Downsizing Home for Seniors: Strategic Guide to Rightsizing for Retirement

Downsizing Home for Seniors: Strategic Guide to Rightsizing for Retirement

Downsize Home: When, Why, and How to Rightsize for Retirement Living

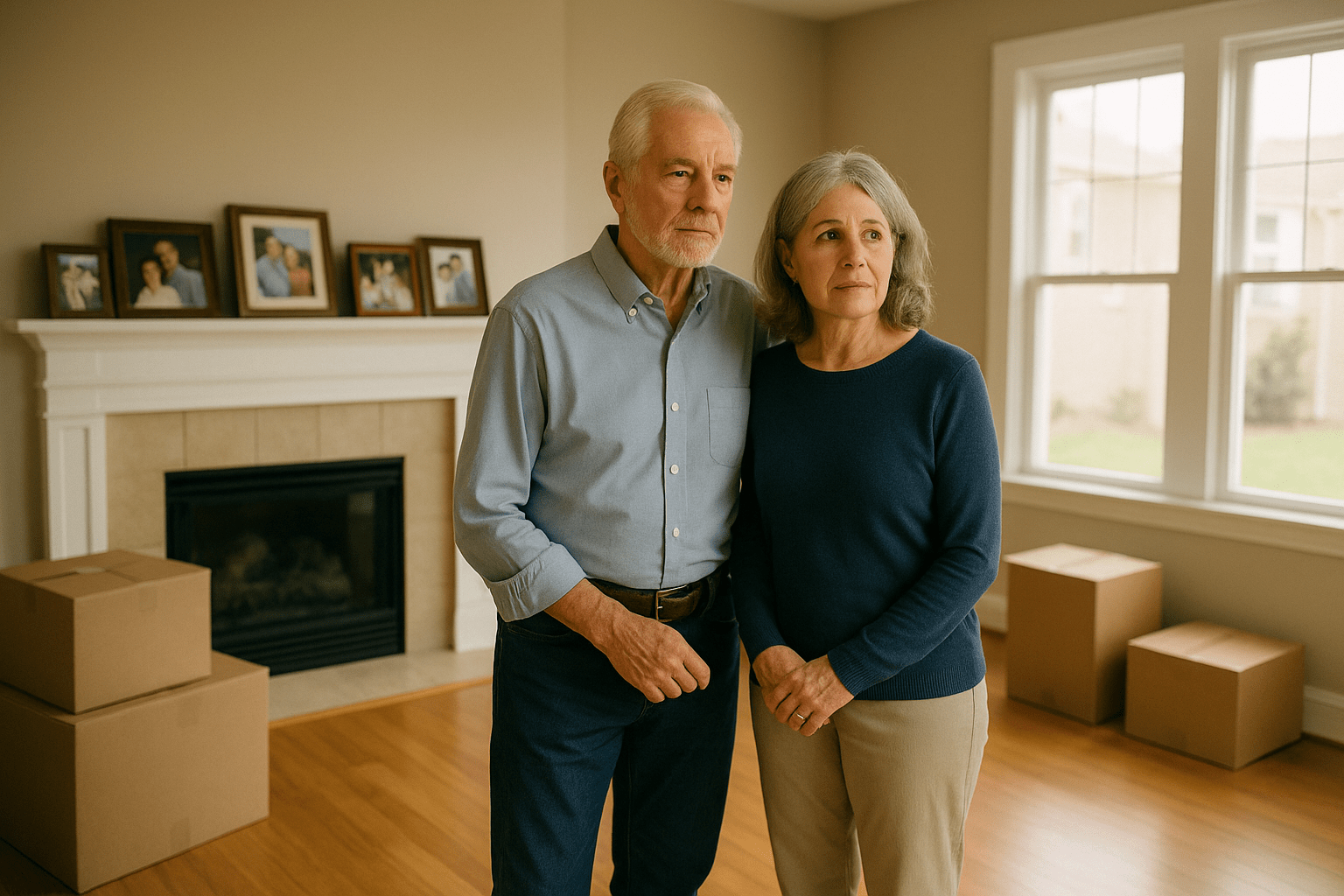

After raising families, building careers, and accumulating possessions over decades, many seniors face a pivotal question: Should we downsize from our family home? The house that once bustled with children now echoes with empty rooms. Maintenance demands increase while energy decreases. Property taxes and upkeep consume retirement income.

Yet downsizing isn’t simply a financial decision—it’s deeply emotional, involving decades of memories, identity tied to place, and major lifestyle changes. Some seniors downsize too hastily and regret it. Others delay too long, making the transition harder than necessary. The key lies in strategic, thoughtful planning that honors both practical realities and emotional needs.

Understanding when downsizing makes sense, what alternatives exist, and how to execute it successfully transforms this overwhelming decision into a manageable transition creating better retirement living situations aligned with your current stage of life.

In this guide, you’ll discover:

- Signs indicating downsizing might be right for you

- Financial analysis: costs versus benefits

- Emotional considerations and how to process them

- Alternative options to selling and moving

- Step-by-step downsizing process

- HECM for Purchase as downsizing financing strategy

- Decluttering and moving strategies for seniors

- Choosing the right-sized home for retirement

This comprehensive guide helps seniors and their families navigate downsizing decisions wisely, avoiding both premature moves and delayed transitions.

Considering downsizing or need help deciding? Schedule a call to discuss your options.

What Signs Indicate Downsizing Might Be Right?

Certain circumstances suggest it’s time to seriously consider downsizing:

Physical Maintenance Becomes Burdensome

Yard work, home repairs, cleaning multiple floors, and general upkeep that once seemed manageable now feel overwhelming. You’re hiring help for tasks you used to handle yourself, increasing costs while reducing the satisfaction of maintaining your space.

Multi-story homes become particularly challenging as mobility decreases. Stairs you climbed effortlessly for decades now cause hesitation or require handrails.

Financial Strain From Home Expenses

Property taxes, insurance, utilities, maintenance, and repairs consume excessive portions of fixed retirement income. You’re making difficult choices between home expenses and other needs or desires.

The home’s size means heating, cooling, and maintaining far more space than you actually use or need.

Empty Nest Syndrome Becomes Empty Home Reality

Children moved out years ago and rarely visit. Guest bedrooms sit empty most of the year. You’re maintaining multiple bathrooms, bedrooms, and living areas you never use.

The house feels too big, echoing and empty rather than cozy and comfortable.

Location No Longer Serves Your Needs

Suburban or rural isolation that once provided peace now means distance from healthcare, shopping, and social activities. Driving becomes more concerning, but everything requires a car.

You’re far from family who could provide support or companionship as you age. Visiting grandchildren requires extensive travel.

Desire for Simplified Living

Managing possessions accumulated over decades feels like a burden rather than a joy. You’re tired of cleaning, organizing, and maintaining things you no longer use or value.

A simpler lifestyle appeals—less space to maintain, fewer possessions to manage, more freedom to travel or pursue interests.

Safety Concerns Emerge

The neighborhood changed over decades, and you no longer feel as safe or connected to neighbors. Crime increased or demographics shifted dramatically.

The home itself poses risks—slippery bathrooms, steep stairs, difficult entries—that worry you or your family about falls and injuries.

What Are the Financial Benefits and Costs of Downsizing?

Honest financial analysis reveals whether downsizing improves your financial situation:

Potential Financial Benefits

Lower ongoing housing costs:

- Reduced property taxes in less expensive home

- Lower utility bills from smaller spaces

- Decreased insurance premiums

- Reduced maintenance and repair expenses

- Simplified yard care or none at all

Equity access:

- Selling releases equity for other uses

- Can pay off debts, fund retirement travel, or supplement income

- Provides financial flexibility and security

Reduced financial stress:

- Smaller financial obligations relative to income

- Less worry about expensive repairs or rising costs

- More predictable, manageable expenses

Real Costs to Consider

Transaction costs of selling:

- Real estate agent commissions (typically several percentage points)

- Closing costs

- Pre-sale repairs and staging

- Moving expenses

- Time and energy investment

Transaction costs of buying:

- Down payment on new home

- Closing costs

- Moving expenses

- New furniture or modifications

- Setup and utility deposits

Potential tax implications:

- Capital gains taxes if gains exceed exclusion limits (though most qualify for substantial exclusions)

- Changes in property tax calculations depending on location

Lifestyle adjustments:

- Storage fees if downsizing dramatically

- Costs of replacing belongings that don’t fit

- Potential increase in HOA fees in some communities

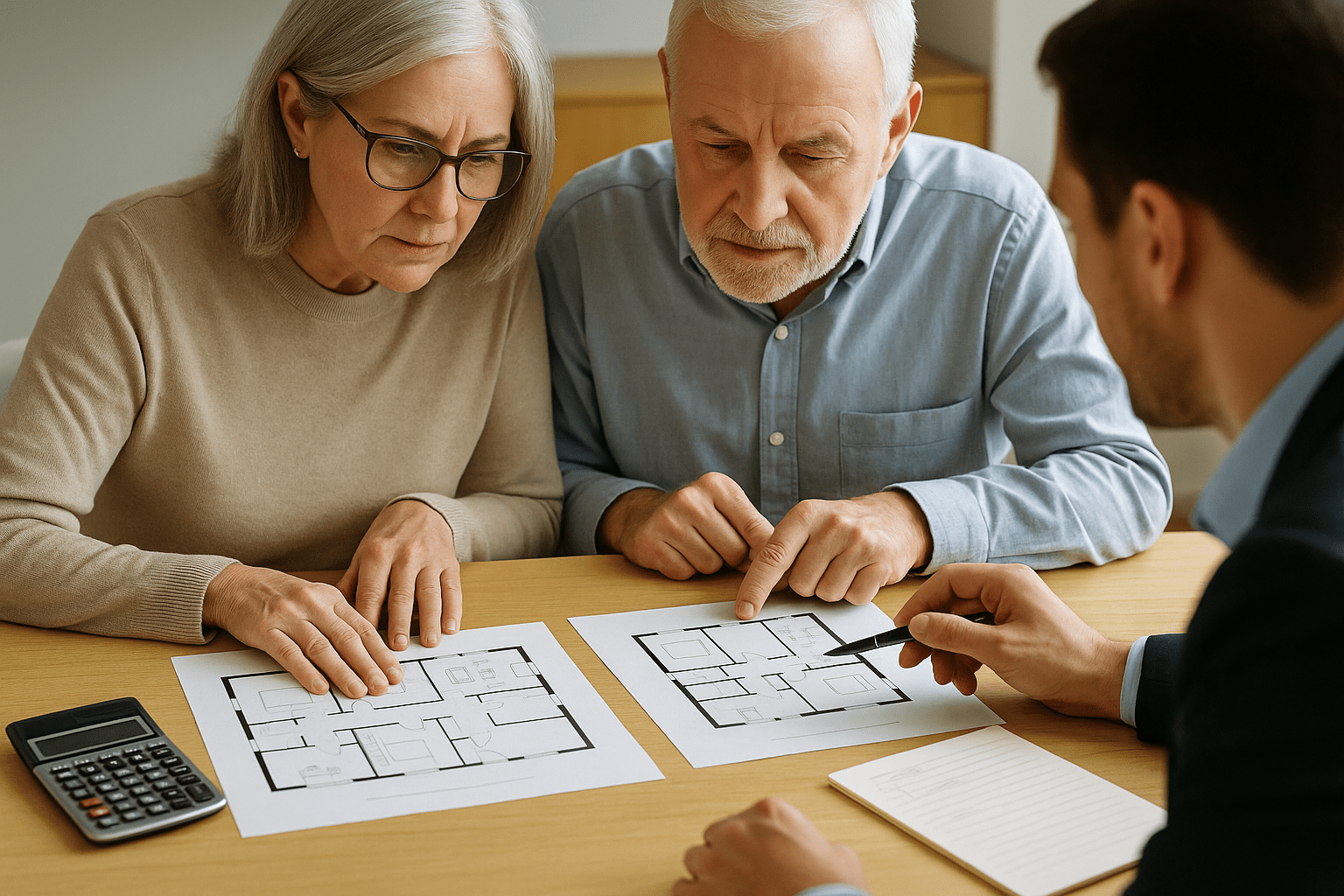

Running the Numbers

Calculate your complete financial picture:

Current home annual costs: Property taxes + insurance + utilities + maintenance + repairs + HOA if applicable

Potential new home annual costs: Similar calculation for target home

Net annual savings or increase: Difference between the two

One-time costs: All selling and buying transaction costs

Break-even analysis: How many years of savings does it take to recover one-time costs?

This analysis reveals whether downsizing makes financial sense or if the costs outweigh benefits.

