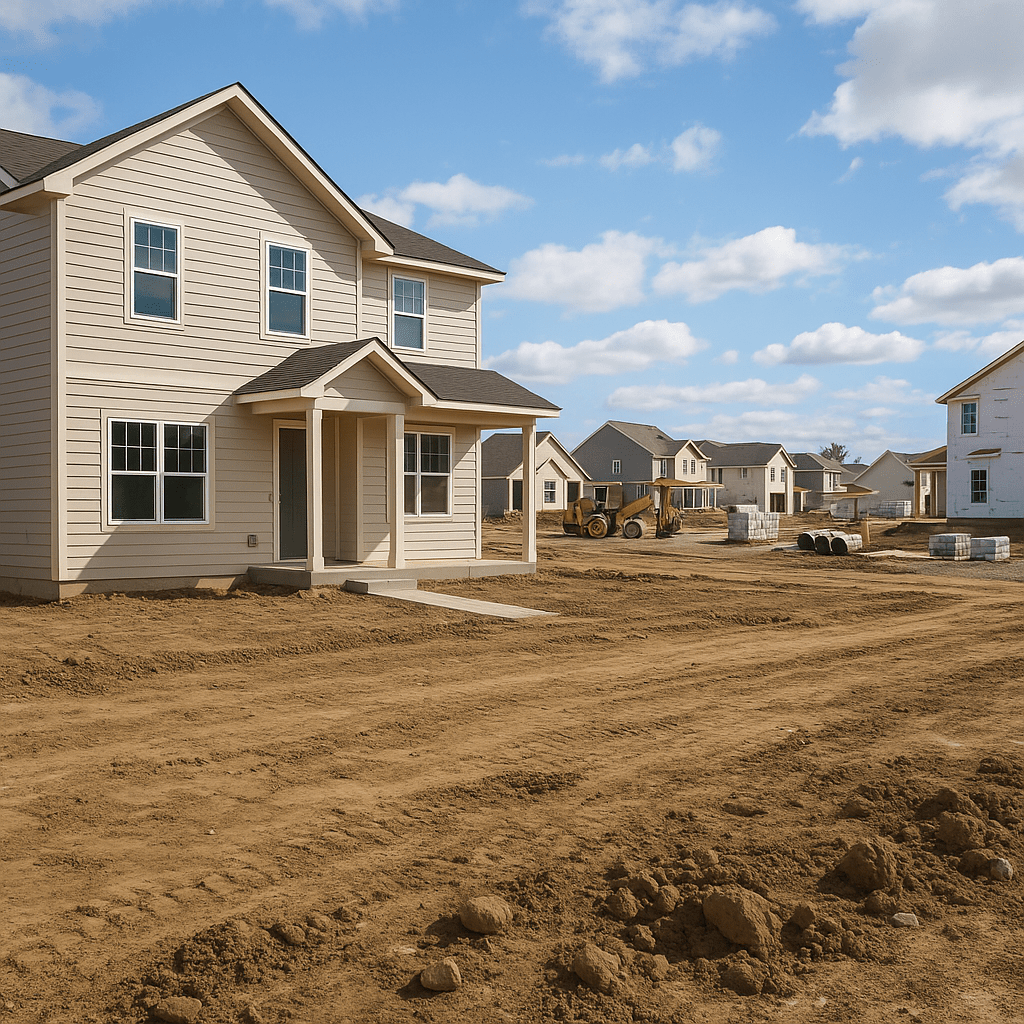

New construction means homes never previously occupied—built within the past year or currently under construction when you purchase. These range from spec homes (built by builders without a specific buyer) to custom homes built to your specifications.

Existing homes (sometimes called resale homes) have had at least one previous owner. They range from nearly new (a few years old) to historic properties over a century old. The category encompasses everything from well-maintained move-in ready homes to fixer-uppers requiring significant work.

The distinction seems simple, but it creates cascading differences affecting every aspect of your purchase and ownership experience:

Purchase process differences: New construction typically involves contracts heavily favoring builders, limited negotiation flexibility, and extended timelines if the home isn’t yet complete. Existing home purchases use more standardized contracts, offer greater negotiation flexibility, and close more quickly since the property already exists.

Condition and systems: New construction features brand new everything—appliances, HVAC, roof, plumbing, electrical, finishes. Existing homes have systems of varying ages requiring evaluation during inspection. Even “like new” existing homes a few years old have systems that have aged and might need attention sooner than brand new counterparts.

