Off-Market Deal: Software Developer Finds First Rental Property $40K Below Market Through REIA Networking

Educational Case Study Disclosure

This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms, interest rates, and outcomes are illustrative examples and do not represent current offers or guaranteed terms.

For specific details including initial investment requirements, closing cost estimates, interest rate details, closing cost breakdowns, financing cost calculations, cash-to-close estimates, or an official Loan Estimate, it is highly recommended you schedule a meeting with one of our licensed mortgage advisors.

Learn more:

- CFPB official regulation – off-market deal mortgage advertising requirements

- Electronic Code of Federal Regulations – off-market property financing compliance

- CFPB interpretations – off-market real estate advertising rules

- FTC guidance – off-market deal advertising compliance

- Verify lender credentials – off-market deal lender verification

- Finding off-market deals – National Real Estate Investors Association networking

- Off-market property taxation – off-market rental property tax guidance

- Fair housing for off-market purchases – off-market deal fair housing compliance

Actual loan terms vary by credit profile, property, occupancy, location, market conditions, and lender guidelines. For current options tailored to you, schedule a consultation or apply online.

Ready to explore your options? Schedule a call with a loan advisor.

Off-Market Deal Discovery: How One Software Developer Cracked the Code on Finding Hidden Properties

Michael Johnson spent six months scrolling through Zillow and Redfin every evening after work. He was pre-approved, motivated, and ready to become a real estate investor. But every property he found either got snatched up within hours or was priced so high that the rental numbers didn’t work.

Sound familiar?

Michael was making the same mistake most first-time investors make: looking for off-market deals in the same place everyone else looks—online listing sites. The problem isn’t that MLS properties are bad. The problem is that by the time a property hits the MLS, you’re competing with dozens of other buyers, many of whom have more experience, better financing, or faster decision-making processes.

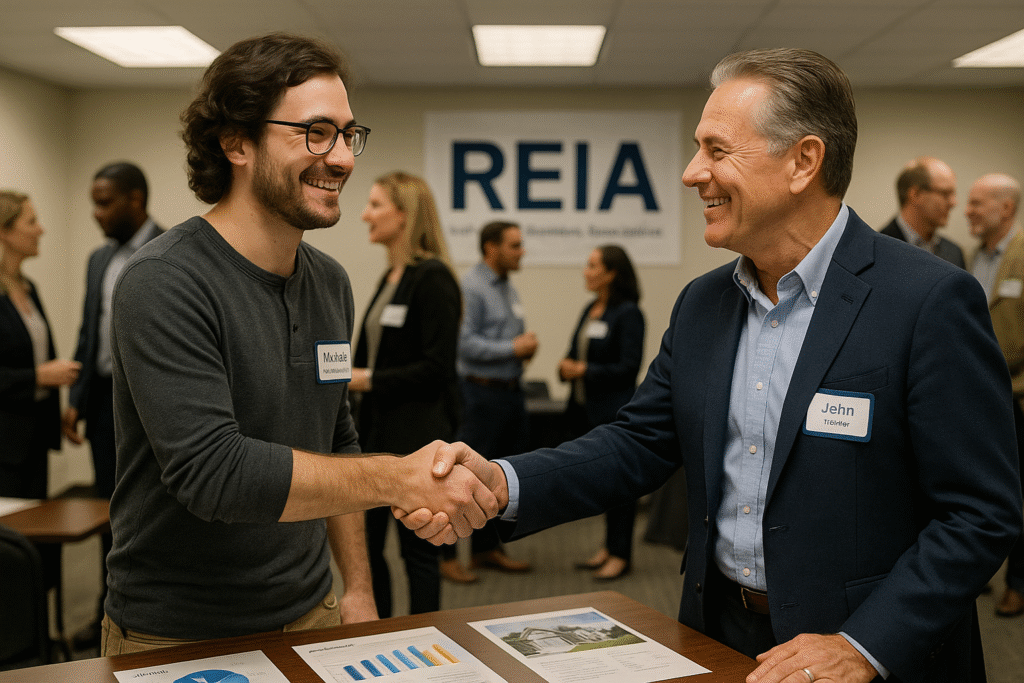

The breakthrough came when Michael’s coworker mentioned attending a local Real Estate Investment Association (REIA) meeting. That single suggestion changed everything. Within four months of committing to consistent networking, Michael secured an off-market deal that was $40,000 below market value—a property he would never have found online.

This case study breaks down exactly how Michael transformed from frustrated online browser to confident off-market deal buyer, including his month-by-month networking strategy, the relationships that led to his purchase, his complete financial analysis, and the lessons learned that you can apply to your own off-market deal search.

If you’re tired of losing bidding wars and watching overpriced properties sit on the MLS, Michael’s story shows there’s a better way. Get pre-approved before you start networking so you’re ready to act when off-market deals appear.

The Challenge: Why Online Searches Fail First-Time Investors

+

Client Profile:

- Name: Michael Chen (name changed for privacy)

- Age: 32

- Occupation: Software Developer

- Annual income: $115,000

- Location: Austin, Texas

- Investment experience: Zero properties owned

- Goal: Purchase first rental property with positive cash flow

- Available capital: $75,000 saved for investment

- Additional reserves: $20,000 emergency fund

The Six-Month Online Search:

Michael’s journey started like most first-time investors—with enthusiasm and online research. He read every blog post about real estate investing for beginners, watched YouTube videos about finding off-market deals, and set up alerts on every major real estate website.

“I had Zillow notifications going off on my phone multiple times daily,” Michael recalled. “I’d drop what I was doing to check new listings. But by the time I pulled comparable sales and ran the numbers, someone else was already writing an offer.”

Michael’s Online Search Results Over Six Months:

- Properties viewed online: 247

- Properties visited in person: 23

- Offers written: 2

- Offers accepted: 0

His two offers were both rejected immediately—one property had 14 competing offers, and the other went to a cash buyer willing to waive inspection.

“I realized I was playing a game I couldn’t win,” Michael said. “Online listings favor experienced investors who can analyze deals faster and cash buyers who can close quicker. I needed a different strategy.”

Three Core Problems Michael Faced:

Problem 1: Timing disadvantage

By the time a property appears on Zillow or Realtor.com, experienced local investors have already seen it through their agent networks. First-time investors are always 6-24 hours behind the curve when searching online.

Problem 2: Information overload without focus

Michael was looking at every property type in every Austin neighborhood. His criteria were too broad—”a good deal on a rental property”—which meant he was chasing properties that didn’t really fit his financial situation or investment goals.

Problem 3: No relationships with deal sources

The best off-market deals come from relationships with wholesalers, other investors, agents who specialize in investment properties, and property owners looking to sell without listing. Michael had none of these relationships.

“I realized the investors winning in Austin weren’t smarter than me,” Michael explained. “They just had access to off-market deals through relationships I didn’t have yet.”

Understanding how to find investment property requires shifting from online browsing to relationship-based deal sourcing—exactly what Michael discovered.

The Turning Point:

During a casual lunch conversation, Michael’s coworker David mentioned attending the Austin Real Estate Investment Association monthly meeting. “He said there were about 100 investors there every month, sharing strategies and talking about actual deals,” Michael recalled. “I thought it was worth checking out.”

That decision to attend his first REIA meeting became the catalyst that led to Michael’s first off-market deal.

Ready to start building your off-market deal network while securing financing? Schedule a call to discuss loan options that work for off-market purchases with quick closing timelines.

Month 1: Committing to Consistency Over Convenience

Michael attended his first REIA meeting in January with lowered expectations. “I thought it would be a bunch of gurus trying to sell $5,000 courses,” he admitted. “I almost didn’t go.”

But within the first 15 minutes, Michael realized this was different. The meeting featured an experienced local investor walking through a recent off-market deal—complete with actual numbers, photos of the property, and lessons learned from renovation challenges.

“Everyone was sharing real information,” Michael said. “People were talking about specific neighborhoods, lender recommendations, contractor horror stories, and properties coming on the market. It wasn’t theory—it was practical, local knowledge.”

What Michael Did Right from Meeting #1:

Strategy 1: Introduced himself honestly

Instead of pretending to have experience he didn’t have, Michael was upfront about being a first-time investor.

“I told people, ‘I’m Michael, I’m a software developer, and I own exactly zero rental properties,'” he recalled. “I expected people to dismiss me, but instead they were encouraging. Several investors told me their first property story and offered advice.”

This honesty made Michael memorable in a positive way. Experienced investors appreciated his authenticity and were more willing to help someone who acknowledged their beginner status rather than someone pretending to know more than they did.

Strategy 2: Asked specific, thoughtful questions

During the Q&A portion, Michael didn’t ask vague questions like “How do I get started?” Instead, he asked targeted questions based on his research:

- “What Austin neighborhoods would you recommend for someone looking for their first off-market deal focused on long-term rentals with 3 bedrooms?”

- “How do you calculate whether a property will actually cash flow with Austin property taxes and insurance costs?”

- “What’s the typical timeline from finding an off-market deal to closing here?”

“People want to help specific questions, not general confusion,” Michael said. “I did my homework before asking, so people knew I was serious.”

Strategy 3: Stayed for the entire networking hour

While many attendees left immediately after the formal presentation, Michael stayed for the full networking hour. He introduced himself to 8-10 people, collected business cards, and listened more than he talked.

“I made it a rule to introduce myself to at least 5 new people every meeting,” Michael explained. “I focused on listening to their stories and asking about their investing journey rather than immediately asking for deals.”

Strategy 4: Committed to attending every monthly meeting

This was Michael’s most important decision. After meeting #1, he blocked off every third Thursday evening on his calendar for the next six months—before even seeing results from networking.

“Most beginners attend one meeting, don’t find a deal that night, and never come back,” Michael said. “I committed to six months minimum regardless of immediate results. That consistency made all the difference.”

Meeting #1 Takeaways:

Michael left his first REIA meeting with:

- 12 new business cards from investors, agents, and property managers

- 3 neighborhood recommendations for first-time off-market deal investors

- 1 invitation to visit a rehab project the following weekend

- Understanding that finding off-market deals requires relationship building, not just showing up once

“I didn’t find a property at meeting #1,” Michael said. “But I started building relationships that would eventually lead to my first off-market deal.”

Month 2: Providing Value Before Asking for Help

By his second REIA meeting in February, Michael had a realization: everyone at these meetings was looking for off-market deals, but very few people were providing value to the community.

“I noticed people constantly asking ‘Does anyone have deals?’ but rarely offering anything helpful themselves,” Michael observed. “I realized if I wanted to stand out, I needed to give value before asking for anything in return.”

Michael’s Value-Creation Strategy:

Contribution 1: Volunteered technical skills

Michael approached the REIA president after the February meeting and offered to help redesign the association’s outdated website. As a software developer, this was easy for Michael but highly valuable to the organization.

“The website was from 2007 and looked terrible,” Michael said. “I offered to rebuild it using a modern template and set up an automated email system for meeting announcements. It took me about 10 hours over a weekend, but it made me memorable.”

The president introduced Michael to several experienced investors as “the guy who fixed our website,” creating instant credibility and goodwill.

Contribution 2: Connected people who could help each other

Michael started playing connector rather than just networker. When a property manager mentioned needing a new website, Michael introduced them to a web developer he’d met at the previous meeting. When a wholesaler asked about property management software, Michael shared research he’d done.

“I realized I could add value even as a beginner,” Michael explained. “I had tech skills, research abilities, and a growing network. Every time I connected two people who could help each other, both remembered me positively.”

This strategy—often called “giving to give” rather than “giving to get”—transformed how other investors perceived Michael. He wasn’t just another beginner asking for help; he was someone who contributed to the community.

Contribution 3: Shared detailed market research

Michael spent time each week researching Austin rental market trends, neighborhood appreciation rates, and property tax changes. At the March meeting, he shared a one-page summary of his findings with several investors.

“I wasn’t providing information they couldn’t find themselves,” Michael said. “But I was saving them time by synthesizing it. Several experienced investors told me they forwarded my research to their partners.”

The Relationship With David Begins:

At the March REIA meeting, Michael had his first substantive conversation with David Martinez, a 58-year-old investor who owned 15 rental properties throughout Austin.

“David asked me what I was looking for,” Michael recalled. “I started to say ‘a good deal on a rental property,’ but then I remembered that advice from meeting #1 about being specific. So I stopped myself and said ‘Actually, I don’t have a specific enough target yet. Could you help me think through my criteria?'”

This honest request for guidance—rather than vague deal-seeking—opened the door to a mentorship relationship that would eventually lead to Michael’s first off-market deal.

David spent 20 minutes asking Michael questions about his financial situation, risk tolerance, property management plans, and long-term investing goals. Then he helped Michael create a specific “buy box” of criteria for his first off-market deal search.

Michael’s Specific Buy Box (Developed With David’s Help):

Property characteristics:

- Single-family homes only (easiest to finance and manage as first property)

- 3 bedrooms, 2 bathrooms minimum (high rental demand)

- 1,600-2,000 square feet (sweet spot for families)

- Built after 1990 (fewer major systems issues)

- Turnkey to light cosmetic condition (not ready for major renovation)

Location parameters:

- Three specific ZIP codes: 78745, 78748, 78749

- Good school ratings (7+ on GreatSchools)

- Low crime (below Austin average)

- Strong rental demand (vacancy under 5%)

Financial criteria:

- Purchase price: $280,000-$350,000 (based on financing capacity)

- Minimum monthly cash flow: $300 after all expenses

- Target cash-on-cash return: 8% minimum

- Maximum initial capital needed: $85,000 (leaving $10,000 reserves)

Seller situation:

- Motivated to sell quickly (job relocation, inheritance, life change)

- Willing to negotiate below retail pricing

- Property not currently listed on MLS

“Once I had specific criteria written down, David said ‘Now I know what to look for on your behalf,'” Michael explained. “Vague criteria help nobody. Specific criteria make you memorable and make it easy for others to send you potential off-market deals.”

Michael created simple business cards with his buy box criteria, photo, and contact information. He handed these to every investor, agent, and wholesaler he met.

“The business card approach was genius,” Michael said. “People can’t remember everyone they meet, but they can save a card with specific criteria. Several people told me they kept my card and thought of me when properties came up.”

Understanding the complete investment property analysis framework helped Michael define realistic criteria for his first off-market deal.

Month 3-4: The Off-Market Deal Pipeline Begins

With his specific buy box defined and business cards in circulation, Michael’s REIA networking started producing results—though not immediately in the way he expected.

Early Pipeline Activity:

Week 9: A wholesaler sent Michael an off-market deal that met his location criteria but was priced too high. Michael ran the numbers, determined it wouldn’t cash flow, and politely declined. “I explained why the numbers didn’t work at that price,” Michael said. “He appreciated the detailed analysis rather than just ‘not interested.'”

Week 10: An agent Michael met at REIA invited him to preview a property before listing. It was in Michael’s target area but needed $40,000 in renovations Michael wasn’t ready to handle. He passed but stayed in touch with the agent.

Week 11: David sent Michael an off-market deal in the right ZIP code. Property looked good initially, but when Michael drove by, he discovered it backed to a busy commercial street. “David didn’t know that detail,” Michael said. “I thanked him for thinking of me and explained what I learned. That gave him even better criteria for next time.”

Week 12: Another investor mentioned a property owner looking to sell a rental after his tenant moved out. Michael contacted the owner within 2 hours, ran analysis, but the seller’s price expectations were $50,000 above market value. “I shared my comparable sales analysis respectfully,” Michael said. “He thanked me but decided to list with an agent. I stayed friendly and told him to contact me if listing didn’t work out.”

The Pattern Michael Noticed:

“None of these were THE deal,” Michael explained. “But each one was practice. I was getting faster at running numbers, more confident evaluating properties, and better at building relationships even when deals didn’t work out.”

More importantly, Michael was demonstrating to his network that he was serious, responsive, and analytical. Every person who sent him a potential off-market deal received:

- Fast response (within 24 hours)

- Detailed analysis showing his work

- Respectful explanation if he passed

- Appreciation for thinking of him

- Follow-up staying in touch

“This responsiveness set me apart,” Michael said. “Most beginners ghost after seeing a property that doesn’t work. I treated every opportunity as relationship building for the long term.”

April: The Call That Changed Everything

On April 3rd, Michael’s phone rang during his lunch break. It was David.

“I have a property that might be exactly what you’re looking for,” David said. “The owner contacted me directly about selling, but it’s too small for my portfolio—I only purchase properties above $500,000 now. Your name came to mind immediately because it matches your buy box perfectly.”

The Property Details:

- Address: 1847 Cedar Ridge Lane (name changed)

- Property type: Single-family home

- Bedrooms/Bathrooms: 3 bed, 2 bath

- Square footage: 1,850 sq ft

- Year built: 1995

- Condition: Well-maintained, currently tenant-occupied

- Location: 78748 ZIP code (one of Michael’s target areas)

- School rating: 8/10 on GreatSchools

- Status: Not listed on MLS, seller contacted David directly

Why This Off-Market Deal Came to David:

The property owner was relocating to California for work. He’d inherited the property from his parents five years earlier and rented it successfully to the same tenant since then. Now he needed to sell quickly without the complexity of MLS listing, agent coordination, showings, and uncertain timeline.

The seller’s brother knew David from a previous transaction two years earlier and suggested contacting him. “David could have easily wholesaled this off-market deal for a $15,000-$20,000 assignment fee,” Michael said. “Instead, he connected me directly with the seller because he remembered my specific criteria and I’d built trust by helping with the REIA website, making introductions, and sharing research.”

Michael’s Immediate Response:

Within 2 hours of David’s call, Michael had:

- Driven by the property to assess exterior condition and neighborhood

- Pulled recent comparable sales within half-mile radius

- Checked rental rates for similar properties in the area

- Reviewed property tax records and assessed value

- Called his lender to confirm pre-approval status

- Run preliminary cash flow analysis

“I knew I had to move fast on off-market deals,” Michael said. “If I’d waited even a day to ‘think about it,’ another investor would have grabbed it.”

Within 24 hours, Michael had:

- Scheduled property showing with seller for next day

- Asked his agent to prepare purchase agreement templates

- Contacted property manager for rental rate confirmation

- Reviewed his investment property analysis framework to ensure nothing missed

- Called David to thank him and confirm no conflicts with David making offer

The Property Showing:

Michael toured the property the next evening. “It was even better than I expected,” he said. “The property was clean, well-maintained with good bones. Current tenant had taken excellent care of it. Minor cosmetic updates needed—fresh paint, maybe new carpet—but nothing major.”

The property included:

- Recently replaced HVAC system (3 years old)

- Roof in good condition (8 years remaining useful life)

- Updated electrical panel

- Newer water heater (4 years old)

- Well-maintained landscaping

- Two-car garage with good storage

Michael asked the seller thoughtful questions:

- “What’s your timeline for selling and relocating?”

- “Have you considered listing with an agent or exploring other options?”

- “Are there any property issues I should be aware of that aren’t immediately visible?”

- “What’s your ideal outcome from this sale beyond just price?”

- “How has your experience been with the current tenant?”

“I wanted to understand his real motivations,” Michael said. “The answers told me this wasn’t someone trying to squeeze out maximum value—he needed certainty, speed, and simplicity more than the absolute highest price.”

The seller explained:

- He needed to relocate by June 1st (8 weeks away)

- He was stressed about coordinating the move with his new job start date

- He didn’t want to manage the property from California

- He wanted to avoid the uncertainty of MLS listing during a time-sensitive move

- He’d been dreading dealing with agent showings, staging, and potential deal fall-throughs

“Once I understood his situation, I knew I could structure an off-market deal that solved his problems beyond just offering a price,” Michael said.

[IMAGE 4 PLACEHOLDER]

The Analysis: Running the Numbers on the Off-Market Deal

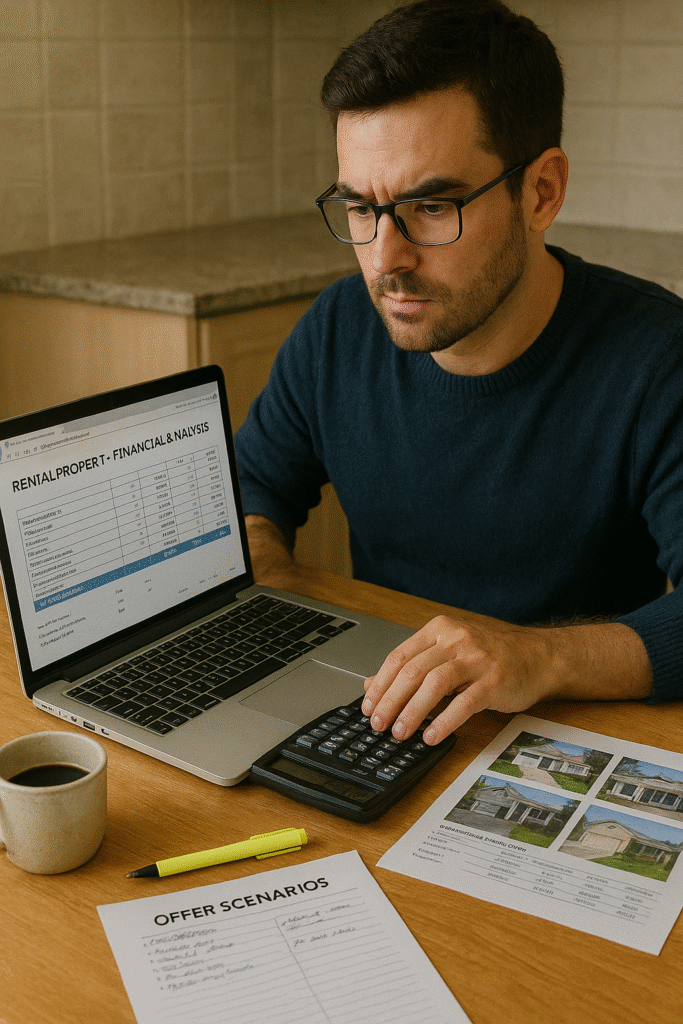

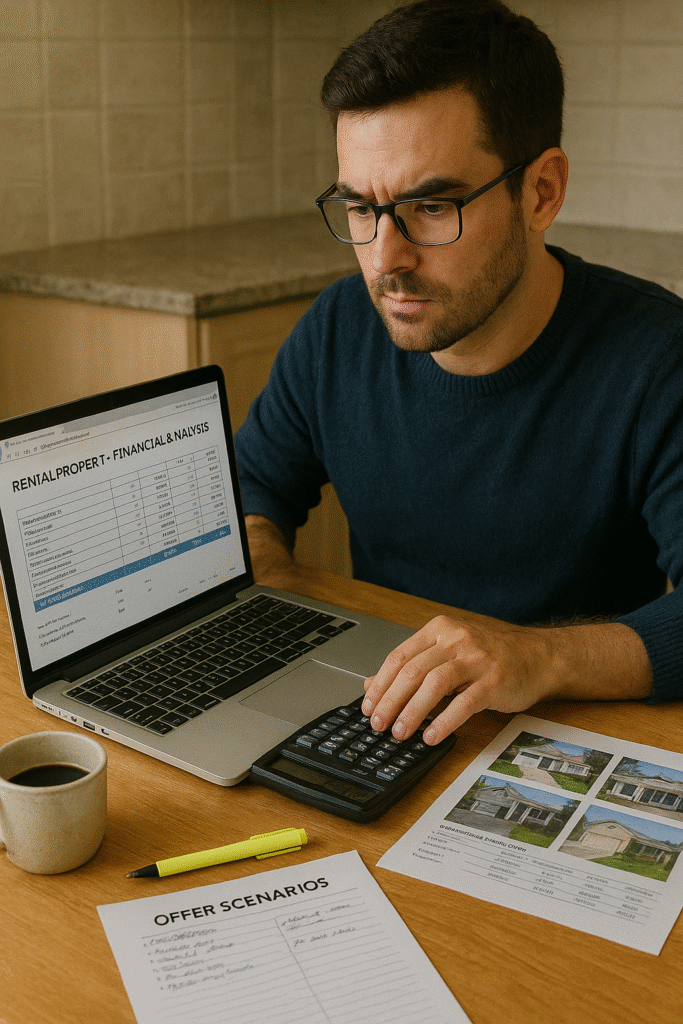

Before making any offer on the off-market deal, Michael spent two full evenings running comprehensive financial analysis. This wasn’t his first time analyzing a potential property—he’d evaluated several properties through REIA networking—but it was his first time analyzing a property he was seriously considering purchasing.

Step 1: Comparative Market Analysis

Michael pulled recent sales of similar properties to establish true market value. The seller had mentioned thinking the property was worth around $370,000 based on Zillow’s Zestimate.

Comparable Sales (Past 3 Months, Same Neighborhood):

1842 Maple Street:

- 3 bed, 2 bath, 1,870 sq ft, built 1993

- Sold for: $332,000

- Condition: Similar to subject property

- Days on market: 18

2156 Oak Avenue:

- 3 bed, 2.5 bath, 1,825 sq ft, built 1997

- Sold for: $338,000

- Condition: Updated kitchen, otherwise similar

- Days on market: 12

1729 Pine Drive:

- 3 bed, 2 bath, 1,900 sq ft, built 1990

- Sold for: $328,000

- Condition: Needed minor cosmetic work

- Days on market: 22

Average comparable sale price: $332,667

“The comps clearly showed the property was worth $330,000-$335,000 in current condition,” Michael explained. “Zillow’s $370,000 estimate was inflated—probably based on different property types or neighborhoods. I needed to show the seller real evidence, not just my opinion.”

Michael prepared a one-page comparable sales analysis showing:

- Map with comparable properties marked

- Photos of comparable properties

- Sale prices and price per square foot

- Condition notes and upgrades

- Days on market for each property

“I wanted to have evidence ready when discussing price,” Michael said. “Not to be argumentative, but to have objective data supporting my offer.”

Step 2: Rental Income Analysis

The current tenant was paying $2,100 monthly. Michael needed to confirm whether this was below market, at market, or above market for rental income.

Comparable Rental Properties Currently Listed:

Similar properties in the area:

- 1823 Valley View: 3/2, 1,820 sq ft – Listed at $2,250/month

- 2045 Sunset Drive: 3/2, 1,900 sq ft – Listed at $2,200/month

- 1754 Canyon Road: 3/2, 1,775 sq ft – Listed at $2,150/month

- 1960 Ridge Avenue: 3/2.5, 1,850 sq ft – Listed at $2,300/month

Average market rent range: $2,150-$2,250/month

“The current tenant was paying $2,100, which was $50-$150 below market,” Michael noted. “This meant I could increase rent to market rate when the lease renewed in 4 months, improving cash flow.”

Michael confirmed these rental rates with a property manager contact from REIA who managed 30 properties in the area. “She said $2,200-$2,250 was realistic for that property in good condition, and that similar properties rarely sat vacant more than 2-3 weeks.”

Step 3: Expense Projections

Michael created conservative expense estimates using information from his property manager contact, insurance quotes, and tax records:

Monthly Operating Expenses (Conservative Projections):

Property-specific expenses:

- Property tax: $394/month ($4,728 annually based on tax records)

- Insurance: $125/month ($1,500 annually based on quote)

- HOA fees: $0 (no HOA)

Management and maintenance reserves:

- Property management: $0 (self-managing initially, would be $220/month at 10%)

- Maintenance reserve: 6% of rent = $132/month (conservative for 1995 property)

- Vacancy reserve: 7% annually = $129/month

Capital expenditure reserve:

- CapEx reserve for major systems: $100/month (roof, HVAC, appliances, etc.)

Total monthly expenses before financing cost: $880/month

“I used conservative assumptions because I’d rather be pleasantly surprised than financially stressed,” Michael explained. “The 6% maintenance reserve was high for a well-maintained newer property, but I wanted buffer as a first-time landlord.”

Step 4: Financing Cost Calculation

Michael’s lender had pre-approved him for a conventional investment property loan requiring 25% initial capital with good credit. His credit score of 742 qualified him for favorable terms.

Financing scenarios Michael modeled:

Scenario A: Purchase at $320,000

- Initial investment (25%): $80,000

- Loan amount: $240,000

- Estimated monthly financing cost: $1,581

Scenario B: Purchase at $300,000

- Initial investment (25%): $75,000

- Loan amount: $225,000

- Estimated monthly financing cost: $1,481

Scenario C: Purchase at $285,000

- Initial investment (25%): $71,250

- Loan amount: $213,750

- Estimated monthly financing cost: $1,407

“I needed to figure out what purchase price would give me my target $300 minimum monthly cash flow,” Michael said.

Step 5: Cash Flow Analysis at Different Purchase Prices

Cash Flow Analysis: Purchase at $320,000

Monthly rental income: $2,100 (current rate)

Monthly expenses:

- Financing cost: $1,581

- Property tax: $394

- Insurance: $125

- Maintenance: $132

- Vacancy: $129

- CapEx: $100

- Total: $2,461

Monthly cash flow: -$361 (NEGATIVE)

“At $320,000, even with the current tenant paying rent, I’d be losing money every month,” Michael noted. “Not acceptable for my first property.”

Cash Flow Analysis: Purchase at $300,000

Monthly rental income: $2,225 (projected market rate after lease renewal)

Monthly expenses:

- Financing cost: $1,481

- Property tax: $394

- Insurance: $125

- Maintenance: $133

- Vacancy: $129

- CapEx: $100

- Total: $2,362

Monthly cash flow: -$137 (STILL NEGATIVE)

“Getting closer but still negative,” Michael said. “I needed the purchase price lower.”

Cash Flow Analysis: Purchase at $285,000

Monthly rental income: $2,225 (projected market rate)

Monthly expenses:

- Financing cost: $1,407

- Property tax: $394

- Insurance: $125

- Maintenance: $133

- Vacancy: $129

- CapEx: $100

- Total: $2,288

Monthly cash flow: -$63 (Nearly break-even)

“At $285,000 with market rent, I was almost cash flow positive using conservative assumptions,” Michael explained. “If actual maintenance came in lower than my 6% reserve—which was likely for a well-maintained newer property—I’d be positive. And I had room to increase rent modestly over time.”

Revised cash flow with 4.5% maintenance reserve (more realistic for newer property):

Monthly expenses:

- Financing cost: $1,407

- Property tax: $394

- Insurance: $125

- Maintenance: $100 (4.5% of $2,225)

- Vacancy: $129

- CapEx: $100

- Total: $2,255

Monthly cash flow: +$30 (POSITIVE)

“With more realistic maintenance assumptions, I had positive cash flow of $30 monthly at $285,000 purchase price,” Michael said. “Not spectacular, but it worked, and I knew I could improve it over time through rent increases and lower actual expenses.”

Step 6: Return on Investment Calculations

Michael calculated his target returns at different purchase prices to determine his maximum offer:

At $285,000 Purchase Price:

Initial capital required:

- Initial investment (25%): $71,250

- Closing costs (buyer’s): $2,800

- Inspection and appraisal: $900

- Total upfront capital: $75,000 (approximately)

Annual cash flow: $360 (12 months × $30)

Cash-on-cash return: 0.48% (not including equity buildup, appreciation, or tax benefits)

“The cash-on-cash return looked low on paper,” Michael acknowledged. “But this analysis didn’t include three other profit centers: mortgage principal reduction, property appreciation, and tax benefits. Plus I valued the education from owning my first property.”

Complete return projection (5-year hold):

Year 1 returns:

- Cash flow: $360

- Principal reduction: ~$3,200

- Appreciation (conservative 3%): $8,550

- Tax benefits: ~$7,800

- Total year 1 return: $19,910

- Year 1 ROI on $75,000 invested: 26.5%

“When I looked at all five profit centers—cash flow, equity buildup, appreciation, tax benefits, and leverage—the returns were excellent for a conservative, well-located property,” Michael said.

Step 7: Risk Assessment

Michael identified potential risks before making his offer on the off-market deal:

Risk 1: Tenant turnover – Current tenant could move out, requiring new tenant placement and potential vacancy.

Mitigation: Property in high-demand area, market rent competitive, property manager confirmed 2-3 week typical vacancy.

Risk 2: Major maintenance unexpected – Older properties can have surprise expensive repairs.

Mitigation: Thorough inspection, property well-maintained, major systems recently replaced, keeping healthy reserve fund.

Risk 3: Market downturn – Property values could decline, affecting refinance or sale options.

Mitigation: Buying below market value creates equity buffer, planning long-term hold regardless of short-term market fluctuations.

Risk 4: Rent decreases – Market rents could drop, affecting cash flow. Mitigation: Buying in strong school district with good employment drivers, conservative rent assumptions, positive cash flow even at current below-market rent eventually.

“I wasn’t looking for perfect,” Michael said. “I was looking for acceptable risk with good long-term potential. This off-market deal met that criteria.”

Use the rental property calculator to run similar scenarios when evaluating off-market deals.

The Negotiation: Structuring a Win-Win Off-Market Deal

Armed with comprehensive financial analysis and comparable sales data, Michael was ready to make his offer. But instead of leading with price, he first had an honest conversation with the seller about his situation and constraints.

Michael’s Pre-Offer Conversation:

Michael called the seller and said: “Before I present a formal offer, I want to make sure I understand your situation fully so I can structure something that works for both of us. Can you walk me through your ideal timeline and any concerns you have about selling?”

This question opened a 30-minute conversation where the seller revealed:

Seller’s Priorities (in order):

- Certainty of close – Couldn’t risk deal falling through during critical job transition

- Quick timeline – Needed to close within 30 days if possible

- Minimal hassle – Didn’t want showings, staging, or ongoing management

- Fair price – Wanted reasonable value but not trying to squeeze out every dollar

Seller’s Concerns:

- Finding temporary housing during California transition (apartment lease wouldn’t start for 45 days after his move)

- Coordinating property sale with work start date

- Dealing with tenant if property went on market

- Potential repairs or inspection issues delaying close

“Once I understood his true priorities, I realized price wasn’t his primary concern,” Michael said. “He needed certainty and convenience more than maximum sale price. That’s when I knew I could structure an off-market deal that solved his problems.”

Michael’s Initial Offer Strategy:

Instead of starting at his target price of $285,000, Michael came in at $280,000 with several non-price terms designed to address the seller’s concerns:

Initial Offer Terms:

Purchase price: $280,000

Favorable non-price terms:

- 14-day inspection period (fast)

- 21-day close (meets his timeline)

- Michael covers seller’s typical transaction costs ($3,500 estimated)

- Seller can remain in property 30 days after closing (solves housing gap)

- Property sold with existing tenant in place (no listing disruption)

- Cash offer with pre-approved financing (high certainty)

- Minimal contingencies (inspection only)

Estimated value to seller of non-price terms:

- Transaction costs covered: $3,500

- 30-day post-close occupancy: $2,500 value (vs. temporary housing)

- Avoided agent commission (if selling himself): $0 additional

- Certainty and convenience: Significant but unquantifiable value

“I explained that my $280,000 offer was below his $370,000 expectation, but showed him the comparable sales data and emphasized the non-price benefits,” Michael said. “I wanted him to see the total package value, not just the number.”

