Buying First Rental Property With LLC: Protect Your Assets Before You Close

Buying First Rental Property With LLC: Protect Your Assets Before You Close

Buying First Investment Property: Understanding LLC Asset Protection Strategies

When you’re buying your first rental property, most investors focus entirely on finding the right deal, securing financing, and calculating cash flow. But there’s a critical decision you need to make before closing: should you buy in your personal name or form an LLC?

This decision affects your asset protection, financing options, taxes, and long-term investment strategy. Getting it right from the start saves you headaches and money down the road. Getting it wrong can leave your personal assets vulnerable to lawsuits or create unnecessary complications.

The question of buying first rental property with LLC protection isn’t just for experienced investors with large portfolios. Even first-time investors need to understand how LLCs work and whether forming one makes sense for their situation.

In this guide, you’ll discover:

- What an LLC actually is and how it protects your personal assets (following your state’s business formation laws)

- When to form an LLC: before or after purchasing your first rental

- How LLC ownership affects mortgage financing options

- Which state to form your LLC in and why it matters

- Tax implications of owning rental property through an LLC (per IRS guidelines)

- Common LLC mistakes that pierce the corporate veil and destroy your protection

- Insurance strategies that work alongside LLC protection

Understanding these factors helps you make an informed decision about whether buying first investment property through an LLC makes sense for your specific situation.

Questions about financing your first rental property? Schedule a call with a loan advisor who understands how LLCs affect your mortgage options.

What Is an LLC and Why Do Investors Use Them?

An LLC (Limited Liability Company) is a legal business structure that separates you personally from your rental property business. Think of it as creating a protective barrier between your personal assets and your investment property.

The fundamental concept: When you own rental property in your personal name, you and the property are legally the same entity. If someone sues over a slip-and-fall at your rental, they’re suing you personally—which means they can potentially go after your personal bank accounts, your primary residence, your retirement accounts, and any other assets you own.

When you own through an LLC: The LLC owns the property, not you personally. You own the LLC. If someone sues over an incident at the rental property, they’re typically limited to suing the LLC and going after only the assets held within that LLC—not your personal wealth.

Why investors form LLCs:

Asset protection is the primary reason. Real estate investing involves risk—tenants can get injured, contractors can make mistakes, environmental issues can emerge. An LLC creates a legal shield that protects your personal assets from these business risks.

Professional credibility matters when dealing with contractors, property managers, and tenants. Operating under an LLC name signals you’re serious about real estate as a business, not just a casual landlord.

Privacy benefits exist in some states where LLC ownership doesn’t publicly display your personal name on property records. This can reduce unwanted solicitation and maintain privacy.

What an LLC is NOT: It’s not a tax entity that automatically saves you money. For most single-member LLCs, you still report rental income on your personal tax return—there’s no tax difference between LLC and personal ownership. The benefit is asset protection, not tax savings.

When you’re learning real estate investing for beginners, understanding LLCs early helps you build proper protection as you scale.

Asset Protection Fundamentals for Rental Properties

Before deciding whether you’re buying first rental property with LLC protection, understand how asset protection actually works and what risks you’re protecting against.

The liability risks rental property owners face:

Tenant injuries are the most common lawsuit risk. Slip-and-fall accidents, stair collapses, carbon monoxide poisoning, lead paint exposure—if someone gets hurt at your property, they can sue. Medical bills and pain-and-suffering claims can reach substantial amounts quickly.

Tenant disputes can escalate into lawsuits. Wrongful eviction claims, Fair Housing violations (even unintentional ones), security deposit disputes, or claims of uninhabitable conditions can result in legal action.

Third-party injuries extend beyond tenants. Contractors, delivery people, guests, or even trespassers who get injured might sue the property owner.

Environmental issues like mold, asbestos, or lead paint can trigger expensive lawsuits, especially if they cause health problems.

Code violations and zoning issues can result in fines and legal problems, particularly if they cause harm.

How LLCs create asset protection:

The corporate veil is the legal separation between you and your LLC. When properly maintained, this veil means creditors and plaintiffs must sue the LLC—not you personally. They can seize LLC assets but cannot typically reach your personal assets held outside the LLC.

Separate legal entity status means the LLC can own property, sign contracts, sue and be sued in its own name. You’re simply the owner/member of the LLC, not the direct property owner.

Limited personal liability protects your personal assets—your home, savings, retirement accounts, other properties—from judgments against the LLC. The plaintiff is limited to the LLC’s assets: the rental property itself and any cash the LLC holds.

Important limitation: LLCs don’t protect you from personal wrongdoing. If you personally commit fraud or cause harm through your own actions, you can still be sued personally. The LLC protects you from business-related liabilities, not personal negligence.

The multi-LLC strategy: As you scale to multiple properties, many investors form separate LLCs for each property (or small groups of properties). This compartmentalizes risk—a lawsuit on property A doesn’t threaten properties B, C, and D held in separate LLCs.

Understanding landlord responsibilities helps you identify which risks you’re protecting against when buying your first rental property.

When to Form an LLC: Before vs After Purchase

One of the most common questions about buying first rental property with LLC protection is timing: should you form the LLC before or after closing?

Forming LLC before purchase:

Advantages of LLC ownership from day one:

- Clean title transfer directly to the LLC

- No “due-on-sale” clause concerns with lenders

- Clear separation from the start

- Property has always been an LLC asset, never personal

Disadvantages of pre-purchase LLC formation:

- More complex financing (discussed below)

- Some lenders won’t finance LLC purchases

- Typically requires larger initial investment

- May face less favorable financing terms

Best for: Investors with substantial capital paying cash or using business purpose loans, or those buying with DSCR loans designed for LLC ownership.

Buying personally, then transferring to LLC:

Advantages of personal ownership first:

- Access to conventional residential financing with lower initial capital requirements

- Better financing terms on owner-occupied mortgages

- Easier qualification for first-time investors

- Straightforward closing process

Disadvantages of transfer strategy:

- “Due-on-sale” clause technically allows lender to call loan

- Transfer requires deed recording and potential transfer taxes

- Gap period where property is in personal name

- Extra step and costs after closing

The due-on-sale clause reality: Most mortgages contain clauses stating the lender can demand full loan repayment if you transfer property ownership. In practice, lenders rarely enforce this for transfers to your own LLC—they care about getting paid, and the borrower hasn’t changed. However, there’s no guarantee they won’t enforce it.

Best for: First-time investors maximizing financing options with conventional or FHA loans, especially those house hacking with owner-occupied financing.

The hybrid approach:

Some investors buy personally, stabilize the property with tenants, then refinance into a commercial loan or portfolio loan in the LLC’s name after 6-12 months. This captures both good initial financing and eventual LLC protection.

Most common first-time investor strategy: Buy personally with conventional financing, then transfer to LLC within the first year. Accept the small due-on-sale risk for better financing terms. Most lenders don’t enforce the clause for LLC transfers as long as you continue making payments.

Use the FHA loan calculator to see if owner-occupied financing makes sense for your first property before deciding on LLC timing.

LLC vs Personal Name Ownership: Pros and Cons

Understanding the complete picture of buying your first rental property through an LLC versus personal ownership helps you make the right decision.

Personal name ownership advantages:

Easier conventional financing is the biggest benefit. Residential mortgages (conventional, FHA, VA) are designed for individual borrowers. You can get competitive financing terms and favorable conditions that aren’t available for LLC purchases.

Lower initial capital requirements make it possible to start investing sooner. Conventional loans require reasonable initial investment for investment properties. Owner-occupied house hacking with FHA loans requires even less upfront capital.

More favorable financing terms on residential mortgages can save you thousands over the loan term compared to commercial LLC financing.

Simpler qualification means clearer requirements and faster closing. Lenders understand personal income documentation; LLC financing is more complex.

No LLC formation costs saves you initial setup fees and ongoing annual state fees.

Personal name ownership disadvantages:

No liability protection means your personal assets are at risk if you’re sued over the rental property.

Public record exposure shows your personal name on property records, making you easier to find for solicitors and potential litigants.

Scaling complications emerge when you own multiple properties personally—you can’t compartmentalize risk.

LLC ownership advantages:

Asset protection is the primary benefit. Your personal assets are shielded from rental property liabilities.

Professional image helps when dealing with property managers, contractors, and tenants.

Scaling flexibility allows you to create separate LLCs for different properties or property groups, compartmentalizing risk.

Privacy in some states keeps your personal name off public property records.

Estate planning benefits can make transferring property to heirs cleaner with LLC membership interests.

LLC ownership disadvantages:

Financing challenges are significant. Many residential lenders won’t finance LLC purchases. Those that do often require larger initial capital contributions.

Less favorable financing terms on commercial LLC loans can cost substantial amounts over time.

Formation and maintenance costs include initial filing fees, annual state fees, and potential registered agent costs.

More complex operations mean maintaining proper LLC formalities, separate accounting, and compliance with state regulations.

No tax benefits for most single-member LLCs, which are “disregarded entities” for tax purposes.

The decision factors:

Choose personal ownership if you’re buying your first property with limited capital using conventional or FHA financing, plan to house hack, want the simplest path forward, and will transfer to LLC later.

Choose LLC ownership if you have substantial capital for commercial financing, are paying cash, already own other assets worth protecting, or are buying multiple properties simultaneously.

Many first-time investors choose personal ownership initially to maximize financing options, then either transfer to LLC post-purchase or form LLCs for properties two, three, and beyond.

Check out this first rental property case study showing how an investor structured LLC protection while maintaining good financing.

How LLCs Affect Financing Your First Rental

Understanding how buying first investment property through an LLC affects your mortgage options is crucial for planning.

Conventional residential mortgages and LLCs:

Most conventional lenders (Fannie Mae/Freddie Mac) don’t offer residential mortgages for LLC-owned properties. Their loan programs are designed for individual borrowers buying in their personal names.

Why lenders avoid LLC mortgages:

- Increased complexity in underwriting

- Perceived higher risk

- Can’t easily verify LLC income/assets

- Difficulty enforcing personal liability

A few portfolio lenders do offer residential-style financing for LLCs, but terms are typically less favorable than personal mortgages.

Commercial financing for LLCs:

When an LLC owns the property, you’re typically in the commercial lending space. This changes everything about your financing.

Commercial loan characteristics:

- Larger initial capital requirements

- Less favorable financing terms compared to residential loans

- Shorter loan terms (often 20 years instead of 30)

- Sometimes balloon payments after 5-10 years

- Underwriting focuses on property cash flow, not just your personal income

DSCR loans for LLC properties:

DSCR (Debt Service Coverage Ratio) loans are designed specifically for LLC-owned investment properties. They qualify you based on the property’s rental income covering the mortgage cost—not your personal income.

DSCR loan benefits:

- LLC ownership from day one

- No personal income verification required

- Property cash flow determines qualification

- Good for self-employed or portfolio investors

DSCR loan requirements:

- Typically reasonable initial capital requirement

- Property must have positive DSCR (rental income exceeds debt service)

- Good credit required

- Competitive terms for commercial lending

Portfolio loans for LLC investors:

Some banks offer portfolio loans they hold on their own books rather than selling to Fannie/Freddie. These lenders can make their own rules, sometimes allowing LLC ownership with reasonable terms.

The financing strategy progression:

Property #1: Buy personally with conventional financing for best terms, then transfer to LLC post-purchase if desired.

Property #2-3: Consider DSCR loans in LLC names. By now you have experience and can handle commercial financing.

Property #4+: Portfolio lending or blanket loans in LLC names become attractive as you scale.

Critical consideration: Discuss LLC plans with your lender before starting the purchase process. If you’re using conventional financing, you’ll buy personally. If you’re using DSCR loans, you can buy in LLC name from day one.

Use the DSCR loan calculator to see if your property’s cash flow qualifies for LLC financing.