Location and lot characteristics: Existing homes occupy established neighborhoods with mature landscaping, proven schools, and known community dynamics. New construction often sits in developing areas where infrastructure, schools, and neighborhood character are still forming—sometimes on smaller lots with less mature landscaping.

Warranties and protection: New construction includes builder warranties covering defects and systems for specified periods. Existing homes transfer “as-is” with whatever condition exists at purchase (though you can negotiate repairs), though major systems might retain transferable manufacturer warranties.

Understanding these foundational differences helps you evaluate which trade-offs you’re willing to make.

What Are the Advantages of New Construction?

Let’s examine the compelling benefits that attract buyers to new homes:

Modern Design and Energy Efficiency

New homes incorporate current building codes and standards, including energy-efficient windows, enhanced insulation, high-efficiency HVAC systems, LED lighting, and modern appliances. These features reduce monthly utility costs significantly compared to older homes—potentially saving hundreds monthly in some climates.

Open floor plans reflect contemporary lifestyles with fewer walls, larger great rooms, and better flow between spaces. Existing homes often have compartmentalized layouts from earlier eras that feel dated and don’t match modern living preferences.

Smart home technology comes standard or as easily added options—programmable thermostats, integrated security, app-controlled lighting, video doorbells. Retrofitting existing homes with comparable technology costs substantially more.

No Immediate Maintenance or Repairs

Everything is brand new and under warranty. That HVAC system? New, not 15 years old approaching replacement. The roof? Fresh with decades of life ahead, not needing repair in two years. Appliances? Covered by manufacturer warranties, not aging models likely to fail soon.

Your first several years focus on enjoying your home, not repairing it. No surprise expenses for system failures, no wondering about deferred maintenance from previous owners.

Builder Warranties Provide Protection

Structural warranties typically last 10 years covering major defects in foundation, framing, and structural elements.

System warranties cover HVAC, plumbing, and electrical for 2-5 years depending on builder and components.

Cosmetic warranties address finish issues like drywall cracks, paint problems, and minor defects typically for 1 year.

These warranties create substantial peace of mind impossible with existing homes. If something fails, the builder or manufacturer handles it at no cost during warranty periods.

Customization Opportunities (Sometimes)

Pre-construction purchases allow you to select finishes, flooring, countertops, cabinets, and sometimes even layout modifications. You can create a home matching your preferences without post-purchase renovation expense.

Spec homes offer less customization but might allow buyer selections if early enough in construction.

Financing Advantages

Builders sometimes offer incentives including closing cost assistance, rate buy-downs, or upgrades when you use their preferred lenders. While you should still shop loans, these incentives can provide real value.

Appraisals come in more predictably since comparable new homes in the development establish clear value. Existing homes sometimes face appraisal challenges if they’re unique or recent sales are limited.

What Are the Disadvantages of New Construction?

Despite compelling advantages, new construction includes significant drawbacks:

Premium Pricing

New homes typically cost more per square foot than comparable existing homes in the same market. You’re paying for new everything—systems, finishes, warranties, and builder profit margins.

The “new home premium” often amounts to multiple percentage points more than established homes nearby. This higher entry price means you’re starting with less instant equity compared to buying existing homes at better values.

Longer Purchase Process

If the home isn’t complete, you’re waiting months for construction to finish. Timeline uncertainties create stress—will it finish when promised? Delays happen frequently due to weather, material shortages, or contractor scheduling.

Even completed spec homes typically involve longer closing timelines than existing home purchases due to builder requirements and processes.

Unknown Neighborhood Development

New developments lack established character. You’re buying into a vision, not a proven community. Will nearby lots develop as expected? Will promised amenities materialize? Will the neighborhood attract the residents you hoped for?

Schools, shopping, and infrastructure might not exist yet. You’re betting on future development improving the area, which doesn’t always unfold as planned.

Smaller lots and tighter spacing characterize many new developments compared to more generous lots in established neighborhoods.

Limited Negotiation Flexibility

Builders use their contracts heavily weighted in their favor. Unlike existing home sellers who negotiate freely, builders often present “take it or leave it” terms with minimal flexibility on price, contingencies, or terms.

Seller concessions are limited or unavailable from builders who know they can find other buyers. Existing home sellers often provide concessions to facilitate sales.

Hidden Costs and Upgrade Expenses

Base models include minimal features. That attractive model home? It includes tens of thousands in upgrades not in the base price. Achieving comparable finishes requires substantial additional expense.

Landscaping, fencing, window treatments, and other items included in existing homes become your post-closing expenses with new construction—potentially adding thousands you hadn’t budgeted.

HOA fees in new developments sometimes increase substantially once the builder turns over control to homeowners and actual costs emerge.

Construction Quality Variations

Not all builders maintain high standards. National builders, regional companies, and local builders vary dramatically in quality, attention to detail, and customer service. Some deliver excellent products, others cut corners.

Rushed construction during housing booms sometimes results in quality compromises as builders maximize volume over craftsmanship.

What Are the Advantages of Existing Homes?

Now let’s examine why existing homes attract savvy buyers:

Better Value Per Square Foot

Existing homes typically cost less than new construction of comparable size and features. This value advantage means you’re starting with more instant equity—the difference between what you paid and what the home is truly worth.

Motivated sellers negotiate. Unlike builders with backup buyers, existing home sellers often accept below asking price, provide repair credits, contribute toward closing costs, and work with buyers to reach agreements.

Established Neighborhoods with Proven Value

You see exactly what you’re buying. Mature trees, established landscaping, defined community character, proven schools, existing infrastructure, nearby shopping and services—no guessing about future development.

Neighborhood stability means fewer unknowns. You can research crime statistics, school ratings, property value trends, and community dynamics based on established history.

Larger lots were common in many older developments, providing more yard space, distance from neighbors, and room for additions or outdoor improvements.

Move-In Ready with Included Features

Existing homes typically include items you’d pay extra for in new construction: mature landscaping, fencing, window treatments, garage door openers, and often appliances. These “included” features represent substantial value.

Established systems have proven track records. That HVAC system has heated and cooled the home for years—you know it works. That roof has withstood local weather successfully. Uncertainty about new system performance doesn’t exist.

Character and Unique Features

Older homes often feature craftsmanship impossible to replicate affordably today—hardwood floors, detailed molding, solid wood doors, established architectural styles with character.

Variety and uniqueness mean you’re not buying a cookie-cutter home identical to dozens on your street. Each existing home has distinctive qualities.

Faster Purchase and Closing Process

You can close in weeks, not months. No waiting for construction, no uncertainty about completion dates. Once your offer is accepted and financing/inspections are complete, you close and move in.

Flexibility in timing accommodates your schedule better than construction timelines dictated by builders.

Proven Investment in Appreciating Areas

Established neighborhoods have price history showing appreciation trends. You can analyze decades of data indicating whether the area builds wealth through appreciation or stagnates.

Prime locations with limited inventory often mean existing homes are your only option in desirable areas where new construction doesn’t exist.

What Are the Disadvantages of Existing Homes?

Existing homes include trade-offs you must evaluate:

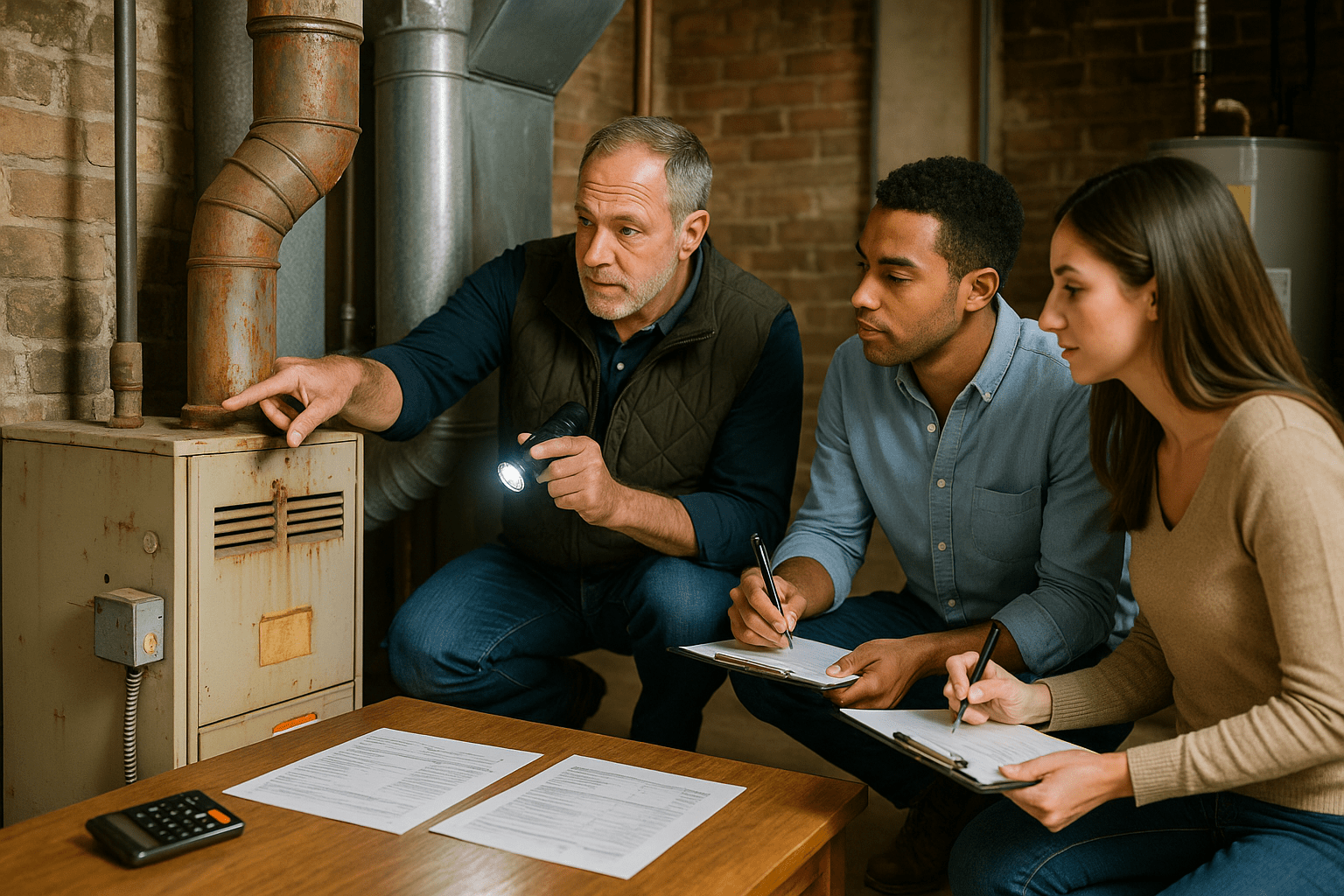

Immediate and Ongoing Maintenance Needs

Systems are aging and will need replacement on your watch. That 12-year-old HVAC system, 18-year-old roof, original appliances—these represent upcoming expenses you must plan for.

Deferred maintenance by previous owners creates problems you discover during ownership. Even move-in ready homes hide issues that emerge after you move in.

Inspection findings can be extensive depending on home age and maintenance history. Negotiating repairs or accepting properties as-is requires careful evaluation.

Outdated Design and Less Energy Efficiency

Floor plans reflect when the home was built, often with smaller rooms, separated spaces, and layouts that feel dated compared to modern open concepts.

Energy efficiency lags modern standards significantly in many existing homes. Higher utility bills, drafty rooms, and expensive upgrade needs to improve efficiency can substantially impact your budget.

Lack of modern conveniences like adequate electrical capacity, sufficient outlets, updated plumbing, and modern HVAC zones common in new construction.

No Warranty Protection Beyond Inspections

You’re buying as-is with whatever condition exists. After closing, every repair and replacement is your responsibility and expense.

Home warranties purchased at closing provide some protection but typically exclude many items, include deductibles, and cover repairs not replacements.

Unknown history means you don’t know how previous owners maintained systems or whether shortcuts were taken on repairs.

Competition and Multiple Offers

In competitive markets, good existing homes receive multiple offers driving prices up and forcing buyers to waive contingencies, offer above asking, or accept seller-favorable terms.

New construction often faces less competition since supply typically exceeds demand and builders accommodate more buyers.

Potential for Surprises

Even thorough inspections miss hidden issues—problems behind walls, under flooring, or in systems inspectors can’t fully evaluate. Post-purchase discoveries can require unexpected expenses.

Code violations or unpermitted work from previous owners become your problems, potentially affecting resale or requiring expensive correction.

Which Option Builds More Wealth Over Time?

The wealth-building winner depends on multiple factors including purchase price, appreciation rates, maintenance costs, holding period, and market timing.

Let’s analyze the financial implications:

Initial Equity Position

Existing homes often provide instant equity if you negotiate well below asking price or purchase in markets where comps support higher values. Starting with substantial equity accelerates wealth building.

New construction rarely provides instant equity. You’re paying full retail price plus premium for new, starting your ownership with minimal or zero equity until appreciation occurs.

Example: Two buyers each invest the same down payment. Buyer A purchases existing home for moderately below market value with strong negotiation. Buyer B pays full price for new construction. Immediately, Buyer A has more equity—a head start on wealth building.

Appreciation Potential

Existing homes in established, desirable neighborhoods with proven appreciation histories often grow in value predictably. Location and scarcity drive long-term appreciation.

New construction in developing areas can appreciate rapidly if the area develops favorably—but can also stagnate or decline if development falls short of promises or the area doesn’t attract desired residents.

Market cycles affect both, but new construction in oversupplied markets faces steeper appreciation challenges. Existing homes in supply-constrained areas typically appreciate more consistently.

Maintenance and Repair Costs

New homes have minimal maintenance costs for several years. No immediate system replacements, fewer repairs, warranty coverage for defects. This preserves cash for other investments or reserves.

Existing homes require ongoing maintenance and potentially significant repair or replacement expenses. A new roof, HVAC system, or water heater can cost thousands, reducing cash available for wealth building.

However, planned maintenance is predictable. You can budget for known upcoming needs. Existing home buyers who prepare financially handle maintenance without derailing wealth-building plans.

Energy Efficiency and Operating Costs

New homes’ lower utility costs free up monthly cash flow. Saving several hundred monthly on utilities over years creates substantial savings available for investing, paying down principal, or building reserves.

Existing homes’ higher utility costs affect your monthly budget, potentially limiting how much you can save or invest elsewhere.

Resale Value and Market Liquidity

Existing homes in established neighborhoods typically sell faster than homes in developing areas. When you eventually sell, strong demand and proven comps support your asking price.

New construction in areas that haven’t developed as expected can be harder to sell. If the development stagnates or neighboring areas prove more desirable, your resale timeline and price might disappoint.

Tax Benefits

Both provide equivalent mortgage interest and property tax deductions, though existing homes purchased below new construction prices have smaller loan amounts and thus smaller interest deductions.

The Verdict: It Depends

No universal winner exists. Your wealth-building outcome depends on:

- How aggressively you negotiate existing home purchases (creating instant equity)

- Whether new construction areas develop favorably (driving appreciation)

- How long you own the property (longer ownership periods reduce impact of initial equity differences)

- Your maintenance discipline with existing homes (avoiding deferred maintenance that destroys value)

- Market timing when you buy and sell

Strategic buyers build wealth with both options by purchasing smartly, maintaining properties well, and holding for sufficient periods to benefit from appreciation and principal paydown.

Use the conventional loan calculator or FHA loan calculator to model both scenarios with realistic purchase prices, maintenance costs, and appreciation assumptions for your specific market.

How Does Your Loan Type Affect Your Decision?

Different loan programs have varying relationships with new versus existing homes:

FHA Loans and Property Type

FHA loans work well with both new and existing homes, though considerations differ:

For existing homes, FHA appraisers flag condition issues requiring repairs before closing. Older properties sometimes need work to meet FHA standards—peeling paint, safety issues, required handrails. These requirements protect buyers but can delay closings or kill deals if sellers won’t complete repairs.

For new construction, FHA appraisals are straightforward since everything meets current codes. However, FHA’s stringent appraisal requirements sometimes mean builders prefer conventional buyers to avoid FHA’s potential complications.

Conventional Loans and Property Type

Conventional loans offer maximum flexibility with both property types:

Existing homes rarely face conventional loan obstacles unless condition is extremely poor or significant safety issues exist. Appraisers note deficiencies but requirements for repairs are less stringent than FHA.

New construction works smoothly with conventional financing. Builders generally prefer conventional buyers due to fewer potential complications.

VA Loans and Property Type

VA loans have standards similar to FHA, ensuring military buyers purchase safe, sound properties:

Existing homes must meet VA property standards, which can require repairs similar to FHA. However, VA’s zero down payment and no mortgage insurance make the program attractive despite potential repair negotiations.

New construction works well with VA financing since new homes naturally meet all VA standards.

Construction Loans for New Builds

If you’re building new (not buying spec), construction loans like conventional construction loans, FHA construction loans, or VA construction loans fund both the lot purchase and building process in one transaction.

What Strategy Should First-Time Buyers Use?

Making the right choice between new and existing homes requires honest evaluation of your priorities, financial situation, and risk tolerance:

Choose New Construction If You:

- Value modern design, energy efficiency, and low maintenance above all else

- Have sufficient budget for premium pricing and potential upgrades

- Can wait extended periods if homes aren’t yet complete

- Prefer warranty protection and peace of mind over instant equity

- Are comfortable buying in developing areas with less established character

- Plan to own long-term (7+ years) giving appreciation time to work

Choose Existing Homes If You:

- Prioritize value, negotiation leverage, and starting with more equity

- Prefer established neighborhoods with proven track records

- Can handle maintenance responsibilities and potential upcoming system replacements

- Value unique character, larger lots, and mature landscaping

- Need to move quickly without waiting for construction

- Are comfortable evaluating property condition and negotiating repairs

Strategic Hybrid Approach:

Some buyers employ creative strategies combining benefits of both:

Purchase newer existing homes (1-5 years old) in established neighborhoods. You get relatively modern features and systems with remaining warranty periods, while benefiting from established neighborhoods and sometimes better values than brand new counterparts.

Buy fixer-uppers in prime locations using FHA 203k loans or HomeStyle renovation loans that finance both purchase and renovations. You create “like new” condition in established desirable areas at total costs sometimes less than new construction.

This FHA 203k case study demonstrates how a first-time buyer transformed a dated existing home into a modern property in a prime established neighborhood—getting the best of both worlds.

How Does Stairway Mortgage Help You Decide?

Choosing between new construction and existing homes involves complex financial analysis beyond simple preference. At Stairway Mortgage, we help first-time buyers evaluate both options strategically:

We model both scenarios financially showing total costs, equity positions, and projected wealth building over your anticipated ownership period. Real numbers replace guesswork.

We explain how different loan programs work with each property type, identifying advantages and potential obstacles based on your financing choice.

We coordinate with builders and agents to ensure smooth transactions whether you’re buying new or existing. We understand builder processes and requirements that differ from traditional existing home purchases.

We identify renovation loan opportunities when existing homes need work but occupy prime locations. FHA 203k and HomeStyle renovation loans sometimes create the best value by transforming existing properties.

We provide honest assessments of market conditions affecting both new and existing home values in your target areas. Some markets favor one option significantly over the other—we help you understand which.

Many first-time buyers we’ve worked with made decisions between new and existing homes based on solid financial analysis rather than emotional preferences, resulting in better wealth-building outcomes.

Ready to Make Your Decision Confidently?

Choosing between new construction and existing homes doesn’t require agonizing uncertainty. Armed with clear understanding of each option’s advantages, disadvantages, and financial implications, you can select the path best aligned with your situation and goals.

Your next steps:

If you’re torn between new and existing homes in your market, schedule a call to analyze both options financially and discuss which builds more wealth for your specific situation.

If you’re ready to move forward, get pre-approved so you can compete effectively whether pursuing new construction or existing properties.

If you’re considering fixer-uppers as a middle ground, explore FHA 203k loans or HomeStyle renovation loans that create custom results in established neighborhoods.

Remember: Both paths can build substantial wealth. The right choice is the one that fits your priorities, budget, and long-term strategy—not the one everyone else is choosing or the one that seems “safer” or “better” in abstract. Make your decision based on your unique circumstances, and you’ll build wealth successfully regardless of which path you take.

Frequently Asked Questions

Is new construction always more expensive than existing homes?

Generally yes, but not always. New construction typically costs more per square foot than comparable existing homes due to new systems, warranties, modern features, and builder profit margins. However, in some markets during certain periods, overbuilt new construction developments offer pricing competitive with or even below existing homes to move inventory. Additionally, when you factor in immediate repair needs for existing homes, total costs can sometimes favor new construction. Compare total cost of ownership—purchase price, immediate repairs, near-term maintenance, energy costs—rather than just asking price.

Can I negotiate price with builders like I can with existing home sellers?

Limited negotiation is possible but differs significantly from existing homes. Builders use standard contracts with minimal flexibility, and in strong markets they often won’t negotiate at all knowing other buyers exist. However, negotiation opportunities include: requesting upgrades at no cost or reduced pricing, asking for closing cost assistance, negotiating earnest money amounts, adjusting deposit structures, or purchasing inventory or spec homes sitting unsold where builders become more flexible. Never accept builders’ first terms without attempting negotiation—even small concessions provide value. Your agent and lender should coordinate to present compelling cases maximizing your negotiation success.

Do new homes appreciate faster than existing homes?

Not necessarily—appreciation depends on location and market conditions more than age. Existing homes in highly desirable, supply-constrained areas with proven appreciation histories often outperform new construction in developing areas. New construction can appreciate rapidly if the area develops favorably and attracts strong demand, but can also stagnate or decline if development falls short of expectations. The key factors driving appreciation are location desirability, job growth, school quality, and housing supply relative to demand—not whether the home is new or existing. Some of the fastest-appreciating properties are existing homes in prime locations where new construction isn’t possible due to limited land.

Should I buy new construction if I’m handy and can handle repairs?

Being handy doesn’t necessarily favor existing homes. While DIY skills reduce maintenance costs for existing homes, consider: (1) Your time has value—hours spent on repairs could be spent earning income or pursuing other goals; (2) Warranty coverage eliminates many expenses entirely for new construction, not just reducing them; (3) Major systems requiring professional service (HVAC, electrical, plumbing) cost the same regardless of your handiness; (4) New construction’s energy efficiency saves money beyond what DIY repairs can achieve with existing homes. Being handy makes existing homes more manageable financially, but new construction still offers benefits beyond what DIY skills provide. Evaluate based on your complete situation, not just repair capability.

What happens if I buy new construction and the builder goes bankrupt during construction?

Builder bankruptcy during construction creates serious problems though protections exist in many states. If building on spec, you might lose deposits if bankruptcy occurs before closing—though earnest money held by third parties often receives some protection. If building custom, construction financing provides some protection as lender oversight ensures funds release only as work completes. To protect yourself: research builder financial stability before contracting, verify deposits go into escrow accounts with third-party control, understand your state’s construction trust laws, consider title insurance for new construction, and never pay builders directly for incomplete work beyond small deposits. Working with established, financially stable builders dramatically reduces this risk. If concerned, ask builders about their bonding and insurance, check licensing and complaint histories, and consult attorneys before signing contracts. Use FHA or conventional construction loans providing lender oversight throughout the building process.

Can I use down payment assistance with new construction?

Yes, most down payment assistance programs work with new construction, though some builders prefer buyers without DPA due to additional requirements or paperwork. FHA, conventional, VA, and USDA loans all accept down payment assistance, and these programs finance both new and existing homes. However, builders sometimes limit incentives or upgrades for buyers using DPA or certain loan types. Be upfront about your financing plans early in negotiations—some builders work smoothly with all programs, others prefer certain buyer profiles. Don’t let builder preferences discourage you from using assistance you qualify for—many builders readily work with DPA buyers. See our down payment assistance guide for programs that work with new construction.

Also Helpful for First-Time Home Buyers

Loan Programs for Both Property Types:

Understand financing options for your purchase:

- Review FHA loans for minimal down payment

- Explore conventional loans with flexible terms

- Check VA loans for zero down military benefits

- Consider construction loans for building new

Calculate costs for both scenarios:

- FHA loan calculator with maintenance assumptions

- Conventional loan calculator showing total costs

- Construction loan calculator for building

See real examples of both paths:

- FHA loan case study with existing home purchase

- Construction loan success building new

- 203k renovation story creating custom home

What’s Next in Your Journey?

Now that you understand the new versus existing home decision, additional knowledge completes your path to homeownership:

Final topics for confident buying:

- Understanding your monthly budget beyond just the mortgage payment

- Building equity through strategic improvements and maintenance

- Planning your eventual move to your next home

- Leveraging your first home’s equity for future investments

- Understanding tax benefits that build wealth over time

Each decision builds on previous knowledge—transforming you from uncertain buyer into strategic homeowner building long-term wealth.

Explore Your Complete Options

Loan Programs for Any Property Type:

- Browse all loan programs for flexible options

- Explore renovation loans creating custom results

- Review construction loans for building

Tools for Complete Analysis:

- Access all calculators for comprehensive modeling

- Use purchase calculators with maintenance costs

- Try renovation calculators for transformation projects

Success Stories for Guidance:

- Read all case studies across property types

- Browse first-time buyer journeys with both options

- Explore renovation success stories

Need help deciding between new and existing homes? Schedule a call to analyze both options for your specific situation and market.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.