Mortgage Broker Fees: Why We Work With 300+ Lenders (Transparent Pricing)

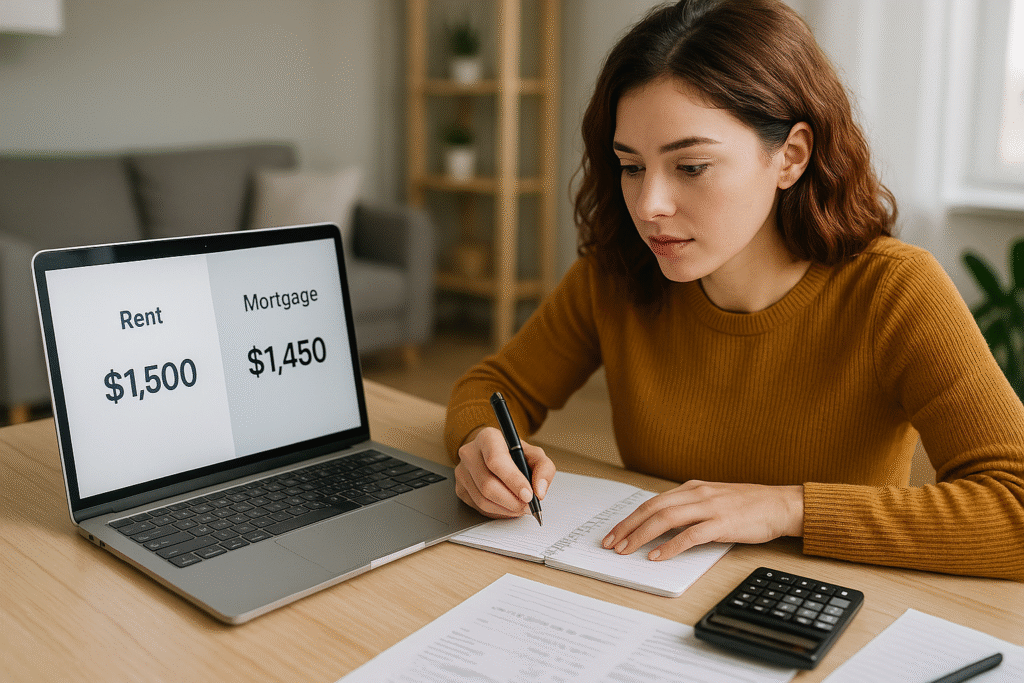

Mortgage broker fees create more confusion and hesitation than almost any other aspect of homebuying. Borrowers worry they’re paying extra for broker services, or that hidden fees will appear at closing. This confusion often drives people toward banks—even when broker pricing would save them money.