Michael included his comparable sales analysis one-pager with the offer, showing the recent $328,000, $332,000, and $338,000 sales of similar properties.

The Seller’s Counter:

The seller took two days to consider (during which Michael nervously checked his phone every hour). Then he called with a counter-offer:

Seller Counter-Offer:

Purchase price: $305,000 (up from $280,000)

Counter-explanation:

“The seller said he appreciated the comparable sales analysis and understood $370,000 was too high,” Michael recalled. “But he felt $280,000 was below fair market value even accounting for the convenience. He countered at $305,000, which was still well below the $330,000-$338,000 comparable sales.”

Michael had two options:

- Accept $305,000 (still a good off-market deal below comps)

- Counter again at his target price

Michael’s Second Offer Strategy:

Instead of meeting in the middle at $292,500, Michael made a strategic decision based on advice from David and his agent. He came back at $285,000 but enhanced the non-price terms:

Second Offer Terms:

Purchase price: $285,000 (up from $280,000 but below $305,000 counter)

Enhanced non-price terms:

- Covers seller’s transaction costs: $3,500 (same as before)

- 45-day post-close occupancy instead of 30 days (even more flexibility)

- Pays for any minor repairs identified in inspection up to $2,000

- Faster close if seller prefers: 14 days instead of 21 days

- Guarantees close even if tenant vacates before closing

“I realized the seller valued certainty and flexibility more than price,” Michael explained. “By giving him 45 days post-close occupancy instead of 30, I solved his housing transition problem completely. That was worth more to him than $20,000 in price.”

Why This Strategy Worked:

The extended occupancy gave the seller:

- No temporary housing costs during transition: $3,500 savings

- No stress coordinating move with job start: Significant peace of mind value

- Ability to move belongings gradually: Convenience value

- Time to handle California apartment lease timing: Problem solved

Michael’s total effective cost: $285,000 + $3,500 transaction costs + $2,000 repair cap = $290,500

Seller’s effective received value: $285,000 + $3,500 + $3,500 (avoided temporary housing) = $292,000 equivalent value

The Seller Accepted:

After one more day of consideration, the seller called Michael and accepted the $285,000 offer with enhanced terms.

“He told me three other investors had contacted him about the property but everyone just negotiated on price,” the seller explained. “You were the only one who asked about my situation and structured an offer that solved my actual problems. The extra 15 days of occupancy was the deciding factor.”

Final Agreement Terms:

- Purchase price: $285,000

- Seller transaction costs paid by Michael: $3,500

- Inspection repair cap paid by Michael: $2,000

- 14-day inspection period

- 21-day close

- 45-day post-close seller occupancy at no cost

- Property sold with existing tenant’s lease assigned to new owner

Total effective cost to Michael: $290,500

Market value based on comps: $330,000-$338,000

Instant equity: $39,500-$47,500 (12-14% below market)

“This off-market deal worked because I understood the seller’s true priorities,” Michael said. “Win-win negotiation beats pure price haggling every time.”

Understanding buying first rental property with LLC considerations helped Michael structure the purchase correctly from the start.

The Financing: Conventional Loan Approval for Off-Market Deal

Michael’s financing process was smooth because he’d done three critical things before finding his off-market deal:

- Got pre-approved early – His pre-approval was current when David called

- Understood financing requirements – He knew what properties would qualify before searching

- Maintained strong financial profile – He’d avoided taking on new debt or making major purchases

Michael’s Financial Profile:

Credit and income:

- Credit score: 742 (excellent)

- Annual income: $115,000 (stable W-2 employment)

- Debt-to-income ratio: 28% (low existing debt)

- Employment history: 8 years same employer (strong stability)

Savings and reserves:

- Capital saved for investment: $75,000

- Emergency reserves: $20,000 additional

- Total liquid assets: $95,000

“I spent a year building my financial profile before ever searching for properties,” Michael explained. “Paid down credit cards, increased my credit score from 690 to 742, and saved aggressively. When this off-market deal appeared, I was ready.”

Conventional Investment Property Loan Details:

Michael qualified for a conventional investment property loan with favorable terms:

Financing structure:

- Property purchase price: $285,000

- Required initial investment: 25% ($71,250)

- Loan amount: $213,750

- Loan term: 30-year fixed

- Required PITI reserves: 6 months (met easily with $20,000 emergency fund)

Why the lender counted rental income:

Because the property had an existing tenant with a current lease agreement, the lender could include the rental income in Michael’s debt-to-income calculation. This made qualification easier.

“The lender used 75% of the monthly rent ($2,100 × 0.75 = $1,575) in my income calculation,” Michael explained. “This offset the new financing cost and made my debt-to-income ratio stay favorable even with the new property.”

Cash Required at Closing:

Breakdown of upfront capital needed:

Property-related:

- Initial investment (25%): $71,250

- Buyer’s transaction costs: $2,800

- Seller’s transaction costs (Michael paying): $3,500

- Inspection fee: $450

- Appraisal fee: $550

- First year insurance premium: $1,500 (prepaid at closing)

- Property tax prorations: $1,100

- Subtotal property-related: $81,150

Lender fees and reserves:

- Loan origination: $1,450

- Title insurance and escrow: $1,800

- HOA transfer fees: $0 (no HOA)

- Recording fees: $175

- Subtotal lender/closing: $3,425

Total cash to close: $84,575

Michael used $75,000 from his saved investment capital plus $9,575 from his $20,000 reserves, leaving him with $10,425 in emergency reserves after closing.

“I wanted at least $10,000 remaining in reserves after closing as first-time landlord,” Michael said. “Keeping buffer was important for peace of mind.”

The Appraisal Process:

Michael’s biggest concern was the appraisal coming in below his $285,000 purchase price, which would require him to bring additional cash to close or renegotiate.

“I had comparable sales supporting $330,000+ value, but appraisers can be unpredictable,” Michael said. “I didn’t relax until I got the appraisal report.”

Appraisal Results:

The property appraised at $325,000 – significantly above Michael’s $285,000 purchase price.

The appraiser used the same three comparable sales Michael had researched ($328,000, $332,000, $338,000) and noted the subject property’s well-maintained condition and desirable location.

“That $325,000 appraisal created instant equity of $40,000,” Michael said. “I bought at $285,000, and it immediately appraised for $325,000. That’s equity I didn’t have to wait for through appreciation—it existed from day one because I negotiated an off-market deal below market value.”

Closing Timeline:

Day 1 (April 15): Offer accepted, both parties sign purchase agreement

Day 2-3: Michael orders inspection, submits financing application

Day 4: Appraisal ordered by lender Day 7: Inspection completed (minor items noted: worn weatherstripping on doors, slow-draining bathroom sink, loose handrail) Day 8: Michael and seller agree seller will fix inspection items before closing Day 12: Appraisal completed ($325,000 value)

Day 15: Final loan approval received (“clear to close”) Day 18: Final walkthrough confirms repairs completed Day 21 (May 6): Closing at title company

Total time from offer acceptance to closing: 21 days

“The process was smooth because I was prepared financially, the property was in good condition, and the seller was motivated to close quickly,” Michael said. “Having strong pre-approval before finding the off-market deal was critical.”

Understanding tax break for buying a house as investment property helped Michael plan for first-year tax benefits.

The Results: First Year Performance and Returns

Michael closed on his off-market deal on May 6th and immediately began his journey as a rental property owner. Here’s what happened during his first 12 months:

Months 1-4 (May-August): The Learning Curve

The existing tenant stayed in place, which gave Michael valuable time to learn property management without immediate tenant placement pressure.

Month 1 (May):

- Rent collected: $2,100 (on time via online payment)

- Maintenance issues: None

- Property management time: 1 hour (setting up rent collection, reviewing lease)

- Cash flow: +$73 (after all expenses)

“The first rent payment arriving on time was exciting,” Michael said. “Made it feel real.”

Month 2 (June):

- Rent collected: $2,100 (on time)

- Maintenance: Replaced worn HVAC filter ($45), fixed slow-draining sink ($120 plumber call)

- Time commitment: 3 hours (coordinating repairs, communicating with tenant)

- Cash flow: +$8 (after maintenance costs)

Month 3 (July):

- Rent collected: $2,100 (on time)

- Maintenance: Landscaping trim needed ($150), replaced loose handrail ($85 handyman)

- Time commitment: 4 hours

- Cash flow: -$108 (negative due to maintenance)

“July was the first month I experienced negative cash flow,” Michael said. “The maintenance items were minor but they added up. I reminded myself I’d conservatively budgeted for this.”