What Emotional Considerations Should You Address?

The emotional dimensions of downsizing often outweigh financial factors:

Attachment to Home and Memories

Your home holds decades of memories—children’s first steps, holiday gatherings, significant life moments. Every room tells stories. Leaving feels like abandoning those memories.

Reality check: Memories live in your heart and mind, not in physical spaces. Photographs, videos, and storytelling preserve what matters. New spaces create new memories.

Identity and Life Stage Acceptance

Your home represents achievement, success, and a certain life stage. Downsizing can feel like admitting age, accepting limitations, or moving backward.

Reframing: Downsizing is strategic optimization, not failure. You’re choosing a home matching your current priorities rather than past responsibilities. This is evolution, not regression.

Fear of Regret

“What if I regret this?” is a common concern, particularly after seeing others who regretted downsizing.

Mitigation: Careful planning, avoiding hasty decisions, involving family in discussions, and ensuring the new situation truly fits your needs reduces regret risk dramatically. Most downsizers feel relief and satisfaction, not regret.

Grief and Loss

Leaving a long-time home involves legitimate grief. Acknowledging this rather than dismissing it helps process emotions healthily.

Healthy processing:

- Give yourself time and permission to grieve

- Create rituals marking the transition (farewell gathering, photo documentation)

- Focus on what you’re gaining, not just what you’re losing

- Seek support from family, friends, or counselors if needed

What Alternatives to Downsizing Should You Consider First?

Before committing to selling and moving, explore these options:

Aging-in-Place Modifications

Transform your current home to better suit your changing needs through aging-in-place modifications—installing main-floor bedroom and bathroom, adding grab bars and accessibility features, creating safer entrances.

Benefits: Stay in familiar home and neighborhood. Avoid moving stress and costs.

When this works: If location and community matter more than size, and modifications can address accessibility concerns.

Accessory Dwelling Unit (ADU) or House Sharing

Add a rental unit generating income helping cover expenses. Or invite compatible housemate sharing space and costs while providing companionship.

Benefits: Generate income without moving. Maintain larger home while offsetting costs.

When this works: If you have space for ADU or are comfortable with housemate arrangements.

Reverse Mortgage

Access home equity without selling through reverse mortgages, eliminating monthly mortgage payments and providing funds for expenses, reducing financial pressure to downsize.

Benefits: Stay in home while accessing equity. No monthly mortgage payments.

When this works: If financial stress drives downsizing consideration but you want to stay in your home.

Temporary or Trial Moves

Rent in a new location or living situation before committing to selling, testing whether smaller spaces or different areas actually suit you.

Benefits: Experience the change before permanent commitment. Can return if it doesn’t work.

When this works: If uncertainty about whether downsizing will satisfy you creates hesitation.

How Do You Choose the Right-Sized Retirement Home?

If downsizing makes sense, selecting the right new home matters critically:

Size Considerations

Don’t downsize too drastically. Many who move from large homes to tiny apartments regret the dramatic reduction. Moderate downsizing often provides better balance.

Consider:

- Enough bedroom space for you plus occasional guests

- Adequate storage for possessions you keep

- Room for hobbies and activities you enjoy

- Comfortable entertaining space if you value hosting

Typical pattern: Moving from multi-bedroom family homes to more modest properties that still feel spacious and comfortable without excessive unused space.

Location Priorities

Consider:

- Proximity to healthcare facilities

- Access to shopping and services

- Distance from family members

- Social and recreational opportunities

- Public transportation or walkability as driving becomes challenging

- Climate and weather preferences

Many seniors prioritize being closer to family, particularly grandchildren, even if it means relocating to new regions.

Single-Story Living

Main-floor living becomes increasingly important as mobility decreases. Prioritize:

- Ranch-style homes or first-floor condos

- Main-floor bedroom and full bathroom

- Minimal or no steps at entrances

- Wide doorways and hallways

Maintenance Considerations

Consider:

- Condos or townhomes with exterior maintenance included

- HOA communities handling landscaping

- Newer construction requiring less immediate repair

- Simplified yard spaces or none

Trading maintenance responsibilities for HOA fees often makes sense for seniors wanting simplified living.

Community and Amenities

55+ communities offer:

- Age-appropriate activities and social opportunities

- Built-in peer group

- Services tailored to senior needs

- Often walkable, golf-cart-friendly designs

Traditional neighborhoods offer:

- Multi-generational community

- Often more affordable

- Greater variety in home styles

- Established infrastructure

What Is HECM for Purchase and How Can It Help Downsizing?

A unique financing tool helps seniors downsize more strategically:

HECM for Purchase lets seniors buy retirement homes using substantial down payments plus reverse mortgage financing, eliminating monthly mortgage payments in the new home.

How It Works

You sell your current home, using substantial proceeds as down payment on the right-sized retirement property. HECM financing covers the remainder, creating payment-free homeownership in your new space.

Example Scenario

Current situation: You sell your family home, netting substantial proceeds after payoff and closing costs.

New home purchase: You find a perfect right-sized home in a 55+ community near family.

Traditional approach: Pay cash using all proceeds, depleting liquid assets. Or get conventional mortgage, creating monthly payment obligations.

HECM for Purchase approach: Use substantial proceeds as down payment, finance remainder with reverse mortgage. Keep remaining cash for retirement living. No monthly mortgage payments in new home.

Benefits for Downsizing Seniors

- Preserve cash for retirement living, emergencies, travel

- No monthly mortgage payment stress on fixed income

- Can afford more desirable properties than cash-only would allow

- Maintain financial flexibility and security

See complete details in our HECM for Purchase guide.

What’s the Step-by-Step Downsizing Process?

Systematic approaches reduce stress and improve outcomes:

Phase 1: Decision and Planning (Months 1-3)

Make the decision thoughtfully:

- Discuss with spouse and family

- Analyze finances thoroughly

- Consider alternatives

- Address emotional concerns

- Set timeline and goals

Begin research:

- Explore target locations and communities

- Understand local housing markets

- Research real estate agents

- Consider financing options

Phase 2: Preparation and Decluttering (Months 3-6)

Begin decluttering gradually:

- Start with least emotional items (old paperwork, duplicates)

- Progress to more challenging categories

- Sort into keep, donate, sell, discard

- Involve family in distribution of heirlooms

Prepare home for sale:

- Complete needed repairs

- Update cosmetically where valuable

- Deep clean and organize

- Consider professional staging

Phase 3: Marketing and Transition (Months 6-9)

List current home:

- Select experienced agent

- Price strategically

- Market effectively

- Handle showings

Search for new home simultaneously:

- Tour options in target areas

- Narrow selections

- Consider timing coordination

- Make offers strategically

Phase 4: Closing and Moving (Months 9-12)

Manage dual transactions:

- Coordinate closing dates when possible

- Arrange temporary housing if needed

- Hire reputable movers

- Transfer utilities and services

Execute the move:

- Pack systematically

- Label clearly

- Handle valuables personally

- Arrange help as needed

How Does Stairway Mortgage Help With Downsizing Decisions and Financing?

Downsizing involves complex financial decisions and multiple financing options. At Stairway Mortgage, we guide seniors through this process:

We help you analyze whether downsizing makes financial sense in your specific situation with complete cost-benefit comparisons.

We explain alternatives like reverse mortgages on current homes, HECM for Purchase for new homes, or traditional financing, showing which serves your goals best.

We coordinate timing between selling current homes and purchasing new ones, minimizing stress and avoiding costly gaps.

We connect you with real estate professionals experienced in senior transitions and trusted resources for moving and decluttering assistance.

Many seniors we’ve worked with successfully downsized strategically, improving their retirement situations financially and emotionally while maintaining independence and quality of life.

Ready to Explore Downsizing or Make the Transition?

Downsizing done thoughtfully and strategically creates retirement living situations better aligned with current priorities—often improving financial flexibility, reducing stress, and enhancing quality of life. Done hastily or for wrong reasons, it can create regret and complications.

Your next steps:

If you’re considering downsizing and want help analyzing whether it makes sense, schedule a call to discuss your situation.

Explore financing options for strategic downsizing:

- HECM for Purchase for payment-free retirement home

- Reverse mortgage on current home as alternative to selling

- Review case studies showing successful transitions

Remember: Downsizing is deeply personal. The “right” answer depends on your specific financial situation, emotional attachment, family considerations, health, and goals. Take time to make thoughtful decisions honoring both practical realities and emotional needs. There’s no universal timeline—move when YOU’RE ready, not when others think you should.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.