Home Inspection Checklist for Buyers: What to Look For (And What to Skip)

Home Inspection Checklist for Buyers: What to Look For (And What to Skip)

Home Inspection List for Buyers: Identifying Problems Before Buying Your Home

Once your offer is accepted, you’ll likely feel two conflicting emotions: excitement and anxiety. The home inspection is where many first-time buyers experience their first real wave of doubt—suddenly that perfect house reveals dozens of “issues” in a lengthy report.

But here’s the truth: The purpose of an inspection isn’t to find a perfect home. Perfect homes don’t exist. Inspections exist to help you know exactly what you’re buying and negotiate with confidence based on facts, not fears.

This guide helps you understand what matters, what doesn’t, and how to use your findings strategically.

In this guide, you’ll discover:

- What home inspections cover and what they don’t (following InterNACHI inspection standards)

- The difference between red flags and normal wear-and-tear (per HUD homebuying guidance)

- Which repairs to prioritize in negotiations (based on FHA property standards)

- How to avoid losing deals over minor issues

- Smart negotiation strategies that protect your investment without killing the deal

Almost every inspection report will include findings. The question isn’t whether problems exist—it’s which problems justify negotiation, which ones you can handle yourself, and which ones should make you walk away.

Need help interpreting your inspection report? Schedule a call to discuss how findings might affect your financing and next steps.

What Is a Home Inspection and Why Does It Matter?

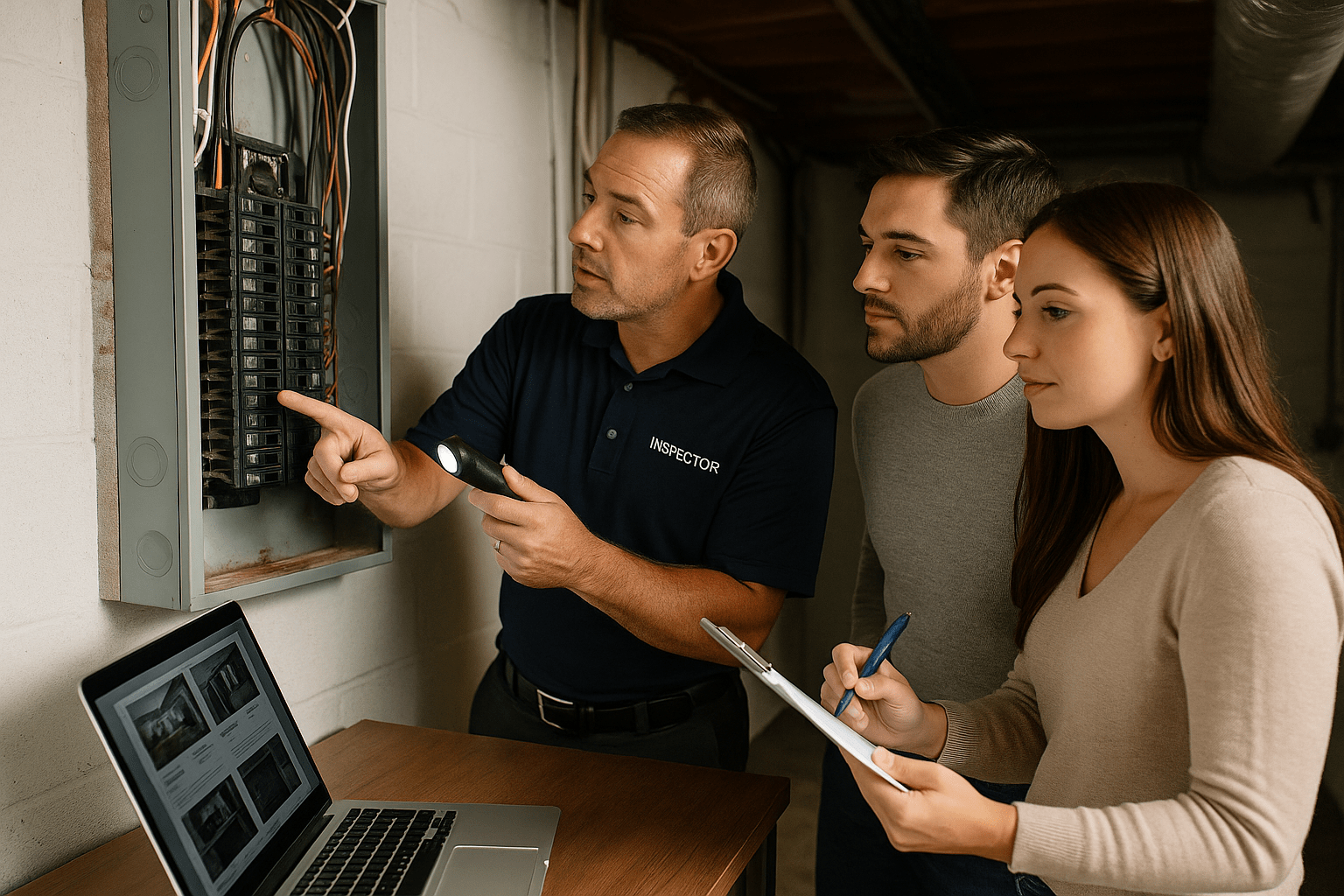

A home inspection is a professional examination of a property’s visible condition, typically conducted after your offer is accepted but before you finalize the purchase. A licensed inspector spends several hours examining the home’s major systems and components, then provides a detailed report of their findings.

What inspections cover:

- Foundation and structural elements

- Roof condition and remaining life expectancy

- Electrical systems and safety

- Plumbing systems and fixtures

- HVAC (heating, ventilation, air conditioning)

- Appliances included with the sale

- Water heater and hot water systems

- Windows, doors, and weatherproofing

- Attic, basement, and crawl space conditions

- Visible signs of pests, mold, or water damage

- Safety concerns like missing GFCI outlets or handrails

Inspectors use specialized equipment—moisture meters, infrared cameras, electrical testers—to identify issues invisible to untrained eyes. They document everything with photos and detailed descriptions.

What inspections DON’T cover:

- Items hidden behind walls, under flooring, or otherwise not visible

- Specialized systems requiring specific expertise (pools, septic systems, wells)

- Cosmetic concerns like paint color or style preferences

- Code compliance for additions or renovations (unless obviously unpermitted)

- Future predictions about how long systems will last beyond general estimates

Inspections are not pass/fail tests. They’re information-gathering tools that empower you to make informed decisions about whether to proceed, negotiate, or walk away.

For buyers using FHA loans, inspections gain additional importance because FHA appraisers will also note property condition issues that must be addressed before the loan can close. While inspections are typically optional, they’re highly recommended—especially for first-time buyers purchasing older homes or fixer-uppers financed with programs like FHA 203k loans that combine purchase and renovation financing.

Why Do Home Inspection Checklists Matter for First-Time Buyers?

First-time buyers lack the experience to identify problems independently. You might notice cosmetic issues like worn carpet or outdated fixtures, but you probably can’t assess foundation integrity, electrical safety, or whether that water stain indicates active leaks or past repairs.

Inspections level the playing field. For a few hundred dollars, you gain access to professional expertise that reveals:

- Safety hazards that could harm your family

- Major system failures requiring immediate expensive repairs

- Deferred maintenance indicating neglect by previous owners

- Deal-breakers that justify walking away

- Minor issues you can easily handle yourself

The emotional protection matters as much as the physical findings. Buyers often fall in love with homes during showings and open houses. Inspections inject objectivity into emotional decisions. When you see the full picture of a home’s condition, you can make rational choices about whether the property truly fits your needs and budget.

Inspections also provide leverage in negotiations. Armed with documented findings from a neutral professional, you can request repairs, credits, or price reductions based on facts rather than guesses. Sellers take inspection reports seriously because they know the issues will surface for future buyers if you walk away.

Finally, inspections offer education. Accompanying your inspector during the examination—which most inspectors encourage—teaches you about your future home’s systems. You’ll learn where shutoffs are located, how to maintain major components, and what normal versus concerning conditions look like. This knowledge serves you throughout homeownership.

