First Time Homebuyer Checklist: Are You Actually Ready to Buy?

First Time Homebuyer Checklist: Are You Actually Ready to Buy?

First Time Homebuyer Checklist: Assess Your True Readiness

Whether you’re feeling pressure to buy because “it’s time” or genuinely ready to transition from renting, this comprehensive checklist helps you assess your actual preparedness honestly. Being ready to buy isn’t about hitting an age milestone—it’s about meeting specific financial, professional, and personal criteria that predict success.

In this guide, you’ll discover:

- Financial readiness markers that separate prepared buyers from struggling ones

- Credit and income requirements for different loan programs (according to lending guidelines)

- Life stability factors that predict homeownership success

- Market timing considerations for your specific area

- Red flags that suggest waiting makes more sense than rushing

The buyers who thrive in homeownership took time to prepare properly. Those who struggle often bought before truly ready, creating financial stress that could have been avoided.

Ready to assess your homebuying readiness? Schedule a call for honest evaluation of where you stand and what gaps to address before purchasing.

Financial Readiness: The Foundation of Successful Homeownership

Your financial situation is the bedrock determining whether homeownership strengthens or strains your life. Being financially ready isn’t about perfection—it’s about meeting minimum thresholds with comfortable margin.

Down Payment Saved:

☐ Have saved target down payment for your loan program

- FHA: 3.5% of purchase price

- Conventional: 3-5% (first-time buyers) to 20%

- VA: 0% (if eligible)

- USDA: 0% (if eligible and property qualifies)

☐ Down payment funds are liquid and accessible

- In savings account, not tied up in investments

- Can be transferred to title company at closing

- If using gift funds, properly documented

☐ Source of down payment is clear and verifiable

- Can show deposits through bank statements

- No large unexplained cash deposits

- Paper trail demonstrates legitimate savings

Closing Costs Covered:

☐ Saved 2-5% of purchase price for closing costs

- Varies by location and loan type

- Typically $5,000-$15,000 depending on price

- Can sometimes negotiate seller to pay portion

☐ Understand what closing costs include

- Loan origination fees

- Title insurance

- Appraisal and inspection fees

- Prepaid taxes and insurance

- Recording fees and transfer taxes

Emergency Fund Intact:

☐ Have 3-6 months living expenses in separate emergency fund

- This is BEYOND your down payment

- Covers mortgage payment, utilities, food, transportation

- Should not be depleted by home purchase

☐ Additional reserves for homeowner surprises

- HVAC system failures

- Roof repairs

- Plumbing emergencies

- Appliance replacements

Debt Management:

☐ Debt-to-income ratio under 43-50%

- All monthly debt payments divided by gross monthly income

- Includes proposed mortgage payment

- Lower is better for qualification

☐ No recent large purchases on credit

- New car loans affect qualification

- Credit card balances should be low

- Student loans managed appropriately

Use the FHA loan calculator to determine exact down payment and closing costs for your target purchase price.

