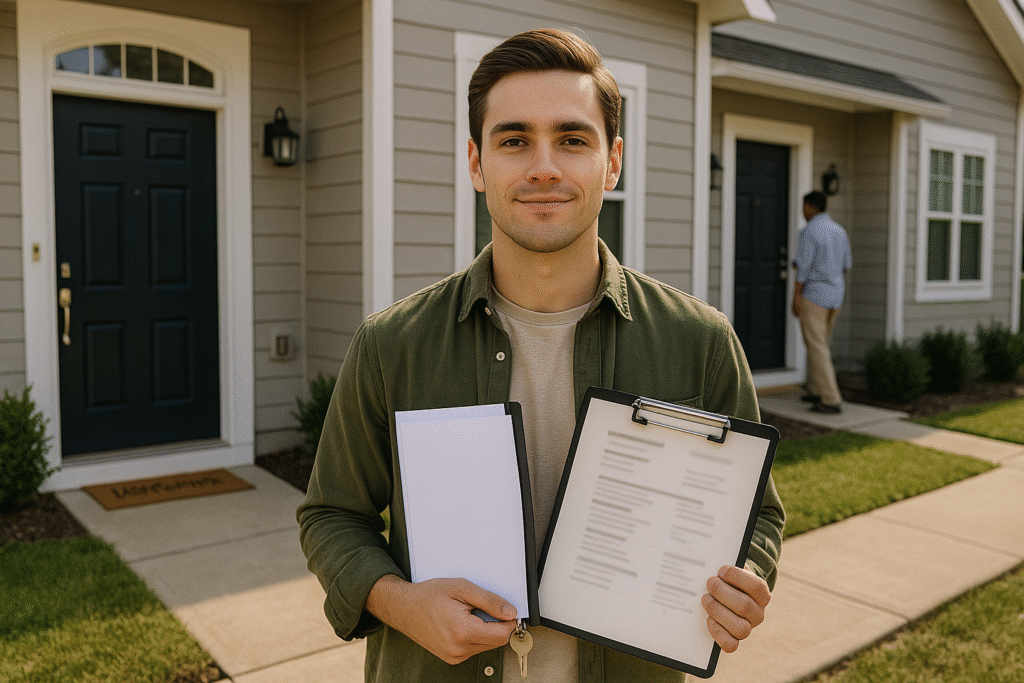

Appraisal When Buying a House: What Happens and How to Prepare Before It’s Too Late

You’ve found the perfect home. Your offer was accepted. You’ve made it through inspections. You’re weeks from closing and mentally decorating your new space. Then comes the appraisal—and suddenly everything stops. The appraiser says the home isn’t worth what you offered to pay.