What are the 4 Ways Real Estate Pays Me?

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

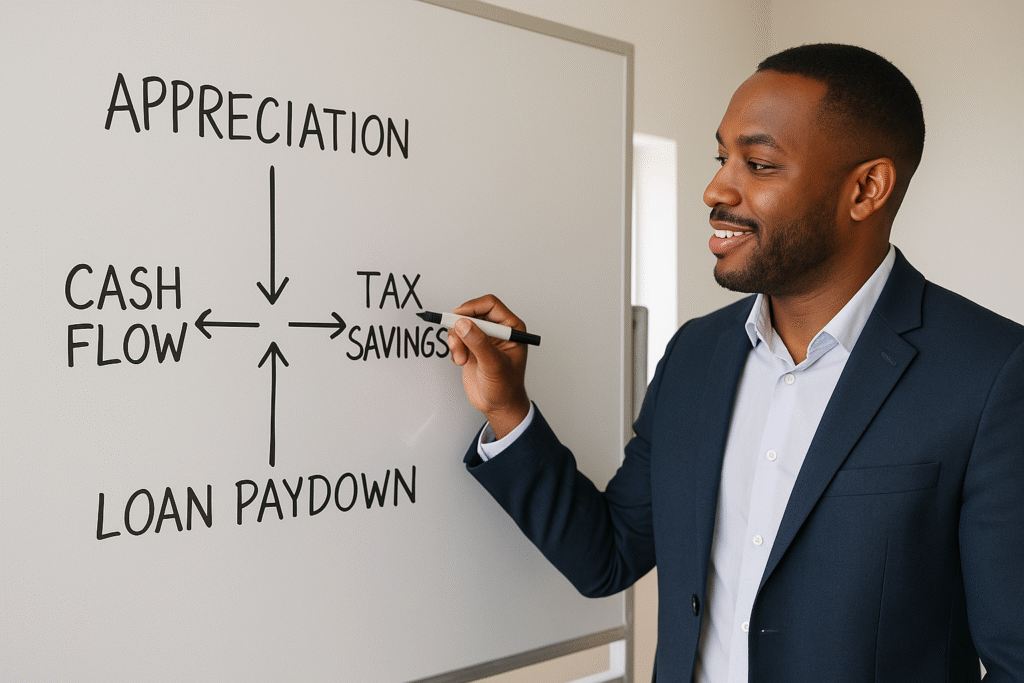

The 4 Ways Real Estate Pays You

Most people think real estate just builds wealth through home appreciation.

But that’s only part of the picture.

The truth is, real estate is a four-in-one wealth machine — and when done right, it works in the background while you sleep.

Let’s walk through the four ways real estate pays you, and how each one contributes to long-term financial freedom.

Want to see all four wealth pillars working together? Calculate your Buy & Hold: Cashflow, Appreciation, Equity, Depreciation & Tax Savings now to understand the complete financial picture of real estate investment.

