Mortgage Process: How Does it Work at Stairway Mortgage?

- By Jim Blackburn

- on

- Buy A House, First-Time Home Buyer, Mortgage Preapproval, Stairway Mortgage, Stairway Process

Buying a home is one of the biggest financial decisions you’ll ever make — but it doesn’t have to feel overwhelming. At Stairway Mortgage, we’ve developed a simple, clear, and empowering way to guide you every step of the way.

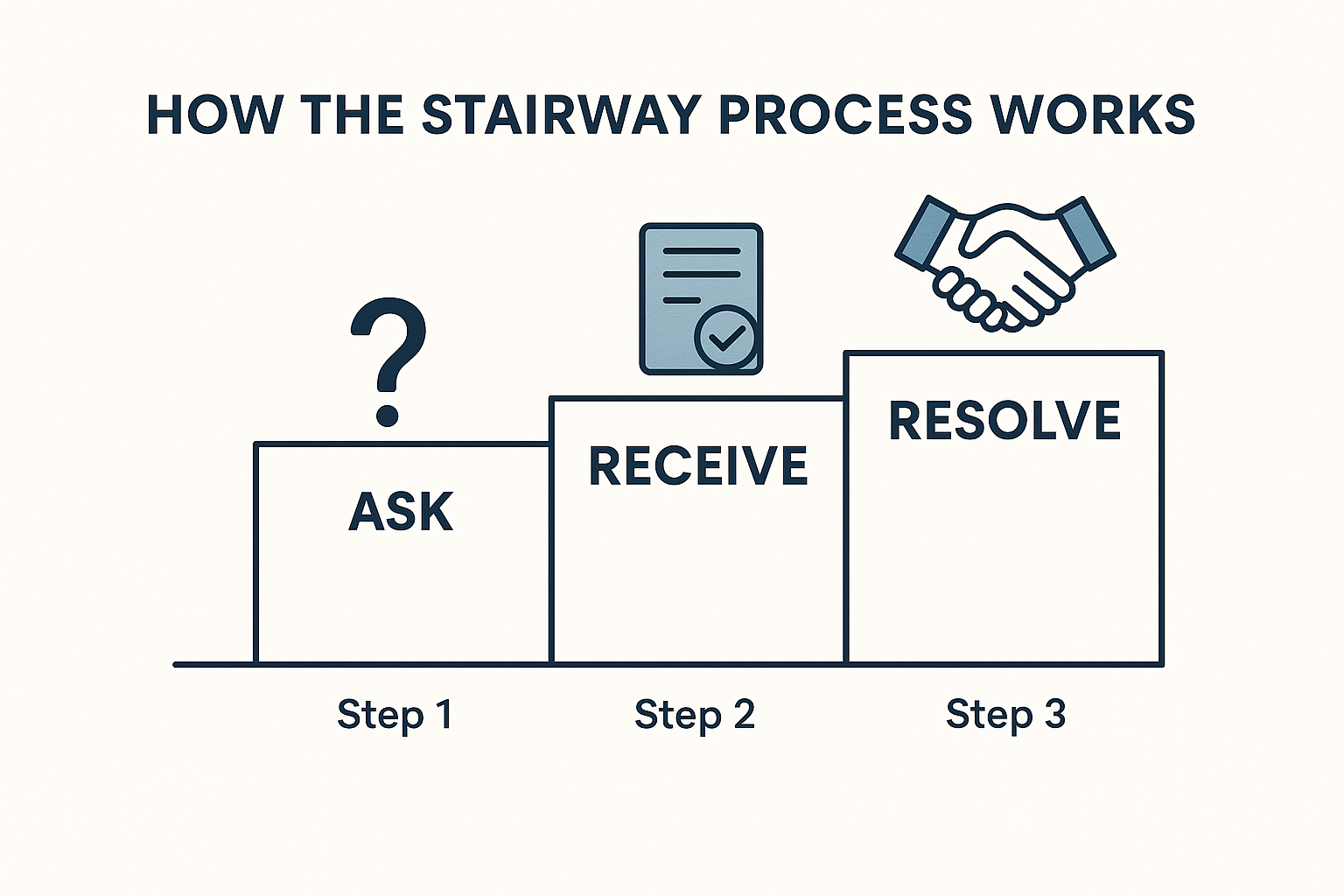

We call it the Stairway Process — a 3-step path built to take you from where you are now to the doorstep of your new home with confidence, clarity, and control.

Step 0: You Are Here – Acknowledging Your Starting Point

Every journey starts with awareness. Before we jump into rates or documents, we want to understand you — your dreams, your timeline, your concerns. This is where we listen carefully and assess your goals so we can tailor your path forward.

Step 1: Ask – Discovery and Intention

This is where we learn the key details of your financial life: income, assets, credit, and more.

It’s not just about forms — it’s about asking the right questions and clarifying your vision.

The more we understand your situation, the better we can design the ideal loan strategy.

Before we dive into your discovery session, get a sense of what you can afford. Calculate your Conventional Purchase Loan Payment now to see how different loan amounts and terms affect your monthly payment and total costs.

Step 2: Receive – Preapproval and Personalized Strategy

Now that we know where you want to go, we match you with the best-fit mortgage solutions.

You’ll receive a clear preapproval, plus options to compare and guidance on how to win offers.

We handle the heavy lifting — you focus on finding the perfect home.

Want to explore your loan options before your preapproval? Calculate your FHA Purchase Loan Payment now to compare conventional financing with FHA’s low down payment option and see which program fits your situation best.

Step 3: Resolve – Close Confidently and Begin Wealth-Building

Our job doesn’t end with an accepted offer. From appraisal to underwriting to closing, we coordinate every step while keeping you in the loop. Once the keys are in your hand, we don’t disappear — we stay connected to support your long-term financial goals and future refinances or investment moves.

Ready to start your journey? Visit our Buy a House page to explore the complete homebuying process, understand different loan programs, and take your first step on the Stairway.

Why This Framework Works

Most mortgage processes feel rushed, unclear, or one-size-fits-all. The Stairway Process works because it’s built around you.

It blends expert structure with personal attention and long-term strategy — which is why our clients come back again and again.

Ready to Start Your Stairway Journey?

At Stairway Mortgage, we don’t just close loans—we build relationships and guide you toward long-term financial success.

📘 Download our homebuyer guides to prepare for your journey.

🧮 Start planning with our Conventional Purchase Calculator.

🏠 Begin your journey on our Buy a House page.

📊 Check Current Rates to see what’s available.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallRecent Post

What Is a Closing Disclosure, and Why Is It Important?

Mortgage Process Step by Step

Real Estate Team: How to Build Your Team (Realtor, Lender, Planner, Attorney)

Vision Board Examples | Create Your 5-Year Real Estate Vision Board

Is an ARM a Good Idea | Fixed vs Adjustable Rates: When & Why

What Does a Mortgage Advisor Do? (And Who Else Is on Your Refinance Team)

How Stairway Mortgage Saves You More Than Big Banks

How Can I Refinance With Purpose and Build Wealth Smarter?