Construction To Permanent Loan: Everything You Need to Know About Financing Options

Construction To Permanent Loan: Everything You Need to Know About Financing Options

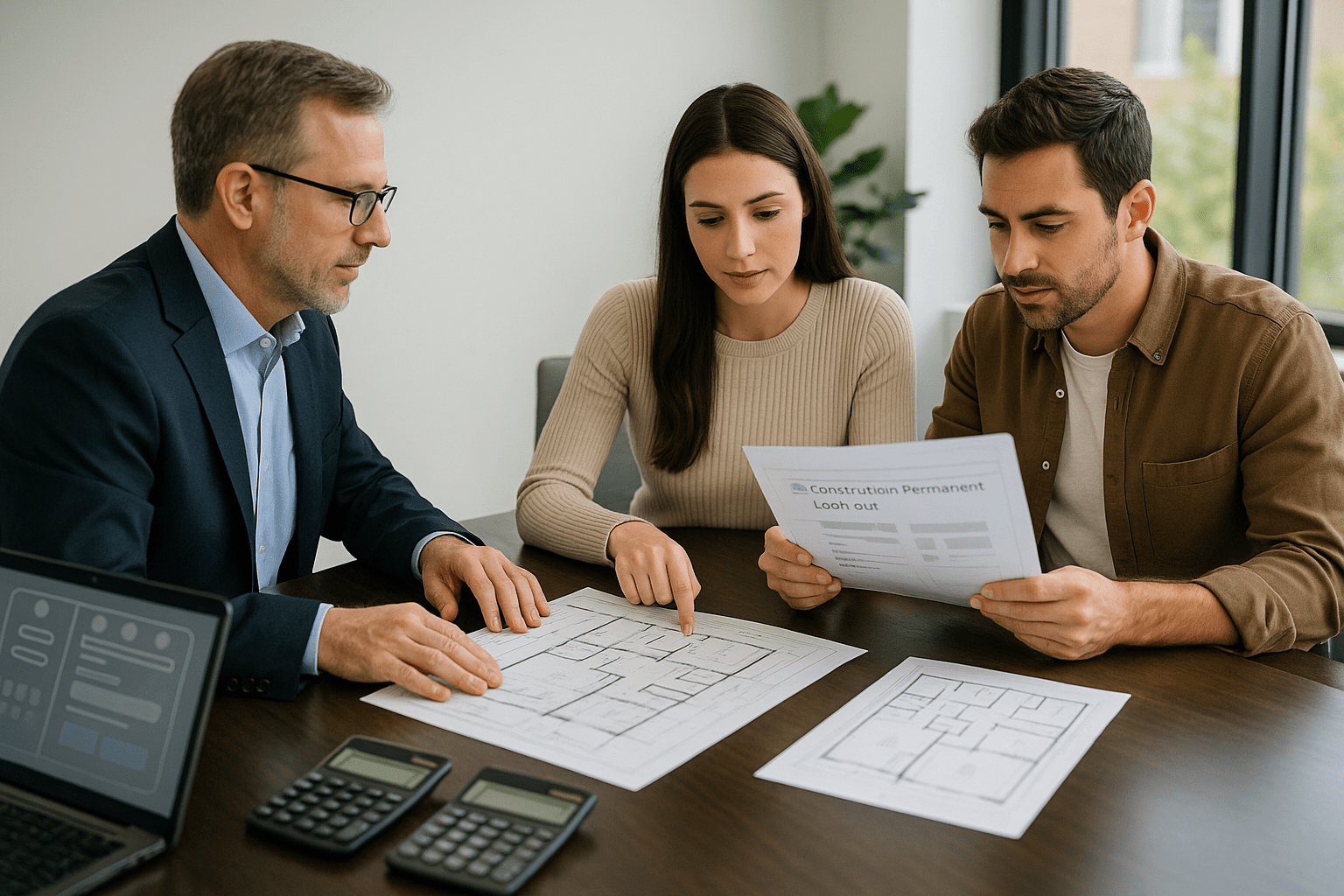

Building a custom home should feel like bringing your vision to life—not drowning in paperwork for two separate loans. Construction to permanent loan financing changes the game by combining construction and mortgage into one streamlined process.

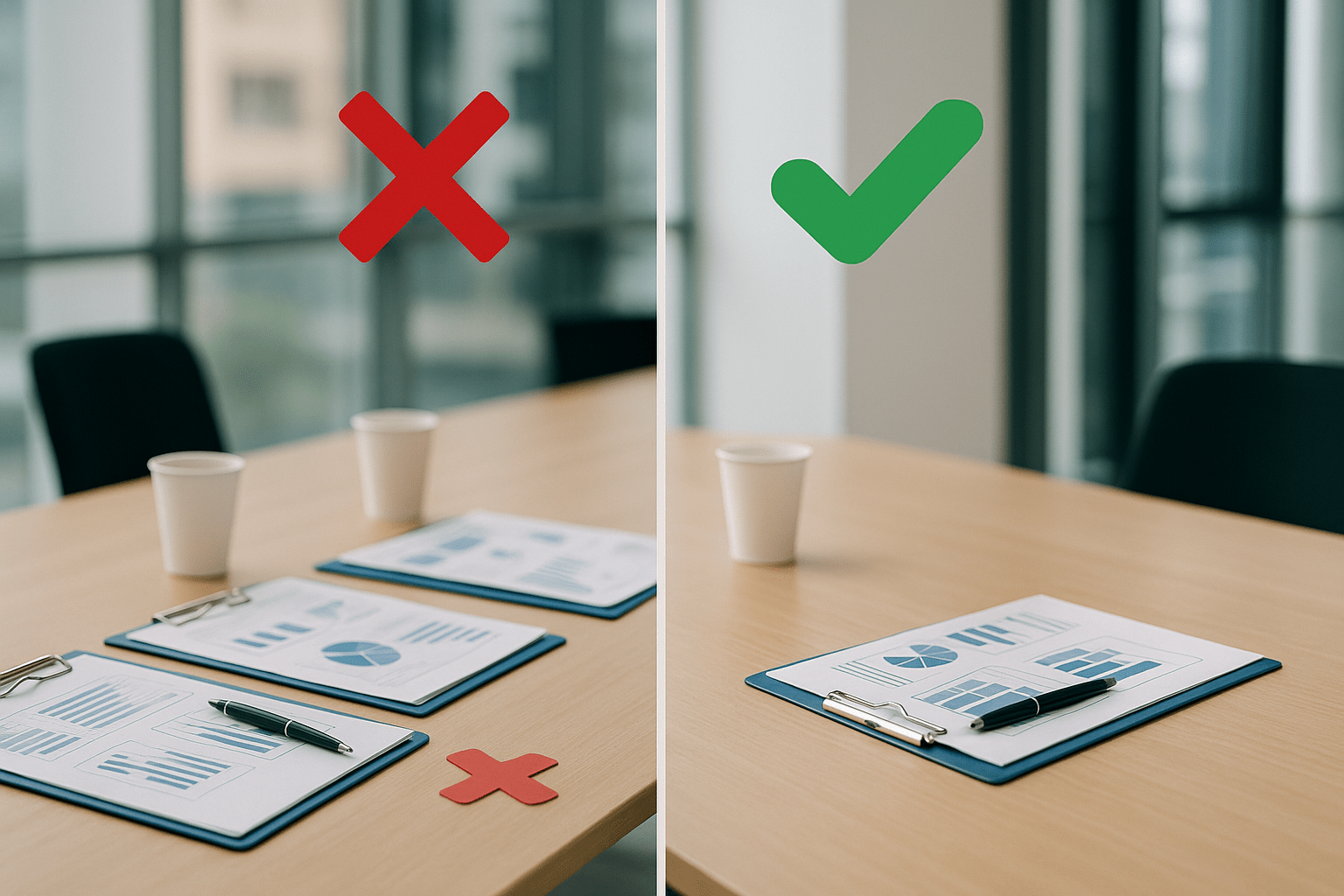

Traditional construction requires closing twice: once for temporary construction financing, then again for your permanent mortgage after completion. Each closing means duplicate fees, multiple qualifications, and separate rate locks.

Single-close construction financing eliminates this complexity. You qualify once, close once, and lock your rate once. Your construction funds and permanent mortgage roll together seamlessly.

This comprehensive guide explains how construction loan permanent loan financing works, compares program types, and shows you exactly what to expect from application through move-in day.

Key Summary

Construction to permanent loans streamline custom home building into one convenient financing package, saving time and money compared to traditional two-loan approaches.

In this comprehensive guide:

- Understanding single-close construction financing and how it differs from traditional approaches

- Construction loan requirements and qualification standards for borrowers and builders

- Builder licensing and construction timeline considerations that impact your project success

- VA construction benefits for eligible veterans building custom homes

- FHA 203k construction guidelines for combining purchase and renovation

Understanding Construction Loan Permanent Loan Financing: The One-Time Close Advantage

What Is a Construction to Permanent Loan?

A construction to permanent loan combines temporary construction financing with permanent mortgage financing into a single loan. You close once, qualify once, and pay closing costs once.

During construction, you make interest-only costs on funds drawn for construction. Once construction completes, the loan automatically converts to a traditional mortgage with principal and interest costs.

This eliminates the need for two separate closings with two sets of fees. Calculate your construction loan permanent loan costs to see total project expenses.

How Does Construction Permanent Financing Differ from Traditional Construction Financing?

Traditional construction requires two separate loans with two separate closings. First, you get short-term construction financing to build. Then, you refinance into permanent financing after construction completes.

Each closing costs 2-5% of your loan amount. On a typical custom build, this means $6,000-$15,000 in duplicate closing costs. See how much you can save with single-close financing compared to two-close approaches.

What Are the Primary Benefits of Builders Loan Single-Close Financing?

Single-close financing offers compelling advantages:

One qualification process means less paperwork and faster approval. You provide documentation once instead of twice.

One closing saves thousands in duplicate fees. Title work, appraisals, credit reports, and origination fees happen once.

One rate lock protects you from rising rates during construction. With traditional two-loan approaches, rates could increase between closings. Lock your construction to permanent rate before breaking ground.

Simplified timeline keeps your project moving. You avoid the refinance process after construction, going straight from final inspection to permanent financing.

What Happens During the Construction Phase of New Build Loan Financing?

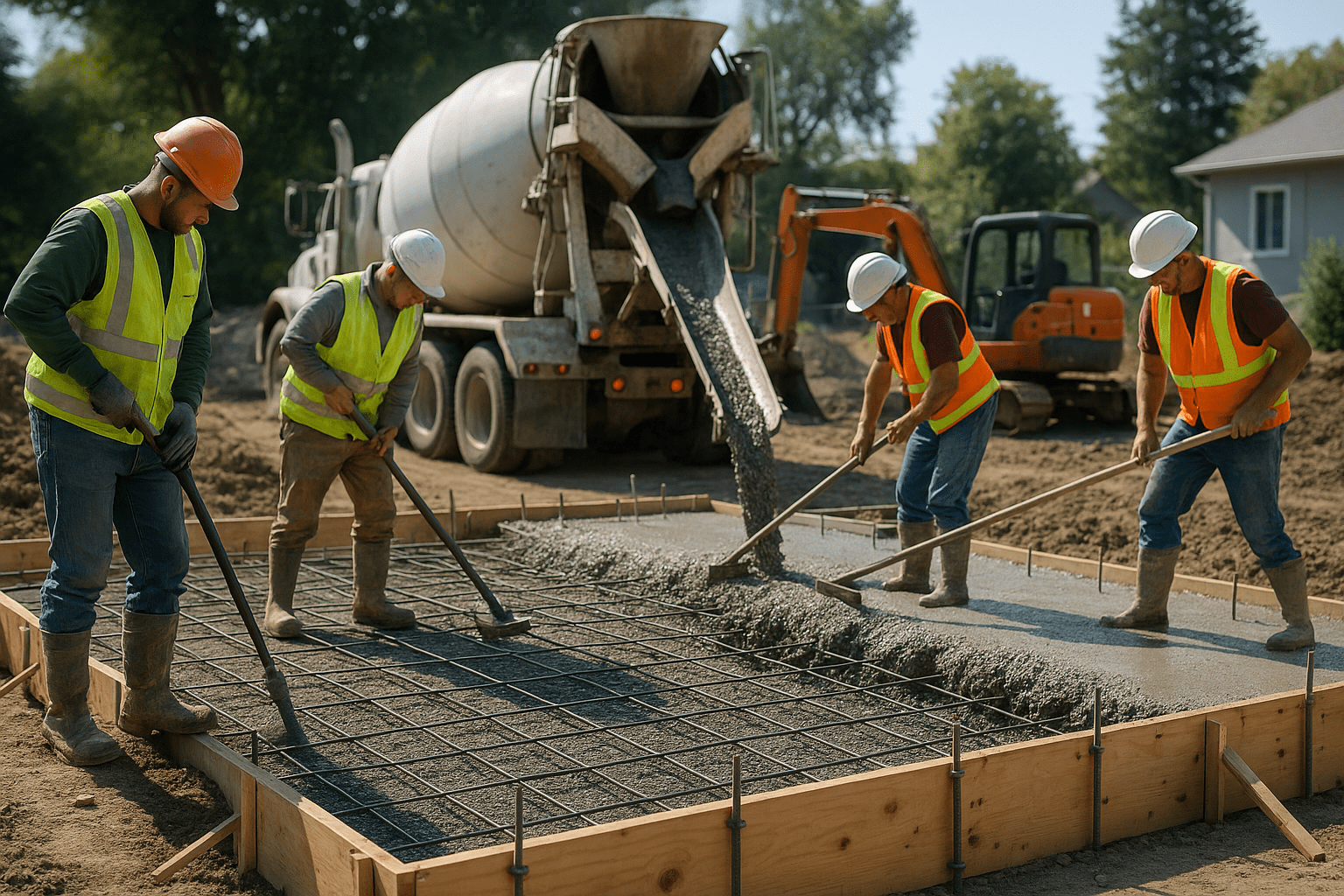

Construction phase typically lasts 6-12 months depending on project complexity and size. You make interest-only costs on funds drawn from your construction reserve.

Your lender establishes a draw schedule tied to construction milestones. As your builder completes each phase, an inspector verifies work before releasing the next draw.

Common draw schedule milestones include:

Foundation completion typically triggers the first major draw after the initial foundation is poured and inspected.

Framing inspection occurs once walls and roof structure are complete with proper bracing and connections.

Rough-in verification happens after plumbing, electrical, and HVAC systems are installed but before drywall.

Final completion inspection confirms all work meets building codes and contract specifications before final draw.

Calculate your interest-only construction costs during the building phase.

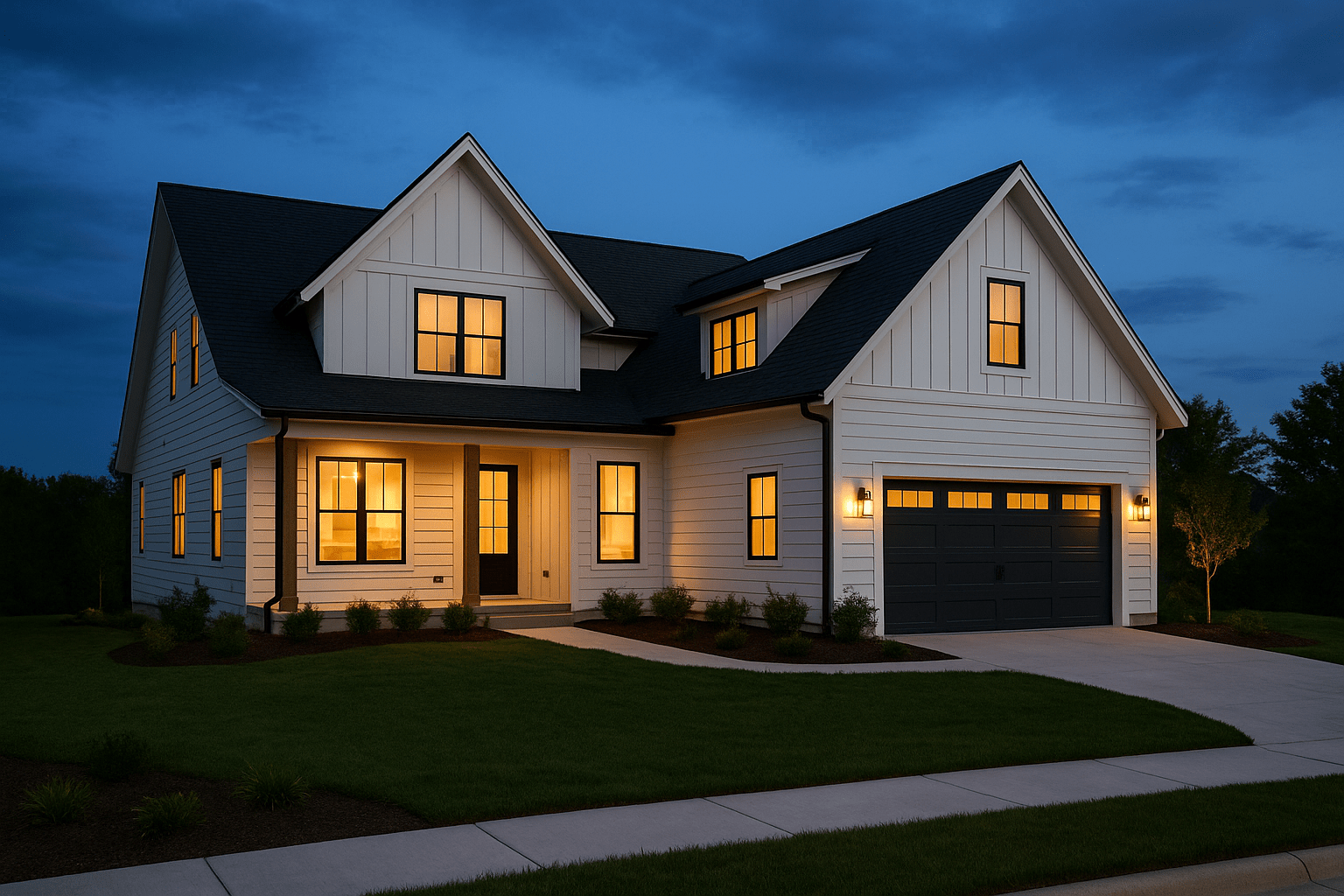

How Does New Build Loan Financing Convert to Permanent Financing?

Conversion happens automatically once construction completes and final inspection passes. Your loan terms shift from interest-only construction costs to fully amortizing principal and interest costs.

The lender orders a final appraisal confirming the completed home’s value meets or exceeds the construction budget. If everything checks out, your permanent financing activates.

Your rate was locked at closing, so you avoid market fluctuations during construction. Compare permanent financing terms across different loan types.

FHA Builders Loan: Government-Backed Construction Financing

What Is an FHA Construction Loan and How Does It Work?

FHA construction financing combines FHA’s low initial capital requirements with construction financing in one convenient package.

These loans work through FHA-approved lenders who specialize in construction financing. Your builder must be approved by the lender and meet FHA construction standards.

Initial capital requirements start at 3.5% of the total project cost, making custom home construction accessible to more families. Calculate your FHA builders loan with minimal initial capital requirements.

What Are FHA Construction Loan Requirements for Borrowers?

Credit score minimums for FHA construction financing typically require 580 or higher for 3.5% initial capital. Scores between 500-579 require larger initial capital of 10%.

Debt-to-income ratios can stretch to 56.9% with compensating factors like excellent payment history or significant reserves. This flexibility helps more families qualify.

Initial capital can come from savings, gifts, grants, or down payment assistance programs. Explore FHA loan eligibility requirements for construction financing.

Can You Use FHA Construction Financing for Owner-Builder Projects?

FHA generally requires licensed general contractors for construction projects. Owner-builder arrangements typically don’t qualify under FHA guidelines because of quality control and completion concerns.

However, you can act as your own general contractor if you’re a licensed builder or have substantial construction experience. Documentation of your qualifications is required.

Most families choose licensed builders with FHA approval to ensure smooth project completion.

What Happens to FHA Construction Financing After Building Completes?

Your FHA construction financing automatically converts to permanent FHA financing with no separate refinance required. Interest-only costs during construction become fully amortizing costs.

FHA mortgage insurance continues on the permanent financing, typically costing 0.55%-1.05% annually depending on your initial capital amount and loan balance.

Your permanent financing inherits the construction loan’s rate lock, protecting you from market increases. Review FHA mortgage insurance costs for your construction project.

VA New Home Construction Loan: Building Custom Homes with VA Benefits

How Do VA Construction Loans Work for Eligible Veterans?

VA construction financing extends VA’s zero initial capital benefit to custom home construction. Eligible veterans, active duty service members, and qualifying surviving spouses can build without initial capital requirements.

The VA doesn’t make loans directly. Instead, VA-approved lenders provide construction financing with VA guarantee backing. This reduces lender risk and extends favorable terms to military families.

Your builder must be approved by your VA lender and agree to VA appraisal requirements. The property must serve as your primary residence to qualify.

What Are the Advantages of VA New Home Construction Financing?

Zero initial capital eliminates the typical 10-20% construction financing initial capital requirement. This keeps more cash available for customizations and upgrades.

No mortgage insurance costs unlike FHA and conventional construction financing. This saves 0.5%-1.0% annually on your loan balance.

Competitive rates reflect the VA’s guarantee reducing lender risk. Veterans typically access rates 0.25%-0.50% below comparable conventional construction financing.

Flexible qualification standards consider military income types and circumstances that conventional lenders might decline. Calculate your VA construction benefits with zero initial capital.

Can You Build Investment Properties with VA Construction Financing?

VA construction financing requires owner-occupancy as your primary residence. Investment properties, second homes, and vacation properties don’t qualify for VA benefits.

However, you can include a rental unit in your custom build as long as you occupy one unit as your primary residence. Multi-family construction up to four units is permitted.

Explore VA loan primary residence requirements for construction projects.

What Builder Requirements Apply to VA New Home Construction Projects?

Builders must accept VA appraisal and construction standards. Some contractors decline VA projects because of additional requirements and inspections.

VA requires builders to provide warranty coverage for construction defects. Specific warranty terms vary by project scope and local VA office requirements.

Construction timelines must be reasonable. Unusually long construction periods might trigger additional VA scrutiny and requirements.

Review successful VA construction case studies showing typical project requirements.

Construction Loan for Home Renovation vs New Construction: Understanding Your Options

What Types of Projects Qualify for Construction Loan Permanent Loan Financing?

Ground-up construction starts with raw land or a cleared lot. You’re building from the foundation up, creating a brand new structure meeting current building codes.

Major renovation projects can also qualify for construction-to-permanent financing. These involve substantial work beyond cosmetic updates: moving walls, adding square footage, or major system replacements.

Land acquisition combined with construction is possible if your lender allows land purchase as part of the total project cost. Some require you to own land before applying.

Compare construction financing options for different project types.

How Does Renovation Construction Financing Differ from Ground-Up Construction?

Renovation financing through FHA 203k programs combines purchase price plus renovation costs into one loan. You can buy a fixer-upper and finance improvements immediately.

Ground-up construction starts with either land you own or land acquisition, then builds from scratch. Project costs typically run higher because you’re creating all structure and systems.

Appraisal approaches differ significantly. Renovations use the existing structure’s value plus improvement costs. Ground-up construction relies entirely on as-complete appraised value.

Timeline varies based on project scope. Major renovations might take 3-6 months while ground-up construction typically requires 6-12 months.

Can You Use Construction Financing for Major Home Improvements?

Major home improvements qualify when they add substantial value or square footage. Examples include adding a second story, finishing a basement, or completely remodeling outdated spaces.

FHA 203k renovation financing works well for substantial improvements because it rolls renovation costs into your mortgage. Your initial capital covers combined purchase and renovation amounts.

Cosmetic updates like painting, flooring, or new appliances typically don’t require construction financing. These minor improvements are better handled through home equity financing or personal savings.

What About Homestyle Renovation Financing for Existing Homes?

Homestyle renovation financing is Fannie Mae’s conventional alternative to FHA 203k loans. It offers more flexibility for higher-value properties and renovations.

Initial capital requirements start at 5% for primary residences and increase for investment properties. Credit requirements are stricter than FHA but loan limits are higher.

Calculate Homestyle renovation costs for major home improvements.

Owner Builder Construction Loans: Building Your Own Custom Home

What Are Owner-Builder Construction Loans?

Owner-builder construction loans let you act as your own general contractor, overseeing subcontractors and managing construction yourself. This eliminates general contractor markup but adds significant responsibility.

These loans are harder to qualify for than traditional construction financing. Lenders see higher risk when borrowers lack construction experience or proper licensing.

You’ll need to demonstrate construction knowledge, provide detailed budgets, and show you can manage subcontractors effectively. Many lenders require you to have completed similar projects successfully.

What Are the Advantages and Disadvantages of Owner-Builder Financing?

Cost savings represent the primary advantage of owner-builder approaches. Eliminating general contractor fees can save 15-25% on construction costs.

Direct control over every decision lets you customize without compromise. You select all materials, finishes, and subcontractors personally.

However, significant time investment is required. Managing construction while maintaining full-time employment proves challenging for most families.

Risk increases substantially as the owner-builder. If you run over budget or timeline, you’re personally responsible for additional costs. Review owner-builder requirements before committing.

What Qualification Requirements Apply to Owner-Builder Construction Financing?

Construction experience or licensing requirements vary by lender. Some require general contractor licenses while others accept demonstrated experience managing similar projects.

Higher initial capital requirements often apply—typically 20-25% minimum instead of the 10-15% for traditional construction financing. This offsets increased lender risk.

Detailed construction plans and budgets must be submitted showing every phase of construction with accurate cost estimates. Vague estimates get declined quickly.

Reserve requirements increase because lenders want assurance you can cover cost overruns. Expect to show 3-6 months of reserves beyond typical requirements.

How Do Draw Schedules Work for Owner-Builder Construction Projects?

Draw schedules for owner-builder projects typically require more documentation than traditional construction financing. Lenders want detailed verification before releasing funds.

Inspection requirements increase. Independent inspectors verify work quality and code compliance before each draw.

Payment timing shifts. Rather than paying contractors then requesting reimbursement, many owner-builder loans pay contractors directly after inspection approval.

Calculate owner-builder construction budgets including contingency reserves.

Home Construction Loans: Qualification Requirements and Approval Process

What Credit Score Do You Need for Construction to Permanent Financing?

Credit score requirements vary by loan type and lender. FHA construction financing accepts scores as low as 580 for minimum initial capital.

Conventional construction financing typically requires 680 minimum, with better rates available at 740+. The higher your score, the better your rate and term options.

VA construction financing doesn’t set minimum credit scores but lenders typically want 620 or higher for construction projects.

Portfolio lenders might approve lower scores with compensating factors like large initial capital or substantial reserves. Check your construction loan eligibility before applying.

What Initial Capital Requirements Apply to New Construction Home Loans?

Conventional construction financing requires minimum 10-20% initial capital depending on your credit profile and project details. Stronger qualifications might access lower initial capital options.

FHA construction financing starts at 3.5% for qualified borrowers, making custom construction more accessible. However, project costs must stay within FHA loan limits for your area.

VA construction financing offers zero initial capital for eligible veterans building primary residences. This is the most powerful benefit for military families.

Calculate your required initial capital based on project costs and loan type.

What Income and Employment Documentation Is Required?

Income verification for construction financing mirrors permanent mortgage requirements. W-2 employees provide pay stubs, W-2 forms, and tax returns covering two years.

Self-employed borrowers need two years of personal and business tax returns plus year-to-date profit and loss statements. Bank statement loan programs offer alternatives for business owners.

Stable employment history matters significantly for construction financing. Lenders prefer two years in the same field, though job changes for advancement within your industry are acceptable.

Multiple income sources strengthen your application. Rental income, part-time work, or investment income can all help qualification.

What Reserve Requirements Apply to Construction Financing?

Cash reserves beyond your initial capital and closing costs provide financial cushion for unexpected construction expenses. Requirements vary by loan type and lender.

Conventional construction financing typically requires 2-6 months of reserves. The specific amount depends on your debt-to-income ratio, credit profile, and project scope.

FHA construction financing might require fewer reserves for strong credit profiles. However, lenders still prefer seeing 2-3 months available.

Construction projects often encounter unexpected costs. Having adequate reserves protects both you and your lender if original budgets prove insufficient. Calculate total costs including reserves for your construction project.

New Construction Home Loans: Understanding Draw Schedules and Construction Timeline

How Do Draw Schedules Work During Construction?

Draw schedules establish when construction funds release from your construction reserve. Money doesn’t transfer in a lump sum—it’s released as work progresses and inspections verify completion.

Typical draw schedules include 4-7 major milestones from foundation through final completion. Your lender reviews budgets and establishes specific release points during loan approval.

Each draw request triggers an inspection. The lender’s inspector verifies work quality, confirms completion percentage, and approves the next fund release.

Your builder must stay on schedule to maintain cash flow. Delays in completing draw milestones can slow subsequent progress if funds aren’t available.

What Inspections Are Required During Construction?

Foundation inspection occurs after concrete is poured and properly cured. Inspector verifies proper depth, reinforcement, and drainage systems before approving the foundation draw.

Framing inspection happens once exterior walls, interior framing, and roof structure are complete. Proper spacing, bracing, and connections must meet local building codes.

Rough-in inspection reviews all mechanical, electrical, and plumbing systems before they’re concealed behind drywall. This is your last chance to verify proper installation of critical systems.

Final inspection is the most comprehensive review. Every system must function properly, all finishes must be complete, and the home must meet the approved plans.

Review construction timeline requirements for your project type.

What Happens If Construction Costs Exceed the Original Budget?

Cost overruns happen frequently in construction due to unforeseen issues, material price increases, or change orders. Your construction financing contract establishes how overruns are handled.

You’re typically responsible for additional costs beyond the approved construction budget. This is why adequate reserves are essential—they provide buffer for unexpected expenses.

Change orders modifying original plans might be funded through construction reserves if funds remain available. However, major changes often require personal funds.

Some lenders allow construction budget increases through loan modifications if your qualifications support higher amounts. This requires re-approval and additional documentation.

How Long Does the Construction Phase Typically Last?

Construction timelines vary dramatically based on project size, complexity, and local factors. Simple single-story homes might complete in 4-6 months while complex custom builds take 9-12 months.

Most construction financing includes 12-month construction periods before automatic conversion to permanent financing. Extensions are possible but might incur fees.

Weather delays are common and expected. Builders typically build buffer time into schedules for rain delays, temperature restrictions, and material delivery issues.

Labor availability affects timeline significantly. In hot construction markets, finding qualified subcontractors takes longer and might push completion dates.

Calculate construction timeline costs including interest-only costs during building.

Remodel Construction Loan: Financing Major Home Renovations

What Types of Renovation Projects Qualify for Construction Financing?

Major structural changes typically qualify for construction-style financing. Adding square footage, raising ceilings, or reconfiguring floor plans require this level of financing.

Complete system replacements like new HVAC, electrical panel upgrades, or plumbing repiping fall into renovation construction financing territory.

Cosmetic updates like painting, flooring, or cabinet refinishing don’t usually require construction financing. Home equity loans or HELOCs work better for these lighter projects.

Combination projects mixing structural and cosmetic work often make the most sense for construction financing. You’re creating significant additional value.

How Does FHA 203k Financing Work for Renovation Projects?

FHA 203k loans combine purchase price plus renovation costs into one mortgage with FHA’s low initial capital requirements. You can buy a fixer-upper and start improvements immediately.

Two types exist: limited 203k for smaller projects under a certain dollar amount, and standard 203k for major renovations exceeding that threshold or involving structural work.

Your contractor must be approved by your lender and follow FHA guidelines. Some contractors decline 203k projects because of paperwork requirements and inspection protocols.

Calculate 203k renovation costs including purchase and improvement expenses.

What About Conventional Renovation Financing Options?

Homestyle renovation financing offers Fannie Mae’s conventional alternative with fewer restrictions than FHA 203k. Initial capital starts at 5% for primary residences.

Project scope flexibility increases with conventional renovation financing. You can renovate investment properties, second homes, and luxury properties exceeding FHA limits.

Credit requirements are stricter than FHA but terms are often more favorable for qualified borrowers. Compare conventional renovation options versus FHA approaches.

Can You Use Construction Financing to Remodel Rental Properties?

Investment property renovation financing is available through conventional renovation programs. Initial capital requirements increase to 15-25% for non-owner-occupied properties.

DSCR loans sometimes include renovation components for experienced investors. These qualify based on property income rather than personal income.

FHA 203k requires owner-occupancy so it won’t work for pure investment property renovations. You must live in the property as your primary residence.

Interest-Only Payments During Construction Phase

How Do Interest-Only Costs Work During Construction?

During active construction, you make interest-only costs on funds drawn from your construction reserve. You’re not yet making principal and interest costs because the home isn’t complete.

Interest accrues only on money actually drawn—not the full construction budget. If you’ve drawn $150,000 of a $300,000 construction budget, interest calculates on $150,000.

Costs fluctuate as construction progresses and more funds are drawn. Your first few costs are relatively low, then increase as major draws occur.

This keeps costs manageable during construction when you might still be paying rent elsewhere or covering temporary housing. Calculate interest-only construction costs for your project.

What Happens If You Miss an Interest-Only Cost?

Late costs during construction are treated seriously by lenders. Your construction financing could be paused or terminated if costs become delinquent.

Construction timelines depend on reliable fund releases. If you’re not making required costs, lenders might stop releasing draws even if your builder has completed work.

Credit damage occurs just like any mortgage delinquency. Late costs report to credit bureaus and impact your scores significantly.

Communication is critical if financial difficulties arise during construction. Contact your lender immediately to explore options before missing costs.

How Are Interest Rates Determined for Construction Financing?

Construction financing rates typically run 0.5%-1.0% higher than permanent financing rates because of increased risk during the building phase. However, your rate locks at closing.

Your credit profile significantly impacts your rate. Higher scores access better rates while lower scores pay premiums reflecting increased risk.

Initial capital amount affects pricing. Larger initial capital reduces lender risk and often qualifies for better rates.

Your permanent financing rate might differ from your construction rate. Review terms carefully to understand both phases of your financing.

What Happens to Costs When Construction Converts to Permanent Financing?

Interest-only costs end when construction completes and your loan converts to permanent financing. You begin making fully amortizing principal and interest costs.

Your cost will likely increase because you’re now paying both principal and interest on the full loan amount rather than just interest on drawn funds.

However, you’re also eliminating rent or temporary housing costs because you’re moving into your completed home. Net housing cost might decrease despite higher mortgage costs.

Rate locks from closing protect you from market increases during construction. Your permanent financing rate was established before ground breaking. Review permanent financing terms for different loan types.

Builder Requirements for Construction to Permanent Financing

What Builder Qualifications Do Lenders Require?

Licensed general contractors are typically required for construction financing. Lenders want assurance that your builder has proper credentials and can complete work to code.

Insurance coverage including general liability and workers’ compensation protects all parties during construction. Your lender will verify coverage before approving your builder.

Financial stability of your builder matters to lenders. Builders facing financial difficulties might abandon projects or cut corners to preserve profits.

References and portfolio review help lenders assess builder quality. They want to see similar completed projects meeting acceptable standards.

How Do You Find FHA-Approved or VA-Approved Builders?

FHA-approved builders have experience with FHA construction requirements and inspection protocols. Your FHA construction lender maintains lists of approved contractors.

VA-approved builders understand VA-specific requirements including appraisal standards and warranty provisions. Not all builders accept VA construction projects.

Builder approval isn’t automatic. Your chosen builder must submit documentation to your lender and gain approval before you can proceed.

Some builders specialize in working with specific loan programs. Ask builders about their experience with your chosen financing type before signing contracts.

What Happens If Your Builder Goes Out of Business During Construction?

Builder bankruptcy or business closure during construction creates serious complications. Your construction financing might be paused while resolution is determined.

Completion bonds or builder warranties provide some protection but aren’t always required by lenders. Review your construction contract for protection provisions.

You might need to hire a new builder to complete work, potentially at higher cost. Your lender might allow construction budget increases or require personal funds.

This is why builder financial stability matters during lender approval. Strong, established builders with solid track records reduce this risk.

Can You Change Builders Mid-Project?

Changing builders mid-project is possible but complicated. Your new builder must be approved by your lender through the same process as your original builder.

Work already completed must be inspected and verified before the new builder proceeds. This protects everyone from inheriting problematic work.

Additional costs often result from builder changes. New builders might charge premiums for completing someone else’s work.

Your construction contract with the original builder governs termination terms. Legal advice is recommended before terminating existing builder relationships.

Converting to Permanent Mortgage: Rate Locks and Timing

How Do Rate Locks Work for Construction to Permanent Financing?

Rate locks establish your permanent financing rate at closing before construction begins. This protects you from rate increases during the 6-12 month construction period.

Lock periods must cover your entire construction timeline plus conversion to permanent financing. Standard locks run 12-15 months for construction projects.

If construction delays push past your lock expiration, extensions might be available for a fee. Discuss extension options during loan approval.

Your locked rate applies to permanent financing automatically when construction completes. No separate rate negotiation occurs during conversion.

What Appraisal Requirements Apply to Construction Financing?

Initial land appraisal establishes the value of your building lot or existing structure you’re renovating. This helps determine total project costs relative to final value.

Construction plans and budgets are reviewed to estimate as-complete value. Your lender wants assurance the finished home will be worth the total invested.

As-complete appraisal happens after construction finishes, verifying the home’s market value meets or exceeds projections. This triggers conversion to permanent financing.

Appraisal shortfalls occur when completed value falls below projections. You might need to bring additional cash to closing or accept different terms.

What Happens During the Conversion from Construction to Permanent Financing?

Final inspection must pass before conversion occurs. All work must meet building codes, match approved plans, and function properly.

Certificate of occupancy is issued by local building departments once final inspection passes. This confirms the home is safe for occupancy.

Your lender orders the final appraisal confirming market value. If everything checks out, conversion to permanent financing happens automatically.

Closing typically doesn’t require your presence because the conversion was established at your original closing. Terms shift from interest-only to fully amortizing costs.

Can You Refinance After Construction Completes?

Refinancing after construction completes is possible but usually unnecessary with construction-to-permanent financing. Your rate was already locked favorably.

However, if market rates drop significantly during construction, refinancing might make sense. Weigh closing costs against potential savings carefully.

Calculate refinance savings if considering refinancing after construction completes.

Comparing Construction Financing Options: Finding the Right Program

FHA Construction Loan vs VA Construction Loan vs Conventional Construction Loan

FHA construction financing offers the lowest initial capital requirement at 3.5% for qualified borrowers. However, mortgage insurance is required for the life of the loan.

VA construction financing provides zero initial capital for eligible veterans with no mortgage insurance requirements. This is the most powerful option for qualified military families.

Conventional construction financing requires higher initial capital (10-20%) but offers flexibility for higher loan amounts and investment properties. No mortgage insurance is required with 20%+ initial capital.

Compare all three options to determine which works best for your situation.

When Does Jumbo Construction Financing Make Sense?

Jumbo construction financing is required when project costs exceed conforming loan limits for your area. These limits vary by county.

High-value custom homes in expensive markets almost always require jumbo construction financing. Your lender can provide specific limits for your building location.

Qualification requirements increase for jumbo construction financing. Expect higher credit score requirements (typically 700+), larger initial capital (15-25%), and substantial reserves.

Rates on jumbo construction financing are typically competitive with conforming programs for well-qualified borrowers. Calculate jumbo construction costs for your project.

What About USDA Construction Financing for Rural Properties?

USDA construction financing offers zero initial capital for eligible rural and suburban properties. Your building location must be in a USDA-eligible area.

Income limits apply to USDA financing. Your household income cannot exceed 115% of area median income for your location and family size.

Property must serve as your primary residence. Investment properties and second homes don’t qualify for USDA construction benefits.

Check USDA construction eligibility for your building location.

Portfolio Construction Financing for Unique Situations

Portfolio construction financing from local banks and credit unions offers flexibility for unique situations that don’t fit standard program guidelines.

Owner-builder projects often require portfolio financing because major lenders avoid the additional risk. Local lenders familiar with your qualifications and project might approve where others decline.

Unusual properties like earth-sheltered homes, geodesic domes, or other non-traditional construction sometimes need portfolio financing.

Expect higher rates and larger initial capital requirements because these loans don’t sell to Fannie Mae or Freddie Mac. The lender holds the loan in their own portfolio.

Construction Cost Management and Contingency Planning

How Do You Create Accurate Construction Budgets?

Detailed bids from licensed contractors provide the foundation for accurate budgets. Vague estimates lead to cost overruns and funding shortfalls.

Your construction budget must itemize every aspect of construction from site work through final finishes. Missing line items become your financial responsibility.

Material selection dramatically impacts total costs. High-end finishes, custom features, and upgraded systems increase budgets significantly.

Geographic location affects both material and labor costs. Construction in expensive markets costs substantially more than building in lower-cost areas.

What Contingency Reserves Should You Plan For?

Contingency reserves typically run 10-20% of base construction costs. This buffer covers unexpected issues, change orders, and market fluctuations.

Underground surprises like poor soil conditions, rock, or groundwater often trigger the biggest unexpected expenses during construction.

Material price volatility creates budget risks. Lock in material prices early when possible or build larger contingencies if market conditions are uncertain.

Change orders modify original plans after construction begins. Every change impacts cost and timeline. Minimizing changes keeps budgets on track.

How Do You Handle Construction Cost Overruns?

Personal savings cover most construction overruns unless your construction financing includes adequate contingency reserves. This is why cash reserves matter so much.

Construction budget modifications might be possible if your qualifications support increased loan amounts. This requires lender re-approval and additional documentation.

Value engineering reduces costs by finding less expensive alternatives for materials or methods without sacrificing quality or function significantly.

Plan for construction contingencies in your original budget.

What Happens If Your As-Complete Appraisal Comes in Low?

Appraisal shortfalls occur when your completed home’s appraised value falls below projected value. This can prevent conversion to permanent financing as originally planned.

You might need to bring additional cash to closing to satisfy loan-to-value requirements. The difference between appraised value and loan amount must be covered.

Value appeals are possible if you believe the appraisal is inaccurate. Provide comparable sales and construction cost documentation supporting higher value.

Revised terms might reduce your loan amount to match appraised value. This requires qualified approval for the modified loan amount.

Frequently Asked Questions About Construction to Permanent Loans

What is a construction to permanent loan and how does it work?

A construction to permanent loan combines construction financing and permanent mortgage financing into one loan with one closing. You qualify once, close once, and lock your rate once before building begins. During construction, you make interest-only costs on funds drawn for construction. Once construction completes, the loan automatically converts to a traditional mortgage with principal and interest costs. This eliminates the need for two separate loans and two sets of closing costs that traditional construction financing requires.

How much initial capital do you need for construction financing?

Initial capital requirements vary by loan type. FHA construction financing requires as little as 3.5% of total project costs for qualified borrowers. VA construction financing offers zero initial capital for eligible veterans building primary residences. Conventional construction financing typically requires 10-20% initial capital depending on your credit profile. Calculate your required initial capital based on project costs and loan type.

Can you act as your own general contractor with construction financing?

Owner-builder construction financing allows you to act as your own general contractor, but these loans are more difficult to qualify for than traditional construction financing. Lenders see higher risk when borrowers lack construction experience or proper licensing. You’ll typically need demonstrated construction knowledge, detailed budgets, and 20-25% initial capital instead of the standard 10-15%. Most lenders require you to have completed similar projects successfully or hold a general contractor license.

What credit score do you need for construction loan approval?

Credit score requirements depend on your chosen loan program. FHA construction financing accepts scores as low as 580 for minimum initial capital requirements. Conventional construction financing typically requires 680 minimum, with better rates available at 740+. VA construction financing doesn’t set specific minimums but most lenders want 620 or higher for construction projects. Higher scores always improve your rate and approval odds across all program types.

How long does construction phase financing typically last?

Construction phase duration varies based on project size and complexity. Simple single-story homes might complete in 4-6 months while complex custom builds take 9-12 months. Most construction financing programs include 12-month construction periods before automatic conversion to permanent financing. Extensions are possible but might incur fees. Weather delays, material shortages, and labor availability all impact actual timelines. Estimate your construction timeline costs including interest-only costs during building.

What happens if construction costs exceed the original budget?

Cost overruns are your financial responsibility beyond the approved construction budget. This is why adequate cash reserves are essential—they provide buffer for unexpected expenses. Change orders modifying original plans might be funded through remaining construction reserves if available. However, major overruns often require personal funds. Some lenders allow construction budget increases through loan modifications if your qualifications support higher amounts, though this requires re-approval and additional documentation.

Can you use FHA construction financing for investment properties?

No, FHA construction financing requires owner-occupancy as your primary residence. You must live in the home you’re building. However, you can build multi-family properties up to four units as long as you occupy one unit as your primary residence. Investment properties, second homes, and vacation properties don’t qualify for FHA construction benefits. Conventional construction financing or portfolio loans work better for non-owner-occupied construction projects.

What inspections are required during the construction process?

Construction inspections occur at major milestones throughout your build. Foundation inspection verifies proper concrete work and drainage systems. Framing inspection reviews wall structure, roof framing, and proper connections. Rough-in inspection examines all mechanical, electrical, and plumbing systems before drywall installation. Final inspection comprehensively reviews all completed work, verifies code compliance, and confirms the home matches approved plans. Your lender’s inspector must approve work before releasing funds for the next construction phase.

How do draw schedules work during construction?

Draw schedules establish when construction funds release from your construction reserve as work progresses. Money doesn’t transfer in a lump sum—it’s released at specific completion milestones. Typical draw schedules include 4-7 major milestones from foundation through final completion. Each draw request triggers an inspection where the lender’s inspector verifies work quality and completion before approving the next fund release. Your builder must stay on schedule to maintain cash flow for purchasing materials and paying subcontractors.

What builder qualifications do lenders require for construction financing?

Licensed general contractors are typically required with proper credentials for completing work to building codes. Insurance coverage including general liability and workers’ compensation must be verified before approval. Financial stability matters—builders facing difficulties might abandon projects or cut corners. Lenders review builder references, portfolios of similar work, and track records before approval. FHA construction lenders maintain lists of approved contractors familiar with FHA requirements.

Can you refinance after construction completes?

Refinancing after construction completes is possible but usually unnecessary with construction-to-permanent financing since your rate was already locked favorably. However, if market rates drop significantly during your 6-12 month construction period, refinancing might make sense. Weigh closing costs carefully against potential savings. Calculate potential refinance savings to determine if refinancing makes financial sense after your build completes.

What happens if your builder goes out of business during construction?

Builder bankruptcy or business closure during construction creates serious complications. Your construction financing might be paused while resolution is determined. Completion bonds or builder warranties provide some protection but aren’t always required. You might need to hire a new builder to complete work, potentially at higher cost through budget modifications or personal funds. This is why builder financial stability matters during the approval process—strong, established builders with solid track records reduce this risk significantly.

How much do you pay in closing costs for construction financing?

