Mortgage with Cosigner | Qualify for a Bigger Mortgage Without Higher Income

You Don’t Have to Buy a Home Alone

If you’re a first-time buyer with solid credit but not enough income to qualify for the home you want, there’s a powerful solution: bring in a non-occupant co-borrower.

This strategy lets someone (usually a parent, relative, or close friend) co-sign on your mortgage without living in the home. Their income counts toward your loan approval—and your homeownership dream just became reality.

What Is a Non-Occupant Co-Borrower?

A non-occupant co-borrower is someone who signs onto your mortgage to help you qualify, but won’t actually live in the home. They’re legally responsible for the loan, but the home is yours to live in, maintain, and grow equity in.

This is different from a co-owner or a roommate. A non-occupant co-borrower is often:

- A parent or older relative helping a first-time buyer

- A trusted friend or business partner

- Someone with strong credit and steady income who wants to support your future

Why Use This Strategy?

Adding a co-borrower can:

- Increase your approved loan amount

- Help you qualify with lower income or higher debt

- Boost your overall credit profile

- Get you into a better home, neighborhood, or school district

You still m5ake the payments—but their income opens the door.

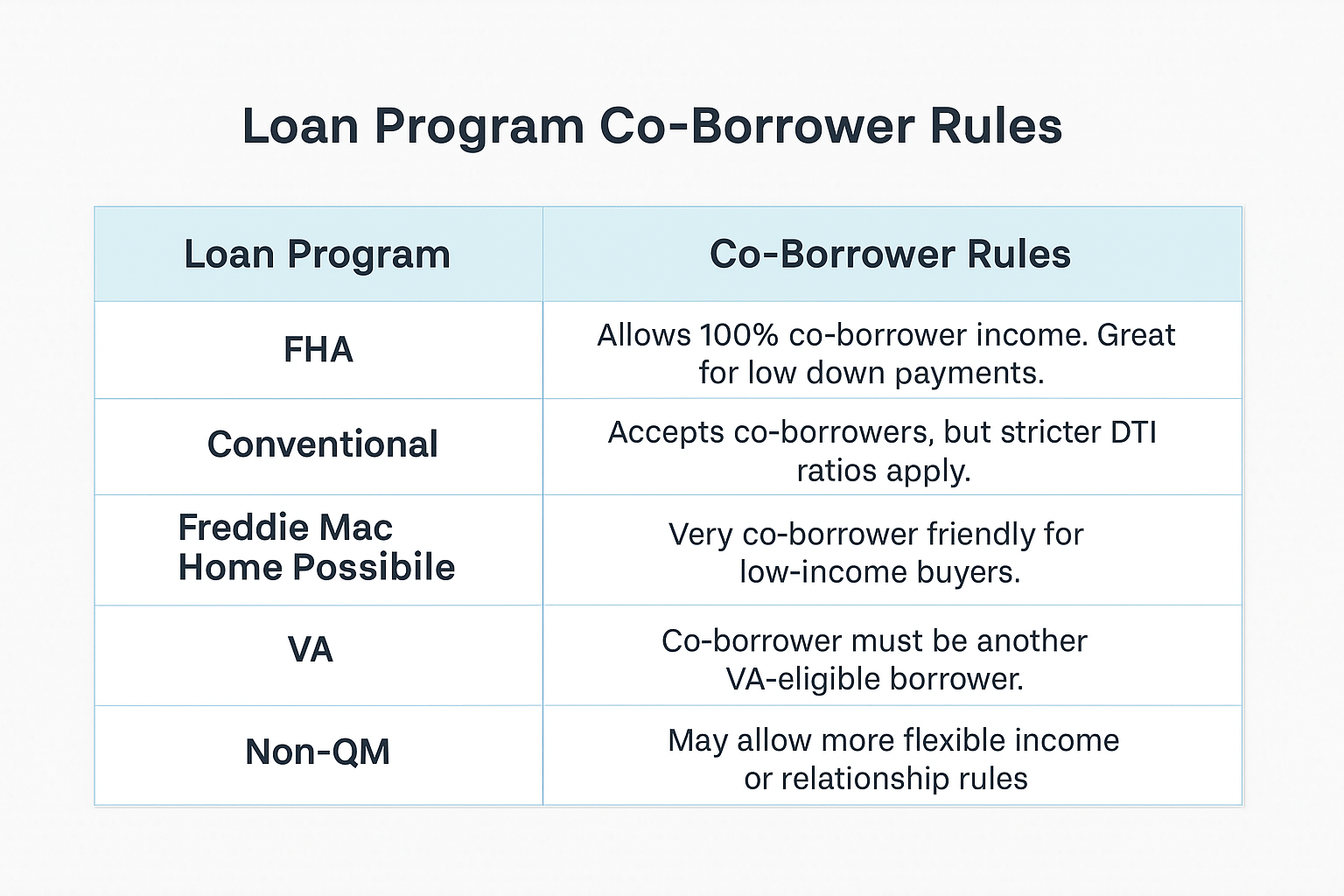

Best Loan Combos to Consider

You can mix and match based on your credit, income, and goals. We’ll guide you.

How to Structure It Right

Before you add a co-borrower:

- Have an honest conversation about financial roles and expectations

- Decide if they’ll be on title (they don’t have to be)

- Consider exit plans if your income rises and you want to refinance solo

We’ll walk you both through the structure, legal responsibilities, and options.

Common Scenarios That Work

- Student buyers using parents as co-borrowers

- Immigrant families with multiple generations supporting one another

- Young professionals just starting out in their careers

- Divorced borrowers with spousal support but lower income

Final Word: You’re Not Alone in This

Homeownership is a family affair. With the help of someone who believes in you, you can go further, faster. We’ll structure the loan smartly so you can qualify now—and plan for independence later.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact