Already Have a VA Loan? This Is the Fastest Way to Lower Your Rate.

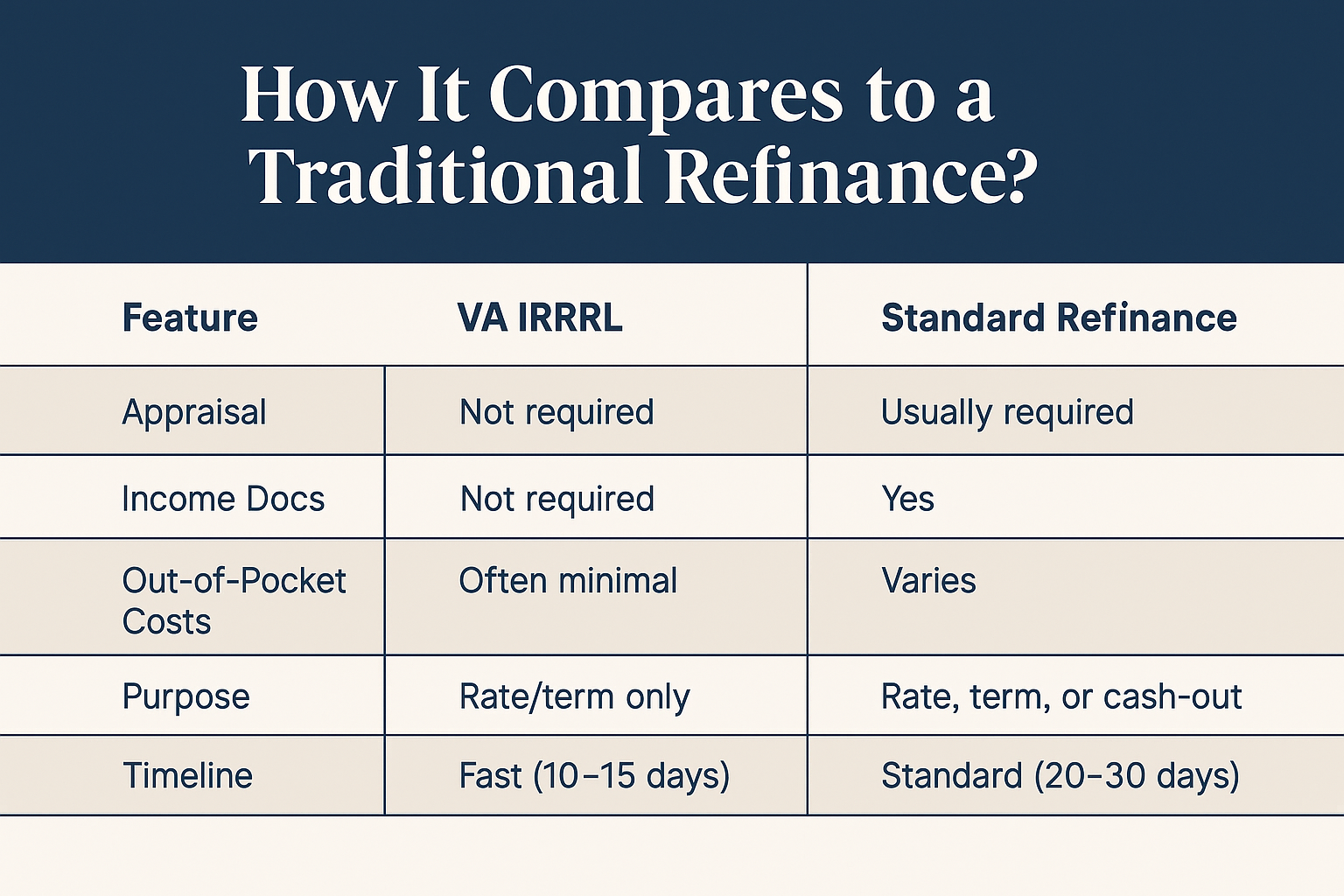

If you’re a veteran or service member with an existing VA loan, the VA IRRRL (Interest Rate Reduction Refinance Loan) gives you a streamlined way to refinance with minimal documentation and maximum savings.

You don’t need a new appraisal, income verification, or piles of paperwork. Just a few simple steps—and potentially lower payments within days.

What Is a VA IRRRL?

The VA IRRRL—often called a “VA Streamline Refinance”—is designed to help existing VA loan holders reduce their interest rate or switch to a safer loan structure (like going from ARM to fixed).

Top Benefits of the VA IRRRL:

- No appraisal required

- No income documentation

- Fast approvals and closings

- Lower monthly payments

- Minimal out-of-pocket costs

If rates have dropped since you got your VA loan, this is likely your fastest path to savings.

Who Qualifies for a VA IRRRL?

You must meet these simple criteria:

- You already have a VA-backed loan

- You’re current on mortgage payments

- You’ve made at least 6 payments on your existing VA loan

- Your new loan will have a lower rate or improved term

- It’s for a primary or former primary residence

If you have VA disability income, the funding fee is waived—even more savings.

When Is a VA IRRRL a Smart Move?

This streamlined refinance is ideal if:

- Rates have dropped at least 0.5%–1.0%

- You want to lock in a fixed rate after an ARM

- You need a faster, easier refinance process

You’re not looking to cash out—just save

Final Word: Fast. Simple. Earned.

The VA IRRRL is one of the most efficient refinance tools available—designed specifically for those who’ve already earned it. If you’ve got a VA loan, let’s make it work harder for you.

Schedule Your Free VA Streamline Call Now

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact