If you’re planning to purchase a home and have decent credit and income, a Conventional Home Purchase Loan might be your best move. With low down payments, flexible terms, and no government hoops to jump through, it’s a powerful tool for building long-term wealth.

Let’s walk you through the essentials—and give you tools to make it real today.

What Is a Conventional Loan?

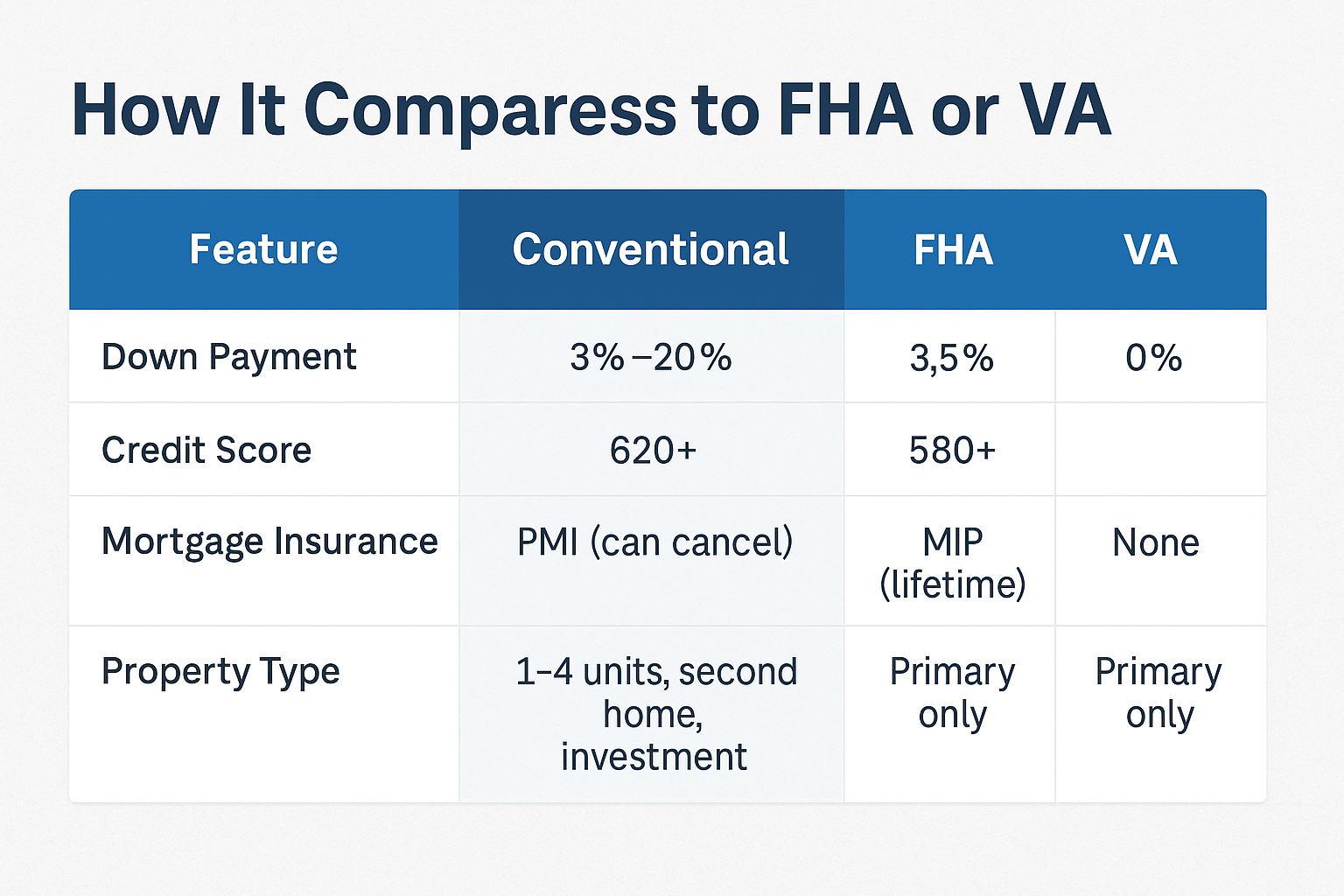

A conventional loan is a mortgage not backed by a government program like FHA or VA. It’s issued by private lenders and must meet Fannie Mae and Freddie Mac guidelines.

These loans are typically called “conforming” loans when they stay under local lending limits. For higher price points, you might use a jumbo conventional loan—which we also offer.

Top Benefits of a Conventional Loan:

- Down payments as low as 3%

- Competitive interest rates

- PMI drops off automatically at 20% equity

- Eligible for second homes and investment properties

Flexible terms (15, 20, or 30 years)

Who Qualifies for a Conventional Loan?

To get approved, most lenders are looking for:

- 620+ credit score

- 3–20% down payment

- Stable employment or income stream

- Debt-to-income ratio under 45%

- Proof of funds for closing

Self-employed or freelance? Check out our Bank Statement Loan program.

Loan Terms & Flexibility

Conventional loans offer:

- Fixed and adjustable rates

- Term options: 15, 20, or 30 years

- Financing for primary, second, or investment homes

- Optional escrow waivers

Tip: Not sure if your income qualifies? Take our Mortgage Readiness Quiz to find out.

Related Reading:

- FHA Home Loans for First-Time Buyers

- VA Loans for Veterans

When Is a Conventional Loan the Best Fit?

This loan works well if you:

- Have solid credit and steady income

- Can put 3–20% down

- Want to build equity and eliminate PMI

- Are buying a second home or rental

Plan to stay in the home for 5+ years

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact