ADU Financing Options: Complete Guide to Funding Your Accessory Dwelling Unit

ADU Financing Options: Complete Guide to Funding Your Accessory Dwelling Unit

Accessory Dwelling Unit Financing: How to Finance an ADU

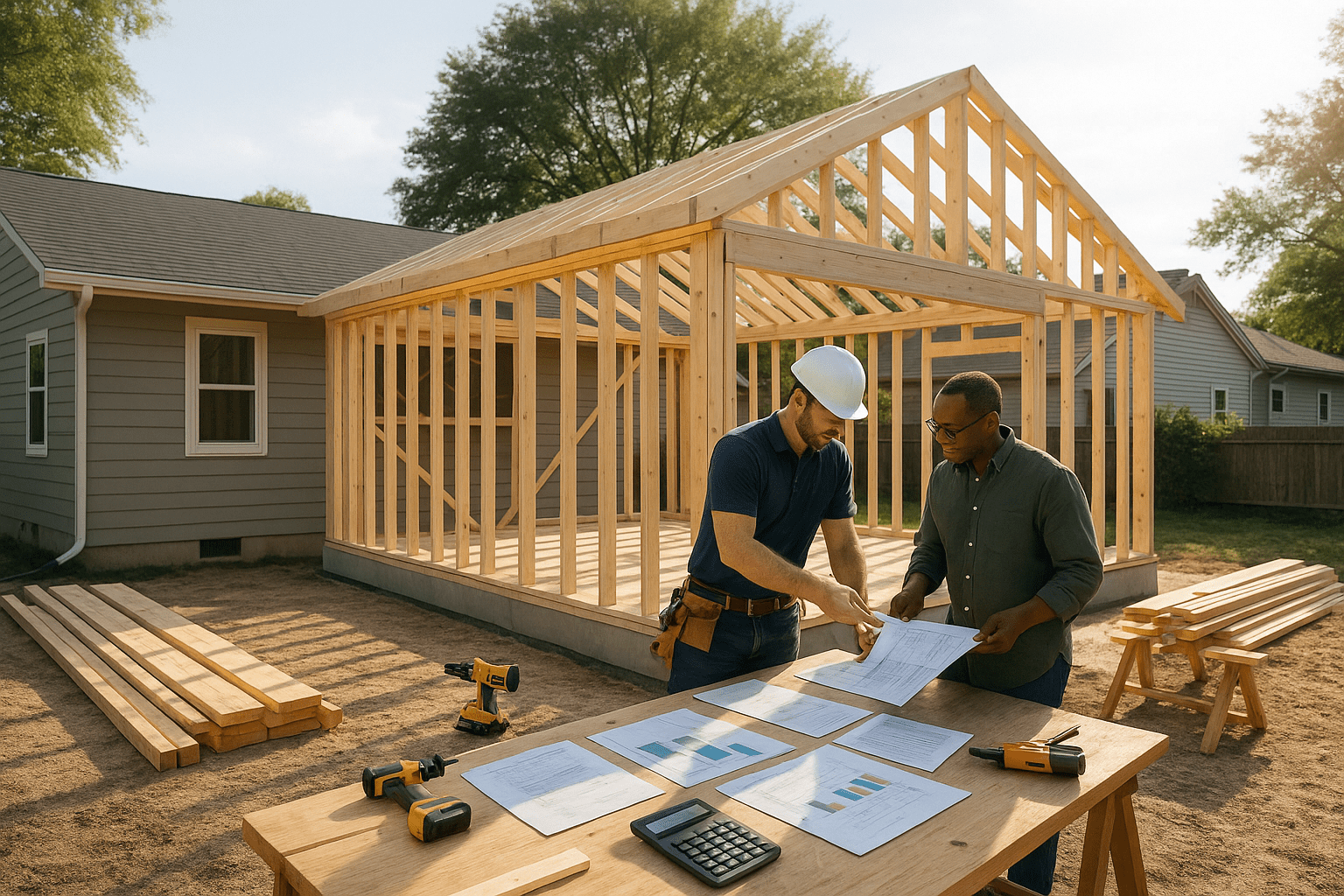

Accessory Dwelling Units (ADUs) have transformed from niche housing solutions into mainstream wealth-building strategies. Whether you call them granny flats, in-law suites, backyard cottages, or casitas, ADUs create rental income, housing flexibility, and significant property value increase—all on land you already own.

But building an ADU requires substantial capital, and most homeowners need financing to make it happen. The good news: multiple financing options exist, each suited to different situations, timelines, and financial positions.

In this guide, you’ll discover:

- What ADUs are and their income potential (following HUD housing guidelines)

- Financing methods including cash-out refinance, HELOC, construction loans, and home improvement loans

- ADU-specific loan programs and requirements

- Zoning and permit considerations affecting financing (understanding local regulations)

- ROI calculations for rental ADUs to justify investment

- Best loan types for different ADU scenarios and budgets

Whether you’re building passive income through rentals, housing family members, or creating multi-generational living arrangements, understanding ADU financing options helps you choose the strategy that maximizes returns while minimizing costs.

Planning to build an ADU? Schedule a call to explore financing options that make your accessory dwelling unit financially viable.

What Are ADUs and Their Income Potential?

An Accessory Dwelling Unit is a secondary housing unit on a single-family residential lot. It’s a complete living space with its own kitchen, bathroom, and sleeping area—either detached (standalone structure), attached (addition to main house), or internal (converted garage or basement).

Common ADU types include:

- Detached backyard cottages or casitas

- Garage conversions with full amenities

- Basement apartments with separate entrance

- Attached in-law suites or additions

- Above-garage apartments

Why ADUs matter for homeowners: They create value in three powerful ways:

Rental Income Generation:

- Monthly rent provides passive cash flow

- Helps cover your mortgage payment

- Builds wealth through tenant-funded equity

- Typically rents for moderate monthly amounts depending on size and location

Property Value Increase:

- ADUs add substantial value to properties

- Buyers pay premiums for income-producing features

- Additional square footage increases overall property worth

- Marketability improves with versatile living options

Housing Flexibility:

- Provides space for aging parents or adult children

- Creates home office or workspace separate from main house

- Offers guest accommodations without sacrificing privacy

- Generates income when not needed for family

What kind of returns can ADUs generate? In markets with strong rental demand, ADUs often produce moderate to strong annual returns on construction investment through rental income alone, plus the appreciation from increased property value.

Use the rental property calculator to model potential ADU rental income against your financing costs.

Why ADU Financing Matters for Homeowners

Most ADU construction costs range from moderate to substantial investment depending on size, finishes, and local construction costs. Few homeowners have that capital sitting in savings, making financing strategy critical to success.

What makes ADU financing different from other home improvements?

Investment vs. Expense Mindset:

- ADUs generate income, unlike most renovations

- Financing costs should be offset by rental revenue

- ROI calculations must account for both rental income and appreciation

- Think like an investor, not just a homeowner

Multiple Financing Options Available:

- Cash-out refinance for lump-sum funding

- HELOC for flexible draw as construction progresses

- Construction loans specifically designed for building

- Home improvement loans for smaller projects

- ADU-specific loan programs in some markets

The financing method you choose affects:

- Your monthly payment and cash flow

- Total interest paid over loan life

- Construction timeline and contractor payments

- Risk profile and payment stability

- Tax deductibility of interest (rental property considerations)

Why strategic financing matters: An ADU financed poorly eats into your rental income through excessive interest or payment structures that don’t align with cash flow. An ADU financed strategically creates positive cash flow from day one, with rental income covering or exceeding your financing costs.

The cash-out refinance program provides one popular path to ADU funding, while HELOCs offer another approach with different advantages.

How Do Different ADU Financing Methods Work?

Each financing option has distinct mechanics, costs, and ideal use cases. Understanding how they work helps you choose the right tool for your ADU project.

Cash-Out Refinance: Lump Sum Funding

A cash-out refinance replaces your current mortgage with a larger loan, providing a lump sum to fund ADU construction.

How it works:

- Your home is appraised to determine current value

- You refinance for more than you owe (up to substantial percentage of value)

- You receive the difference in cash at closing

- One new mortgage payment replaces your old payment

Example:

- Current home value: Substantial amount

- Current mortgage balance: Moderate amount

- Available equity for cash-out: Significant sum

- You refinance for higher amount

- Cash received for ADU: Adequate for construction

- New mortgage payment: Higher than before, but offset by ADU rent

Advantages of cash-out refinance:

- Fixed interest rate for predictability

- Single consolidated payment

- Potentially lower rate than current mortgage

- Can improve terms while accessing equity

- All funds available immediately for construction

Disadvantages:

- Closing costs (several thousand typically)

- Extends your loan term unless you choose shorter term

- Need good credit and income to qualify

- Reduces your equity immediately

- Makes sense only if staying long-term

When to use cash-out refinance for ADU:

- You want all construction funds upfront

- You prefer fixed-rate, predictable payments

- Current rates make refinancing attractive anyway

- You’re confident in construction timeline and budget

HELOC: Flexible Draw as You Build

A Home Equity Line of Credit provides revolving access to your equity like a credit card secured by your home.

How it works:

- Lender approves you for a credit line based on available equity

- You draw funds as needed during ADU construction

- You only pay interest on amounts actually drawn

- You can repay and redraw during the draw period

Example:

- Approved HELOC limit: Substantial credit line

- ADU construction budget: Moderate to significant amount

- Draw schedule: As contractor completes phases

- Interest payments: Only on drawn amounts

- Flexibility: Adjust borrowing based on actual costs

Advantages of HELOC:

- Only pay for what you actually use

- Flexibility for cost overruns or scope changes

- Lower closing costs than refinancing

- Preserves your existing favorable mortgage rate

- Can draw conservatively and increase if needed

Disadvantages:

- Variable interest rate (payments can increase)

- Requires discipline not to overuse credit line

- Interest-only initially, then payment jumps

- Two payments (mortgage plus HELOC)

- Rates typically higher than first mortgage rates

When to use HELOC for ADU:

- Your construction has multiple phases

- Budget might change as you build

- You want to preserve your current mortgage rate

- You value flexibility over fixed payments

- You’re disciplined with credit management

See how a HELOC works strategically in this case study where a financial advisor used home equity to fund an investment.

Construction Loan: Purpose-Built for Building

Construction loans are specifically designed for building projects, with draw schedules that release funds as work progresses.

How it works:

- Lender approves you based on plans, budget, and contractor

- Funds are held in escrow and released in draws

- You pay interest only on drawn amounts during construction

- Loan converts to permanent mortgage after completion (one-time close)

- Or you refinance into permanent financing after completion (two-time close)

Example:

- ADU construction loan approval: Full project amount

- Initial draw: Foundation and framing

- Second draw: Rough plumbing/electrical/HVAC

- Third draw: Drywall and finishes

- Final draw: Completion and certificate of occupancy

- Conversion: Permanent mortgage at completion

Advantages of construction loan:

- Purpose-built for building projects

- Contractor oversight and inspection requirements

- Draw schedule protects you from paying ahead of work

- One-time close options simplify process

- Interest-only during construction keeps payments low

Disadvantages:

- More complex underwriting than standard loans

- Requires detailed plans, budgets, and contractor info

- Higher interest rates during construction phase

- Appraisal based on completed value (not current)

- Strict timelines and inspection requirements

When to use construction loan for ADU:

- You’re building from scratch (not converting existing space)

- You want structure and oversight on construction

- Your budget and plans are well-defined

- You need contractor accountability through draw process

FHA construction loans, conventional construction loans, and VA construction loans all offer paths to building ADUs with single-close convenience.

Home Improvement Loan: Smaller Projects Without Refinancing

Home improvement loans provide fixed lump sums without touching your first mortgage.

How it works:

- Apply for fixed-rate loan secured by your home

- Receive lump sum at closing

- Use funds for ADU construction

- Repay with fixed monthly payment

Example:

- Home improvement loan: Moderate amount

- ADU conversion project: Garage to ADU

- Fixed rate: Competitive percentage

- Term: Several years

- Monthly payment: Manageable addition to housing costs

Advantages:

- Preserves your first mortgage and rate

- Fixed rate and fixed payment

- Faster closing than refinancing

- Lower costs than cash-out refinance

- Good for smaller ADU projects

Disadvantages:

- Typically higher rates than first mortgages

- Limited to smaller amounts

- Adds second payment to budget

- Shorter terms mean higher payments

- Not ideal for large, expensive ADUs

When to use home improvement loan for ADU:

- Your ADU project is moderate in cost (conversions, smaller builds)

- You have a great first mortgage rate to preserve

- You want fixed payments and rate

- Your credit and income support second payment

The home improvement loan program works well for garage conversions or smaller detached units without the complexity of construction loans.

ADU-Specific Loan Programs and Requirements

Some lenders and markets offer specialized ADU financing programs designed specifically for accessory dwelling unit construction with streamlined requirements.

California and West Coast ADU Programs

States with strong ADU markets (California, Oregon, Washington) have developed specialized loan programs recognizing ADU value and rental potential.

Features of ADU-specific programs:

- Underwriting considers projected ADU rental income

- Streamlined approval for pre-approved ADU designs

- Lower down payment requirements recognizing income potential

- Combined land value plus construction in one loan

- Faster processing for standard ADU models

How ADU rental income affects qualification:

- Lenders may count projected rental income toward debt-to-income ratios

- Typically require market rent analysis from appraiser

- May apply discount factor to projected rent (conservative underwriting)

- Stronger qualification for experienced landlords

FHA 203k for ADU Construction

The FHA 203k loan program finances purchase or refinance plus renovations in a single loan, and can include ADU construction as part of improvements.

When FHA 203k works for ADUs:

- You’re buying a property and adding ADU simultaneously

- You want to refinance and build ADU in one transaction

- You qualify for FHA financing (owner-occupied requirement)

- Your ADU plans meet FHA property standards

FHA 203k considerations:

- Must be owner-occupied (you live in main house or ADU)

- Can include ADU construction in renovation budget

- Single-close convenience with contractor oversight

- FHA loan limits apply to total project

The FHA 203k loan program offers a path for homeowners who want to add ADUs while leveraging FHA’s flexible qualification.

HomeStyle Renovation Loan for ADUs

Fannie Mae’s HomeStyle Renovation Loan is the conventional equivalent to FHA 203k, financing property plus improvements including ADU construction.

HomeStyle advantages for ADUs:

- Conventional loan limits (higher than FHA in many markets)

- Can finance investment properties (not just owner-occupied)

- Includes ADU construction in single loan

- Competitive rates for borrowers with strong credit

When to use HomeStyle for ADU:

- You exceed FHA loan limits

- You want to build ADU on investment property

- You have strong credit for conventional rates

- You’re buying or refinancing and building ADU simultaneously

The HomeStyle renovation loan streamlines ADU construction financing by combining everything into one transaction.

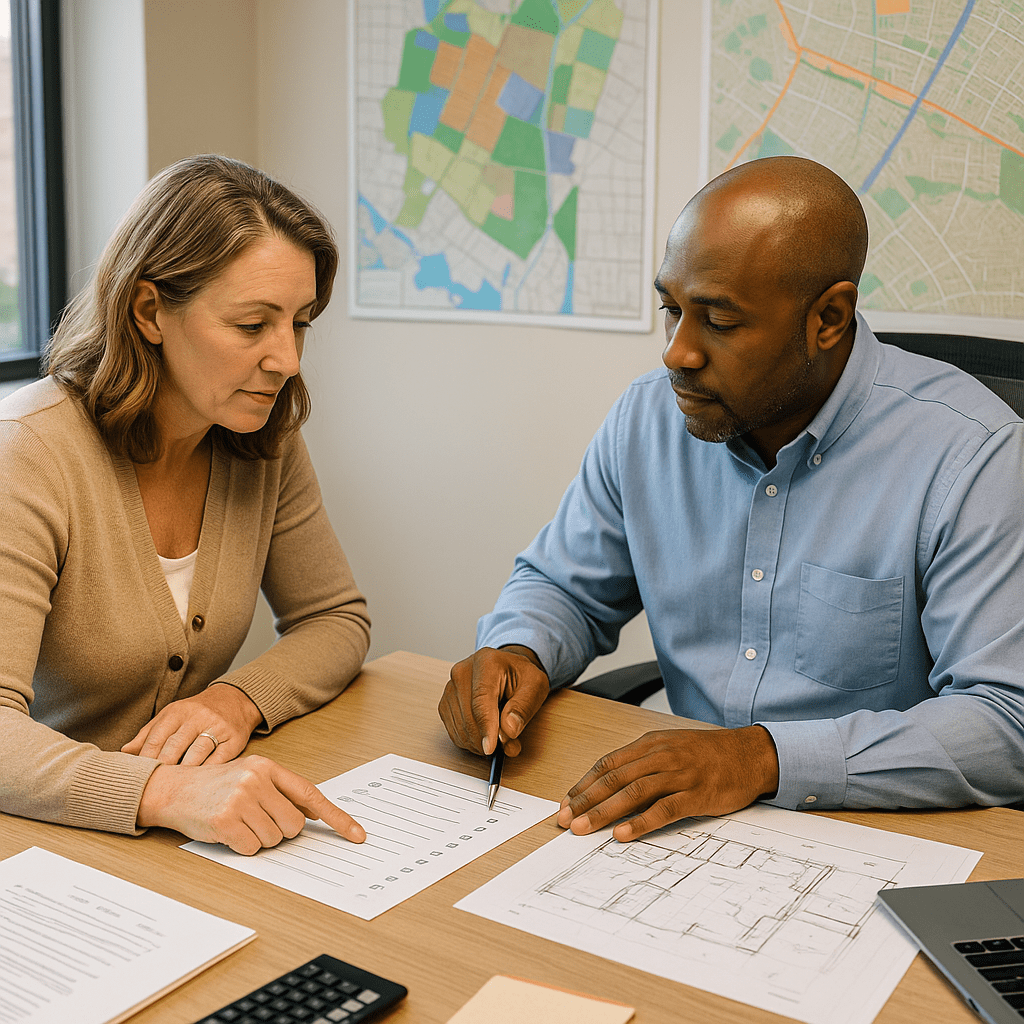

Zoning and Permit Considerations Affecting Financing

Before financing an ADU, you must ensure your project is legally permitted. Lenders won’t fund construction that violates zoning or can’t obtain necessary permits.

Understanding Local ADU Regulations

ADU regulations vary dramatically by location:

Zoning requirements typically address:

- Lot size minimums for ADU eligibility

- Maximum ADU size (square footage or percentage of main house)

- Setback requirements from property lines

- Height restrictions

- Parking requirements (often waived in urban areas)

- Owner-occupancy requirements (some jurisdictions)

Where to research your local rules:

- City or county planning department websites

- Zoning ordinances specific to accessory structures

- ADU-specific regulations (many cities now have these)

- Building department for permit requirements

Why this matters for financing: Lenders require proof that your ADU is legally permitted before funding construction. If your property doesn’t meet zoning requirements or can’t obtain permits, you can’t get financing.

Permit Process and Timeline

Most ADU construction requires multiple permits:

- Building permit for construction

- Electrical permit for wiring

- Plumbing permit for water/sewer connections

- Mechanical permit for HVAC systems

- Potentially grading or site work permits

Timeline considerations:

- Permit approval can take weeks to months

- Some lenders won’t approve loans until permits are obtained

- Construction loans typically include permit costs in budget

- Delays in permitting delay your construction timeline

Pro tip: Work with architects and contractors experienced in local ADU permitting. They know the process, have relationships with planning departments, and can navigate requirements efficiently.

Impact on Appraisal and Loan Approval

Lenders base your loan amount on appraised value, and ADU appraisals work differently than standard home appraisals.

For cash-out refinance or HELOC:

- Appraiser values your property in current condition

- Available equity determines borrowing capacity

- ADU plans don’t affect current appraisal

- You’re borrowing against existing equity to build

For construction loans:

- Appraiser provides “subject to completion” valuation

- Projected value assumes completed ADU

- Comparable sales include properties with ADUs

- Lender loans based on future completed value

Challenge in new ADU markets: If few comparable sales exist with ADUs, appraisers may struggle to document value increase. This can limit your borrowing capacity even though you know the ADU will add value.

ROI Calculations for Rental ADUs

Building an ADU makes financial sense when rental income and appreciation exceed your financing costs. Running the numbers before committing ensures your investment delivers positive returns.

Calculating ADU Rental Income Potential

Research local rental market for ADU-sized units:

- What do studios and one-bedrooms rent for?

- Are there ADU-specific rental listings to compare?

- How does your location affect rental demand?

- What amenities do renters expect?

Example rental analysis:

- Market rent for ADU in your area: Moderate monthly amount

- Annual gross rent: Substantial yearly income

- Vacancy factor: Account for turnover (typically moderate percentage)

- Effective annual rent: Slightly reduced for realistic expectations

Don’t forget rental operating expenses:

- Property management (if not self-managing): Percentage of rent

- Additional insurance for rental unit: Monthly cost

- Utilities if included: Monthly cost

- Maintenance and repairs: Annual budget

- Property tax increase from added value: Annual amount

Net operating income = Effective rent – Operating expenses

This is your real cash flow before considering financing costs.

Calculating Total Investment and Financing Costs

Add up all costs to build your ADU:

- Hard construction costs (materials, labor)

- Soft costs (permits, plans, engineering)

- Utility connections (water, sewer, electrical, gas)

- Landscaping and site work

- Contingency buffer (always include extra percentage)

Example ADU budget:

- Construction: Substantial investment

- Plans and permits: Moderate costs

- Utility connections: Additional costs

- Contingency: Buffer amount

- Total project cost: Complete investment

Calculate your financing costs:

- Loan amount (if not paying all cash)

- Interest rate

- Loan term

- Monthly payment

- Total interest over loan life

Use the construction loan calculator to model different financing scenarios.

Break-Even and Cash Flow Analysis

When does your ADU investment break even?

Simple break-even = Total investment ÷ Annual net operating income

Example:

- Total investment: Full project cost

- Annual NOI: Net rental income after expenses

- Simple break-even: Several years

This tells you how long rental income takes to recover your investment, ignoring appreciation.

Cash-on-cash return: If you financed the ADU:

- Annual cash flow = Annual NOI – Annual debt service

- Cash invested = Down payment + closing costs

- Cash-on-cash return = Annual cash flow ÷ Cash invested × 100

Example:

- Annual NOI: Strong rental income

- Annual debt service: Mortgage payments

- Annual positive cash flow: Net income

- Cash invested: Down payment and costs

- Cash-on-cash return: Healthy percentage

What’s a good return? Positive cash flow from day one is ideal. Returns exceeding standard investment returns justify the effort and risk of being a landlord.

Accounting for Appreciation and Tax Benefits

ADU value goes beyond rental income:

Property value increase:

- ADUs typically add substantial value to properties

- Value increase often exceeds construction cost

- Creates instant equity if built efficiently

- Improves marketability when selling

Tax considerations:

- Rental income is taxable

- But expenses are deductible (including depreciation)

- Mortgage interest on rental portion may be deductible

- Consult tax professional for your specific situation

Total return calculation:

- Rental income (cash flow)

- Property appreciation (equity gain)

- Tax benefits (after-tax cash flow)

- Minus financing costs and expenses

When you factor in all benefits, ADUs often deliver excellent total returns that justify the construction investment.

Best Loan Types for Different ADU Scenarios

The “best” financing depends on your specific situation, goals, and financial position. Here’s how to match financing to scenario:

Scenario 1: Detached New Construction ADU

You’re building a detached ADU from scratch with complete construction timeline and defined budget.

Best financing options:

- Construction loan – Purpose-built for ground-up building with draw schedule

- Cash-out refinance – If you want all funds upfront and fixed rate

- Combination approach – Cash-out for most of budget, HELOC for overruns

Why these work: Detached new construction has longest timeline and highest costs, benefiting from structured financing with contractor oversight.

Scenario 2: Garage Conversion ADU

You’re converting existing garage into complete living unit with moderate construction scope.

Best financing options:

- Home improvement loan – Fixed amount for defined conversion project

- HELOC – Flexible draws as conversion progresses

- HomeStyle renovation loan – If combining with other improvements

Why these work: Conversion projects have shorter timelines and lower costs than new construction, making smaller loan products appropriate.

Scenario 3: ADU with Simultaneous Purchase

You’re buying a property and plan to add ADU immediately.

Best financing options:

- FHA 203k loan – Purchase and construction in one loan

- HomeStyle renovation loan – Conventional alternative with higher limits

- Purchase with cash-out refi after closing – Two-step approach

Why these work: Combining purchase and construction in one loan saves you a second financing transaction and lets you start building immediately.

Scenario 4: Investment Property ADU

You own rental property and want to add ADU for additional rental income.

Best financing options:

- DSCR loan – Qualifies based on property income, not your personal income

- Cash-out refinance – Access equity on investment property

- HomeStyle renovation loan – Allows investor property renovation

Why these work: Investment property financing differs from owner-occupied, requiring programs that don’t depend on W-2 income.

The DSCR loan program lets real estate investors qualify based on rental income, making it perfect for adding ADUs to rental properties.

Scenario 5: Multi-Generational Living ADU

You’re building ADU primarily for family (aging parents, adult children) with rental income as secondary benefit.

Best financing options:

- Cash-out refinance – Predictable payments, all funds upfront

- HELOC – Flexibility if family situation uncertain

- Home improvement loan – If ADU is modest size for family use

Why these work: Family-focused ADUs benefit from payment stability since rental income might not materialize or might be below market rate for family members.

How to Compare ADU Financing Options

Before committing to financing, run scenarios comparing total costs, monthly payments, and flexibility across different options.

Key Comparison Factors

Total interest paid over loan life:

- Cash-out refinance: Moderate rate, long term = Substantial total interest

- HELOC: Variable rate, uncertain term = Hard to predict total

- Construction loan: Higher rate during construction, converts to mortgage

- Home improvement loan: Higher rate, shorter term = Less total interest but higher payment

Monthly payment impact:

- Will rental income cover the payment increase?

- What’s your cash flow buffer if unit is vacant?

- Can you afford payments during construction before rent starts?

Flexibility for changes:

- HELOC: Maximum flexibility, draw only what you need

- Cash-out: All funds upfront, no flexibility but predictable

- Construction loan: Structured draws, moderate flexibility

- Home improvement: Fixed amount, no flexibility

Closing costs and fees:

- Cash-out refinance: Several thousand (highest)

- Construction loan: Moderate to high

- HELOC: Low to moderate

- Home improvement loan: Moderate

Timeline to funding:

- HELOC: Fastest (weeks)

- Home improvement loan: Fast (weeks)

- Cash-out refinance: Moderate (weeks to month)

- Construction loan: Slower (month or more)

Running the Complete Analysis

Create spreadsheet comparing options:

Cash-Out Refinance:

- Loan amount: Full ADU budget plus existing mortgage

- Rate: Current refinance rates

- Term: Standard terms

- Monthly payment: New payment amount

- Total interest: Over full term

- Pros: Fixed rate, predictable, one payment

- Cons: Closing costs, reduces equity, extends term

HELOC:

- Credit line: ADU budget amount

- Rate: Current HELOC rates (variable)

- Draw period: Typical timeline

- Monthly payment: Interest-only initially

- Total interest: Dependent on draw/repayment pattern

- Pros: Flexibility, lower costs, only pay on drawn amounts

- Cons: Variable rate, requires discipline, payment jump later

Home Improvement Loan:

- Loan amount: ADU budget

- Rate: Typically higher than first mortgage

- Term: Shorter than mortgage

- Monthly payment: Higher due to shorter term and higher rate

- Total interest: Lower due to shorter term

- Pros: Preserves first mortgage, fixed rate, faster payoff

- Cons: Higher payment, limited amounts, second payment

Construction Loan:

- Loan amount: ADU budget

- Rate: Construction rate (higher initially)

- Conversion: To permanent financing

- Monthly payment: Interest-only then full payment

- Total interest: Moderate over term

- Pros: Purpose-built, draw schedule, oversight

- Cons: Complex process, higher rates during construction

Use multiple calculators to model each option with your specific numbers before deciding.

How Stairway Mortgage Helps

ADU financing requires specialized knowledge of construction lending, renovation loans, and rental property analysis. We help you structure financing that maximizes your ADU’s income potential while minimizing your costs and risk.

Our team helps you:

- Evaluate which financing option matches your specific ADU project

- Calculate realistic rental income and ROI for your market

- Structure loans that align with construction timelines

- Access construction loan programs with contractor oversight

- Compare cash-out refinance versus HELOC versus other options

- Coordinate with contractors and architects on budget requirements

- Navigate zoning and permit requirements affecting financing

We work with hundreds of lenders, giving us access to ADU-specific programs, construction loans, and renovation financing that maximizes your borrowing capacity while minimizing interest costs.

What does the process look like?

- We review your ADU plans, budget, and timeline

- We calculate projected rental income and ROI in your market

- We model multiple financing scenarios with total costs

- We recommend the option that delivers best returns

- We handle the application and coordinate with contractors if using construction loan

- We ensure your financing aligns with construction phases

Whether you’re building for rental income, family housing, or property value increase, we’ll show you how to finance your ADU in ways that turn your backyard into a wealth-building asset.

Ready to finance your ADU project? Get pre-approved to understand your borrowing capacity and options.

Ready to Get Started?

Building an ADU creates wealth through rental income and property appreciation when financed strategically with the right loan product for your situation.

Next steps for ADU financing:

- Research local ADU regulations and confirm your property qualifies

- Develop preliminary budget including construction, permits, and soft costs

- Analyze rental market to project realistic income

- Calculate ROI comparing rental income to financing costs

- Compare financing options based on your timeline and financial situation

- Get pre-approved to confirm borrowing capacity before finalizing plans

Don’t start building until you’ve secured financing and confirmed your ADU will deliver positive returns. The planning phase determines whether your ADU becomes a wealth-building asset or an expensive addition that doesn’t pencil out.

Have questions about ADU financing options? Schedule a call with a loan advisor who specializes in ADU and investment property financing.

Want to model ADU rental income scenarios? Use the rental property calculator to see if your projected rent covers financing costs.

Frequently Asked Questions

What’s the best way to finance an ADU?

It depends on your situation. Cash-out refinance works best for large detached ADUs when you want all funds upfront with fixed rates. HELOCs work well for garage conversions or phased construction with uncertain budgets. Construction loans suit ground-up building with contractor oversight. Home improvement loans work for smaller conversion projects. The “best” option balances your budget, timeline, current mortgage rate, and risk tolerance. Compare total costs across options using cash-out refinance and HELOC calculators.

Can you get a mortgage to build an ADU?

Yes, several mortgage products finance ADU construction. FHA 203k loans and HomeStyle renovation loans combine purchase or refinance with construction in one loan. Standard construction loans provide building financing with draw schedules. You can also use cash-out refinance or HELOC to access equity for ADU construction. Each has different requirements, costs, and timelines.

How much does it cost to build an ADU?

ADU construction costs vary dramatically by location, size, and finishes. Small garage conversions might cost moderate amounts, while large detached units with high-end finishes can reach substantial six-figure investments. Your specific market determines costs—California and coastal markets run higher than inland or rural areas. Include soft costs (permits, plans, engineering), utility connections, site work, and contingency buffer in your budget. Get multiple contractor bids and add extra percentage for unexpected costs.

Does adding an ADU increase property taxes?

Yes, adding an ADU increases your property’s assessed value, which typically increases property taxes. The increase depends on your local assessment methodology and the value the ADU adds. However, rental income from the ADU usually far exceeds the tax increase. Some jurisdictions offer ADU-specific tax benefits or deferrals to encourage construction. Check with your local assessor’s office about how ADUs are valued and any available programs. Factor tax increases into your ROI calculations to ensure positive cash flow.

Can you use rental income from an ADU to qualify for a mortgage?

Some lenders will consider projected ADU rental income when qualifying you for financing, though typically with conservative factors applied. If the ADU is already built and generating documented rental income, most lenders count it toward qualification. For planned ADUs, some programs (especially ADU-specific loans in California and other strong ADU markets) will underwrite using appraisal-supported market rents. Expect lenders to apply substantial discount factor to projected rent and require market rent analysis documentation.

Also Helpful for Homeowners

Related ADU and investment financing:

- Cash-Out Refinance – Access equity for ADU construction

- HELOC – Flexible funding for phased ADU projects

- Construction Loan – Purpose-built financing for building

What’s Next in Your Journey?

Continue building rental income strategies:

- View all loan calculators to model ADU financing scenarios

- Explore rental property success stories including ADU projects

- Discover all loan programs for real estate investment

Explore Your Complete Options

Strategic ADU financing creates passive income:

- FHA 203k Loan – Purchase and build ADU in one loan

- HomeStyle Renovation Loan – Conventional renovation financing

- Home Improvement Loan – Fixed-rate project funding

Ready to discuss financing your ADU project? Schedule a call to explore options that make your accessory dwelling unit financially viable.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.