Inflation, Interest Rates, and the Power of Ownership

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

- Inflation

- Interest rates

- Ownership

What Inflation Really Does to Your Money

- Erodes the value of your cash

- Increases rent and cost of living

- Rewards debt holders and owners

- Punishes savers and renters

Understanding how real estate builds wealth during inflation is crucial. Calculate your Buy & Hold: Cashflow, Appreciation, Equity, Depreciation & Tax Savings now to see how property ownership protects against inflation while building long-term wealth.

Why Interest Rates Matter — But Not the Way You Think

Yes, rising interest rates increase mortgage payments.

But:

- Rates fluctuate — and you can refinance later

- The purchase price you lock in matters more than temporary financing

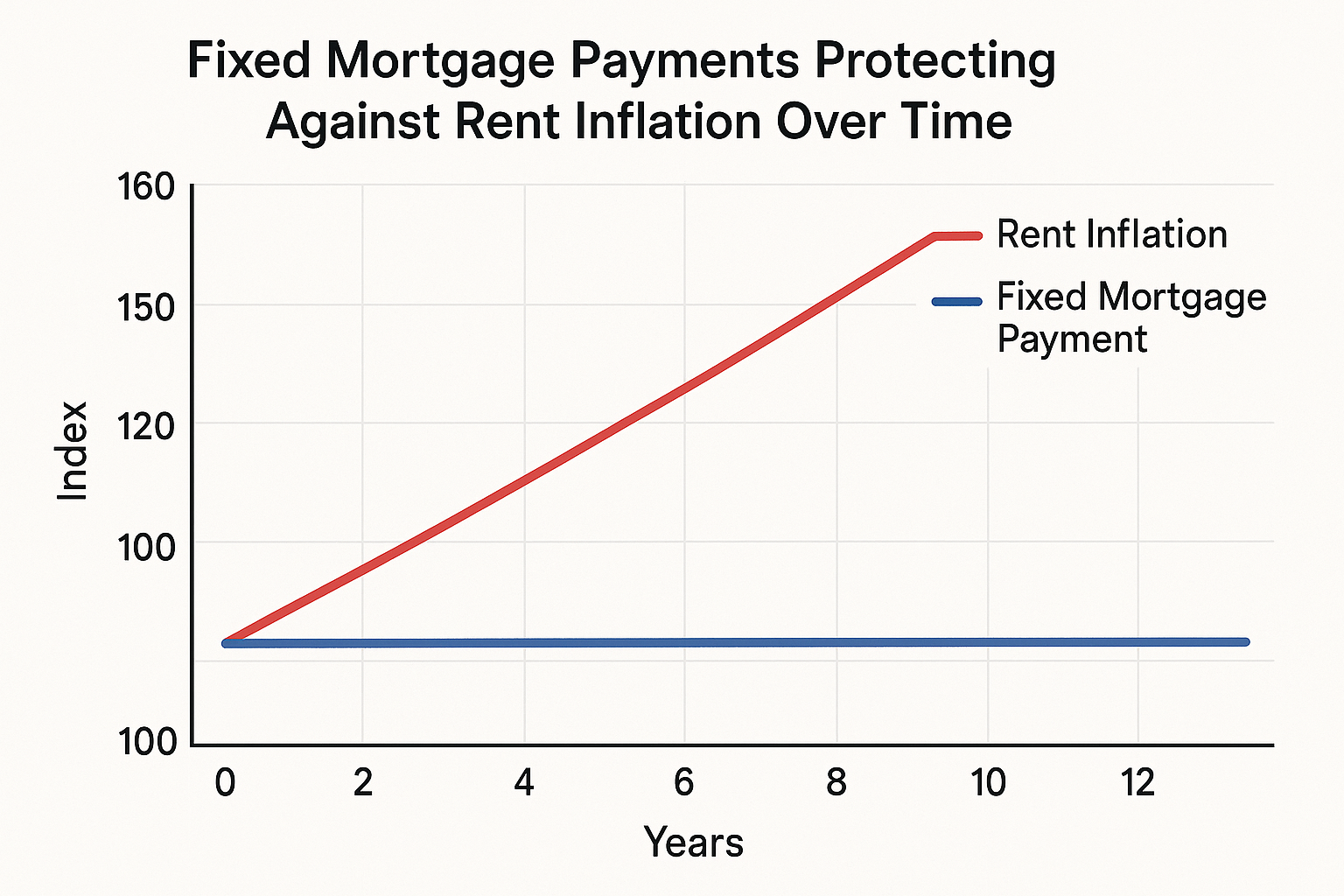

- Owning now locks in a payment — while rent keeps rising with inflation

Waiting for “perfect rates” often costs buyers tens of thousands in appreciation and rent paid to someone else.

Want to see the real cost of waiting for rates to drop? Calculate your Compare 2 Rates (Interest Costs) now to understand how buying now versus waiting affects your total costs when factoring in appreciation and continued rent payments.

The Power of Ownership in an Unstable Economy

When you own real estate:

- Your payment is fixed (if using a fixed-rate loan)

- Your equity grows as inflation lifts property values

- You gain control over housing costs, upgrades, and exit timing

Renters? They’re subject to market forces every year — and rising costs with no return.

Ready to lock in your housing costs against inflation? Calculate your Conventional Purchase Loan Payment now to see how a fixed-rate mortgage protects you from rising rents and builds equity as inflation increases property values.

How to Use Ownership as an Inflation Shield

- Lock in a fixed-rate mortgage

- Choose markets and properties with strong fundamentals

- Consider income-producing homes to create a hedge + income stream

Build a long-term plan — and let time + inflation grow your equity

Interested in income-producing properties as an inflation hedge? Calculate your DSCR Investment Purchase Loan Payment now to explore how rental properties provide both appreciation protection and cash flow during inflationary periods.

Want to protect your wealth and start building equity now?

At Stairway Mortgage, we help you use homeownership as a strategic hedge against inflation and economic uncertainty.

📘 Download our homebuyer guides about inflation protection strategies.

🧮 Analyze wealth building with our Buy & Hold Calculator.

🏠 Start your journey on our Buy a House page.

📊 Check Current Rates and lock in your protection.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call