Closing costs for construction-to-permanent financing are similar to traditional mortgage closing costs, typically 2-5% of your loan amount. However, you only pay once instead of twice. Traditional construction requires two separate closings—once for construction financing and again for permanent financing after completion. Single-close construction financing eliminates $6,000-$15,000 in duplicate closing costs on typical projects. Estimate your total closing costs for construction-to-permanent financing.

What is the difference between construction-to-permanent and traditional construction financing?

Traditional construction financing requires two separate loans with two separate closings. First, you obtain short-term construction financing to build. Then, you refinance into permanent financing after construction completes. Each closing costs 2-5% of your loan amount. Construction-to-permanent financing combines both into one loan with one closing, one qualification, and one rate lock. You save thousands in duplicate fees and avoid refinancing after completion. The loan automatically converts from interest-only construction costs to permanent principal and interest costs once building finishes.

Can you build on land you already own with construction financing?

Yes, land you already own can be used as your “initial capital” toward construction costs in many cases. The lender will order a land appraisal to establish value. If you owe money on the land, that existing lien must be paid off as part of your construction financing. Some lenders allow you to purchase land as part of your total construction budget, combining land acquisition and construction into one loan. Requirements vary by lender and program type, so discuss land ownership specifics early in your application process.

What are the advantages of VA construction financing for veterans?

VA construction financing extends VA’s zero initial capital benefit to custom home construction. Eligible veterans, active duty service members, and qualifying surviving spouses can build without any initial capital requirement. No mortgage insurance costs save 0.5%-1.0% annually compared to FHA and conventional construction financing. Competitive rates typically run 0.25%-0.50% below comparable conventional construction financing. Flexible qualification standards consider military income types that conventional lenders might decline. This makes VA construction financing the most powerful option for qualified military families.

How do you qualify for USDA construction financing?

USDA construction financing requires your building location to be in a USDA-eligible rural or suburban area. Income limits apply—your household income cannot exceed 115% of area median income for your location and family size. The property must serve as your primary residence; investment properties don’t qualify. Credit requirements are similar to conventional financing, typically 640 minimum. USDA construction financing offers zero initial capital for qualified borrowers meeting income and location requirements. Check USDA construction eligibility for your specific situation.

What is the interest rate difference between construction and permanent financing?

Construction financing rates typically run 0.5%-1.0% higher than permanent financing rates because of increased risk during the building phase. However, your permanent financing rate locks at closing before construction begins, protecting you from rate increases during your 6-12 month build. Your locked rate applies automatically when construction completes and the loan converts to permanent financing. This rate lock protection is one of the major advantages of construction-to-permanent financing over traditional two-loan approaches where you’re exposed to rate changes between loans.

Can you make changes to plans after construction begins?

Yes, but change orders modifying original plans after construction begins impact both cost and timeline. Every change requires builder approval, potential lender approval if increasing total costs, and additional inspections if structural elements are affected. Minor cosmetic changes like paint colors or fixture selections are usually acceptable. Major changes involving square footage, room configurations, or structural modifications require formal change orders documenting new costs. Minimizing changes after construction starts keeps budgets and timelines on track while avoiding conflicts with approved plans.

What reserves are required beyond initial capital and closing costs?

Cash reserves beyond your initial capital and closing costs provide financial cushion for unexpected construction expenses. Conventional construction financing typically requires 2-6 months of reserves depending on your debt-to-income ratio and credit profile. FHA construction financing might require fewer reserves for strong credit profiles but lenders still prefer 2-3 months available. These reserves protect you if construction costs exceed original budgets due to unforeseen issues. Construction projects often encounter unexpected expenses, making adequate reserves essential for both qualification and successful project completion.

How long does the approval process take for construction financing?

Construction financing approval typically takes 30-45 days from application to closing, longer than traditional mortgage approval because of additional complexity. Your builder must be approved, construction plans must be reviewed, budgets must be verified, and land appraisals must be ordered. Some lenders specialize in construction financing and move faster than lenders unfamiliar with construction loans. Start your approval process early—ideally before finalizing builder selection and construction plans. This ensures your financing is secured before making significant deposits or commitments to builders or vendors.

What happens if construction takes longer than expected?

Most construction financing includes 12-month construction periods before automatic conversion to permanent financing. If construction extends past 12 months due to delays, extensions are typically available for a fee. However, extended construction periods mean longer interest-only cost obligations and potential rate lock expiration issues. Communicate early with your lender if delays appear likely. Weather delays, material shortages, and labor availability all can legitimately extend timelines beyond original projections. Building buffer time into original schedules helps avoid extension complications.

Can you lock in material prices to control construction budgets?

Locking in material prices early helps control construction budgets, especially during periods of material price volatility. Some suppliers offer price protection programs where you pay a deposit to lock in current prices for future delivery. This works well for major purchases like lumber packages, windows, or roofing materials. However, not all materials can be locked in advance, particularly custom items manufactured specifically for your project. Discuss material price protection strategies with your builder during budget development. Building larger contingency reserves provides buffer if materials cannot be price-locked.

What financing options exist for building spec homes as investments?

Building spec homes (homes built for resale rather than personal occupancy) requires different financing than owner-occupied construction. Conventional construction financing requires larger initial capital (typically 20-25%) for non-owner-occupied properties. DSCR loans sometimes include construction components for experienced investors. Spec home construction calculators help estimate costs and returns. Hard money construction financing offers another option for experienced builders despite higher rates because of faster approval and more flexible terms.

How does renovation construction financing differ from ground-up construction?

Renovation financing through FHA 203k programs combines purchase price plus renovation costs into one loan. You can buy a fixer-upper and finance improvements immediately. Ground-up construction starts with raw land and builds from scratch. Renovation projects typically complete faster (3-6 months versus 6-12 months) and cost less because you’re working with existing structure. Appraisal approaches differ significantly—renovations use existing structure value plus improvement costs while ground-up construction relies entirely on as-complete value. Qualification requirements and initial capital are similar between both approaches.

Conclusion: Ready to Build Your Custom Home with Construction to Permanent Financing?

Construction to permanent loan financing streamlines custom home building into one convenient process. You qualify once, close once, and lock your rate once before construction begins.

Whether you choose FHA construction financing for low initial capital requirements, VA construction financing for zero initial capital military benefits, or conventional construction financing for maximum flexibility, the single-close approach saves thousands compared to traditional two-loan construction financing.

Understanding builders loan requirements, draw schedules, and conversion mechanics prepares you for successful custom home construction. Your new build loan transforms from interest-only construction costs to permanent principal and interest costs automatically once construction completes.

Calculate your construction to permanent loan costs and schedule a consultation to discuss your custom home construction financing options today.

Related Resources

Construction Financing Programs:

- FHA Construction Loan Program Details

- VA Construction Loan Benefits

- USDA Construction Loan Requirements

- Jumbo Construction Loan Options

- Conventional Construction Financing

Construction Calculators:

- Construction Loan Calculator

- FHA Construction Calculator

- VA Construction Calculator

- USDA Construction Calculator

- Spec Home Construction Calculator

Renovation Financing:

Take Action:

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.