Meaning of Residuary Estate: What Happens to Everything You Don’t Specify

Meaning of Residuary Estate: What Happens to Everything You Don’t Specify

Most people creating wills carefully designate who receives major assets—primary residences to surviving spouses, investment properties to children, retirement accounts to named beneficiaries, and specific valuables to designated heirs. Yet these careful asset-by-asset distributions typically cover only 60-80% of total estates, leaving substantial portions unspecified: forgotten bank accounts, recently acquired assets, lawsuit settlement proceeds, tax refunds, insurance policies without beneficiary designations, and hundreds of other items accumulating throughout lifetimes that no one thought to specifically bequeath in estate documents.

The residuary estate represents the “everything else” category—a catch-all provision in wills determining who receives all assets not specifically designated elsewhere in estate documents. This residuary clause might read simply: “I give all the rest, residue, and remainder of my estate to [named beneficiaries].” Despite its brief language, the meaning of residuary estate proves critically important since residuary provisions often control distribution of 20-40% of total estates, sometimes capturing hundreds of thousands in overlooked assets flowing to residuary beneficiaries rather than intended recipients if asset-specific bequests weren’t properly documented.

Understanding the meaning of residuary estate, how residuary clauses function within comprehensive estate plans, what happens when residuary provisions are missing or poorly drafted, and strategic uses of residuary designations prevents unintended distributions, family conflicts, and estate administration complications that destroy wealth built over lifetimes. Real estate investors particularly need grasping residuary estate concepts since properties acquired shortly before death, 1031 exchange proceeds held temporarily, insurance proceeds from casualty losses, and sale proceeds from liquidations often fall into residuary estates rather than being captured by specific property bequests listing addresses that no longer apply when owners sell properties between will execution and death.

Key Summary

This comprehensive guide explains the meaning of residuary estate—the catch-all provision determining distribution of all assets not specifically designated in wills or trusts.

In this guide:

- How residuary estate clauses function as safety nets capturing unspecified assets and preventing intestacy (residuary estate legal definition)

- Common assets falling into residuary estates including recently acquired property, forgotten accounts, and proceeds from asset sales (estate administration assets)

- Consequences of missing or poorly drafted residuary provisions creating partial intestacy and unintended distributions (intestacy laws by state)

- Strategic residuary designations balancing specific bequests with flexible catch-all provisions adapting to changing circumstances (estate planning strategies)

Understanding the Meaning of Residuary Estate: The Legal Definition

The residuary estate encompasses all property and assets remaining in estates after paying debts, expenses, taxes, and distributing specific bequests designated in wills. This “remainder” or “residue” gets distributed to residuary beneficiaries according to residuary clauses in estate documents—the final catch-all provisions ensuring every asset gets distributed rather than passing through intestacy (dying without effective estate plans covering all assets).

Residuary clauses typically appear near the end of wills using standardized language: “I give, devise, and bequeath all the rest, residue, and remainder of my estate, both real and personal property, of whatever nature and wherever situated, to [named beneficiaries] in equal shares.” This comprehensive language creates legal mechanisms capturing everything not specifically designated earlier in documents—closing gaps that would otherwise create partial intestacy where portions of estates distribute according to state laws rather than testator intentions.

The distinction between specific bequests and residuary provisions determines distribution paths for different assets. Specific bequests identify particular items going to named beneficiaries: “I give my property located at 123 Main Street to my daughter Sarah.” These targeted distributions take priority—specific beneficiaries receive designated assets before residuary distributions begin. Only after satisfying all specific bequests, paying estate expenses, and settling liabilities does the residuary estate get distributed to residuary beneficiaries receiving “everything else” according to residuary clause language.

Assets commonly falling into residuary estates include: bank accounts without payable-on-death designations, brokerage accounts without transfer-on-death beneficiaries, personal property not specifically listed (furniture, vehicles, collectibles), proceeds from asset sales occurring after will execution, newly acquired properties purchased after estate document creation, lawsuit settlement proceeds, tax refunds, insurance proceeds from policies lacking beneficiary designations, business interests without succession provisions, and literally every other item owned at death not captured by specific bequests or beneficiary designations bypassing wills entirely.

Real estate frequently ends up in residuary estates despite property representing many families’ most valuable assets. Investors might specifically bequeath properties they own when executing wills: “my rental property at 456 Oak Street to my son Michael” and “my vacation home at 789 Beach Road to my daughter Jennifer.” However, if you subsequently sell the Oak Street property, acquire a new rental at 321 Pine Avenue, and die before updating your will, the new Pine Avenue property falls into your residuary estate since no specific bequest covers it—your will still references the Oak Street property you no longer own. Residuary beneficiaries receive the Pine Avenue rental despite your intention that Michael inherit rental properties, simply because outdated specific bequests didn’t capture property acquisitions occurring after initial estate planning.

The legal effect of residuary clauses creates either smooth estate administration when properly drafted or complications when missing or inadequate. Strong residuary provisions designate one or more residuary beneficiaries with clear distribution percentages, provide alternate residuary beneficiaries if primary choices predecease testators, and include comprehensive language capturing all possible asset types. Weak or missing residuary clauses create partial intestacy—portions of estates distributing according to state intestacy laws rather than will provisions, potentially sending assets to unintended recipients like distant relatives rather than close family, friends, or charities testators wanted benefiting from their wealth.

Pour-over provisions in wills work with revocable living trusts as specialized residuary clauses: “I give all the rest, residue, and remainder of my estate to the trustee of the [Trust Name] to be administered according to trust terms.” These provisions “pour” all remaining assets into trusts where trust beneficiary designations control ultimate distribution. This structure combines wills (capturing assets inadvertently titled in personal names) with trusts (providing detailed distribution instructions and probate avoidance) through residuary mechanisms ensuring comprehensive estate coverage.

Common Assets That Fall Into Residuary Estates

Certain asset categories frequently end up in residuary estates despite their substantial values, often surprising heirs who assumed specific bequests covered all significant property or that beneficiary designations eliminated everything from estate distributions.

Recently acquired property of any type commonly falls into residuary estates when owners don’t update wills after new acquisitions. If you execute a will in 2020 specifically bequeathing three rental properties you then own, then acquire two additional properties in 2023 and 2024 before dying in 2025, those later acquisitions aren’t covered by specific bequests referencing only the 2020 properties. The newer properties flow to residuary beneficiaries unless you updated your will adding specific bequests for them. This applies equally to real estate, vehicles, artwork, collectibles, or any property acquired after will execution—without specific bequests or amendments adding new items, recent acquisitions default to residuary estates.

Forgotten financial accounts at old banks, former brokerages, or forgotten online platforms frequently surface during estate administration shocking executors discovering accounts no one knew existed. Perhaps you opened savings accounts at three different banks to capture promotional bonuses, funding them with $5,000 each then forgetting them as decades pass and balances grow to $15,000-$30,000. Without payable-on-death designations, these accounts become residuary assets despite potentially significant values. Similarly, old 401(k) accounts from previous employers without beneficiary designations become estate assets flowing through residuary provisions rather than passing directly to beneficiaries outside probate.

Proceeds from asset sales occurring between will execution and death create residuary estate complications since wills reference specific assets you no longer own. Example: your will bequeaths “my Apple stock” to your grandson, but you subsequently sell that stock converting it to cash sitting in brokerage accounts at death. Without updated instructions, proceeds from stock sales flow to residuary beneficiaries—your grandson receives nothing despite your intention that he inherit the Apple position value. This applies to any asset sales: properties you specifically bequeathed but sold before death, businesses you designated for children but liquidated during retirement, or collectibles you assigned to heirs but sold when needing capital—all convert to cash or other assets falling into residuary estates unless you update wills reflecting new asset forms.

Insurance proceeds from policies lacking beneficiary designations default to estates rather than passing directly to survivors, creating unnecessary probate administration and potential creditor exposure. Life insurance normally bypasses estates through beneficiary designations, but policies without designated living beneficiaries (perhaps primary beneficiaries predeceased you and you never named alternates) pay proceeds to estates flowing through residuary provisions. Similarly, property insurance proceeds from destroyed buildings or casualty insurance settlements from accidents become residuary assets if not specifically addressed in estate documents.

Tax refunds, lawsuit settlements, and other post-death receivables frequently become residuary assets since they didn’t exist when wills were executed. If you die in March before filing prior year’s tax return showing $8,000 refund due, that refund becomes estate asset distributing through residuary provisions. If you’re plaintiff in pending lawsuit that settles after your death, settlement proceeds—potentially substantial if injury or business dispute cases—flow to residuary beneficiaries rather than specific bequest recipients unless your will somehow anticipated these proceeds (highly unlikely).

Business interests without specific succession planning end up in residuary estates creating potential operational complications. If you own 40% of a business without buy-sell agreements or specific bequest language addressing that ownership, those shares become residuary assets potentially fragmenting among multiple residuary beneficiaries lacking expertise or interest in business operations. This can destroy businesses if residuary beneficiaries don’t cooperate with surviving partners or demand immediate value liquidations when businesses need operational continuity.

Personal property with sentimental or monetary value frequently becomes residuary because people don’t specifically address every item in wills. Perhaps you collect artwork worth $150,000, own jewelry valued at $75,000, or possess tools and equipment worth $40,000, but your will only specifically designates a few items with remaining personal property falling into residuary estates. Even if you intended certain family members receiving specific items, without written documentation those items distribute to residuary beneficiaries who might not honor verbal wishes or understand sentimental attachments.

Digital assets including cryptocurrency, online accounts, websites, digital media libraries, and intellectual property increasingly fall into residuary estates as digital wealth grows but estate planning lags behind technological change. If you hold $50,000 in cryptocurrency without addressing digital assets in your will, those holdings become residuary assets potentially creating access challenges if residuary beneficiaries don’t have passwords or recovery information. Similarly, valuable domain names, monetized YouTube channels, or self-published book royalties become residuary assets potentially surprising heirs discovering unanticipated income streams continuing after your death.

What Happens When Residuary Clauses Are Missing or Inadequate

Dying without residuary provisions or with poorly drafted residuary clauses creates partial intestacy—portions of estates distributing according to state intestacy statutes rather than testator intentions, often producing results dramatically different from what deceased owners would have wanted.

Partial intestacy occurs when wills effectively dispose of some assets through specific bequests but fail to include comprehensive residuary clauses capturing everything else. Perhaps your will carefully designates recipients for your home, rental property, and retirement accounts, but includes no residuary provision. Assets covered by specific bequests distribute accordingly, but anything not specifically mentioned falls into intestacy distributing per state law. If you accumulated $75,000 in savings accounts, recently inherited $125,000 from a relative, and held $50,000 in vehicles and personal property—none specifically addressed in your will—that $250,000 distributes through intestacy rather than according to your preferences.

State intestacy laws follow standardized distribution formulas heavily favoring spouses and children, potentially excluding other family members, friends, or charities you intended benefiting from your wealth. Typical intestacy distribution: if you’re married with children, your spouse might receive 50% with remaining 50% split among children. If unmarried without children, assets might flow to parents or siblings. These statutory formulas ignore your actual wishes—perhaps you wanted a niece inheriting substantial amounts, or intended leaving portions to charity, or preferred one child receiving more than others due to special needs or circumstances. Without residuary provisions capturing all assets, intestacy laws override your preferences for anything not covered by specific bequests.

Failed residuary provisions through lapse or ademption create distribution gaps even when residuary clauses exist. Lapse occurs when residuary beneficiaries predecease testators and no alternate beneficiaries were designated. Example: your residuary clause names “my sister Mary” as sole residuary beneficiary, but Mary dies before you. Without alternate residuary beneficiaries designated, the residuary clause “lapses” creating intestacy for those assets despite having attempted addressing them. Anti-lapse statutes in most states save failed bequests to direct relatives by substituting their descendants, but these statutes don’t always apply to residuary provisions or non-relative beneficiaries, potentially creating intestacy for substantial estate portions.

Ademption problems arise when specific bequests fail because testators no longer own designated property at death, and no residuary clause exists to capture substitute assets. If your will bequeaths “my 2015 Honda Accord to nephew Kevin” but you sold that vehicle buying a 2023 Toyota Camry before death, Kevin receives nothing through ademption doctrine (specific bequest fails because specific property no longer exists). Without residuary provisions, the Toyota might distribute through intestacy to your spouse or children rather than to Kevin despite your clear intention that he receive your vehicle. Strong residuary clauses prevent this—even if specific bequests fail through ademption, residuary provisions ensure assets go to designated residuary beneficiaries rather than falling into intestacy.

Abatement complications arise when estates lack sufficient assets satisfying all specific bequests plus estate expenses, requiring reduction of bequests. Legally, residuary estates bear abatement burden first—if estate expenses and debts exceed expectations, residuary beneficiaries receive reduced amounts or nothing while specific bequest recipients receive full designated gifts. However, without residuary provisions, specific bequests might need abatement proportionally creating complex administration determining reduction percentages. Additionally, if estate values unexpectedly decrease (market crashes, business failures, litigation losses), missing residuary clauses create uncertainty about distribution of diminished estates not anticipated when making specific dollar-amount bequests summing to more than remaining estate values.

Creditor claim implications exist when estates lack proper residuary provisions. Creditors collect from estates before distributions to beneficiaries, with residuary estates typically bearing liability for estate debts. Without residuary provisions, determining which assets satisfy creditor claims becomes complicated—should specific bequest recipients receive designated assets despite estate insolvency, or do specific bequests get reduced to pay creditors? Residuary clauses clarify that estate obligations get satisfied from residuary assets before any distributions occur, protecting specific bequest recipients from complicated abatement calculations.

Practical administration challenges multiply when executors must identify every asset determining whether it’s covered by specific bequests or falls into intestacy without residuary provisions. This creates extensive legal work, court proceedings, and potential disputes among heirs arguing about asset classifications. Each uncovered asset requires separate intestacy analysis potentially creating dozens of small distributions to distant relatives under intestacy formulas rather than simple single distribution to one or two residuary beneficiaries. The administrative costs from this complexity might consume 5-15% of estate values compared to 1-3% for straightforward residuary distributions—destroying wealth through avoidable legal fees.

Strategic Uses of Residuary Estate Provisions

Beyond serving as safety nets preventing intestacy, residuary clauses enable sophisticated estate planning strategies balancing flexibility with control when properly structured and thoughtfully deployed.

Unequal residuary distributions among children provide opportunities addressing different circumstances without specifically itemizing reasoning in wills. Perhaps one child has special needs requiring additional financial support, another has been financially successful not needing inheritance equally, or a third has been estranged from family. Rather than making unequal specific bequests generating questions and potential disputes, some parents equalize specific bequests (perhaps giving each child a rental property) while designating unequal residuary percentages: “40% to Child A, 40% to Child B, 20% to Child C.” This structure provides each child something tangible through specific bequests while adjusting total inheritance amounts through residuary flexibility without highlighting unequal treatment as starkly as obviously different specific bequest values would.

Charitable remainder strategies use residuary provisions creating major charitable bequests without reducing lifetime asset use or requiring current giving sacrifices. You might make specific bequests to family members covering their needs (perhaps $500,000 total to children through specific property and cash bequests), then designate charities as residuary beneficiaries receiving everything else. This allows accumulating wealth throughout lifetime using it freely without concern about spending “charity money,” while ensuring whatever remains at death (potentially millions) flows to charitable causes. Families get adequate provisions through specific bequests, charities receive potentially enormous residuary gifts, and you maintain complete financial flexibility until death not restricted by lifetime charitable commitments.

Contingent planning through layered residuary provisions creates backup plans if primary beneficiaries predecease or are unable to receive distributions. Example: “I give my residuary estate to my spouse if surviving, but if my spouse predeceases me, then to my children in equal shares, but if any child predeceases leaving descendants, then to that child’s descendants per stirpes.” These contingent provisions ensure distributions pass according to your wishes across multiple scenarios rather than creating intestacy if simple residuary clauses fail through lapse. Each “but if” clause creates another layer preventing distribution gaps regardless of when deaths occur relative to yours.

Percentage-based residuary distributions provide flexibility as estate values fluctuate. Rather than dollar-specific bequests that might leave little for residuary beneficiaries if estates grow substantially, or that might exceed estate values if assets decline unexpectedly, percentage-based residuary provisions ensure distributions remain proportional. Example: “50% of my residuary estate to Beneficiary A, 30% to Beneficiary B, 20% to Beneficiary C.” Whether your estate ends up being worth $500,000 or $5 million at death, these percentages automatically adjust ensuring intended proportional distribution without requiring will amendments tracking estate value changes.

Trust funding through residuary provisions elegantly combines wills with trusts avoiding probate while maintaining will simplicity. Your will makes simple specific bequests of valuable items, then residuary clause states: “I give all the rest, residue, and remainder of my estate to the trustee of my revocable living trust to be administered according to trust terms.” This pour-over provision catches everything not specifically bequeathed or retitled into trusts during lifetime, ensuring comprehensive trust funding at death providing detailed distribution instructions through trust documents rather than cluttering wills with extensive provisions. Most sophisticated estate plans use this structure combining simple wills with comprehensive trusts funded through residuary provisions.

Equalization strategies among beneficiaries receiving different asset types use residuary provisions preventing inequities. Perhaps Child A receives rental property you specifically bequeath valued at $400,000, Child B receives business interests valued at $300,000, and Child C receives nothing specific. To equalize, your residuary clause might state: “I give my residuary estate to Child C until receiving $350,000, with any excess split equally among all three children.” This structure gives Child C approximate equality through residuary estate priority, then distributes remaining residuary assets among everyone once substantial equalization occurs. Calculate these equalizations using our legacy planning calculator understanding how different bequest structures affect ultimate distributions.

Residuary Estate Planning for Real Estate Investors

Real estate investors face unique residuary estate challenges since property portfolios change frequently through acquisitions, sales, 1031 exchanges, and ownership restructuring—creating high probability that specific property bequests become outdated between will execution and death.

Property-specific versus entity-level bequests determine whether individual property transfers need updating constantly or whether entity ownership provides automatic updating as portfolios evolve. If you own properties individually and make specific bequests: “my property at 123 Main Street to Son A, my property at 456 Oak Avenue to Daughter B,” you must amend wills every time buying or selling properties. However, if you own properties through entities (LLCs) and bequeath entity interests rather than individual properties: “my ownership interests in Smith Family Holdings LLC to my children equally,” your will automatically captures all properties owned by that entity regardless of portfolio changes. Entity-level bequests work through residuary provisions: “I give my residuary estate including all entity ownership interests to [beneficiaries],” capturing entity holdings without specific property-by-property designation.

1031 exchange complications arise when dying mid-exchange or shortly after exchanges before updating estate documents. If you sell a rental property specifically bequeathed in your will (“my property at 789 Pine Street to nephew David”) and die during the 180-day exchange period before acquiring replacement property, David receives nothing through ademption (the Pine Street property no longer exists). Worse, if you complete the exchange acquiring new property at 321 Elm Avenue but die before updating your will to specify that replacement property, Elm Avenue falls into your residuary estate rather than going to David. Investors using 1031 exchanges should either make entity-level bequests automatically capturing replacement properties, or update wills immediately after exchanges adding specific bequests for new properties if wanting beneficiaries receiving particular properties rather than general residuary distributions.

Mortgaged property in residuary estates creates questions about whether beneficiaries receive properties subject to debt or whether estates pay off mortgages before distribution. Most state laws require estates paying debts before distributions, but mortgage debt secured by property doesn’t necessarily get paid from other estate assets—beneficiaries typically receive properties subject to existing mortgages unless wills specifically direct mortgage payoff. If your residuary estate includes rental property with $300,000 debt against $500,000 value, residuary beneficiaries inherit $500,000 property but also $300,000 debt obligation—receiving net $200,000 equity, not gross $500,000 value. Clarify intentions: “I give my residuary estate including all real property to [beneficiaries], directing my executor to pay all secured debts from other estate assets before distribution,” if wanting beneficiaries receiving unencumbered property.

Reverse mortgage properties require special attention in residuary provisions since these loans become due at death, requiring property sale or refinancing by heirs wanting to keep properties. If your primary residence with reverse mortgage falls into your residuary estate, residuary beneficiaries must either pay off the reverse mortgage through refinancing or sell the property with proceeds first satisfying reverse mortgage debt, then distributing remaining equity. Without adequate estate liquidity or heir financing capacity, reverse mortgage properties in residuary estates might force sales even when heirs want keeping homes, simply because they can’t refinance qualifying conventionally. Estate plans should address reverse mortgage payoff explicitly: “My executor shall pay all secured debts including any reverse mortgage from my residuary estate before distribution,” ensuring clarity about reverse mortgage handling rather than leaving beneficiaries surprised by immediate loan maturity.

Partnership and tenancy interests in investment properties create complications when passing through residuary estates without coordination with co-owners. If you own properties jointly with partners or family members, those interests pass through residuary provisions potentially fragmenting among multiple residuary beneficiaries not involved in property management or relationships with partners. Strong real estate investor estate plans include buy-sell agreements with co-owners triggered by death, preventing residuary distributions of partnership interests to beneficiaries unfamiliar with properties or partners. Alternatively, establish that partnership interests flow to specific beneficiaries through targeted bequests rather than residuary provisions: “I give my partnership interests in [Property LLC] to [specific business-savvy heir]” rather than letting those interests distribute generally through residuary clauses to beneficiaries potentially including minor children or spouses lacking business acumen for partnership participation.

Professional management transition plans for properties in residuary estates ensure continuous operations during estate administration. If your rental portfolio falls into your residuary estate without specific management succession instructions, who collects rents, handles repairs, and makes decisions during the months or years until estate administration completes? Include provisions: “My executor is authorized to continue operating all real estate businesses during estate administration, hiring professional management if necessary, with costs paid from property income,” preventing operational disruptions harming property values before residuary distributions occur. Consider whether to keep properties under management during administration or sell them quickly, and document those intentions rather than leaving executors guessing about your preferences.

Coordinating Residuary Provisions with Non-Probate Transfers

Many assets bypass wills entirely through beneficiary designations, joint ownership, or trust ownership—creating coordination challenges ensuring residuary provisions work harmoniously with non-probate transfers rather than creating conflicts or unintended results.

Beneficiary designation assets including retirement accounts, life insurance, payable-on-death bank accounts, and transfer-on-death brokerage accounts pass directly to named beneficiaries regardless of will provisions or residuary clauses. If your will names your children as residuary beneficiaries but your $500,000 IRA designates your spouse, your spouse receives the IRA despite your children being residuary beneficiaries—beneficiary designations supersede wills. Review all beneficiary designations ensuring they align with overall estate plans. Many people intend residuary estates capturing “everything” not realizing 60-70% of wealth might bypass wills entirely through beneficiary designations, leaving only 30-40% flowing through residuary provisions to designated residuary beneficiaries. This creates unintended distribution imbalances if not carefully coordinated.

Joint tenancy with right of survivorship property automatically passes to surviving joint tenants rather than through residuary estates, potentially creating unintended consequences if you assume jointly owned property will flow to residuary beneficiaries. Perhaps you add your daughter to your home deed for convenience helping with management, intending your residuary estate distributing equally among all three children. However, joint tenancy means your daughter automatically inherits the full home at your death regardless of residuary provisions, giving her the home plus one-third of your residuary estate while her siblings each receive only one-third residuary shares—creating 40/30/30 distribution instead of intended 33/33/33 equality. Either avoid joint tenancy for estate planning purposes or adjust residuary designations offsetting joint tenancy advantages: “I give my residuary estate to Child B and Child C in equal shares” (excluding Child A who already receives the home through joint tenancy).

Trust assets don’t pass through wills or residuary provisions since trusts own property directly, distributing according to trust terms rather than will provisions. If you transferred rental properties into revocable living trust, those properties distribute per trust beneficiary designations, not your will’s residuary clause. Ideally, wills and trusts coordinate: your will’s residuary clause might “pour over” any assets still in your personal name into your trust, ensuring comprehensive trust funding at death combining both properly titled trust assets plus anything accidentally left outside trusts. Without pour-over provisions, assets titled in personal names that you assumed were in trusts might distribute through residuary clauses to different beneficiaries than trust provisions designate—creating unintended distribution splits between will beneficiaries and trust beneficiaries.

Life insurance proceeds generally bypass estates through beneficiary designations, but policies naming estates as beneficiaries dump proceeds into residuary estates, subjecting insurance money to probate costs, creditor claims, and estate tax exposure. Never designate estates as life insurance beneficiaries except in unusual circumstances requiring estate liquidity for tax payments or debt satisfaction. However, if you purchased policies decades ago before understanding estate planning, you might have named your estate as beneficiary thinking that meant “everything in my will.” Review all policies ensuring beneficiary designations name actual people or trusts, not estates, preventing unnecessary probate administration and potential creditor exposure to insurance proceeds that could bypass estates entirely with proper beneficiary designations.

Payable-on-death and transfer-on-death designations on bank accounts and brokerage accounts create immediate post-death transfers to named beneficiaries without probate, but many account holders don’t realize these designations exist or never established them. Survey all financial accounts determining whether they have beneficiary designations. Accounts without designations become residuary estate assets subject to probate and creditor claims, while properly designated accounts transfer immediately to named beneficiaries bypassing estate administration entirely. Financial institutions should be offering these beneficiary designation options during account opening, but many customers don’t complete paperwork or understand implications, inadvertently making accounts residuary estate assets when simple beneficiary designations could have avoided probate.

Updating Residuary Provisions: When and How to Revise Estate Documents

Estate plans require periodic updating as circumstances change, with residuary provisions particularly needing attention when family situations, asset composition, or distribution intentions evolve from initial estate planning assumptions.

Major life events triggering estate document review include: marriages, divorces, births, adoptions, deaths of beneficiaries or executors, significant wealth changes (substantial increases or decreases), major asset acquisitions or sales, moving to different states (potentially changing applicable laws), and relationship changes (estrangements, reconciliations, new important relationships). Any of these events potentially requires adjusting residuary provisions reflecting new realities—perhaps adding new family members as residuary beneficiaries, removing divorced spouses from residuary designations, or adjusting residuary percentages after one child’s death leaving grandchildren you want treating equally with surviving children.

Property portfolio changes for real estate investors demand particular attention to residuary provision adequacy. If you’ve acquired five new rental properties since last updating your will, those properties fall into your residuary estate unless you’ve added specific bequests for them or use entity-level bequests automatically capturing new acquisitions. Review estate documents every 3-5 years minimum, or immediately after major portfolio changes like 1031 exchanges, partnership formations, or significant acquisitions, ensuring residuary provisions and specific bequests remain aligned with current portfolio composition and intended beneficiary allocations.

Changing beneficiary relationships sometimes require residuary adjustment rather than specific bequest modifications. Perhaps you’ve grown closer to certain family members while becoming distant from others, or charitable interests have shifted toward different causes. Adjusting residuary beneficiary percentages or designations proves simpler than rewriting numerous specific bequests—change your residuary clause from “50% to Child A, 50% to Child B” to “60% to Child A, 25% to Child B, 15% to charity” reflecting new priorities without modifying every specific bequest throughout your will.

Tax law changes occasionally require residuary provision updates optimizing estate tax efficiency. While most estates fall below federal estate tax thresholds ($13.61 million per person in 2024, though scheduled to decrease), state estate taxes with lower thresholds affect many estates. Residuary provisions incorporating tax planning formulas (perhaps allocating amounts equal to estate tax exemptions to family trusts, with remaining residuary assets to marital trusts) need updating when exemption amounts change through legislation. Consult estate planning attorneys after major tax law changes determining whether existing residuary provisions remain optimal under new rules or need modification.

Beneficiary designation coordination requires verifying that beneficiaries named on retirement accounts, insurance policies, and financial accounts align with residuary provisions in wills or trusts. Perhaps your will names your three children equally as residuary beneficiaries, but your retirement account worth half your estate names only your oldest child as beneficiary from 20 years ago when you first opened it. This creates massive distribution imbalance—one child receives half the estate through retirement account beneficiary designation plus one-third of remaining estate through residuary provisions (totaling 67% of estate), while siblings each receive only 17% through residuary estate shares. Update beneficiary designations on all accounts whenever updating wills, ensuring coordinated comprehensive plans rather than contradictory distributions.

Codicils versus complete rewrites represent two approaches to estate document updating. Codicils are amendments to existing wills modifying specific provisions without rewriting entire documents—useful for minor changes like adjusting residuary percentages or updating executor nominations. However, multiple codicils create confusion and interpretation challenges if provisions contradict. Complete will rewrites prove cleaner for substantial changes affecting many provisions, particularly when updating estate plans you haven’t reviewed in 10+ years. Most modern estate planning uses complete rewrites even for moderate changes, avoiding codicil complications and ensuring clean comprehensive documents reflecting current intentions without requiring tracking multiple codicils to understand complete distribution plans.

Schedule a call discussing how estate planning considerations affect real estate portfolio management, including strategic use of HELOCs or home equity loans accessing equity during lifetime potentially reducing estate values and tax exposure while funding lifetime goals rather than leaving everything for distribution at death. Some investors prefer spending equity rather than leaving large estates, while others prioritize legacy wealth transfer—understanding your priorities guides appropriate residuary provision structures.

Your Next Steps: Creating or Updating Residuary Estate Provisions

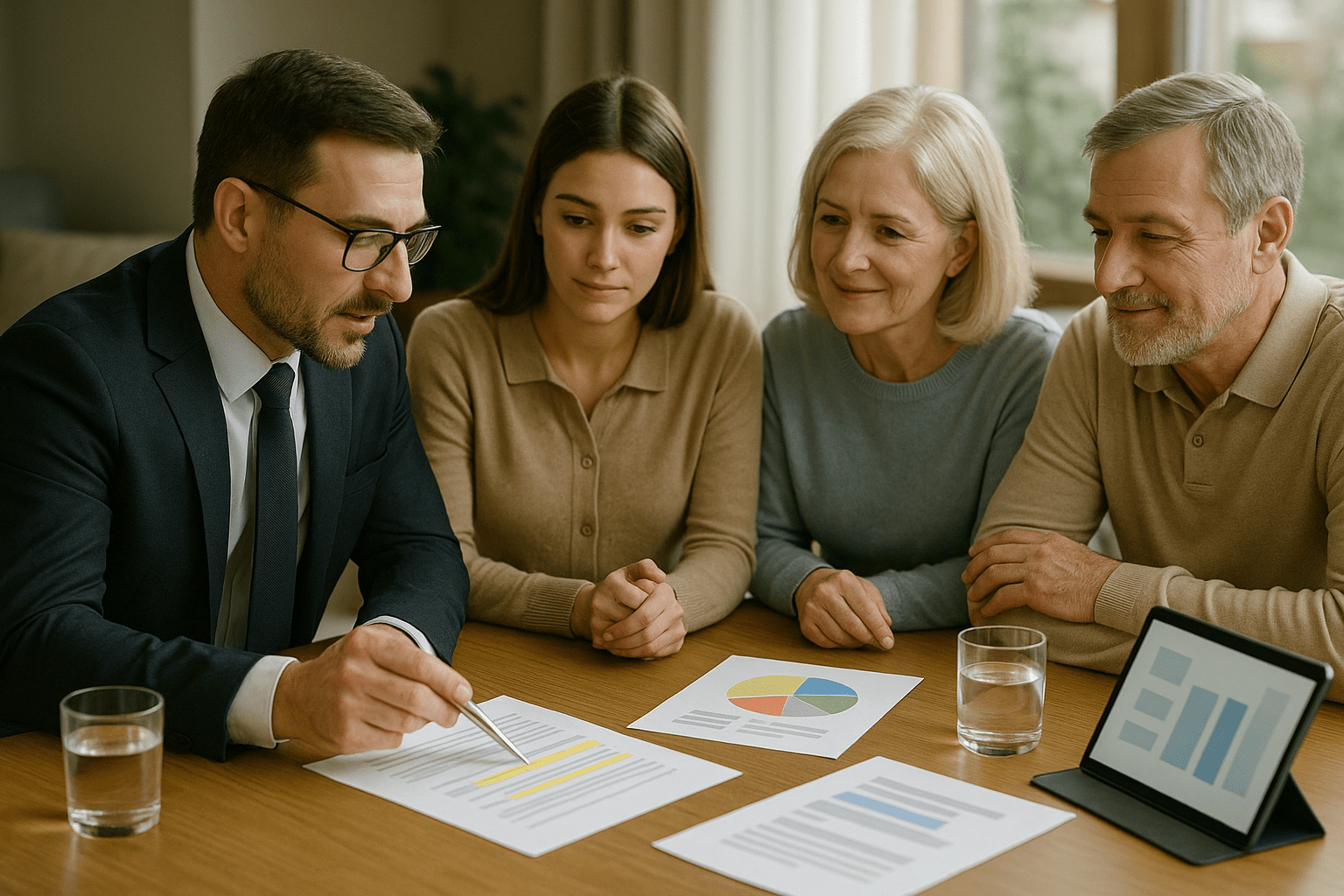

Converting residuary estate knowledge into protected estate plans requires systematic action ensuring comprehensive provisions prevent intestacy while maintaining appropriate flexibility as circumstances evolve.

Inventory all assets determining what you own and how each asset is titled or designated. Create comprehensive lists including: real property with deeds (check exact title status—individual, joint, trust, entity ownership), financial accounts with beneficiary designation status noted, business interests documenting ownership structures, vehicles and titled personal property, valuable collections and assets, digital assets (cryptocurrency, accounts, intellectual property), and life insurance policies with current beneficiary designations confirmed. This inventory reveals which assets have specific disposition mechanisms (beneficiary designations, joint ownership) versus those likely flowing through wills and residuary provisions.

Review existing estate documents if you have them, identifying your current residuary clause language and residuary beneficiaries. Does your residuary provision name specific people with clear percentages? Does it include alternate beneficiaries if primary choices predecease you? Does it use comprehensive language capturing all asset types? If your will was prepared over a decade ago, residuary provisions might not address digital assets, cryptocurrency, or other recently developed asset categories—update language ensuring comprehensive coverage of modern wealth forms.

Engage experienced estate planning attorneys rather than using online templates or DIY approaches for anything but simplest situations. Attorneys help coordinate wills with trusts, beneficiary designations with residuary provisions, and specific bequests with catch-all clauses ensuring comprehensive plans without gaps creating partial intestacy. Budget $1,500-$5,000 for comprehensive estate planning including wills, powers of attorney, healthcare directives, and potentially trusts—reasonable investments protecting estates worth hundreds of thousands or millions from intestacy, disputes, or tax exposure through improper planning.

Decide residuary beneficiary designations thoughtfully, considering whether equal treatment among family members proves appropriate or whether different circumstances justify unequal distributions through specific bequests and residuary allocations. Some families benefit from equal residuary provisions avoiding perceived favoritism, while others appropriately adjust for different needs (special needs family members, successful children not needing inheritance equally, estranged relationships). Document reasoning for unequal distributions in separate letters of instruction (not wills directly) explaining decisions reducing likelihood of will contests from disappointed beneficiaries.

Coordinate all non-probate transfers ensuring beneficiary designations on retirement accounts, insurance, and financial accounts align with will provisions and residuary clauses creating cohesive comprehensive plans. Review every account confirming beneficiaries are correct and current—outdated beneficiary designations naming deceased relatives or ex-spouses override will provisions creating unintended distributions. Treat beneficiary designation review as important as will creation since those designations often control majority of estate values bypassing wills entirely.

Establish regular review schedules checking estate documents every 3-5 years minimum or immediately after major life changes. Don’t set up estate plans then forget them for 20+ years—outdated plans prove nearly as problematic as no plans when circumstances change dramatically. Calendar biennial reviews, prompting you to verify beneficiaries remain appropriate, asset inventories remain current, executor and trustee nominations remain suitable, and residuary provisions still reflect distribution intentions matching current family and financial situations.

Communicate estate plan outlines to family members avoiding confusion and disputes when plans eventually get implemented. You don’t need disclosing specific dollar amounts or exact provisions, but letting family know general distribution approaches (perhaps equal treatment among children, or explanation that one child receives business while others receive liquid assets, or clarity that significant charitable bequests are planned) helps manage expectations preventing surprises that often trigger will contests. Some families benefit from open discussions while others prefer privacy—choose approaches fitting your family dynamics.

Remember that meaning of residuary estate extends beyond legal technicalities—residuary provisions represent your final safety net ensuring everything you’ve accumulated over your lifetime gets distributed according to your wishes rather than defaulting to state intestacy formulas that might contradict your intentions entirely. Strong residuary clauses capture everything not otherwise designated, provide clear beneficiary instructions, anticipate possible scenarios through contingent provisions, and create administrative efficiency allowing executors distributing estates smoothly without legal complications or family conflicts. Invest time creating strong residuary provisions preventing inheritance chaos that destroys wealth and relationships.

Frequently Asked Questions

What happens if I don’t have a residuary clause in my will?

Assets not covered by specific bequests or beneficiary designations pass through intestacy—state laws determine who inherits based on statutory formulas prioritizing spouses, children, and other close relatives. These intestacy distributions might completely contradict your wishes: perhaps you wanted a close friend or charity receiving substantial bequests, but intestacy laws only recognize family relationships sending everything to relatives you barely knew. Additionally, intestacy creates administrative complications requiring court proceedings establishing heirship and distribution rights, potentially consuming months and substantial legal fees that properly drafted residuary clauses would have avoided. Even simple residuary provisions stating “I give all the rest, residue, and remainder of my estate to [named person]” prevents intestacy for any assets not specifically bequeathed elsewhere in your will. Never execute wills without comprehensive residuary clauses regardless of how thoroughly you believe specific bequests cover everything—you can’t possibly anticipate every asset you’ll own at death, and residuary provisions provide essential safety nets preventing intestacy gaps.

Can residuary beneficiaries refuse their inheritances or redirect them to different recipients?

Yes—beneficiaries can disclaim (refuse) inheritances within nine months of death, causing disclaimed property passing according to will provisions as if disclaiming beneficiaries had predeceased. If your residuary clause names “my three children equally” as beneficiaries but one child disclaims, that child’s residuary share typically passes to remaining residuary beneficiaries (your other two children splitting disclaimed portions equally) unless your will specifies alternate distribution. Disclaimers must be complete refusals—beneficiaries can’t accept partial portions while disclaiming others, or accept then give assets to intended recipients (those transactions count as completed inheritances followed by gifts). Disclaimers serve various purposes: perhaps beneficiaries in high tax brackets disclaim passing inheritance to lower-bracket relatives, or wealthy residuary beneficiaries disclaim allowing next generation receiving inheritances directly skipping estate tax on beneficiaries’ eventual deaths. Consult estate and tax attorneys before disclaiming since disclaimers create permanent binding consequences that can’t be reversed if circumstances change or beneficiaries regret decisions.

How do residuary provisions work with trusts—do I need both?

Most sophisticated estate plans combine wills with revocable living trusts using pour-over provisions in wills functioning as specialized residuary clauses. Your trust owns assets during lifetime and distributes them at death according to detailed trust beneficiary provisions. Your will contains residuary clause stating: “I give all the rest, residue, and remainder of my estate to the trustee of my revocable living trust to be administered according to trust terms.” This structure captures anything inadvertently left outside trusts during lifetime, “pouring” those assets into trusts where comprehensive distribution instructions govern ultimate beneficiary allocation. Without wills containing pour-over residuary provisions, assets accidentally titled in personal names instead of trusts distribute according to will-based residuary beneficiaries or through intestacy—potentially sending those assets to different beneficiaries than trust provisions designate. The combination ensures comprehensive estate coverage: trusts provide probate avoidance and detailed distribution instructions for properly titled assets, while wills with pour-over residuary provisions catch anything missing from trusts ensuring everything ultimately flows to trust beneficiaries rather than creating split distributions.

What if my residuary beneficiary dies before me—what happens to the residuary estate?

Consequences depend on whether your will includes alternate residuary beneficiaries and whether anti-lapse statutes in your state apply. If your residuary clause names single beneficiary without alternates, that beneficiary’s death creates lapsed residuary bequest potentially causing partial intestacy unless anti-lapse statutes save failed bequests by substituting descendants. Most states have anti-lapse rules providing that if beneficiaries who were relatives of testators predecease, their descendants automatically substitute—so if your residuary beneficiary was your sister who predeceased you, her children would receive residuary estate through anti-lapse provisions. However, these statutes don’t always apply to non-relatives, and rules vary by state. Prevent these complications by including comprehensive contingent beneficiary provisions: “I give my residuary estate to my brother, but if my brother predeceases me, then to his children in equal shares, but if no children survive, then to [charity].” These layered provisions ensure clear distribution regardless of death order, avoiding intestacy even if multiple beneficiaries predecease you.

Should real estate investors use residuary provisions or specific property bequests?

Most real estate investors benefit from hybrid approaches: specific bequests for properties they’re certain keeping until death with strong intent about particular recipients, combined with comprehensive residuary provisions capturing properties acquired after will execution or held in entities. For properties you’re confident keeping long-term and want specific heirs receiving (perhaps your primary residence to spouse, family vacation property to children collectively), use specific bequests providing clarity and reducing potential disputes. However, for rental properties you might sell, 1031 exchange, or restructure frequently, entity-level ownership with residuary provisions capturing entity interests proves more flexible: “I give my ownership interests in [Family Holdings LLC] to my children equally” combined with residuary clause ensuring anything not specifically bequeathed flows to designated residuary beneficiaries. This structure avoids constant will amendments every time portfolio composition changes while ensuring clear distribution of entity holdings automatically capturing portfolio changes without document updates. Review estate plans every 3-5 years regardless of approach, ensuring specific bequests remain accurate and residuary provisions continue reflecting distribution intentions as portfolios and family circumstances evolve.

Related Resources

Also helpful for legacy planning:

- Building Generational Wealth Through Real Estate — Long-term wealth transfer strategies

- Tax Strategies for Real Estate Investors — Minimizing estate and inheritance taxes

- Passive Portfolio Management — Transitioning to passive investments for estate simplification

What’s next in your journey:

- Advanced Estate Planning Strategies — Trusts, family limited partnerships, and sophisticated techniques

- Gifting Strategies During Lifetime — Reducing estate values through strategic giving

- Protecting Real Estate Assets — Shielding property from creditors and litigation

Explore your financing options:

- Reverse Mortgage Program — Accessing home equity in retirement

- HELOC Program — Flexible equity access for lifetime needs

- Home Equity Loan Program — Fixed-rate equity borrowing

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.