What Happens After My Offer Is Accepted?

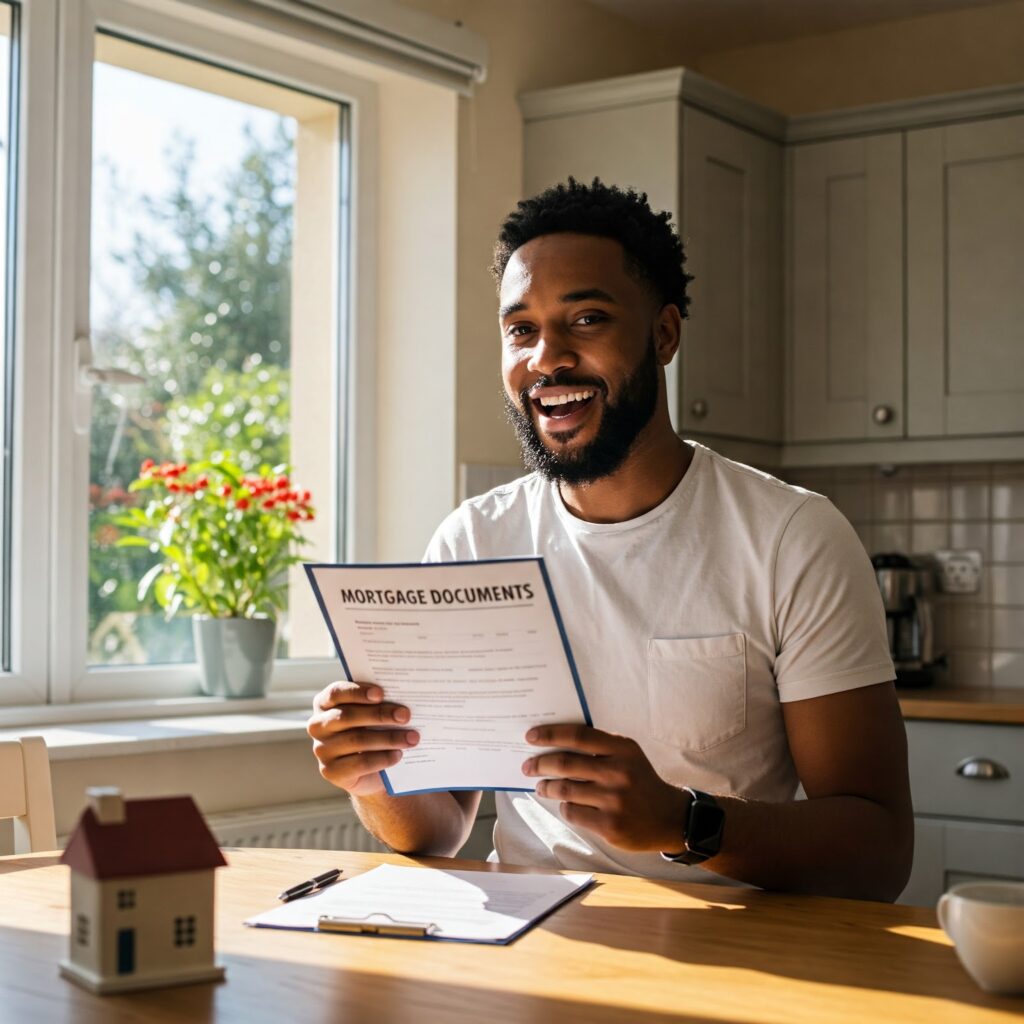

1. Schedule the Home Inspection ASAP Your first priority is the home inspection. This is your opportunity to make sure the house is in good condition—roof to foundation. Hire a trusted, licensed inspector who can uncover any issues, big or small. If problems come up, you’ll have the chance to renegotiate or request repairs before […]