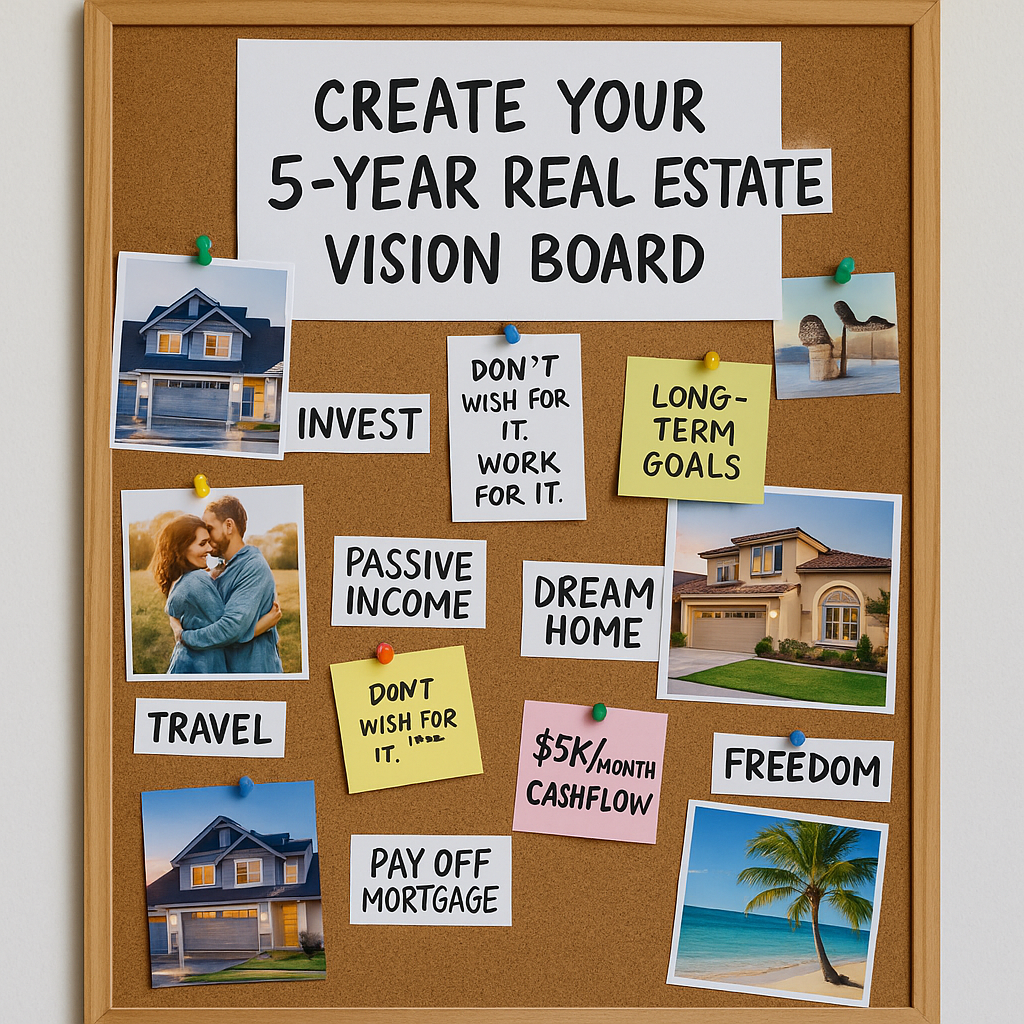

Cash Out Refinance vs HELOC: Which Equity Access Strategy Is Right for You?

You’ve built equity in your home—congratulations. But now you’re facing a choice that feels more complicated than it should be: cash-out refinance or HELOC? Both let you tap into that equity, but they work in fundamentally different ways. Choose wrong, and you could pay thousands more in interest or lock yourself into the wrong financial structure for your needs.