Apply for Mortgage: Your Complete Step-by-Step Guide

Apply for Mortgage: Your Complete Step-by-Step Guide

Applying for a mortgage doesn’t have to feel overwhelming. Whether you’re buying your first home, refinancing to improve your terms, or accessing equity to build wealth, understanding how to apply for a mortgage gives you control and confidence.

Most people assume the mortgage application takes months and requires perfect credit. The reality? With the right preparation and guidance, you can get pre-approved in as little as one day and feel completely prepared for what comes next.

In this guide, you’ll discover:

- How the mortgage application process works from start to finish (according to CFPB consumer guidance)

- What documentation you’ll need to gather before you apply (following HUD FHA requirements)

- The difference between pre-qualification and pre-approval and why it matters

- How to choose the right loan program for your situation (based on Fannie Mae HomeReady guidelines)

- Timeline expectations from application to closing

Whether you’re exploring FHA loans with minimal down payment, VA loans with no down payment for veterans, USDA loans for rural properties, or conventional financing, the application process follows a similar path.

Questions about your situation? Schedule a call to speak with a loan advisor.

What Is a Mortgage Application?

A mortgage application is the formal process of requesting financing to purchase or refinance real estate. When you apply for a mortgage, you’re asking a lender to evaluate your financial situation and determine how much they’re willing to lend you and under what terms.

What form do you complete? The application itself uses the Uniform Residential Loan Application, also known as Form 1003 or “the ten-oh-three.” This standardized form collects information about:

- Your income and employment history

- Assets and savings

- Current debts and obligations

- Credit history

- The property you’re financing

The mortgage application isn’t just paperwork. It’s the beginning of a relationship with your lender and the foundation for one of the biggest financial decisions you’ll make. A strong application with complete documentation can mean the difference between getting approved quickly with favorable terms or facing delays and potential denial.

How is this different from pre-qualification? Pre-qualification is a quick, informal estimate based on information you provide verbally. A mortgage application is formal, verified, and legally binding. It triggers a credit check, income verification, and asset documentation review.

Whether you’re a first-time buyer applying for an FHA home loan or refinancing your existing property, understanding this process puts you in the driver’s seat.

Why Does the Mortgage Application Matter for Your Journey?

Establishes Your True Buying Power

Understanding exactly how much you can borrow removes the guesswork from your home search. When you apply for a mortgage and receive pre-approval, you know your budget with certainty.

What does this prevent? This keeps you from:

- Falling in love with properties outside your price range

- Shopping below what you can actually afford

- Wasting time on homes that won’t work financially

- Losing out to buyers with verified financing

Pre-approval also shows sellers and their agents that you’re a serious buyer with verified financing. In competitive markets, this can be the difference between having your offer accepted or rejected.

Opens Access to Hundreds of Loan Programs

When you apply for a mortgage through a broker like Stairway, you gain access to over 300 lenders and countless loan programs. This means you’re not limited to what one bank offers.

Which programs might you qualify for? Different loan programs serve different needs:

- FHA loans: Minimal down payment requirements

- VA loans: No down payment required for eligible veterans

- USDA loans: No down payment required for rural properties

- Conventional loans: Competitive rates for strong credit

- Jumbo loans: Financing above conventional limits

- Construction loans: Build your dream home

- Home improvement loans: Renovation financing

- Specialized programs: Self-employed loans, Bank statement loans, DSCR loans

The application process helps match you with the optimal program for your specific situation. You might discover you qualify for better terms than you expected, or find programs you didn’t know existed.

Ready to explore your options? Use our mortgage calculator to see how different scenarios work for your situation.

Starts Building Your Wealth Strategy

Every mortgage application represents an opportunity to build wealth through real estate. Whether you’re house hacking with a multi-unit FHA loan application, accessing equity through a cash-out refinance, or purchasing your first rental property, the application is where your wealth-building strategy becomes real.

How does proper preparation improve your terms? Understanding how to present your financial situation effectively can:

- Improve your interest rate

- Lower your closing costs

- Accelerate your path to building equity

- Position you for future investment opportunities

How Does the Mortgage Application Process Work?

The mortgage application follows a predictable sequence. Understanding each phase helps you prepare properly and avoid surprises.

Pre-Qualification: The Initial Discovery Phase

Pre-qualification happens before the formal application. You provide basic information about your income, assets, and debts to get a general idea of what you might qualify for.

How long does this take? This typically takes just minutes and requires no documentation. You can get pre-qualified over the phone or online with basic information.

Is this enough for house hunting? Pre-qualification gives you a ballpark figure for your home search but doesn’t carry much weight with sellers because it’s unverified. Think of it as a helpful starting point, not a commitment.

Pre-Approval: The Verified Application Phase

Pre-approval is the formal application process. You submit complete documentation and authorize the lender to verify everything.

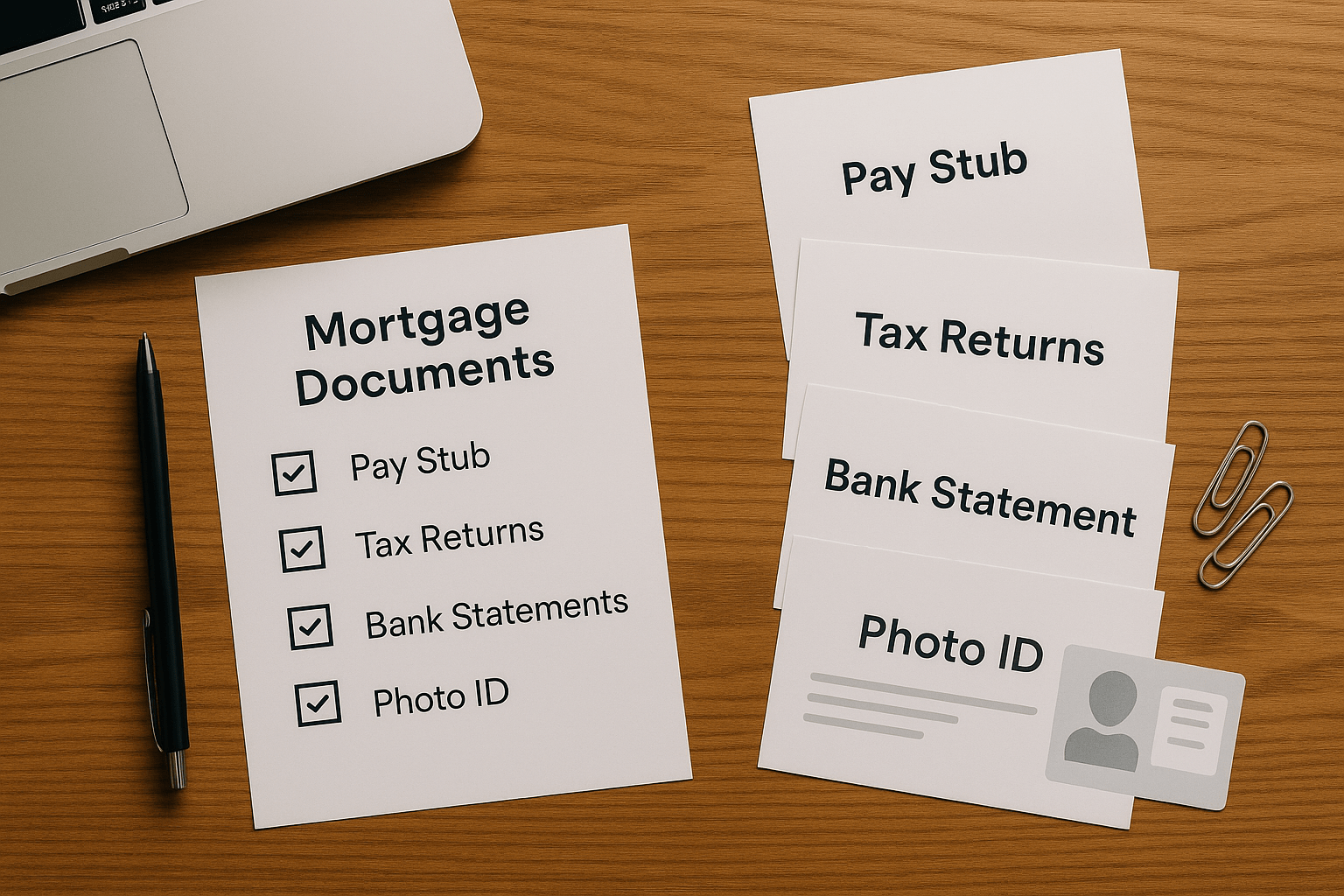

What documents do you need? You’ll provide:

- Pay stubs from the last 30 days

- Tax returns from the last 2 years

- Bank statements from the last 60 days

- Employment verification

- Photo ID and Social Security card

- Credit authorization

How long does verification take? Strong pre-approval typically takes one to three business days with complete documentation. At Stairway Mortgage, we can often deliver pre-approval within 24 hours when you provide complete documents.

Your lender verifies everything and issues a pre-approval letter stating the specific loan amount and program you qualify for. This letter is valid for 60-90 days and gives you serious negotiating power.

Property Selection and Purchase Agreement

Once pre-approved, you can shop for homes within your budget with confidence. When you find the right property, you’ll make an offer and enter into a purchase agreement.

What happens during this phase? Your real estate agent prepares an offer that includes:

- Purchase price

- Earnest money deposit

- Contingencies (including financing contingency)

- Closing timeline

- Any special terms or requests

The seller either accepts, rejects, or counters your offer. Once you reach agreement, the contract goes into escrow and your loan process advances.

Full Underwriting: The Detailed Review

After you’re under contract, your application goes to the underwriter for full review. This is where the lender verifies every detail and ensures the property meets their requirements.

What is the underwriter checking? The underwriting process examines:

- Your income stability and sufficiency

- Your credit history and payment patterns

- Your debt-to-income ratio

- The property’s value and condition

- Your asset reserves

- Any red flags or concerns

How long does underwriting take? Initial underwriting typically takes 2-5 business days. The underwriter may request additional documentation to clarify questions or concerns. These requests are normal and expected.

Conditional Approval and Clearing Conditions

The underwriter issues a conditional approval, which means you’re approved subject to meeting specific conditions.

What are typical conditions? Common conditions include:

- Updated pay stub closer to closing

- Explanation for recent large deposits

- Verification of gift funds

- Homeowners insurance policy

- Final walkthrough confirmation

- Updated credit report

You work with your loan officer to satisfy each condition. Some are automatic (like the final credit check), while others require your action.

Clear to Close and Final Review

Once all conditions are met, the underwriter issues a “clear to close.” This means your loan is fully approved and ready for closing.

What happens in the final days? Before closing:

- Final numbers are calculated

- Closing disclosure is prepared and sent to you

- You review all final documents

- Wire instructions are provided

- Closing is scheduled

You’ll receive your Closing Disclosure at least three business days before closing, giving you time to review all final costs and loan terms.

Closing: The Final Step

At closing, you sign all final documents, pay your down payment and closing costs, and receive the keys to your new property.

Who attends the closing? Typical attendees include:

- You (the buyer)

- The seller

- Both real estate agents

- The closing agent or attorney

- Sometimes the lender’s representative

The entire closing typically takes 60-90 minutes. You’ll sign numerous documents, receive disclosures, and complete the transaction.

Have questions about the process? Schedule a consultation to get personalized guidance.

Who Should Apply for a Mortgage?

Are You a First-Time Home Buyer?

First-time buyers often benefit most from understanding the application process early. When you apply for a house loan for the first time, you’re building the foundation for future real estate transactions.

What advantages do first-time buyers have? You may qualify for:

- Lower down payment requirements

- First-time buyer assistance programs

- Special loan programs like FHA with minimal down

- Down payment assistance grants

- Favorable underwriting guidelines

What if your credit isn’t perfect? FHA mortgage applications accept lower credit scores with appropriate down payments. Don’t assume you won’t qualify without checking.

Current Homeowners Seeking to Refinance

If you already own a home, you might apply for a mortgage to refinance and:

- Lower your monthly payment

- Reduce your interest rate

- Change your loan term

- Access equity for renovations or investments

- Remove a co-borrower after divorce

When does refinancing make sense? Generally, refinancing is worth considering when you can reduce your rate by at least half a percentage point, or when accessing equity serves a strategic purpose.

Veterans and Active Military Personnel

If you’re eligible for VA benefits, applying for a VA home loan offers unmatched advantages. The application process is streamlined for military members.

What makes VA loans special? Benefits include:

- No down payment requirement

- No private mortgage insurance

- Competitive interest rates

- Flexible credit guidelines

- Funding fee (can be financed)

Veterans can use their VA benefits multiple times throughout their lives, making this an excellent tool for building wealth through real estate.

