How to Remove PMI: Your Complete Guide to Eliminating Mortgage Insurance

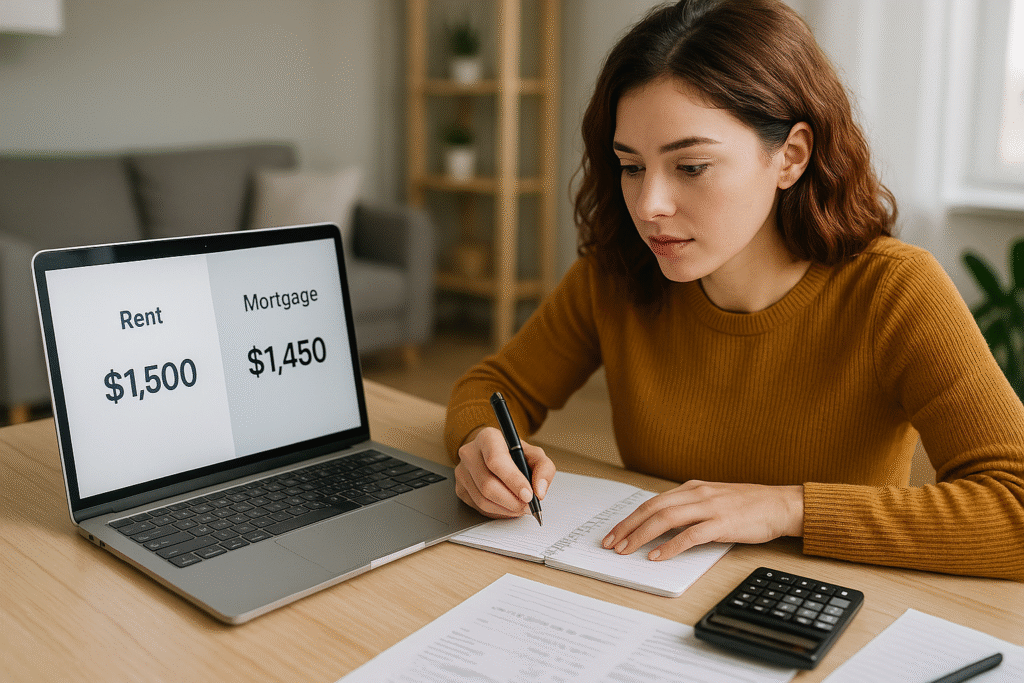

Your monthly mortgage payment includes more than just principal and interest. For many homeowners, private mortgage insurance adds a substantial cost that doesn’t build equity or provide any direct benefit to you. Understanding how to remove PMI can save you hundreds each month and thousands over the life of your loan.