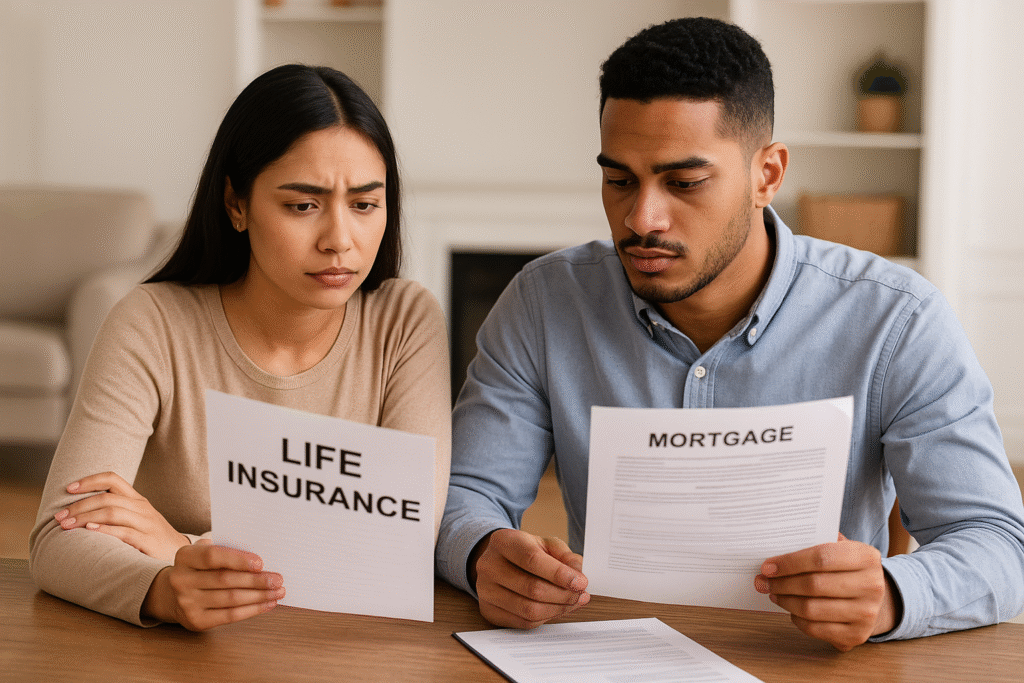

Term Life Insurance Mortgage Protection: Why Homeowners Need Coverage

Owning a home is one of the biggest financial commitments of your life. So here’s the question:If something happened to you tomorrow… would your family still be able to stay in the home? That’s where term life insurance comes in — and why it’s one of the most overlooked but essential tools every homeowner should […]