Senior Property Tax Exemption: How to Reduce Property Taxes in Retirement

Senior Property Tax Exemption: How to Reduce Property Taxes in Retirement

Senior Citizen Property Tax Exemption: Reducing Housing Costs in Retirement

“Can I reduce my property taxes now that I’m retired?” This practical question addresses one of homeownership’s largest ongoing costs—and the answer brings welcome relief for millions of senior homeowners. Property tax exemptions, freezes, deferrals, and reductions specifically targeting seniors exist in virtually every state, yet many eligible retirees never apply simply because they don’t know these programs exist. From age-based exemptions reducing assessed values to income-qualified freezes preventing increases, from homestead exemptions providing flat reductions to circuit breaker programs capping taxes relative to income, strategic use of available relief programs can save hundreds or thousands annually—money that stays in your pocket for living expenses, healthcare, or enjoyment.

In this guide, you’ll discover:

- State-by-state senior property tax exemption programs

- Age requirements and income limits for qualification

- Homestead exemptions and how they work

- Property tax freezes and assessment caps

- Application processes and required documentation (following local assessor guidelines)

- Combining multiple relief programs for maximum savings

- Impact on reverse mortgages and home equity decisions

Ready to reduce property taxes? Schedule a consultation to discuss coordinating tax relief with home equity strategies.

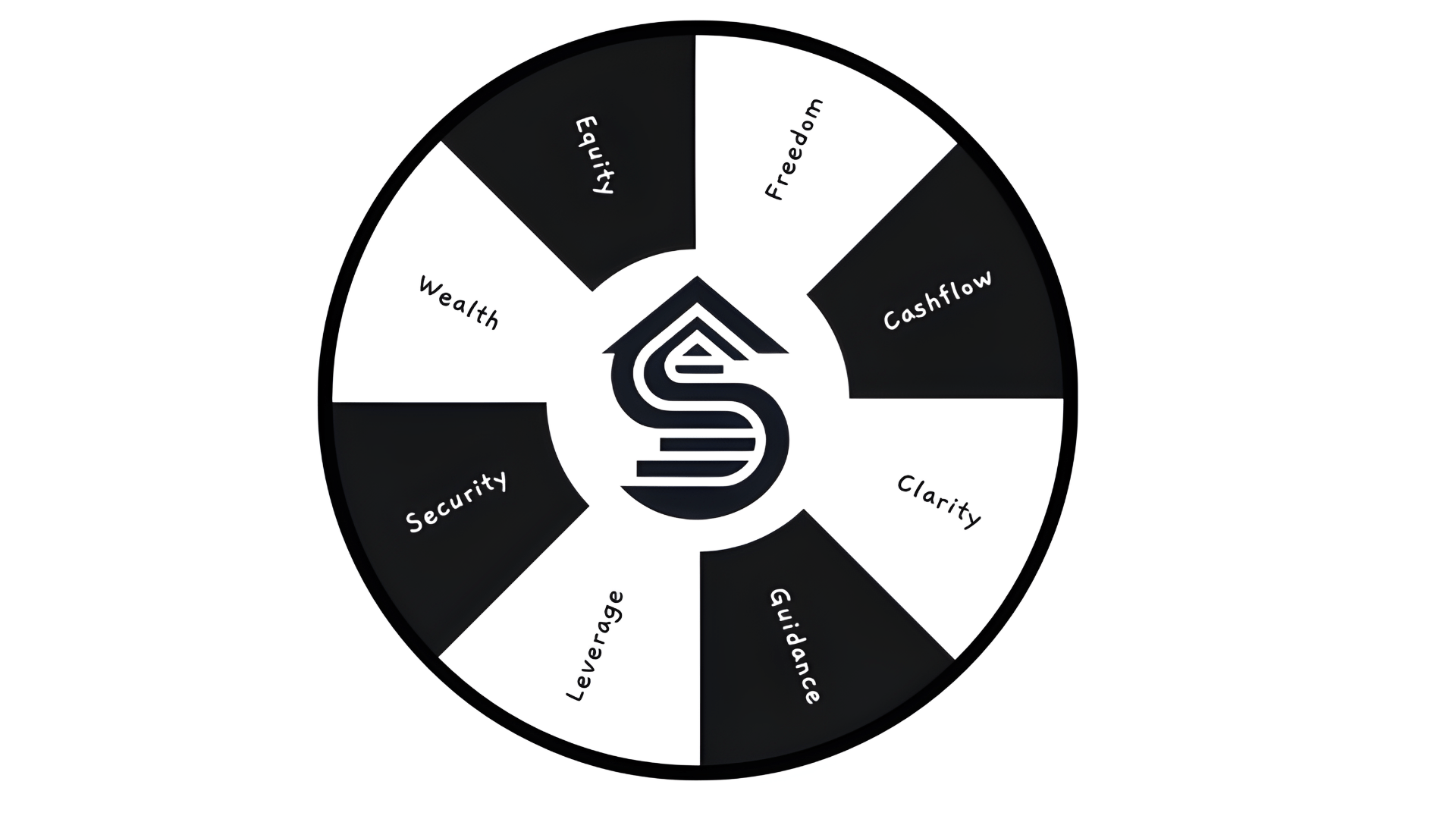

Property Tax Relief for Seniors: Understanding Available Programs

What types of property tax relief exist? Most states offer multiple programs, each serving different purposes and populations.

