Private Placement Life Insurance: The Ultra-Wealthy’s Secret Tax-Sheltered Investment

Private Placement Life Insurance: The Ultra-Wealthy’s Secret Tax-Sheltered Investment

You’ve built substantial wealth accumulating a $50 million net worth through business success and real estate investments. Your financial advisor mentions you’re paying over $2 million annually in investment taxes—capital gains on stock sales, dividends, interest income, and rental property income all generating substantial tax liability year after year.

You’ve maxed out traditional tax-advantaged accounts. Your retirement accounts hold the maximum allowable. 1031 exchanges defer real estate gains but don’t eliminate taxes. Opportunity zone investments provided some benefits but have strict limitations. You’re searching for additional tax-efficient investment vehicles that don’t sacrifice returns or impose inflexible restrictions.

Your wealth advisor mentions something you’ve never heard of: private placement life insurance. Unlike retail variable universal life policies sold to mass market, private placement life insurance offers institutional investment platforms wrapped in life insurance structures, providing tax-free growth on alternative investments—hedge funds, private equity, real estate funds, and other sophisticated strategies—without the investment restrictions plaguing retail insurance products.

It sounds complex, exclusive, and almost too good to be legitimate. Yet thousands of ultra-high-net-worth families use private placement life insurance as cornerstone tax planning vehicles, sheltering tens of millions from taxation while maintaining investment flexibility that retail products can’t match.

Key Summary

Private placement life insurance represents customized variable life insurance policies available exclusively to ultra-high-net-worth individuals with typically $5 million+ liquid net worth, offering tax-free growth on institutional-grade alternative investments within life insurance wrappers that provide permanent tax elimination rather than mere deferral, assuming compliance with insurance tax law requirements.

In this guide:

- PPLI structure fundamentals explaining how institutional life insurance differs from retail products through separate account customization, alternative investment access, and sophisticated fee arrangements (IRS tax code guidance)

- Tax advantages and mechanics showing how properly structured policies achieve tax-free investment growth, tax-free policy loans, and estate tax benefits through permanent insurance taxation (estate tax fundamentals)

- Investment flexibility and options including hedge funds, private equity, real estate funds, and other alternative strategies unavailable in retail variable policies (alternative investment fundamentals)

- Qualification requirements, costs, and implementation showing minimum net worth thresholds, fee structures, and working with specialized advisors navigating PPLI complexity (wealth management strategies)

Private Placement Life Insurance: Understanding the Structure

Before exploring tax benefits and investment options, understanding what makes private placement life insurance different from retail life insurance establishes the foundation for appreciating this sophisticated planning tool.

What Makes PPLI Different from Retail Life Insurance

Private placement life insurance operates under the same basic insurance tax law as retail variable universal life policies, but implementation differs dramatically in ways that benefit ultra-wealthy policyholders.

Core structural differences:

Separate account customization: Retail variable life policies offer limited investment menu—typically 50-150 mutual fund subaccounts selected by insurance carrier. Private placement life insurance creates dedicated separate accounts holding virtually any investment the policyholder selects, including hedge funds, private equity funds, venture capital funds, real estate funds, and other alternative investments unavailable in retail products.

Institutional pricing: Retail policies carry high internal expenses, commissions, and insurance charges built into standard pricing. Private placement life insurance typically costs less for insurance coverage since policies are sold without commissions to sophisticated buyers who negotiate transparent fee arrangements.

Minimum premium thresholds: Retail variable life accepts premiums from thousands annually. Private placement life insurance requires substantial premiums—typically $1-$5 million minimum initial premium, with many policies funded at $5-$25 million or more.

Securities regulation exemption: Retail variable life policies are registered securities regulated under Securities Act of 1933. Private placement life insurance is offered under private placement exemptions (Regulation D) to accredited investors, avoiding registration requirements and enabling greater investment flexibility.

Customized underwriting: Retail policies use standardized underwriting and pricing. Private placement life insurance underwrites each case individually, often obtaining better mortality pricing for exceptionally healthy wealthy individuals given their superior health profiles and access to premium healthcare.

How the insurance wrapper works:

Life insurance receives preferential tax treatment because death benefits compensate beneficiaries for human life loss. Congress extended tax benefits to cash value buildup inside permanent life insurance, reasoning that accumulated cash value supports death benefit guarantees.

This tax treatment applies to both retail and private placement life insurance, provided policies satisfy insurance tax law requirements including:

- Minimum mortality risk (actual insurance protection, not pure investment)

- Premium limitations preventing over-funding

- Distribution restrictions (substantial penalties for early withdrawals)

- Diversification requirements (no concentrated positions in single securities or real property)

Private placement life insurance leverages these tax advantages while maximizing investment flexibility within regulatory boundaries.

The Insurance Component Versus Investment Component

Private placement life insurance combines two distinct components serving different purposes within unified product.

Insurance component:

The mortality risk element provides death benefit protection—when insured dies, policy pays income-tax-free death benefit to beneficiaries. For ultra-wealthy individuals, this insurance serves multiple purposes:

Estate liquidity: Death benefit provides liquidity for estate taxes, allowing heirs to pay estate tax bills without forced liquidation of businesses or real estate at disadvantageous timing.

Creditor protection: Life insurance enjoys creditor protection in most states, shielding policy values from lawsuits, bankruptcies, or business liabilities.

Estate tax leverage: For estates exceeding exemptions, death benefit passes estate-tax-free to beneficiaries through irrevocable life insurance trusts (ILITs), multiplying wealth transfer efficiency.

Legacy creation: Even for ultra-wealthy individuals who don’t “need” life insurance financially, death benefits create wealth transfer leverage and leave lasting legacies for heirs, charities, or foundations.

However, for many PPLI purchasers, insurance benefits are secondary to tax-advantaged investment growth. They’re not buying insurance that happens to have investment features—they’re buying tax-sheltered investment vehicles that happen to include insurance.

Investment component:

The cash value accumulation within policy represents the primary economic benefit for most PPLI owners. This cash value:

Grows tax-deferred: Investment returns—capital gains, dividends, interest—accumulate tax-free within policy. No annual 1099 forms, no capital gains taxes on portfolio rebalancing, no tax drag reducing compounding.

Access via tax-free loans: Policyowners can access cash value through policy loans that aren’t treated as taxable income, effectively withdrawing investment gains without taxation during lifetime.

No required distributions: Unlike retirement accounts requiring minimum distributions after age 73, life insurance has no forced distribution requirements, allowing unlimited tax-free compounding.

Estate tax benefits: Cash value and death benefit can pass estate-tax-free to heirs through proper ILIT structuring, eliminating both income and estate taxes permanently.

Minimum insurance requirements:

IRS rules require legitimate insurance protection preventing pure investment accounts from receiving life insurance tax treatment. Specifically:

Guideline Premium Test or Cash Value Corridor: Policies must maintain minimum ratio of death benefit to cash value, ensuring meaningful mortality risk exists. Death benefit must exceed cash value by percentages declining with age (250% at age 40, declining to 105% at age 95).

Seven-Pay Test: Premiums cannot exceed seven annual level premiums funding policy to maturity. Violating this test converts policy to Modified Endowment Contract (MEC) losing favorable loan tax treatment.

These requirements mean PPLI cannot be pure investment accounts—genuine insurance must exist. However, sophisticated policy design minimizes insurance costs while maximizing investment capacity within allowable limits.

Many successful real estate investors who built wealth using DSCR loans or portfolio loans to scale rental portfolios eventually explore PPLI as vehicles for tax-efficiently investing liquidity generated from property sales, refinancing proceeds, or accumulated cash flow.

Domestic Versus Offshore PPLI

Private placement life insurance can be structured as domestic policies (issued by U.S. insurance companies) or offshore policies (issued by non-U.S. carriers), with significant differences in flexibility, regulation, and tax treatment.

Domestic PPLI:

Policies issued by U.S. insurance carriers licensed in various states:

Advantages:

- Clear U.S. tax law application

- State insurance regulatory oversight and protections

- No offshore reporting requirements (no FATCA, FBAR filings)

- Potentially stronger creditor protection under state insurance laws

- Simpler administration and compliance

Disadvantages:

- More restrictive investment diversification rules

- State insurance department oversight of investment choices

- Potentially higher insurance costs due to state reserve requirements

- Less investment flexibility compared to offshore alternatives

Offshore PPLI:

Policies issued by insurance carriers domiciled in favorable offshore jurisdictions (Cayman Islands, Bermuda, Switzerland, Liechtenstein):

Advantages:

- Maximum investment flexibility with fewer restrictions

- Access to broader range of alternative investments

- Often lower insurance costs due to favorable reserve requirements

- Potential asset protection benefits from offshore structuring

- Favorable jurisdictions for multi-generational wealth planning

Disadvantages:

- Complex offshore reporting (FATCA Form 8938, FBAR FinCEN 114)

- Potential IRS scrutiny of offshore structures

- Less clear regulatory oversight

- Higher setup and ongoing administration costs

- Requires specialized advisors with offshore expertise

Tax treatment:

For U.S. taxpayers, properly structured domestic and offshore PPLI receive identical income tax treatment under IRC Section 7702. Both provide tax-free accumulation and tax-free access through loans.

However, offshore PPLI requires careful structuring avoiding “investor control” doctrine where IRS could argue policyholder controls underlying investments too directly, causing taxation. This doctrine has more application to offshore policies than domestic ones.

Which to choose:

Domestic PPLI: Best for most ultra-wealthy U.S. investors seeking simplicity, clear regulatory framework, and avoiding offshore complexity. Works well when domestic carriers’ investment platforms meet needs.

Offshore PPLI: Appropriate for exceptionally wealthy families ($50 million+ liquid net worth) requiring maximum investment flexibility, willing to accept offshore complexity and costs, comfortable with specialized advisors navigating offshore structures.

For most readers, domestic PPLI represents the practical starting point. Offshore structures add complexity justified only when specific investment needs or planning objectives cannot be achieved domestically.

Tax Advantages and Mechanics

The primary appeal of private placement life insurance comes from extraordinary tax benefits that can save millions in lifetime taxation for wealthy families.

Tax-Free Growth on Alternative Investments

The most powerful PPLI benefit is permanent elimination of investment income taxation during accumulation.

How tax-free growth works:

Investments held inside properly structured life insurance policies grow without annual taxation:

Capital gains: When policy investments appreciate and are sold, gains are not taxable. In taxable accounts, selling appreciated securities triggers capital gains tax (15-20% federal plus 3.8% net investment income tax plus state taxes = 24-30%+ total). In PPLI, these gains accumulate tax-free.

Dividends and interest: Income generated by policy investments is not taxable. In taxable accounts, dividends and interest face ordinary income tax rates (potentially 37% federal plus 3.8% NIIT plus state = 45%+ total). In PPLI, this income compounds tax-free.

Trading and rebalancing: Portfolio managers can trade within policy, rebalancing allocations or taking gains without triggering taxable events. In taxable accounts, active management creates substantial tax drag. In PPLI, unlimited tax-free trading enables optimal portfolio management.

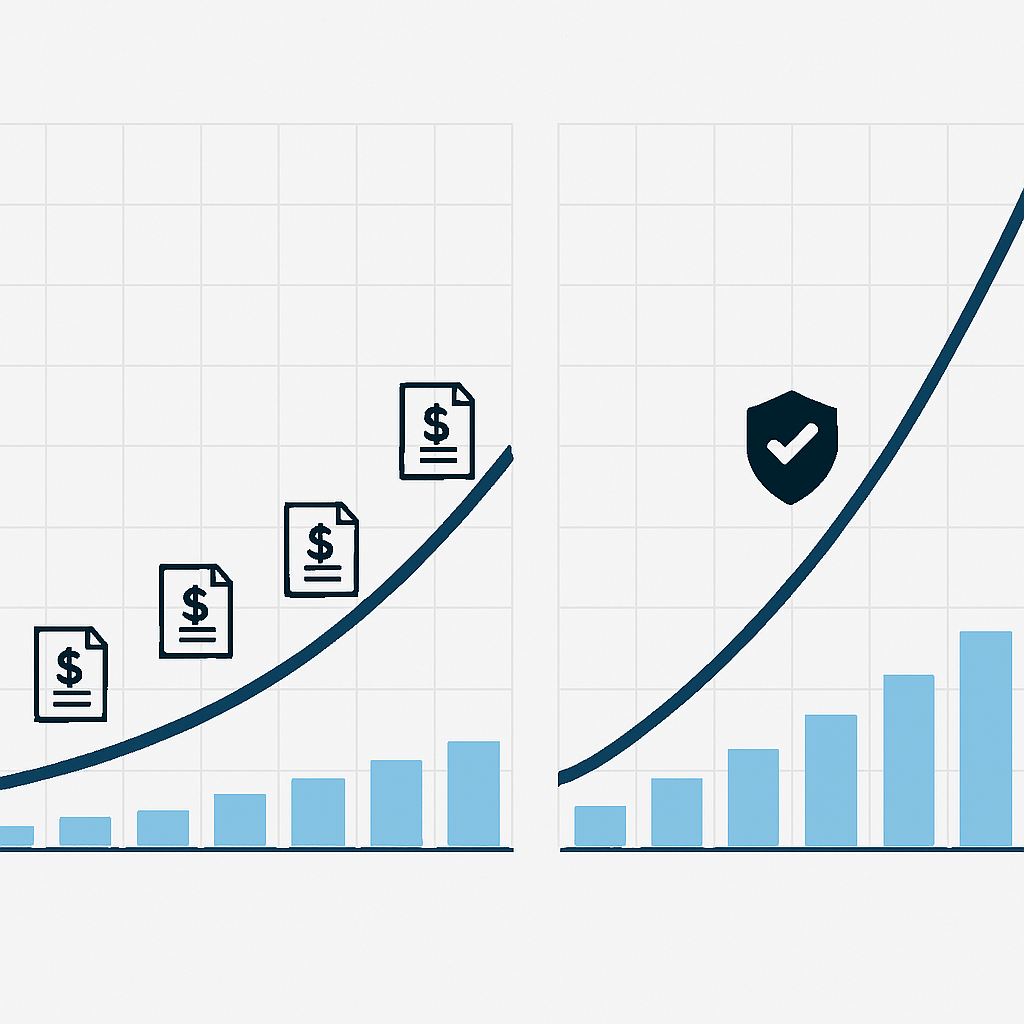

Quantifying tax savings:

The compounding effect of eliminating annual taxation dramatically increases long-term wealth accumulation.

Example comparison:

$10 million invested in aggressive hedge fund strategy earning 15% annually before taxes:

Taxable account (assuming 30% average tax rate):

- After-tax return: 10.5% annually

- Value after 20 years: $73.8 million

- Taxes paid over 20 years: $36.2 million

PPLI (tax-free accumulation):

- After-tax return: 15% annually (no tax drag)

- Value after 20 years: $163.7 million

- Taxes paid over 20 years: $0

Tax savings: $36.2 million paid taxes avoided, plus $89.9 million additional wealth accumulated through tax-free compounding = $126.1 million total benefit over 20 years

This dramatic difference stems from eliminating annual tax drag allowing full returns to compound. Higher returns, longer time horizons, and higher tax rates magnify PPLI advantages further.

Tax-Free Access Through Policy Loans

Tax-free accumulation alone wouldn’t suffice if accessing funds triggered taxation. PPLI’s second major advantage is tax-free lifetime access through policy loans.

How policy loans work:

Life insurance allows policyholders to borrow against cash value without triggering taxable income. These loans are not treated as withdrawals or distributions—they’re legitimate loans collateralized by policy values.

Loan mechanics:

Carrier lends money to policyholder using policy cash value as collateral. Loans accrue interest (typically floating rate tied to indices or fixed rates of 3-6%). Loans need not be repaid during lifetime—they remain outstanding until death, when death benefit pays loan balance with remainder going to beneficiaries tax-free.

Why loans avoid taxation:

IRS treats policy loans as genuine loans, not taxable income. Just as borrowing against your home via HELOC doesn’t trigger income tax, borrowing against life insurance doesn’t trigger taxation.

This enables policyholders to access investment gains without taxation during lifetime, effectively making PPLI a permanent tax elimination vehicle rather than mere tax deferral.

Loan strategy in practice:

Wealthy individual funds PPLI with $10 million, invests in alternative strategies earning 12% annually. After 10 years, cash value grows to $31 million (tax-free accumulation). They need $5 million for business investment opportunity. Rather than selling investments and paying capital gains tax, they borrow $5 million from policy:

- Loan of $5 million taken tax-free

- Cash value remains $31 million (slightly reduced over time by loan interest)

- No 1099 form, no taxable income, no capital gains

- Loan remains outstanding indefinitely or until repaid

- At death, death benefit pays loan balance, remainder passes tax-free to heirs

This strategy converts highly taxed investment income into completely tax-free access during lifetime.