Rural and Suburban Home Buyers

If you’re purchasing in an eligible rural or suburban area, applying for a USDA home loan can provide financing with no down payment required.

What areas qualify? USDA defines “rural” more broadly than most people think. Many suburban areas near major cities qualify. The application process verifies property eligibility.

Are there income limits? Yes, USDA mortgages include income limits based on your area and household size. However, these limits are generous and often higher than people expect.

Self-Employed and Business Owners

If you’re self-employed, your mortgage application may require additional documentation, but you absolutely can qualify. Options include:

- Traditional mortgage with full tax returns

- Bank statement loans based on deposits

- 1099 loans for contract workers

- Stated income programs in some cases

What’s the main challenge? Self-employed applicants often write off business expenses, which reduces their taxable income. Lenders may see lower income than what you actually earn, making qualification harder through traditional programs.

See yourself in these scenarios? Get pre-approved to start your journey.

What Are Common Scenarios for Mortgage Applications?

First-Time Buyer with Minimal Savings

Sarah, age 28 and working as a teacher, wanted to stop paying rent but had limited savings. She applied for an FHA home loan with minimal down payment and combined it with a local down payment assistance grant. Within 45 days, she owned her first home with minimal cash out of pocket.

Key takeaway: FHA loan applications accept low down payments, and when combined with assistance programs, can require very little upfront cash.

Veteran Transitioning to Civilian Life

Marcus, age 32 and recently separated from the Navy, applied for a VA mortgage loan to purchase his first home. Using his VA benefits, he bought a house with no down payment required and no mortgage insurance. His military service provided a financial advantage that accelerated his path to homeownership.

Key takeaway: Applying for a VA home loan leverages your military service for long-term financial benefit with no down payment requirement.

Homeowner Accessing Equity for Investment

Jennifer, age 45 and a small business owner, applied for a home equity line of credit to fund the down payment on her first rental property. She used the equity in her primary residence strategically to begin building passive income.

Key takeaway: Apply for home equity line of credit strategically to leverage existing assets for wealth building.

Rural Family Seeking Homeownership

The Rodriguez family, relocating for work, applied for a USDA mortgage loan in their eligible suburban area. Despite the area being just 25 minutes from a major city, it qualified as “rural” under USDA guidelines. They purchased with no down payment required.

Key takeaway: The USDA mortgage application process serves more areas than most people realize, including many suburban communities.

How Does Stairway Mortgage Make Applying for a Mortgage Easy?

Access to 300+ Lenders Through One Application

When you apply for a mortgage loan with Stairway, you’re not limited to one lender’s guidelines and programs. We submit your application to our network of over 300 lenders.

What does this mean for you? You get:

- Multiple loan options compared side-by-side

- Competition among lenders for your business

- Better rates and terms than direct lenders offer

- Specialized programs you won’t find at traditional banks

- One application, countless opportunities

How is this different from a bank? When you apply for a mortgage at a bank, you get what that bank offers. Period. With a broker, you get what 300+ lenders offer, and we help you choose the best fit. Learn more about mortgage brokers vs lenders.

Expert Guidance Through Every Step

The mortgage application can feel complex, especially for first-time buyers. Our loan advisors guide you through each phase.

What support do you receive? We help you:

- Gather the right documentation the first time

- Understand which loan program best fits your situation

- Prepare for underwriting questions

- Clear conditions quickly and efficiently

- Navigate challenges or complications

- Understand all your options before deciding

We’ve helped thousands of people successfully apply for mortgage loans across every journey stage. See real success stories. Your success is our priority.

Fast Pre-Approval Within 24 Hours

Time matters in real estate. When you find the right property, you need to move quickly. Our streamlined process delivers pre-approval within 24 hours when you provide complete documentation.

Why does speed matter? In competitive markets:

- Properties receive multiple offers

- Sellers favor buyers with verified financing

- Delays can cost you your dream home

- Fast response shows you’re serious

We make the mortgage app process efficient without cutting corners on quality or accuracy. Get started with pre-approval.

