50 30 20 Budget Rule: The Budget That Actually Works for Young Adults

50 30 20 Budget Rule: The Budget That Actually Works for Young Adults

What Is the 50 30 20 Budget Rule for First-Time Home Buyers?

Whether you’re 18 learning to budget for the first time or a parent teaching your young adult money management, the 50/30/20 budget rule provides a framework that works in real life—not just theory. This isn’t about restricting every purchase or tracking every dollar obsessively. It’s about creating sustainable spending patterns that let you save for a down payment while living your life.

Here’s what makes the 50/30/20 rule work for Smart Stewards building toward homeownership:

In this guide, you’ll discover:

- How the 50/30/20 budget rule divides your income for needs, wants, and savings (according to CFPB money management principles)

- Why the standard rule needs adjustment when you’re saving for a house in expensive markets

- Which budgeting apps and tools make the 50/30/20 framework effortless (based on FTC consumer recommendations)

- How to use the 50/30/20 rule to accelerate down payment savings

- Real strategies Smart Stewards families use to balance current quality of life with future homeownership goals

The difference between budgeting strategically versus living paycheck-to-paycheck determines whether you’re buying a house to house hack at 22 or still renting at 30.

Ready to align your budget with homeownership goals? Schedule a call to understand how much you need to save for different loan programs.

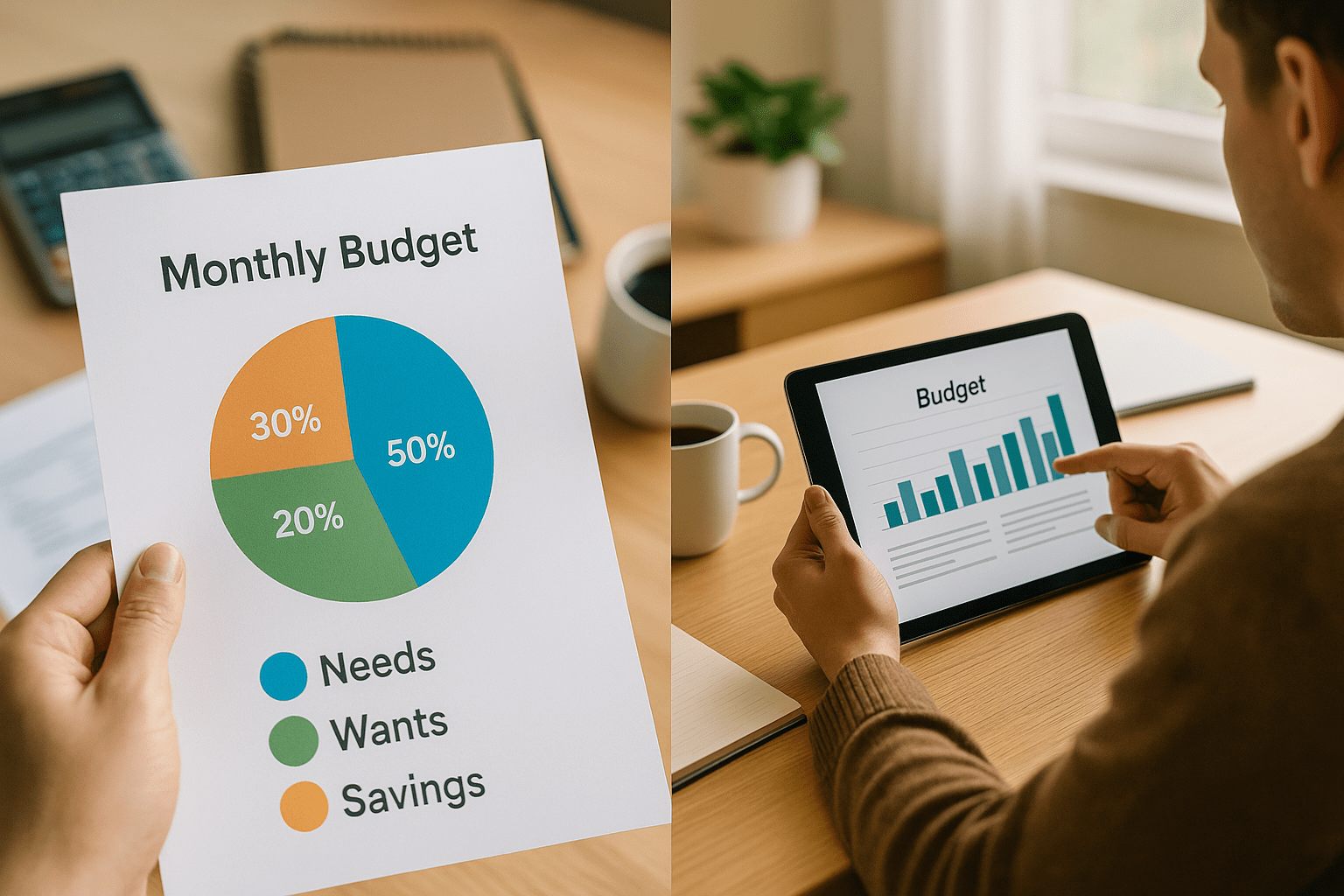

What Is the 50/30/20 Budget Rule?

The 50/30/20 budget rule is a simple framework for dividing your after-tax income into three categories: needs, wants, and savings. It was popularized by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in the book “All Your Worth: The Ultimate Lifetime Money Plan.”

The breakdown:

50% for Needs – Essential expenses you must pay to survive and maintain employment. Rent or mortgage, utilities, groceries, insurance, minimum loan payments, transportation costs to work. These are non-negotiable expenses that keep your life functioning.

30% for Wants – Discretionary spending that improves your quality of life but isn’t strictly necessary for survival. Dining out, entertainment, hobbies, travel, streaming subscriptions, gym memberships, shopping beyond essentials. These make life enjoyable but you could technically live without them.

20% for Savings – Money directed toward financial goals rather than current consumption. Emergency fund, retirement contributions, debt payments beyond minimums, down payment savings, investments. This is the portion that builds your future.

Why this framework works:

The 50/30/20 rule succeeds where other budgets fail because it’s flexible enough to adapt to different income levels and living situations while maintaining clear boundaries. You’re not tracking every dollar or living on rice and beans. You’re making intentional choices within each category.

For Smart Stewards focused on homeownership, the “savings” category becomes your down payment fund, your FHA loan qualification buffer, and your path to house hacking a multi-unit property in your early twenties.

How to Calculate Your 50/30/20 Budget (With Real Examples)

Theory is useless without practical application. Here’s how to actually implement the 50/30/20 rule with your real income and expenses.

Step 1: Calculate Your After-Tax Monthly Income

Start with what actually hits your bank account, not your gross salary. If you’re salaried, look at your paycheck after taxes, health insurance, and 401k contributions are deducted. That’s your after-tax income.

Example 1: Entry-level job

- Gross annual salary: $45,000

- After-tax monthly income: approximately $2,900

- 50% for needs: $1,450

- 30% for wants: $870

- 20% for savings: $580

Example 2: College student with part-time work

- Monthly income from part-time job: $1,200

- Monthly support from parents: $800

- Total after-tax income: $2,000

- 50% for needs: $1,000

- 30% for wants: $600

- 20% for savings: $400

Example 3: Young professional with roommates

- After-tax monthly income: $4,000

- 50% for needs: $2,000

- 30% for wants: $1,200

- 20% for savings: $800

Use a mortgage calculator to see how different savings rates affect your down payment timeline. Saving $800/month gets you to a down payment faster than $400/month—which determines when you can buy.

Step 2: List Every Expense in the Right Category

Be honest about where your money goes. Track spending for 30-60 days before categorizing. Most people are shocked when they see actual spending versus what they think they spend.

Needs (50%):

- Rent or mortgage

- Utilities (electric, water, gas, trash)

- Groceries (not dining out)

- Insurance (health, auto, renters)

- Minimum debt payments (credit cards, student loans, car payment)

- Transportation (gas, car maintenance, or public transit pass)

- Essential phone/internet for work

Wants (30%):

- Dining out and takeout

- Entertainment (movies, concerts, events)

- Streaming services (Netflix, Spotify, etc.)

- Gym membership

- Shopping beyond essentials

- Travel and vacations

- Hobbies

- Non-essential subscriptions

Savings (20%):

- Emergency fund contributions

- Down payment savings account

- Retirement accounts beyond employer match

- Extra debt payments above minimums

- Investment accounts

Step 3: Adjust Until the Numbers Work

If your needs exceed 50% of income, you have three options: increase income, decrease needs, or temporarily adjust the percentages while working toward better ratios.

Common need adjustments:

- Get roommates to split rent (drops housing from 40% to 20% of income)

- Move to lower cost area (not always possible but sometimes necessary)

- Reduce car payment by selling and buying used with cash

- Switch to cheaper phone plan or insurance provider

- Meal prep instead of buying lunch daily

The goal isn’t perfection immediately—it’s progress toward the 50/30/20 framework while maintaining sanity.

Why the Standard 50/30/20 Rule Needs Adjustment for Homeownership

The traditional 50/30/20 split works for general financial health, but Smart Stewards saving for house hacking need modifications.

The High-Rent Problem

If you live in expensive markets—think coastal cities, major metros—rent alone might consume 40-50% of your after-tax income even with roommates. That doesn’t leave much room in the “needs” category for everything else.

The adjustment: Consider 60/20/20 or even 65/15/20 temporarily if housing costs are unavoidable. The priority is maintaining the 20% savings rate while acknowledging that needs might exceed 50% in high-cost markets.

Example: San Francisco young professional

- After-tax income: $4,500/month

- Rent with roommate: $1,800 (40% of income)

- Other needs: $900

- Total needs: $2,700 (60%)

- Wants: $900 (20%)

- Savings: $900 (20%)

This person is “failing” the 50/30/20 rule by having 60% needs, but they’re still saving 20% toward down payment. That’s success, not failure.

The Aggressive Savings Modification

If you’re serious about house hacking at 22-23, consider flipping the script temporarily: 50/10/40 or even 50/5/45. Live with parents or multiple roommates, minimize wants dramatically, and stack cash for down payment.

Example: Living at home to accelerate savings

- After-tax income: $3,500/month

- Needs (minimal rent to parents, car, phone, food): $1,400 (40%)

- Wants (severely restricted): $350 (10%)

- Savings (aggressive): $1,750 (50%)

At $1,750/month savings, you accumulate $21,000 in 12 months. That’s enough for a down payment on a fourplex using an FHA loan in many markets. By 23, you’re a homeowner with tenants paying your mortgage while peers are still renting.

Is it extreme? Yes. Does it work? Absolutely. This is how Smart Stewards families build wealth starting in their twenties.

The House Hacking Adjustment

Once you buy a multi-unit property and live in one unit while renting others, your “housing need” drops dramatically or even goes negative if rental income exceeds your mortgage payment.

Example: After house hacking a triplex

- Mortgage payment (PITI): $2,200/month

- Rental income from 2 units: $2,400/month

- Net housing cost: -$200/month (you’re making money)

Suddenly your “needs” category shrinks by $1,500-2,000/month, freeing up massive cash flow for the next property, investments, or simply living better. This is the goal the 50/30/20 budget helps you reach.

Use the rental property calculator to model how house hacking changes your budget entirely.

The Best Apps and Tools for 50/30/20 Budgeting

Manual budgeting works, but apps make it effortless by automating categorization and tracking. Here are the best options for Smart Stewards.

YNAB (You Need A Budget) – Best for Active Budgeters

YNAB uses a “give every dollar a job” philosophy that aligns perfectly with 50/30/20 framework. You manually input transactions (or link accounts for auto-import) and assign each dollar to a category. The visual interface shows exactly how much you have left in each budget category.

Best for: People who want detailed control and don’t mind spending 10-15 minutes weekly reviewing budget. Students get one year free.

Cost: $14.99/month or $109/year

50/30/20 setup: Create category groups for Needs, Wants, and Savings. Assign your income to each category according to 50/30/20 percentages. YNAB forces you to allocate before spending—powerful for staying on track.

Rocket Money (formerly Truebill) – Best for Subscription Management

Rocket Money automatically tracks spending, categorizes transactions, and identifies subscriptions you’re paying for. Great for the “wants” category where subscriptions hide and accumulate. They negotiate bills and cancellations on your behalf.

Best for: People who want automation and hate manually tracking. Perfect for identifying spending leaks in the wants category.

Cost: Free basic version, premium $6-12/month depending on features

50/30/20 setup: Use their spending insights to see where money goes, then manually enforce 50/30/20 split based on their categories.

Mint (Free) – Best for Complete Beginners

Mint connects to all your accounts, automatically categorizes transactions, and provides spending breakdowns. The interface is simple and the price (free) can’t be beat for starting out.

Best for: Complete beginners who need to see where money is going before implementing structure.

Cost: Free (ad-supported)

50/30/20 setup: Create custom budget categories matching needs/wants/savings. Mint shows if you’re over or under budget in each category monthly.

Simple Spreadsheet – Best for Total Control

A Google Sheet with three columns: Needs, Wants, Savings. Manually log every transaction in the appropriate column. Track monthly totals and compare to 50/30/20 targets.

Best for: People who want zero cost, complete customization, and detailed control. Also best for teaching teens budgeting fundamentals.

Cost: Free

50/30/20 setup: Column A = Date, Column B = Description, Column C = Amount, Column D = Category (Needs/Wants/Savings). Use formulas to sum each category and calculate percentages.

The “Three Checking Accounts” Method – Best for Automated Budgeting

Open three checking accounts at your bank: one for needs, one for wants, one for savings. When income hits your main account, immediately transfer 50% to needs account, 30% to wants account, 20% to savings account. Spend from the appropriate account only.

Best for: People who struggle with self-control and need physical separation of money to enforce boundaries.

Cost: Free (most banks allow multiple free checking accounts)

50/30/20 setup: Automatic. The money division IS the budget. When the wants account is empty, you’re done with discretionary spending for the month.

Whichever tool you choose, the key is consistent use. Check your budget weekly, adjust as needed, and stay committed to the 20% savings minimum.

How to Use 50/30/20 Budget to Save for Your First House

The 50/30/20 framework becomes a down payment savings machine when you understand what you’re saving toward and how much you need.

Calculate Your Down Payment Target

Different loan programs require different down payments. Know your target before you start saving.

FHA loans: Minimum down payment, making them most accessible for first-time buyers and young adults. You need funds for down payment plus closing costs (typically additional amount).

Conventional loans: Often require larger down payments but offer more flexibility long-term and eventually no mortgage insurance.

Multi-unit properties with FHA: Same down payment requirements but the property must be 2-4 units with you living in one. This is the house hacking strategy Smart Stewards use.

Use the FHA loan calculator to see how much you need for different purchase prices in your market.

Calculate Your Timeline

If you’re saving 20% of after-tax income ($600/month) and need to accumulate funds for a down payment, how long will it take?

Example timelines:

Saving $600/month reaches your target in 17 months. Increase savings to $900/month (by reducing wants from 30% to 20%) and you hit the same target in 11 months. Cut wants to 10% and save $1,200/month? Target reached in 8 months.

The math is simple. The discipline is hard. The payoff is worth it.

Use the “Savings” Category Strategically

The 20% savings category should be subdivided:

Emergency fund first: Before aggressive down payment saving, you need a buffer. Start with a basic emergency fund, then build to a more substantial amount after you have down payment saved.

Down payment savings: This is your house hacking fund. This money goes into a high-yield savings account and doesn’t get touched until closing.

Retirement: Don’t completely neglect retirement to save for a house. At minimum, contribute enough to get employer match if offered. That’s free money you can’t leave on the table.

The split might be: 10% to down payment savings, 5% to emergency fund, 5% to retirement until emergency fund is complete. Then shift to 15% down payment, 5% retirement. Adjust based on your situation.

