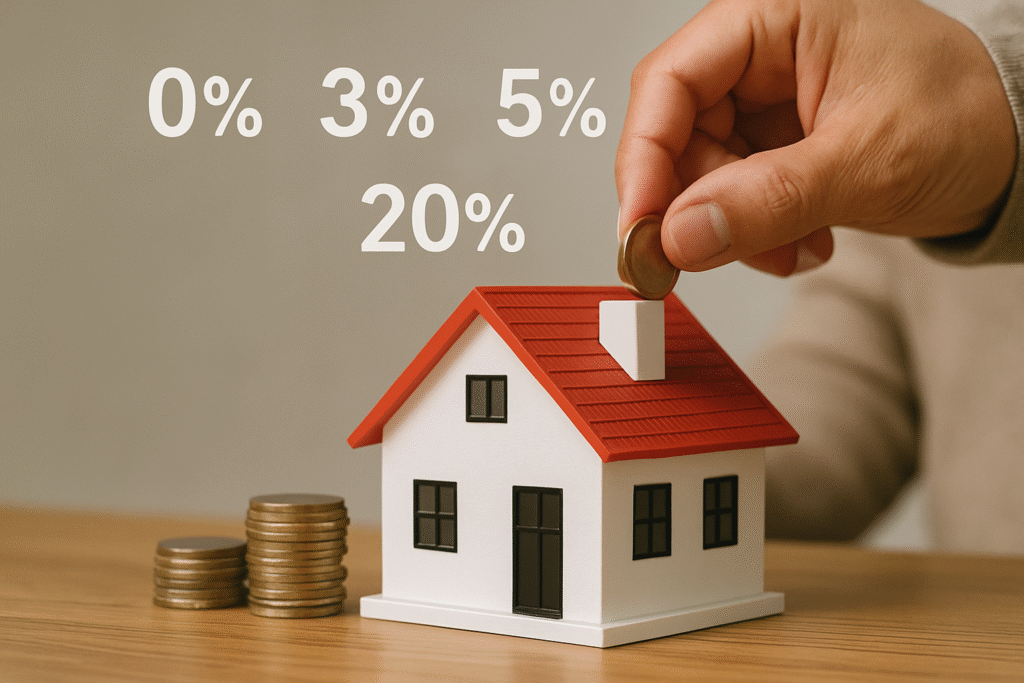

USDA Loan: Young Couple Purchases $295K Home with $0 Down Payment in Rural Florida Community

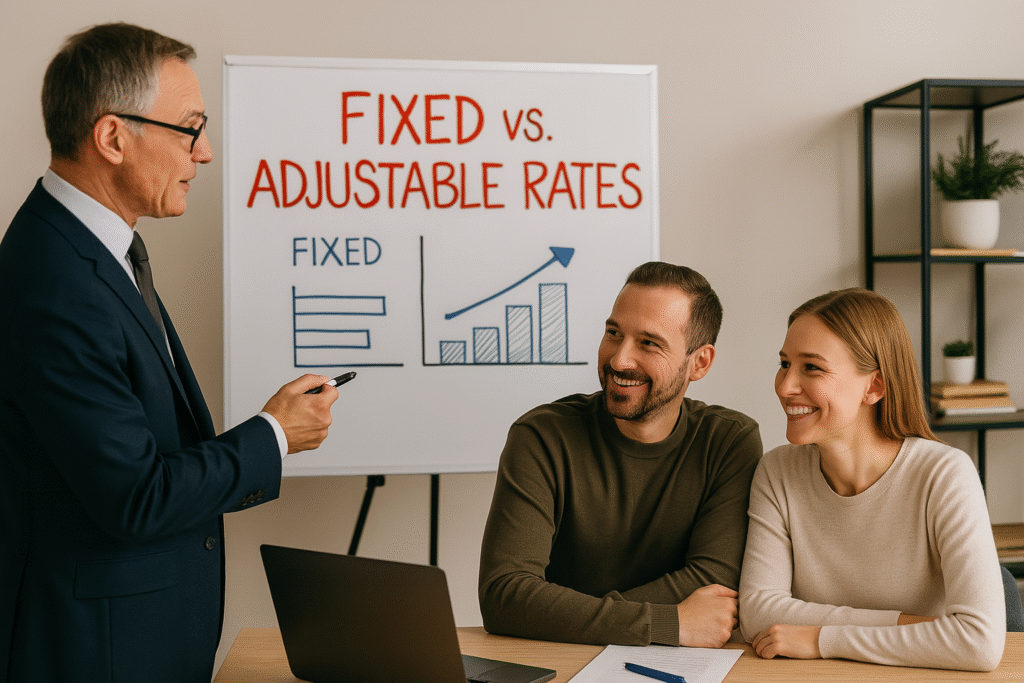

Educational Case Study Disclosure This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms, interest rates, and APRs are illustrative examples and do not represent current offers or guaranteed terms. If specific loan terms (e.g., down payment %, payment amount, rate/APR, points, or repayment period) appear in this article, required […]