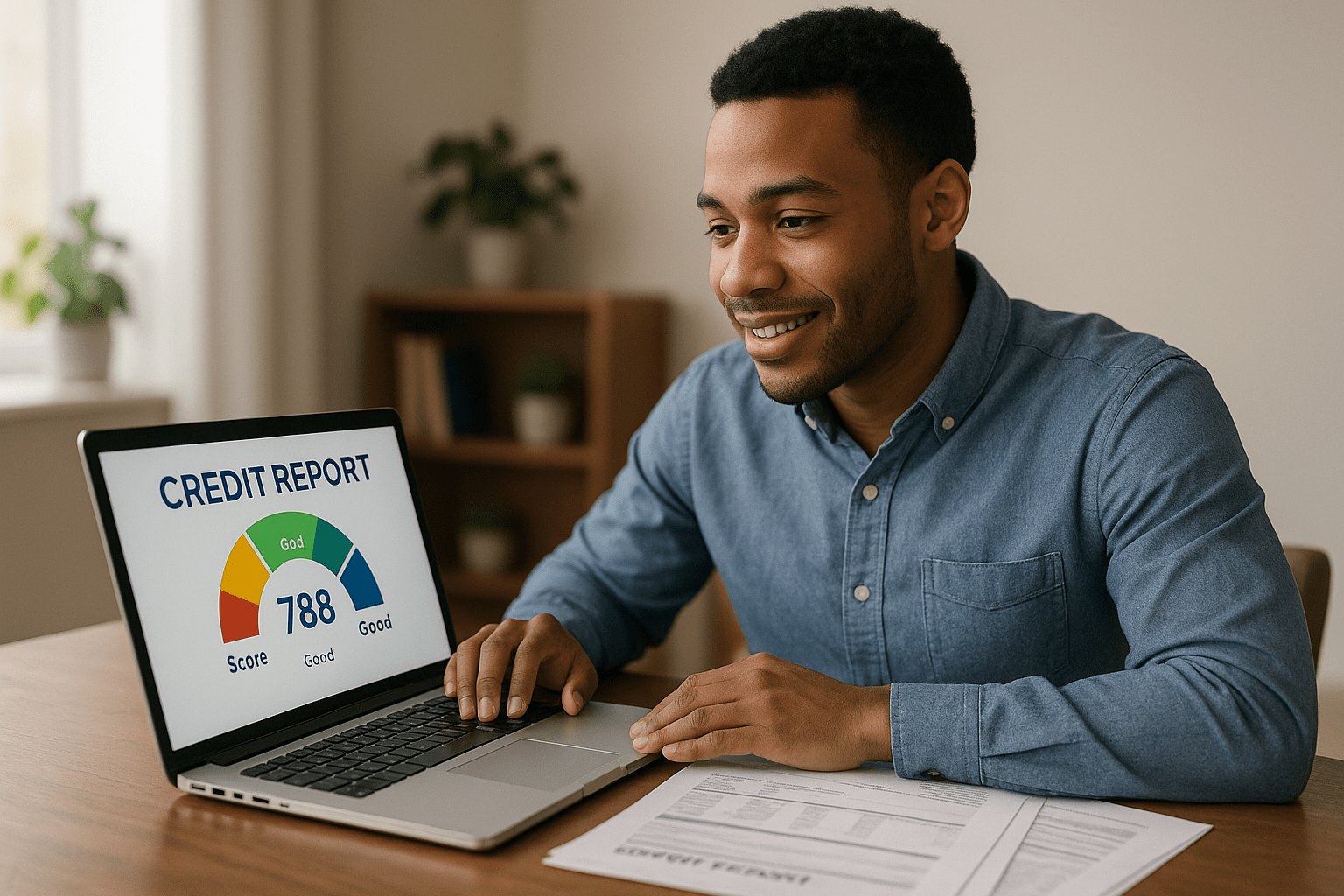

Credit and Income Readiness: The Qualification Foundation

Lenders evaluate two primary factors beyond down payment: your credit history and income stability. Meeting these thresholds determines not just whether you qualify, but what interest rate you’ll receive.

Credit Score Requirements:

☐ Credit score meets minimum for target loan program

- FHA: 580+ for 3.5% down (500+ for 10% down)

- Conventional: 620+ minimum, 680+ for better rates

- VA: No official minimum (typically 580-620 lender requirement)

- USDA: 640+ preferred

☐ Credit report is accurate with no errors

- Pulled reports from all three bureaus

- Disputed any inaccurate information

- Negative items are legitimate and explained

☐ Payment history is strong

- No late payments in past 12 months minimum

- Ideally 24 months of perfect payment history

- Any past issues have good explanations

☐ Credit utilization is low

- Using under 30% of available credit limits

- Preferably under 10% for optimal scores

- Paid down high balances before applying

Income Stability:

☐ Employed for minimum 2 years (same field)

- Can be different employers in same career

- Job hopping explained by career progression

- Current position is stable

☐ Income is sufficient for target home price

- Mortgage payment under 28-30% of gross income

- All debts under 43-50% of gross income

- Comfortable payment, not maximum qualification

☐ Income documentation is available

- Last 2 years W-2s and tax returns

- Last 30 days pay stubs

- If self-employed: 2 years business tax returns

- If using side income: proper documentation

☐ No major income changes pending

- Not planning to change careers

- Not expecting significant pay reduction

- No plans to leave workforce

- Job security is reasonable

Red flags in this category:

- Credit score just barely meets minimum

- Recent late payments or collections

- Job history is unstable or changing

- Income is stretched to maximum for qualification

- Self-employed less than 2 years

Review conventional loan requirements to understand income and credit thresholds for different programs.

Life Stability Readiness: The Personal Foundation

Financial readiness alone doesn’t guarantee homeownership success. Life circumstances significantly impact whether buying now makes sense or waiting is wiser.

Timeline Commitment:

☐ Planning to stay in area minimum 3-5 years

- Long enough to reach break-even point

- Accounts for transaction costs

- Builds meaningful equity

- Justifies homeownership commitment

☐ Career path is relatively clear

- Not planning major career changes

- Job location is stable

- Industry isn’t contracting in your area

- Promotion path doesn’t require relocation

☐ Relationship status is settled

- If single: comfortable buying alone

- If partnered: on same page about purchase

- Not in flux about living arrangements

- Clear on ownership structure

Housing Needs Understanding:

☐ Know what type of property fits your life

- House vs. condo vs. townhome

- Number of bedrooms/bathrooms needed

- Neighborhood characteristics important to you

- Commute requirements

☐ Realistic about what you can afford

- Not letting HGTV expectations drive choices

- Understand starter home vs. forever home

- Willing to compromise on some wants

- Focused on needs more than wishes

Responsibility Readiness:

☐ Comfortable with homeowner responsibilities

- Lawn care, snow removal, general maintenance

- Handling repairs or hiring contractors

- Dealing with unexpected problems

- Time and money for upkeep

☐ Understand it’s an investment, not just a home

- Property maintenance affects value

- Neighborhood changes matter

- Market cycles exist

- May need to sell eventually

Red flags in this category:

- Significant uncertainty about staying in area

- Career in flux or major changes pending

- Relationship unstable or changing

- No idea what you want in a home

- Uncomfortable with maintenance responsibility

- Seeing home as status symbol more than financial decision

Market and Timing Readiness: The External Factors

Even when you’re personally ready, market conditions and timing can affect whether now is the right moment. Understanding these external factors prevents buying at precisely wrong time.

Market Conditions Assessment:

☐ Understand your local market dynamics

- Is it buyer’s market, seller’s market, or balanced?

- How long do properties stay on market?

- Are prices stable, rising, or falling?

- Is inventory sufficient in your price range?

☐ Home prices are reasonable relative to rent

- Monthly mortgage comparable to or less than rent

- Rent vs. buy analysis favors ownership

- Not obvious bubble conditions

- Price-to-income ratios are sustainable

☐ Interest rates are acceptable

- Understand current rate environment

- Rates allow you to afford target homes

- Not waiting for “perfect” rate that may never come

- Can refinance later if rates improve significantly

Timing Considerations:

☐ Season works for your situation

- Spring/summer typically more inventory but more competition

- Fall/winter often less competition but less inventory

- Some markets are year-round

- Personal timeline aligns with market patterns

☐ No major life changes imminent

- Not expecting baby in next 6 months

- No planned surgeries or medical situations

- No family obligations requiring relocation

- Stable personal situation

☐ Have time for the process

- Can attend showings

- Available for inspections and appointments

- Can respond quickly in competitive markets

- Not traveling extensively during search

Red flags in this category:

- Obvious bubble conditions in market

- Prices skyrocketing unsustainably

- Inventory virtually nonexistent in your range

- You’re buying purely out of FOMO (fear of missing out)

- Major life change happening simultaneously

- No time to dedicate to search and purchase

Use the rent vs buy calculator to determine if current market conditions favor ownership in your area.

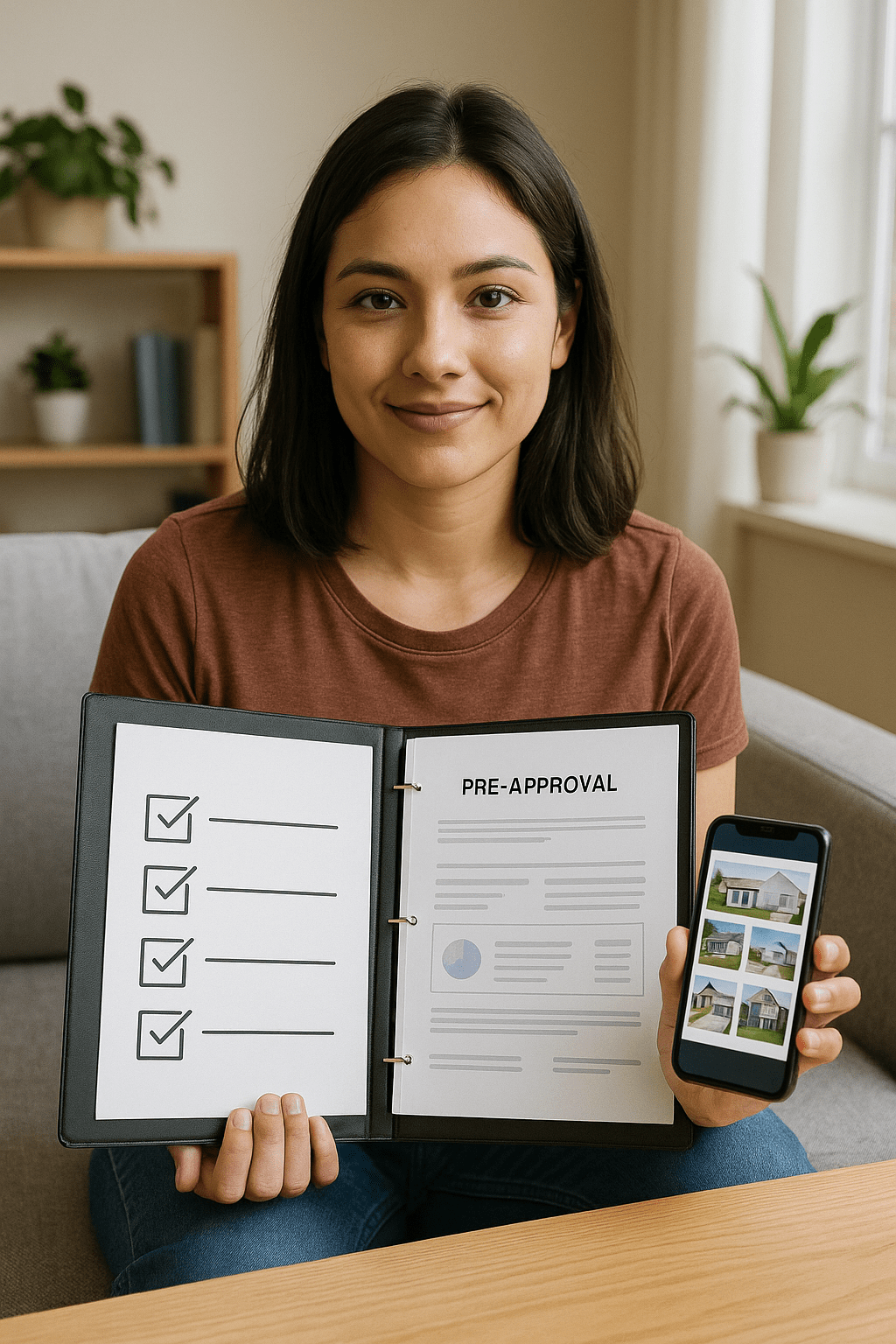

Professional Team Readiness: The Support System

Buying your first home isn’t a solo venture. Having the right professional support assembled before you need it prevents last-minute scrambling and poor decisions.

Lender Relationship Established:

☐ Connected with mortgage lender early in process

- Not waiting until you find a house

- Discussed loan options and qualification

- Understand what programs work for you

- Have preliminary numbers and timeline

☐ Pre-approval completed (not just pre-qualification)

- Provided actual documentation

- Credit pulled and reviewed

- Income and assets verified

- Pre-approval letter in hand

☐ Understand loan options available to you

- FHA, conventional, VA, USDA compared

- Down payment requirements clear

- Interest rates and costs explained

- Know what programs you qualify for

Real Estate Agent Selected:

☐ Interviewed and selected buyer’s agent

- Experience with first-time buyers

- Knowledge of target neighborhoods

- Good communication style fit

- Strong negotiation skills

☐ Established working relationship

- Agent understands your needs and budget

- Communication preferences established

- Search criteria clear

- Response time expectations set

Other Professionals Identified:

☐ Home inspector researched and selected

- Licensed and insured

- Good reviews and reputation

- Available in your timeframe

- Understand their process

☐ Homeowners insurance agent contacted

- Understand coverage needs

- Got preliminary quotes

- Know timing for policy

- Understand costs

☐ Real estate attorney (if required in your state)

- Identified qualified professional

- Understand their role and costs

- Available when needed

Red flags in this category:

- Planning to shop for home before getting pre-approved

- Haven’t researched lenders or agents at all

- Waiting until last minute to build team

- No idea what professionals you’ll need

- Planning to skip inspections or cut corners

Review this first-time home buyer assistance guide for building your complete professional team.

Knowledge and Education Readiness: The Preparation Foundation

Understanding the home buying process before you’re in it prevents costly mistakes and reduces stress dramatically. Educated buyers make better decisions and have smoother transactions.

Process Understanding:

☐ Understand basic home buying timeline

- Pre-approval comes first

- Property search and offers

- Under contract and inspections

- Final loan approval and closing

- Typical timeline is 30-45 days from offer acceptance

☐ Know what happens at each stage

- What documents you’ll need when

- Who does what at each step

- Your responsibilities vs. professionals’

- Common delays and how to prevent them

☐ Understand offer and negotiation process

- How to structure strong offer

- What contingencies protect you

- How negotiations typically work

- When to walk away from deal

Financial Understanding:

☐ Understand true cost of homeownership

- Monthly mortgage payment (PITI)

- Utilities (often higher than renting)

- Maintenance (1-2% of home value annually)

- HOA fees if applicable

- Property taxes and insurance

☐ Know what closing costs include

- Not just down payment

- Typically 2-5% of purchase price

- What’s negotiable vs. fixed

- How to review closing disclosure

☐ Understand mortgage basics

- Principal, interest, taxes, insurance breakdown

- Difference between fixed and adjustable rates

- Amortization and how equity builds

- Refinancing possibilities

Market Knowledge:

☐ Researched target neighborhoods thoroughly

- Visited areas multiple times

- Understand price ranges

- Know school districts and ratings

- Researched crime statistics and trends

☐ Attended open houses

- Understand what’s available in your budget

- Can spot value vs. overpriced

- Know what features matter to you

- Developed realistic expectations

☐ Understand local market conditions

- How competitive is your target area

- Typical time properties stay on market

- Whether sellers are negotiating

- Seasonal patterns in your market

Red flags in this category:

- No idea what the process involves

- Haven’t attended any open houses

- Don’t know target neighborhoods

- Expecting process like buying a car

- No research into true homeowner costs

- Unrealistic expectations about affordability

Take first-time buyer education courses and review resources at Stairway Mortgage blog for comprehensive preparation.

How Stairway Mortgage Assesses Your Readiness

We believe in honest assessment over pressured sales. Our readiness evaluation helps you understand where you stand and what to address before purchasing—even if that means waiting a bit longer.

Our readiness assessment process:

Financial Evaluation:

- Review your actual financial situation

- Calculate debt-to-income ratios

- Assess down payment and reserves sufficiency

- Identify any financial gaps to address

Qualification Analysis:

- Pull and review credit reports

- Verify income documentation

- Calculate exactly what you can borrow

- Determine optimal loan programs for your situation

Timeline Development:

- If ready now: Begin pre-approval immediately

- If gaps exist: Create plan to address them

- Set realistic timeline for purchase

- Establish milestones and check-ins

Honest Guidance:

- Tell you if waiting makes more sense

- Identify what to improve before buying

- Explain how to strengthen your application

- Support you whether buying now or preparing for future

Ready for honest readiness assessment? Schedule a call for comprehensive evaluation and personalized guidance—we’ll tell you the truth about where you stand.

Ready to Take the Next Step?

You’ve completed a comprehensive assessment of your home buying readiness. If you checked most boxes confidently, you’re likely prepared to move forward. If multiple gaps exist, you have a clear roadmap for preparation.

Your next steps based on results:

If You’re Ready (Most Boxes Checked):

- Get formally pre-approved with complete documentation

- Begin serious property search with your agent

- Attend showings and open houses actively

- Be prepared to make offers on suitable properties

If You Have Minor Gaps:

- Address specific gaps identified (credit improvement, save more, etc.)

- Continue education and preparation

- Stay in touch with lender for progress updates

- Set target timeline based on gap-closing plan

If Major Preparation Needed:

- Create comprehensive improvement plan

- Work on credit, savings, income stability

- Set realistic timeline (typically 12-24 months)

- Re-assess quarterly until ready

If You’re Not Ready:

- Continue renting without guilt

- Build emergency fund and savings

- Improve credit systematically

- Revisit readiness in 6-12 months

The buyers who succeed aren’t those who rush in unprepared. They’re the ones who honestly assess readiness, address gaps systematically, and move forward when truly prepared.

Get pre-approved if you’re ready, or take our discovery quiz to see where you stand on the path to homeownership.

Frequently Asked Questions

How do I know if I’m really ready or just making excuses?

True readiness has objective markers: sufficient down payment saved, credit score meeting program minimums, stable income, and reasonable confidence about staying in area 3-5 years. If you meet these criteria but keep finding reasons to wait, you might be making excuses. Conversely, if you feel pressure to buy but don’t meet financial minimums, that pressure is the excuse—not preparedness. Be honest: do you meet the financial criteria and feel confident, or are you hoping things will work out? Use this readiness checklist systematically for objective assessment.

Should I wait until I have 20% down or buy sooner with less?

For most first-time buyers, buying sooner with 3.5-5% down builds more wealth than waiting years to save 20%. While you’ll pay mortgage insurance with less down, you’re building equity and capturing appreciation during those years rather than paying rent with zero return. The compound effect of early equity typically outweighs mortgage insurance costs. Exception: if your market is clearly overheated or you can save 20% within 12-18 months, waiting might make sense. Run specific numbers with the FHA calculator.

What if I’m ready financially but uncertain about my career?

Career stability is crucial for homeownership success. If you’re considering major career changes, waiting usually makes more sense unless the change is within the same geographic area and won’t reduce income significantly. However, distinguish between reasonable uncertainty (which everyone has) and actual instability. If you’re reasonably confident in your career path and location for 3-5 years, that’s sufficient. You don’t need certainty about the next 30 years—just reasonable confidence about medium term.

Can I buy a home if I have student loan debt?

Yes—student loan debt doesn’t prevent homeownership, it’s just factored into your debt-to-income ratio calculation. Many successful first-time buyers carry student loans. The key is having sufficient income so your total monthly debts (including proposed mortgage and student loans) stay under 43-50% of gross monthly income. If student loan payments push you over this threshold, consider income-driven repayment plans or waiting until income increases. Thousands of buyers purchase homes annually while managing student debt responsibly.

What if I don’t check all these boxes but really want to buy?

Wanting to buy doesn’t override readiness requirements. Missing one or two boxes (especially minor ones) might be acceptable with good explanations and compensating factors. Missing multiple major items—insufficient down payment, poor credit, unstable income, no emergency fund—predicts struggle and potential foreclosure. Be brutally honest: are you ready or just tired of renting? Partner with a lender who will give honest assessment even if it means suggesting you wait. Better to prepare properly than rush into a purchase that creates financial crisis.

Also Helpful for First-Time Home Buyers

Related Resources:

- All Available Loan Programs – Explore financing options

- FHA Loans – Popular first-time buyer choice

- First-Time Buyer Assistance – Find help and support

What’s Next in Your Journey?

Continue your first-time buyer path:

- FHA vs Conventional (Post #17) – Choose your loan program

- Ideal Home (Post #18) – Define what you’re looking for

- How to Make an Offer (Post #20) – Win in competitive markets

Explore Your Complete Options

Calculate Your Scenarios:

- FHA Loan Calculator – See what you can afford

- Conventional Loan Calculator – Compare programs

- All Calculators – Explore every option

See Real Success Stories:

- FHA Loan Success – First-time buyer journey

- Conventional Success – Traditional path

- All Case Studies – Every story documented

Ready to Take Action:

- Schedule a Call – Get readiness assessment

- Discovery Quiz – Find your starting point

- Get Pre-Approved – Begin your journey

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.