Age-Based Exemptions

How do senior exemptions work? These programs reduce your home’s assessed value for tax calculation purposes once you reach qualifying age (typically 65, though some states use 62).

Example:

- Home assessed value: $300,000

- Senior exemption: $50,000 reduction

- Taxable assessed value: $250,000

- Result: Pay taxes on $250,000 instead of $300,000

Typical savings: Hundreds to over a thousand dollars annually depending on local tax rates and exemption amounts.

Income-Based Reductions

What if you’re on fixed income? Many programs provide additional relief for seniors below income thresholds.

Common structures:

- Tiered reductions (lower income = larger exemption)

- Sliding scale exemptions

- Complete exemptions for very low income seniors

These programs recognize that property taxes strain fixed-income retirees disproportionately.

Property Tax Freezes

Can you lock in current tax amounts? Freeze programs prevent property tax increases for qualifying seniors, regardless of home value appreciation or millage rate increases.

How freezes work:

- Apply when eligible

- Current year’s tax becomes your maximum

- Future increases capped or eliminated

- Protection continues while you qualify

Major advantage: Predictable housing costs without unexpected tax increases straining budgets.

Circuit Breaker Programs

What if taxes consume too much income? Circuit breaker programs cap property taxes at percentage of income, providing relief when taxes become excessive relative to earnings.

Typical caps: Property taxes limited to certain percentage (often 3-10%) of household income.

Example scenario:

- Annual income: $25,000

- Circuit breaker cap: 5% of income

- Maximum property tax: $1,250

- Relief provided if actual taxes exceed this amount

Use property tax savings to enhance retirement security or coordinate with reverse mortgage strategies.

[IMAGE 2 PLACEHOLDER] Description: Property tax bill showing “before” and “after” amounts with senior exemption applied, calculator displaying annual savings, senior homeowner reviewing reduced bill with satisfaction

Senior Property Tax Exemption by State: Where You Live Matters

Do all states offer senior property tax relief? Yes, though specifics vary dramatically—understanding your state’s programs is essential.

High-Relief States (Examples)

Florida:

- Additional homestead exemption for seniors 65+

- Assessment caps preventing rapid increases

- Income limits apply for some programs

- Can save substantial amounts annually

Texas:

- School tax exemption ($10,000 minimum) for 65+

- Optional local exemptions

- Tax ceiling freeze available

- Percentage exemptions in many counties

California:

- Supplemental senior exemption available in some counties

- Proposition 13 caps all property tax increases

- Transfer of assessment to new home (seniors 55+)

Moderate-Relief States

Many states offer:

- Standard homestead exemptions

- Age-based additions (65+)

- Income-qualified enhancements

- Deferral programs (pay when home sells)

Documentation Requirements

What do you need to apply?

Common requirements:

- Proof of age (birth certificate, driver’s license)

- Proof of ownership (deed, title)

- Proof of residency (utility bills, documents showing primary residence)

- Income documentation (tax returns, Social Security statements)

- Homestead declaration (if not already filed)

Application timing: Most programs require annual or one-time application, with specific deadline dates.

Tax Relief for Seniors: Combining Multiple Programs

Can you use several programs simultaneously? Often yes—strategic stacking maximizes savings.

Common Combinations

Base homestead + senior exemption:

- General homestead exemption (available to all homeowners)

- Plus additional senior exemption (age 65+)

- Combined reductions significantly lower assessed value

Exemption + freeze:

- Apply exemption first (reduces starting point)

- Then apply freeze (locks in lower amount)

- Double benefit: lower initial tax plus protection from increases

State + local programs:

- State exemptions

- Plus county or municipal exemptions

- Plus school district exemptions

- Each layer adds savings

Strategic Timing

When should you apply?

Before age 65: File standard homestead if not already done

Upon turning 65: Apply for all age-based programs immediately (don’t delay—you may miss year’s savings)

Annual renewal: Some programs require reapplication—mark calendar to avoid lapses

Life changes: Widow(er) status, disability, or income changes may trigger additional eligibility—reapply

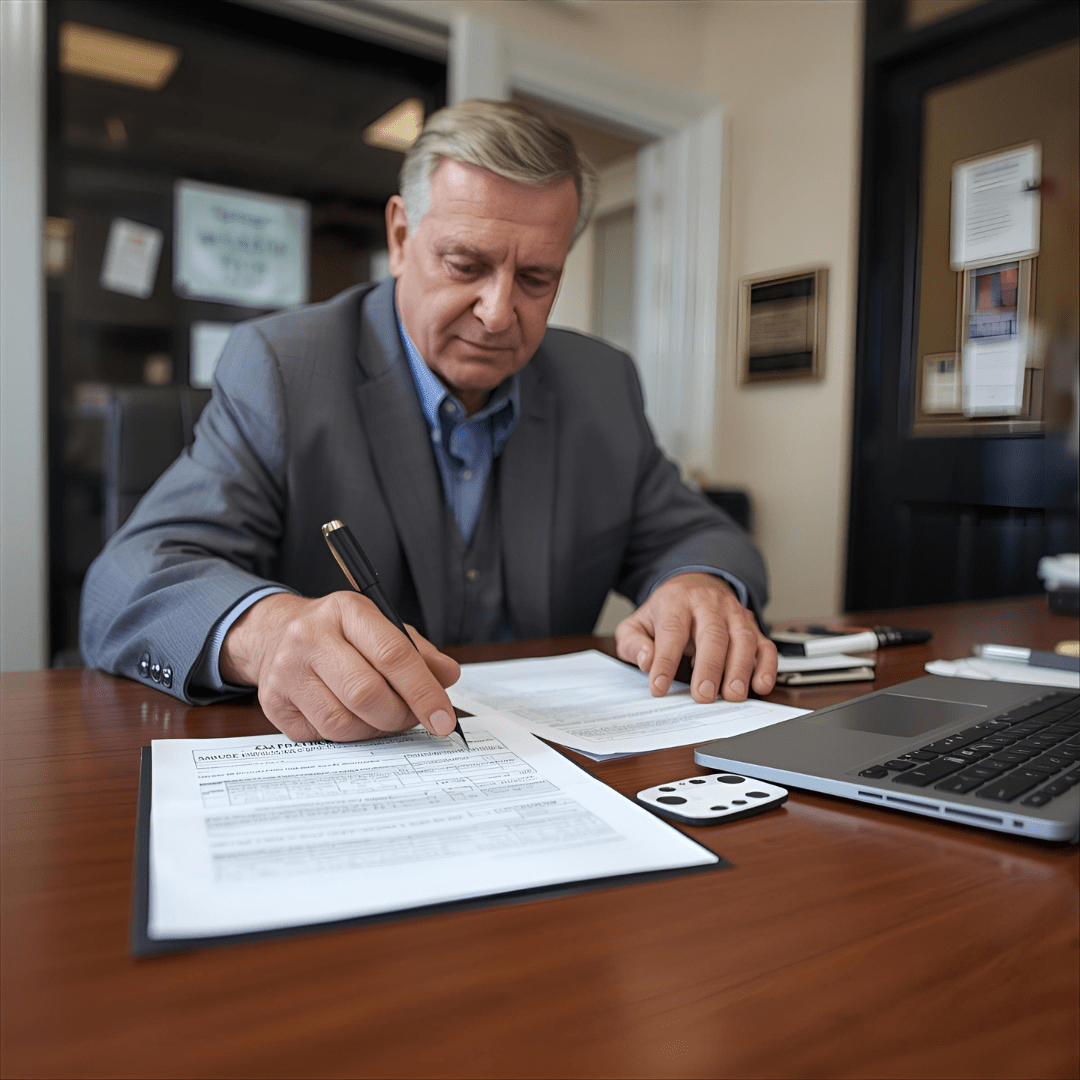

Property Tax Exemptions for Seniors: Impact on Home Equity Decisions

How do property tax exemptions affect reverse mortgage decisions? Understanding this connection is crucial for comprehensive retirement planning.

Ongoing Obligation Consideration

Critical reverse mortgage requirement: You must continue paying property taxes even with reverse mortgage (no monthly mortgage payment, but property taxes remain your responsibility).

Property tax exemptions help by:

- Reducing annual property tax burden

- Making reverse mortgage more sustainable long-term

- Freeing cash flow for other retirement needs

- Reducing default risk (unpaid taxes trigger reverse mortgage foreclosure)

Financial Assessment Impact

What’s financial assessment? Reverse mortgage lenders evaluate ability to maintain property charge obligations (taxes, insurance, maintenance).

Property tax exemptions improve assessment by:

- Lowering required annual property tax payments

- Demonstrating better ability to sustain obligations

- Potentially avoiding Life Expectancy Set Aside (LESA) requirements

- Strengthening qualification position

Strategic Sequencing

Best approach:

Step 1: Apply for all property tax exemptions first Step 2: Calculate reduced ongoing property tax obligation Step 3: Assess reverse mortgage feasibility with lower property charge requirements Step 4: Proceed with reverse mortgage application showing sustainable obligations

Learn more about reverse mortgage qualification and ongoing requirements.

[IMAGE 3 PLACEHOLDER] Description: Financial planner showing senior couple calculation combining property tax exemption savings with reverse mortgage benefits, spreadsheet displaying enhanced retirement cash flow from coordinated strategies

How Stairway Mortgage Helps Coordinate Tax Relief

At Stairway Mortgage, we recognize property tax management as integral component of retirement housing affordability.

Comprehensive Guidance

We help clients:

- Understand property tax obligations relative to reverse mortgage requirements

- Identify applicable exemption programs in their jurisdictions

- Time applications strategically before reverse mortgage

- Demonstrate sustainable financial picture to underwriters

Resource Connections

We connect you with:

- Local assessor office contact information

- Application deadlines and processes

- Required documentation checklists

- Appeal resources if applications denied

Ongoing Support

After reverse mortgage closing:

- Annual reminders about property tax due dates

- Alerts about exemption renewal requirements

- Assistance if financial circumstances change

- Coordination with LESA if established

Ready to discuss comprehensive affordability? Schedule a consultation or check reverse mortgage options.

Ready to Reduce Your Property Tax Burden?

Property tax exemptions represent low-hanging fruit for retirement cost reduction—yet many eligible seniors never claim available relief simply due to lack of awareness.

Your next steps:

- Research your state programs – Visit county assessor website or call office

- Determine eligibility – Check age, income, and residency requirements

- Gather documentation – Assemble proof of age, ownership, income

- Apply before deadlines – Don’t miss application windows

- Mark renewal dates – Calendar any required annual reapplications

- Consider home equity coordination – Discuss with Stairway how tax relief affects reverse mortgage options

Every dollar saved on property taxes is a dollar available for retirement enjoyment—claim all relief for which you qualify.

Frequently Asked Questions

Do I automatically get senior property tax exemptions at 65?

No—you must apply for most exemptions even if you’re clearly eligible. Applications typically go through your county assessor or tax collector office with specific deadlines (often early in the tax year). Missing application deadlines can cost you year’s worth of savings. Research your jurisdiction’s specific process and mark deadline on your calendar. Some locations offer one-time application that continues automatically, while others require annual renewal—confirm which applies to your situation.

Can I get property tax exemptions if I still have a mortgage?

Yes—having mortgage doesn’t disqualify you from property tax exemptions. The exemptions reduce your assessed value and resulting tax bill regardless of whether you own home outright or have mortgage. However, if property taxes are escrowed (paid through mortgage servicer), your monthly payment may decrease as taxes reduce. Contact your servicer to ensure they’ve adjusted escrow accordingly after exemptions approved to avoid overpaying.

Will property tax exemptions affect my reverse mortgage?

Property tax exemptions actually help with reverse mortgages by reducing your ongoing obligations. Since you must continue paying property taxes with reverse mortgage, lower taxes mean more sustainable situation long-term. Lenders view lower property tax obligations favorably during financial assessment. Apply for all exemptions before reverse mortgage application to demonstrate lowest possible ongoing costs and strengthen qualification position.

What if I’m denied property tax exemption?

Most jurisdictions have appeal processes if exemption denied. Common denial reasons include: missed application deadline, incomplete documentation, income exceeds limits, or property doesn’t qualify. Request written explanation for denial, gather any missing documentation, and file appeal if you believe you qualify. County assessor offices often have staff who can help identify issues and guide reapplication or appeal process.

Can I get property tax relief AND use a reverse mortgage?

Absolutely—and this combination is actually ideal. Property tax exemptions reduce your ongoing obligations, while reverse mortgage eliminates mortgage payment. Together, they dramatically lower monthly housing costs. Many retirees use this dual strategy: apply for maximum property tax relief, establish reverse mortgage for income or line of credit, result in sustainable retirement housing affordability. The two programs complement each other perfectly for comprehensive cost reduction.

Also Helpful for Senior Homeowners

- Reverse Mortgage Basics – Eliminating mortgage payments

- Ongoing Obligations – Property charge requirements

- Financial Assessment – Qualification process

What’s Next in Your Journey?

- Cost Reduction Strategies – Additional ways to lower retirement housing expenses

- Reverse Mortgage Planning – Coordinating with property tax savings

- Retirement Budgeting – Comprehensive fixed-income management

Explore Your Complete Options

- All Loan Programs – Retirement financing solutions

- Schedule Consultation – Discuss complete cost-reduction strategy

- USA.gov Property Tax Information – Government resources

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.