Month 4 (August):

- Rent collected: $2,100 (on time)

- Maintenance: None

- Time commitment: 2 hours (general check-in communication)

- Cash flow: +$73

Months 1-4 totals:

- Total rent collected: $8,400

- Total maintenance spent: $400

- Average monthly time: 2.5 hours

- Total cash flow: +$46 (basically break-even as projected)

“The first four months taught me that property management wasn’t as scary as I’d feared,” Michael said. “The tenant communicated well, issues were minor, and I was building systems for tracking everything.”

Month 5 (September): First Rent Increase

When the tenant’s lease came up for renewal in September, Michael faced his first major decision: how much to increase rent without losing a good tenant.

Market analysis showed similar properties renting for $2,250-$2,300. The tenant was currently paying $2,100—below market by $150-$200.

“I didn’t want to shock the tenant with a huge increase,” Michael said. “They’d been excellent—paid on time, maintained the property well, communicated clearly. I wanted to balance market rent with tenant retention.”

Michael’s rent increase strategy:

He sent the tenant a lease renewal notice 60 days before expiration, proposing:

- New rent: $2,225/month (increase of $125)

- 12-month lease term

- All other terms unchanged

- Explanation: “Market rents have increased significantly. Comparable properties in the area are now renting for $2,250-$2,300. I’m pleased to offer you $2,225, which is still below current market rate, for another 12 months.”

The tenant accepted immediately, appreciating the below-market rate and stability of a full-year lease.

Month 5-12 (September-April): Positive Cash Flow Achieved

With the new rent of $2,225/month, Michael’s cash flow improved significantly:

Revised monthly numbers after rent increase:

Monthly income: $2,225

Monthly expenses:

- Financing cost: $1,407

- Property tax: $394

- Insurance: $125

- Vacancy reserve: $129

- Property management: $0 (still self-managing)

- Maintenance: Average $120/month actual (below $133 budgeted reserve)

- CapEx reserve: $100

Total monthly expenses: $2,275

Monthly cash flow: -$50 (still slightly negative on paper)

“But my actual maintenance costs ran lower than projected,” Michael explained. “The property was well-maintained, and in months without maintenance I was significantly cash flow positive.”

Months 5-12 actual results:

- September: $73 cash flow (no maintenance)

- October: $58 cash flow ($65 minor repair)

- November: $73 cash flow (no maintenance)

- December: -$82 cash flow ($280 plumbing repair)

- January: $73 cash flow (no maintenance)

- February: $73 cash flow (no maintenance)

- March: $48 cash flow ($100 landscaping)

- April: $73 cash flow (no maintenance)

Months 5-12 cash flow: +$389

Complete First Year Financial Summary:

Income:

- Months 1-4: $2,100 × 4 = $8,400

- Months 5-12: $2,225 × 8 = $17,800

- Total rental income: $26,200

Expenses:

Financing cost: $1,407 × 12 = $16,884

Property tax: $4,728 Insurance: $1,500 Actual maintenance: $1,335 Property management: $0 (self-managed) Vacancy: $0 (tenant stayed full year) CapEx reserve: $1,200 (set aside)

Total expenses: $25,647

First year cash flow: +$553

“Modest cash flow, but positive in year one,” Michael said. “For a first property focused on learning, this exceeded my expectations.”

Additional First-Year Returns:

Profit Center 1: Cash flow = $553

Profit Center 2: Equity buildup through mortgage principal reduction = $3,247

“Every financing cost includes principal and interest,” Michael explained. “The principal portion is forced savings—equity I’m building with the tenant’s rent.”

Profit Center 3: Property appreciation

Property values in Michael’s neighborhood increased approximately 4% during his first year of ownership.

- Purchase price: $285,000

- Estimated current value (based on new comparable sales): $338,000

- Appreciation: $53,000

“I didn’t cause this appreciation—the market did,” Michael acknowledged. “But I captured it by owning the property during a strong market year.”

Profit Center 4: Tax benefits

Michael worked with his CPA to understand first-year tax advantages:

Tax deductions claimed:

- Depreciation: $10,364 (building value ÷ 27.5 years)

- Mortgage interest: $15,750 (approximate first-year interest)

- Property tax: $4,728

- Insurance: $1,500

- Maintenance and repairs: $1,335

- Property management expenses: $450 (software and education)

- Total deductions: $34,127

At Michael’s 24% marginal tax rate: $8,190 in tax savings

“These deductions lowered my overall tax liability significantly,” Michael said. “My CPA said rental real estate offers some of the best tax advantages available.”

Total First-Year Return Calculation:

- Cash flow: $553

- Equity through principal reduction: $3,247

- Appreciation: $53,000

- Tax savings: $8,190

- Total first-year return: $64,990

Return on invested capital:

- Capital invested at closing: $84,575

- Total first-year return: $64,990

- First-year ROI: 76.9%

“When you look at all five profit centers together—cash flow, equity, appreciation, tax benefits, and leverage—the returns were incredible,” Michael said. “This off-market deal that took four months of relationship building produced a 77% first-year return.”

What Michael Learned About Managing His First Property:

Lesson 1: Communication prevents problems

Michael sent his tenant a friendly check-in email every quarter asking if anything needed attention. “Proactive communication meant small issues got handled before becoming expensive problems,” he said.

Lesson 2: Quality tenants are worth below-market rent

“When I calculate what tenant turnover costs—vacancy, cleaning, repairs, advertising, screening, showing—keeping a good tenant at $25 below market rent is great business,” Michael explained.

Lesson 3: Conservative budgeting reduces stress

Because Michael budgeted conservatively for maintenance, when actual costs ran lower, he felt like he was winning. “If I’d budgeted optimistically and costs ran higher, I’d have been stressed,” he said.

Lesson 4: Systems beat motivation

Michael created simple systems for rent collection (automated), maintenance tracking (spreadsheet), and expense recording (property management software). “Systems meant I didn’t have to remember everything—it was documented,” he said.

Lesson 5: Self-management teaches valuable skills

“Managing my first property myself taught me what good property management looks like,” Michael said. “When I eventually hire a manager for future properties, I’ll know what questions to ask and what standards to expect.”

Understanding long term rental vs short term rental strategies helped Michael confirm his long-term rental approach was right for his first off-market deal.

The Lessons: What Michael Learned About Off-Market Deals

After successfully purchasing, managing, and profiting from his first off-market deal, Michael reflected on the key lessons that transformed him from frustrated online browser to confident investor:

Lesson 1: Relationships Trump Algorithms Every Time

“I spent six months searching online and found nothing,” Michael said. “I spent four months networking at REIA and got an off-market deal $40,000 below market value. Personal relationships beat technology for off-market deal sourcing.”

Why relationships matter more than online searching:

- Off-market deals come from people, not databases

- Sellers prefer working with people they know or who come recommended

- Experience investors share off-market deals with people they trust

- Wholesalers send deals to buyers who’ve proven they close

- Agents prioritize clients with established relationships

Michael’s relationship-building approach:

“I didn’t network transactionally,” Michael explained. “I wasn’t asking ‘Got any deals?’ every conversation. I was building genuine relationships by providing value, staying consistent, and being someone people wanted to help.”

Lesson 2: Provide Value Before Asking for Help

The breakthrough moment in Michael’s networking came when he stopped just attending meetings and started contributing to the community.

“When I volunteered to redesign the REIA website, I wasn’t thinking ‘This will get me deals,'” Michael said. “I was thinking ‘I have skills that can help this community.’ But that value-first approach made me memorable when David had an off-market deal that was too small for his portfolio.”

Ways to provide value as a beginner off-market deal investor:

- Volunteer skills (technical, design, administrative)

- Connect people who can help each other

- Share research and market analysis

- Help at events and meetings

- Provide thoughtful feedback on presentations

- Share resources and tools you discover

“Every experienced investor remembers what it was like being a beginner,” Michael said. “When you show you’re willing to help the community rather than just take, people want to see you succeed.”

Lesson 3: Get Specific About Your Off-Market Deal Criteria

Michael’s turning point came when David asked what he was looking for and Michael couldn’t give a specific answer beyond “a good deal.”

“David helped me get specific—exact property type, specific neighborhoods, defined price range, clear cash flow target,” Michael recalled. “Once I had that specific buy box, I created business cards and everyone knew exactly what off-market deals to send me.”

The power of specificity:

- Specific criteria make you memorable

- People can’t help vague requests

- Specific buy box filters out wrong deals quickly

- Clarity demonstrates seriousness to potential partners

- Defined targets focus your own search

“When you say ‘I’m looking for off-market deals,’ nobody remembers you,” Michael said. “When you say ‘I’m looking for 3-bedroom single-family homes in these three ZIP codes between $280-350K that cash flow $300+ monthly,’ people remember you.”

Lesson 4: Speed Matters With Off-Market Deals

When David called about the off-market deal, Michael acted within hours—not days or weeks.

“Off-market deals move faster than MLS properties because there’s no listing period,” Michael explained. “If I’d said ‘Let me think about it for a few days,’ another investor would have grabbed it.”

Michael’s speed playbook:

Within 2 hours of hearing about off-market deal:

- Drove by property to see exterior and neighborhood

- Pulled comparable sales

- Ran initial cash flow analysis

- Checked rental comps

- Called lender to confirm pre-approval current

Within 24 hours:

- Scheduled showing

- Prepared offer strategy

- Contacted property manager for market rent confirmation

- Reviewed complete investment analysis framework

- Had agent ready to write offer

“Speed doesn’t mean being reckless,” Michael said. “It means being prepared so you can move quickly when the right off-market deal appears.”

Lesson 5: Solve the Seller’s Problem, Not Just Negotiate Price

Michael’s successful negotiation came from understanding the seller’s true priorities beyond price.

“The seller needed certainty, speed, and simplicity more than maximum price,” Michael said. “When I structured my offer to solve his housing transition problem with 45-day post-close occupancy, that was worth more than $20,000 in price negotiations.”

Questions to ask sellers of off-market deals:

- What’s driving your decision to sell?

- What’s your ideal timeline?

- What concerns do you have about the selling process?

- What would make this transaction easiest for you?

- What matters most—price, speed, certainty, or simplicity?

“When you understand seller motivations, you can structure off-market deals that create value beyond just price,” Michael explained. “Win-win negotiations beat haggling every time.”

Lesson 6: Conservative Analysis Prevents Expensive Mistakes

Michael ran the numbers multiple ways before making his offer, using conservative assumptions throughout.

“I assumed higher maintenance costs than needed, included vacancy reserve even though tenant was staying, and modeled different purchase price scenarios,” Michael said. “This conservative analysis prevented me from overpaying or buying an off-market deal that couldn’t actually cash flow.”

Michael’s analysis discipline:

- Pulled multiple comparable sales (not just Zillow estimates)

- Researched actual rent comps (not just online listings)

- Used conservative expense assumptions

- Modeled multiple purchase price scenarios

- Calculated required returns before making offer

- Built in buffer for unexpected costs

“I’d rather be conservative and pleasantly surprised than optimistic and financially stressed,” Michael said.

Lesson 7: The First Off-Market Deal Is About Education, Not Maximizing Returns

Michael’s cash flow in year one was modest—$553 total for the year. But he valued the education as much as the returns.

“My first property taught me tenant screening, lease agreements, maintenance coordination, expense tracking, rent collection systems, and dealing with small repairs,” Michael said. “Those skills are worth far more than a few hundred dollars monthly because they let me scale confidently.”

What Michael learned from his first off-market deal:

- How to analyze properties accurately

- How to coordinate inspections and repairs

- How to communicate effectively with tenants

- How to track income and expenses properly

- How to make decisions under uncertainty

- How to build systems that scale

“Property number one is your MBA in real estate investing,” Michael said. “You’re paying tuition through modest returns and time commitment, but you’re learning skills that make properties 2, 3, and 4 much easier.”

Lesson 8: Network Consistently, Not Just When You Need Something

After buying his property, Michael continued attending REIA meetings monthly.

“I still go to REIA even though I own my property,” Michael said. “I’m building relationships for off-market deals 2, 3, and 4. Networking is a long-term relationship strategy, not a one-time transaction.”

Michael’s ongoing networking approach:

- Attends REIA meetings monthly (hasn’t missed one in 14 months)

- Shares his off-market deal story with beginners to help them

- Connects people who can help each other

- Stays in touch with David and other experienced investors

- Volunteers on REIA committees

- Views networking as relationship building, not deal hunting

“The investors with the best off-market deal flow are the ones who show up consistently for years,” Michael said. “You can’t network only when you need something. You network because you’re part of a community.”

Lesson 9: Documentation and Systems Enable Scale

From day one, Michael documented everything systematically.

“I tracked every expense, saved every receipt, recorded every maintenance issue, and documented every tenant communication,” Michael said. “These systems mean I can scale to multiple properties without chaos.”

Michael’s documentation systems:

- Property management software for tracking income/expenses

- Google Drive folder for all property-related documents

- Spreadsheet for maintenance and capital expenditure tracking

- Digital filing of receipts and invoices

- Email templates for tenant communication

- Checklists for recurring tasks

“Systems beat motivation,” Michael explained. “When you have systems, managing properties becomes process-driven rather than dependent on remembering everything.”

Lesson 10: Leverage Every Success for the Next Opportunity

Michael’s first off-market deal success opened doors for future opportunities.

“Now when I attend REIA meetings or talk to investors, I’m not just the beginner,” Michael said. “I’m the investor who actually closed an off-market deal. That credibility changes conversations.”

How Michael leverages his first success:

- Shares his off-market deal story to help other beginners

- Uses his property as proof he’s a serious buyer who closes

- Plans cash-out refinance to extract equity for property #2

- Demonstrates analytical skills through detailed first-deal analysis

- Has established relationship with lender who knows he performs

“Every property makes the next property easier,” Michael said. “Your first off-market deal proves you’re not just browsing—you’re a real investor who executes.”

What’s Next: Michael’s Growth Plans

Michael isn’t stopping at one property. His first off-market deal success has created momentum toward building a multi-property portfolio.

Year 2 Goals:

Property #2 using cash-out refinance equity extraction:

Michael plans to use a cash-out refinance on his current property to fund the initial capital for property #2.

“My property purchased at $285,000, appraised at $325,000, and is now worth approximately $338,000 based on recent comps,” Michael explained. “I owe $210,000 on my loan. If I refinance at 75% loan-to-value, I can access approximately $35,000 in equity to use as initial capital on property #2.”

Cash-out refinance math:

- Current estimated value: $338,000

- 75% loan-to-value: $253,500

- Current loan balance: $210,000

- Available equity to extract: $43,500

- Closing costs: ~$3,500

- Net cash available: $40,000 (more than enough for 25% initial capital on $280-350K property)

“The cash-out refinance will increase my monthly financing cost on property #1 slightly,” Michael said. “But the additional cost is more than offset by cash flow from property #2. This is how investors scale—they recycle equity rather than needing new savings for every property.”

Continued REIA networking for off-market deal #2:

Michael continues attending REIA monthly and has established himself as a credible buyer.

“Now when wholesalers and investors have off-market deals, they think of me because I’ve proven I analyze properties thoroughly and close transactions quickly,” Michael said. “My reputation for executing is my biggest asset for finding property #2.”

Potentially hiring property management:

“Once I have 2-3 properties, I’ll likely hire professional property management,” Michael said. “Right now I’m self-managing to learn the business and maximize cash flow. But eventually my time is better spent finding off-market deals #3, #4, and #5 than handling maintenance calls.”

Five-Year Vision:

Michael’s goal is owning 5-7 rental properties by age 37.

Projected portfolio in 5 years:

- 5-7 properties owned

- Average property value: $350,000

- Average monthly cash flow per property: $300-500

- Total monthly cash flow: $1,500-$3,500

- Total portfolio value: $1.75M-$2.45M

- Total equity: $400,000-$600,000 (between initial capital, appreciation, and principal reduction)

“If each off-market deal generates modest cash flow and appreciates reasonably, I’ll have substantial equity and passive income within five years,” Michael said. “But it all started with showing up consistently to REIA meetings and building genuine relationships.”

Michael’s Advice to Aspiring Off-Market Deal Investors:

“Stop browsing Zillow and start attending your local REIA meetings,” Michael said. “Find one meeting, put it on your calendar for the next six months, and commit to showing up consistently regardless of immediate results. Provide value to the community before asking for help. Get specific about your buy box criteria. Move fast when opportunities appear. And remember—your first off-market deal is about education as much as returns.”

Understanding DSCR loan meaning will help Michael as he scales to multiple properties and wants to qualify based on property cash flow rather than personal income.

How Stairway Mortgage Supports Off-Market Deal Investors

At Stairway Mortgage, we understand that off-market deals often move quickly and require flexible, responsive financing.

We helped Michael by:

Fast pre-approval before property search:

Michael was pre-approved and ready to act immediately when David called about the off-market deal. We provided clear guidance on purchase price limits, initial capital requirements, and qualification criteria so Michael knew his boundaries before searching.

Education on investment property financing:

We walked Michael through conventional loan requirements for investment properties so he understood what properties would qualify before making offers on off-market deals.

Quick closing timeline (21 days):

When Michael found his off-market deal with a motivated seller needing fast close, we moved quickly through underwriting to meet his timeline. This responsiveness helped Michael compete against all-cash offers.

Rental income consideration:

Because Michael’s property had an existing tenant with a lease, we could count 75% of the rental income in his debt-to-income calculation, making qualification easier.

Planning for future growth:

We’re already discussing cash-out refinance options so Michael can extract equity for property #2. We provide long-term partnership, not just one-time transactions.

For first-time investors building off-market deal sourcing strategies, we offer:

Fast pre-approvals – Be ready to act within 24-48 hours when off-market deals appear

Investment property expertise – We understand the unique challenges of off-market deal financing across multiple loan programs

Education on deal analysis – We help you understand how lenders evaluate properties so you make sound financial decisions on off-market deals

Flexible financing options – As you scale your off-market deal portfolio, we have programs that grow with you

Quick response times – Off-market deals move fast, and we move fast too

Partnership approach – We educate you on financing strategies that help you build wealth through off-market deals, not just push loans

Ready to start finding off-market deals through relationship building?

Get pre-approved so you’re ready to act when opportunities appear, or schedule a call to discuss financing strategies for your first investment property purchased through off-market deal networking.

Like Michael, your first off-market deal probably won’t come from Zillow—it will come from relationships you build in your local investing community. We help you be financially ready when those relationships produce opportunities.

Frequently Asked Questions About Off-Market Deals

- What exactly is an off-market deal and how is it different from MLS properties?

An off-market deal is a property that sells without being publicly listed on the Multiple Listing Service (MLS) or major real estate websites like Zillow or Realtor.com. These properties typically sell through direct relationships between buyers and sellers, often facilitated by investors, wholesalers, or agents specializing in off-market deals.

The key differences between off-market deals and MLS properties:

Competition: Off-market deals typically have few or no competing buyers, while MLS properties often receive multiple offers within days. This lack of competition often allows off-market deal buyers to negotiate better pricing and terms.

Timing: Off-market deals move faster because there’s no listing period, professional photography, or open houses required. Sellers choosing off-market deals usually prioritize speed and certainty over maximum price.

Pricing: Off-market deals are often priced below market value because sellers save on agent commissions and accept lower prices in exchange for convenience and quick closing.

Access: You can’t find true off-market deals through online searches—they come exclusively through personal relationships with wholesalers, other investors, agents, or property owners directly.

Michael’s off-market deal came through REIA networking, sold $40,000 below comparable MLS properties, and closed in 21 days without competition. This is typical of off-market deal transactions.

- How long does it typically take to find your first off-market deal through networking?

Michael’s timeline was four months of consistent REIA networking from first meeting to closing his off-market deal, but timeframes vary significantly based on several factors.

Factors affecting off-market deal timeline:

Networking consistency: Attending monthly meetings consistently (like Michael did) builds relationships faster than sporadic attendance. Most successful off-market deal investors attend every meeting for at least 3-6 months before seeing results.

Value provided: Investors who contribute to the community (like Michael’s website redesign) become memorable faster than those who only ask for deals.

Market conditions: In competitive markets with high demand, off-market deals move even faster once you find them. In slower markets, you may find opportunities more quickly but at different pricing.

Buy box specificity: Having specific criteria (like Michael’s detailed buy box) makes it easier for people to remember you and send relevant off-market deals your way.

Network size: Larger real estate investing associations with 100+ active members generate more off-market deal flow than smaller groups with 20-30 members.

Realistic expectations for finding your first off-market deal:

- 0-2 months: Building relationships, learning market, defining buy box criteria

- 3-4 months: First potential off-market deals appearing, likely not right fits

- 4-6 months: Higher quality off-market deals matching criteria

- 6-12 months: Closing first off-market deal for most consistent networkers

“I attended REIA for four months before finding my off-market deal, but I was building relationships the entire time,” Michael said. “If you’re going to networking events expecting immediate results, you’ll be disappointed. Think 6-12 month timeline realistically.”

The investors who find off-market deals fastest are those who commit to consistency regardless of immediate results.

- Do off-market deals always require 25% initial capital, or are there lower options?

Michael’s off-market deal required 25% initial capital ($71,250) because he used a conventional investment property loan, which is standard for non-owner-occupied properties with excellent credit.

However, several financing options allow lower initial capital on off-market deals:

Lower initial capital financing strategies:

House hacking with FHA loan (3.5% initial capital):

Purchase a 2-4 unit property as your primary residence using an FHA loan, live in one unit, and rent the others. You can often find small multifamily off-market deals through the same REIA networking.

Example: $300,000 duplex with 3.5% FHA = $10,500 initial capital

VA loan for veterans (0% initial capital):

Veterans and active military can purchase properties with VA loans requiring zero upfront capital. While primarily for primary residences, you can house hack a multifamily property or later convert it to rental after moving.

Conventional primary residence (5-10% initial capital):

Purchase an off-market deal as your primary residence with conventional financing requiring 5-10% initial capital, live in it for at least a year, then convert to rental when you purchase your next primary residence.

Seller financing (negotiated terms):

Some off-market deal sellers are willing to provide financing directly, allowing you to negotiate initial capital percentage, terms, and interest rates. This works best when sellers own properties free and clear.

Example: $285,000 off-market deal with seller carrying $240,000 note at 6% interest, buyer provides $45,000 (15.8%) initial capital

Partnerships (split initial capital requirement):

Partner with another investor to split the required initial capital and jointly purchase off-market deals. Each partner might contribute 12.5% instead of 25% solo.

DSCR loans (variable initial capital, typically 20-25%):

DSCR loans qualify based on property cash flow rather than personal income and typically require 20-25% initial capital. Useful for off-market deal investors who are self-employed or have complex income.

“I used conventional 25% initial capital because I had stable W-2 income and good credit,” Michael said. “But I know investors who found off-market deals and used FHA house-hacking with only 3.5% initial capital. Explore options based on your situation.”

- How do I find local REIA meetings and real estate investing groups in my area?

Finding quality real estate investing associations where off-market deals are shared is essential for building your network.

Resources for finding REIA meetings and investment groups:

National REIA website: Visit nationalreia.org and use their “Find a Local REIA” search tool. This database includes hundreds of affiliated real estate investing associations across the United States.

Meetup.com: Search for “real estate investing,” “rental property,” or “off-market deals” in your city on Meetup.com. Many cities have multiple investing groups meeting monthly.

Facebook groups: Search Facebook for “[Your City] Real Estate Investing” or “[Your City] Rental Property Investors.” Many groups announce monthly meeting schedules and off-market deal opportunities.

BiggerPockets local forums: The BiggerPockets website has local forums for most major markets where investors share information about meetings, events, and off-market deal networking opportunities.

Ask local agents and investors: Real estate agents specializing in investment properties usually know which REIA meetings are most active. Ask agents, property managers, or investors you meet where they network for off-market deals.

Google search: Search “[Your City] real estate investors association” or “[Your City] REIA meeting” to find local groups.

What to look for in quality REIA meetings for off-market deals:

Meeting size: Groups with 50-100+ attendees typically have more off-market deal flow than small groups with 10-20 members.

Active investors: Best meetings have experienced investors actively purchasing properties, not just beginners or people selling courses.

Networking time: Meetings should include dedicated networking time, not just presentations. Off-market deals come from relationships built during networking.

Local focus: Groups focused on your specific local market (not national strategies) provide better off-market deal opportunities and relevant market information.

Regular schedule: Monthly meetings on consistent schedule (like third Thursday every month) make it easy to commit to consistent attendance.

Wholesaler attendance: Meetings where wholesalers share off-market deals with the group tend to have higher deal flow than meetings focused only on education.

“I found Austin REIA through Google search and visited once to see if it was legitimate,” Michael said. “After seeing 100+ investors, experienced presenters, and active off-market deal discussions, I committed to attending every month. Visit a few meetings before deciding which group to commit to long-term.”

- What if the seller’s asking price on an off-market deal is too high? How do I negotiate without offending them?

Michael faced exactly this situation—the seller initially thought his property was worth $370,000 when comparable sales showed $330,000-$338,000 market value. Here’s his approach to negotiating off-market deals respectfully:

Professional negotiation strategies for off-market deals:

Step 1: Prepare objective data

Create a simple one-page comparable sales analysis showing:

- 3-5 recent sales of similar properties

- Photos and addresses of each comparable

- Sale prices and price per square foot

- Condition notes and key features

- Map showing locations relative to subject property

“I showed the seller clear evidence rather than just saying ‘Your price is too high,'” Michael said. “Data is less personal than opinions.”

Step 2: Lead with understanding

Begin negotiations by acknowledging the seller’s perspective and situation before discussing price:

“I understand you were thinking around $370,000 based on online estimates. I’d like to share the recent comparable sales I researched in your neighborhood so we’re both working from the same market data.”