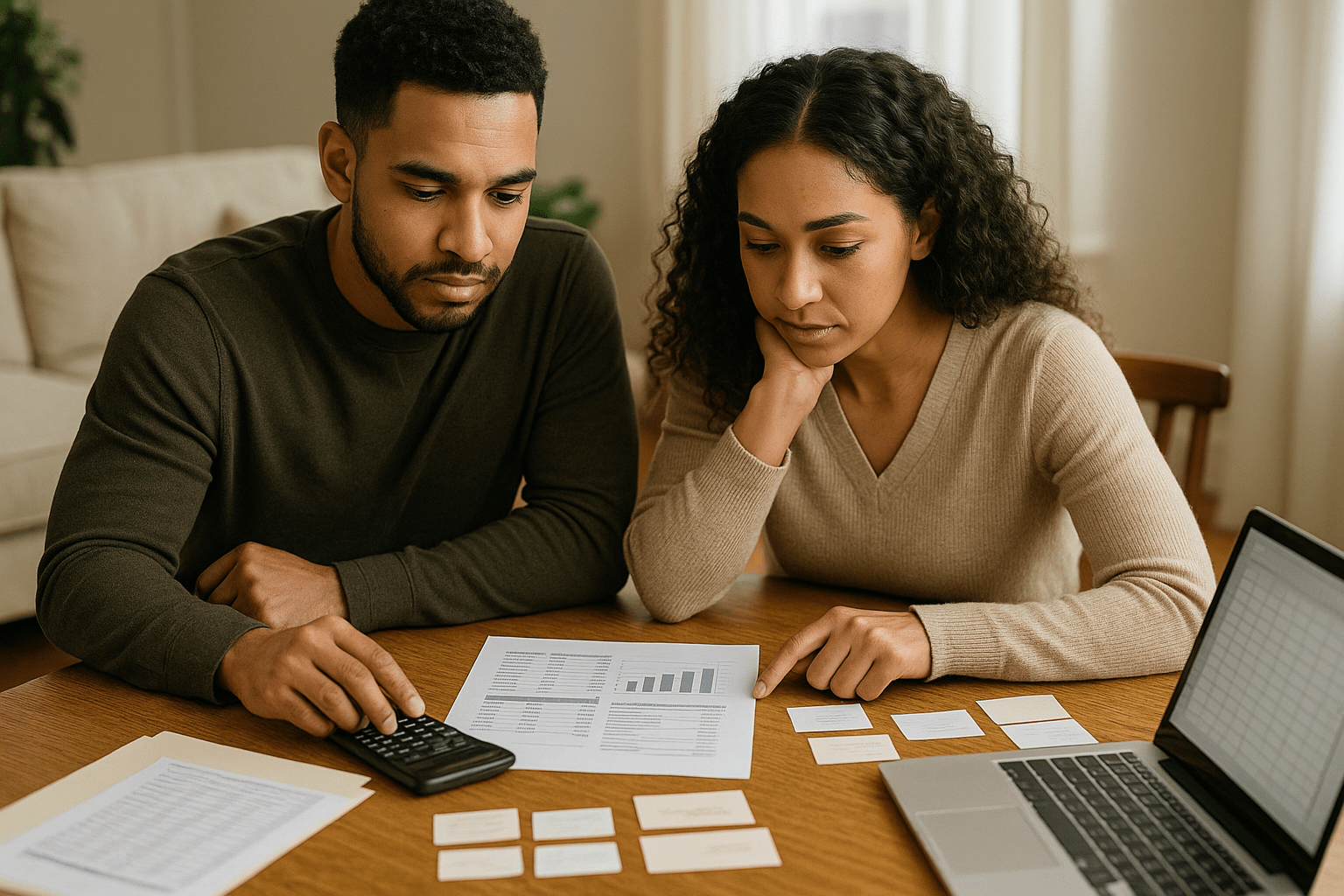

Use the conventional loan calculator or FHA loan calculator to factor potential repair costs into your budget analysis—inspection findings might affect whether you can afford a particular property comfortably.

How Does the Home Inspection Process Work?

Understanding the timeline and logistics helps you maximize the inspection’s value:

Step 1: Schedule Immediately After Offer Acceptance

Most purchase contracts include inspection contingencies giving you a specific timeframe—typically 5 to 10 days—to complete inspections. Schedule your inspection immediately after offer acceptance. Don’t wait—good inspectors book up quickly, and you need time to receive the report, discuss findings, and negotiate before your contingency period expires.

Choosing an inspector matters:

- Seek licensed, certified professionals (requirements vary by state)

- Look for inspectors certified by professional organizations like InterNACHI or ASHI

- Ask your real estate agent for referrals, but independently verify credentials

- Read reviews focusing on thoroughness and communication

- Confirm they provide detailed written reports with photos

- Verify they carry errors and omissions insurance

Cost typically ranges from a few hundred to around a thousand dollars depending on home size, age, and location. This is money well spent—skipping inspections to save a few hundred dollars can cost tens of thousands in unexpected repairs.

Step 2: Attend the Inspection

Always accompany your inspector during the examination if possible. This typically takes two to four hours depending on property size and complexity. During the inspection:

- Ask questions about anything unclear

- Take your own photos and notes

- Learn where main shutoffs are located (water, gas, electrical)

- Understand how major systems operate

- Get informal opinions about system lifespans and maintenance needs

- Request recommendations for any necessary specialists (structural engineers, roofers, electricians)

Many inspectors provide verbal summaries of major concerns at the end—don’t rely solely on this. Wait for the full written report, which provides detail, documentation, and photos you’ll need for negotiations.

Step 3: Review the Full Report Carefully

Within 24 to 48 hours, you’ll receive a comprehensive report—often 30 to 50+ pages for older homes. The report typically categorizes findings by:

- Safety concerns requiring immediate attention

- Major issues involving significant expense or system failures

- Recommended repairs for proper maintenance

- Minor concerns and cosmetic issues

- Informational items about system ages and maintenance needs

Don’t panic when you see the length. Every home—even new construction—will have findings. Your job is prioritizing which items matter most.

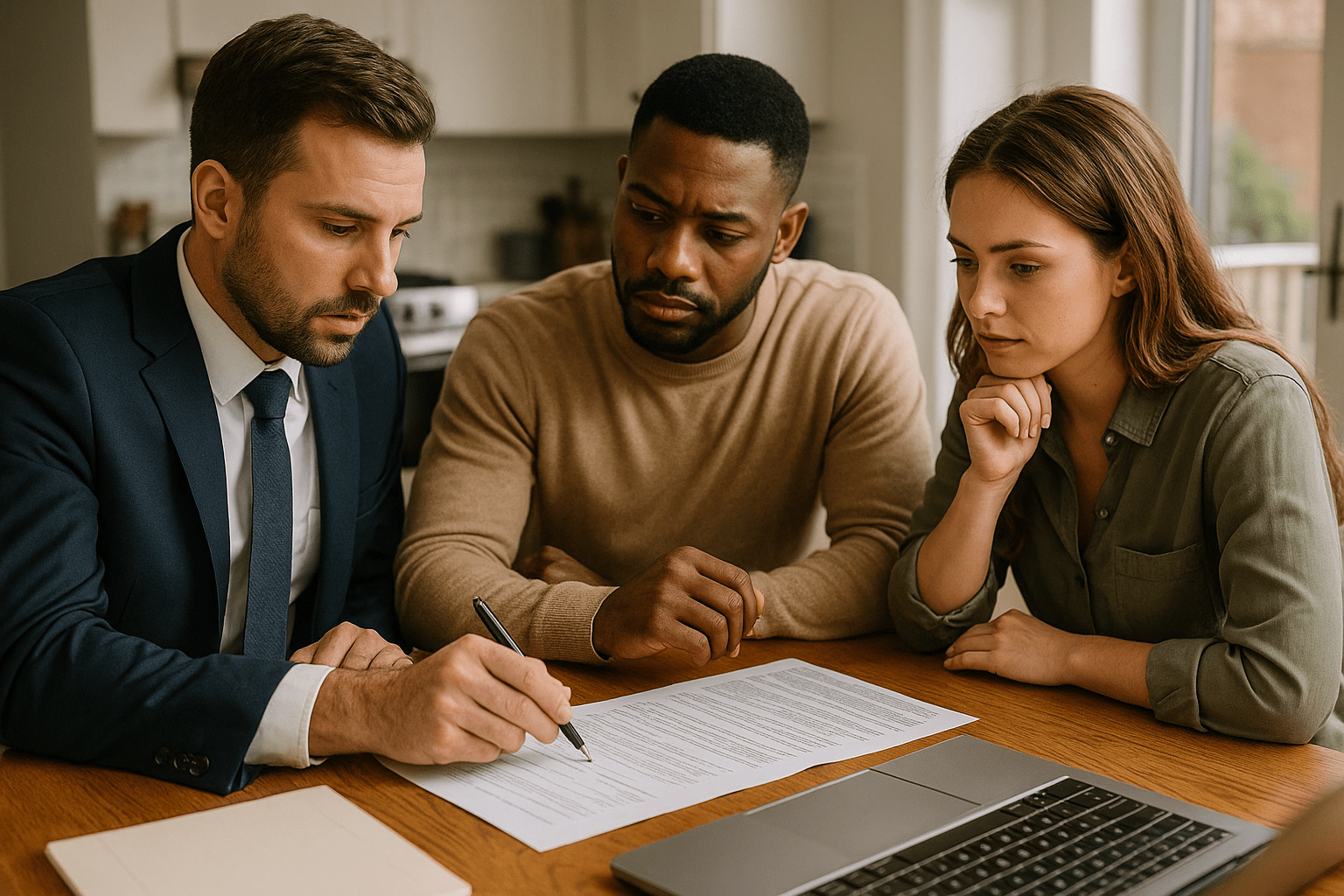

Step 4: Consult with Your Agent and Lender

Before deciding how to proceed, discuss the report with:

Your real estate agent can provide market context: Are these findings typical for homes in this age and price range? Which items do sellers in this market typically address? How might this affect negotiations?

Your lender needs to know about any findings that could affect loan approval. FHA and VA loans require certain repairs be completed before closing. Conventional loans have fewer requirements, but major safety or structural issues might prevent any lender from approving the loan until addressed.

For fixer-upper properties where renovation is expected, the inspection informs your FHA 203k loan or HomeStyle renovation loan scope of work and budget.

Step 5: Decide Your Next Steps

You have several options:

- Request repairs: Ask the seller to fix specific items before closing

- Request credits: Negotiate price reduction or closing cost credits so you can handle repairs yourself

- Accept as-is: Proceed without any repair requests (perhaps because you got a great price knowing repairs were needed)

- Walk away: Exercise your inspection contingency to terminate the contract if major issues make the property unacceptable

Your choice depends on market conditions, the severity of issues, your budget for repairs, and your negotiation leverage. In hot markets with multiple offers, sellers may refuse repair requests. In buyer’s markets, they might be more accommodating.

What Are the Red Flags That Should Concern You?

Not all inspection findings carry equal weight. Let’s separate genuine concerns from normal homeowner responsibilities:

Critical Safety Hazards – Take These Seriously

Electrical fire risks include outdated wiring (knob-and-tube, aluminum), overloaded panels, improper DIY work, or missing ground fault circuit interrupter (GFCI) protection in bathrooms and kitchens. Electrical issues cause thousands of house fires annually—these aren’t cosmetic concerns.

Active water intrusion and mold indicate ongoing problems that worsen over time. Past water damage that was properly remediated is far less concerning than current leaks damaging structure and creating health hazards. Look for fresh water stains, musty odors, visible mold growth, and moisture meter readings indicating hidden dampness.

Gas leaks or carbon monoxide concerns require immediate attention. Inspectors test for gas leaks and carbon monoxide. Any findings here should be addressed before occupancy.

Structural movement or failure shows up as foundation cracks, severely sagging rooflines, doors and windows that don’t operate properly due to settling, or floor slopes beyond normal tolerances. While minor settling is normal in older homes, significant structural issues can require extremely expensive repairs.

Major System Failures – Expensive But Not Necessarily Deal-Breakers

Roof needing replacement within the next few years is common in older homes. Roofs have finite lifespans. The question isn’t whether it will need replacement, but when. A roof at end-of-life requires negotiation—either repairs by the seller or credits to you—but doesn’t necessarily justify walking away unless you can’t afford the replacement.

HVAC systems near end-of-life or not functioning properly need attention. Replacing an HVAC system can be costly, but it’s a known, quantifiable expense. If the system failed its inspection, request repair or credit.

Plumbing issues like polybutylene pipes (known to fail), galvanized pipes (rust and restriction), or sewer line problems can be expensive but addressable. Sewer line inspections via camera are sometimes additional (not included in standard inspections) but highly recommended for older properties.

Water heater failure or near end-of-life is relatively affordable to address but does need attention. Water heaters typically last 8 to 12 years. One at the end of its lifespan should be noted in negotiations.

Code Violations and Unpermitted Work

Unpermitted additions or renovations create multiple problems: they may not meet code, could affect resale value and insurance, and might require expensive corrective work. This is particularly concerning for major additions like finished basements, room additions, or deck construction. Some lenders won’t finance properties with significant unpermitted work until it’s legalized or removed.

Missing permits for replaced systems (HVAC, electrical, plumbing) aren’t ideal but are often less serious than unpermitted structural work. However, if permits were required and not obtained, inspectors can’t verify work was done correctly.

What’s Normal and What You Can Live With

Minor wear and tear appears in every lived-in home: scratched floors, worn fixtures, outdated but functional appliances, cosmetic cracks in walls or ceilings, minor weathering on siding or trim.

Deferred maintenance like dirty HVAC filters, neglected caulking, unmaintained landscaping, and similar items are fixable with minimal effort and expense.

“Grandpa wiring” refers to outdated but still safe electrical systems like older two-prong outlets. While not ideal and something to upgrade eventually, if it’s safe and functional, it doesn’t warrant killing a deal.

Age-appropriate condition means systems showing normal wear for their age. A system halfway through its expected lifespan showing age-appropriate wear shouldn’t be surprising.

What Should You Fight For in Negotiations?

Smart negotiation balances protecting your investment with maintaining goodwill needed to reach closing. Here’s how to prioritize:

Always Fight For:

Safety hazards affecting habitability or creating danger should always be addressed. This includes electrical fire risks, gas leaks, carbon monoxide issues, severely defective stairs or railings, and similar concerns. No reasonable seller should object to fixing genuine safety problems.

Major system failures that make the home non-functional or will require immediate significant expense warrant negotiation. Non-functioning HVAC in extreme climates, failed water heaters, sewage backup issues, and major plumbing or electrical failures all justify repair requests or substantial credits.

Issues affecting loan approval must be resolved before closing if you can’t get financing otherwise. FHA and VA loans require certain repairs be completed. If your lender says an issue must be fixed, that’s non-negotiable—either the seller addresses it or you can’t close.

Structural concerns beyond normal settling should be evaluated by structural engineers and addressed based on their recommendations. Significant foundation problems, load-bearing wall issues, or roof structural failures warrant serious negotiation or walking away.

Selectively Fight For:

Systems near end-of-life depend on market conditions and negotiation posture. In buyer’s markets, requesting credits for aging roofs or HVAC systems is reasonable. In competitive markets, you might need to accept these as-is or negotiate modest credits.

Moderate repairs involving several hundred to a few thousand dollars can go either way. Consider your overall deal—if you got a great price knowing some work was needed, pushing for additional repairs might sour the relationship. If you paid top dollar expecting move-in condition, moderate repairs are fair game for negotiation.

Code compliance issues for unpermitted work should be addressed, but the solution might be bringing work into compliance, obtaining after-the-fact permits, or negotiating credits so you can handle it post-closing.

Let Go Of:

Cosmetic issues should never be part of inspection negotiations unless you bought a turnkey property at premium pricing with explicit expectations of pristine condition. Worn carpet, outdated fixtures, paint colors, and minor aesthetic concerns are your choices as the future homeowner.

Minor repairs under a few hundred dollars aren’t worth losing deals over. That loose doorknob, missing outlet cover, or dripping bathroom faucet? Fix them yourself for minimal cost and avoid souring negotiations over trivialities.

Safe but outdated systems don’t justify repair demands. Two-prong outlets that aren’t unsafe, older appliances that still function, vinyl siding from the 1980s—these are age-appropriate conditions, not defects.

Normal wear and tear is expected in existing homes. Scratches, dings, minor weathering, and similar items come with non-new properties.

When to Walk Away

Multiple major problems creating a repair burden beyond your budget or expertise might justify terminating the contract. If the inspection reveals extensive issues totaling tens of thousands in repairs, reconsider whether this property fits your situation.

Sellers unwilling to address safety hazards signal potential problems. If a seller refuses to fix legitimate safety concerns, what else are they hiding? This attitude often indicates you’ll discover additional problems after closing with no recourse.

Issues your lender won’t finance leave you unable to close. If FHA requires repairs the seller won’t complete, you can’t proceed with FHA financing. You’d need to either switch to a loan type without those requirements, pay for repairs yourself before closing (risky), or walk away.

Your gut feeling combined with major findings shouldn’t be ignored. If the inspection plus other concerns create serious doubt, use your contingency period to exit gracefully.

This FHA loan case study demonstrates how a first-time buyer successfully negotiated inspection repairs and moved forward confidently, while this conventional loan case study shows someone who walked away from a property with too many issues and found a better option.

How Do You Negotiate Repairs Effectively?

Successful negotiation requires strategy, not just presenting the inspection report and demanding everything be fixed. Here’s how to approach it:

Step 1: Prioritize Your Requests

Create three categories:

- Must-fix: Safety hazards, major system failures, issues affecting loan approval

- Should-fix: Significant but not critical repairs, items you lack budget or expertise to handle

- Nice-to-fix: Minor issues you’d like addressed but won’t walk away over

Focus negotiations on categories one and two. Don’t muddy the waters with category three unless you’re in a strong buyer’s market where sellers expect comprehensive repair lists.

Step 2: Decide Between Repairs and Credits

Repair requests ask the seller to fix specific items before closing. Advantages: work is done before you own the home, sellers often have existing contractor relationships. Disadvantages: you don’t control quality, timing can delay closing, scope disputes might arise.

Credit requests ask for price reduction or closing cost credits so you can handle repairs yourself. Advantages: you control quality and contractor selection, no delays coordinating repairs before closing. Disadvantages: you need cash or financing capacity to handle repairs, you accept responsibility if actual costs exceed credits.

Generally, credits work better for most repairs except those requiring immediate attention before occupancy. For safety hazards needing expert evaluation, insist on proper professional repairs before closing.

Step 3: Be Reasonable and Professional

Present requests professionally, ideally through your agent using standard forms. Include:

- Specific inspection report page references

- Clear descriptions of each requested repair

- Why each item matters (safety, functionality, loan requirement)

- Whether you’re requesting repair or credit for each item

- Deadline for seller response

Avoid emotional language or accusatory tone. The seller didn’t try to deceive you—they may not have known about some issues, and others are simply normal for the home’s age.

Be willing to compromise. If you request thousands in repairs and the seller offers hundreds, counter with your highest priorities. Negotiation is give-and-take.

Step 4: Know Your Market Position

In hot seller’s markets with multiple offers:

- Limit requests to genuine safety hazards and loan requirements

- Consider credits over repair requests to simplify closing

- Be prepared for sellers to refuse all but legally required repairs

- Remember you competed to win this property—unreasonable repair demands might cost you the house

In balanced or buyer’s markets:

- Request all reasonable repairs

- Negotiate firmly for major issues

- Expect sellers to address most significant problems

With properties priced below market due to known condition issues:

- You accepted that discount in exchange for repair responsibility

- Limit requests to items undisclosed or worse than expected

- Focus on safety and major system failures only

Step 5: Have a Walk-Away Threshold

Before negotiating, decide what outcome would make you terminate the contract. Is it the seller refusing to address certain critical items? Is it a repair credit amount below a specific threshold? Know your line in advance so emotions don’t drive decisions in the moment.

If negotiations fail and you walk away, your earnest money is typically refundable if you’re within your contingency period. This protection is why inspection contingencies exist.

How Does Your Loan Type Affect Inspection Importance?

Different loan programs have varying standards for property condition:

FHA Loans and Inspections

FHA loans involve both inspections (optional but recommended) and FHA appraisals (required). The FHA appraiser notes property condition issues affecting safety, security, and soundness. Common FHA appraisal conditions include:

- Peeling paint on homes built before 1978 (lead paint concern)

- Missing handrails on stairs

- Damaged roof requiring repair

- Non-functioning systems (HVAC, plumbing, electrical)

- Tripping hazards or safety concerns

FHA appraisal conditions must be resolved before closing. This is non-negotiable—the appraiser must reinspect and clear all conditions or the loan won’t fund. Your inspection helps you identify these issues early and negotiate who handles them.

Conventional Loans and Inspections

Conventional loans have fewer required repairs. Appraisers note obvious deficiencies but aren’t held to FHA’s stringent standards. This gives buyers more flexibility—you can often close on properties with minor issues that would delay FHA closings.

However, major problems affecting value still matter to conventional underwriters. If the appraiser notes significant issues, the lender might require repairs for loan approval.

VA Loans and Inspections

VA loans have standards similar to FHA, ensuring military buyers purchase safe, sound properties. VA appraisers flag condition issues requiring correction before closing.

203k and Renovation Loans

For FHA 203k loans or HomeStyle renovation loans, inspections are critical—they inform your renovation scope of work and budget. You’re buying a fixer-upper, so extensive inspection findings are expected and become part of your renovation plan.

What Common Mistakes Do First-Time Buyers Make?

Avoid these pitfalls that derail deals or create post-closing regrets:

Overreacting to normal findings: When you receive a thick inspection report, it’s easy to panic. Remember: every home has issues. Distinguish normal age-appropriate condition from genuine problems.

Focusing on cosmetics instead of systems: Don’t request the seller repaint rooms or replace outdated light fixtures while ignoring the aging HVAC system or electrical safety concerns. Prioritize function over aesthetics.

Requesting everything in the report: Submitting repair requests for every single inspection finding—including minor, cosmetic, or informational items—marks you as unreasonable and can kill deals. Sellers may refuse all requests or accept backup offers rather than negotiate with someone making unreasonable demands.

Not attending the inspection: Skipping the inspection means missing the educational opportunity and losing the chance to ask questions about concerns. Attend whenever possible.

Hiring cheap or unqualified inspectors: Saving a couple hundred on inspection costs can lead to missed major problems costing thousands post-closing. Invest in quality inspection services.

Skipping specialist inspections when recommended: If your general inspector recommends a structural engineer, roofer, or pest specialist, follow their advice. These specialists have expertise general inspectors lack for specific concerns.

Negotiating emotionally instead of strategically: Don’t let fear or anger drive repair requests. Approach negotiations calmly with clear priorities.

How Does Stairway Mortgage Help With Inspection-Related Decisions?

Your lender plays an important role in the inspection and negotiation process. At Stairway Mortgage, we support buyers through this critical phase:

We help you understand how findings affect your loan approval. Not sure if that electrical issue will prevent FHA approval? We can tell you immediately based on the report details. Need to know if that roof condition requires repair before closing? We know underwriting standards and can guide you.

We coordinate with appraisers when condition issues arise. If your appraiser flags concerns, we manage communication between you, your agent, and the appraiser to ensure everyone understands what’s required and how to satisfy conditions efficiently.

We adjust timelines when inspections reveal complications. Sometimes inspection findings require additional time—specialist evaluations, repair completion, re-inspection. We work with all parties to extend closing dates when necessary, protecting your financing approval through the process.

We help you understand repair cost implications for your budget. Inspection findings might reveal expenses you’ll face immediately post-closing. We can discuss whether these fit within your financial plan or if they create concerns about your reserves and emergency funds.

We suggest financing solutions when properties need work. If inspection reveals more needed repairs than expected, perhaps a 203k or HomeStyle renovation loan better fits your situation than the conventional or FHA loan you’re currently pursuing. We evaluate options and, if appropriate, help you pivot to programs that fund both purchase and repairs.

Many of our clients have navigated successful closings despite concerning inspection findings because we provided guidance on which issues matter to lenders, how to negotiate effectively, and when to proceed versus walk away.

Ready to Approach Your Inspection Confidently?

Home inspections don’t need to be anxiety-inducing ordeals. Armed with knowledge about what to expect, how to interpret findings, and which issues warrant action, you can turn inspections into strategic advantages rather than sources of fear.

Your next steps:

If you’re under contract and facing inspection decisions, schedule a call to discuss how findings affect your financing and what your options are.

If you’re still preparing to buy, get pre-approved so you understand your buying power, then approach inspections knowing you can afford necessary repairs.

If you’re exploring fixer-upper properties requiring renovation, learn about FHA 203k loans or HomeStyle renovation loans that finance purchase and improvements together.

Remember: Inspections protect you. They’re investments in information that prevent expensive surprises and provide negotiation leverage. Embrace the process, respond strategically, and you’ll close on a home where you understand exactly what you’re buying.

