Applying for a Mortgage: What to Expect at Stairway Mortgage

- By Jim Blackburn

- on

- Buy A House, First-Time Home Buyer, Mortgage Preapproval, Stairway Mortgage, Stairway Process

Applying for a mortgage doesn’t have to be overwhelming — especially when you know what to expect.

At Stairway Mortgage, we simplify the process so you feel confident every step of the way.

Whether you’re a first-time buyer or a seasoned investor, here’s everything you need to know to get started with ease.

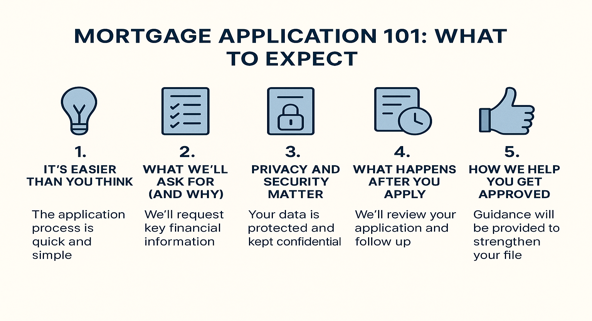

1. It’s Easier Than You Think

Let’s clear this up:

You don’t need perfect credit. You don’t need a giant down payment. You don’t even need all your paperwork upfront.

You just need to begin.

Our application process is secure, mobile-friendly, and takes about 10 minutes to complete. After that, we’ll walk you through the rest.

Before you apply, see what you might qualify for. Calculate your Conventional Purchase Loan Payment now to understand potential loan amounts and monthly payments based on different income and debt scenarios.

2. What We’ll Ask For (and Why)

To match you with the best loan — and get you preapproved fast — we’ll ask for:

- Income Info: W-2s, pay stubs, or 1099s

- Asset Info: Bank statements or retirement account balances

- Credit Check: We’ll run it — you don’t need to

- Personal Info: ID, address history, and employment details

We don’t collect anything we don’t need. No fluff, no digging.

If you’re self-employed or have non-traditional income, we specialize in creative documentation. Calculate your DSCR Investment Purchase Loan Payment now to explore investor-focused loans that qualify based on property income rather than personal tax returns.

3. Privacy and Security Matter

Our application portal uses bank-level encryption to protect your data.

We don’t share your information with anyone outside the loan process — and we’ll never sell your contact info. Ever.

4. What Happens After You Apply

Once you submit your application:

- We review your file within 24 hours

- One of our Mortgage Advisors reaches out to confirm details

- You receive a custom mortgage plan based on your goals

- We walk you through loan options and next steps

This isn’t just data entry — this is the beginning of your custom-built mortgage journey.

Want to understand the complete process from application to closing? Visit our Buy a House page for comprehensive resources about what happens at each stage of your mortgage journey.

5. How We Help You Get Approved

If anything on your file needs improvement (credit score, document gaps, debt ratio), don’t worry — we’ll show you how to fix it fast.

We’re not here to judge. We’re here to help you win.

If you have credit or income challenges, explore flexible loan options. Calculate your FHA Purchase Loan Payment now to see how FHA’s more lenient requirements might help you qualify when conventional loans won’t.

Still In Learning Mode?

At Stairway Mortgage, we make the application process simple, secure, and stress-free.

📘 Download our homebuyer guides to prepare your documents.

🧮 See what you qualify for with our Conventional Purchase Calculator.

🏠 Learn more on our Buy a House page.

📊 Check Current Rates before you apply.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call