Property Management For Landlords: Complete Comprehensive Guide

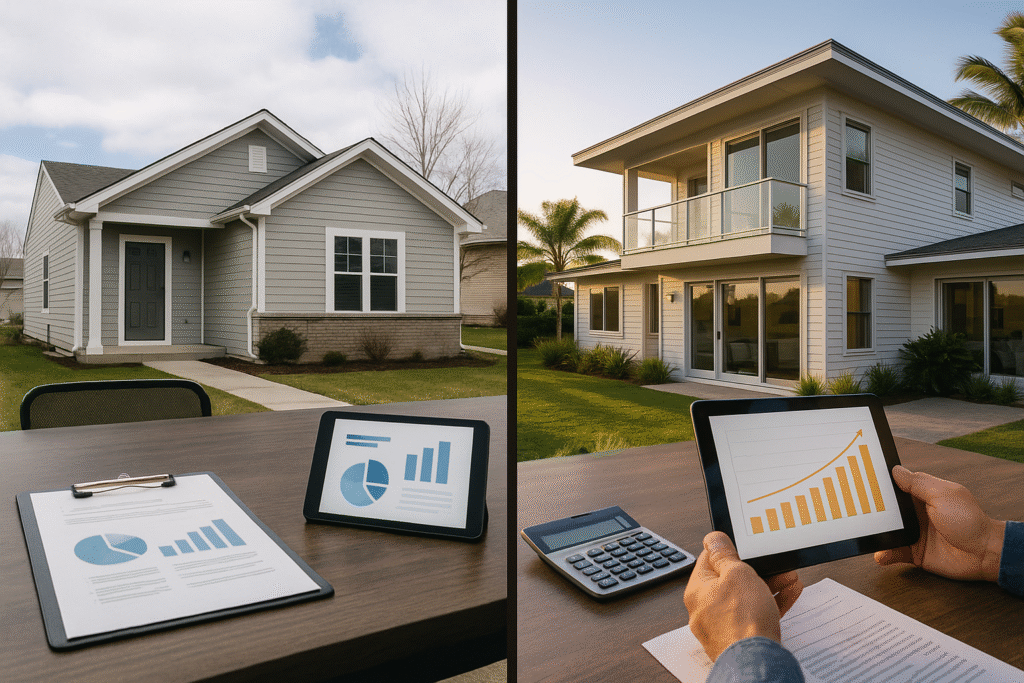

Managing rental properties requires balancing tenant satisfaction, property maintenance, and financial performance while navigating complex legal requirements. Whether you oversee a single rental unit or manage multiple properties, understanding property management for landlords transforms overwhelming responsibilities into systematic operations.