Frequently Asked Questions

Should I get an inspection on a new construction home?

Yes—even new homes benefit from third-party inspections. While new construction typically includes builder warranties, builders can miss details or cut corners. Independent inspectors find issues with framing, electrical, plumbing, HVAC installation, and finish work before you close. It’s easier to have builders correct issues before closing than fight warranty claims afterward. New construction inspections differ from resale inspections—seek inspectors experienced with new builds who understand construction phase inspections.

Can I back out of buying a home after the inspection?

Yes, if you have an active inspection contingency. Most purchase contracts include contingencies allowing you to terminate within a specific timeframe if inspection findings are unsatisfactory. You typically recover your earnest money when exercising contingencies properly. However, once your contingency period expires, backing out becomes difficult and might cost you your deposit. Never let inspection contingencies expire without making a conscious decision about how to proceed.

How much do repairs typically cost after an inspection?

It varies dramatically based on findings, but expect anywhere from zero to tens of thousands. Cosmetic issues might cost a few hundred to handle yourself. Moderate repairs like HVAC service, minor electrical updates, or plumbing fixes might total a few thousand. Major system replacements—roofs, HVAC systems, water heaters—can reach well into the thousands or even tens of thousands for roofs on large homes. Foundation repairs or extensive mold remediation can be extremely expensive. Your inspection report helps you estimate costs before finalizing purchase—get contractor quotes for major items to understand true expenses.

What if the seller refuses to fix anything?

You have several options depending on your situation. First, evaluate whether you can afford to handle repairs yourself. If so, consider proceeding without repair requests if you got a fair price accounting for property condition. Second, negotiate price reduction instead of repairs—many sellers prefer credits over coordinating contractors. Third, if essential repairs affecting safety or loan approval aren’t addressed, exercise your inspection contingency and walk away. In hot markets, sellers sometimes refuse all repair requests knowing backup offers exist. Decide in advance whether you’re willing to accept the property as-is at the agreed price.

Do I need specialized inspections beyond the general inspection?

Sometimes yes, based on general inspection recommendations and property characteristics. General inspectors often recommend specialists for concerns beyond their expertise: structural engineers for foundation or framing issues, roofers for detailed roof assessments, chimney specialists, pest inspectors for termites or other infestations, mold specialists, sewer line camera inspections, well and septic inspections for rural properties, and environmental assessments if contamination is suspected. These additional inspections cost extra but provide detailed expertise on specific concerns. Don’t skip recommended specialist inspections—they often uncover issues that dramatically affect purchase decisions. Use the conventional loan calculator or FHA calculator to ensure you’ve budgeted for inspection costs in your overall transaction expenses.

Can I negotiate inspection costs into my loan?

Not directly, but you can negotiate seller concessions covering closing costs that include inspection fees. Inspection costs are typically paid upfront by buyers before closing, not financed. However, if you negotiate seller concessions (seller contributing toward your closing costs), you have more cash available to cover inspections since the seller is covering other expenses. Some buyers structure offers with higher purchase prices and larger seller concessions, effectively financing some transaction costs including inspections. Discuss this strategy with your loan officer to ensure it complies with loan program limits on seller concessions.

Also Helpful for First-Time Home Buyers

Loan Programs and Property Condition:

Understand how different loans handle property condition:

- Review FHA loan requirements for condition standards

- Explore conventional loan flexibility with fewer repair requirements

- Consider FHA 203k renovation loans for fixer-uppers

- Check HomeStyle renovation financing for major improvements

Calculate costs including repairs:

- FHA loan calculator with repair cost considerations

- Home improvement calculator for post-closing projects

- FHA 203k calculator for purchase plus renovation

See how others handled inspections:

- FHA loan case study with successful inspection negotiation

- FHA 203k success story transforming a fixer-upper

- Conventional loan case study navigating property condition

What’s Next in Your Journey?

Now that you understand inspections, additional steps await before closing:

Upcoming decisions and milestones:

- Understanding appraisals and how they differ from inspections

- Navigating final walkthrough before closing

- Reviewing closing disclosures and preparing for settlement

- Coordinating move-in timing and utility transfers

- Planning first-month homeowner priorities

Each step builds on knowledge you’re gaining now—transforming from confused buyer into confident homeowner who makes informed decisions.

Explore Your Complete Options

Loan Programs for Different Property Conditions:

- Browse all loan programs including renovation options

- Explore purchase programs for move-in ready homes

- Review renovation programs for properties needing work

Tools for Budget Planning:

- Access all calculators to model different scenarios

- Use purchase calculators with repair costs included

- Try renovation calculators for fixer-upper budgeting

Success Stories for Guidance:

- Read all case studies across different situations

- Browse inspection negotiation examples from real buyers

- Explore renovation success stories

Have inspection concerns? Schedule a call to discuss how findings might affect your financing and what your options are moving forward.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.