Long Term Rental vs Short Term Rental: Which Strategy Builds Wealth Faster?

Long Term Rental vs Short Term Rental: Which Strategy Builds Wealth Faster?

Long Term Rental vs Short Term Rental: Understanding Your Investment Strategy Options

When you’re buying your first investment property, one of the most important decisions you’ll make is choosing between long term rental vs short term rental strategies. This choice fundamentally affects your cash flow, time commitment, financing options, and overall investment experience.

Long-term rentals mean leasing your property to tenants on 6-month or 12-month leases. They pay monthly rent, stay for extended periods, and you function as a traditional landlord. Short-term rentals mean listing your property on platforms like Airbnb or VRBO, hosting guests for days or weeks at a time, and operating more like a hotel.

Both strategies can build wealth, but they work very differently. Long-term rentals offer stability and passive income with minimal time commitment. Short-term rentals can generate higher revenue but require active management and come with more complexity.

Most first-time investors assume they must choose one strategy or the other. The reality is more nuanced—your property location, personal situation, available time, risk tolerance, and financial goals determine which approach makes sense.

In this comprehensive guide, you’ll discover:

- Clear definitions of long-term and short-term rental strategies

- Real revenue comparisons showing potential cash flow from each approach

- Management time requirements and daily operational differences

- Financing and insurance considerations that affect your choice (following lending guidelines)

- Regulatory landscape including zoning laws and HOA restrictions

- Tax treatment differences between strategies (per IRS rules)

- Tenant quality, turnover, and screening differences

- Market saturation and competitive factors

- Hybrid strategies combining both approaches

- Which strategy fits different investor profiles and goals

Understanding the complete picture of short term vs long term rental strategies helps you choose the right approach for your first property and long-term investment success.

Ready to explore financing for your investment property? Schedule a call to discuss loan options for both rental strategies.

Defining Long-Term and Short-Term Rental Strategies

Before comparing long term rental vs short term rental approaches, let’s clearly define what each strategy entails.

Long-term rental (traditional rental) strategy:

Long-term rentals involve leasing your property to tenants for extended periods—typically 6-month or 12-month lease agreements, though some markets use month-to-month arrangements after initial lease terms.

Long-term rental characteristics:

- Lease agreements typically 6-12 months minimum

- Tenants live in the property as their primary residence

- Monthly rent paid by tenant, typically due on the 1st

- Tenant responsible for most utilities

- Property furnished or unfurnished (usually unfurnished)

- Landlord role: maintenance, repairs, lease enforcement

- Tenant turnover every 1-3 years on average

- Income relatively stable and predictable

- Management can be mostly passive

Typical long-term rental tenants:

- Families renting homes in good school districts

- Young professionals renting apartments or condos

- Students renting near universities

- Anyone needing stable housing for extended periods

Long-term rentals are what most people think of as traditional landlording. You screen tenants, sign a lease, collect monthly rent, handle occasional maintenance, and repeat the process when tenants move out.

When you’re learning real estate investing for beginners, long-term rentals represent the most straightforward entry point with established processes and clear expectations.

Short-term rental (vacation rental) strategy:

Short-term rentals involve listing your property on platforms like Airbnb, VRBO, or Booking.com and hosting guests for short stays—typically ranging from one night to several weeks, with average stays around 3-7 days.

Short-term rental characteristics:

- Guests book stays ranging from 1 night to several weeks

- Property must be fully furnished and guest-ready

- Nightly rates charged instead of monthly rent

- Host provides amenities (toiletries, linens, kitchen supplies)

- Frequent turnover requiring cleaning between guests

- Active management responding to bookings and guest needs

- Income fluctuates based on seasonality and occupancy

- Higher gross revenue potential but more expenses

- Operates similar to running a small hotel

Typical short-term rental guests:

- Vacationers visiting tourist destinations

- Business travelers attending conferences or meetings

- Families visiting relatives or attending events

- Digital nomads staying in cities for weeks or months

- Anyone preferring home-like accommodations over hotels

Short-term rentals require significantly more active involvement than long-term rentals. You’re essentially operating a hospitality business, not just being a landlord.

The fundamental difference:

Long-term rentals prioritize stability and passive income. Short-term rentals prioritize revenue maximization through active management.

Neither strategy is universally “better”—they serve different investor goals and situations. The question isn’t which is objectively superior, but rather which fits your specific circumstances, property location, available time, and financial objectives.

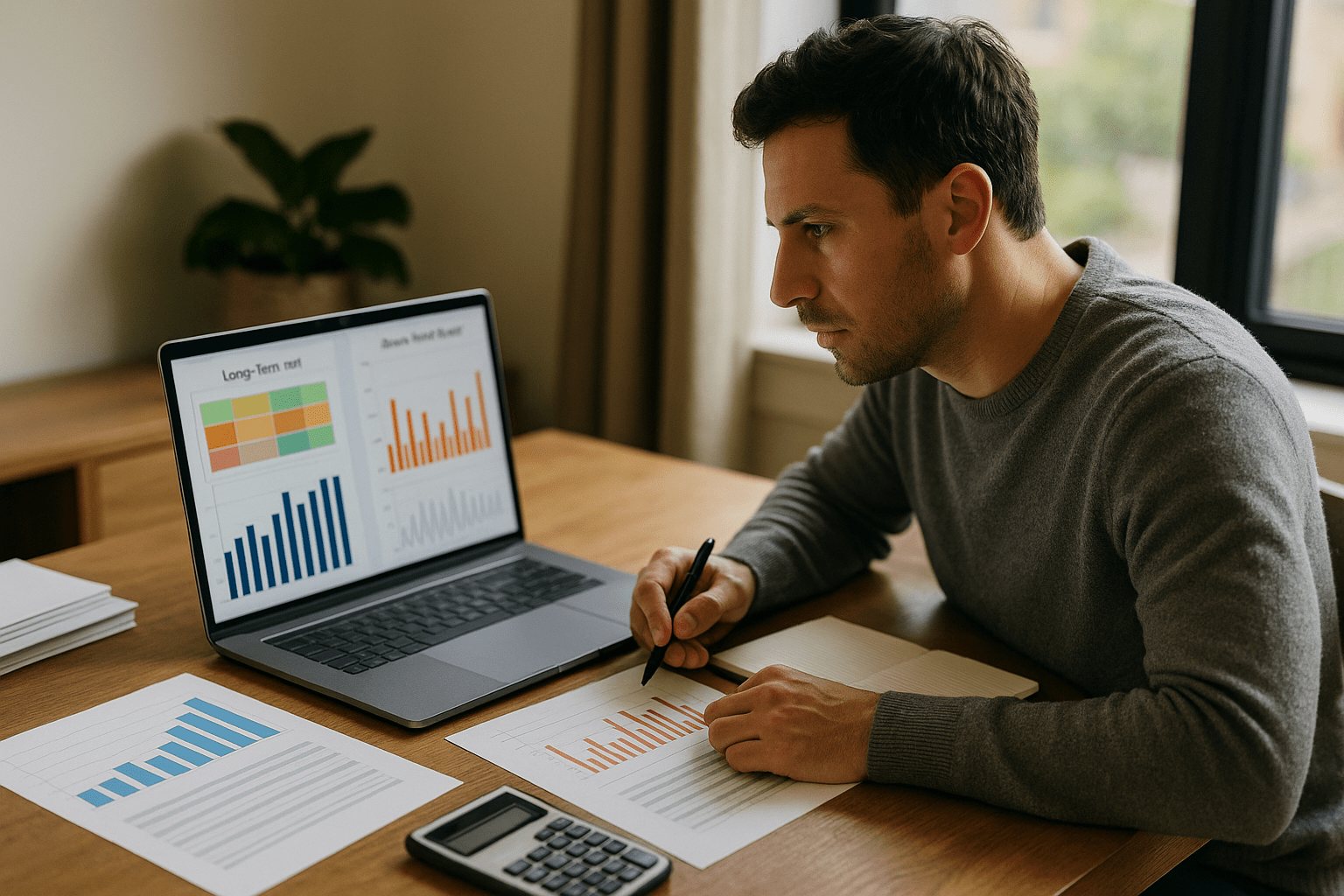

Revenue Potential: Real Numbers Comparison

The most compelling argument for short-term rentals is revenue potential. Let’s examine realistic numbers comparing long term rental vs short term rental income.

Long-term rental revenue model:

Long-term rental income is straightforward: monthly rent multiplied by 12 months, minus vacancy periods.

Example long-term rental (single-family home in suburban market):

- Monthly rent: $2,000

- Annual gross rent: $24,000

- Vacancy/turnover (5% average): -$1,200

- Effective annual gross income: $22,800

Revenue is predictable once you have a tenant in place. You know exactly what rent you’ll collect monthly barring vacancy or tenant non-payment.

Your effective monthly income after vacancy: Approximately $1,900/month averaged across the year.

Short-term rental revenue model:

Short-term rental income fluctuates based on nightly rates, occupancy rates, and seasonal demand.

Example short-term rental (same property in tourist-friendly location):

- Average nightly rate: $150

- Average occupancy rate: 65% (varies by market)

- Occupied nights per year: 237 (365 × 0.65)

- Annual gross rent: $35,550 (237 × $150)

Revenue fluctuates dramatically by season. Summer months might generate $4,000-5,000 while winter months might generate $1,500-2,000.

Your effective monthly income: Approximately $2,963/month averaged across the year (before higher operating expenses).

Initial comparison suggests short-term rentals generate 56% more gross revenue than long-term rentals for the same property.

But that’s only part of the story—expenses matter:

Long-term rental expenses (annual):

- Property management (if hired): 8-10% of rent = $1,824-2,280

- Maintenance/repairs: $1,500-2,500

- Vacancy/turnover costs: Already factored in gross income

- Property tax, insurance, mortgage: Same regardless of strategy

Short-term rental expenses (annual):

- Platform fees (Airbnb/VRBO): 3-5% = $1,066-1,778

- Cleaning between guests: $75 per turnover × 75 turnovers = $5,625

- Extra utilities (all included for guests): $2,400

- Supplies (toiletries, paper products, etc.): $1,200

- Furniture replacement/maintenance: $1,500

- Property management (if hired): 20-30% = $7,110-10,665

- Increased insurance: $500-1,000 more than standard landlord policy

- Marketing/professional photos: $500-1,000

Total additional short-term rental expenses: $19,901-24,168 annually

Net income comparison (same property):

Long-term rental net operating income:

- Gross income: $22,800

- Operating expenses: $3,324-4,780

- Net operating income: $18,020-19,476

- Average NOI: $18,748

Short-term rental net operating income:

- Gross income: $35,550

- Operating expenses: $19,901-24,168

- Net operating income: $11,382-15,649

- Average NOI: $13,516

Wait—the long-term rental nets more income despite lower gross revenue!

This example illustrates a crucial point: short-term rentals generate higher gross revenue but also substantially higher expenses. The net difference isn’t as dramatic as gross revenue suggests.

When do short-term rentals out-earn long-term rentals?

Short-term rentals outperform financially when:

- Location has strong tourist/business demand year-round

- You can achieve high occupancy rates (70%+ annually)

- Nightly rates support premium pricing

- You self-manage to avoid 20-30% management fees

- Property is in area where long-term rents are depressed

Markets where short-term rentals typically win:

- Beach destinations with year-round tourism

- Major cities with business travel and tourism

- Ski resort towns during ski season

- National park adjacent properties

- College towns during football season and events

Markets where long-term rentals typically win:

- Suburban family neighborhoods

- Areas with strong local rental demand but low tourism

- Markets with strict short-term rental regulations

- Properties requiring extensive travel for self-management

The revenue sweet spot:

Properties located in areas with both strong long-term rental demand AND tourist/business travel interest offer the most optionality. You can start with one strategy and switch if circumstances change.

Use the rental property calculator to model both strategies for specific properties you’re evaluating.

Management Time and Complexity Differences

Perhaps the biggest difference in comparing long term rental vs short term rental strategies is the time commitment and management complexity.

Long-term rental management time requirements:

Long-term rentals can be relatively passive once you establish systems.

Initial setup time (per tenant placement):

- Marketing property: 5-10 hours

- Showing property to prospects: 3-8 hours

- Screening applications: 2-4 hours

- Lease signing and move-in: 2-3 hours

- Total: 12-25 hours per tenant placement

Ongoing management time (per month with tenant in place):

- Rent collection: 15-30 minutes (mostly automated)

- Maintenance requests: 1-3 hours (varies by property condition)

- Property inspections: 1-2 hours quarterly

- Communication with tenant: 30 minutes to 2 hours

- Average ongoing time: 3-6 hours monthly

Turnover time (when tenant moves out):

- Move-out inspection: 1-2 hours

- Cleaning/repairs: Time depends on condition

- Finding new tenant: 12-25 hours (as above)

- Total: 15-30 hours per turnover

Annual time commitment for long-term rental:

- With stable tenant staying full year: 36-72 hours annually

- With one turnover per year: 51-102 hours annually

- Average: 60-80 hours annually (5-7 hours monthly averaged)

Long-term rentals can be truly passive, especially if you hire property management. Many landlords spend just a few hours monthly on well-maintained properties with good tenants.

Short-term rental management time requirements:

Short-term rentals demand constant attention and active management.