Track Progress Visually

Nothing motivates like seeing progress. Create a visual tracker—a thermometer chart, a savings graph, a countdown calendar—whatever helps you see the finish line approaching.

Share it with an accountability partner. If you’re a parent teaching your teen, track together. If you’re a young adult, share with a financially-minded friend or mentor.

Every month that 20% savings gets deposited is a month closer to becoming a homeowner instead of a renter.

Common 50/30/20 Budget Mistakes That Delay Homeownership

Even people trying to follow the 50/30/20 rule make mistakes that sabotage progress.

Miscategorizing wants as needs. The most common error. Dining out, premium streaming bundles, new clothes every month—these are wants disguised as needs. Your need is food. How you get that food (cooking vs. takeout) determines if it’s a need or want.

Not accounting for irregular expenses. Annual expenses like insurance premiums, car registration, or holiday gifts blow up monthly budgets when you forget them. Calculate annual irregular expenses, divide by 12, and allocate that monthly to your needs category.

Lifestyle inflation eating savings. You get a raise. Your income increases. Suddenly the wants category expands to match—new apartment, new car, more expensive everything. Your savings rate stays flat at 20% instead of accelerating to 25-30%. This is how people earn six figures and still live paycheck to paycheck.

Analysis paralysis preventing any action. Some people spend months researching the perfect budgeting app, the perfect spreadsheet, the perfect system. Meanwhile, they’re not actually budgeting. Start with something basic today. Improve it next month.

Giving up after one bad month. You overspent on wants in June. Budget blown. So you abandon the whole system. Wrong. July is a new month. Get back on track. One month doesn’t define your trajectory—your response to setbacks does.

Neglecting the “why” behind the budget. If you’re just following 50/30/20 because someone told you to, it won’t stick. But if you’re following it because you’re determined to house hack a duplex at 23 and build wealth while peers waste rent money? That motivation carries you through hard months.

For Smart Stewards serious about early homeownership, the budget isn’t restriction—it’s strategic resource allocation toward your biggest wealth-building opportunity.

How Stairway Mortgage Helps You Turn Savings into Homeownership

You’ve followed the 50/30/20 rule for 12-18 months. You’ve accumulated your down payment. Your credit is strong from following the authorized user and first credit card strategies. You’re 22 or 23 and ready to buy. Now what?

We help you understand exactly how much house you can afford. Not the maximum you qualify for—the amount that lets you house hack successfully with positive or neutral cash flow. We run the numbers on multi-unit properties with you living in one unit and renting the others.

We work with young buyers and family support structures. Most loan officers don’t understand 22-year-olds buying fourplexes with parental gift funds or co-borrowers. We do. We know how to structure these arrangements correctly for smooth approval.

We connect your budget discipline to wealth-building strategy. You saved 20% of income for 18 months. That discipline doesn’t end at closing—it continues as you save for your next property, leverage equity through HELOCs, and scale your real estate portfolio.

Your 50/30/20 budget got you to the down payment. We help you turn that down payment into a house hacking property that generates cash flow and builds equity while your peers continue paying rent.

Ready to see what your savings qualifies you for? Schedule a call to discuss loan programs and house-hacking strategies for young buyers.

Ready to Start Your 50/30/20 Budget?

You understand the framework. You know which tools make it effortless. You see how it connects to homeownership goals. Time to implement.

If you’re earning income right now: Calculate your after-tax monthly income today. Multiply by 0.5, 0.3, and 0.2. Those are your targets for needs, wants, and savings. Pick a budgeting method (app or spreadsheet) and start tracking this week.

If you’re a parent teaching your teen: Walk through this framework together. Show them your own budget as an example. Help them set up their first budget with whatever income they have (part-time job, allowance, gift money). Start the habits early.

If you’re saving for a house: Calculate your down payment target using the FHA loan calculator. Divide by your monthly savings (20% of income). That’s how many months until you buy. Mark it on your calendar and work backward.

If high rent is crushing you: Consider the aggressive modifications. Move home temporarily if possible. Get additional roommates. Reduce wants to 10-15% instead of 30%. The sacrifice is temporary. House hacking is permanent.

The 50/30/20 budget works because it’s simple enough to follow and flexible enough to adjust while maintaining focus on the goal: accumulating enough to stop paying rent and start building equity.

Frequently Asked Questions

What if my needs are more than 50% of my income?

This is common in high-cost areas or for people early in their careers. Two approaches: either accept 60/20/20 or 65/15/20 temporarily while maintaining the 20% savings rate, or make bigger changes to reduce needs (roommates, cheaper area, lower car payment). The priority is keeping savings at 20% minimum even if needs exceed 50%.

Should I pay off debt or save for a down payment?

It depends on the debt. High-interest credit card debt? Pay that off first—you can’t build wealth with cards charging interest rates. Student loans or car payments with reasonable rates? You can balance minimum payments (in your needs category) while saving for down payment. The down payment fund is time-sensitive if you want to buy young. Use the improve credit score guide to optimize both.

Can I use the 50/30/20 rule if my income varies?

Yes, but calculate based on your lowest typical month, not your highest. If you earn variable amounts (gig work, commission, seasonal), budget using your minimum expected income. Months you earn more, the excess goes straight to savings (the 20% category). Never count on the high months for your base budget.

What counts as “needs” versus “wants”?

The test: Can you live and work without it? Rent is a need. A luxury apartment with premium amenities is partly a want. Food is a need. Restaurant meals are wants. Transportation to work is a need. A new car when your current one runs fine is a want. Be honest with yourself about the distinction.

How long does it take to save a down payment with 50/30/20?

It depends on income and home prices in your market. Saving 20% of a modest income takes longer than 20% of a higher income. But the framework scales. Use the FHA loan calculator to see what you need, divide by your monthly savings, and you have your timeline. Most Smart Stewards who start at 18-20 can buy by 22-24 with disciplined 50/30/20 budgeting.

Should I adjust the percentages to save faster?

Yes, if you’re willing to sacrifice current wants for faster homeownership. Going from 50/30/20 to 50/20/30 doubles your savings rate. Going to 50/10/40 triples it. These aggressive modifications work for 12-24 months while living with parents or multiple roommates. Once you house hack, your housing costs drop dramatically and you can rebalance to more comfortable percentages. Review our case studies to see how young buyers made these tradeoffs successfully.

Also Helpful for Smart Stewards

The 50/30/20 budget connects to everything else you’re building:

- First Credit Card: Strategic Use Framework – Your budget determines whether your first credit card stays manageable or spirals into debt. The “wants” category must cover any credit card spending.

- Improve Credit Score for Mortgage: 60-Day System – Strong credit plus disciplined savings equals mortgage qualification. You need both.

- House Hacking Strategy: Multi-Unit FHA Financing – The goal your 50/30/20 budget enables. Save the down payment, buy the multi-unit property, let tenants pay your mortgage while you build equity.

What’s Next in Your Journey?

Your budget provides the foundation, but understanding what you’re saving toward accelerates progress:

Explore which loan programs your savings will qualify you for: FHA loans require minimal down payments for multi-unit properties, conventional loans offer long-term flexibility, FHA 203k loans let you buy and renovate simultaneously.

Run scenarios to see what becomes possible: FHA loan calculator shows purchase amounts at different down payments, rental property calculator models house-hacking cash flow, conventional loan calculator compares options.

Learn from young adults who budgeted disciplinedly and bought early: case studies including FHA success stories and first-time buyers.

Explore Your Complete Options

Ready to see how your budgeted savings translates to actual homeownership?

Browse all loan programs from FHA to conventional to VA for military families.

Use loan calculators to model different scenarios as your savings grow—see exactly what your 20% savings rate unlocks.

Explore case studies to find young buyers who used disciplined budgeting for early homeownership.

Schedule a call with a loan advisor who specializes in helping Smart Stewards families turn budgeting discipline into house-hacking wealth-building strategies.

Your 50/30/20 budget isn’t restriction—it’s your roadmap from renting to homeownership, from tenant to landlord, from paycheck-to-paycheck to building generational wealth.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.