Rent-to-Own Mortgage Loans | How to Buy Your Home and End Your Lease for Good

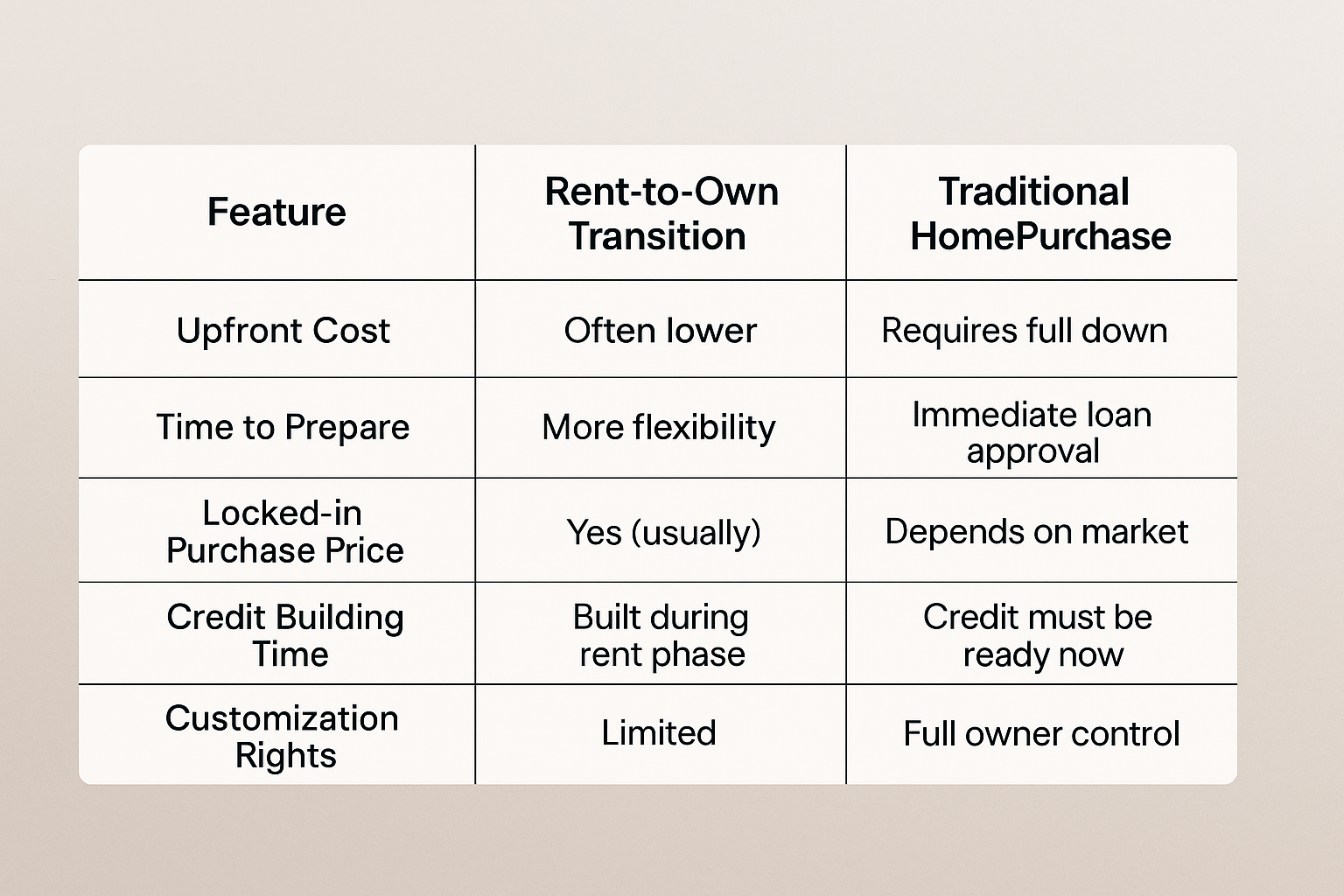

If you started your journey with a rent-to-own agreement, you’re already one step closer to owning a home. But how do you make that final leap from tenant to owner?

In this guide, we’ll show you how to use a mortgage to complete your rent-to-own contract, including timelines, tips, and strategies to protect your investment and secure the best loan terms.

What Is a Rent-to-Own Agreement?

A rent-to-own (or lease-option) agreement lets you rent a property with the right to buy it later—typically within 1 to 3 years. Part of your monthly rent may go toward the future purchase, and the sale price is often locked in advance.

Now that your option period is nearing its end, it’s time to secure financing and execute your option.

How to Refinance After Divorce

If you want to keep the home:

- Get approved based on your solo income and credit

- Refinance the loan into your name only

- Use equity (or additional funds) to buy out your ex’s share

We’ll help you:

- Run the numbers

- Estimate the buyout amount

Plan the best timing based on divorce proceedings

Step-by-Step: How to Transition from Rent to Mortgage

- Review Your Lease Agreement

- Confirm your option price, credit toward purchase, and expiration date

- Get Pre-Approved for a Mortgage

- Use your current income, credit score, and down payment sources

- Verify the Property’s Value

- Get an appraisal to confirm the home is worth the agreed price

- Negotiate Repairs or Credits (if needed)

- Treat it like any home purchase—an inspection still matters

- Finalize Your Loan and Close

Lock your rate, submit final documents, and complete the transaction

What Mortgage Programs Work for Rent-to-Own?

- FHA Loans – Flexible credit, low down payment, allows gifted funds

- Conventional Loans – Lower mortgage insurance, strong for well-qualified buyers

- VA Loans – For eligible veterans and active-duty; $0 down

- First-Time Buyer Programs – Grants, down payment assistance, and low rates

- Bank Statement or 1099 Loans – For self-employed buyers with non-traditional income

Want to know which loan fits your timeline and price point? Let’s build your approval plan together.

Tips for a Smooth Transition

- Save Documentation: Keep all rent receipts and option payments

- Monitor Your Credit: A small bump in score could save you thousands

- Communicate with the Seller: Make sure timelines and expectations are aligned

- Don’t Wait Until the Last Minute: Start the mortgage process 60–90 days before your option expires

Final Word: You Didn’t Come This Far to Stop Short

You’ve invested time and money. Now let’s make it official. We’ll walk you through the transition from renter to homeowner with clarity, confidence, and a mortgage that fits.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact