First Time Home Buyer Mistakes: 15 Things We See (And How to Avoid Them)

First Time Home Buyer Mistakes: 15 Things We See (And How to Avoid Them)

First Home Buyer Mistakes: Learn from Others’ Errors Before They Cost You

After helping thousands of first-time buyers navigate home purchases, we’ve seen patterns emerge. The same mistakes repeat across different buyers, markets, and circumstances. While every situation is unique, certain errors appear so consistently that they’re almost predictable—and therefore entirely preventable.

The good news? You don’t have to learn these lessons the expensive way. By understanding common first-time home buyer mistakes before you make them, you can avoid thousands in unnecessary costs, months of stress, and years of regret.

These aren’t theoretical problems—they’re real issues we see weekly from well-intentioned buyers who simply didn’t know better. Some mistakes cost a few hundred dollars. Others cost tens of thousands or even force buyers to lose homes they love.

In this guide, you’ll discover:

- The 15 most common first-time buyer mistakes we consistently see

- Real consequences these errors create

- Specific strategies to avoid each pitfall

- How to approach your purchase with wisdom rather than emotion

- Resources that help you make better decisions

This isn’t about scaring you away from homeownership. It’s about preparing you to succeed where others have struggled, making informed decisions rather than reactive ones, and building wealth through smart homebuying rather than losing money through avoidable errors.

Want guidance avoiding these mistakes in your specific situation? Schedule a call to discuss your purchase strategy.

Mistake #1: Not Getting Pre-Approved Before House Hunting

The mistake: Buyers start touring homes, fall in love with properties, then discover they don’t qualify for financing or can’t afford what they’ve been viewing.

Why it happens: The excitement of house hunting overrides practical preparation. Buyers want to “just look” before committing to the mortgage process.

The consequence: Heartbreak when you can’t buy homes you love. Wasted time viewing inappropriate properties. Weak negotiating position in competitive markets. Sellers don’t take your offers seriously without pre-approval.

How to avoid it: Get pre-approved BEFORE viewing a single property. Pre-approval clarifies your actual budget, strengthens your offers, and prevents emotional attachment to unaffordable homes. This takes days, not weeks—there’s no excuse to skip it.

See how pre-approval strengthens your position in this FHA loan case study where solid pre-approval helped a buyer win in a multiple-offer situation.

Mistake #2: Confusing Pre-Qualification With Pre-Approval

The mistake: Buyers think their online pre-qualification (based on unverified information) means they’re actually approved for a loan.

Why it happens: Lenders’ marketing makes pre-qualification sound official. Buyers don’t understand the critical difference.

The consequence: Offers fall through when actual underwriting reveals problems. Buyers lose earnest money and dream homes because they weren’t truly approved.

How to avoid it: Understand that pre-qualification is an estimate based on what you tell a lender—no verification. Pre-approval involves submitting documentation, pulling credit, and having an underwriter review your file. Only accept full pre-approval before making offers.

Mistake #3: Shopping for Homes at Maximum Approval Amount

The mistake: Buyers view homes at the top of their approved loan amount, stretching their budget to the absolute limit.

Why it happens: Lenders approve you for the maximum amount you can technically afford, but that doesn’t mean you should spend it all. Buyers see approval amounts as recommendations rather than ceilings.

The consequence: House-poor buyers struggle with monthly payments, have no financial flexibility, can’t save or invest, and face stress with any financial disruption.

How to avoid it: Buy below your maximum approval—typically focusing on homes costing modestly less than your approval allows. This leaves room for life, unexpected expenses, and other financial goals. Use the conventional loan calculator to model comfortable payment levels, not just maximum amounts.

Mistake #4: Focusing Only on Monthly Payment, Ignoring Total Costs

The mistake: Buyers ask “what’s the monthly payment?” without considering total homeownership costs beyond principal and interest.

Why it happens: Online calculators show basic mortgage payments. Buyers don’t realize they’ll pay property taxes, insurance, HOA fees, maintenance, utilities, and other expenses beyond the loan payment.

The consequence: Budget shock when total housing costs exceed expectations by hundreds monthly. Inability to afford the home they technically “qualified” for.

How to avoid it: Budget for complete housing costs including PITI (principal, interest, taxes, insurance), HOA fees if applicable, maintenance reserves (typically one percent of home value annually), utilities, and other ownership expenses. Calculate total costs, not just mortgage payments.

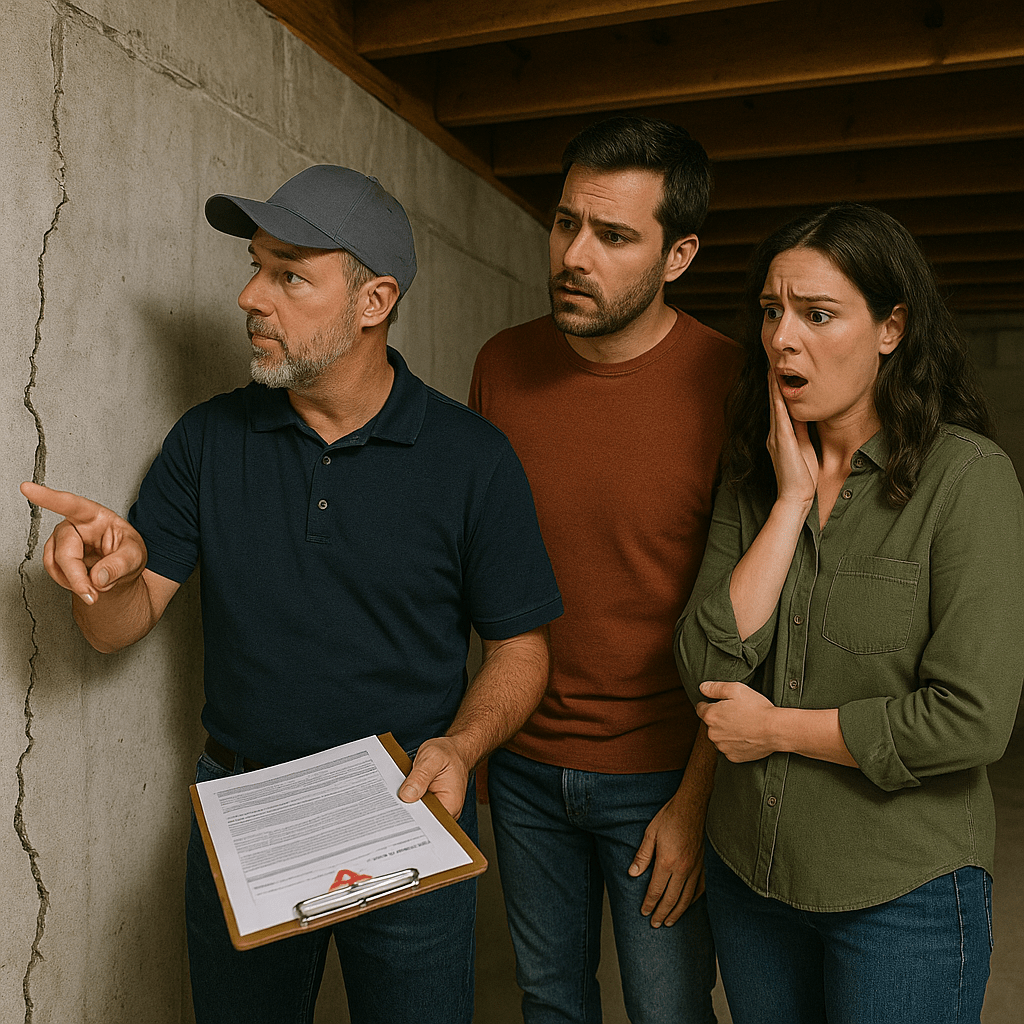

Mistake #5: Skipping or Rushing the Home Inspection

The mistake: Buyers waive inspection contingencies to strengthen offers in competitive markets, or they conduct cursory inspections without thoroughly reviewing reports.

Why it happens: Fear of losing the home to other buyers. Pressure from sellers or agents to move quickly. Inspection fatigue after viewing the report’s length.

The consequence: Buying homes with major hidden problems—foundation issues, roof failures, electrical hazards, plumbing nightmares—costing tens of thousands in unexpected repairs.

How to avoid it: NEVER waive inspections unless you have substantial cash reserves and accept the risk knowingly. Hire qualified inspectors, attend the inspection, read the entire report, and address significant issues before closing. Your inspection typically costs a few hundred dollars—cheap insurance against five-figure problems.

Mistake #6: Letting Emotions Override Logic in Offers

The mistake: Buyers fall in love with homes and make emotional decisions—over-offering, waiving contingencies, accepting terrible terms—because they “must have” the property.

Why it happens: Home buying is inherently emotional. Beautiful staging, attractive features, and fear of missing out cloud judgment.

The consequence: Overpaying for homes that don’t appraise. Buying properties with problems you can’t afford to fix. Winning bidding wars but losing financially.

How to avoid it: Set firm limits before viewing properties. Walk away from homes that require compromising your financial boundaries. Remember that other homes exist—this isn’t your only opportunity. Make offers based on comp data and logic, not emotions.

Mistake #7: Failing to Compare Multiple Lenders

The mistake: Buyers use the first lender they contact—often their bank—without shopping rates, fees, and programs from multiple sources.

Why it happens: Loyalty to existing banking relationships. Belief that “all lenders are the same.” Not understanding that mortgage terms vary dramatically between lenders.

The consequence: Paying thousands more in unnecessary fees. Getting higher interest rates than you qualify for. Missing loan programs perfectly suited to your situation.

How to avoid it: Compare at least three lenders. Request loan estimates showing complete costs, not just interest rates. Evaluate total fees, programs offered, and lender responsiveness. Understand that FHA loans, conventional loans, and other programs have different benefits—shop for the right program, not just the lowest payment.

Mistake #8: Making Major Financial Changes During the Process

The mistake: After applying for mortgages, buyers make large purchases, open new credit accounts, change jobs, or make major deposits/withdrawals from accounts.

Why it happens: Buyers don’t understand that lenders verify everything multiple times through closing. They assume approval means they can resume normal financial activities.

The consequence: Loan denials at the last minute. Closing delays while lenders investigate changes. Lost earnest money when deals fall through. Higher rates if credit scores drop.

How to avoid it: From application through closing: don’t change jobs, don’t make large purchases (especially financed ones), don’t open new credit accounts, don’t miss payments on anything, don’t move money between accounts without documenting it, and don’t co-sign for others. Wait until after closing for any major financial changes.

Mistake #9: Draining All Savings for Down Payment and Closing

The mistake: Buyers use every available dollar for down payment and closing costs, leaving zero reserves for emergencies, moving, or unexpected expenses.

Why it happens: Aggressive saving toward homeownership goals. Not understanding that reserves matter after closing as much as before.

The consequence: Financial crisis when unexpected expenses arise (and they always do). No buffer for job loss, medical issues, or urgent home repairs. Forced to use high-interest credit for emergencies.

How to avoid it: Maintain several months of expenses in liquid savings beyond your down payment and closing costs. Some loan programs require reserves—but even if yours doesn’t, keep substantial savings accessible. Your home will need something expensive repaired sooner than you expect.

Mistake #10: Ignoring Total Commute and Location Realities

The mistake: Buyers prioritize home features and price over location, accepting long commutes or inconvenient areas to get more house for their money.

Why it happens: Beautiful homes in affordable areas tempt buyers to compromise on location. Commutes seem manageable when measured once, not experienced daily for years.

The consequence: Quality of life suffers from hours spent commuting. Resale challenges when selling homes in less desirable locations. Isolation from friends, family, and activities.

How to avoid it: Prioritize location appropriately. Drive your commute during actual rush hours—multiple times—before buying. Consider proximity to work, schools, family, activities, and services. Great homes in poor locations rarely satisfy long-term. Better to buy smaller homes in better locations.

Mistake #11: Overlooking Future Resale Potential

The mistake: Buyers purchase homes perfect for their current needs without considering resale appeal when they eventually sell.

Why it happens: Focus on immediate needs and preferences. Belief they’ll stay forever (most move within seven to ten years).

The consequence: Difficulty selling unique or over-improved properties. Financial loss when homes don’t appreciate like neighborhood comps. Extended time on market when ready to move.

How to avoid it: Consider resale appeal even if you plan to stay long-term. Avoid the most expensive or most unique home in the neighborhood. Don’t over-improve beyond neighborhood norms. Maintain broad appeal in finishes and layouts. Think: “Will typical buyers want this?”

Mistake #12: Underestimating Maintenance and Repair Costs

The mistake: Buyers budget only for mortgage payments, not ongoing maintenance, repairs, and system replacements.

Why it happens: Renters aren’t responsible for maintenance, so new buyers don’t anticipate these costs. Sellers’ homes appear maintenance-free during showings.

The consequence: Financial stress when HVAC systems fail, roofs leak, appliances break, or other expensive repairs arise. Deferred maintenance that damages homes and decreases values.

How to avoid it: Budget at least one percent of your home’s value annually for maintenance and repairs. Set aside reserves specifically for home maintenance. Plan for major system replacements (HVAC, water heater, roof, appliances). Accept that maintenance is part of ownership, not optional.

Mistake #13: Choosing the Wrong Loan Program

The mistake: Buyers use conventional financing when FHA loans would save money, or they miss VA loan benefits they qualify for, or they don’t know specialized programs exist for their situation.

Why it happens: Limited knowledge of available loan programs. Working with lenders who only offer limited products.

The consequence: Higher down payments than necessary. Paying PMI when it could be avoided. Missing programs with better terms for specific situations.

How to avoid it: Understand all programs you might qualify for. Explore FHA, VA, USDA, conventional, and specialized programs like FHA 203k for renovations. Work with lenders offering multiple program types. Use calculators comparing different scenarios.

Mistake #14: Not Reading Documents Thoroughly

The mistake: Buyers sign contracts, loan documents, and disclosures without reading or understanding them.

Why it happens: Document fatigue from the volume of paperwork. Trust that professionals caught everything. Eagerness to close quickly.

The consequence: Surprises about loan terms, closing costs, or contract obligations. Missing errors that cost money. Agreeing to unfavorable terms unknowingly.

How to avoid it: Read every document you sign. Ask questions about anything unclear. Don’t let anyone rush you through signing. Verify numbers on closing disclosure match loan estimate expectations. Understand what you’re agreeing to—it’s legally binding whether you read it or not.

Mistake #15: Buying Before You’re Truly Ready

The mistake: Buyers purchase homes because they feel pressure—age milestones, social expectations, rent frustration—rather than being genuinely prepared financially and emotionally.

Why it happens: External and internal pressure to achieve homeownership. Comparison with peers who’ve already bought. Frustration with renting.

The consequence: Financial stress from buying before establishing career stability, emergency savings, or clear life plans. Forced sales when circumstances change. Regret from rushed decisions.

How to avoid it: Assess readiness honestly. Do you have stable income? Sufficient savings beyond down payment? Plans to stay in the area for years? Understanding of homeownership responsibilities? If not, wait. Renting while preparing properly is wiser than buying prematurely and struggling.

How Does Stairway Mortgage Help You Avoid These Mistakes?

Preventing first-time buyer mistakes requires experienced guidance from professionals who’ve seen these errors repeatedly and know how to avoid them. At Stairway Mortgage, protecting buyers from common pitfalls is central to our mission:

We educate thoroughly before you commit, ensuring you understand complete costs, various loan options, and realistic budgets before you start shopping.

We provide honest pre-approval based on verified documentation, not optimistic estimates, so you know your true buying power.

We help you compare loan programs showing how FHA, conventional, VA, and other options fit your specific situation.

We warn you about financial changes to avoid during your transaction, preventing last-minute problems that kill deals.

We coordinate with your agent and other professionals to ensure inspections happen properly, appraisals support your purchase, and closing proceeds smoothly.

We explain every document you’ll sign, ensuring you understand your obligations and aren’t surprised by terms.

We tell you when to wait if buying now isn’t in your best interest, even though it costs us a transaction. Your long-term success matters more than our short-term commission.

Many of our clients successfully avoided these common mistakes because we prepared them properly, set realistic expectations, and provided guidance at every decision point.

Ready to Buy Smart and Avoid Costly Mistakes?

Understanding common first-time buyer mistakes transforms your approach from reactive and emotional to strategic and informed. You don’t have to learn these lessons the expensive way—benefit from others’ experiences and make wise decisions from the start.

Your next steps:

If you’re preparing to buy and want guidance avoiding these pitfalls, schedule a call to discuss your specific situation and create a strategy for success.

If you’re ready to move forward with proper preparation, get pre-approved with a lender who will educate and protect you throughout the process.

If you want to understand your complete options and costs:

- Explore all loan programs to find the best fit

- Use our calculators to model realistic scenarios

- Read case studies showing how buyers successfully navigated purchases

Remember: Avoiding these 15 common mistakes doesn’t just save money—it transforms your home buying experience from stressful and uncertain to confident and successful. Take the time to prepare properly, and you’ll thank yourself for years to come.

Frequently Asked Questions

How can I tell if I’m truly ready to buy or if I’m just feeling pressured?

Ask yourself these honest questions: Do I have stable income I expect to continue? Have I lived in this area long enough to know I want to stay? Do I have adequate savings beyond down payment for emergencies and maintenance? Do I understand total homeownership costs? Am I buying because I genuinely want to or because I feel I “should”? If you’re buying primarily due to external pressure, age milestones, or comparison with peers, you’re probably not ready. True readiness combines financial stability, emotional preparedness, location certainty, and genuine desire for homeownership responsibilities. There’s no shame in waiting—buying before you’re ready creates far more problems than renting another year while preparing properly. Use the time to build savings, improve credit, research neighborhoods, and clarify your goals.

What’s the single most important thing to avoid as a first-time buyer?

While all 15 mistakes matter, emotional decision-making causes the most damage because it leads to multiple other errors. When buyers make emotional rather than logical decisions, they overpay for homes, waive inspections, drain all savings, ignore red flags, and compromise financial boundaries. Emotion makes you vulnerable to every other mistake on this list. The antidote is setting firm limits before you start shopping—maximum price, required features, deal-breakers—then sticking to those limits regardless of how much you love specific properties. Treat home buying as the largest financial decision of your life (which it is), not as an emotional journey to find “the one.” Homes are shelter and investments, not soulmates. This mindset protects you from costly mistakes driven by attachment rather than wisdom.

Should I buy now or wait until I have perfect credit and substantial savings?

Don’t wait for perfection—wait for readiness, which is different. You don’t need perfect credit; acceptable credit suffices for most programs. You don’t need enormous down payments; many programs accept minimal down payments. However, you do need: income stability (steady job for at least two years), adequate credit (typically mid-range or better), sufficient savings for down payment AND reserves, understanding of complete costs, and plans to stay in the area for years. If you have readiness factors but imperfect credit or modest savings, buying might make sense—programs like FHA loans accommodate these situations. But if you lack income stability, have zero savings beyond down payment, or don’t know if you’ll stay in the area, wait regardless of credit scores. Readiness means you can sustain homeownership successfully, not that every factor is perfect.

How much below my maximum approval should I actually buy?

Most financial advisors recommend staying at least modestly below your maximum approval—buying at a comfortable level rather than stretching to your limit. This leaves room for life’s other priorities, unexpected expenses, and financial flexibility. Exact amounts depend on your situation, but general guidelines suggest leaving meaningful buffer between comfortable payments and maximum approval. Consider: Will this payment let you save adequately? Can you handle mortgage payments if income temporarily drops? Do you have room for increased costs (property tax increases, insurance increases, maintenance surprises)? Can you still fund retirement, pursue hobbies, and enjoy life? If your maximum approval pushes against these limits, buy significantly below max. Use the FHA loan calculator or conventional calculator to compare payments at different price points—find the level that feels comfortable, not stressful.

What if I’ve already made some of these mistakes?

Many mistakes can be corrected or mitigated if caught early enough. If you’re still in the buying process, immediately address problems—switch lenders if you didn’t shop properly, order thorough inspections if you rushed initial ones, renegotiate if you over-offered emotionally, or even walk away if you’re truly buying before you’re ready and have contingencies allowing it. If you’ve already closed, focus on preventing additional mistakes and managing consequences of those made—build emergency reserves if you drained savings, create maintenance budgets if you ignored those costs, or consider refinancing if you chose wrong loan programs. Some mistakes you’ll simply learn from for next time. Don’t compound errors by refusing to acknowledge them or making additional poor decisions trying to justify initial ones. Learn, adapt, and move forward wiser.

Also Helpful for First-Time Home Buyers

Complete Education Resources:

Learn the right way to buy:

- Understanding your true budget beyond just payments

- Comparing all loan program options thoroughly

- Preparing financially and emotionally for ownership

- Evaluating properties objectively not emotionally

Loan Programs to Explore:

Find the right financing for your situation:

- Review FHA loans for minimal down payments

- Explore conventional options with flexibility

- Check VA benefits if military-eligible

- Consider specialized programs for unique situations

Tools for Smart Decisions:

Calculate realistic scenarios:

- Access all calculators for comprehensive planning

- Use payment calculators showing complete costs

- Try comparison tools for different programs

Learn from Success Stories:

See how others did it right:

- Read all case studies for inspiration

- Browse successful purchases avoiding pitfalls

- Explore smart strategies that worked

What’s Next in Your Journey?

You’ve now completed comprehensive education covering every aspect of first-time home buying—from initial preparation through closing and beyond. Armed with this knowledge, you’re positioned to succeed where others struggle and to avoid the costly mistakes that derail unprepared buyers.

Your path forward:

Take time to absorb and apply these lessons. Review the mistakes that resonate most with your situation. Create your personal strategy for avoiding pitfalls while maximizing opportunities.

Then take action—confidently, strategically, and successfully.

Explore Your Complete Options

Loan Programs for Every Situation:

- Browse all programs with complete information

- Compare options for your needs

- Find specialized financing

Tools for Success:

- Access all calculators for planning

- Model scenarios before committing

- Compare programs side-by-side

Real Success Stories:

- Read case studies for guidance

- Learn from others who succeeded

- See strategies that work

Ready to buy smart and avoid mistakes? Schedule a call for personalized guidance.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.