Refinance Purchase: Best Loan Combinations to Buy Your Next Home (Without Selling)

If you already own a home, you may be sitting on the key to your next one—your equity. Instead of waiting to save for a new down payment, many homeowners use a refinance strategy to unlock cash and keep things moving forward.

Whether you’re moving up, downsizing, or buying an investment property, refinancing your current mortgage can provide the funds to make it happen.

What Is a Refi-to-Buy Strategy?

A “refi-to-buy” strategy means you refinance your current home—often with a cash-out refinance—and use the equity you’ve built to help purchase your next property.

This approach works especially well for:

- Growing families needing a bigger home

- Empty nesters ready to downsize

- Real estate investors buying a second or third property

- Remote workers relocating but keeping their current home as a rentalCondotel

You don’t need to sell your current home first—you just need to structure the loan the right way.

How the Process Works

- Refinance your current home based on its new appraised value

- Access the equity as cash at closing

- Use those funds for the down payment or closing costs on your next purchase

- Apply for your new mortgage separately using traditional or investor-friendly programs

You can often close both loans in sequence—or even concurrently with the right planning.

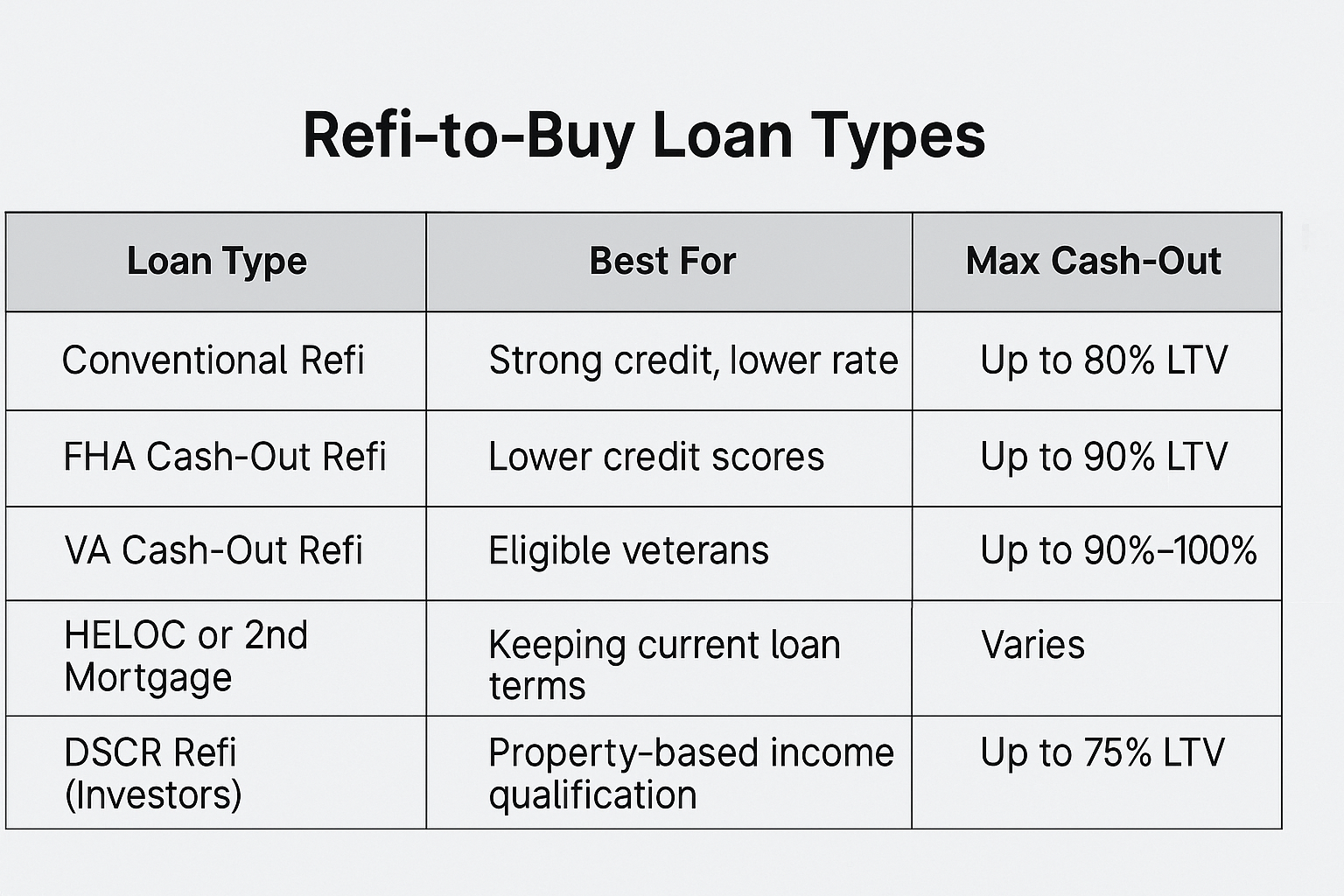

Best Loan Combos to Consider

What to Watch For

- Appraisal gaps (your current home’s value affects your cash-out limit)

- Timing of purchases (coordination matters if buying quickly)

- Reserve requirements (lenders may want you to keep 6–12 months of mortgage payments in the bank)

- Rental income (if converting your current home to a rental, that may count toward your next loan)

We’ll help you run the numbers to make sure it all lines up.

Final Word: You Don’t Have to Sell to Step Up

Your next home—or investment—is closer than you think. With smart refinancing, you can use the equity you already have to create new opportunity, cash flow, or comfort.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact