College Savings vs Home Down Payment: How to Balance Both Financial Goals

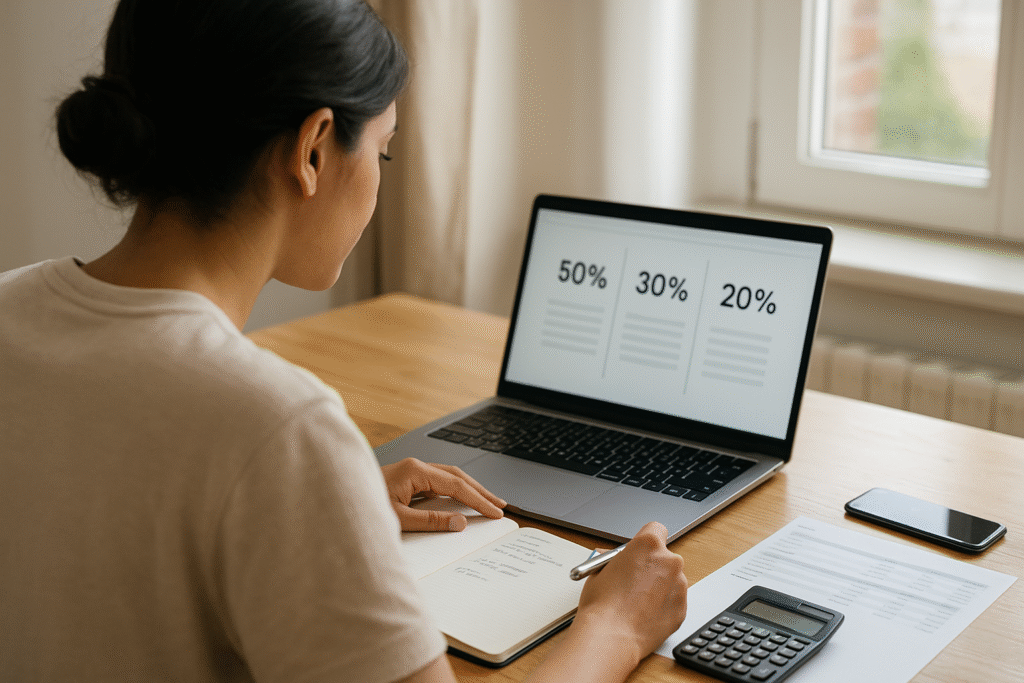

Whether you’re a parent planning for your child’s future or a young adult mapping your own path, one question keeps coming up: Should you prioritize college savings or a home down payment? The answer isn’t either/or—it’s both, with the right strategy.