Charitable Remainder Annuity Trust: Create Income Now, Give to Charity Later

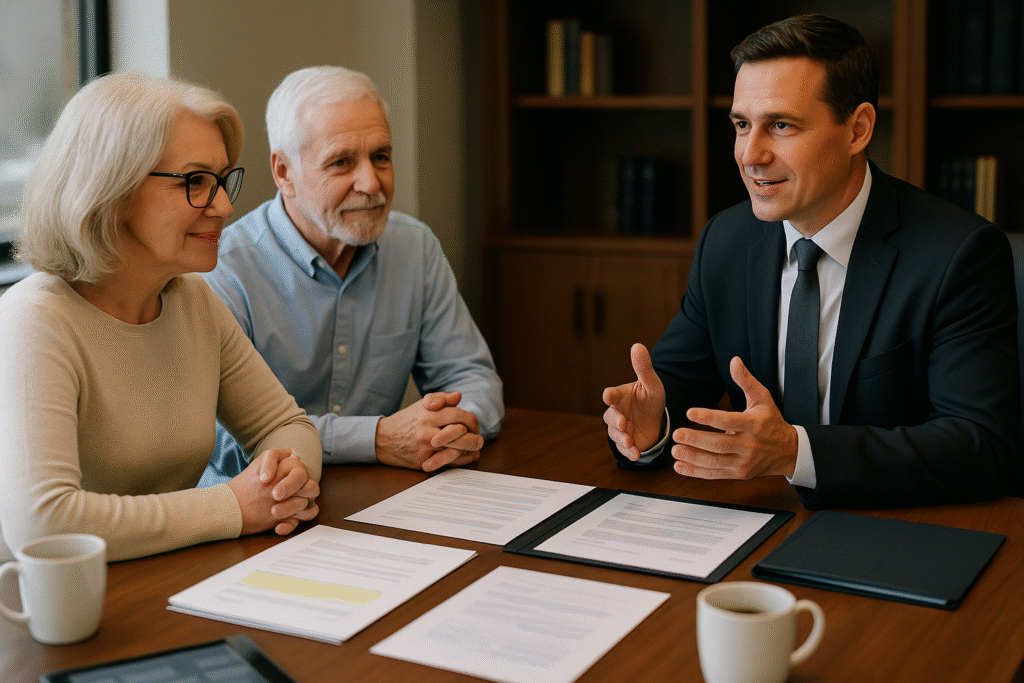

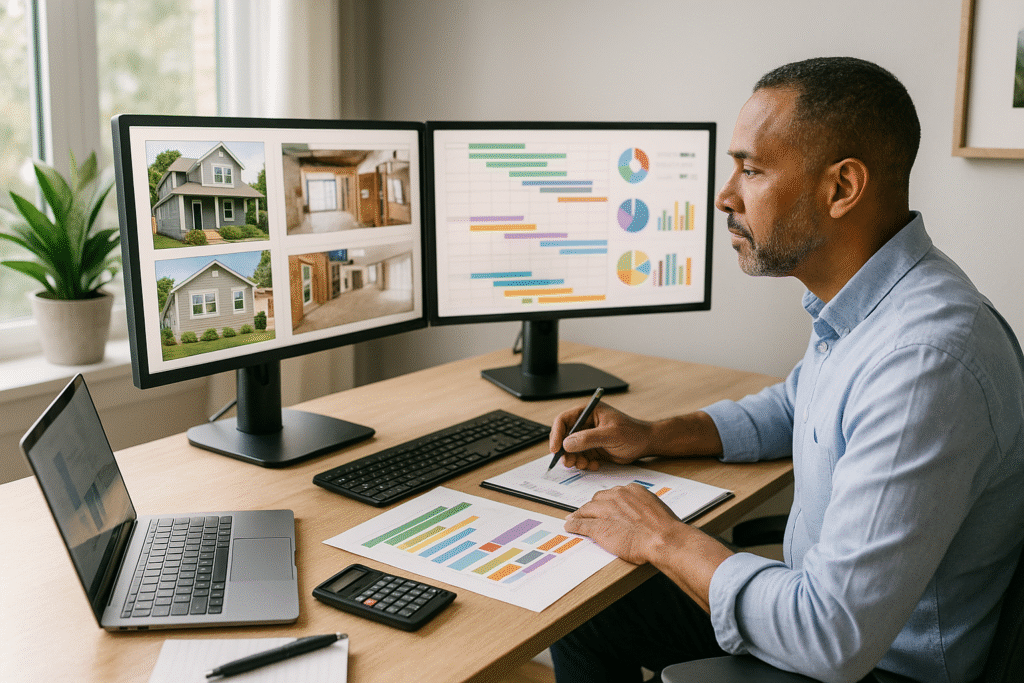

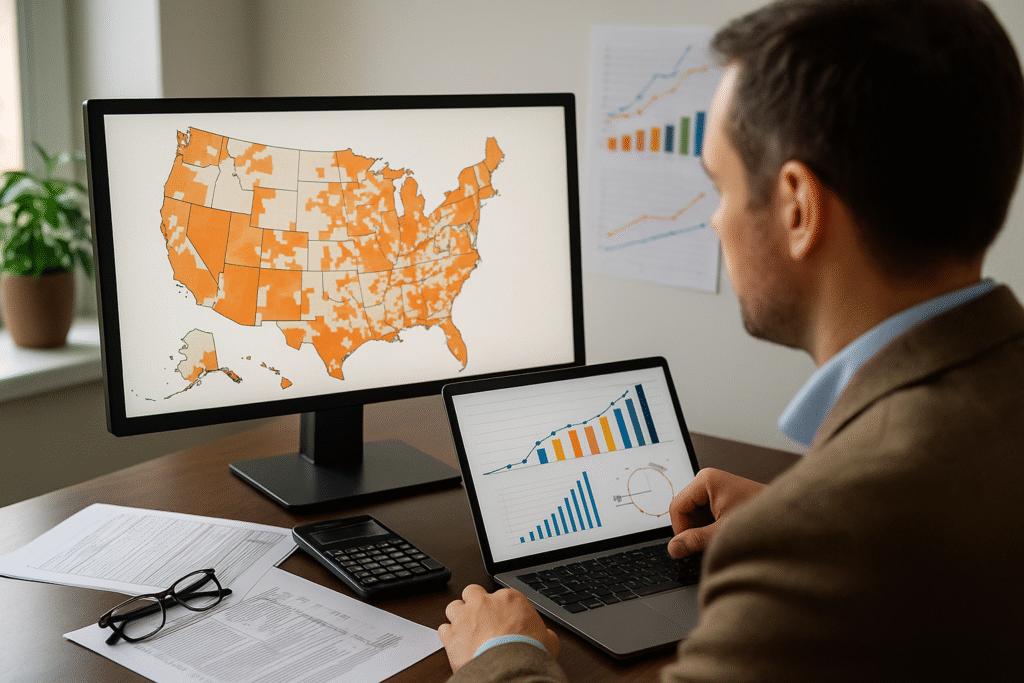

You own highly appreciated real estate purchased decades ago for $200,000 now worth $2,000,000. Selling triggers $450,000+ in capital gains taxes, consuming nearly 25% of your equity before you see a dollar. A charitable remainder annuity trust converts this appreciated property into guaranteed lifetime income—tax-free—while providing immediate six-figure tax deductions and fulfilling philanthropic goals you’ve held for years.