Initial setup time:

- Furnishing and staging property: 40-80 hours

- Professional photography: 3-5 hours

- Creating listings on platforms: 5-10 hours

- Setting up systems (pricing, automation): 5-10 hours

- Total initial setup: 53-105 hours

Ongoing management time per booking:

- Guest communication (inquiry to checkout): 1-2 hours

- Coordinating cleaning after checkout: 30 minutes

- Restocking supplies: 30 minutes

- Quality check after cleaning: 30 minutes

- Total per booking: 2.5-3.5 hours

With 75 bookings annually (65% occupancy):

- Guest management: 188-263 hours

- Maintenance and repairs: 40-60 hours

- Managing cleaners and vendors: 30-50 hours

- Marketing and pricing optimization: 20-40 hours

- Financial tracking and taxes: 20-30 hours

- Total annual time: 298-443 hours

That’s 25-37 hours monthly on average—essentially a part-time job.

Daily/weekly tasks for short-term rentals:

Daily tasks:

- Check messages from guests and potential bookers

- Respond to inquiries within hours (platforms prioritize quick responders)

- Coordinate cleaning schedules

- Monitor reservations and calendar

Weekly tasks:

- Adjust pricing based on demand and competition

- Restock supplies

- Property inspection and quality checks

- Review and respond to guest reviews

- Update calendar for personal blocks or maintenance

The management intensity difference is stark: Long-term rentals require a few hours monthly. Short-term rentals require a few hours daily.

Can you outsource short-term rental management?

Yes, but it’s expensive. Professional short-term rental management companies typically charge 20-30% of gross revenue—dramatically impacting your net income.

Even with management, you’re involved in major decisions about furnishings, renovations, pricing strategy, and responding to emergencies.

Technology helps but doesn’t eliminate work:

Automated messaging, smart locks, dynamic pricing software, and scheduling tools reduce some management tasks. But someone still needs to coordinate cleaners, handle maintenance, manage supplies, and address guest issues.

The time commitment question for first-time investors:

Do you have 5-10 hours monthly for a long-term rental, or 25-35 hours monthly for a short-term rental?

For investors with full-time jobs and families, long-term rentals fit more realistically. For investors with flexible schedules or those treating real estate as their primary business, short-term rentals become manageable.

Understanding landlord responsibilities for long-term rentals helps you grasp the baseline time commitment before considering more intensive short-term strategies.

Financing and Insurance Considerations

The choice between long term rental vs short term rental strategies significantly affects your financing options and insurance requirements.

Financing for long-term rentals:

Long-term rental properties qualify for standard investment property financing with relatively straightforward requirements.

Conventional investment property loans:

- Typically require reasonable initial capital investment

- Interest rates slightly higher than owner-occupied rates

- Income documentation required

- Property must be suitable for long-term rental

FHA loans for house hacking:

- Lower initial capital requirements if you live in one unit

- Must be 1-4 unit property

- Owner-occupancy required for first year

- Can rent other units immediately

DSCR loans for portfolio investors:

- Qualify based on property’s rental income, not personal income

- Great for self-employed or portfolio builders

- Typically require reasonable initial investment

- Focus on property cash flow covering debt service

Standard investment property financing works well for long-term rentals because lenders understand the traditional landlord model and can verify income through lease agreements.

Conventional loans and DSCR loans are both designed with long-term rental properties in mind.

Financing challenges for short-term rentals:

Short-term rental properties face significantly more financing challenges.

Why lenders are cautious about short-term rentals:

- Income is unpredictable and seasonal

- Properties are vacant between guests (higher risk)

- Regulatory environment uncertain (cities ban them suddenly)

- Higher wear and tear from guest turnover

- Business model considered more speculative

Many conventional lenders prohibit short-term rental use in their loan agreements. If you finance as a long-term rental then convert to short-term rental without lender approval, you’re technically violating your mortgage agreement.

Financing options for short-term rentals:

Option 1: Residential loan as primary residence or long-term rental, then convert

- Finance as owner-occupied or long-term rental

- Convert to short-term rental after closing

- Risk: May violate mortgage terms

- Many investors do this despite the risk

Option 2: Commercial loans or portfolio lenders

- Some lenders specifically finance short-term rentals

- Higher initial capital requirements

- Higher interest rates

- More documentation about business plan

Option 3: Specialty vacation rental lenders

- Emerging niche lenders focus on short-term rentals

- Underwrite based on projected rental income

- Higher costs but purpose-built for strategy

Option 4: Cash purchase

- Eliminates lender restrictions entirely

- Requires substantial capital

- Offers maximum flexibility

Refinancing considerations:

If you start with long-term rental and want to convert to short-term, refinancing into a short-term rental-friendly loan or paying off the mortgage might be necessary to avoid violating loan terms.

Insurance for long-term rentals:

Long-term rentals require landlord insurance (also called dwelling fire policy or DP3 policy).

Standard landlord insurance covers:

- Property damage from fire, storms, vandalism

- Liability for injuries on property

- Loss of rental income during repairs

- Optional: Contents coverage for appliances, etc.

Cost: Typically 15-25% more than homeowners insurance for same property. For a property with moderate insurance costs for homeowners coverage, landlord insurance might cost slightly more.

Landlord insurance is straightforward to obtain and relatively affordable.

Insurance for short-term rentals:

Short-term rentals require specialized insurance that’s more expensive and harder to find.

Why standard landlord insurance doesn’t cover short-term rentals:

- Higher risk with constantly changing guests

- Commercial activity (running business from property)

- Increased liability from injuries, theft, property damage

- Standard policies specifically exclude commercial use

Short-term rental insurance options:

Option 1: Airbnb/VRBO host protection

- Platforms provide limited liability coverage

- Typically $1 million in liability protection

- Doesn’t cover property damage in many situations

- Doesn’t cover lost income or host liability

- Not a replacement for real insurance

Option 2: Specialty short-term rental insurance

- Companies like Proper Insurance, CBIZ, Foremost

- Cover property damage, liability, loss of income

- Cost: 2-4x standard landlord insurance

- For property with standard landlord insurance costs, short-term rental insurance might cost 2-4x more

Option 3: Commercial property insurance

- Treats property as commercial business

- Comprehensive coverage but expensive

- Typically for larger operations

Insurance cost impact:

The difference in insurance costs can affect net income substantially. If landlord insurance is a certain amount annually but short-term rental insurance is 3x more, that extra cost directly reduces your net income.

Financing and insurance together can make or break the strategy. A property that looks profitable on paper as a short-term rental might not pencil out once you factor in commercial financing costs and specialty insurance premiums.

Regulatory and Legal Landscape

Understanding the regulatory environment is crucial when deciding between long term rental vs short term rental strategies.

Long-term rental regulations:

Long-term rentals face relatively light regulation in most markets.

Common long-term rental regulations:

- Landlord-tenant law (security deposits, evictions, habitability)

- Fair Housing laws (no discrimination)

- Local rental registration or licensing

- Property inspection requirements

- Rent control (in some cities)

These regulations are well-established with decades of case law and clear procedures. Landlords know what’s required and how to comply.

Most markets welcome long-term rental properties as they provide stable housing for residents. Cities rarely ban or restrict traditional long-term rentals.

Short-term rental regulations are complex and changing:

Short-term rentals face a regulatory patchwork that varies dramatically by location and changes frequently.

Common short-term rental restrictions:

Outright bans:

- Some cities completely prohibit short-term rentals

- Often in expensive housing markets (San Francisco, New York, etc.)

- Aimed at preserving housing stock for residents

- Violations result in fines, forced closure, legal action

License and permit requirements:

- Many cities require special licenses to operate

- Application processes, fees, inspections required

- Limited number of licenses issued

- Renewal requirements annually

Owner-occupancy requirements:

- Some cities only allow short-term rentals in owner-occupied properties

- Can’t rent entire home if you don’t live there

- Limits investor short-term rental opportunities

Night/booking limitations:

- Restrict number of nights property can be rented annually

- Common limits: 90, 120, or 180 nights per year

- Platforms enforce restrictions in some markets

Tax collection requirements:

- Must collect and remit hotel/occupancy taxes

- State and local taxes can be 10-15%+

- Administrative burden on hosts

- Platforms collect automatically in some jurisdictions

Zoning restrictions:

- Short-term rentals prohibited in residential zones

- Only allowed in commercial or specific districts

- Rezoning applications expensive and uncertain

HOA restrictions:

- Many HOAs prohibit short-term rentals

- Violation can result in fines or forced sale

- Must check HOA bylaws before purchasing

The regulatory landscape is unstable:

Cities frequently change short-term rental rules. A property legal for short-term rental today might be banned tomorrow.

Recent regulatory trends:

- More cities implementing restrictions

- Existing regulations becoming stricter

- Increased enforcement and fines

- Platform liability for illegal listings

Examples of major market restrictions:

New York City: Short-term rentals under 30 days in most buildings are illegal unless owner is present. Heavy enforcement with large fines.

San Francisco: Must register with city, live in property 275+ days/year, rent out 90 days maximum annually. Strict enforcement.

Los Angeles: Requires registration, host presence during rental, primary residence requirement, 120-day annual cap.

Paris: 120-day annual limit for primary residences, registration required, heavy fines for violations.

Miami Beach: Banned short-term rentals under 6 months in most residential areas.

Before committing to short-term rental strategy:

Research current regulations thoroughly:

- City/county short-term rental ordinances

- State-level laws affecting vacation rentals

- HOA restrictions if applicable

- Zoning for your specific property address

Understand enforcement:

- Are regulations actively enforced?

- What are penalties for violations?

- How do neighbors typically react?

Consider regulatory risk:

- Could regulations change before you recoup investment?

- Do you have exit strategy if short-term rentals banned?

- Can property work as long-term rental if forced to switch?

Many first-time investors underestimate regulatory risk. Buying a property specifically for short-term rental in a market with uncertain regulations is risky.

The safest approach: Buy in markets with clear, established short-term rental regulations that seem unlikely to change, or buy properties that work well as either long-term or short-term rentals.

Startup Costs and Furnishing Requirements

The initial investment required differs substantially between long term rental vs short term rental strategies.

Long-term rental startup costs (unfurnished):

Long-term unfurnished rentals require minimal initial investment beyond the property purchase.

Essential startup costs:

- Minor repairs and cleaning before tenant move-in: $500-2,000

- Paint/minor cosmetic updates: $1,000-3,000

- Appliances if property doesn’t include them: $2,000-5,000

- Lawn equipment if you maintain landscaping: $300-800

- Key lockbox or smart lock: $100-300

- Basic tools and supplies: $200-500

Total long-term rental startup costs: $4,100-11,600 beyond purchase, closing costs, and reserves.

Many long-term rental properties can be rented as-is or with very minimal work if they’re in decent condition.

Long-term rental startup costs (furnished):

Some long-term rentals are furnished—common for corporate housing, student rentals, or luxury properties.

Furnishing costs for 3-bedroom property:

- Living room furniture: $2,000-5,000

- Dining room furniture: $1,000-2,500

- Bedroom furniture (3 bedrooms): $3,000-7,500

- Kitchen supplies, dishes, cookware: $500-1,500

- Linens, towels, basics: $500-1,000

- TVs and electronics: $1,000-2,500

- Decorations and finishing touches: $500-1,500

Total furnished long-term rental: $8,500-21,500 plus the basic startup costs above.

Most first-time investors start with unfurnished long-term rentals to minimize upfront costs.

Short-term rental startup costs:

Short-term rentals require substantial upfront investment to create guest-ready, fully furnished spaces.

Essential furnishing (same 3-bedroom property):

- Living room furniture (quality, durable): $3,000-8,000

- Dining room furniture: $1,500-4,000

- Bedroom furniture (3 bedrooms, quality): $5,000-12,000

- Kitchen fully equipped (dishes, cookware, utensils, small appliances): $1,500-3,500

- Linens and towels (multiple sets per bed): $1,000-2,500

- TVs in living room and bedrooms: $1,500-4,000

- Wi-Fi, streaming services setup: $200-500

- Decorative elements and artwork: $1,500-4,000

- Outdoor furniture if applicable: $1,000-3,000

- Smart home technology (locks, thermostats): $500-1,500

Total furnishing: $16,700-43,500

Additional short-term rental startup costs:

Property preparation:

- Deep cleaning and staging: $500-1,500

- Professional photography: $200-800

- Welcome book and property guide creation: $100-300

- Initial supplies (toiletries, paper products, coffee, etc.): $300-600

Business setup:

- LLC formation (if applicable): $200-800

- Business licenses and permits: $100-500

- Insurance (first year, higher for STR): $2,000-5,000

- Platform listing creation: Free but time-intensive

- Initial marketing materials: $200-500

Operational equipment:

- Extra sets of linens, towels (quick turnovers): $500-1,000

- Cleaning supplies and equipment: $300-600

- Maintenance tools and emergency supplies: $300-600

Total short-term rental startup costs: $21,200-55,200 beyond property purchase and closing costs.

The cost difference is substantial: Short-term rentals require roughly 5-10x more upfront investment than unfurnished long-term rentals.

Furniture quality matters for short-term rentals:

Budget furniture won’t survive the wear and tear of high guest turnover. Investing in durable, comfortable furnishings prevents constant replacement.

Cheap furniture replaced frequently costs more than quality furniture that lasts. Factor durability into furnishing budgets.

Design and aesthetics matter:

Short-term rental guests choose properties based partly on photos and design. Well-designed spaces command premium nightly rates and achieve higher occupancy.

Budget for professional design help if you lack design skills. Even $1,000-2,000 for designer consultation can significantly improve your listing’s appeal.

Return on investment timeline:

The higher startup costs for short-term rentals mean longer payback periods before you recoup initial investment.

Example:

- Extra short-term rental costs: $30,000

- Additional net income over long-term rental: $3,000/year (if managed well)

- Payback period: 10 years

Many short-term rental advocates tout higher revenue without acknowledging the higher upfront costs and longer payback periods.

For first-time investors with limited capital, long-term rentals offer lower barriers to entry and faster returns on investment.

Tax Treatment Differences

The tax implications differ between long term rental vs short term rental strategies in important ways.

Long-term rental tax treatment:

Long-term rentals are treated as passive rental real estate for tax purposes.

Key tax characteristics of long-term rentals:

Passive activity: Rental income is passive, not subject to self-employment tax.

Schedule E reporting: Report rental income and expenses on Schedule E of your personal tax return (for single-member LLCs or personal ownership).

Depreciation: Deduct property depreciation over 27.5 years, creating substantial paper losses even with positive cash flow.

Operating expense deductions: Deduct all ordinary and necessary expenses—mortgage interest, property tax, insurance, repairs, property management, utilities, HOA fees, advertising, professional fees, and more.

$25,000 special allowance: If you actively participate in management and your income is below thresholds, you can deduct up to $25,000 in rental losses against ordinary income annually.

No self-employment tax: Passive rental income isn’t subject to 15.3% self-employment tax.

Tax treatment is straightforward and favorable for long-term rentals. Most investors simply report income and expenses on Schedule E annually.

Review the complete guide to rental property tax benefits to understand all deductions available.

Short-term rental tax treatment:

Short-term rental taxation is more complex and depends on your level of participation and average guest stays.

The 7-day rule (or 30-day rule):

The IRS distinguishes between short-term rentals based on average stay length.

If average stay is 7 days or less (or 30 days or less with substantial services):

- Property is NOT treated as rental real estate

- Treated as business income (Schedule C)

- Potentially subject to self-employment tax

- Different loss limitation rules

- Can potentially deduct 100% of expenses against income immediately

If average stay exceeds 7 days (and 30 days without substantial services):

- Treated as rental real estate (Schedule E)

- Same rules as long-term rentals apply

- Passive activity limitations apply

Material participation matters:

If you materially participate in your short-term rental (spend more than 500 hours annually, or more than 100 hours and more than anyone else), your losses aren’t subject to passive activity limitations—you can deduct them against ordinary income without the $25,000 cap.

This creates planning opportunities for short-term rental hosts who spend significant time managing properties.

Self-employment tax consideration:

If your short-term rental is treated as business income and you materially participate, you might owe self-employment tax (15.3%) on net income.

However, many tax professionals argue that short-term rental income is rental income, not self-employment income, even when reported on Schedule C. This is a gray area with limited IRS guidance.

Work with a CPA experienced in short-term rentals to properly classify income and minimize taxes.

Qualified Business Income (QBI) deduction:

If your short-term rental qualifies as a business, you might be eligible for the 20% QBI deduction on qualified business income.

This can substantially reduce taxes on short-term rental profits, potentially offsetting self-employment tax concerns.

Sales tax and occupancy tax:

Short-term rentals must collect and remit:

- State and local occupancy taxes (hotel taxes)

- Sales taxes in some jurisdictions

- Tourism or convention taxes

Rates vary but often total 10-15% of gross rental income. Platforms like Airbnb automatically collect and remit these taxes in many jurisdictions, simplifying compliance.

Long-term rentals don’t collect these taxes—tenants pay rent without additional taxes added.

Expense classification differences:

Some expenses deductible for short-term rentals might not be for long-term rentals, or vice versa.

Short-term rental specific deductions:

- Platform fees (Airbnb, VRBO commissions)

- Guest supplies (toiletries, coffee, snacks)

- Frequent furniture replacement

- Marketing and advertising costs

- Business registration and licensing fees

- Extra utilities (all included for guests)

Documentation requirements:

Short-term rentals, especially if treated as business income, require more detailed record-keeping:

- Every guest stay documented

- Every cleaning tracked

- All supplies receipts saved

- Mileage logs for property visits

- Time logs if claiming material participation

Tax complexity score:

- Long-term rentals: Simple, straightforward

- Short-term rentals: Complex, requires professional help

Most first-time investors underestimate the tax complexity of short-term rentals. Budget for professional tax preparation—probably $500-1,500 annually vs. $200-500 for simple long-term rental returns.

Tenant Quality, Turnover, and Screening

The nature of who occupies your property differs dramatically between long term rental vs short term rental strategies.

Long-term rental tenant characteristics:

Long-term tenants sign leases and occupy the property as their primary residence for extended periods.

Typical tenant profiles:

- Families seeking stable housing

- Young professionals establishing careers

- Students attending nearby universities

- Retirees downsizing from homeownership

- Anyone needing a place to live for 1-3+ years

Tenant motivations are straightforward: They need housing. They want a safe, comfortable place to call home. They plan to stay for years if the property meets their needs.

Screening and selection process for long-term tenants:

Comprehensive screening includes:

- Credit check (looking for 620+ credit score ideally)

- Income verification (rent should be ≤30% of gross income)

- Employment verification (stable job history)

- Rental history verification (contact previous landlords)

- Criminal background check (red flags for safety)

- Eviction history check (previous evictions indicate risk)

This thorough screening predicts tenant behavior. Good credit, stable income, positive rental history, and no criminal record correlate with reliable rent payment and property care.

You have control over who occupies your property. You choose tenants after careful vetting.

Long-term tenant relationship:

Once a good tenant is in place:

- They pay rent reliably every month

- They maintain property reasonably well

- They contact you for legitimate repair issues

- They typically stay 1-3 years or longer

- You develop an ongoing relationship

Good tenants are assets. When you find quality tenants, you want to keep them as long as possible through fair treatment, reasonable rent increases, and responsive maintenance.

Turnover in long-term rentals:

Turnover costs include:

- Vacancy period (typically 2-4 weeks between tenants)

- Cleaning and repairs after move-out

- Marketing and showing time

- Screening new tenants

- Lease signing and move-in coordination

Well-maintained properties with fair rent attract quality tenants who stay for years, minimizing turnover costs.

Short-term rental guest characteristics:

Short-term rental guests are temporary visitors, not residents.

Typical guest profiles:

- Vacationers visiting tourist destinations

- Business travelers in town for work

- Families visiting relatives or attending events

- Digital nomads staying in cities for weeks

- People attending weddings, conferences, sporting events

Guest motivations differ from tenants: They want comfortable, convenient accommodations for short periods. They’re not establishing a home—they’re temporarily occupying space.

“Screening” short-term rental guests:

You have minimal control over who stays. Platforms like Airbnb screen guests minimally:

- Verified ID

- Profile with reviews from other hosts

- Payment method on file

That’s essentially it. You can’t run credit checks, verify employment, or check criminal backgrounds before accepting bookings.

You set house rules (no parties, no smoking, etc.) and can decline or cancel problematic guests, but screening is reactive, not proactive.

Many hosts accept any guests who book to maximize occupancy. This means strangers with unknown backgrounds occupy your property regularly.

Guest turnover and wear-and-tear:

Turnover is constant:

- New guests every few days

- Property must be cleaned after every checkout

- Inspection needed after each guest

- Restocking supplies continuously

This creates significant wear-and-tear:

- Furniture, linens, and appliances wear out faster

- Increased risk of damage from careless guests

- Higher cleaning and maintenance costs

- Constant need for replacements

Some guests treat properties carelessly because they’re not their home and they’re leaving soon. Damage, excessive mess, and disrespect for property are more common than with long-term tenants.

Guest communication intensity:

Every booking requires communication:

- Pre-arrival questions about check-in, parking, amenities

- During-stay requests or issues

- Check-out instructions and reminders

- Post-stay follow-up for reviews

Multiplied across dozens of guests annually, communication becomes a significant time investment.

Long-term tenants communicate occasionally for maintenance needs or questions. Communication burden is minimal compared to short-term guests.

Review system and reputation:

Short-term rentals depend heavily on reviews. A few bad reviews tank your occupancy and pricing power.

This creates pressure:

- Respond to every guest complaint immediately

- Go above and beyond for 5-star reviews

- Address problems proactively

- Provide extra amenities and services

Long-term tenants don’t review you publicly. Your reputation is local (word of mouth, online tenant reviews if they exist), but bad tenants don’t destroy your business overnight like bad short-term rental reviews can.

Which offers better “tenants”?

Long-term rentals: Fewer, carefully screened tenants who you select and who typically care for property reasonably well.

Short-term rentals: Constant stream of unknown guests who you can’t thoroughly screen and who may treat property carelessly.

For first-time investors nervous about property damage or difficult occupants, long-term rentals offer more control and predictability.

Market Saturation and Competition Analysis

Understanding competitive dynamics is crucial when deciding between long term rental vs short term rental strategies.

Long-term rental market competition:

Long-term rental markets have stable, predictable competition.

Competition comes from:

- Other rental properties in the area

- Homeownership (renters deciding to buy)

- Economic factors affecting demand

Market dynamics are relatively stable:

- Rental demand driven by local employment, population, schools

- Supply changes slowly (new construction takes years)

- Pricing relatively transparent (comparable rents easily found)

You can research long-term rental markets thoroughly:

- Look at vacancy rates

- Check comparable rents

- Analyze population and job growth

- Research school quality and safety

- Understand supply/demand balance

Good long-term rental markets have:

- Strong employment and economic growth

- Population stability or growth

- Desirable schools and amenities

- Limited new rental construction

- Vacancy rates below 5-7%

Bad long-term rental markets have:

- Declining employment and population

- High vacancy rates (10%+)

- Excessive new construction

- Economic instability

Long-term rental competition is manageable through property quality, fair pricing, and good tenant service.

Short-term rental market competition:

Short-term rental markets can be brutally competitive and quickly saturated.

Competition comes from:

- Other short-term rentals in area

- Hotels and traditional accommodations

- New hosts constantly entering market

- Platforms promoting certain listings over others

Market dynamics are volatile:

- New listings can appear overnight, increasing supply dramatically

- Demand fluctuates seasonally and based on events

- Pricing extremely competitive with algorithmic undercutting

- Platform algorithm changes affect visibility and bookings

Market saturation is a real risk:

In popular tourist destinations, the flood of new short-term rentals has led to:

- Oversupply relative to guest demand

- Plummeting occupancy rates

- Price wars with hosts undercutting each other

- Only professionally managed properties succeeding

- Individual hosts struggling to book

Examples of saturated markets:

- Orlando vacation rentals near Disney

- Beach towns with hundreds of similar properties

- Mountain resort communities

- Major cities with tens of thousands of Airbnbs

In saturated markets:

- Occupancy rates fall to 40-50% or lower

- Nightly rates drop below profitable levels

- Only properties with unique advantages succeed

- Average hosts lose money

How to assess short-term rental market saturation:

Research tools:

- AirDNA for market-level data on supply, demand, occupancy, rates

- Mashvisor for property-level STR analysis

- AllTheRooms for inventory tracking

- Manual Airbnb searches for competitive analysis

Key metrics indicating saturation:

- More than 1 STR listing per 100 residents (highly saturated)

- Average occupancy rates below 60%

- Declining average daily rates year-over-year

- Increasing number of new listings

- High percentage of listings with few or no reviews (unsuccessful hosts)

Competitive advantages in short-term rentals:

To succeed in competitive markets, you need:

- Prime location (near attractions, downtown, beaches)

- Unique property features (views, pools, distinctive design)

- Professional management and operations

- 5-star reviews and strong reputation

- Flexible pricing and availability

- Excellent photos and listing optimization

- Fast communication response times

Average properties in average locations struggle in competitive short-term rental markets.

Long-term rentals are more forgiving:

A decent property in a decent neighborhood with fair rent finds tenants in almost any market. You don’t need to be exceptional—just adequate.

Short-term rentals require excellence to succeed in competitive markets. Mediocre properties with average operations lose money.

For first-time investors, the lower competitive barrier for long-term rentals offers easier entry and more forgiving learning curves.

Hybrid Strategies: Combining Both Approaches

Some investors successfully combine long term rental vs short term rental strategies rather than choosing one exclusively.

Mid-term rentals (30+ day stays):

Mid-term rentals occupy the middle ground—longer than vacation stays but shorter than traditional leases.

Typical mid-term rental lengths: 1-6 months

Mid-term rental guests:

- Travel nurses on temporary assignments

- Corporate relocations or extended business trips

- Digital nomads staying in cities for months

- Insurance-displaced homeowners during repairs

- Families relocating while house-hunting

- Interns and temporary workers

Mid-term rental advantages:

- Higher rates than long-term rentals but lower than STR nightly rates

- Less turnover and management than short-term rentals

- Fewer regulatory restrictions (usually fall outside STR regulations)

- Can be furnished or unfurnished

- More stable income than short-term, higher than long-term

Platforms for mid-term rentals:

- Furnished Finder (travel nurses, traveling professionals)

- Airbnb (monthly discounts and filters)

- VRBO (monthly stays)

- Corporate housing companies

- Direct marketing to hospitals and corporations

Mid-term rentals offer attractive middle ground for investors wanting better returns than long-term but less intensity than short-term.

Seasonal strategies:

Some properties work for different strategies at different times of year.

Example: College town property

- Short-term rental during summer (parents weekend, graduations, events)

- Student housing during academic year (9-month leases)

- Maximizes occupancy and revenue year-round

Example: Ski resort property

- Short-term rental during ski season (high rates, high demand)

- Mid-term or long-term rental during off-season

- Avoids dead winter months with zero bookings

Example: Beach property

- Short-term rental during summer peak season

- Long-term rental September through May

- Captures premium summer revenue plus stable off-season income

Seasonal strategies require:

- Flexible leases or rental agreements

- Ability to transition between strategies

- Understanding of both management models

- Furnishings that work for both uses

Many investors discover hybrid strategies perform best after trying pure short-term or long-term approaches.

Owner usage with rental income:

Some investors buy properties primarily for personal use but rent them when not using them.

Example scenarios:

- Vacation home used by owner several weeks annually, rented short-term the rest

- Second home in different city used monthly, rented as mid-term furnished rental otherwise

- Future retirement home rented long-term until retirement, then owner moves in

This approach:

- Generates income offsetting ownership costs

- Provides personal-use property

- Builds equity for retirement

- Offers flexibility as life circumstances change

Platform flexibility:

Some properties are listed on multiple platforms simultaneously:

- Airbnb for short-term vacation rentals

- Furnished Finder for mid-term professionals

- Zillow for long-term tenants if needed

This maximizes occupancy by capturing different market segments.

Hybrid strategy selection factors:

Consider hybrid strategies if:

- Property location suits multiple rental types

- You want flexibility adapting to market changes

- Regulatory environment supports multiple approaches

- You’re comfortable managing different rental models

- Property can be furnished or unfurnished as needed

Hybrid strategies offer optionality that pure strategies don’t. If short-term rental market becomes oversaturated, switch to mid-term or long-term. If regulations change, adapt your model.

For first-time investors, buying properties that work for multiple strategies provides insurance against market changes and regulatory shifts.

Which Strategy Fits Different Investor Profiles?

The choice between long term rental vs short term rental ultimately depends on your personal situation, goals, and preferences.

Long-term rentals are ideal for investors who:

Want passive income with minimal time commitment:

- Have full-time jobs with limited spare time

- Prefer set-it-and-forget-it investments

- Want to spend weekends with family, not managing properties

- View real estate as retirement wealth building, not active business

Prioritize stability and predictability:

- Value reliable monthly cash flow

- Prefer predictable expenses and income

- Want to plan financial future with confidence

- Dislike volatility and uncertainty

Are risk-averse or first-time investors:

- Learning landlording basics before advanced strategies

- Want simpler, more forgiving investment model

- Prefer established processes and clear procedures

- Want to minimize mistakes during learning phase

Have properties in strong long-term rental markets:

- Suburban family neighborhoods

- Areas with stable employment and good schools

- Markets without strong tourist or business travel demand

- Locations where short-term rentals are restricted or banned

Have limited startup capital:

- Can’t afford $20,000-50,000+ in furnishings

- Need to minimize upfront investment beyond initial purchase

- Want faster return on invested capital

- Building portfolio of multiple properties over time

Profile: Traditional wealth-building investor focused on long-term equity growth and supplemental passive income

Check out real estate investing for beginners to understand how long-term rentals build wealth systematically.

Short-term rentals are ideal for investors who:

Can commit significant time to active management:

- Have flexible schedules or work from home

- Enjoy hospitality and guest service

- Willing to respond to messages daily

- View real estate as their primary business focus

Prioritize maximizing revenue:

- Want highest possible returns on investment

- Willing to work for increased income

- Value income optimization over free time

- Comfortable with income volatility for higher average

Have properties in strong short-term rental markets:

- Tourist destinations with year-round demand

- Business travel hubs near convention centers

- Unique properties with special appeal

- Areas with clear, permissive short-term rental regulations

Have substantial startup capital:

- Can invest $20,000-50,000+ in furnishings and setup

- Comfortable with longer payback periods

- Have reserves for seasonal income fluctuations

- Can afford professional management if needed

Enjoy the hospitality business aspects:

- Like interior design and creating beautiful spaces

- Enjoy interacting with guests (even remotely)

- Find satisfaction in 5-star reviews and guest praise

- Comfortable with constant property optimization

Profile: Active entrepreneur treating real estate as their primary business, maximizing returns through hands-on management

Mid-term/hybrid rentals are ideal for investors who:

Want balance between income and management:

- Can handle moderate management requirements

- Want better returns than long-term rentals

- Don’t want daily short-term rental intensity

- Appreciate longer-term guest relationships

Have properties suited to multiple uses:

- Near hospitals, universities, or corporate campuses

- In markets with both tourist and professional demand

- Locations with flexible regulatory environments

- Properties that work furnished or unfurnished

Value flexibility and optionality:

- Want to adapt to changing market conditions

- Prefer diversifying rental strategies

- Like experimenting with different approaches

- Want backup plans if primary strategy fails

Profile: Pragmatic investor who values flexibility and seeks optimal balance between returns and lifestyle requirements

Decision framework questions:

Ask yourself these questions when deciding:

- Time availability: Can I commit 25-35 hours monthly to property management, or only 5-10 hours?

- Risk tolerance: Am I comfortable with income volatility and regulatory uncertainty, or do I need stability?

- Financial situation: Do I have $20,000-50,000 for short-term rental setup, or should I minimize startup costs?

- Property location: Does my property suit short-term, long-term, or both rental strategies?

- Long-term goals: Is real estate my primary business, or supplemental passive income for retirement?

- Management preference: Do I want to actively manage and optimize, or set-and-forget?

- Personality fit: Would I enjoy hospitality and guest service, or find it stressful?

Be honest about your answers. Many investors choose short-term rentals attracted by revenue potential but discover they hate the daily management grind.

Starting strategy isn’t permanent. Many investors begin with long-term rentals to learn basics, then transition some properties to short-term rentals as they gain experience.

How Stairway Mortgage Supports Both Rental Strategies

At Stairway Mortgage, we understand that the decision between long term rental vs short term rental affects your financing needs and options.

We help investors evaluate strategies before purchasing:

Understanding which rental strategy you’ll use affects:

- Property type and location you should target

- Financing options available to you

- Initial capital requirements

- Long-term financial projections

We walk you through how financing differs:

For long-term rental strategies, we offer:

- Conventional investment property loans with competitive rates for traditional rentals

- FHA loans for house hacking small multifamily properties

- DSCR loans that qualify based on property cash flow, ideal for portfolio builders

- Portfolio lending for investors with multiple properties

For short-term rental strategies, we explain:

- Lender restrictions on short-term rental use

- Commercial financing options for vacation rental properties

- How to structure purchases if converting from long-term to short-term post-closing

- Specialty lenders who specifically finance short-term rentals

We model cash flow for both strategies:

Use our rental property calculator to compare projected returns under different rental strategies.

Input different scenarios:

- Long-term rental at market rent

- Short-term rental with estimated occupancy and nightly rates

- Mid-term rental with monthly rates

- Seasonal combinations

See how different strategies affect:

- Monthly cash flow

- Annual returns

- Mortgage coverage

- Long-term wealth building

We support strategy transitions:

Planning to start with long-term rental and potentially transition to short-term later? We help structure initial financing that doesn’t prohibit future strategy changes.

We educate on the complete picture:

Many investors focus only on revenue potential without understanding management intensity, startup costs, regulatory risks, and financing challenges.

We help you see:

- Complete cost structures for both strategies

- Realistic time commitments

- Risk factors to consider

- How financing affects net returns

Our goal is helping you make informed decisions aligned with your actual situation, not just revenue fantasies promoted by short-term rental gurus.

Ready to Choose Your Rental Strategy and Start Investing?

Now you understand the complete picture of long term rental vs short term rental strategies—revenue potential, management intensity, financing considerations, regulatory environment, startup costs, tax treatment, tenant quality, market saturation, and hybrid approaches.

The right strategy depends entirely on your specific situation:

Choose long-term rentals if:

- You have limited time for property management

- You value stability and passive income

- You’re a first-time investor learning the basics

- Your property is in a strong long-term rental market

- You want to minimize upfront investment and complexity

Choose short-term rentals if:

- You can commit significant time to active management

- You prioritize maximizing revenue over free time

- Your property is in a strong short-term rental market with clear regulations

- You have substantial capital for furnishings and setup

- You enjoy hospitality and guest service

Consider hybrid strategies if:

- You want flexibility adapting to market changes

- Your property works for multiple rental types

- You value optionality over pure strategy focus

- You’re willing to learn multiple management approaches

There’s no universally “better” strategy—only the strategy that fits your circumstances best.

Start by taking these steps:

This week:

- Honestly assess your available time, capital, and risk tolerance

- Research regulations for both strategies in your target market

- Analyze comparable properties using both models

This month:

- Interview property managers who handle your preferred strategy

- Run detailed financial projections for properties you’re considering

- Get pre-approved for financing appropriate to your strategy

This quarter:

- Purchase your first investment property aligned with chosen strategy

- Implement systems and processes for your rental model

- Track results and adjust approach based on experience

This year:

- Optimize operations and build experience

- Evaluate if strategy is working or needs adjustment

- Consider adding second property using refined approach

Remember: Your first property is your education. You’ll learn more in the first year of ownership than from reading 100 articles. Choose the strategy that fits your situation, commit to it, and adjust as you gain experience.

Take your next step: Get pre-approved to understand your financing options for both long-term and short-term rental strategies, or schedule a call to discuss which approach makes sense for your specific goals and circumstances.

Your rental property investment journey begins with choosing the right strategy. Now you have the information to make that decision confidently.

Frequently Asked Questions

Can I start with long-term rental and switch to short-term later?

Yes, many investors start with long-term rentals to learn basics, then transition some properties to short-term rentals as they gain experience and capital. However, check your mortgage terms—some loans prohibit short-term rental use without lender approval. You may need to refinance before transitioning strategies. Also research local regulations thoroughly—cities sometimes implement short-term rental restrictions between when you buy and when you want to switch strategies. The safest approach is buying properties that work well for both strategies, giving you flexibility to adapt to market conditions and your evolving goals.

How much money can I realistically make with each strategy?

Long-term rentals typically generate net operating income of 8-12% of property value annually after expenses but before mortgage. Short-term rentals can generate 12-18% NOI in strong markets, but require significantly more management time and have higher expenses. However, your actual returns depend heavily on property location, management efficiency, market conditions, occupancy rates, and your ability to control expenses. Most first-year investors should expect lower returns than projected as they learn. Focus on stable, positive cash flow rather than maximum revenue when starting. Use conservative projections—if properties pencil out with pessimistic assumptions, you’ll likely do better in reality.

Do I need an LLC for short-term or long-term rentals?

LLCs provide liability protection for both strategies but aren’t legally required. Long-term rentals face standard landlord liability (slip-and-falls, habitability issues), while short-term rentals face additional risks from constantly changing guests. Many investors form LLCs for asset protection regardless of strategy, though buying your first rental property with an LLC affects financing options. For short-term rentals specifically, some investors feel LLC protection is more important due to guest turnover and unpredictability. Consider both strategies’ risks and your overall asset protection plan when deciding. Work with real estate attorney to determine best structure.

What if short-term rentals become illegal in my city after I buy?

This is a real risk—many cities have implemented short-term rental bans or severe restrictions in recent years. Before buying property specifically for short-term rental, research current regulations, pending legislation, and political climate around STRs. Buy properties that work well as long-term rentals too, providing exit strategy if regulations change. Consider getting zoning confirmation or permits before closing. Some investors accept regulatory risk for higher returns; others avoid markets with uncertain STR futures. Don’t assume current regulations will remain unchanged—have contingency plans for strategy changes.

Can I use Airbnb management companies to run short-term rentals passively?

Professional short-term rental management companies handle day-to-day operations, but they charge 20-30% of gross revenue—substantially reducing your net income. Even with management, you’re still involved in major decisions about furnishings, renovations, pricing strategy, and handling emergencies. Professional management makes short-term rentals more passive than self-management, but they’re never truly hands-off like long-term rentals can be. Calculate net income after management fees—many properties that appear profitable with self-management become marginal or negative after paying professional management. Management works best for investors with multiple properties justifying the expense.

Also Helpful for First-Time Investors

Deciding on your rental strategy? These resources help:

- Real Estate Investing for Beginners – Foundation before choosing rental strategies

- How to Find Investment Property – Finding properties suitable for your chosen strategy

- Investment Property Analysis – Evaluating deals under different rental models

- Property Management Checklist – Systems for managing long-term rentals

What’s Next in Your Journey?

Ready to implement your chosen rental strategy? These guides help:

- Landlord Responsibilities – Understanding duties for long-term rental management

- Landlord Insurance for Rental Property – Protecting investments under both strategies

- Tax Break for Buying a House – Understanding tax implications for rental properties

- Buying First Rental Property With LLC – Asset protection for both rental strategies

Explore Your Complete Financing Options

Different rental strategies may require different financing. Find your best fit:

- FHA Loans – House hacking small multifamily, can be rented long-term

- Conventional Loans – Standard investment property financing

- DSCR Loans – Qualify based on property cash flow, works for both strategies

- Portfolio Lending – Multiple properties with flexible underwriting

- All Loan Programs – Complete investment property financing guide

- Rental Property Calculator – Model both rental strategies

- Get Pre-Approved – Understand financing for your chosen strategy

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.