Important constraints:

Policy loans must be managed carefully avoiding policy lapse:

Excessive loans: Borrowing too much can cause policy to lapse if insufficient cash value remains to cover insurance costs and loan interest. Lapsed policies with outstanding loans trigger taxable income on gains (the loan amount minus premium basis).

Interest accumulation: Unpaid loan interest compounds, potentially causing loans to grow faster than underlying investments in poor market conditions.

Maximum loan-to-value: Carriers typically limit loans to 85-90% of cash value, preventing complete depletion.

Prudent borrowing—extracting 2-4% of cash value annually—provides substantial tax-free access while maintaining policy sustainability long-term.

Estate Tax Advantages Through ILIT Ownership

For ultra-wealthy families facing federal estate taxes (40% on amounts exceeding $13.61 million individual, $27.22 million couple), PPLI provides additional estate tax elimination through proper ownership structuring.

ILIT structure:

Rather than owning PPLI personally (including it in your taxable estate), create irrevocable life insurance trust (ILIT) that:

- Owns PPLI from inception

- Receives gifts from you funding premium payments

- Holds policy for remainder of your life

- Distributes death benefit to beneficiaries (children, grandchildren) estate-tax-free at your death

Why ILIT ownership matters:

Life insurance owned personally is included in your taxable estate, potentially subjecting death benefit to 40% estate tax. Life insurance owned by properly structured ILIT is excluded from your estate, passing estate-tax-free to beneficiaries.

Example:

Without ILIT:

- $20 million PPLI death benefit included in $40 million estate

- Estate tax (40%) on amount exceeding exemption: $6.6 million

- Net benefit to heirs: $33.4 million

With ILIT:

- $20 million death benefit excluded from estate

- Estate tax applies only to other $20 million of assets: $2.6 million

- Net benefit to heirs: $37.4 million

ILIT planning saves $4 million in estate taxes in this example.

Gift tax considerations:

Funding ILIT requires making gifts to trust for premium payments. These gifts use annual exclusion amounts ($18,000 per beneficiary) or lifetime exemption if larger.

Through “Crummey” withdrawal rights, gifts to ILIT can qualify for annual exclusion even though beneficiaries don’t actually withdraw funds—they simply have temporary right to do so.

Three-year rule:

If you die within three years of transferring existing life insurance to ILIT, death benefit is pulled back into estate for tax purposes. Therefore, have ILIT purchase policy from inception rather than transferring existing personal policies.

Asset protection bonus:

ILIT ownership provides additional asset protection since policy is owned by trust, not by you personally. Creditors pursuing judgments against you generally cannot reach ILIT-owned assets.

Calculate the combined income tax and estate tax savings from PPLI using a legacy planning calculator that models different structuring scenarios across various wealth levels.

Investment Flexibility and Alternative Asset Access

Beyond tax advantages, private placement life insurance’s greatest differentiator from retail insurance products is the extraordinary investment flexibility enabling access to institutional alternative investments.

What You Can Invest In

Private placement life insurance separate accounts can hold nearly any investment meeting diversification requirements, providing access far beyond retail variable life insurance limitations.

Alternative investment options:

Hedge funds: Long-short equity strategies, global macro funds, event-driven strategies, relative value arbitrage—sophisticated hedge fund approaches unavailable in retail insurance products or standard retirement accounts.

Private equity funds: Buyout funds, growth equity, venture capital funds investing in private companies. These funds typically require $5-10 million minimum commitments limiting access to ultra-wealthy investors, but become accessible through PPLI separate account structures.

Real estate funds: Opportunistic real estate funds, value-add multifamily syndicati ons, commercial real estate private equity funds, real estate debt funds—all generating tax-inefficient ordinary income that becomes tax-free within PPLI.

Debt strategies: Direct lending funds, distressed debt funds, structured credit strategies, mezzanine financing funds—yielding high income that would be heavily taxed outside insurance wrapper.

Collectibles and tangible assets: While direct ownership of real property or collectibles is prohibited in PPLI (diversification requirements), funds investing in these assets are permissible. Funds holding portfolios of farmland, timberland, oil/gas royalties, or other alternative tangibles can be included.

Customized separately managed accounts: Rather than investing in commingled funds, PPLI can hold separately managed accounts implementing customized strategies tailored to your investment views.

What you cannot invest in:

IRS diversification requirements (IRC Section 817(h)) prohibit certain concentrated holdings:

Direct real property: Cannot hold direct ownership of specific real estate properties. Must invest through diversified real estate funds.

Concentrated stock positions: Cannot hold more than 55% in single stock, or more than 70% in two stocks, or more than 80% in three stocks. Prevents using PPLI to shelter single-company stock appreciation.

Closely held business interests: Cannot invest in your own operating businesses or partnerships where you have material participation.

These restrictions prevent abusive structures while allowing broad diversification across alternative investment strategies.

Investment Manager Selection and Oversight

Private placement life insurance enables you to work with institutional investment managers rather than being limited to insurance company selected retail mutual funds.

Manager selection freedom:

You select investment managers and funds based on performance, strategy alignment, and relationship quality rather than being confined to insurance carrier’s limited menu.

Process:

- Research and identify top-performing alternative investment managers

- Conduct due diligence on strategies, track records, fees, and operations

- Negotiate terms and minimum investment thresholds

- Direct insurance carrier to establish relationships and fund allocations

- Monitor performance and rebalance allocations over time

Institutional manager access:

Many top-tier investment managers have minimum investment requirements of $5-25 million, limiting access to ultra-wealthy family offices. PPLI separate accounts enable accessing these managers through insurance structure even when your individual allocation might be below manager minimums, since carrier can aggregate multiple policies’ investments.

Investment advisor coordination:

Most PPLI owners work with registered investment advisors (RIAs) or multi-family offices coordinating overall investment strategy across PPLI policies, taxable accounts, and other structures. These advisors:

- Develop asset allocation aligned with risk tolerance and goals

- Research and recommend investment managers and funds

- Monitor performance and rebalance portfolios periodically

- Coordinate with insurance carrier executing investment changes

- Provide comprehensive wealth management beyond PPLI

Avoiding “investor control” issues:

IRS “investor control” doctrine could disqualify insurance tax treatment if policyholder exercises too much direct control over investments, essentially acting as investment manager rather than policy owner selecting pre-packaged strategies.

Safe harbors exist avoiding control issues:

- Use independent investment managers making day-to-day decisions

- Select among pre-existing fund strategies rather than directing individual securities purchases

- Limit investment changes to reasonable frequency (quarterly or annual rebalancing rather than daily trading)

- Document investment manager independence and discretionary authority

Working with experienced PPLI advisors ensures policy structuring avoids control doctrine pitfalls while maximizing investment flexibility within safe boundaries.

Fee Structures and Cost Considerations

Private placement life insurance costs are generally transparent but require understanding multiple fee components.

Insurance charges:

Mortality costs: Charges for death benefit protection. For healthy wealthy individuals, mortality costs are typically modest given favorable underwriting and low mortality risk. Expect $5,000-$15,000 annually per million of death benefit for healthy 50-year-old, increasing with age.

Administrative fees: Carrier charges for policy administration, recordkeeping, and servicing. Typically $5,000-$25,000 annually depending on policy size and complexity.

State premium taxes: Most states impose premium taxes of 1-3.5% on premium payments (some states exempt PPLI, others apply reduced rates). This one-time charge applies when premium is paid.

Investment management fees:

Fund management fees: Alternative investment funds charge management fees (typically 1-2% annually) and performance fees (typically 20% of profits). These fees are embedded in fund returns, not separately billed to PPLI.

Advisory fees: If using investment advisor coordinating overall strategy, expect advisory fees of 0.25-1% of assets under management.

Total cost expectations:

For well-structured domestic PPLI policy with $10 million premium:

Year 1 costs:

- State premium tax (2%): $200,000

- Insurance carrier setup/admin: $50,000

- Mortality costs: $100,000 (assuming $15 million death benefit)

- Investment management (1.5% average): $150,000

- Advisory fees (0.5%): $50,000

- Total year 1: $550,000 (5.5% of premium)

Ongoing annual costs (years 2+):

- Mortality costs: $100,000-$150,000 (increasing with age)

- Administrative fees: $25,000

- Investment management (1.5%): $150,000-$200,000 (on growing values)

- Advisory fees (0.5%): $50,000-$75,000 (on growing values)

- Total ongoing: $325,000-$450,000 annually

Cost comparison to taxable investing:

While PPLI costs seem high, compare to taxes paid on taxable investing:

$10 million earning 12% annually = $1.2 million annual gains Taxes at 30% average rate = $360,000 annually

PPLI ongoing costs ($325,000-$450,000) are similar to taxes paid on taxable account, but PPLI provides permanent tax elimination plus estate tax benefits versus ongoing annual taxation of taxable account.

For high-return alternative investments facing high ordinary income tax rates, PPLI costs are substantially lower than tax drag of taxable investing, making economic analysis favorable.

Qualification Requirements and Implementation

Private placement life insurance isn’t available to everyone. Understanding qualification requirements and implementation process helps determine whether PPLI makes sense for your situation.

Who Qualifies for PPLI

Private placement life insurance targets ultra-high-net-worth individuals meeting specific financial and regulatory thresholds.

Minimum net worth requirements:

Accredited investor status: PPLI is offered as private placement under Regulation D, requiring purchasers to be accredited investors:

- $1 million net worth excluding primary residence, OR

- $200,000 individual income ($300,000 married) in each of past two years with expectation of same going forward

However, accredited investor status alone is insufficient—practical minimums are substantially higher.

Qualified purchaser status: Many PPLI carriers and investment managers require qualified purchaser status:

- $5 million in investments for individuals

- $25 million in investments for family-owned entities

Practical minimums: Even meeting regulatory minimums, practical economic thresholds are higher:

- Minimum liquid net worth: $5-10 million for domestic PPLI

- Minimum liquid net worth: $50 million+ for offshore PPLI

- Minimum initial premium: $1-5 million (preferably $3-5 million+)

- Total premium capacity: $5-25 million over lifetime

Why high minimums:

PPLI economics don’t work at lower premium levels:

- Fixed costs (legal, setup, administration) need spreading over larger premiums

- Investment minimums for alternative funds often require $1-10 million allocations

- Tax savings need exceeding setup and ongoing costs justifying structure complexity

- Insurance costs are fixed regardless of premium size, creating better economics at scale

Insurability requirements:

PPLI requires life insurance underwriting assessing mortality risk:

Health assessment: Medical examinations, blood work, physician reports, health history review. Favorable underwriting (standard or better ratings) required obtaining reasonable insurance pricing.

Age considerations: Most optimal PPLI implementation occurs ages 40-65. Younger ages (under 40) have lower mortality costs but less wealth to fund policies. Older ages (over 70) face higher mortality costs potentially outweighing tax benefits.

Lifestyle factors: Smoking status, dangerous hobbies (aviation, racing, mountaineering), foreign travel to high-risk regions all affect underwriting and pricing.

Uninsurable or highly rated individuals might not qualify for PPLI or might face insurance costs making structures uneconomical.

Working With Specialized Advisors

Successfully implementing private placement life insurance requires coordinating multiple specialized professionals—attempting DIY approaches or working with generalist advisors unfamiliar with PPLI leads to expensive mistakes.

PPLI specialist advisors:

PPLI insurance brokers: Specialized brokers understanding variable life insurance structures, familiar with carriers offering PPLI products, navigating underwriting and policy design. Not all life insurance agents understand PPLI—you need specialists who’ve placed dozens of PPLI cases.

Estate planning attorneys: Attorneys with PPLI experience structuring ILITs, advising on gift tax implications, coordinating with overall estate planning. General estate planning attorneys often lack PPLI expertise.

Tax attorneys/CPAs: Tax professionals understanding insurance tax law (IRC 7702, 817(h)), investor control doctrine, MEC rules, and PPLI reporting requirements. This specialization exceeds typical CPA capabilities.

Investment advisors: RIAs or family offices with alternative investment expertise, relationships with hedge funds/private equity funds, experience coordinating PPLI investment platforms.

PPLI consultants: Specialized consultants who coordinate entire team, advise on policy design, negotiate with carriers, and provide ongoing compliance oversight.

Team coordination:

Successful PPLI implementation requires all advisors working together:

- Estate attorney designs ILIT structure

- Insurance broker sources carrier and negotiates policy terms

- Tax advisor reviews for compliance and tax optimization

- Investment advisor designs portfolio and selects managers

- PPLI consultant coordinates entire process ensuring nothing falls through cracks

Expect to spend $50,000-$150,000 in professional fees designing and implementing PPLI structure initially, with ongoing advisory fees of $25,000-$100,000+ annually for continued management and compliance.

Implementation Timeline and Process

From decision to funding, implementing private placement life insurance takes several months requiring patience through complex process.

Phase 1: Assessment and design (4-8 weeks)

- Meet with PPLI specialist advisors discussing goals, current situation, and suitability

- Develop initial policy design including death benefit amount, premium schedule, investment strategy

- Preliminary underwriting assessment determining likely insurability and pricing

- Carrier selection based on investment flexibility, costs, and service quality

Phase 2: Estate planning and entity formation (4-6 weeks)

- Draft or update ILIT for policy ownership

- Execute trust documents and obtain EIN

- Establish trust bank account for premium payments

- Complete gift tax planning and Crummey notice procedures

- Coordinate with existing estate planning documents

Phase 3: Underwriting and policy approval (6-12 weeks)

- Complete insurance application and authorization forms

- Medical examination and testing

- Attending physician statements and medical records review

- Underwriting review and rating determination

- Policy contract issued with final pricing and terms

Phase 4: Investment platform setup (4-8 weeks, concurrent with underwriting)

- Finalize investment strategy and manager selection

- Establish separate account at insurance carrier

- Complete investment manager onboarding and documentation

- Review and approve policy illustrations showing projected values

Phase 5: Funding and implementation (2-4 weeks)

- Execute ILIT gift procedures with Crummey notices

- Wire premium payment from ILIT to carrier

- Policy issued and funded

- Initial investments executed according to allocation strategy

- Confirm all documentation and compliance items complete

Total timeline: 5-9 months from initial assessment to funded policy.

This extended timeline frustrates individuals accustomed to quick financial decisions, but rushing PPLI implementation creates mistakes and compliance failures. Patience through proper process ensures structure works correctly for decades.

Many investors who accumulated substantial liquidity from real estate portfolios built with asset-based loans or jumbo loans financing high-value properties eventually explore PPLI as vehicles for tax-efficiently investing real estate sale proceeds or refinancing cash-out distributions.

When PPLI Makes Sense (And When It Doesn’t)

Private placement life insurance isn’t appropriate for every wealthy individual. Understanding when PPLI provides value versus when simpler alternatives suffice prevents implementing complex structures unnecessarily.

Ideal PPLI Candidate Profile

Private placement life insurance works best for individuals and families meeting several criteria simultaneously.

Financial profile:

Liquid net worth: $10 million+: While lower thresholds exist, PPLI economics work best with substantial liquid assets generating ongoing taxable income that PPLI can shelter.

High ongoing tax burden: Paying $500,000+ annually in investment taxes (capital gains, dividends, interest income) creates meaningful tax savings opportunity justifying PPLI costs and complexity.

Maxed traditional tax advantages: Already maxing retirement account contributions, exhausted opportunity zone benefits, utilized 1031 exchanges for real estate—PPLI provides additional tax shelter when conventional options are exhausted.

Long investment horizon: Planning to hold investments 15-30+ years allowing tax-free compounding to overcome setup costs and generate substantial benefit.

Alternative investment allocation: Current or desired allocation to hedge funds, private equity, or other tax-inefficient strategies generating ordinary income that benefits most from PPLI tax shelter.

Investment sophistication:

Comfortable with complexity: Willing to invest time understanding PPLI mechanics, coordinating multiple advisors, and maintaining ongoing compliance rather than seeking simple turnkey solutions.

Alternative investment experience: Prior experience investing in hedge funds, private equity, or other alternatives enabling evaluation of investment strategies within PPLI.

Advisor relationships: Existing relationships with sophisticated investment advisors, estate attorneys, and CPAs who can expand into PPLI coordination or willing to engage specialized PPLI advisors.

Estate planning objectives:

Estate tax concerns: Estates approaching or exceeding federal or state estate tax exemptions benefit from PPLI’s estate tax elimination through ILIT ownership.

Multi-generational wealth transfer: Desire to pass wealth to children, grandchildren, and beyond with maximum tax efficiency across multiple generations.

Charitable intentions: Plans to use portion of wealth for charitable purposes can be enhanced through PPLI as source of tax-free charitable gifts or bequests.

Life insurance needs: Genuine life insurance needs for estate liquidity, business succession, or family protection making insurance component valuable beyond investment benefits.

When Simpler Alternatives Work Better

Several circumstances make PPLI unnecessarily complex compared to alternatives.

Insufficient wealth scale:

Net worth under $5-10 million: Setup and ongoing costs consume too much of benefit for smaller portfolios. Stick with maxing retirement accounts, using donor-advised funds for charitable giving, and accepting some tax drag on taxable investments.

Premium capacity under $2-3 million: Minimum economical premium thresholds mean smaller commitments don’t justify structure complexity.

Short time horizons:

Less than 10-15 years: PPLI requires long horizons for tax-free compounding overcoming upfront costs. If you’re 75+ or need accessing funds within decade, simpler approaches work better.

Near-term liquidity needs: PPLI creates illiquidity through insurance structure. If you need substantial investment portfolio liquidity in near future, keep assets in taxable accounts enabling full access.

Simpler tax situations:

Minimal investment income: If most wealth is in businesses or real estate (not generating substantial taxable investment income), PPLI provides limited benefit. Focus on qualified opportunity zones, 1031 exchanges, or other strategies specific to your asset mix.

Low tax bracket: If current effective tax rate is modest (under 25-30%), PPLI tax savings don’t justify complexity. Wait until income and taxes increase making shelter more valuable.

Risk of non-compliance:

Uncomfortable with complexity: If coordinating multiple advisors, maintaining documentation, and ensuring ongoing compliance feels burdensome rather than manageable, avoid PPLI. Non-compliance can destroy tax benefits retroactively.

Lack of advisor access: Without qualified PPLI specialists in your location or network, attempting PPLI with generalist advisors creates serious risk of mistakes.

Alternative approaches:

Before committing to PPLI, consider whether these simpler alternatives meet needs:

Maximize retirement accounts: Max 401(k), defined benefit plans, backdoor Roth conversions before moving to PPLI complexity.

Qualified opportunity zones: For capital gains deferral and elimination on new investments in QOZ funds.

Charitable remainder trusts: For combining tax deductions, income deferral, and charitable giving.

Index fund investing: For long-term passive investors, simple low-turnover index funds in taxable accounts generate minimal tax drag.

Municipal bonds: For conservative fixed-income allocation, tax-exempt municipals provide tax-free interest income without PPLI complexity.

PPLI makes sense only when these simpler alternatives are insufficient for your tax situation, and when your wealth level justifies the additional complexity and cost.

Calculate whether PPLI economics make sense for your specific situation using an investment growth calculator that models tax savings versus costs across different wealth levels and time horizons.

Conclusion: PPLI as Sophisticated Tax Planning Tool

Private placement life insurance represents one of the most powerful tax planning vehicles available to ultra-high-net-worth families, providing permanent elimination of investment income taxation, estate taxation, and generation-skipping taxation when properly structured and implemented with qualified specialized advisors.

Key Takeaways:

- Private placement life insurance combines institutional investment platforms with life insurance tax advantages, enabling tax-free growth on hedge funds, private equity, real estate funds, and other alternative investments unavailable in retail variable life insurance

- Tax benefits include completely tax-free accumulation, tax-free access through policy loans during lifetime, and estate-tax-free wealth transfer through ILIT ownership—providing permanent tax elimination rather than mere deferral

- Qualification requires ultra-high-net-worth status with typically $5-10 million minimum liquid net worth, $1-5 million minimum initial premiums, accredited investor status, and favorable life insurance underwriting

- Implementation requires coordinating specialized advisors including PPLI insurance brokers, estate planning attorneys, tax advisors, and investment advisors navigating complex structures over 5-9 month timelines

- PPLI works best for families paying $500,000+ annually in investment taxes, with long investment horizons of 15-30+ years, maxed traditional tax advantages, and comfort with sophisticated planning complexity

The most successful PPLI implementations share common characteristics: they’re implemented proactively during favorable tax and health periods rather than rushed during crises, they’re structured conservatively within well-established safe harbors rather than pushing boundaries aggressively, they’re maintained properly with ongoing compliance and monitoring rather than implemented then forgotten, and they’re used as components of comprehensive wealth planning rather than isolated solutions.

Private placement life insurance isn’t for everyone. It’s not for emerging wealthy still building net worth. It’s not for individuals seeking simple low-maintenance solutions. It’s not for families with short investment horizons or near-term liquidity needs. And it’s definitely not for anyone attempting DIY implementation or working with advisors lacking PPLI specialization.

However, for ultra-wealthy families meeting qualification thresholds, comfortable with sophisticated planning, working with specialized advisors, and committed to long-term tax-efficient wealth accumulation and transfer, PPLI provides extraordinary benefits potentially saving millions in lifetime and estate taxation while maintaining investment flexibility that retail products and traditional tax-advantaged accounts cannot match.

Don’t let PPLI’s complexity or exclusivity deter you if you meet qualification thresholds. The tax savings for appropriate candidates can dwarf implementation costs and ongoing expenses by factors of 10-100x over multi-decade horizons. Conversely, don’t force PPLI if you don’t meet thresholds—simpler alternatives serve most wealthy families perfectly well without unnecessary complexity.

When you’re ready to explore whether private placement life insurance makes sense for your specific wealth level, tax situation, and planning goals, connect with advisors who specialize in PPLI and sophisticated tax planning for ultra-high-net-worth families. Schedule a call to discuss how advanced wealth preservation strategies integrate with comprehensive financial planning across real estate investments, businesses, and traditional portfolios.

Remember that tax law complexity and constant change means strategies valid today might face future legislative or regulatory challenges. Never implement PPLI based solely on article content—work with qualified legal and tax advisors who can analyze your specific circumstances and structure plans appropriately given current law and your individual situation.

Frequently Asked Questions

What is the minimum net worth and premium required for private placement life insurance?

While regulatory minimums require accredited investor status ($1 million net worth excluding primary residence), practical minimums for economically viable PPLI are substantially higher. Expect minimum liquid net worth of $5-10 million and initial premium capacity of $1-5 million for domestic PPLI, with most carriers preferring $3-5 million+ initial premiums. Offshore PPLI typically requires $50 million+ liquid net worth and $5-10 million+ minimum premiums. These high thresholds exist because setup costs ($50,000-$150,000), ongoing administration fees ($25,000-$100,000 annually), and investment manager minimums need spreading over larger policy values to achieve favorable economics. Attempting PPLI below these thresholds results in costs consuming significant portions of tax savings, making simpler alternatives more appropriate.

How does private placement life insurance differ from variable universal life insurance?

Private placement life insurance and retail variable universal life (VUL) both provide tax-advantaged investment growth within life insurance structures, but differ dramatically in investment flexibility, pricing, and minimum thresholds. PPLI offers customized separate accounts holding institutional alternative investments (hedge funds, private equity, real estate funds) while VUL limits investors to carrier-selected mutual fund subaccounts (typically 50-150 options). PPLI typically costs less for actual insurance protection since policies are sold without commissions to sophisticated buyers who negotiate transparent fees, while VUL includes substantial embedded commissions and charges. PPLI requires $1-5 million minimum premiums targeting ultra-wealthy buyers, while VUL accepts premiums from thousands annually serving mass market. PPLI is offered as private placement under Regulation D to accredited investors, while VUL is registered security available to general public.

Can I access money from private placement life insurance without triggering taxes?

Yes, properly structured PPLI provides tax-free lifetime access to accumulated cash value through policy loans. Carriers lend money to policyholders using policy cash value as collateral, with loans not treated as taxable income by IRS. These loans accrue interest but need not be repaid during lifetime—they remain outstanding until death when death benefit pays loan balance with remainder passing tax-free to beneficiaries. This enables accessing investment gains without taxation during lifetime, effectively making PPLI permanent tax elimination vehicle rather than mere deferral. However, loans must be managed prudently avoiding excessive borrowing that could cause policy lapse. Lapsed policies with outstanding loans trigger taxable income on gains (loan amount minus premium basis). Conservative borrowing—extracting 2-4% of cash value annually—provides substantial tax-free access while maintaining policy sustainability.

What investments are prohibited in private placement life insurance?

IRS diversification requirements (IRC Section 817(h)) prohibit certain concentrated holdings in PPLI. You cannot hold direct ownership of specific real estate properties—must invest through diversified real estate funds instead. Cannot hold more than 55% in single stock, 70% in two stocks, or 80% in three stocks—prevents using PPLI to shelter single-company stock appreciation. Cannot invest in closely held business interests where you have material participation or exercise control. Additionally, “investor control” doctrine prohibits excessive direct control over day-to-day investment decisions—must use independent investment managers making discretionary decisions rather than directing individual securities purchases yourself. Despite these restrictions, PPLI allows broad diversification across hedge funds, private equity funds, real estate funds, debt strategies, and other alternative investments meeting diversification requirements.

Is offshore or domestic private placement life insurance better for U.S. taxpayers?

For most ultra-wealthy U.S. investors, domestic PPLI represents the practical starting point providing clear regulatory framework, simpler compliance, and avoiding offshore reporting complexity while offering sufficient investment flexibility for most needs. Domestic policies issued by U.S. carriers licensed in various states offer clear U.S. tax law application, state insurance regulatory oversight and protections, no offshore reporting requirements (no FATCA or FBAR filings), potentially stronger creditor protection under state insurance laws, and simpler administration. Offshore PPLI issued by carriers in Cayman Islands, Bermuda, Switzerland, or Liechtenstein provides maximum investment flexibility, access to broader range of alternatives, often lower insurance costs, and favorable jurisdictions for multi-generational planning—but requires complex offshore reporting, higher setup costs, and specialized advisors. Offshore structures make sense primarily for exceptionally wealthy families ($50 million+ liquid net worth) requiring investment flexibility impossible domestically.

Related Resources

Also helpful for ultra-wealthy investors:

- Family Limited Partnership: Discount Asset Values and Transfer Wealth Tax-Efficiently – Combine PPLI with FLP strategies for comprehensive estate planning

- The Great Wealth Transfer: Position Your Family for $84 Trillion in Motion – Understand how PPLI fits into generational wealth transfer strategies

- Legacy Planning Calculator – Model tax savings from PPLI across different wealth levels

What’s next in your journey:

- Investment Growth Calculator – Calculate how tax-free compounding in PPLI affects long-term wealth accumulation

- Opportunity Zone Funds: Defer Capital Gains While Investing in Growth Markets – Compare PPLI to other tax-advantaged investment strategies

- Asset Protection for Real Estate Investors: Beyond Basic LLCs – Combine PPLI creditor protection with comprehensive asset protection planning

Explore your financing options:

- Asset-Based Loan Program – Leverage substantial assets for liquidity while keeping investments tax-sheltered in PPLI

- Portfolio Loan Program – Finance real estate portfolios generating cash flow for PPLI premium funding

- Jumbo Loan Program – High-value property financing for ultra-wealthy investors

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.