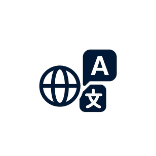

Moving Out of State: How to Handle Your Mortgage and Property Strategically

Moving out of state represents one of life’s major transitions—new job opportunities, family considerations, lifestyle changes, or career advancement pulling you to a different location. But unlike renters who simply give notice and leave, homeowners face complex financial decisions with long-term consequences.