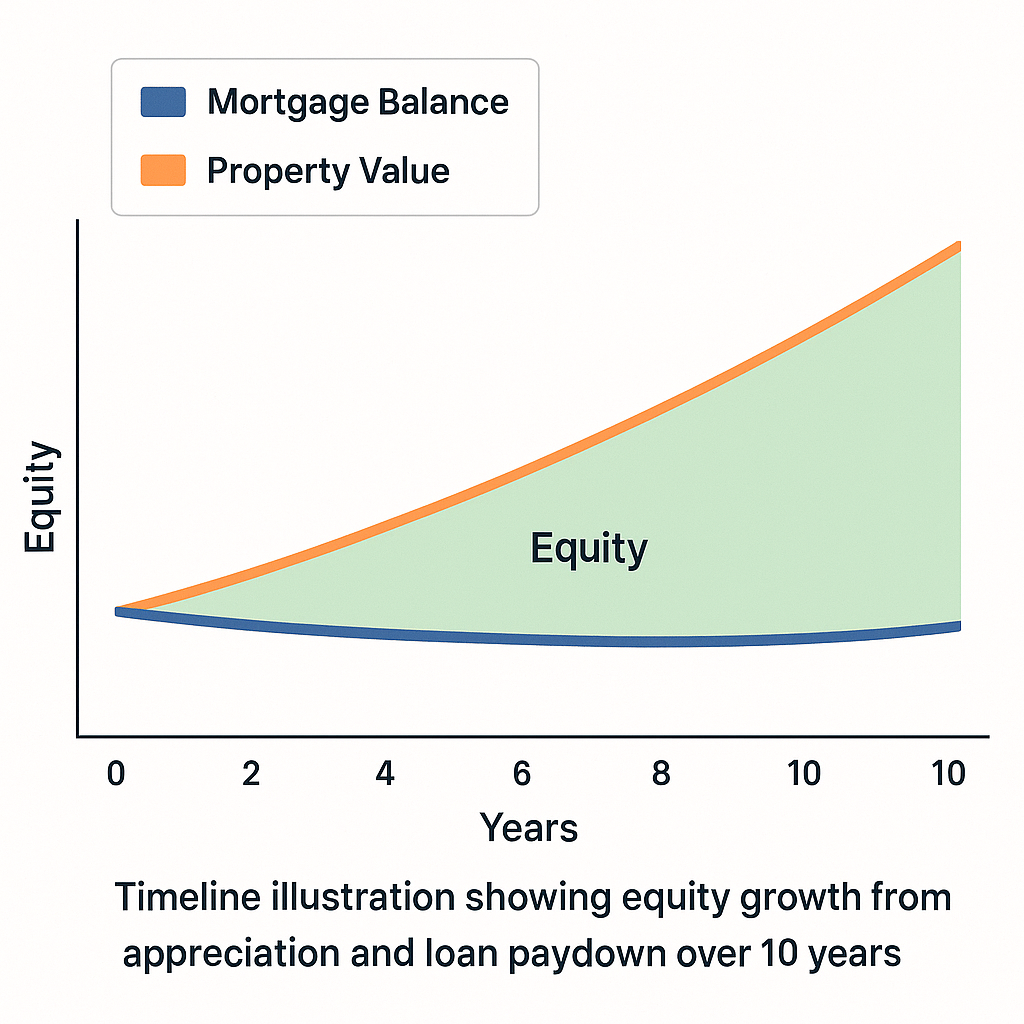

1. Appreciation

- Buy a property for $400K

- Ten years later, it’s worth $500K

- You just gained $100K in equity — without lifting a finger

2. Loan Paydown (Equity Growth)

3. Cash Flow

This one’s huge — especially for investors.

Cash flow is the money left over each month after all expenses are paid:

- Rent collected

- Minus mortgage, taxes, insurance, maintenance

If you run the numbers right, you can buy properties that pay you every single month — and scale them over time.

Cash flow is what allows real estate to replace your job someday.

Ready to explore cash-flowing properties? Calculate your DSCR Investment Purchase Loan Payment now to see how investor financing qualifies based on rental income—allowing the property to pay for itself from day one.

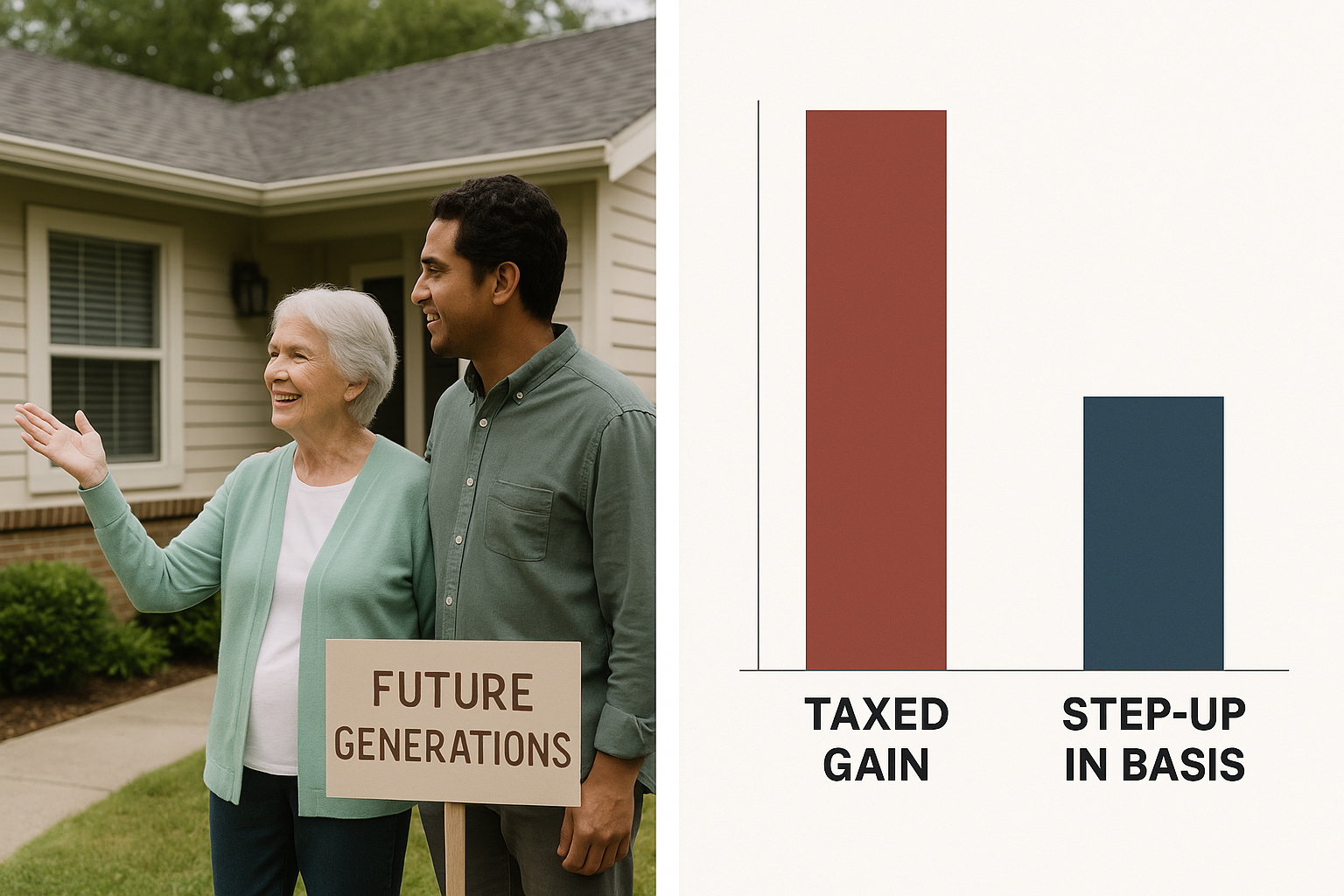

4. Tax Benefits

- Depreciation (paper loss that offsets income)

- Mortgage interest deductions

- Write-offs for maintenance, travel, insurance, and more

Interested in tax-deferred strategies? Calculate your 1031 Exchange, Capital Gains Tax Savings & Purchase now to see how deferring capital gains taxes lets you reinvest more of your profits into larger properties.

Bonus: Leverage Multiplies All 4

The beauty of real estate is that you can use a mortgage to control the asset — and still receive all 4 wealth-building benefits.

No other investment offers this combo with this level of leverage, predictability, and long-term security.

Bottom Line: Real Estate Isn’t Just One Stream — It’s Four

Whether you’re a first-time buyer or a seasoned investor, knowing these four pillars will help you make smarter, more profitable decisions.

We’ll help you find properties, structure your loans, and build a plan to stack all four.

Want help starting or scaling your real estate portfolio?

At Stairway Mortgage, we help you stack all four wealth pillars—appreciation, equity, cash flow, and tax benefits—for maximum returns.

📘 Download our homebuyer guides about real estate wealth building.

🧮 Analyze all four pillars with our Buy & Hold Calculator.

🏠 Start investing on our Buy a House page.

💰 Explore investor financing with our DSCR Calculator.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call