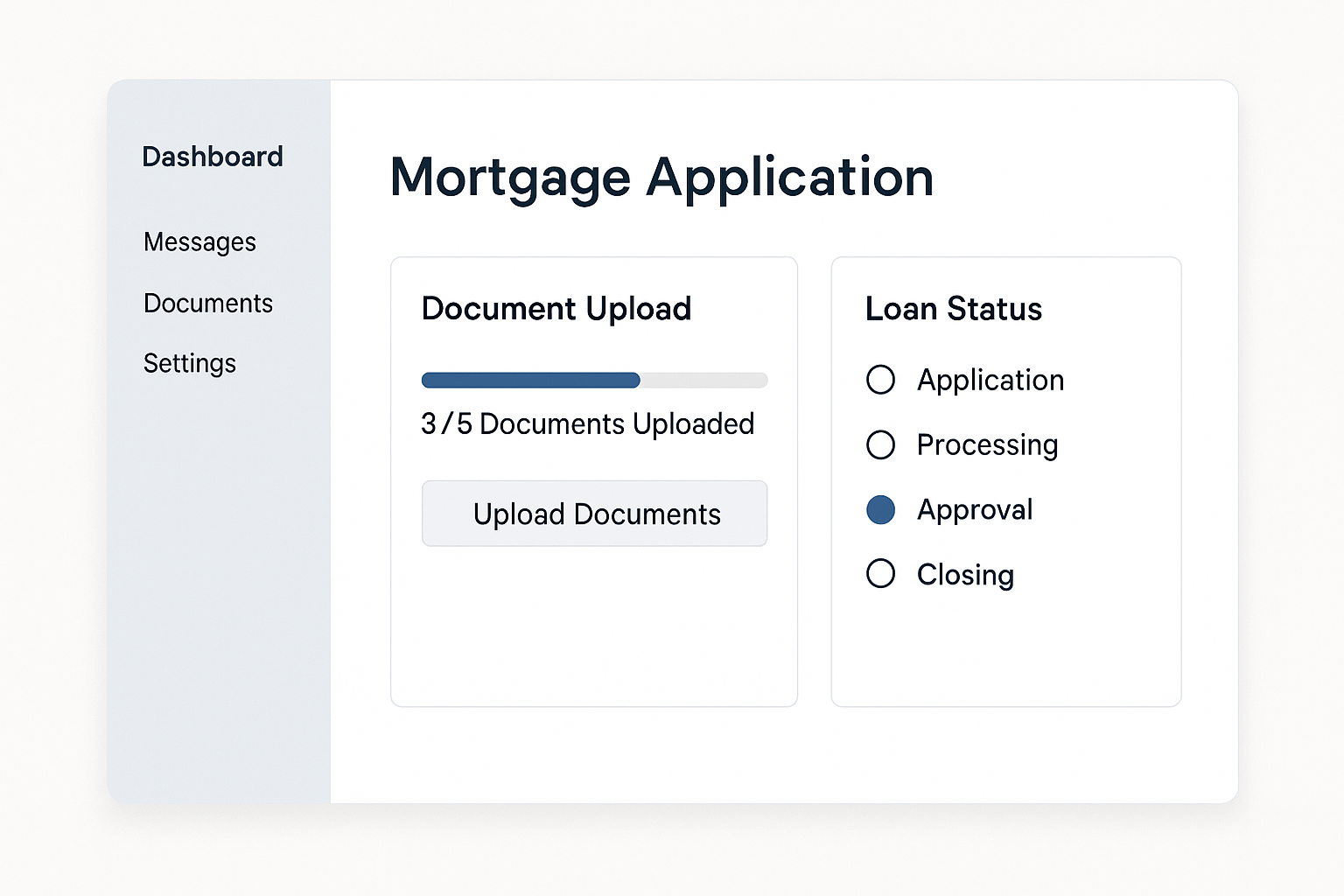

Technology That Simplifies the Process

Apply for a mortgage online through our secure platform. Upload documents digitally, track your application status in real-time, and communicate with your loan officer through your preferred channel.

What makes our technology different? Our platform:

- Securely stores your documents

- Sends automated reminders for needed items

- Provides real-time status updates

- Connects you directly with your loan officer

- Works seamlessly on mobile devices

Whether you prefer applying for a mortgage loan online or working with someone directly, we accommodate your style. Schedule a call to discuss your preferences.

Ready to get started? Use our loan calculators to explore different scenarios.

What Documents Do You Need to Apply for a Mortgage?

Income Verification Documents

Your income documentation proves you can afford the monthly mortgage payment. See how much you can afford.

What do W-2 employees need?

- Last 2 years of W-2 forms

- Last 30 days of pay stubs

- Employment verification (we handle this)

- Year-to-date earnings statement

What do self-employed applicants need?

- Last 2 years of personal tax returns (complete)

- Last 2 years of business tax returns (if applicable)

- Profit and loss statement (year-to-date)

- Business license or proof of business existence

- CPA letter (in some cases)

What if you have rental income? If you own investment properties:

- Last 2 years of tax returns showing rental income

- Current lease agreements

- Proof of security deposits held

Self-employed? Consider bank statement loans or 1099 loans as alternatives.

Asset Verification Documents

Lenders verify you have funds for down payment, closing costs, and reserves. Use our calculator to estimate what you’ll need.

What bank documentation is required?

- Last 60 days of bank statements (all pages)

- Investment account statements (stocks, bonds, retirement)

- Documentation of gift funds (if applicable)

- Proof of sold assets (if using proceeds)

What if you’re receiving gift funds? For gift money from family:

- Gift letter stating the funds are a gift, not a loan

- Donor’s bank statement showing funds

- Paper trail showing transfer of funds

How much in reserves do you need? Reserve requirements vary by loan program:

- Primary residence: Often 2 months

- Investment property: Often 6 months

- Multiple properties: Higher reserves required

Need help understanding reserves? Schedule a consultation with our team.

Credit and Identity Documents

Basic identification and credit authorization are straightforward but essential.

What identity documents do you provide?

- Government-issued photo ID (driver’s license or passport)

- Social Security card

- Credit authorization form

What if you don’t have a Social Security number? Alternative documentation loans exist:

- ITIN loans for tax ID holders

- Foreign national loans for international buyers

Questions about your situation? Get a local introduction to discuss your options.

Property-Related Documents

Once you’re under contract, you’ll need property-specific documentation.

What property documents are needed?

- Fully executed purchase agreement

- Property appraisal (ordered by lender)

- Homeowners insurance quote

- HOA documents (if applicable)

- Condo questionnaire (for condos)

Who orders the appraisal? Your lender orders the appraisal, but you pay for it. The appraiser is independent and ensures the property value supports the loan amount.

Ready to start the process? Get pre-approved today.