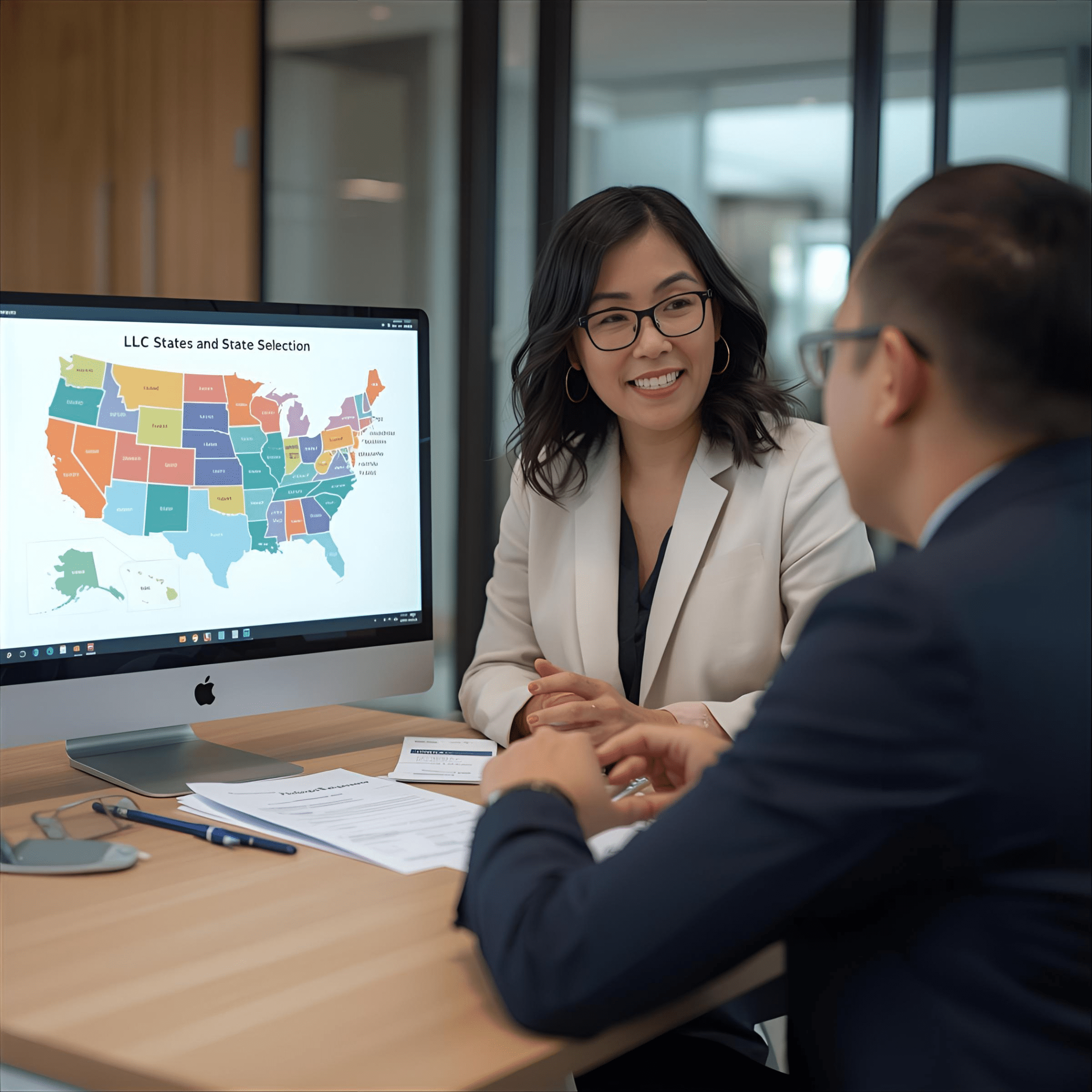

State Selection for LLC Formation

When buying first rental property with LLC protection, choosing which state to form your LLC in matters for costs, compliance, and protection.

Home state formation (most common):

Form in the state where your property is located is the default approach for most investors.

Advantages of home state LLCs:

- Simpler compliance—only one state’s rules to follow

- Lower costs—no need to register as foreign LLC

- Easier banking and local operations

- One state’s annual fees and requirements

When to use home state formation: If you’re buying your first rental property in your home state, form the LLC there. This is the straightforward path.

Delaware and Wyoming (less common for small investors):

Some investors hear about Delaware or Wyoming as “better” states for LLC formation because of their business-friendly laws, privacy protection, and strong legal precedents.

The reality for small rental property investors: The benefits rarely justify the additional complexity and costs.

Why Delaware/Wyoming are overrated for first-time investors:

- You must register as “foreign LLC” in your property’s state anyway

- This means double registration fees and compliance

- Delaware/Wyoming formation plus foreign registration costs more than single-state formation

- Privacy benefits minimal since property records are public regardless

- Legal protection differences negligible for basic LLCs

When Delaware/Wyoming might make sense:

- You plan to invest in multiple states

- You’re creating complex entity structures

- You need maximum privacy protection

- You’re building a large, sophisticated operation

For most first-time investors: Form your LLC in the state where your property is located. The simplicity and cost savings outweigh any theoretical benefits of other states.

Multi-state investors:

If you plan to buy properties in multiple states, you have two options:

Option 1: Separate LLC in each state—simpler compliance, each LLC registered only in its property’s state.

Option 2: Delaware/Wyoming holding LLC with foreign registrations—more complex but potentially cleaner structure.

Most investors start with separate LLCs per state and only move to holding company structures if they build substantial multi-state portfolios.

Formation costs comparison:

Typical LLC formation costs range from modest to higher depending on the state. Annual renewal fees also vary by state. Research your state’s specific costs before forming.

Some states like California have minimum annual franchise taxes regardless of LLC income, while others have minimal annual fees.

Operating Agreement Essentials for Rental Property LLCs

When you’re purchasing your first rental property through an LLC, your operating agreement is the document that defines how your LLC operates.

Why you need an operating agreement:

Even though most states don’t require operating agreements, having one is crucial for maintaining your liability protection and avoiding disputes if you ever add partners.

Key provisions every rental property LLC operating agreement should include:

Member information identifies all LLC owners, their ownership percentages, and capital contributions. Even if you’re the sole member, document this clearly.

Management structure defines whether the LLC is member-managed (you run everything) or manager-managed (you hire a manager). Most single-member rental property LLCs are member-managed.

Capital contributions and distributions establish how much each member contributed initially and how profits and losses are distributed. This prevents disputes if you later add partners.

Decision-making authority specifies what decisions require unanimous consent versus majority vote if you have multiple members. Include spending limits requiring member approval.

Transfer restrictions control who can buy or receive LLC membership interests. This protects you from unwanted partners if a member wants to sell their share.

Dissolution provisions define what happens if the LLC needs to close, how assets are distributed, and what triggers dissolution.

Buy-sell provisions for multi-member LLCs establish how a member can exit and how their interest is valued.

Banking and financial management authorizes who can open bank accounts, sign checks, and make financial decisions on behalf of the LLC.

Real estate specific provisions should address property acquisition procedures, property management, hiring contractors, insurance requirements, and property sales procedures.

Single-member LLC operating agreements:

Even though you’re the only member, document everything. A proper operating agreement:

- Proves the LLC is legitimate if challenged in court

- Establishes the corporate veil between you and your rental property

- Provides clear procedures for future operations

- Can help if you’re audited or sued

Template vs custom agreements:

Online LLC formation services provide basic template operating agreements. These work for simple situations but may not address rental property specifics.

For best protection, have a local real estate attorney review or draft your operating agreement. The few hundred spent upfront can save thousands if problems arise later.

Updating your operating agreement:

Review and update your operating agreement when you add properties, bring in partners, change financing structure, or make other major business changes.

Tax Implications of LLC Ownership

Understanding how buying your first rental property with LLC affects your taxes helps you make informed decisions.

Single-member LLC taxation (most common):

For tax purposes, the IRS treats single-member LLCs as “disregarded entities.” This means:

You report rental income on Schedule E of your personal tax return, exactly as if you owned the property personally. The LLC itself doesn’t file a separate tax return.

No tax difference exists between LLC and personal ownership for single-member LLCs. You claim the same rental property tax benefits—depreciation, interest deductions, operating expenses—regardless of ownership structure.

No self-employment tax applies to rental income whether owned personally or through a single-member LLC. Passive rental income isn’t subject to self-employment tax.

This simplifies taxes dramatically. You get liability protection without tax complexity.

Multi-member LLC taxation:

If you have partners in your LLC, it’s taxed as a partnership by default.

Partnership tax return required: The LLC files Form 1065 annually showing income, expenses, and each member’s share.

K-1 distributions go to each member showing their share of income/loss, which they report on their personal returns.

More complex reporting means you’ll definitely need a CPA. Partnership tax returns are substantially more complex than Schedule E reporting.

Election to be taxed as S Corp or C Corp:

LLCs can elect to be taxed as corporations, though this is rare for basic rental property investing.

S Corp taxation might make sense if you provide substantial services (like property management) and want to reduce self-employment taxes. But passive rental income doesn’t benefit from S Corp treatment.

C Corp taxation is almost never used for rental property LLCs due to double taxation issues.

For most first-time investors: Single-member LLC taxed as disregarded entity is the sweet spot—liability protection without tax complexity.

State tax considerations:

Some states impose franchise taxes or fees on LLCs regardless of income. California, for example, has a minimum annual franchise tax that applies even if your LLC has no income.

Research your state’s LLC tax requirements before forming. This ongoing cost should factor into your decision.

Working with a CPA:

Even though single-member LLC taxation is simple, work with a CPA experienced in rental property. They’ll ensure proper expense tracking, depreciation calculation, and strategic tax planning as you scale.

Insurance Strategy With LLC Protection

LLCs provide legal liability protection, but you still need proper insurance. Smart investors layer multiple protection strategies.

Landlord insurance remains essential:

Even with LLC ownership, your rental property needs landlord insurance covering property damage, liability, and loss of rental income.

The LLC doesn’t replace insurance. Think of them as complementary layers:

- Insurance is your first line of defense, covering most claims

- LLC protection kicks in if claims exceed insurance limits

Liability coverage limits:

Most landlord policies include liability coverage with standard limits. For LLC-owned properties, consider higher liability limits since you’re operating as a business.

Recommended liability coverage: Substantial coverage per property, with higher limits for higher value or higher risk properties.

Umbrella insurance policies:

Umbrella policies provide additional liability coverage beyond your primary landlord insurance limits.

How umbrella insurance works: If a claim exceeds your landlord policy’s limits, the umbrella policy covers the excess up to its limit.

Cost is minimal relative to coverage provided—often a few hundred annually for substantial additional coverage.

Naming the LLC as insured:

Make sure your insurance policy names the LLC as the insured party, not you personally. The LLC owns the property, so the LLC should be covered.

Tell your insurance agent about LLC ownership when purchasing coverage. They’ll structure the policy correctly.

Certificate of insurance:

Lenders and property managers often require proof of insurance. Make sure your policy provides adequate coverage amounts and lists required parties as additional insureds.

The layered protection approach:

Layer 1: Insurance covers most claims and day-to-day liability. Layer 2: LLC liability shield protects your personal assets if claims exceed insurance. Layer 3: Umbrella policy provides additional coverage beyond standard landlord insurance. Layer 4: Multiple LLCs (as you scale) compartmentalize risk across properties.

This comprehensive approach provides maximum protection while maintaining affordable costs.

Common LLC Mistakes First-Time Investors Make

Understanding these common mistakes when buying first rental property with LLC protection helps you avoid expensive problems.

Mistake 1: Not maintaining the corporate veil

The LLC only protects you if you maintain proper separation between yourself and the business.

Corporate veil piercing happens when courts decide your LLC is just an “alter ego” and not a legitimate separate entity. When this happens, you lose liability protection.

How to maintain the veil:

- Keep LLC finances completely separate from personal finances

- Never pay personal expenses from LLC accounts

- Never deposit LLC income into personal accounts

- Maintain proper LLC records and documentation

- Sign contracts in LLC’s name, not yours personally

- Follow your operating agreement’s procedures

Mistake 2: Improper setup and documentation

Cutting corners on LLC formation can invalidate your protection.

Common setup errors:

- Using online formation services without legal review

- Inadequate or missing operating agreement

- Not filing required state documents

- Missing annual reports or renewal fees

Solution: Have a local real estate attorney set up your LLC properly from the start. The upfront cost prevents expensive problems later.

Mistake 3: Not having adequate insurance

Some investors think LLC protection means they don’t need insurance. Wrong.

Your LLC protects your personal assets from LLC liabilities, but if the LLC gets sued, the rental property (the LLC’s primary asset) is still at risk. Insurance protects the property and provides funds to settle claims.

Always maintain proper landlord insurance even with LLC ownership.

Mistake 4: Transferring property to LLC without lender notice

If you buy personally then transfer to LLC, doing so without informing your lender technically violates most mortgages’ due-on-sale clauses.

The risk: Lender could demand full loan payoff. The reality: Rarely enforced if you keep paying. The safe approach: Discuss with your lender before transferring.

Some investors transfer without notice and hope for the best. Others refinance into a commercial loan in LLC’s name. Understand the risk and make informed decisions.

Mistake 5: Not maintaining proper LLC compliance

Every state requires certain annual filings, fees, and compliance for LLCs.

Missing deadlines can result in administrative dissolution of your LLC, destroying your liability protection.

Stay compliant:

- File annual reports on time

- Pay state franchise taxes or fees

- Update registered agent if needed

- Maintain current member information on file

Mistake 6: Using the same LLC for multiple unrelated businesses

Some investors put rental properties and other businesses in one LLC to save formation costs.

The problem: This exposes all LLC assets to liabilities from any LLC business. A lawsuit from your rental property puts your other business assets at risk, and vice versa.

Better approach: Separate LLCs for rental properties and other business activities. As you scale to multiple properties, consider separate LLCs for each property or small property groups.

How Stairway Mortgage Helps Investors Navigate LLC Financing

At Stairway Mortgage, we understand that purchasing your first investment property involves more than just finding a good deal—it includes making smart decisions about ownership structure and protection.

We guide first-time investors through LLC decisions. Whether you’re buying in your personal name or through an LLC, we explain how each approach affects your financing options and help you choose the path that best fits your goals.

We offer financing programs for both approaches:

For personal ownership: Conventional loans, FHA loans for house hacking, and programs with reasonable initial capital requirements that help you get started.

For LLC ownership: DSCR loans that qualify based on property cash flow, bank statement loans for self-employed investors, and portfolio lending for multiple properties.

We explain the tradeoffs honestly: Want maximum asset protection through LLC ownership? We’ll help you understand the financing implications. Want best financing terms? We’ll show you how to structure that while planning for eventual LLC protection.

Our team coordinates with your other advisors. If you’re working with an attorney on LLC formation or a CPA on tax planning, we communicate with them to ensure your financing aligns with your overall investment strategy.

We support you as you scale. Your first property might be in your personal name, but properties two, three, and four might benefit from LLC ownership. We’re here for the entire journey with financing options that grow with you.

Ready to Buy Your First Rental Property?

Whether you’re buying your first rental property in your personal name or through an LLC, the most important step is getting started. You can always adjust your structure as you gain experience and build your portfolio.

For most first-time investors, the path forward looks like this:

Property #1: Buy personally with conventional or FHA financing to access favorable loan terms and reasonable initial capital requirements. Get experience managing a rental. Transfer to LLC after 6-12 months if desired.

Property #2-3: Consider DSCR loans in LLC names now that you have experience. By this point, LLC protection becomes more important as your portfolio grows.

Property #4+: Implement sophisticated strategies with multiple LLCs, portfolio lending, and comprehensive asset protection.

But everyone’s situation is different. If you have substantial capital and assets to protect, forming an LLC before your first purchase might make sense even with less favorable financing terms.

The key is making informed decisions based on your specific circumstances:

This month: Consult with both a real estate attorney about LLC formation and a lender about financing options Next quarter: Choose your ownership approach and get pre-approved This year: Purchase your first rental property with proper protection Years ahead: Build a protected, profitable portfolio

Take the next step: Get pre-approved to understand your financing options for both personal and LLC ownership, or schedule a call with a loan advisor who can explain how different ownership structures affect your mortgage terms.

Your first rental property is the foundation for long-term wealth. Make sure it’s built on a solid legal and financial structure.

Frequently Asked Questions

Should I form an LLC before buying my first rental property?

For most first-time investors, buying personally first provides better financing options—lower initial capital requirements, more favorable terms, easier qualification. You can transfer to an LLC after closing if desired. However, if you’re paying cash or have substantial capital for commercial financing, buying in LLC name from the start provides immediate protection. The decision depends on your financing situation and risk tolerance. Discuss with both a real estate attorney and mortgage lender before deciding.

Will an LLC save me money on taxes for my rental property?

No, single-member LLCs don’t provide tax savings for rental properties. The IRS treats single-member LLCs as “disregarded entities,” meaning you report rental income on your personal tax return exactly as if you owned personally. You claim the same deductions for depreciation, interest, expenses, etc. The benefit of LLCs is liability protection, not tax savings. Work with a CPA to maximize your rental property tax benefits regardless of ownership structure.

Can I get a conventional mortgage if I buy in an LLC name?

Most conventional residential lenders (Fannie Mae/Freddie Mac) won’t finance LLC purchases. They offer mortgages to individuals, not business entities. If you want to buy in LLC name from the start, you’ll need commercial financing like DSCR loans, which typically require larger initial capital contributions. This is why many first-time investors buy personally with conventional financing, then transfer to LLC post-closing.

What happens if I transfer property to LLC after getting a mortgage?

Technically, transferring property to an LLC after closing triggers the “due-on-sale” clause in your mortgage, allowing the lender to demand full repayment. In practice, most lenders don’t enforce this clause as long as you continue making payments—they care about getting paid, not who owns the LLC. However, there’s no guarantee they won’t enforce it. Some investors proceed with the transfer and accept the small risk. Others refinance into a commercial loan in the LLC’s name. Discuss with your lender before transferring.

How much does it cost to set up and maintain an LLC?

LLC formation costs vary by state but typically range from modest filing fees for DIY online formation to higher costs if using an attorney (recommended for proper protection). Add attorney fees for operating agreement drafting. Annual maintenance includes state renewal fees, registered agent fees if using a service, and potential franchise taxes depending on your state. California, for example, has minimum annual franchise tax. While LLCs aren’t expensive, factor these costs into your investment analysis.

Also Helpful for First-Time Investors

Building proper protection for your rental property investment? These resources help:

- Real Estate Investing for Beginners – Foundation for starting your investment journey with protection in mind

- Tax Break for Buying a House – Understanding tax benefits regardless of ownership structure

- Landlord Responsibilities – What you’re responsible for as a property owner

- Landlord Insurance for Rental Property – Layering insurance with LLC protection

What’s Next in Your Journey?

Ready to find and analyze properties with proper protection planning? These guides help:

- How to Find Investment Property – Deal-finding strategies for your first property

- Investment Property Analysis – Evaluating deals before purchase

- Property Management Checklist – Operating your LLC-owned property efficiently

Explore Your Complete Financing Options

Different ownership structures require different financing. Find your best fit:

- FHA Loans – House hacking with minimal upfront capital, buy personally

- Conventional Loans – Standard investment property financing for personal ownership

- DSCR Loans – LLC-friendly financing based on property cash flow

- Portfolio Lending – Multiple properties with flexible LLC structures

- All Loan Programs – Complete investment property financing guide

- Get Pre-Approved – Understand your options for both personal and LLC ownership

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.