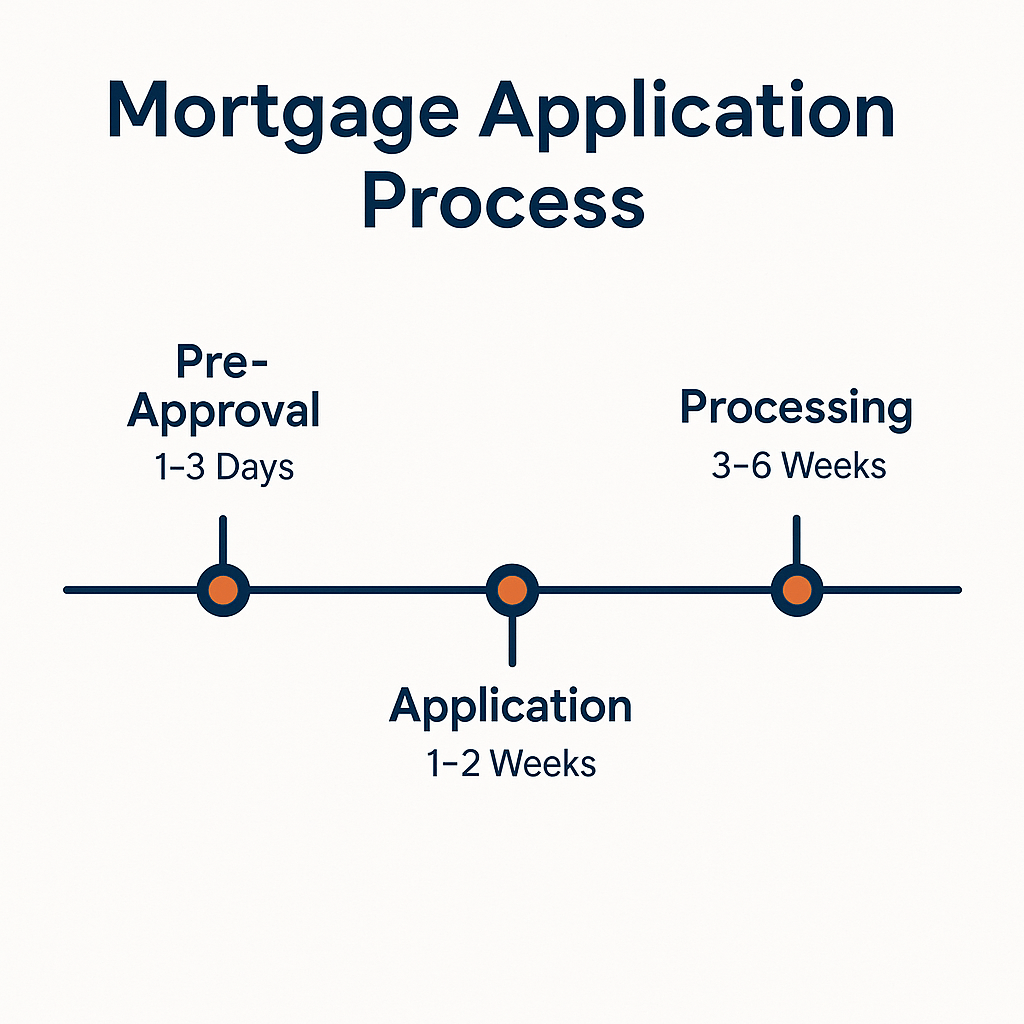

How Long Does the Mortgage Application Process Take?

Pre-Approval Timeline

How fast can you get pre-approved? With complete documentation:

- Immediate submission: Same day

- Initial review: 1-2 business days

- Full pre-approval: 1-3 business days

What slows down pre-approval? Common delays include:

- Missing documentation

- Incomplete bank statements

- Unclear income sources

- Credit issues requiring explanation

Want fast pre-approval? Apply now with complete documents for fastest processing.

From Application to Closing

What’s the typical timeline? For a purchase:

- Pre-approval: 1-3 days

- Home shopping: Varies widely

- Under contract to closing: 30-45 days

- Rush closings: Possible in 15-21 days

What’s the typical refinance timeline? For refinancing:

- Application to closing: 30-45 days

- Streamline refinances: Sometimes faster

- Cash-out refinances: Similar to purchases

What factors affect closing speed? Timeline depends on:

- Your documentation completeness

- Property type and condition

- Appraisal scheduling

- Underwriting workload

- Any complications discovered

Considering refinancing? Start a refinance inquiry to explore your options.

Still have questions? Schedule a call with a loan advisor.

What Can Slow Down Your Mortgage Application?

Documentation Issues

What are the most common problems?

- Incomplete bank statements (missing pages)

- Expired pay stubs (need recent ones)

- Unclear deposits requiring explanation

- Missing tax return schedules

- Outdated employment verification

How can you avoid these delays? Provide:

- Complete documents (all pages)

- Recent documents (within required timeframes)

- Explanations for unusual items proactively

- Everything requested in one batch

Need help gathering documents? Schedule a call and we’ll guide you through the checklist.

Credit Challenges

What credit issues cause delays?

- Recent late payments requiring explanation

- Collections requiring resolution

- Judgments or liens on credit report

- High debt-to-income ratio

- Recent credit inquiries

Can you still qualify with credit issues? Often yes, but you’ll need:

- Letters of explanation

- Proof of resolution

- Payment history showing improvement

- Sometimes larger down payment

Concerned about your credit? Take our discovery quiz to find the right loan program for your situation.

Employment Changes

What employment situations create complications?

- Changing jobs during the process

- Starting self-employment recently

- Gaps in employment

- Switching from W-2 to 1099

- Commission-based income variations

Should you avoid changing jobs? Ideally, maintain employment stability from application through closing. If you must change jobs, discuss with your loan officer immediately.

Recently became self-employed? Explore self-employed loan options.

Large Deposits or Withdrawals

Why do large transactions matter? Lenders must verify that:

- Your down payment isn’t borrowed money

- Large deposits are from acceptable sources

- Your funds are properly seasoned

- Withdrawals don’t impact your reserves

What should you avoid during the process?

- Don’t make large purchases on credit

- Don’t transfer money between accounts unnecessarily

- Don’t accept cash deposits

- Don’t co-sign loans for others

Have questions about a specific transaction? Get guidance from our team before taking action.

Frequently Asked Questions About Applying for a Mortgage

How Much Income Do I Need to Qualify?

Income requirements vary by loan program and your debt obligations. Lenders calculate your debt-to-income ratio by dividing your monthly debts by your gross monthly income.

What’s an acceptable debt-to-income ratio? General guidelines:

- Conventional loans: Up to 45-50%

- FHA loans: Up to 56.9%

- VA loans: No strict limit (case-by-case)

- USDA loans: Up to 43%

Your income must be stable and verifiable. Most programs require two-year employment history, though some accept less with strong compensating factors.

Can I Apply for a Mortgage With Bad Credit?

Yes, you can qualify for a mortgage with less-than-perfect credit. FHA qualification requirements accept lower credit scores with appropriate down payments.

What credit score do you need? Minimum scores vary:

- FHA loans: More flexible credit requirements

- VA loans: No strict minimum (lender guidelines apply)

- USDA loans: Good credit preferred

- Conventional loans: Strong credit typically required

How can you improve your chances? Steps to strengthen your application:

- Pay down credit card balances

- Resolve collections or charge-offs

- Avoid new credit applications

- Build payment history

- Provide strong compensating factors

How Much Down Payment Do I Need?

Down payment requirements vary significantly by loan program. The FHA loan application requires just 3.5% down for qualified buyers.

What are typical down payments? By program:

- FHA: Minimal down payment options available

- VA: No down payment required (eligible veterans)

- USDA: No down payment required (eligible areas and income)

- Conventional: Low down payment options for first-time buyers

- Investment properties: Higher down payment typically required

Can you use gift funds? Yes, most programs allow gifted down payments from family members. You’ll need proper documentation of the gift.

Should I Get Pre-Qualified or Pre-Approved?

Always get pre-approved if you’re serious about buying. Pre-qualification is an informal estimate, while pre-approval is verified and carries weight with sellers.

What’s the difference?

- Pre-qualification: Informal, unverified, takes minutes

- Pre-approval: Formal application, verified documentation, takes days

When should you get pre-approved? Before you start seriously shopping for homes. This gives you:

- Accurate budget knowledge

- Negotiating power

- Faster closing capability

- Seller confidence

How Does Self-Employment Affect My Application?

Self-employment adds documentation requirements but doesn’t prevent qualification. You’ll need to provide business tax returns and profit-and-loss statements.

What documentation do self-employed borrowers provide?

- Personal tax returns (2 years)

- Business tax returns (2 years if applicable)

- Year-to-date P&L statement

- Business license or registration

- CPA letter (sometimes)

Are there easier options? Alternative documentation programs include:

- Bank statement loans (based on deposits)

- 1099 loans (for contract workers)

- Asset-based loans (for high-net-worth individuals)

Ready to continue? Get pre-approved to start your journey.

NEXA Mortgage: The Technology Infrastructure Behind Seamless Applications

Stairway Mortgage operates as a division of NEXA Mortgage, one of the nation’s largest and fastest-growing mortgage companies. This partnership provides us with the infrastructure, technology systems, and lending capacity that enable efficient mortgage application processing across all loan types. NEXA’s robust platform combines advanced digital tools with experienced underwriting teams, allowing us to deliver fast preapprovals and streamlined closings while maintaining access to our network of hundreds of wholesale lenders. Whether you’re applying for your first home loan or your tenth investment property, this operational backbone ensures your application moves smoothly from submission to approval.

Also Helpful for All Home Buyers

Learn more about related mortgage topics:

- Mortgage Pre-Approval – Understand the pre-approval process in detail

- Mortgage Broker vs Lender – Learn why working with a broker gives you more options

- Best Mortgage Company – Discover what makes a mortgage company excellent

- FHA Loan – See a real success story with FHA financing

- VA Loan – Learn how veterans benefit from VA loans

What’s “NEXA” in Your Mortgage Journey?

After understanding how to apply for a mortgage, explore these related topics:

- For First-Time Buyers: Learn about down payment assistance programs that can reduce your upfront costs

- For Refinancing: Discover cash-out refinance options to access your home equity

- For Investors: Explore DSCR loans that qualify based on property income

- For Self-Employed: Check out bank statement loans that use deposits instead of tax returns

Explore Your Complete Options

Ready to see everything available to you? Browse our comprehensive resources:

- All Loan Programs – Explore every loan type we offer

- All Calculators – Run numbers on different scenarios

- All Case Studies – See real success stories from people like you

- Discovery Quiz – Find your ideal loan program in minutes

- Get Local Introductions – Connect with our local partners

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.